Employment

Legal employment for your global team

EOR (Employer of Record)

Your global team, locally employed

Entity Management

Set up and manage entities

HR, Payroll & Benefits

Manage all admin tasks from one place

Global Employee Benefits

Premium benefits for your global team

Relocation and Visa

Relocate your team anywhere

Employment Contracts

Localised employment contracts

Employer of Record (EOR) in Romania

Our Romania EOR solution enables your business to hire employees legally and efficiently, even without a Romanian entity. Once you’ve selected your candidate, Native Teams handles employment contracts, local compliance, tax registration, monthly payroll, and benefits. You maintain day-to-day oversight while we handle the admin.

How does an EOR in Romania work?

Our Romania EOR solution enables your business to hire employees legally and efficiently, even without a Romanian entity. Once you’ve selected your candidate, Native Teams handles employment contracts, local compliance, tax registration, monthly payroll, and benefits. You maintain day-to-day oversight while we handle the admin.

Who can use EOR services in Romania?

Whether you’re a startup testing a new market, a global company expanding your reach, or a remote-first business looking to hire the best talent in Romania, our EOR service is built to scale with your goals. Our all-inclusive EOR solution allows you to hire individuals from Romania without the need to establish your legal entity or worry about providing employment contracts, processing payroll, and complying with local employment laws.

Features of Native Teams EOR services in Romania

When hiring through Native Teams, your new employee will be properly employed through our entity and will receive a contract following all the employment laws and regulations of Romania.

