Employment

Legal employment for your global team

EOR (Employer of Record)

Your global team, locally employed

Entity Management

Set up and manage entities

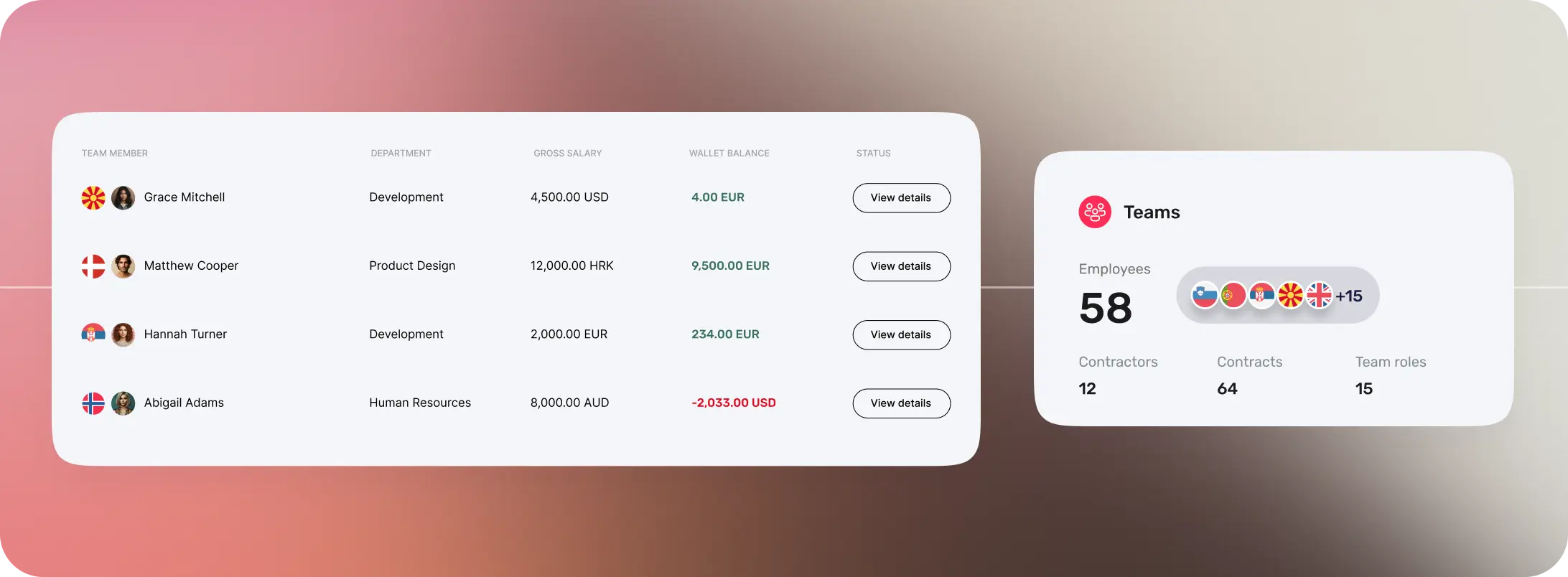

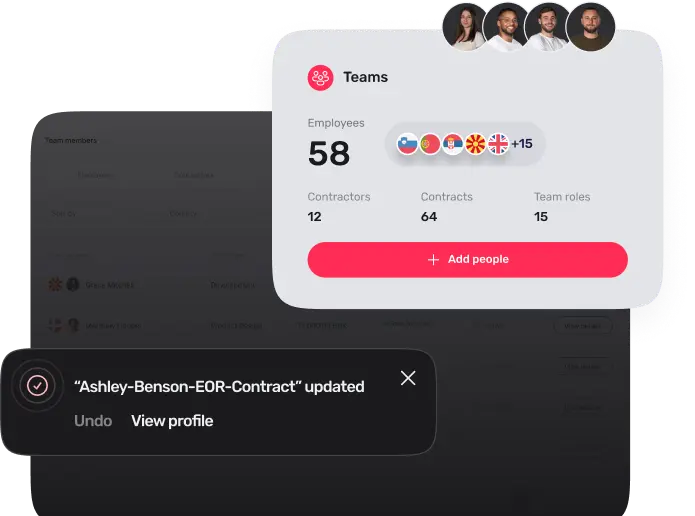

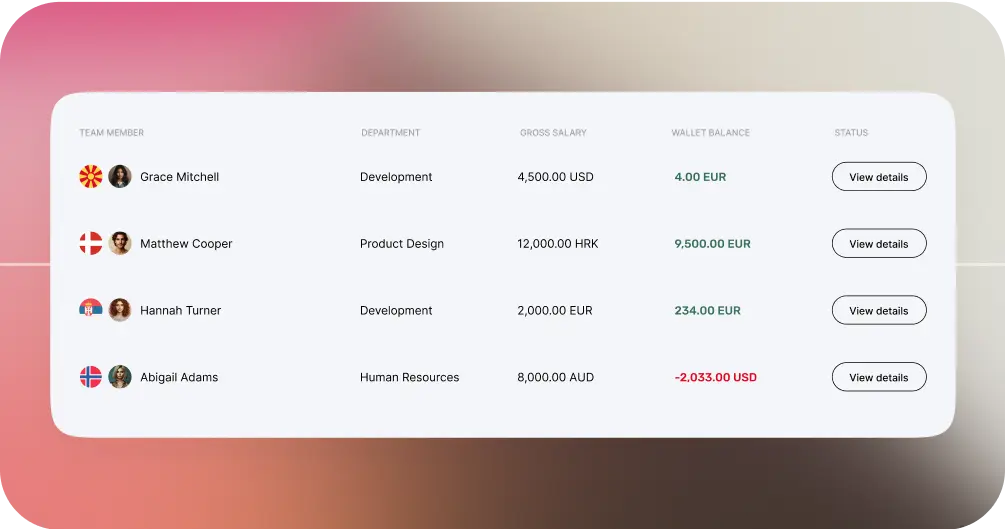

HR, Payroll & Benefits

Manage all admin tasks from one place

Global Employee Benefits

Premium benefits for your global team

Relocation and Visa

Relocate your team anywhere

Employment Contracts

Localised employment contracts

