Employment

Legal employment for your global team

EOR (Employer of Record)

Your global team, locally employed

Entity Management

Set up and manage entities

HR, Payroll & Benefits

Manage all admin tasks from one place

Global Employee Benefits

Premium benefits for your global team

Relocation and Visa

Relocate your team anywhere

Employment Contracts

Localised employment contracts

Employer of Record (EOR) in Algeria

Are you a business owner looking to hire new employees in Algeria? You’ve just found the perfect solution - Native Teams’ EOR services can help you expand and work compliantly in Algeria without the legal legwork!

How does an EOR in Algeria work?

When you use our Employer of Record solutions to onboard an employee, the employment arrangement becomes a shared responsibility between you, the business owner, and Native Teams as the legal employer.

As the legal employer, Native Teams handles administrative tasks, ensures compliance with local regulations, manages global payroll, and provides tax optimisation guidance. Meanwhile, you retain full control over the daily management of your employees, with your only obligation being the payment of service-related fees to Native Teams.

Who can use EOR services in Algeria?

EOR services are ideal for companies looking to hire employees in Algeria without registering a local branch or subsidiary. Whether you're expanding into new markets, running a remote-first team, or hiring project-based contractors, Native Teams provides you with an operational presence in Algeria.

Features of Native Teams EOR services in Algeria

Native Teams facilitates compliant employment arrangements for your workforce in Algeria. Your employees will be formally employed through our entity and provided with employment contracts that adhere to local labour laws and regulations.