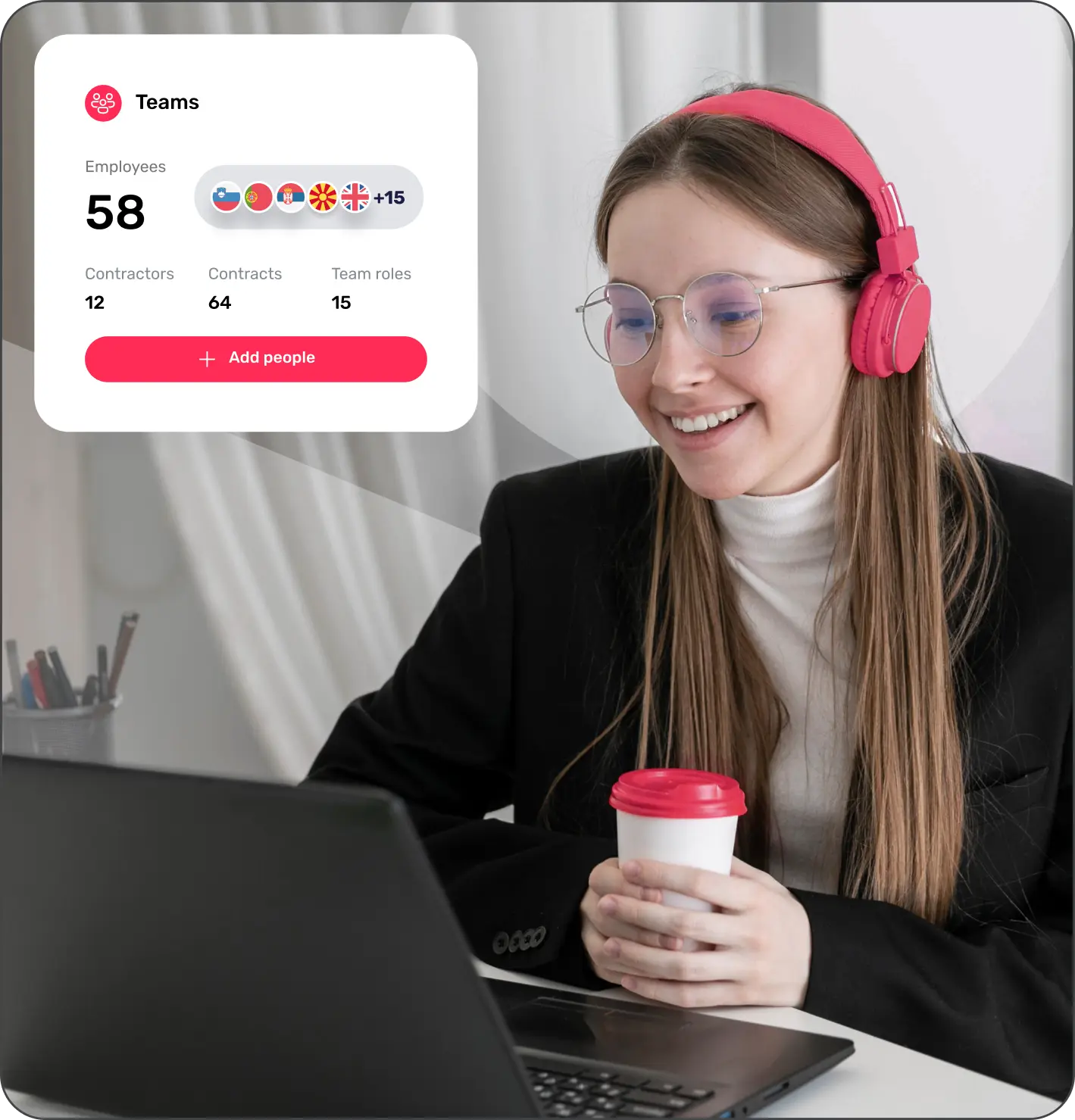

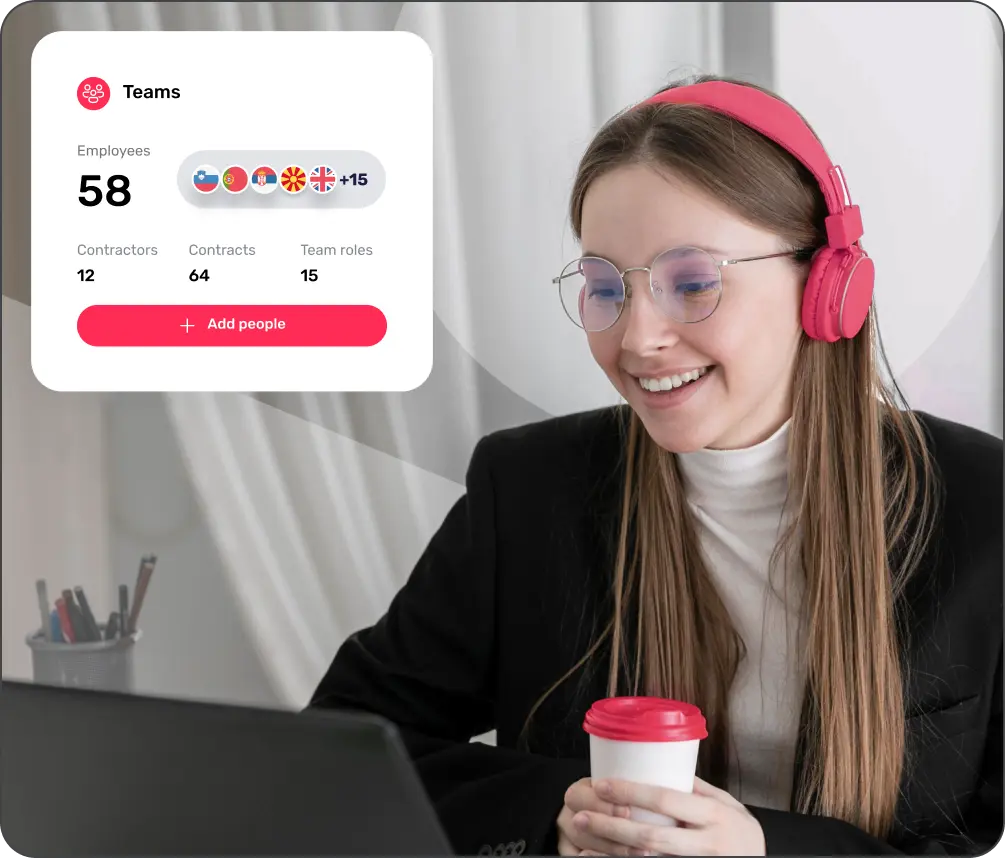

We will automate all the HR administration and keep the documentation of all your global employees in your Native Teams dashboard, allowing you to access everything with one click.