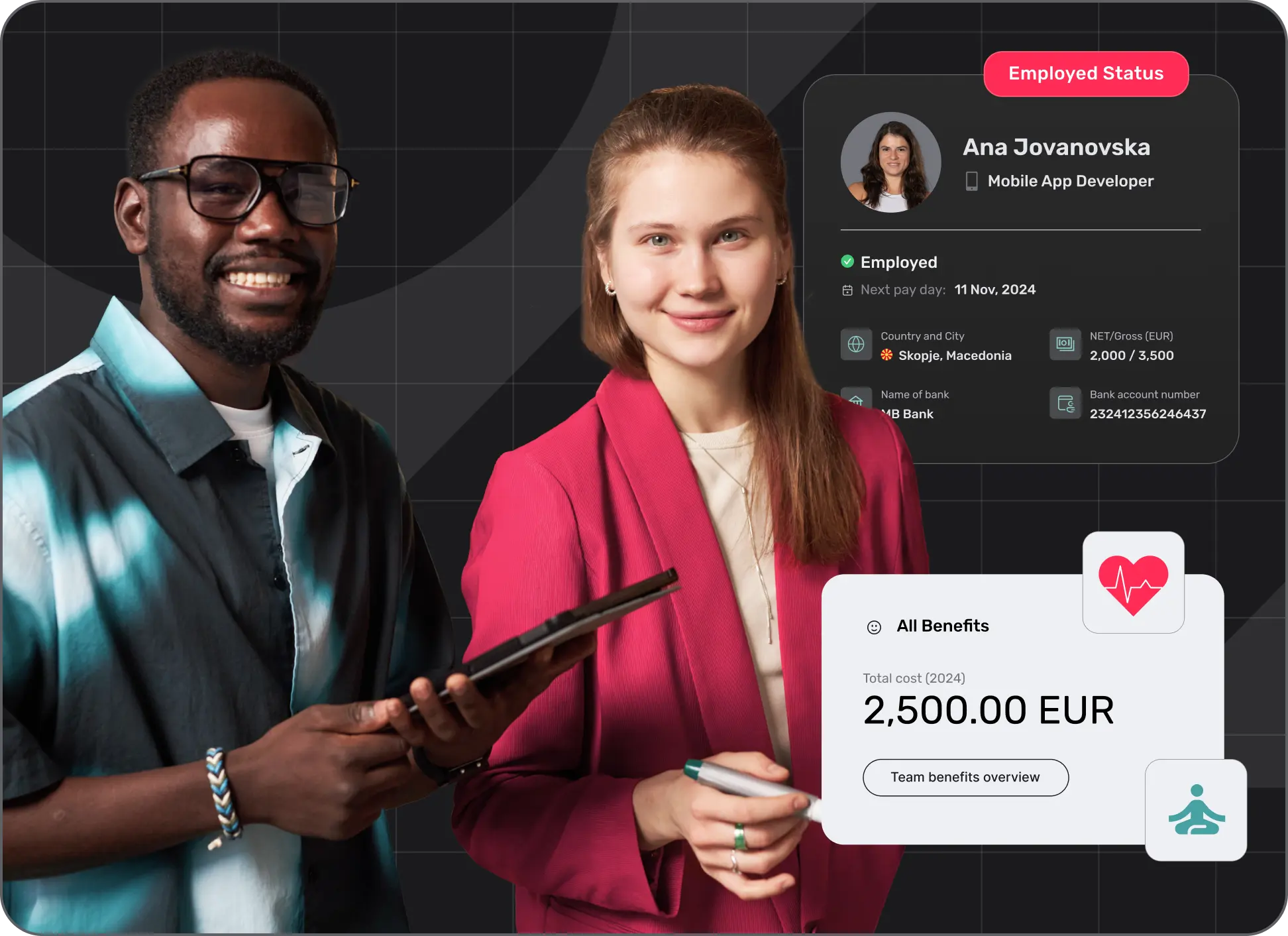

Unmatched Care

for Your Global Team

Native Teams’ employment solution goes beyond employer support — we handle contracts, compliance, and taxes for your global talent. Make your team feel valued, and watch retention soar!

Talk to an expert

Tailored solutions for

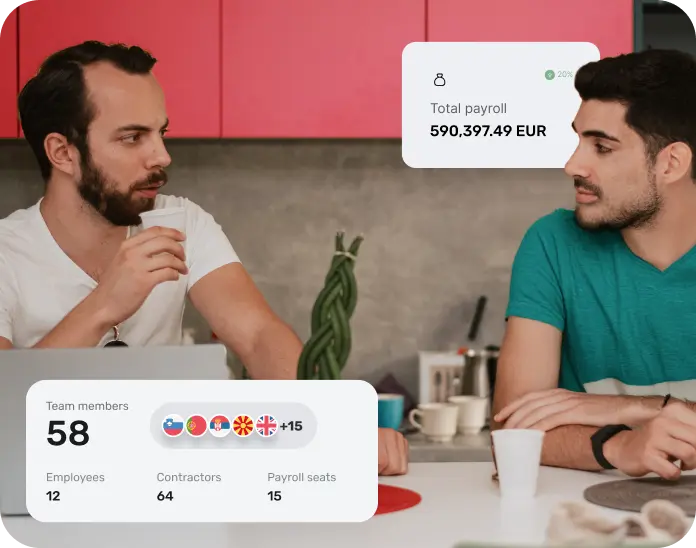

Build distributed teams worldwide with our end-to-end support that goes beyond payroll. From onboarding to offboarding, your employees receive care unlike any other. We’re dedicated to ensuring lasting employee satisfaction and driving guaranteed success.

Enable your team to access their salary in local currency and provide benefits like private health insurance, maternity leave, and more. With us, your employees experience the stability of traditional employment while maintaining the flexibility of global work.

Your complete

employment package

Hire globally via our legal entities in 85+ countries. Give employees access to regulated employment status and full benefits.

