What should you know about hiring in Poland?

Poland ranks highly on factors such as education, safety and standard of living, so there is no surprise that hiring from Poland can help your business grow quicker. But before you hire your first Polish employee, you should familiarize yourself with the country’s labor rules and employment laws and regulations.

Even though hiring in Poland can seem complicated and confusing if this is the first time you’re hiring from this country, Poland has similar employment compliance to other EU countries.

Why is Poland a good choice for finding remote employees?

Companies and individuals are adopting the concept of working remotely, and Poland is no different.

Poland is a country with great tech talent, a welcoming startup environment and a rising business environment. Furthermore, it is also one of the most economically stable and one of the fastest developing countries in the world, so it shouldn’t come as a surprise that it is one of the top places for international expansion.

How can Native Teams help you hire in Poland

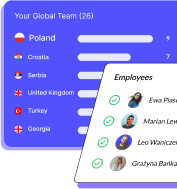

If you want to start hiring from Poland but don’t want to spend time opening up a separate business entity, you can use Native Teams’ employer of record services.

We can take care of payroll, compliance, taxes, benefits and onboarding of your new employees. Native Teams has an entity in Poland, so we can help you hire your new team members in compliance with local laws.

Hire your first Poland employee with Native Teams.

Legal requirements for hiring in Poland

Minimum wage

The current minimum wage in Poland is PLN 3,490.00 per month in 2023. It became valid on January 1, 2023.

Contributions & taxes

In Poland, the employee contribution rate is 13.71% of gross salary.

Employer tax

Employer tax of 1.67% is applied to organizations that employ up to nine employees. For more than nine employees, the employer tax ranges from 0.67% to 3.33%, which is the exact rate depending on the business sector. Foreign employers pay a flat rate of 1.67%.

Corporate tax

The CIT is the only tax levied on corporate income, with the standard CIT rate being 19%.

Employee tax

The average Polish worker faces a tax rate of 24.1%, whereas the OECD average is 24.8%.

Income tax

For income up to PLN 120,000, the tax rate is 17% minus the amount reducing the tax PLN 5,100. The tax-free amount is currently set at PLN 30,000 and was introduced as of 1st January 2022, which means that taxpayers who earn less than PLN 30,000 per year will be exempt from paying taxes.

In the case of income exceeding PLN 120,000, the tax is PLN 15,300 + 32% of the excess over PLN 120,000. The decreasing tax amount is already included in the above sum of PLN 15,300.

To calculate the salary and taxes in Poland please click here.

Payroll cycle

In Poland, the wages are normally paid out once per month, on the same day each month.

Is there a 13th salary in Poland?

Even though a 13th salary is not mandatory in Poland, many employers may pay it as a bonus for performance.

Labor rules

Probation period

Under Polish law, the probationary period agreement can be part of both, fixed-term and open-ended employment agreements. The maximum period of probation is six months.

Notice period

For employees, who have been employed for less than six months, a notice period of at least two weeks is required. For employees who have been employed for more than six months, a one-month notice period is required.

Severance pay

In Poland, employees are entitled to severance pay which is equal to one month’s pay if they have worked for the employer for less than 2 years, two months’ pay if they have worked for the employer for between 2 and 8 years and three months’ pay if they have worked for the employer for over 8 years.

Leave and benefits

Public holidays

Poland has 13 public holidays:

- New Year’s Day

- Epiphany

- Easter Sunday

- Easter Monday

- Labor Day/May Day

- Constitution Day

- Corpus Christi

- Assumption Day

- All Saints’ Day

- Independence Day

- Christmas Day

- Boxing Day

Annual leave

Polish employees must get at least 4 weeks off per year.

Sick leave

Employees in Poland have the right to sick leave, which is linked to the number of completed years, and the employee’s age.

Employees who are less than 50 years old are entitled to up to 33 days paid sick leave, which is paid by the employer. In case the sick leave is longer than 33 days, Social Security (ZUS) will take over the rest of the payments.

Employees who are older than 50 years old are entitled to up to 14 days paid sick leave, which is paid by the employer. In case the sick leave is longer than 14 days, Social Security (ZUS) will take over the rest of the payments

Sick leave which is a result of an illness occurring during pregnancy or is caused by accident on the way to or from work is paid at 80.00% or 100.00% of the allowance basis. Sick leave caused by accident at work or due to the employee’s sick child /sick relative is also paid for by Social Security (ZUS).

Maternity leave & paternity leave

In Poland, both maternity and paternity leave is paid for by the Social Security Bureau (ZUS):

The length of maternity leave depends on the number of children born at one birth, with the minimum being 20 weeks for one child and 37 weeks in case of 5 or more children

A male employee receives 2 weeks of paternity leave before the child reaches 24 months, and it can be taken all at once or in two parts.

When it comes to paternal leave, both parents are entitled to it, and they can use it at the same time. In such cases, the total length of the leave must not exceed the above amounts (32 or 34 weeks, depending on the number of children).

If an employee has been employed for at least six months, they have the right to take up childcare leave that must not exceed 36 months. The leave is granted before the child reaches the age of 6.

Other leave (marriage, bereavement, exam leave)

Depending on the Collective Agreement/Employment Contract terms, an employee may be allowed additional leave types, as approved between the employer and employee.

Disability leave: A person classified as having a severe or moderate degree of disability has the right to additional ten days of annual leave, after one year of being classified in one of the degrees of disability.

Military leave: Employees are entitled to unpaid military leave to perform their duties.

Family leaves: Employees are entitled to two paid days off for close family members’ life events, such as a wedding, a child’s birth, or a funeral.

Insurance

* Native Teams can support you in finding the best private insurance in the country. Contact us and we will send a comparison of insurance packages and prices.*

Visa

Relocation and work permits

Native Teams can be your Employer of Record and apply for your work permit in the country. You will be able to upload all the needed documents in our app. Native Teams will support you by giving you regular updates on the progress until you get your work and residence permit.

How long is the visa/work permit process?

Usually, it takes 2 to 4 weeks to get a work permit, depending on the authorities and provided documents.

Which documents do you need?

To apply for a visa/work permit in Poland, upload the documents from our onboarding list (relocation to log in/pricing).

Why use Native Teams for hiring in Poland?

Native Teams lets you employ team members ‘like a local’ meaning you get all the benefits of a global team, wherever you are based. Here are the reasons why you should use Native Teams for hiring:

- No paperwork: We will handle all the necessary paperwork for you.

- Save on taxes: We help you handle your taxes.

- No company set up: You can expand your business using our company entitles.

- Online onboarding: We’re here to ensure your onboarding process is trouble-free.

- No accounting: We will handle all of your accounting needs, including invoicing, payroll, and more.

- Increase your profit: We assist you in growing your business and maximizing your profits.

- Compliance expertise: we can assist your company in navigating the regulatory environments and ensure you meet all relevant requirements.

- Local support: We can assist you in understanding and complying with the relevant local laws.