Calculating salaries, taxes, benefits, and other deductions for your global workforce can be daunting. Our payroll calculators simplify the process and allow you to manage payroll for all employees on a single platform.

We'll ensure that your new employee receives all mandatory benefits, such as healthcare, insurance, and pension. Additionally, you can offer them extra benefits like gym memberships and wellness options!

Get insights on local laws, payroll, benefits, and more - all in one place.

What legal requirements exist for employment in Romania

The employer must provide a written employment contract for the employee and include the terms and conditions of employment.

Non-EU citizens require a work permit to work in Romania, which has to be obtained before they can legally work in the country.

Employers must make social security contributions on behalf of their employees to the National House of Public Pensions and the National Health Insurance Fund.

Employers must follow Romanian labour laws, which provide minimum wage, working hours, overtime rules, holiday and leave entitlements, and other employment-related regulations.

The income earned by employees is subject to personal income tax, which is levied at a flat rate of 10%.

Both employees and employers must make social security contributions. The employee's contribution is 25% of the gross salary, while the employer's contribution is 2.25% of the gross salary.

Employers must deduct taxes and social security contributions from employee salaries and submit the payments to the relevant tax and social security authorities. Employers must also issue a monthly payslip to each employee and provide an annual tax certificate.

Please note that Romanian laws and regulations can change. So, it’s important to keep abreast of the latest developments regarding labour law.

Why choose Native Teams as your Romania Employer of Record?

Native Teams has legal entities in 95+ countries worldwide and is recognised for its outstanding EOR services, helping companies expand and hire internationally. Our tax, legal and compliance experts will help you comply with all the legal requirements for hiring and paying your employees and take care of all your administrative tasks, such as HR admin, payroll, risk management and more.

What you need to know?

An Employer of Record (EOR) is a third-party service provider that legally employs your workers on your behalf. While you manage daily work responsibilities, an EOR provider will take over administrative and compliance tasks, such as payroll processing, tax withholding, benefits administration, and compliance with all the local labour laws.

The costs for using an Employer of Record may differ due to provider services and countries, and typically include a monthly fee per employee, which covers administrative services, payroll processing, and compliance. Additional expenses may apply depending on benefits, taxes, or customised support needs.

As an EOR provider trusted by global companies in 95+ countries, Native Teams offers a flexible and transparent pricing structure, depending on your unique business needs. Check our pricing page to see what we offer for your business.

An EOR takes on full responsibility for legal employment matters like payroll, taxes, and compliance, whereas a PEO shares these responsibilities in a co-employment model with the client. EORs are ideal for companies expanding into new regions without setting up a legal entity, while PEOs are better for businesses already operating in a country to optimise HR functions.

EOR providers act as the legal employer, managing payroll, benefits, and employment contracts while ensuring compliance with labour laws. They mitigate risks by assuming liability for employment-related issues and offer HR support, enabling businesses to concentrate on their operations.

Yes, it is entirely legal. Native Teams acts as the official employer in Romania, meeting all regulatory requirements for hiring, taxation, and social contributions.

An EOR allows companies to avoid the complexities of setting up a legal entity in Romania. The EOR handles tasks like payroll and compliance and offers the flexibility to scale operations without the difficulties of dissolving a company if plans change.

There is no legal cap on the number of employees a company can hire in Romania as long as labour laws are followed. The number of employees you can hire depends on your business needs, financial capacity, and the ability to manage your workforce effectively.