Employment

Legal employment for your global team

EOR (Employer of Record)

Your global team, locally employed

Entity Management

Set up and manage entities

HR, Payroll & Benefits

Manage all admin tasks from one place

Global Employee Benefits

Premium benefits for your global team

Relocation and Visa

Relocate your team anywhere

Employment Contracts

Localised employment contracts

Employer of Record (EOR) Services in India

Hire and manage your Indian team without setting up a local entity. With Native Teams’ EOR services, you can legally employ team members in India, compliantly and quickly. We handle all the administrative tasks, from paperwork and contracts to payroll and benefits.

How does an EOR in India work?

As your Employer of Record, Native Teams becomes the legal employer of your team members in India. You maintain full control over their daily responsibilities, while we handle all employment-related tasks, like drafting compliant contracts, registering employees, managing monthly payroll, paying statutory taxes, and offering employee benefits.

Once you choose to hire in India, we take care of onboarding, collecting documentation, and ensuring legal employment through our local legal entity. This means your business can start operating in India in days, not months.

Who can use EOR Services in India?

Native Teams’ EOR services in India are ideal for international companies looking to hire full-time or contract employees without setting up a local entity. They're also a great fit for startups and SMEs testing the Indian market, large enterprises managing distributed teams, and contractor outsourcing companies that need to ensure compliant employment for their local partners.

