Employment

Legal employment for your global team

EOR (Employer of Record)

Your global team, locally employed

Entity Management

Set up and manage entities

HR, Payroll & Benefits

Manage all admin tasks from one place

Global Employee Benefits

Premium benefits for your global team

Relocation and Visa

Relocate your team anywhere

Employment Contracts

Localised employment contracts

Employer of Record (EOR) Services in Germany

Native Teams offers hiring and payroll solutions for businesses in Germany looking to expand globally in a compliant manner. We provide fully compliant EOR solutions, helping you focus on your core business without worrying about administration and legal obligations.

How does an EOR in Germany work?

Partnering with an Employer of Record (EOR) like Native Teams enables businesses to expand globally without needing to establish a legal entity or navigate complex regulations. The EOR handles administrative tasks such as payroll, employment contracts, onboarding, and compliance with local laws, while businesses maintain control over employee management.

Who can use EOR services in Germany?

EOR is a great solution for businesses that want to expand their global workforce across borders. Businesses of all sizes, from startups to large corporations, can leverage EOR services in Germany. These services are especially useful for companies expanding into Germany without setting up a legal entity. By partnering with an EOR, companies can hire local employees, handle payroll, and remain compliant with German labour laws efficiently.

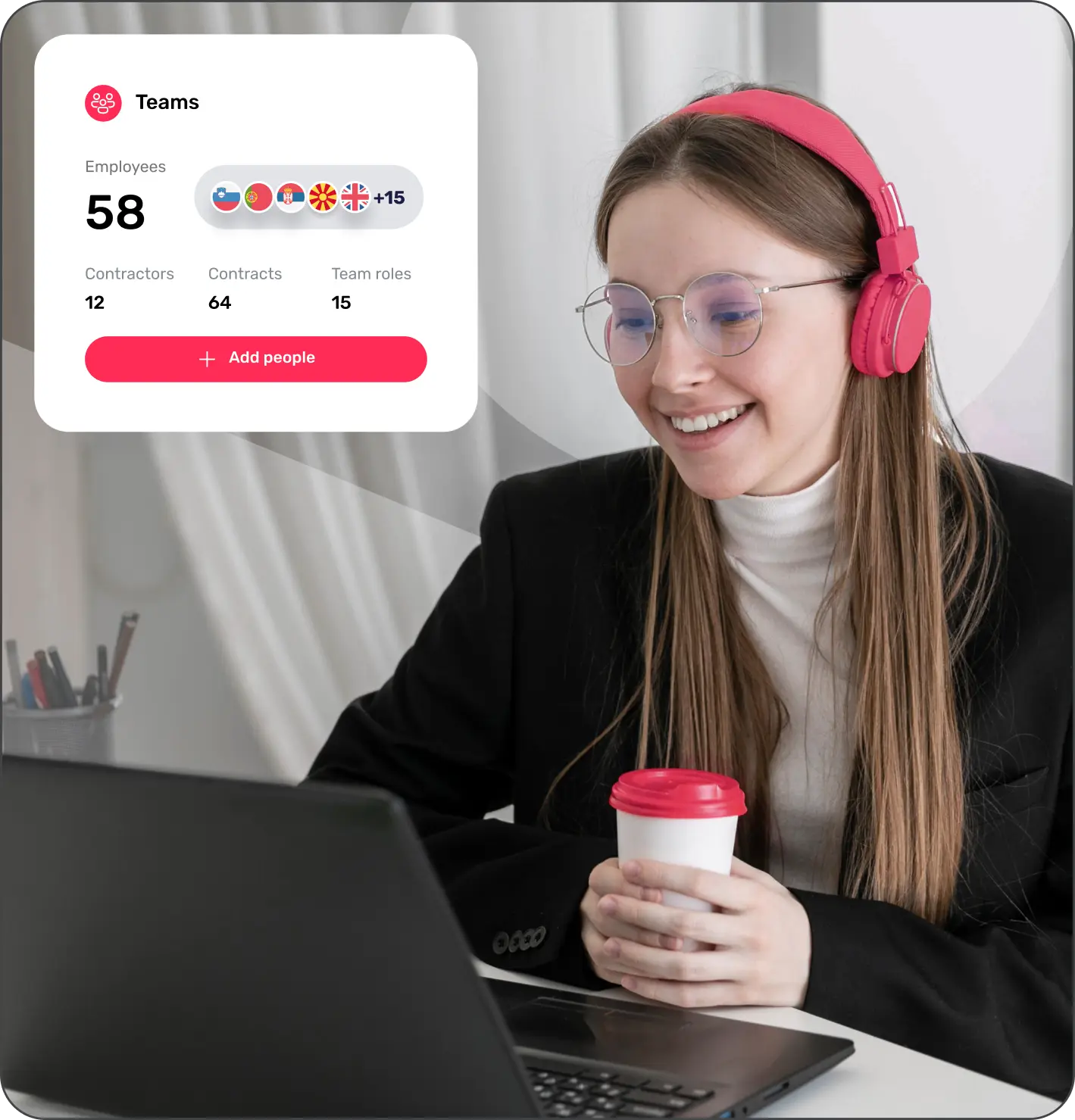

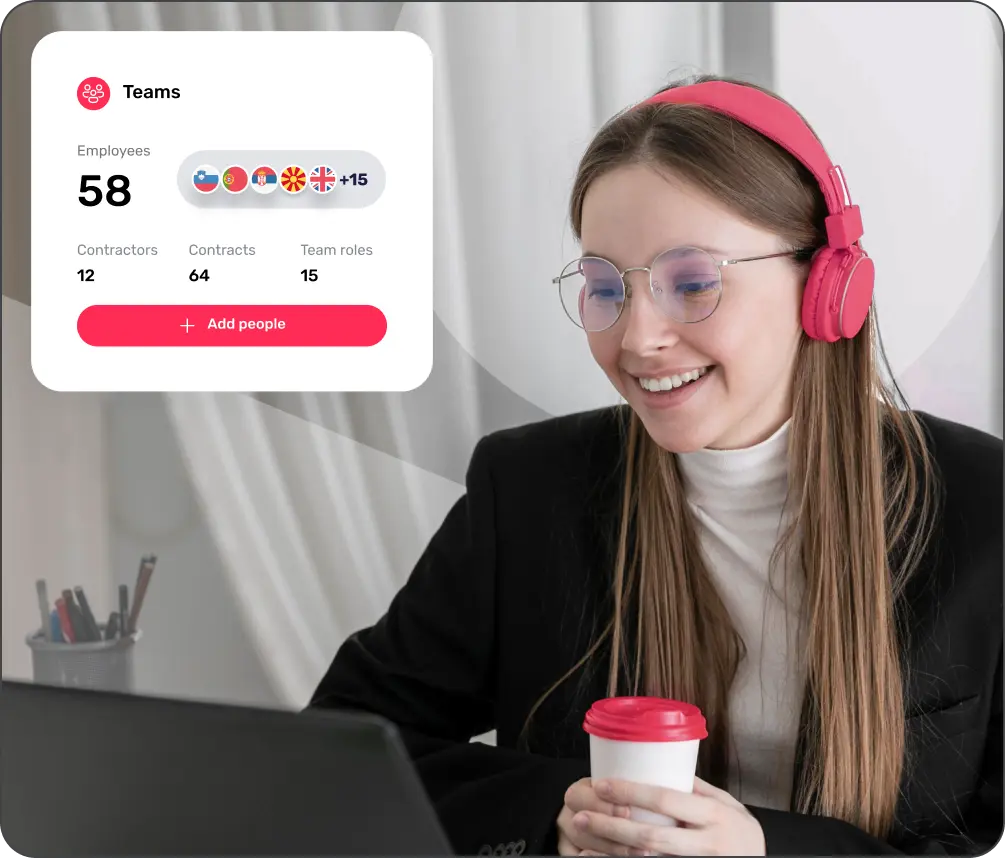

Features of Native Teams EOR Services in Germany

Native Teams EOR allows you to provide local employment status to your employees in Germany. Native Teams’ entity in Germany will let you hire and onboard talents while staying compliant with German labour laws.

HR tasks are automated, with essential documentation accessible in your dashboard with one click.

With a payroll calculator available in over 95 countries, employers can easily pay employees, calculate salaries, taxes, and manage benefits all on one platform.

Employers can offer comprehensive healthcare, lifestyle and more benefits to attract top talent.

Get insights on local laws, payroll, benefits, and more - all in one place.

What legal requirements exist for employment in Germany

Employers must provide a written employment contract to the employee, which outlines the terms and conditions of employment, including job description, working hours, salary, benefits, and notice periods.

Germany has a statutory minimum wage, and employers must ensure that employees are paid at least the minimum wage set by law.

Employers are responsible for deducting social security contributions from the employee's salary and also contributing their share to the social security system. Social security contributions cover health insurance, pension insurance, unemployment insurance, and long-term care insurance.

Employers must withhold income tax from the employee's salary and remit it to the tax authorities on behalf of the employee.

Employers must ensure a safe and healthy working environment for their employees and comply with health and safety regulations.

