Employment

Legal employment for your global team

EOR (Employer of Record)

Your global team, locally employed

Entity Management

Set up and manage entities

HR, Payroll & Benefits

Manage all admin tasks from one place

Global Employee Benefits

Premium benefits for your global team

Relocation and Visa

Relocate your team anywhere

Employment Contracts

Localised employment contracts

Employer of Record (EOR) in the Philippines

Easily hire employees in the Philippines without establishing a local business entity. Native Teams simplifies expanding your workforce internationally by handling local laws, taxes, and payroll management. Focus on growing your business while we ensure compliance.

How does an EOR in the Philippines work?

For companies looking to expand into the Philippines, partnering with an Employer of Record (EOR) provides a streamlined and fully compliant solution, without the need to establish a local legal entity. The EOR becomes the legal employer of your workforce, handling all employment-related administrative tasks such as onboarding, payroll processing, employment contracts, and compliance with Philippine labour laws. While the EOR manages these back-office responsibilities, your business maintains complete control over day-to-day operations, task delegation, and performance management of your local team.

By using EOR services, businesses can fast-track market entry, reduce overhead costs, and eliminate the risks associated with navigating local employment regulations alone. This allows companies to focus on growth and talent development rather than administrative burden.

Who can use EOR Services in the Philippines?

Employer of Record services are particularly well-suited for businesses of all sizes looking to establish a presence in the Philippines quickly and compliantly. Whether a startup exploring new markets or an established enterprise building out regional operations, companies can rely on an EOR to navigate the legal framework of employment in the country. By leveraging an EOR, businesses gain immediate access to the local workforce without the need to register a subsidiary, open a local bank account, or manage in-country HR processes.

This approach not only ensures adherence to all applicable labour and tax laws but also streamlines hiring and onboarding, reducing the administrative burden that typically comes with international expansion. In short, EOR services enable businesses to scale efficiently in the Philippines while fully complying with local regulations.