Features of Native Teams EOR services in India

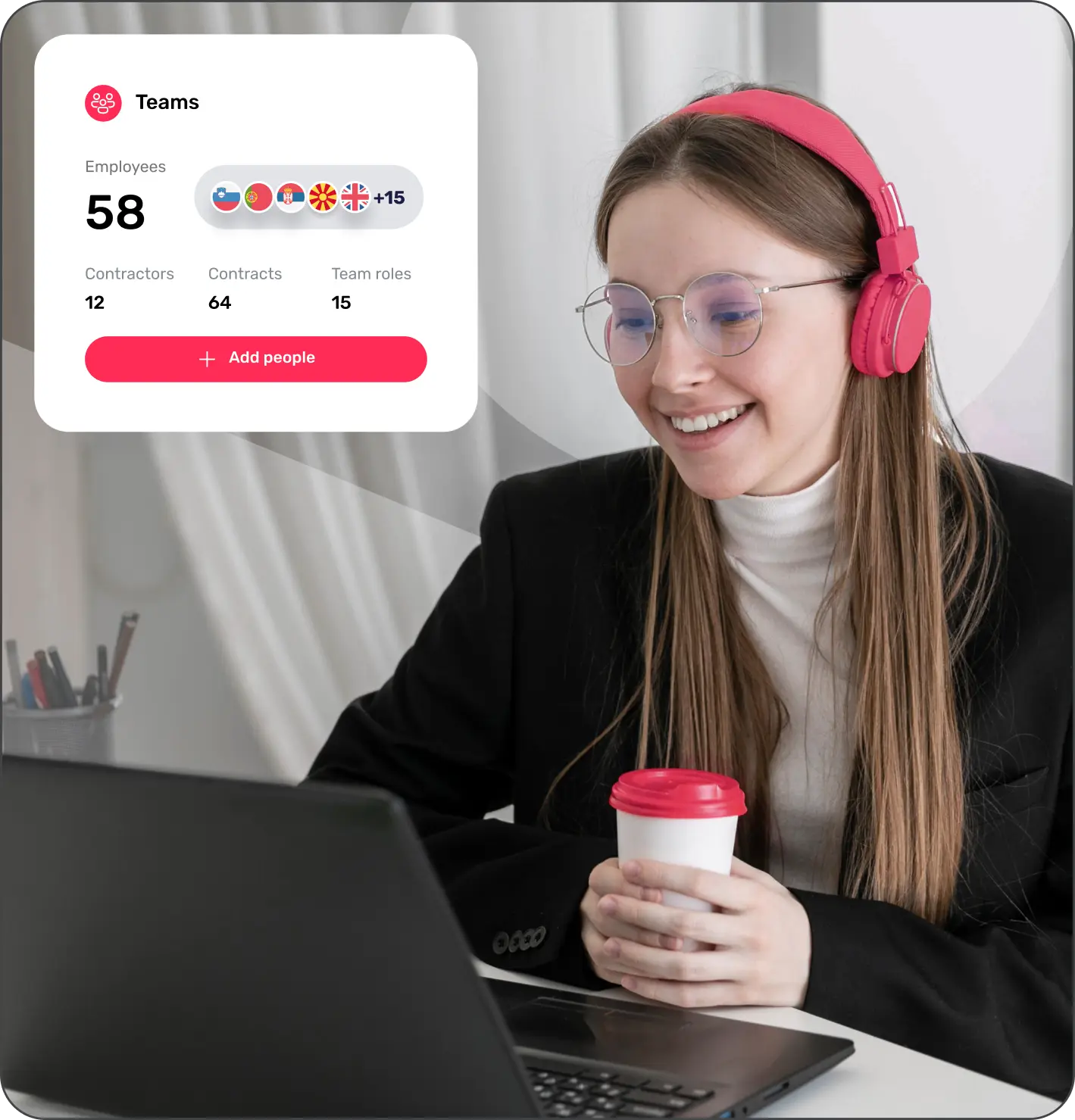

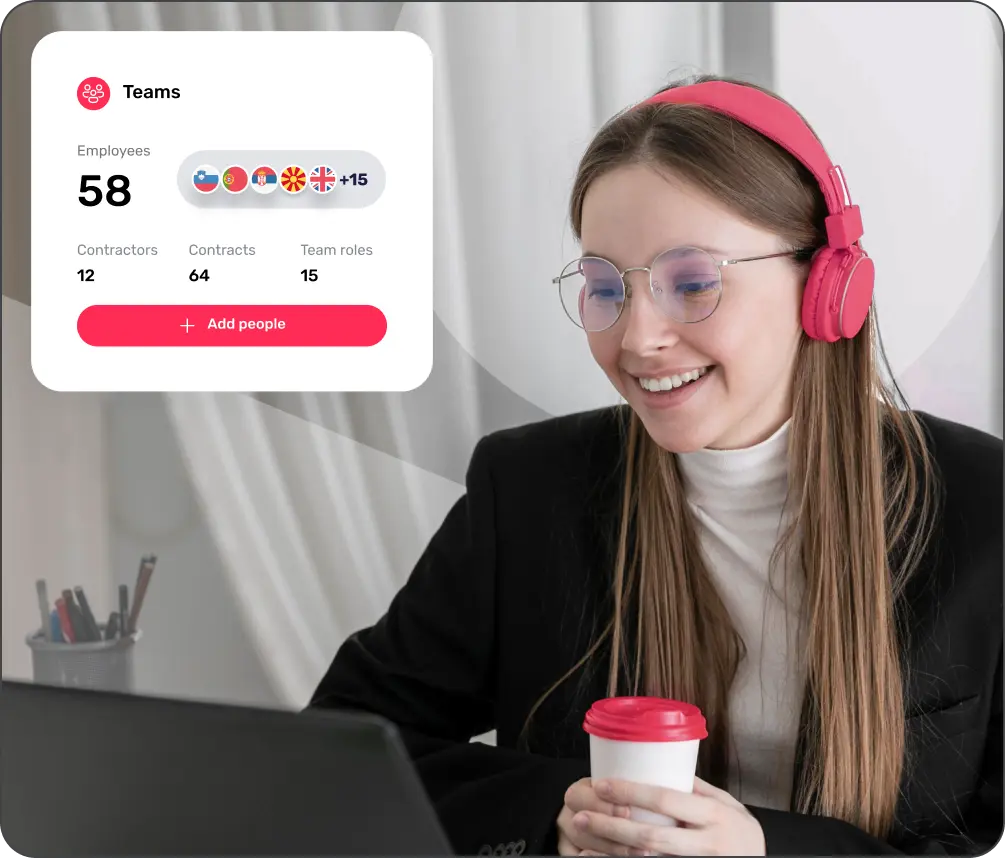

Native Teams enables you to provide your team members with legal employment status in India, without setting up a local entity. We take care of all the legal, admin, and tax-related tasks so your business can run smoothly while your team enjoys the security of formal employment.

