Employment

Legal employment for your global team

EOR (Employer of Record)

Your global team, locally employed

Entity Management

Set up and manage entities

HR, Payroll & Benefits

Manage all admin tasks from one place

Global Employee Benefits

Premium benefits for your global team

Relocation and Visa

Relocate your team anywhere

Employment Contracts

Localised employment contracts

Employer of Record (EOR) in Armenia

Hiring employees in Armenia can be a complicated process with many legal requirements, especially for international businesses. With Native Teams as your Employer of Record partner, you can bypass these challenges. We handle everything from payroll to taxes and admin tasks, so you can focus on your business.

How does an EOR in Armenia work?

Using an EOR in Armenia means you can hire employees without needing to set up a local business or office. We take on the role of the legal employer, managing everything from payroll and taxes to HR tasks.

While Native Teams handles these operational aspects, you remain in control of the work your employees do. We ensure that all legal requirements are met, so you can focus on growing your business while staying compliant with Armenian laws.

Who can use EOR services in Armenia?

Native Teams’ EOR services are perfect for businesses looking to expand into Armenia. This includes global enterprises, startups, and remote teams. Global enterprises seeking to hire internationally without setting up a local entity, startups and SMEs looking to enter the Armenian market without significant overhead, and remote Teams requiring legal employment and compliance management, can use our services in Armenia.

Features of Native Teams EOR services in Armenia

With Native Teams as your Employer of Record, your employees will have the correct legal employment status in Armenia. We provide compliant, locally recognised employment contracts that meet all Armenian legal requirements.