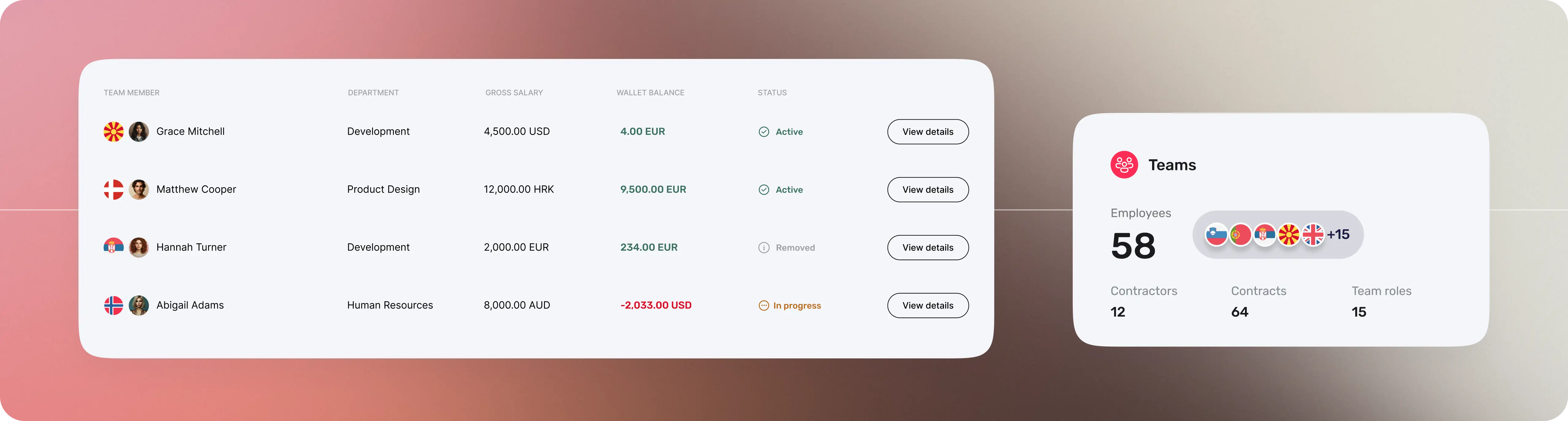

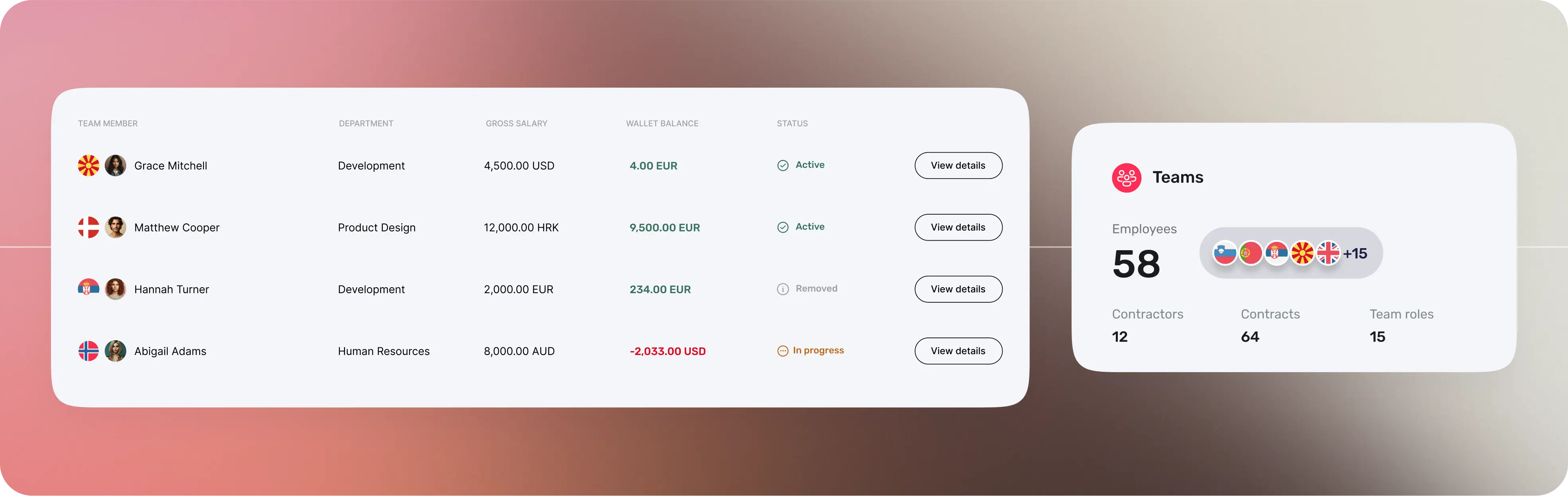

More than a provider — a partner in your growth

Take the hassle out of employing and paying global teams. Our all-in-one employment solution ensures compliance, streamlines payroll, and keeps costs under control. Here’s why we’re the ultimate partner for you:

Customisable options tailored to meet your unique business needs.

Rely on our team of legal and tax experts to manage complex regulations.

Scale your business without hidden fees, or unnecessary expenses.

We go the extra mile to ensure your employees and business thrive.

Helping businesses achieve growth without growing pains

...quick and automated onboarding process

“One of the most notable benefits of working with Native Teams is their quick and automated onboarding process and the localised documentation for our specific needs. Our successful collaboration has enabled us to focus on our core business and achieve exceptional growth.”

...saved us time, resources, and unnecessary paperwork

“With Native Teams’ EOR services, we were able to enter new areas without the need for separate entities, which saved us time, resources, and unnecessary paperwork. Native Teams are distinguished by their comprehensive assistance, freeing us of the pressure.”