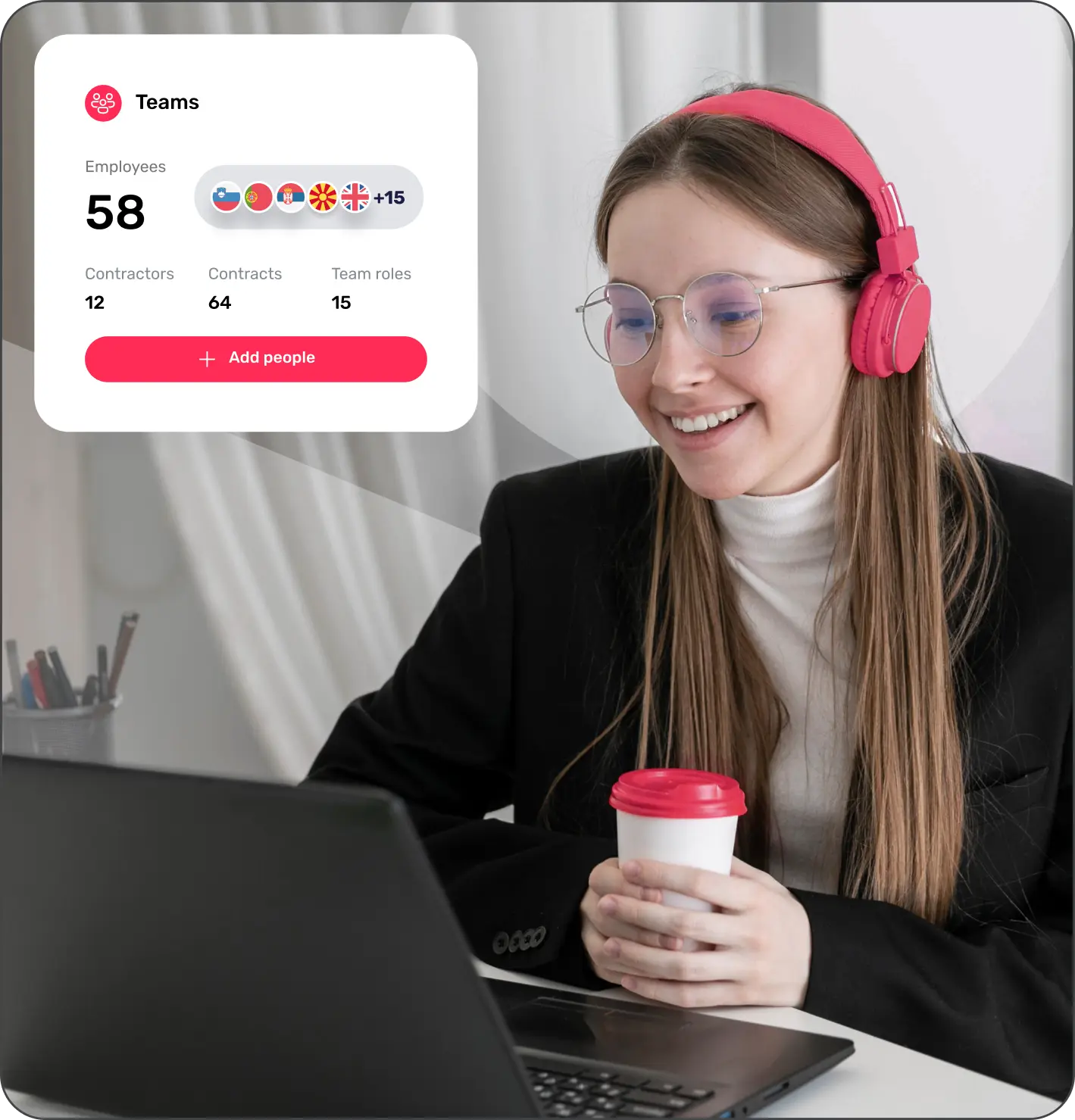

Streamline HR operations with Native Teams' centralised platform. Access a user-friendly dashboard to organise and oversee HR documentation for your international workforce.

Simplify payroll processing in Algeria with Native Teams' tailored payroll calculators. Ensure accurate computations for salaries, taxes, benefits, and other contributions for your employees across more than 95+ countries globally.

Benefit from our Employer of Record solutions, ensuring that your employees in Algeria receive mandatory benefits such as healthcare, pension, and insurance coverage. Employers can also offer additional perks like gym memberships or wellness programs through our platform.

Get insights on local laws, payroll, benefits, and more - all in one place.

What legal requirements exist for employment in Algeria

Employers in Algeria are obligated to register a legal entity before hiring individuals or undertaking any economic activity in the country.

Employers operating in Algeria must understand and adhere to Algerian tax regulations, which encompass corporate taxes as well as the withholding and remittance of employee taxes.

Employers must provide their employees with employment contracts that are compliant with Algerian labour laws. In Algeria, it is possible to find 2 types of employment contracts. These are limited (fixed) term contracts and unlimited term contracts, respectively.

Employees in Algeria typically get 2.5 days of paid vacation leave for each month worked, with a maximum accumulation of 30 days per year.

Employers are legally obligated to accurately calculate, withhold, and remit social security contributions and income taxes from their employees’ salaries to the relevant taxation authorities in Algeria.

Employers must also adhere to local labour laws governing aspects such as working hours, minimum wage standards, termination procedures, and provisions for paid leave. I

It's important to note that this list is not exhaustive, and legal obligations may vary depending on job classifications and individual situations. Therefore, employers should stay informed about the most recent legislation and regulations to mitigate pot

Why choose Native Teams as your Algeria Employer of Record?

With a global presence across 95+ countries, including Algeria, Native Teams speeds up your market entry in the country. Through our platform, you can easily track your employee absences, ensure tax compliance, and provide localised employment contracts. Our expertise in legal matters allows you to stay on the right side of the law, mitigating any potential challenges or fines.

What you need to know?

An Employer of Record (EOR) is a third-party entity that assumes the legal responsibilities of employing workers for another company. The EOR manages tasks such as payroll, tax compliance, benefits, and adherence to local labour laws. It also supports freelancers and remote workers in formalising employment status and accessing benefits.

EOR costs in Algeria vary depending on the provider, employee count, and service requirements. Native Teams has one of the most affordable and transparent pricing structures for your global work needs. Check out our pricing page for full details on plans and costs.

An EOR fully assumes legal employment responsibilities like payroll, taxes, and compliance, while a PEO shares these responsibilities with the client in a co-employment arrangement. EORs are ideal for companies expanding into new regions without legal entities, whereas PEOs are used by businesses already operating in a country to streamline HR functions.

EOR providers act as legal employer, managing payroll, benefits, and employment contracts while ensuring compliance with labour laws. They reduce risk by assuming liability for employment issues and provide HR support, enabling businesses to focus on core operations.

Yes, using an EOR in Algeria is fully legal and complies with Algerian labour regulations. International companies often use EOR services to enter the Algerian market.

An EOR allows businesses to avoid the complexities of setting up a legal entity in Algeria. The EOR handles legal employment tasks, such as payroll and compliance, and offers flexibility to scale operations without the challenges of closing a company if plans change.

There is no legal limit on the number of employees a company can hire in Algeria, as long as labour laws are followed. The number you can hire depends on your business needs, financial capacity, and ability to manage staff effectively.