Employment

Legal employment for your global team

EOR (Employer of Record)

Your global team, locally employed

Entity Management

Set up and manage entities

HR, Payroll & Benefits

Manage all admin tasks from one place

Global Employee Benefits

Premium benefits for your global team

Relocation and Visa

Relocate your team anywhere

Employment Contracts

Localised employment contracts

Employer of Record (EOR) in Australia

Easily hire and pay employees in Australia – without opening a legal entity. Use Native Teams’ EOR solution to legally employ and pay your team in Australia, stay compliant with local labour laws, and manage everything from contracts to payroll in one place.

How does EOR in Australia work?

With Native Teams as your Employer of Record in Australia, you can hire employees without setting up a local entity. We handle all the legal, HR, and payroll responsibilities, while you manage your team’s day-to-day work.

You select your employee and agree on the terms. Native Teams becomes your legal employer in Australia and drafts compliant employment contracts, onboards your team, runs payroll, and handles taxes and benefits, while you maintain full operational control of your team.

Who can use EOR services in Australia?

Native Teams’ EOR services are ideal for global companies expanding into Australia without setting up a local entity, as well as startups and SMEs that want to test the market with minimal risk.

Contractor outsourcing platforms can use our solution to provide legal employment status and local benefits to workers. Agencies and consultancies that need to hire project-based talent in Australia can also benefit from a fast, compliant employment setup.