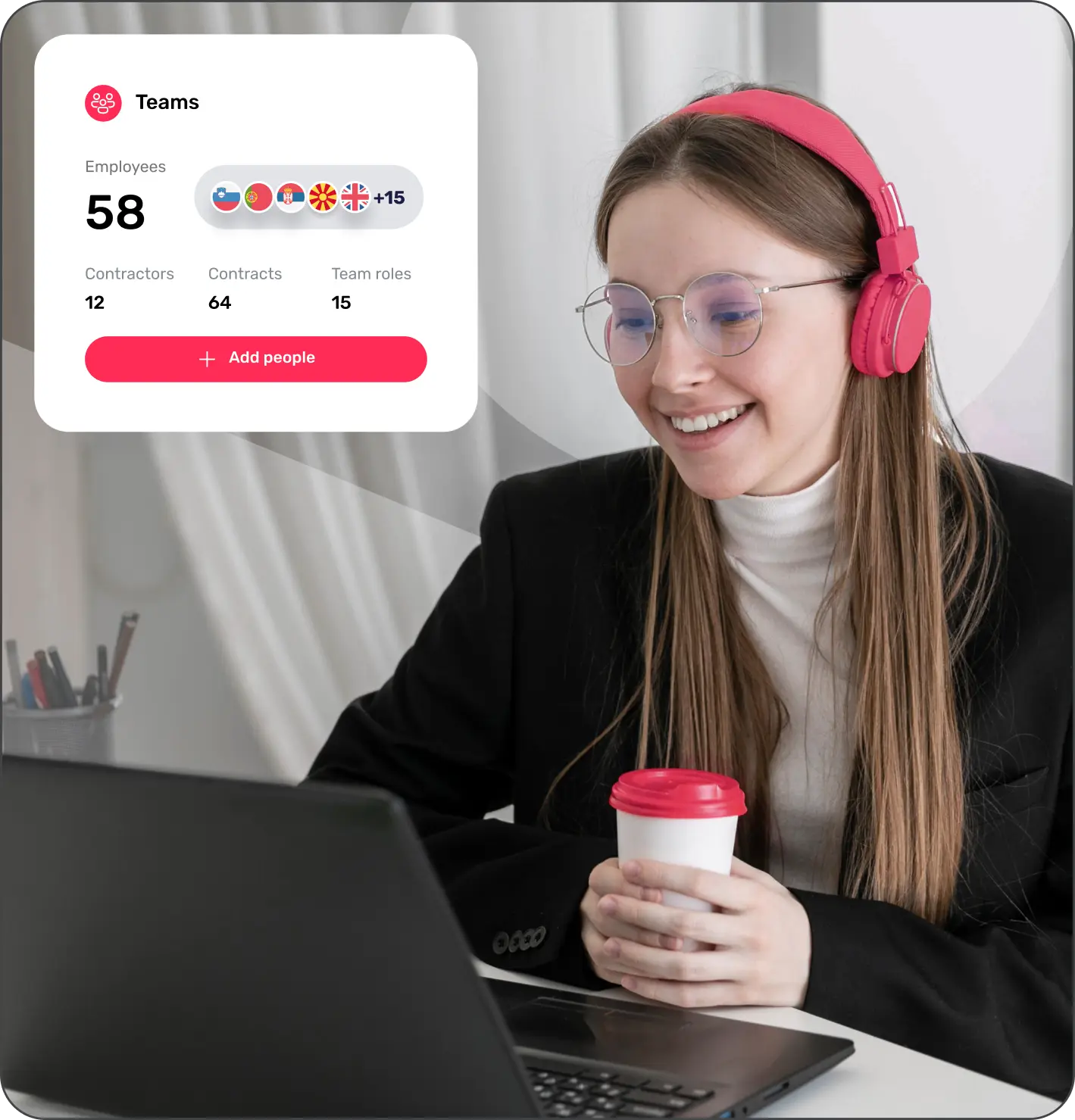

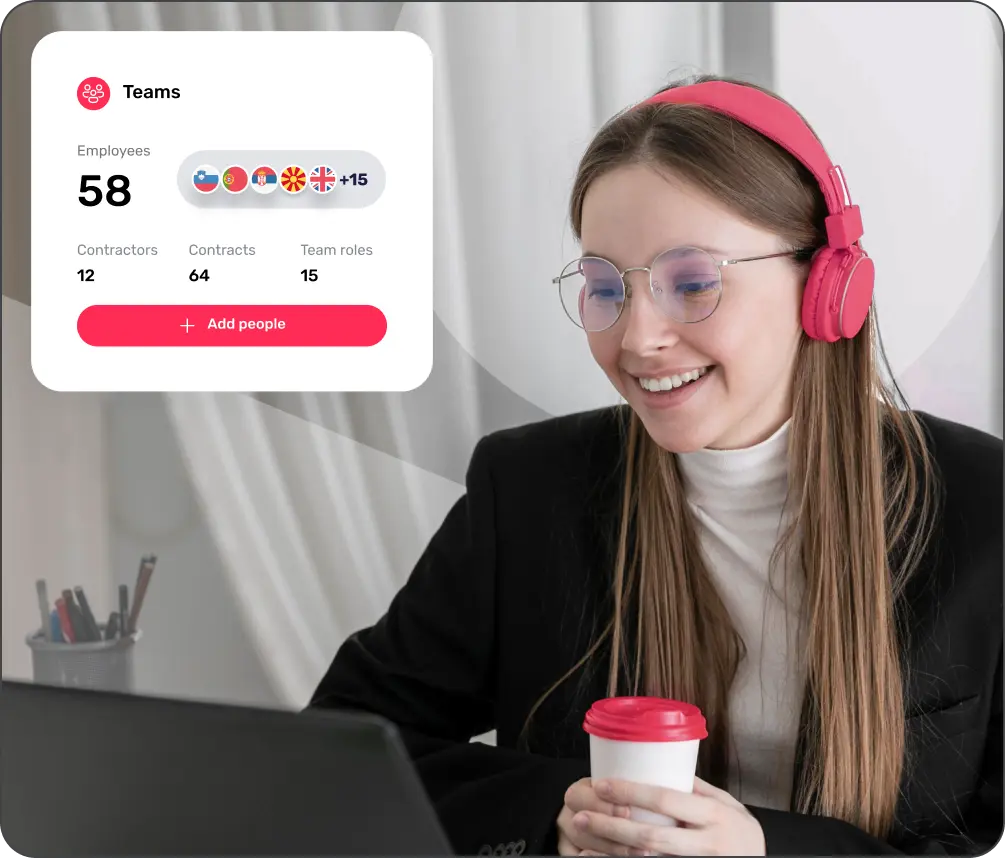

Our centralised platform simplifies HR administration by allowing you to manage documents and employee records in one place. With just a few clicks, you can access and update all HR documents, making the process easy and efficient.

