Employment

Legal employment for your global team

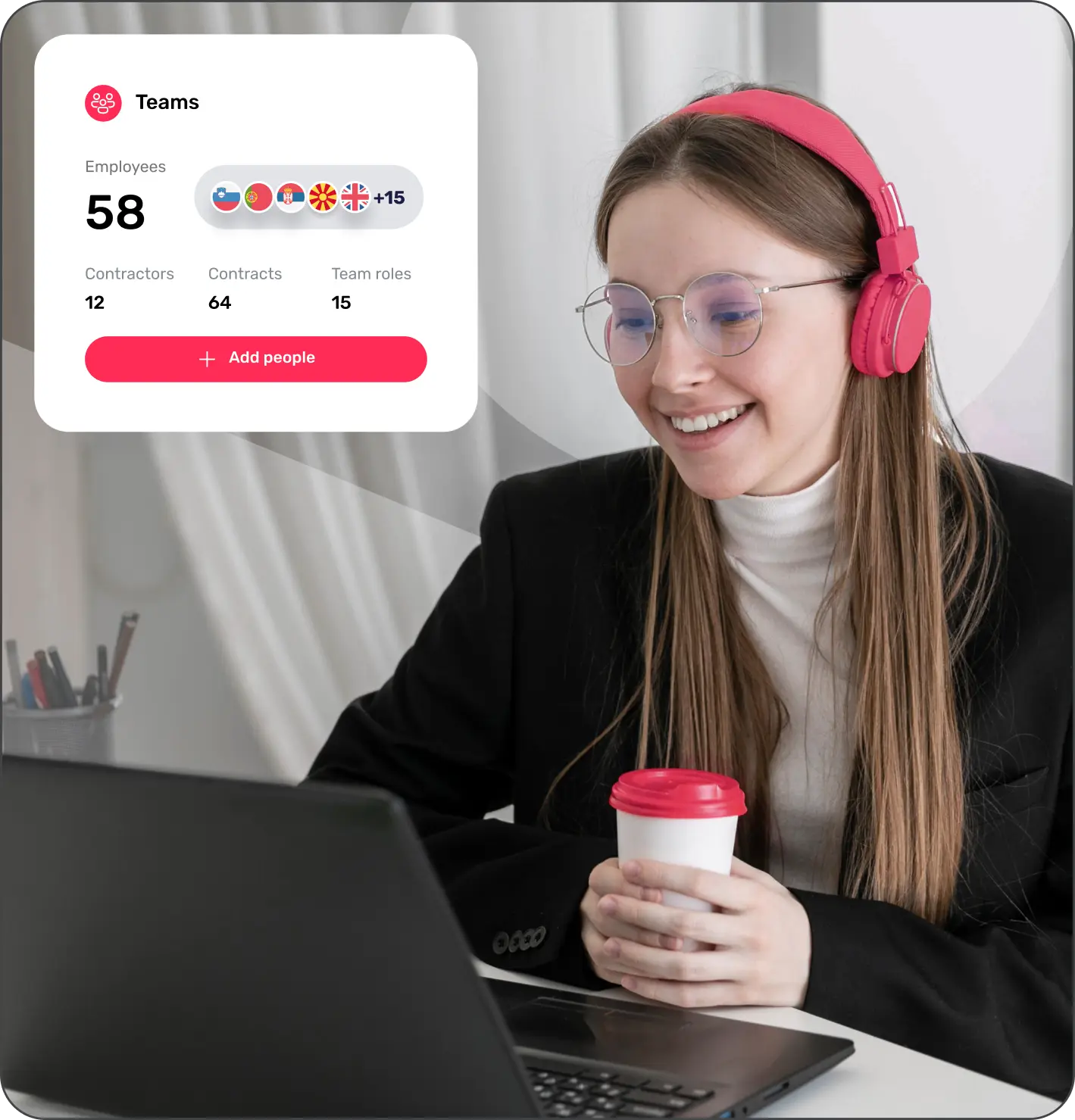

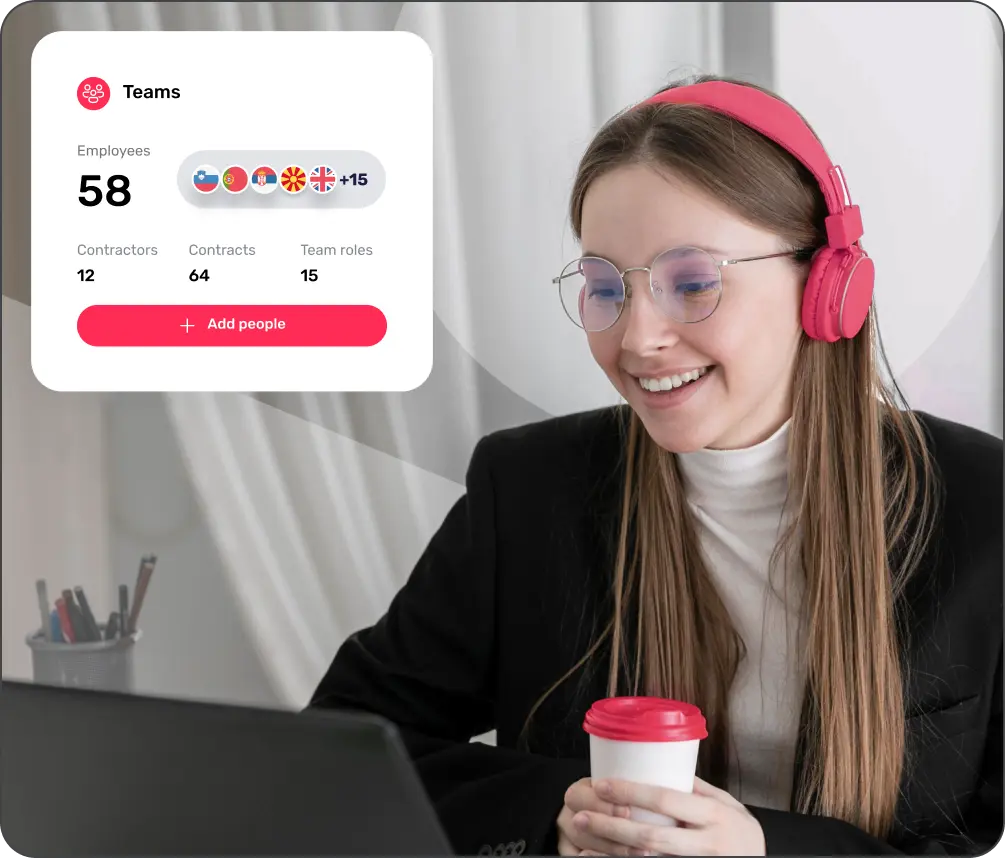

EOR (Employer of Record)

Your global team, locally employed

Entity Management

Set up and manage entities

HR, Payroll & Benefits

Manage all admin tasks from one place

Global Employee Benefits

Premium benefits for your global team

Relocation and Visa

Relocate your team anywhere

Employment Contracts

Localised employment contracts

Employer of Record (EOR) in Italy

Employer of Record Service in Italy provides businesses the opportunity to hire employees, pay them compliantly, create payroll and manage HR tasks without any issues in Italy. Whether you are a startup or an international company, Native Teams is here to help with comprehensive EOR services.

How does an EOR in Italy work?

By partnering up with an EOR provider like Native Teams in Italy, you can expand your business anywhere in the world without opening your legal entities or worrying about compliance. Your EOR provider will take care of all the most time-consuming tasks, including processing payroll, drafting employment contracts, onboarding your new hires, and ensuring compliance with local labour laws. At the same time, you continue to manage your employees on a daily basis.

Who can use EOR services in Italy?

Native Teams can help you hire team members from Italy, whether you’re a startup, a small company, or a large enterprise.

With our EOR solutions, you can skip the complex process of opening your own legal entity to hire individuals from Italy. Instead, Native Teams will handle the entire employment management process, including providing employment contracts, processing payroll for your employees, and ensuring compliance with all local employment laws.

Features of Native Teams’ EOR services in Italy

Employers can hire, onboard, and pay their team members in Italy compliantly without having to set up a company in the country.

Our simplified platform will automate your HR administration and provide all the necessary documentation you need for compliance. With Native Teams, you can access everything you need with just a few simple clicks.

With Native Teams’ payroll calculator, which is adapted to 95+ countries’ labour laws, you can easily calculate salaries, taxes, benefits, and other deductions in Italy.

