Employment

Legal employment for your global team

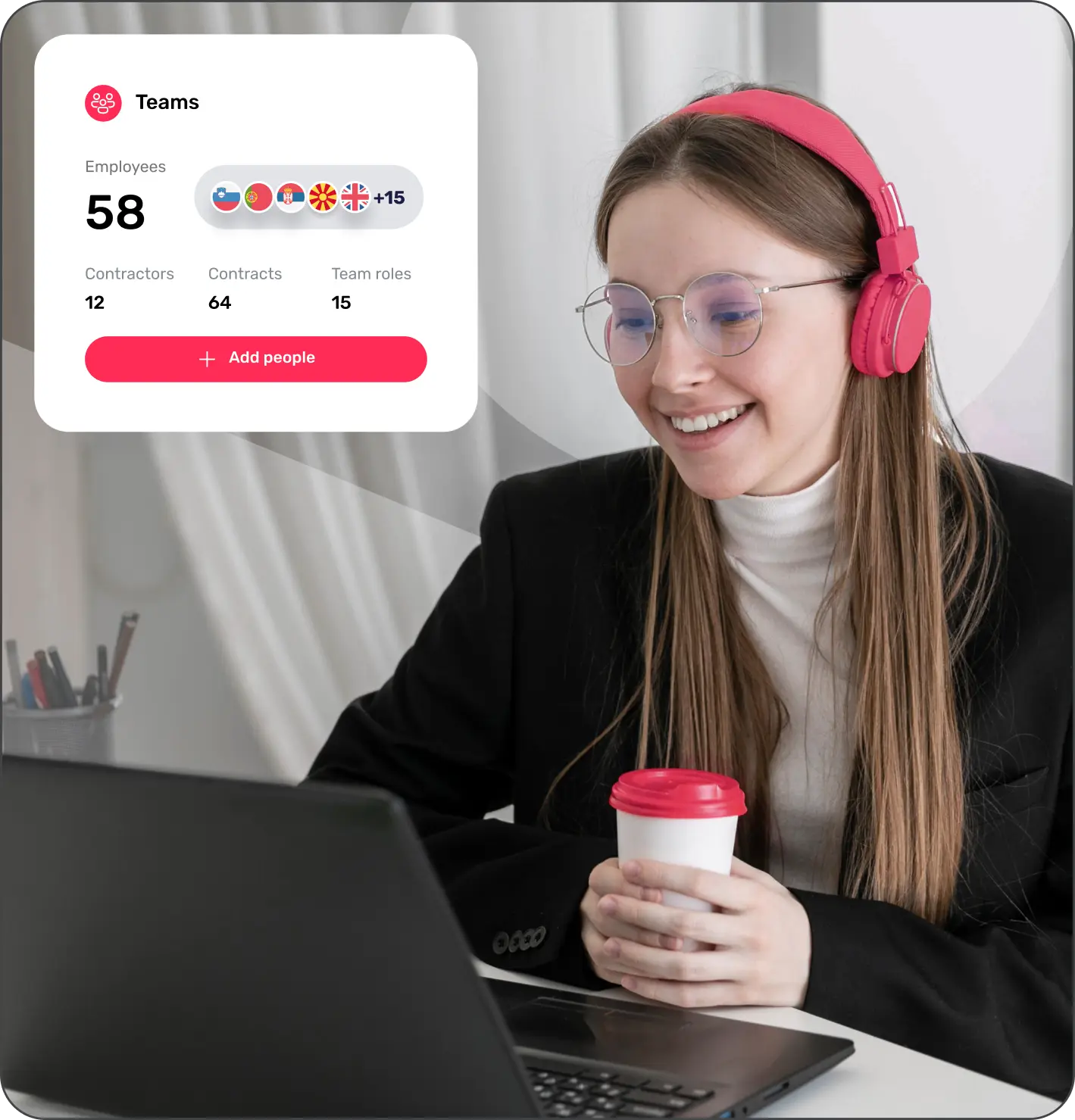

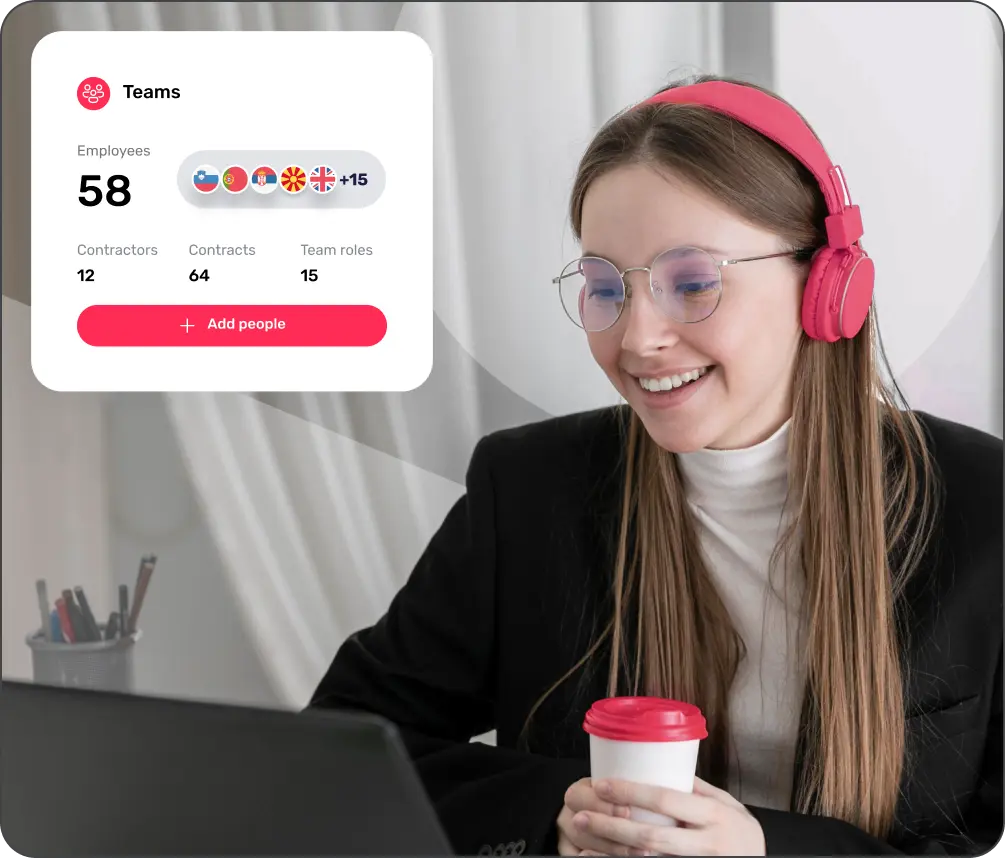

EOR (Employer of Record)

Your global team, locally employed

Entity Management

Set up and manage entities

HR, Payroll & Benefits

Manage all admin tasks from one place

Global Employee Benefits

Premium benefits for your global team

Relocation and Visa

Relocate your team anywhere

Employment Contracts

Localised employment contracts

Employer of Record (EOR) in Kenya

With Native Teams as your Employer of Record in Kenya, you can onboard employees, run compliant payroll, and manage taxes, all through one central platform. We take care of the legal complexities so you can focus on growing your business.

How does an EOR in Kenya work?

When you hire through Native Teams, we become the legal employer of your staff in Kenya, while you retain full control over their day-to-day work. We handle all the administrative and legal responsibilities of employment, including drafting locally compliant contracts, managing monthly payroll, paying mandatory taxes and contributions, and offering statutory benefits.

You won’t need to open a Kenyan entity or set up a payroll system from scratch. We act as the legal bridge between your business and your Kenyan employees, ensuring that everything is compliant with Kenyan employment laws.

Who can use EOR services in Kenya?

EOR services in Kenya are ideal for businesses looking to hire employees in Kenya without establishing a legal entity. Whether you’re an international company exploring new markets or a regional firm expanding your footprint, our EOR solution allows you to hire legally and efficiently.

Features of Native Teams EOR services in Kenya

When you bring on board new team members via Native Teams, they will be appropriately engaged under our organisation and provided with a contract that complies with all employment laws and regulations in Kenya.