...our hiring process became a breeze

“Using Native Teams for hiring and payroll management has been an absolute game-changer for us at Haayaa Inc. From the moment we came on board, our hiring process became a breeze. I will totally recommend them to anyone interested in hiring and managing payroll effectively.”

...revolutionised how we handled transactions

“Native Team's expertise in cross-border transactions and their unified payment system revolutionised how we handled transactions, ensuring accuracy and efficiency in payments and currency conversions.”

...helped us ensure compliance with local laws

“Native Teams’ wide global reach, expertise, and experience in the global market helped us ensure compliance with local laws, avoid the potential legal risks of operating in foreign markets, and gain valuable insights for navigating the global landscape in future.”

...by far the best service we have experienced.

“We have tried several providers, and Native Teams’ Employment as a Service is by far the best service we have experienced. I would definitely recommend Native Teams as a go-to provider for any company at any level.”

...highly professional and I can only talk with superlatives

“Native Teams’ onboarding process was highly professional, and I can only talk with superlatives. I am happy to say that with such amazing collaborators from Native Teams, we have a reliable partner for our future expansion.”

...we successfully navigated the complexities of employment

“Mad Head Games encountered a unique challenge when some of our team members with work visas sought to return to Croatia. With Native Teams' solutions, we successfully navigated the complexities of employment for our employees, ensuring compliance and employee satisfaction.”

...crucial for expanding outside of Switzerland.

“Native Teams' expertise in global employment, compliance, and HR administration gave us the necessary support to hire talent abroad and expand global operations. Their easy onboarding process was crucial for expanding outside of Switzerland.”

...renewed our focus and efficiency

“As we expanded across multiple countries, managing compliance with local regulations and providing local benefits became a challenge. By collaborating with Native Teams, our company positioned itself to concentrate on our mission with renewed focus and efficiency.”

They share our commitment to quality...

“We saw personally Native Teams’ dedication to providing great service. They share our commitment to quality and understand the requirements of global businesses. Our employees have benefited from their suite of services, which includes EOR solutions.”

...quick and automated onboarding process

“One of the most notable benefits of working with Native Teams is their quick and automated onboarding process and the localised documentation for our specific needs. Our successful collaboration has enabled us to focus on our core business and achieve exceptional growth.”

...saved us time, resources, and unnecessary paperwork

“With Native Teams’ EOR services, we were able to enter new areas without the need for separate entities, which saved us time, resources, and unnecessary paperwork. Native Teams are distinguished by their comprehensive assistance, freeing us of the pressure.”

...our hiring process became a breeze

“Using Native Teams for hiring and payroll management has been an absolute game-changer for us at Haayaa Inc. From the moment we came on board, our hiring process became a breeze. I will totally recommend them to anyone interested in hiring and managing payroll effectively.”

...revolutionised how we handled transactions

“Native Team's expertise in cross-border transactions and their unified payment system revolutionised how we handled transactions, ensuring accuracy and efficiency in payments and currency conversions.”

...helped us ensure compliance with local laws

“Native Teams’ wide global reach, expertise, and experience in the global market helped us ensure compliance with local laws, avoid the potential legal risks of operating in foreign markets, and gain valuable insights for navigating the global landscape in future.”

...by far the best service we have experienced.

“We have tried several providers, and Native Teams’ Employment as a Service is by far the best service we have experienced. I would definitely recommend Native Teams as a go-to provider for any company at any level.”

...highly professional and I can only talk with superlatives

“Native Teams’ onboarding process was highly professional, and I can only talk with superlatives. I am happy to say that with such amazing collaborators from Native Teams, we have a reliable partner for our future expansion.”

...we successfully navigated the complexities of employment

“Mad Head Games encountered a unique challenge when some of our team members with work visas sought to return to Croatia. With Native Teams' solutions, we successfully navigated the complexities of employment for our employees, ensuring compliance and employee satisfaction.”

...crucial for expanding outside of Switzerland.

“Native Teams' expertise in global employment, compliance, and HR administration gave us the necessary support to hire talent abroad and expand global operations. Their easy onboarding process was crucial for expanding outside of Switzerland.”

...renewed our focus and efficiency

“As we expanded across multiple countries, managing compliance with local regulations and providing local benefits became a challenge. By collaborating with Native Teams, our company positioned itself to concentrate on our mission with renewed focus and efficiency.”