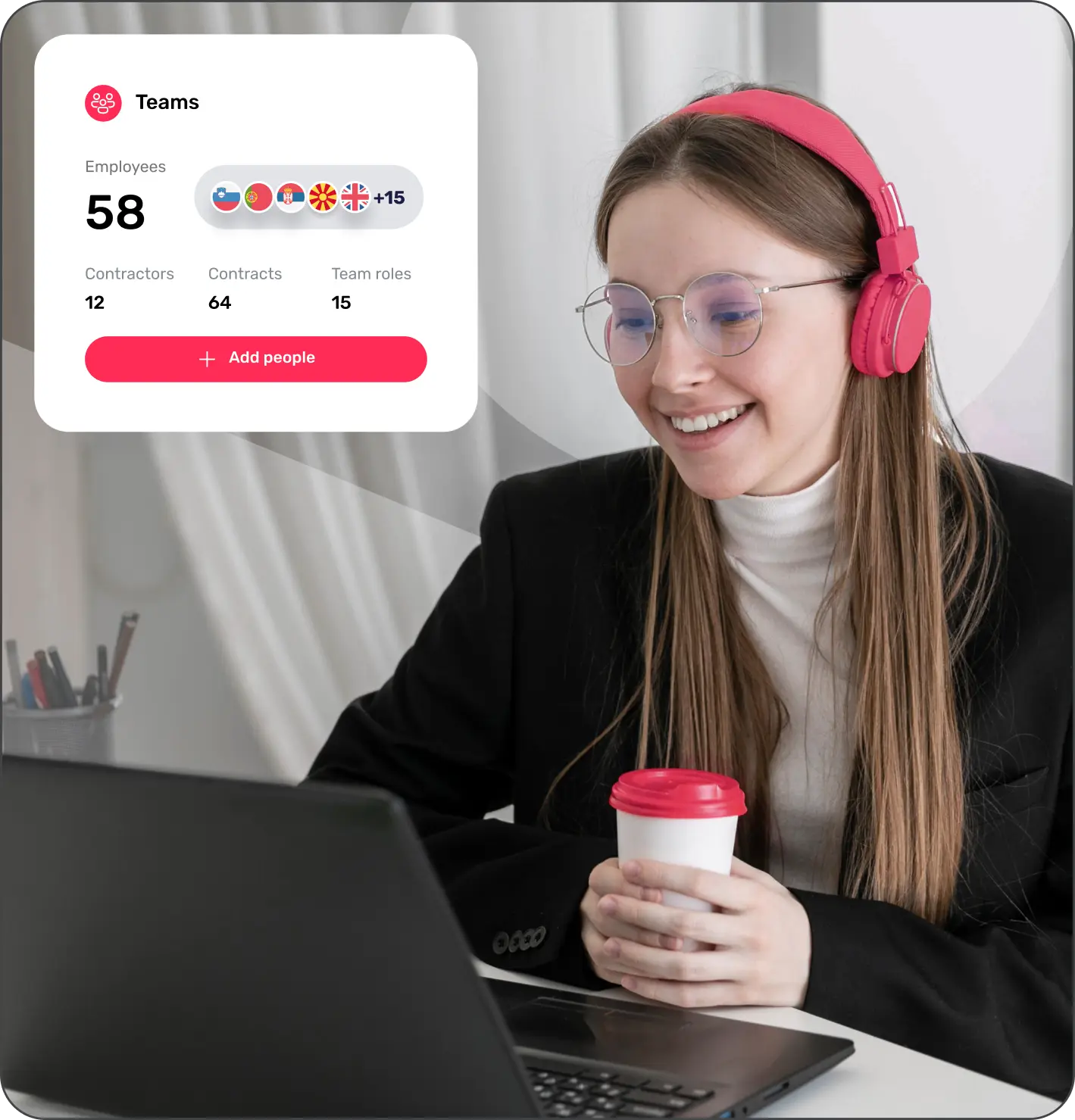

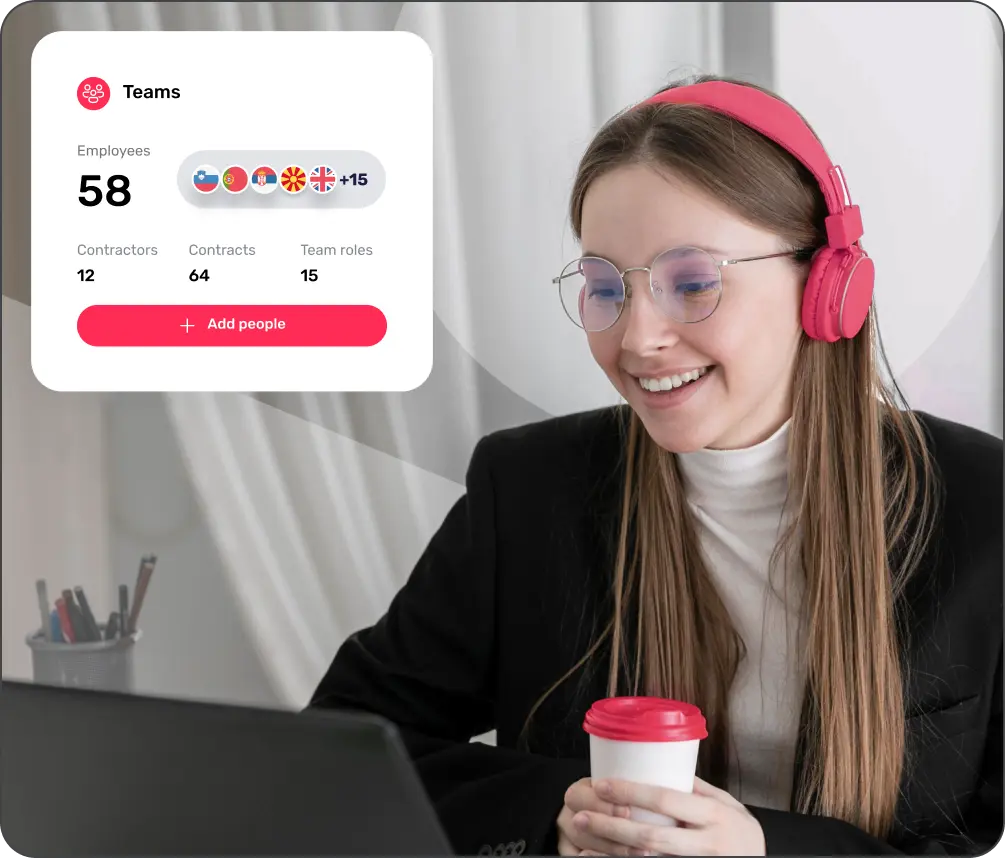

Features of Native Teams’ EOR services in Australia

We hire your employees under Native Teams’ Australian entity, ensuring every contract, benefit, and deduction meets local legal standards. Your employees get the legal employment status and can benefit from it.

