Employment

Legal employment for your global team

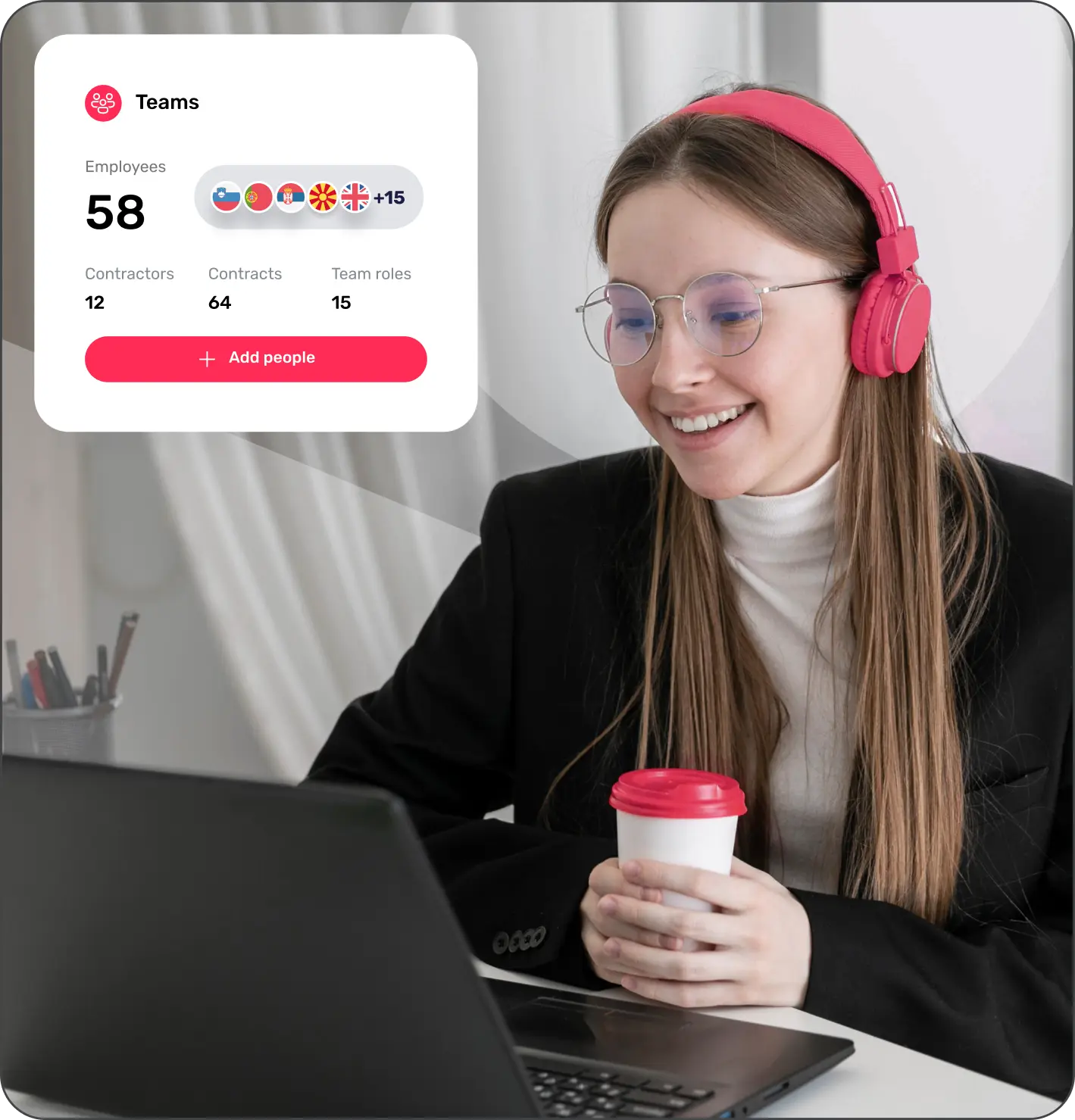

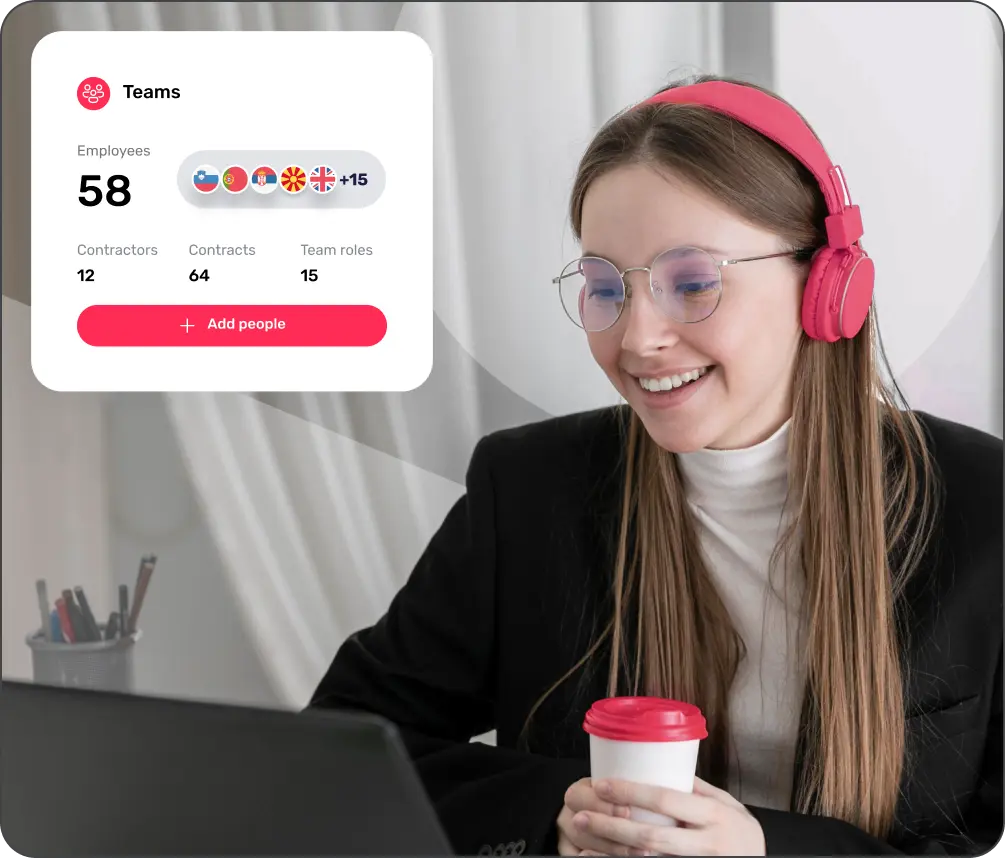

EOR (Employer of Record)

Your global team, locally employed

Entity Management

Set up and manage entities

HR, Payroll & Benefits

Manage all admin tasks from one place

Global Employee Benefits

Premium benefits for your global team

Relocation and Visa

Relocate your team anywhere

Employment Contracts

Localised employment contracts

Employer of Record (EOR) in Georgia

Expand your business in Georgia without the complexities of setting up a legal entity. With Native Teams as your Employer of Record (EOR), you can hire and manage employees while ensuring full compliance with local labour laws, payroll regulations, and tax requirements.

How does an EOR in Georgia work?

Traditionally, hiring employees in Georgia requires setting up a legal entity, managing payroll and taxes, and complying with employment regulations. This process can be time-consuming and costly. With Native Teams as your EOR provider, you can hire employees in Georgia without establishing a local entity.

We act as the legal employer, handling employment contracts, payroll processing, tax compliance, and benefits administration. While we take care of the legal and administrative responsibilities, you retain full control over your employees' daily tasks. This allows you to expand your business seamlessly while ensuring compliance with Georgian labour laws.

Who can use EOR services in Georgia?

Any type of business can use our EOR service to hire and manage employees in Georgia, no matter the business size or industry. Whether you’re a multinational corporation, a fast-growing startup, or a small business looking to expand, our EOR services provide a seamless employment solution.

Features of Native Teams EOR services in Georgia

Employees hired through Native Teams receive full legal employment status under our Georgian entity, ensuring compliance with all local labour laws.

We manage all employment contracts, payroll records, and administrative tasks, making it easy for you to access documents through our platform.