Our platform automates HR administration and centralises all documentation in a single place, giving you the flexibility of accessing anything you need with just one click.

With our payroll calculators adapted to 95+ countries, both freelancers and employers can calculate salaries, taxes, benefits, and other deductions in India.

Native Teams will ensure that you receive all the perks of regular employment, including healthcare, insurance, and pension. Employers can also offer these benefits, allowing them to attract and retain the best global talent.

Get insights on local laws, payroll, benefits, and more - all in one place.

What legal requirements exist for employment in India

Employers in India are obligated to provide a contract or a written agreement to define duties, obligations, and terms of employment.

Foreign employers and employees might need a certain type of visa or a work permit to operate in India.

Employers in India need to submit social security taxes, including those for pension, health insurance, and gratuity contributions.

Employers in India also need to submit income taxes for their employees based on their income levels.

Foreign and local employers in India need to comply with employees’ rights against discrimination, minimum wage, probation period, working hours, and others.

Please note that all these requirements may vary depending on the job type, the employer and individual circumstances.

Why choose Native Teams as your India Employer of Record?

With an established global presence in 95+ countries, Native Teams has been recognised for its outstanding EOR services, helping companies expand and hire globally.

Our teams of tax, legal, and compliance experts will help you hire and pay team members in compliance with Indian labour laws, as well as take care of administrative tasks such as HR admin, payroll, risk management, and more.

What you need to know?

An Employer of Record (EOR) is a third-party organisation that legally employs your workforce in a given country on your behalf. You manage the day-to-day tasks and team performance, while the EOR takes on all legal responsibilities, like issuing contracts, running payroll, and handling taxes. EORs allow companies to expand into new markets without opening a branch or subsidiary.

The costs for EOR services in India can be different, depending on the specific provider, the number of employees, and the scope of services required.

As an EOR provider trusted by global companies in 95+ countries, Native Teams provides a flexible pricing structure that is customised per your unique business needs. To know more about our EOR pricing structure, please visit our pricing page.

An EOR provider’s main responsibility is acting as the legal employer for your team members in their residential countries. Your employees will be legally employed through the EOR’s legal entities in the country, which includes handling the administration of employee benefits, providing employment contracts, and taking over onboarding/offboarding processes.

EOR providers are also responsible for processing payroll, handling employment-related matters, ensuring compliance with local labour laws, and providing additional HR support if needed. This allows the client company to focus on managing its most important business functions while the EOR handles all the employment-related tasks.

An EOR provider’s main responsibility is acting as the legal employer for your team members in their residential countries. Your employees will be legally employed through the EOR’s legal entities in the country, which includes handling the administration of employee benefits, providing employment contracts, and taking over onboarding/offboarding processes.

EOR providers are also responsible for processing payroll, handling employment-related matters, ensuring compliance with local labour laws, and providing additional HR support if needed. This allows the client company to focus on managing its most important business functions while the EOR handles all the employment-related tasks.

Yes, using an EOR is fully legal in India. EOR providers like Native Teams operate under Indian labour law and are recognised by government agencies. We follow all local regulations related to tax, benefits, social security, and contracts, so you can hire safely and confidently.

Setting up a company in India takes time, legal support, and upfront investment. You’ll need to register with multiple government bodies, manage compliance, hire legal counsel, and appoint directors.

By using an EOR, you can start hiring in days, not months. We take care of all compliance, HR, and legal responsibilities, so you can access Indian talent quickly and without risk, ideal for pilot teams, remote hiring, or new market entry.

There is no specific limit on the number of employees you can hire in India or any other country. When using the services of an EOR provider, you can secure legal employment for yourself and employ as many individuals as your business requires.