We ensure accurate salary, tax, and benefits processing while keeping everything compliant with local laws. Our country-adjusted payroll calculators for 95+ countries also give you clear cost estimates, helping you plan and budget with confidence.

As part of our EOR services, we manage benefits for your employees in Armenia. This includes mandatory benefits such as health insurance and pensions, as well as additional benefits like wellness programs or coworking space access.

Get insights on local laws, payroll, benefits, and more - all in one place.

What legal requirements exist for employment in Armenia

To hire employees in Armenia, your company must first be legally registered with the relevant local authorities. This includes obtaining the necessary licences and permits required to operate.

Once registered, your business must get a Tax Identification Number (TIN) from the Armenian tax office. This number is essential for all financial transactions, including payroll and tax filings.

Employers are required to issue written employment contracts that clearly outline job responsibilities, working hours, salary details, and employee rights.

Employers must deduct mandatory contributions such as health insurance and pension from employee salaries and submit them to the relevant government bodies.

Employers are responsible for withholding income tax from salaries and paying it to the Armenian tax authorities on behalf of their employees.

Employment contracts must be ended in accordance with Armenian labour law, which includes rules for notice periods and severance pay, where applicable.

Employers must follow all local labour regulations related to wages, working hours, overtime, holidays, and workplace conditions. Regular updates to the law must be monitored to ensure ongoing compliance.

Please note that all these requirements may vary depending on the job type, the employer, and individual circumstances.

Why choose Native Teams as your Armenia Employer of Record?

Native Teams offers a simple and easy solution for hiring in Armenia. We understand the difficulties of local employment laws, taxes, and regulations. With our EOR services, you don’t need to establish a local entity or office, saving you time, money, and effort. Our platform and expertise ensure that your employees in Armenia are paid on time, receive the benefits they are entitled to, and are working under compliant contracts.

By choosing Native Teams, you get access to our global infrastructure and expert team, who will guide you through the legal and tax requirements of Armenia. We handle all the details, so you can focus on your core business operations.

What you need to know?

An Employer of Record (EOR) is a service provider that takes on the legal responsibilities of employment in a specific country. When you partner with an EOR, they become the legal employer of your workforce in that country. They handle employment contracts, payroll, taxes, benefits, and compliance with local laws. This allows you to hire employees in that country without having to establish a local entity or office.

The cost of using an EOR in Armenia can vary depending on several factors, such as the number of employees you need to hire, the services required, and the type of provider. Native Teams provides transparent and flexible pricing. To learn more about our EOR pricing, please visit our pricing page.

A Professional Employer Organisation (PEO) and an Employer of Record (EOR) both offer services that help businesses manage HR tasks like payroll, compliance, and benefits.

However, there is a key difference between the two.

With a PEO, your company and the PEO are considered co-employers. This means you share responsibility for employment matters, and your company must already have a legal entity in the desired country.

On the other hand, an EOR takes full responsibility for the legal aspects of employment, becoming the sole legal employer of your workers. This is ideal for businesses that want to hire employees in a country without having to set up a local entity or deal with co-employment issues.

The EOR is responsible for managing the legal and administrative aspects of employment. This includes ensuring that employment contracts are compliant with local laws, processing payroll, deducting taxes, administering benefits, and ensuring that the company remains in compliance with all relevant labour regulations. The EOR takes on the risk of employment-related compliance, so you don’t have to worry about potential legal issues.

Yes, using an Employer of Record in Armenia is completely legal. Native Teams operates within the bounds of Armenian employment law and ensures full compliance with all legal requirements.

Opening a local office or company in Armenia requires significant investment, including registering your business, setting up an office, hiring legal and tax experts, and ensuring compliance with local laws. This can be a time-consuming and costly process. By using an EOR, you can skip these steps and focus on building your business in Armenia while we handle all the legal and administrative aspects. It’s a faster, more efficient way to expand into a new market.

There is no limit to the number of employees you can hire using our services. Whether you are hiring a few employees or building a larger team, we handle the administrative and compliance tasks, so you can focus on running your business.