Unlock the power of financial control with Native Tax!

Unlock the power of financial control with Native Tax! Tailored for businesses and individuals, our platform is your go-to place for compliance with tax laws. Navigate taxes smoothly – make sure you pay the right amount and not a penny more and report accurately. Gain a stronghold on the tax system, aligning perfectly with your financial obligations.

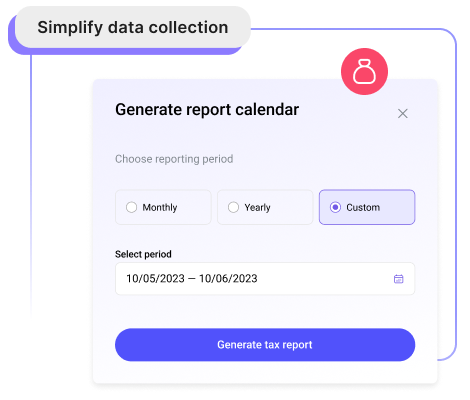

Tax reporting and filling

Effortlessly manage your tax obligations, simplify data collection and calculations and stay on the right side of tax laws – all within our powerful platform. Native Teams delivers a comprehensive solution that simplifies your tax obligations with our expert assistance in tax reporting and filing, allowing you to stay focused on your core activities.

Tax advice and guidance

Navigating the complexities of tax regulations can be challenging. Our expert team provides comprehensive tax advice and guidance, helping you identify opportunities for tax optimisation, minimise liabilities, and make informed decisions that align with the regulatory framework.

How does it work?

Simplify your tax journey with us! We guide you to ensure that you effortlessly adhere to tax regulations and guarantee accurate reporting. Let us handle the intricacies, making your tax responsibilities simple and straightforward.

Benefits of using Native Tax

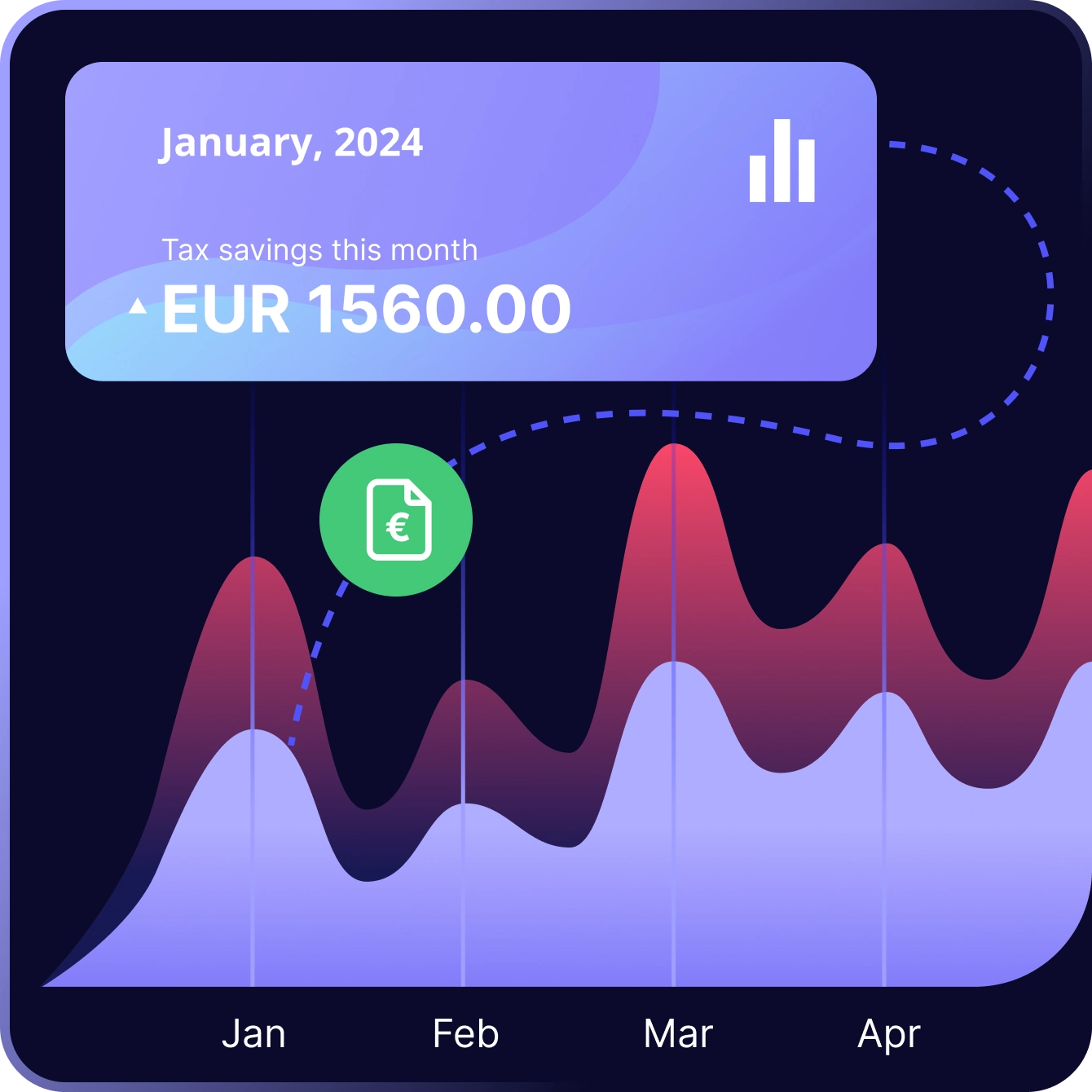

Save money

Native Tax helps you optimise your finances, ensuring you keep more of your hard-earned money through strategic tax planning.

Save time

Streamline your tax processes and eliminate time-consuming tasks, allowing you to manage your tax-related activities quickly and effectively.

Stay compliant

Stay on the right side of tax laws, providing tools and features to simplify compliance, minimise the risk of errors, and ensure timely tax return submission.

Local support

Benefit from local support, ensuring you have assistance and guidance tailored to your specific region or jurisdiction.