With Native Teams, employers can offer all the perks of regular employment, including healthcare, insurance, and a pension, while working with their clients. This allows them to attract and retain the best global talent.

Get insights on local laws, payroll, benefits, and more - all in one place.

What legal requirements exist for employment in Italy

Italian employment laws require having a registered company before hiring employees in the country.

After registering a company, employers must register with the Italian social security authorities and obtain a tax identification number.

Italian labour laws require employees to be provided with an employment contract to define the key terms of the arrangement. Employment contracts in Italy can be either permanent or temporary.

Employers in Italy are obligated to withhold social security contributions for healthcare, pension, and unemployment benefits from the gross salaries of their employees and remit them to the National Institute for Social Security.

Employers are also responsible for withholding and remitting income tax to the country’s tax authorities on behalf of their employees.

Italian labour laws impose requirements regarding minimum wages, benefits, working hours, notice periods, and termination of employment. Employers need to understand and abide by these requirements to stay compliant.

Please note that all these requirements may vary depending on the job type, the employer, and individual circumstances.

Why choose Native Teams as your Italy Employer of Record?

With legal entities in more than 95 countries worldwide, Native Teams helps local and global companies hire and expand their international workforce.

Our professional teams of tax and legal experts will help you comply with all the legal requirements for hiring and paying your Italian employees while also taking care of tasks such as HR admin, employment management, payroll, tax compliance, and more.

What you need to know?

An Employer of Record (EOR) is a service provider that takes over the legal responsibility of employing team members on behalf of another company. An EOR provider will handle the administrative and compliance tasks of the client company, including payroll processing, tax withholding, benefits administration, and ensuring the client remains compliant with all local labour laws.

The costs of using an EOR in Italy can vary depending on factors such as the specific EOR provider, the number of employees, and the services the client company requires. As an EOR provider that operates in 95+ countries worldwide, Native Teams is recognised for its flexible and transparent pricing structure, which can be completely adjusted to fit your unique business needs.

Every global business can get an all-in-one solution for hiring and onboarding team members with Native Teams, including the whole management of the employment process in compliance with Italian labour laws. Check our pricing page to see what we offer for your business.

An EOR provider will assume the role of legal employer for your company, which includes the full responsibility for hiring employees, managing payroll, administering benefits, and withholding taxes. As such, EOR providers are primarily beneficial for companies that want to employ individuals from different countries but do not have a legal entity in the country of employment.

PEO providers cover only part of these responsibilities, including HR tasks such as payroll and benefits administration. The client company remains the legal employer of the new hires while sharing the responsibility for employment management and compliance with the PEO provider. As such, PEO providers are beneficial for businesses that have their legal entity in the country of employment but need expert help to manage their employment and HR operations.

The main responsibility of an EOR provider is to assume the role of the legal employer for your team members in a certain country. This means that your team members will be formally employed through the legal entity of the EOR provider in the specific country. The EOR provider will also take care of benefits administration, employment contracts, payroll, onboarding and offboarding processes, compliance with local laws, and other core functions.

In simple terms, an EOR provider takes over all the administrative and compliance tasks of employment management and provides additional HR support if needed.

Yes, using Employer of Record services in Italy is completely legal. In fact, the main responsibility of EORs, like Native Teams, is to help individuals and businesses stay compliant with local labour laws while handling their employment management. With the help of an EOR provider, every company can comply with hiring team members and manage payroll and HR issues in a legal manner.

Establishing your own company in Italy is a complex and lengthy process that requires resources and legal expertise. The establishment process includes administrative procedures such as company registration with the authorities, obtaining a tax identification number, opening a business bank account, and sometimes even renting a physical office for your business.

EOR providers eliminate this complex process and help you establish your business presence in Italy more quickly and cost-effectively. With Native Teams as your EOR, you can employ any individual through our legal entities in Italy and have your payroll, taxes, and employee benefits handled without worrying about local compliance.

In simple words, EOR providers offer the required expertise and infrastructure to hire in Italy, so you can save time and money and focus on your core business duties.

There is no specific limit on the number of employees you can hire in Italy or any other country. With Native Teams’ EOR solutions, you can easily secure legal employment for yourself and employ as many individuals as your business requires.