5 Best Deel Alternatives to Consider in 2026

Deel has been a popular solution for simplifying international payment management, but it's not the only player in the game.

With new solutions constantly popping up, finding the right platform is crucial for scaling your business and tapping into global talent pools.

However, it can be overwhelming to choose the best fit for your specific needs.

That's why we're diving deep into 5 Deel alternatives so you can find a solution that aligns with your and your employees’ needs.

Let’s dive in!

5 Deel alternatives you should check today

Here’s a quick breakdown of our top picks:

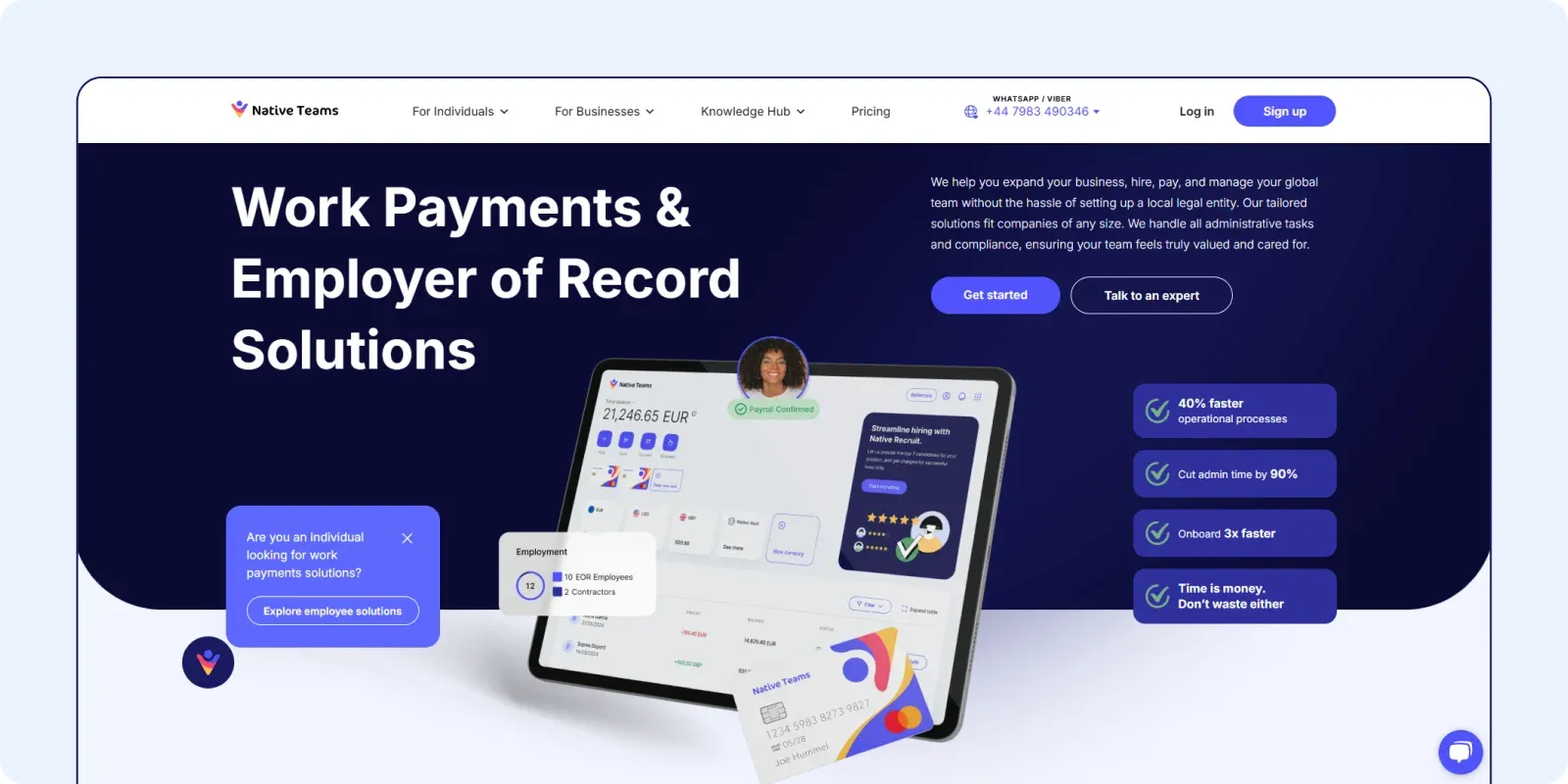

1. Native Teams

Native Teams is a global platform simplifying international expansion for businesses. We offer solutions for:

- Global payments,

- Payroll,

- Legal employment,

- Tax optimisation and

- Wealth management to address the complexities of global hiring and remote work.