Native Teams’ platform automates your HR administration and lets you access everything you need with ease. Within the dashboard, you can find all the necessary documentation for your employees, neatly organised in one place.

Native Teams offers payroll calculators that are adjusted to the payroll, tax, and employment laws in more than 95 countries. Using the platform, every employer can calculate salaries, taxes, benefits, and other mandatory deductions in Australia in just a few clicks.

With Native Teams, employers can offer these mandatory as well as statutory benefits to their employees, allowing them to attract and retain the best talent in Australia and worldwide.

Get insights on local laws, payroll, benefits, and more - all in one place.

What legal requirements exist for employment in Australia

Employers must provide written employment contracts to their employees, outlining terms and conditions of employment, such as wages, hours, and leave entitlements.

Employers must adhere to the Fair Work Act 2009, which sets out minimum employment standards, including National Employment Standards (NES), modern awards, and enterprise agreements.

Employers must pay their employees at least the minimum wage set by the Fair Work Commission. The minimum wage is reviewed annually.

Employers must obtain TFNs from their employees for tax reporting purposes.

Employers must withhold income taxes from their employees' wages and remit them to the Australian Taxation Office (ATO) regularly.

Employers must contribute a percentage of their employees' earnings to a complying superannuation fund or retirement savings account. The current SG rate is 11.5% of ordinary time earnings.

Employers have a duty to provide a safe working environment, comply with WHS laws, and take measures to prevent workplace injuries and illnesses.

Employers must provide employees with paid annual leave, sick leave, and parental leave. They must also comply with provisions for overtime, public holidays, and long service leave.

Please note that all these requirements may vary depending on the job type, the employer and individual circumstances.

Why choose Native Teams as your Australia Employer of Record?

With legal entities in more than 95 countries worldwide, Native Teams’ EOR solutions are recognised for helping companies and individuals expand internationally and work in compliance with laws.

Our tax, legal, and compliance experts will help you understand all the relevant legal requirements for hiring and paying employees, taking care of HR admin, running global payroll, and everything related to administration and compliance while expanding globally.

What you need to know?

An Employer of Record (EOR) is a third-party organisation that handles the legal responsibilities of employing individuals on behalf of another company. An EOR provider takes care of administrative and compliance tasks like employee onboarding, payroll processing, tax withholding, benefits administration, and compliance with local labour laws.

The cost for Employer of Record services in Australia depends on the specific EOR provider, the number of employees you want to onboard, and the scope of services you require.

Check out our pricing page to see which plan works best for your business.

An EOR provider will take over the role of legal employer for your company, meaning they will take full responsibility for employing team members, processing payroll, administering benefits, withholding taxes, and other essential functions. As such, EOR providers are mostly beneficial for companies that want to hire individuals in specific countries but don’t have their own legal entities there.

PEO providers cover only part of these responsibilities, such as HR admin, payroll processing, and benefits administration, while the client company remains the legal employer of the team members. Therefore, PEO providers can be a good option for businesses that have legal entities in every country of hiring but need assistance handling their essential HR responsibilities.

EOR providers’ main responsibility is assuming the role of legal employer for your team members in a specific country. Additionally, the EOR provider is also responsible for processing payroll, drafting employment contracts, administering benefits, handling compliance-related matters, and providing additional HR support if needed.

Yes, using EOR services in Australia is fully legal. In fact, one of the responsibilities of EOR providers is to help you work in compliance with Australian labour laws and regulations so you can hire team members or regulate your employment status in the country without opening a legal entity there.

Opening a company in Australia is a complex and time-consuming process that requires a lot of legal expertise and resources. The process includes registering with the authorities, obtaining a tax number, opening a business bank account, and even finding a physical office space before you can hire anyone from the country.

EOR providers help you skip the complex process and hire more quickly and cost-effectively. The provider will legally employ your new team members and manage payroll, taxes, and benefits for them in full compliance with local labour laws.

There is no specific limit on the number of employees you can hire in Australia or any other country. Using the services of an EOR provider, you can secure legal employment for yourself and employ as many individuals as your business requires.