Features of Native Teams EOR Services in the Philippines

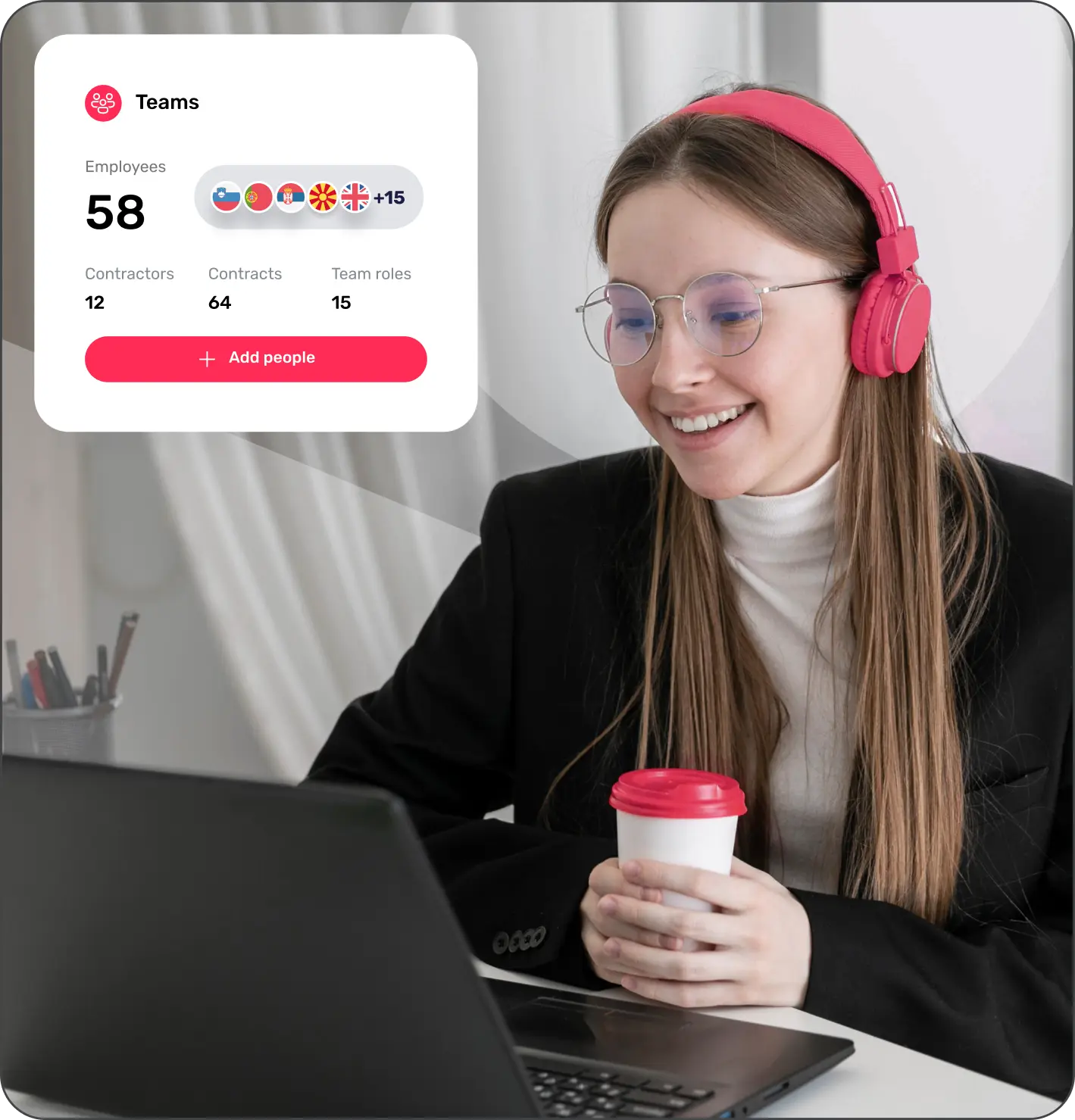

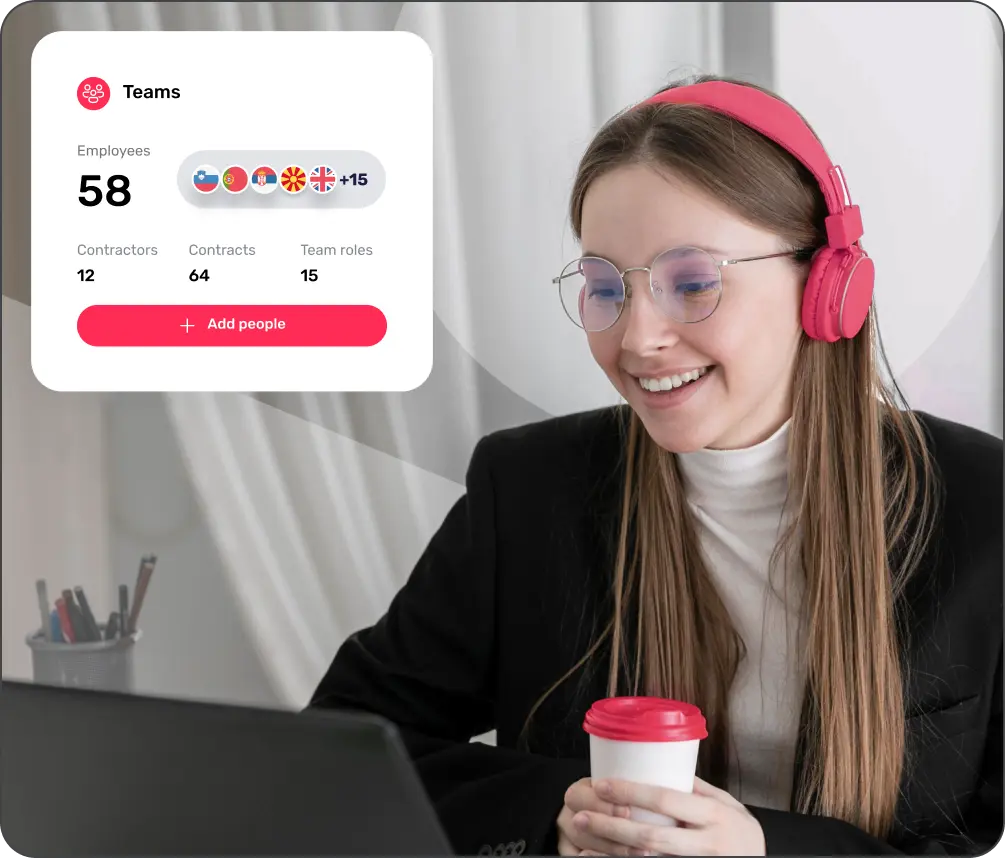

With Native Teams’ Employer of Record services, businesses can manage the employment status of their international team members, regardless of where they live or work. This enables companies to legally and compliantly hire, onboard, and pay their global workforce without setting up local entities.

All HR-related administration is handled through a fully automated system, significantly reducing the operational burden on internal teams. Native Teams provides businesses with all necessary employment documentation, from contracts to compliance paperwork, directly through a centralised dashboard. With one-click access, employers can easily retrieve, review, and manage essential documents, ensuring transparency and efficiency across the entire employment lifecycle.

Managing payroll across multiple countries is simplified through Native Teams’ unified platform. With a payroll calculator available in more than 95 countries, employers can accurately calculate salaries, taxes, benefits, and deductions in line with local laws. This functionality enables businesses to manage their entire global payroll in one place, streamlining operations and reducing the risk of errors or non-compliance.

