What should I know about hiring in Lithuania?

Lithuania is a beautiful, historic country with a rich culture and a strong economy. If you’re considering hiring in Lithuania, you should know a few things. Firstly, being well-versed in the many frameworks of employment contracts that can be signed in Lithuania is crucial.

In addition, Lithuania has two main types of employment contracts: fixed-term and open-ended. Secondly, if you want to attract and retain top talent in Lithuania, you’ll need to provide pay at least as high as the local minimum wage.

Finally, being familiar with the Lithuanian tax and social security systems is essential, as these will impact your employees’ take-home pay. When it comes to business, Lithuania is a fantastic option. Many qualified people are looking for jobs, and the business climate is healthy.

Why is Lithuania a good choice for finding remote employees?

For a long time, Lithuania has been recognized as a source of highly trained and skilled laborers. In addition, the country boasts an excellent infrastructure for remote work, including fast internet and pleasant offices.

Lithuanian workers are also highly educated, with a large number of them having university degrees. This means that they can handle complex tasks and projects and are often able to work independently with little supervision. The government of Lithuania has been very encouraging of the growth of the remote work industry there.

It has implemented various programs to facilitate the establishment and operation of remote businesses in the nation. Several tax breaks and a special visa for remote employees help businesses hire people from foreign nations.

How can Native Teams help you hire in Lithuania

As your business grows, you may need to look for new talent to keep up with demand. You may not have the time or resources to devote to an extensive search, so working with Native Teams can be a great solution. With the help of our Employer of Record services, your business may more easily recruit new workers, pay them, and comply with Lithuanian labor laws.

Hire your first Lithuanian employee with Native Teams.

Legal requirements for hiring in Lithuania

Minimum wage

The government of Lithuania approved a plan to raise the minimum monthly income by about 14%, from EUR 642 to EUR 730, in October 2021.

Contributions & taxes

The state currently contributes 1.2% of the average state salary, rising to 1.5% by 2023. From the very beginning of their enrollment, these people can contribute a maximum amount of 3% (with a governmental subsidy of 1.5%).

Employer tax

The PIT rate for employment income is 20% (it is 15% for sick pay). Earnings from employment above 60 times the average monthly salary in 2021 (or EUR 81,162) will be subject to a higher PIT rate of 32%.

Corporate tax

The average rate of CIT is 15%. In some circumstances, however, CIT rates as low as 0% for small businesses and 5% for agricultural businesses may be applied.

Employee tax

There are two employment-related income tax rates in Lithuania, which are applied to the employee’s gross salary. Incomes up to the equivalent of 60 typical salaries per year (EUR 81,162 in 2021) are taxed at a flat rate of 20%. In case the total amount is higher than the limit mentioned above, a 32% surcharge will be applied.

Income tax

There is a minimum taxable income (called the “Neapmokestinamasis pajam dydis” in Lithuanian). The standard tax rate on wage income is 20%, with a top rate of 32%. The current tax rate on dividend income is 15%. It’s important to note that the tax rate changes depending on your income source.

To calculate the salary and taxes in Lithuania please click here.

Payroll cycle

Payroll is usually processed once each month in Lithuania. Salary payments are due by the 10th of the month after the end of the pay period.

Is there a 13th salary in Lithuania?

Although there is no legal requirement for a 13th-month payout in Lithuania, many companies give out bonuses depending on employee performance.

Labor rules

Lithuanian workers typically work 8 hours a day from 8:00 a.m. or 8:30 a.m. to 5:00 p.m. or 5:30 p.m., Monday through Friday, including an unpaid hour for lunch (i.e.40, hours weekly).

Probation period

Probationary periods may be included in employment contracts following the Labor Code of the Republic of Lithuania (hence – Lithuanian Labor Code). However, the parties can negotiate a shorter probationary term if they want.

Notice period

It is customary for an employer to provide one month’s notice before terminating an employee’s employment if the termination is being made for reasons other than the employee’s performance. The required notice period is two weeks for employment terms shorter than a year.

Severance pay

The employer must provide the employee with a severance payment following Section 38(c) (v) of the Employment and Labor Relations Act. All employees with at least one year of service and up to ten years of service will receive at least seven (7) days of basic wage as severance.

Leave and benefits

Public holidays

Lithuania celebrates 13 national holidays:

- New Year’s Day

- Day of Re-establishment of the State of Lithuania

- Day of Restitution of Independence of Lithuania

- Easter

- Easter Monday

- Labor Day

- St. John the Baptist’s Day

- State Holiday Lithuania

- Assumption Day

- All Saint’s Day

- Christmas Eve

- Christmas

- St. Stephen’s Day

Sick leave

Lithuanian law guarantees workers the right to sick pay. It is common practice for employers to cover all of an employee’s wages. If an employee is sick for more than two days, the company must cover the cost of medical care at a rate of no less than 62.06% of the employee’s regular compensation.

Maternity leave & paternity leave

The State Social Insurance Fund covers pregnancy and childbirth. Female employees are typically given 104 days off between pregnancy and the baby’s birth. All paid time off is available to employees, regardless of how much was used up before their child’s birth.

An employee with a child younger than three years old is protected from being fired without cause.

Parents, grandparents, and other relatives taking care of a child can apply to the State Social Insurance Fund for financial assistance during their leave of absence.

Other leave

Bereavement leave

In Lithuania, workers can take five days off without pay to grieve the loss of a close relative.

Parental leave

A single parent with a minor child is eligible for 35 days of paid vacation each year.

Insurance

Health security & private insurance

* Native Teams can support you in finding the best private insurance in the country. Contact us and we will send a comparison of insurance packages and prices.*

Visa

Relocation and work permits

Native Teams will apply for your work visa in the nation on your behalf and serve as your Employer of Record. All the required documents can be uploaded using our app. Until you have your work and residency visa, Native Teams will support you by providing you with frequent information on the progress.

How long is the visa/work permit process?

Usually, it takes 2 to 4 weeks to get a work permit, depending on the authorities and provided documents.

Which documents do you need?

To apply for a visa/work permit in Lithuania, upload the documents from our onboarding list (relocation to log in/pricing).

Why use Native Teams for hiring in Lithuania?

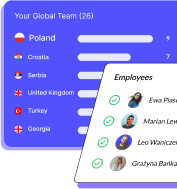

Native Teams lets you employ team members ‘like a local’ meaning you get all the benefits of a global team, wherever you are based. Here are the reasons why you should use Native Teams for hiring:

- No paperwork: We will handle all the necessary paperwork for you.

- Save on taxes: We help you handle your taxes.

- No company set up: You can expand your business using our company entitles.

- Online onboarding: We’re here to ensure your onboarding process is trouble-free.

- No accounting: We will handle all of your accounting needs, including invoicing, payroll, and more.

- Increase your profit: We assist you in growing your business and maximizing your profits.

- Compliance expertise: we can assist your company in navigating the regulatory environments and ensure you meet all relevant requirements.

- Local support: We can assist you in understanding and complying with the relevant local laws.