Operating in over 85 countries, our platform streamlines administrative tasks, enabling you to save time, reduce costs, and scale effortlessly across borders.

Key Features:

1. EOR Services

Employer of Record services secure legal employment status for your team in over 85 countries without setting up your own legal entity.

You can hire and onboard regular employees or contractors with compliance while also

accessing many other convenient tools to help you manage payroll, expenses, absences, and other aspects.

Another perk is that you can easily customise your workflow based on your needs and requirements.

Other handy tools within EOR services include:

- Employee benefits including healthcare, insurance, pension, and other benefits specific to each employee’s country.

- Tax allowances to help you determine your allowance eligibility and help you optimise your tax savings.

- Expenses management tool to allow you to easily upload receipts, approve, validate, pay, and keep track of your team expenses.

- Absence management tool to simplify your absence management system and help you keep track of employee absence.

- Payroll calculators, adjusted per local laws, help you get full salary calculations and breakdowns in a few clicks.

2. Global Payroll

This solution provides a rich suite of payment tools to handle your work payments. One of the stellar tools includes the Multi-currency wallet that allows you to instantly transfer funds between wallets holding different currencies.

You can easily add funds to your wallet using credit or debit cards easy, providing a

direct method to load money onto your accounts.

With our wallet, each transaction comes with a detailed receipt, providing transparency and a record of your spending at your fingertips.

In addition, you can send payroll invites and manage the salaries of all your employees in one single dashboard.

Our solution provides fully-compliant payroll services, covering taxes, social security, and other mandatory contributions.

3. The PEO (professional employer organisation) services

When you hire through Native Teams (the PEO), the employment responsibilities are shared.

You retain control over managing the employee's work, while we handle administrative tasks like wage reporting and employment taxes.

Your primary responsibility is to make a single payment to Native Teams covering payroll, taxes, benefits, and administrative fees and we manage the rest.

Pros & Cons

Pros:

- Multi-Currency Wallet that manages incoming payments so you can decide how you want to access those funds.

- Excellent customer service with dedicated points of contact who understand how things work in practice in all of our focus countries

- Automated access to tax-free allowances, and access to documentation for full tax compliance, both for you as the employer, and your team.

Cons:

Less global reach but intentionally, since we want to have the right expertise in every country we operate and not just expand for the sake of expanding.