We will simplify HR administration through automation and store your employees' paperwork within the Native Teams dashboard, giving you immediate access with just one click.

Calculating salaries, taxes, benefits, and various deductions for your international staff can be challenging. Our payroll calculators will simplify this process, allowing you to manage payroll for your entire global workforce on a unified platform.

Your newly recruited employee will be eligible to receive all mandatory benefits in Kenya, including healthcare, insurance, and retirement coverage. Additionally, you have the choice to offer additional benefits such as gym memberships and wellness options if desired!

Get insights on local laws, payroll, benefits, and more - all in one place.

What legal requirements exist for employment in Kenya

Employers must provide their employees with a written employment contract in English or Swahili outlining the employment conditions and salary.

Pay As You Earn (PAYE) is a compulsory tax imposed on the earnings of all employees by the Kenya Revenue Authority (KRA). Employers are legally required to deduct PAYE from employees' salaries and wages according to the current rates. These deductions must then be submitted to the KRA in full by the 9th day of the subsequent month.

Employers are obliged to contribute towards their employees’ social security contributions. In Kenya, the employer must contribute 6% of the employee’s monthly earnings to the National Social Security Fund (NSSF).

Foreign individuals are only permitted to work in Kenya if they possess a valid work permit or pass issued by the Department of Immigration. Different categories of work permits are available, each tailored to the type of work undertaken by foreign nationals. Among these, Class D is commonly sought by foreign employees.

Employers must ensure workplace safety and health standards are met to protect employees from hazards and accidents.

This Act mandates employers to provide compensation to employees who suffer work-related injuries or occupational diseases.

Employers must register with the National Hospital Insurance Fund and contribute towards employees' access to healthcare benefits.

Please note that Kenya’s laws and regulations can change. So, it’s important to keep abreast of the latest developments regarding labour law.

Why choose Native Teams as your Kenya Employer of Record?

With Native Teams, you gain a reliable partner that ensures full legal compliance when hiring in Kenya. Our global infrastructure spans over 95 countries, and our EOR solution is trusted by thousands of companies to streamline hiring, payroll, and workforce management abroad.

By choosing Native Teams, you can avoid the risks of non-compliance, benefit from accurate and on-time payroll, and rest assured that all employment regulations in Kenya are being followed. Our legal experts stay up to date with the latest legislative changes, so you don’t have to.

What you need to know?

An Employer of Record (EOR) is a third-party service provider that legally employs workers on your behalf in a foreign country. While your company manages the employee’s responsibilities and workload, the EOR manages contracts, payroll, tax deductions, benefits, and compliance with local laws. This model allows companies to expand globally without setting up a local legal entity.

The cost of EOR services in Kenya depends on the provider, the size of your team, and the specific services you require. Native Teams offers one of the most transparent and cost-effective pricing models in the industry. To know more about our EOR pricing structure, please visit our pricing page.

A Professional Employer Organisation (PEO) shares employer responsibilities with your company through a co-employment model, which typically requires your business to have a legal entity in the country.

An Employer of Record (EOR), on the other hand, becomes the sole legal employer of your team in that country, removing the need for a local entity. For companies without an existing presence in Kenya, EOR services are more suitable and provide faster market access.

An EOR takes on the legal employer role in the host country, managing all employment responsibilities on your behalf. This includes issuing compliant employment contracts, handling payroll and taxes, administering benefits, and ensuring full legal compliance with local labour laws. The EOR also assumes liability for employment-related risks, giving your business added protection.

Yes, working with an Employer of Record in Kenya is fully legal and widely used by international businesses hiring remote employees or expanding into the Kenyan market. EORs operate under Kenyan labour law and are authorised to employ staff locally on behalf of foreign companies.

Setting up a legal entity in Kenya can be time-consuming, costly, and resource-intensive. You’ll need to register your business, open local bank accounts, hire legal and HR teams, and stay compliant with evolving local regulations.

An EOR eliminates these challenges by enabling you to hire employees quickly and compliantly through their local entity. It’s an ideal solution for companies that want to enter the market fast or scale their operations without long-term commitments.

There’s no legal limit to how many employees a company can hire in Kenya, as long as you comply with employment laws and can manage your workforce effectively.