Employment

Legal employment for your global team

EOR (Employer of Record)

Your global team, locally employed

Entity Management

Set up and manage entities

HR, Payroll & Benefits

Manage all admin tasks from one place

Global Employee Benefits

Premium benefits for your global team

Relocation and Visa

Relocate your team anywhere

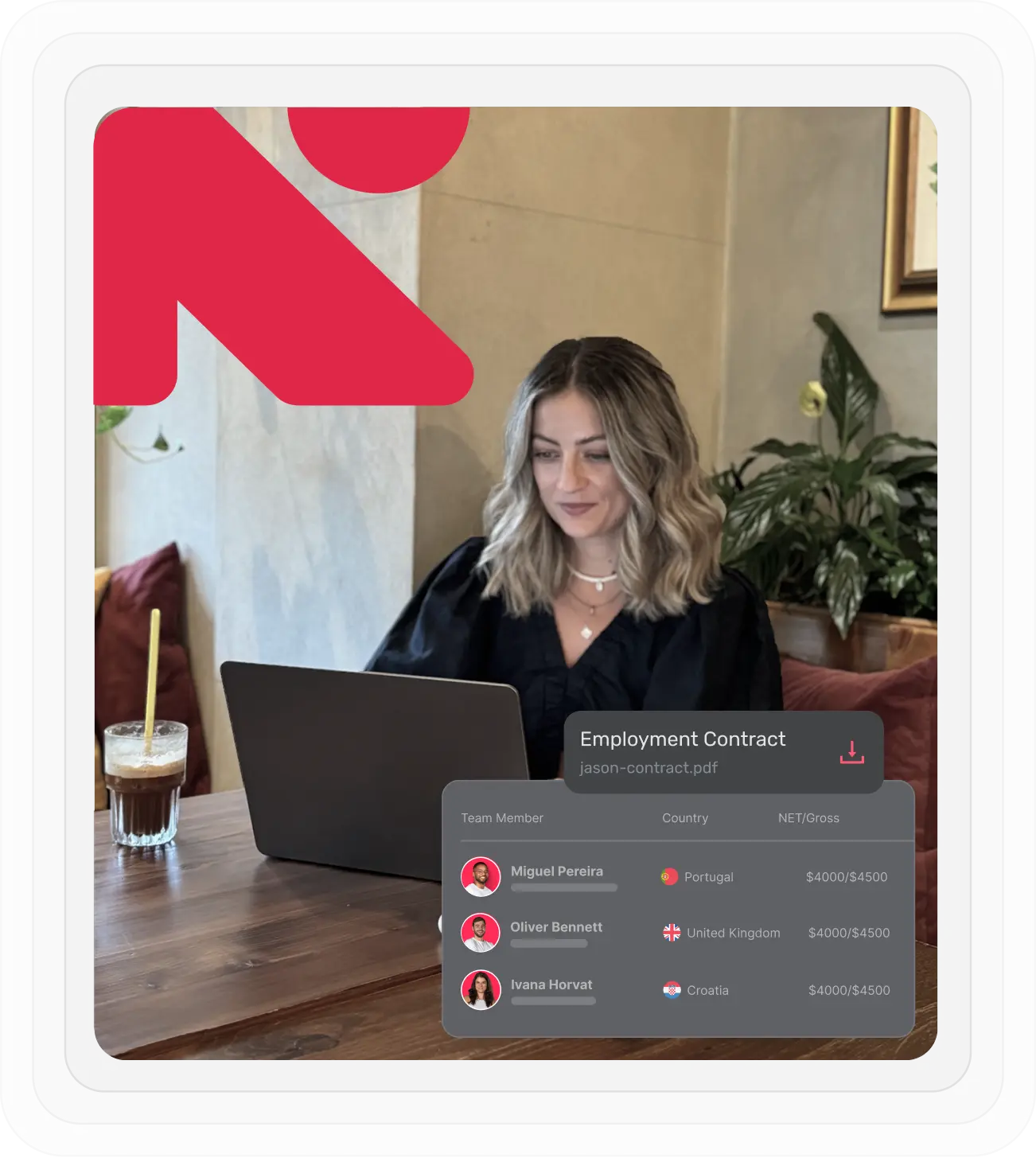

Employment Contracts

Localised employment contracts

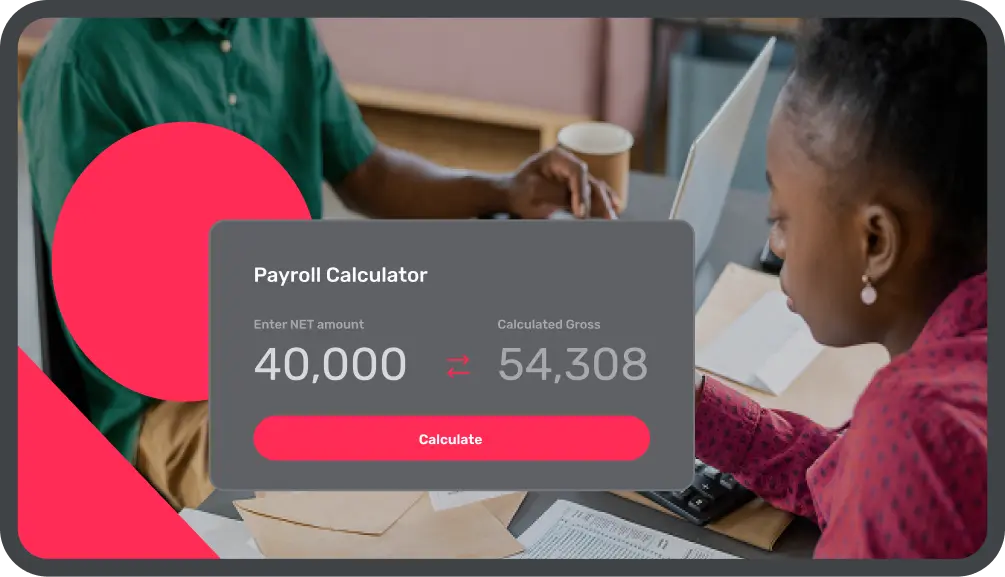

Global Payroll Calculator

Native Teams’ global payroll calculator simplifies the process of calculating salaries and understanding the related costs across more than 95 countries. With our payroll calculator, you can get a breakdown of the expenses for hiring employees in different countries or calculate your own gross and net earnings in your residential country.

How does it work?

Calculating salaries with our simplified payroll calculator only takes a few steps. Select the country and employment status, enter salary details, and instantly get a detailed breakdown of the net and gross salaries, along with detailed insights into social security contributions, tax obligations, and other deductions in the selected country.

We've noticed that you are interested in Payroll in !

Please fill up your email address and get free access to your salary breakdown and a localised work contract template.

How can Native Teams help with employment, salaries, and taxes?

Native Teams offers an all-in-one solution to help you manage legal employment, payroll processing, taxes, and legal compliance in 95+ countries.

Our professional team will assist in calculating salaries, fulfilling your tax obligations, and administering employee benefits, whether you’re a freelancer working for your own clients or an employer hiring global team members. With our simplified platform, you can easily reduce administrative duties and have the peace of mind that all your legal obligations are fulfilled accurately and promptly.

Salary calculators for your country

Discover accurate and up-to-date salary insights with our country-specific calculators - tailored to help you make informed financial decisions wherever you are.

Frequently asked questions (FAQ)

The calculator also provides a detailed breakdown of mandatory deductions, such as taxes and social security contributions. Employers can use the payroll calculator to determine salaries accurately and compliantly with local labour laws. For employees, it can be a helpful tool to understand their earnings and the amounts deducted from their paychecks.