Estimate salaries, taxes, and benefits before hiring in Georgia with our payroll calculator. Our platform supports timely payroll processing while ensuring compliance with local regulations across 95+ countries, including Georgia.

We ensure that your employees receive all mandatory benefits as per Georgian employment law. Additionally, you can offer extra perks such as wellness options, gym memberships, and more to attract and retain top talent.

Get insights on local laws, payroll, benefits, and more - all in one place.

What legal requirements exist for employment in Georgia

Employers must provide written employment contracts specifying job titles, duties, duration, compensation, working conditions, and termination terms. Fixed-term contracts are allowed under certain conditions.

The standard workweek is 40 hours, with a maximum of eight hours per day. Employees must receive at least one rest day per week, and overtime is regulated by law.

Employees are entitled to annual paid leave, sick leave, and maternity leave. Maternity leave typically includes paid leave covered by social security.

Employees in Georgia are subject to a flat income tax rate of 20% on their salary, deducted at the source by the employer.

Employers can terminate employees for reasons such as poor performance, misconduct, or redundancy. However, proper legal procedures must be followed, including notice periods and severance pay where applicable.

Both employees and employers must contribute to the social security system. Employees contribute 2% of their salary, while employers contribute 26%, covering pensions, healthcare, and other social benefits.

Businesses operating in Georgia must register for VAT if their annual turnover exceeds a specific threshold. The standard VAT rate is 18%, applicable to most goods and services.

Please note that all these requirements may vary depending on the job type, the employer and individual circumstances.

Why choose Native Teams as your Georgia Employer of Record?

With Native Teams as your EOR provider, you don’t have to worry about understanding Georgian labour laws, tax regulations, or compliance requirements. Our team of local experts ensures that everything is done according to the law, so you can hire with confidence.

We also provide a user-friendly platform where you can manage payroll, track employee records, and stay updated on tax deductions—all in one place. Whether you’re hiring one employee or building a large team, our services are flexible and scalable to fit your needs.

What you need to know?

An Employer of Record (EOR) is a company that takes on the legal responsibility of employing workers on behalf of another business. This means that instead of setting up a legal entity in a foreign country, businesses can use an EOR to handle all employment-related tasks.

When you hire through an EOR like Native Teams, your employees work directly for you, following your instructions and company policies. However, from a legal standpoint, the EOR is their official employer.

The cost of using an EOR in Georgia varies based on factors like the number of employees and the services required. Native Teams offers transparent and flexible pricing. For detailed information, please visit our pricing page.

A PEO (Professional Employer Organisation) co-employs workers with the client company, requiring the business to have a local entity and share HR responsibilities.

An EOR (Employer of Record), on the other hand, serves as the full legal employer on behalf of the company, allowing businesses to hire in Georgia without setting up a local entity.

An Employer of Record (EOR) takes on all the legal and administrative responsibilities of employing workers on behalf of a company. This includes drafting and managing employment contracts to ensure they comply with local labour laws.

The EOR is responsible for processing payroll, calculating salaries, deducting taxes, and ensuring that employees are paid on time in accordance with Georgian regulations. Additionally, the EOR handles tax filings and compliance with social security contributions, making sure that both the employer and employees meet all their legal obligations.

Beyond payroll and taxes, an EOR also manages employee benefits, ensuring that workers receive all mandatory benefits such as health coverage, pensions, and paid leave.

Yes, using an EOR in Georgia is a legally recognised method of employment, given that your EOR service provider complies with all local labour laws. At Native Teams, we ensure that all employment practices adhere to Georgian regulations, providing a secure and compliant hiring solution.

Opening your own company or office in Georgia requires going through a complex process that involves legal registration, setting up payroll, handling taxes, and complying with local employment laws. This can take a lot of time, effort, and money, especially if you are expanding into a new market.

Using an Employer of Record (EOR) makes hiring in Georgia much easier. With an EOR like Native Teams, you don’t need to set up a local entity. We handle everything for you—employment contracts, payroll, taxes, and legal compliance—so you can focus on running your business. Your employees work for you just like they would if you had your own entity, but we take care of all the administrative and legal responsibilities.

There is no specific limit. Native Teams allows you to hire as many employees as your business requires, ensuring compliance with local regulations. We support your growth and expansion.