If hiring non-EU employees, employers must follow immigration and work permit procedures.

Please note that all these requirements may vary depending on the job type, the employer and individual circumstances.

Why choose Native Teams as your Germany Employer of Record?

Native Teams is an all-in-one platform that enables employers to get a locally crafted employment status for their employees and cover social security contributions and taxes. Our team of experts ensures that your global work is aligned with the local labour laws and regulations in Germany. In addition, we offer global mobility services to make the relocation process smooth, so you don’t have to deal with the administrative procedures required for obtaining a visa.

What you need to know?

An Employer of Record (EOR) is a third-party entity that takes on the legal responsibilities of hiring employees on behalf of another company. The EOR provider will handle the administrative and compliance tasks of the client company, including payroll processing, tax withholding, benefits administration, and ensuring the client remains compliant with all local labour laws.

The cost of using an Employer of Record (EOR) in Germany depends on factors such as the provider, employee count, and the required services. Native Teams offers one of the most budget-friendly and transparent pricing options. Check our pricing page to see what we offer for your business.

An EOR takes full legal responsibility for employees, handling payroll, taxes, benefits, and legal compliance. This is ideal for businesses hiring in new regions without needing to set up a legal entity. A PEO, on the other hand, shares employment duties with the client in a co-employment model. While the PEO manages HR functions, the client remains the legal employer and shares responsibility for compliance. PEOs are typically used by companies with a legal presence that want to simplify HR tasks.

An EOR acts as the legal employer, ensuring compliance with local labour laws and handling payroll, benefits, contracts, and the onboarding and offboarding processes. The EOR reduces the client company's liability for employment-related issues, allowing the client to focus on business management while the EOR manages employment complexities.

Yes, using an EOR in Germany is legal and adheres to local labour laws. Many international companies use EOR services to enter the German market. With the help of an EOR provider, every business can comply with hiring team members in Germany.

An EOR saves you time and money by avoiding the complex process of establishing a legal entity in Germany. The EOR handles legal responsibilities, such as payroll, taxes, and compliance, allowing you to get started quickly. If business conditions change, an EOR also offers the flexibility to scale up or down without the complications of closing a legal entity.

There is no legal limit on the number of employees a company or employer can hire in Germany. The number depends on your business needs, financial capacity, and ability to manage employees effectively, whether you hire through a professional Employer of Record (EOR) company or your own company.