Through Native Teams, businesses can offer their international employees employment benefits, including access to healthcare, insurance, and pension schemes. These benefits, typically reserved for locally hired staff, can now be extended to remote and international teams, helping companies attract top talent and improve retention. By combining flexibility with formal employment advantages, businesses can build more sustainable and competitive global teams.

Get insights on local laws, payroll, benefits, and more - all in one place.

What legal requirements exist for employment in the Philippines

Employers must provide a written employment contract outlining essential details such as job responsibilities, salary, working hours, benefits, and termination conditions. Contracts can be permanent, fixed-term, or project-based, depending on the nature of employment.

Employers must register employees with government-mandated agencies, including the Social Security System (SSS), PhilHealth and Pag-IBIG Fund. Employers must deduct contributions from employees' salaries and make additional contributions on their behalf.

Employers must withhold and remit income tax to the Bureau of Internal Revenue (BIR) based on the progressive tax system. They must also submit regular tax filings and ensure compliance with payroll regulations.

Foreign nationals seeking employment in the Philippines generally require a 9(G) Pre-arranged Employment Visa and an Alien Employment Permit (AEP) issued by the Department of Labor and Employment (DOLE). Employers are responsible for sponsoring these permits and ensuring compliance with immigration laws.

Employers must comply with workplace safety regulations under the Occupational Safety and Health Standards (OSHS). This includes ensuring a safe work environment, providing necessary protective equipment, and conducting regular risk assessments.

In addition to mandatory social security contributions, employers often provide additional benefits such as private health insurance, allowances, and bonuses to attract and retain employees.

Please note that specific legal requirements may vary depending on the industry, job type, and employee status.

Why choose Native Teams as your Philippines Employer of Record?

Expanding into the Philippines can be complex due to its labour laws, tax regulations, and administrative requirements. Native Teams simplifies this process by managing all legal and employment responsibilities, allowing you to focus on growing your business without the need to establish a local entity.

With legal entities in over 95+ countries, Native Teams has extensive experience handling cross-border employment. Our in-depth knowledge of Philippine labour laws ensures full compliance with payroll, taxes, social security contributions, and employee benefits. By choosing Native Teams as your Philippines Employer of Record, you reduce costs, administrative burdens, and legal risks associated with hiring in a new market.

What you need to know?

An Employer of Record (EOR) is a third-party provider that officially employs workers on behalf of a company, handling all legal and administrative employment responsibilities. This includes managing payroll, tax compliance, social security contributions, employee benefits, and ensuring adherence to local labour laws. With an EOR, businesses can hire employees in new markets without the need to establish a local legal entity.

The cost of using an Employer of Record (EOR) in the Philippines depends on the provider, the number of employees, and the services required. Native Teams offers competitive pricing designed to meet your employment needs. To learn more about our plans and pricing, visit our pricing page.

The main difference between a Professional Employer Organisation (PEO) and an Employer of Record (EOR) is their legal responsibilities and employment structures.

An EOR acts as the legal employer on behalf of a company, managing payroll, tax compliance, benefits administration, and ensuring complete adherence to local labour laws. This makes it an ideal solution for businesses looking to expand into a new country without setting up a local entity.

In contrast, a PEO operates under a co-employment model, where it handles HR functions such as payroll and benefits. Still, the client company remains the legal employer and shares compliance responsibilities. PEO services are best suited for companies that already have a legal entity in the country and need support in managing their workforce.

An Employer of Record (EOR) takes on the legal and administrative responsibilities of employing workers on behalf of a company, ensuring compliance with local employment laws. Key responsibilities include payroll management, tax and compliance, employment contracts, benefits administration, onboarding and offboarding, work permits and visas, and risk and liability management. By managing these tasks, an EOR enables businesses to focus on their core operations while expanding into new markets without the complexities of local entity setup.

Yes, using an Employer of Record (EOR) in the Philippines is completely legal and a recognised employment solution for businesses looking to hire local talent without establishing a legal entity. EOR providers fully comply with Philippine labour laws, handling payroll, tax obligations, social security contributions, and employment contracts on behalf of companies.

Setting up a legal entity in the Philippines can be a complex, time-consuming, and costly process, requiring company registration, compliance with local regulations, and ongoing administrative management. Using an Employer of Record (EOR) offers a faster, more efficient, and cost-effective alternative for hiring in the country.

An EOR eliminates the need to establish a local entity, as it acts as the legal employer on your behalf. This means you can hire employees immediately while the EOR handles payroll, tax compliance, social security contributions, and adherence to Philippine labour laws. Additionally, an EOR reduces legal risks, ensuring full compliance with employment regulations and avoiding potential fines and legal complications.

There is no legal limit to the number of employees a company can hire in the Philippines through an Employer of Record (EOR). Whether you need to hire a single employee or an entire team, an EOR allows you to scale your workforce based on your business needs.