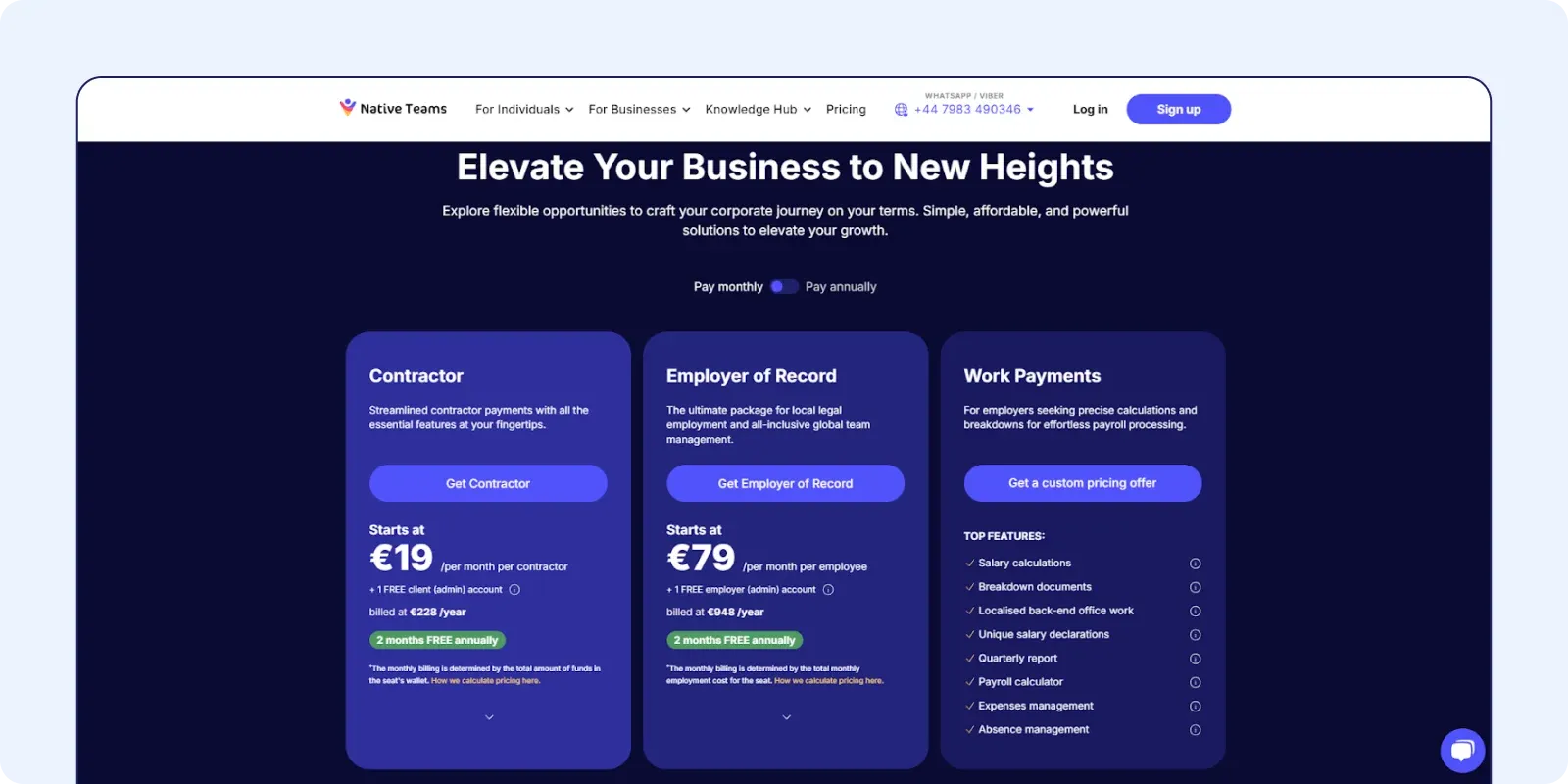

Pricing

Native Teams offers flexible pricing, starting from €19 monthly for contractors and €79 monthly for employees, with additional features and discounts available for annual billing.

2. Rippling

Rippling is a platform that offers a suite of services for managing global workforces, including payroll, HR, IT, and spend management.

It automates tasks like onboarding, compliance, and payroll, making it easier to manage a remote or global workforce.

Key Features:

1. Global Payroll

- Native Payroll System — Rippling's payroll system is built from the ground up to handle global payroll without relying on third-party vendors, ensuring speed and accuracy.

- Multi-Currency Support — Supports payroll in over 50 currencies, allowing employees to be paid in their local currency.

- Automated Tax Compliance — Automatically calculates and files payroll taxes globally, ensuring compliance with local tax laws.

- Payroll Processing — Enables you to shorten payroll lead times: 5 days to payday in popular markets and 12 days in less common markets.

2. HRIS and Employee Management

- Unified HR System — Provides a single platform for managing all employee data globally, including HR, payroll, and benefits.

- Localisation Features — Dynamically localises fields, documents, and currencies based on the employee's work location.

- Onboarding Process — Streamlines onboarding by automating tasks such as setting up employee agreements, benefits, and email addresses.

3. Compliance and Benefits

- Compliance Support — Helps you adhere to local labour laws and tax regulations, reducing compliance risks.

- Benefits Administration — Integrates benefits management with payroll, automating contributions and deductions for publicly funded benefits.

4. Customisation & Integrations

- Customisable Workflows — Allows users to automate administrative tasks and build custom workflows for payroll and HR processes.

- API Integrations — Supports integration with various HR, accounting, and time-tracking software, such as Asana, Salesforce, Carta, Jira, Hubspot, etc.

Pros & Cons

Pros:

- Highly customisable with over 600 integrations.

- Has fast payroll runs and compliance with labour laws.

- Supports payroll in multiple currencies.

Cons:

- The platform can get glitchy when clocking in/clocking out.

- The cost can easily get high when you start adding multiple features.

- Lacks 24/7 live support.

Pricing

Rippling offers customised pricing based on the service you require. You can send a request and get a custom quote.

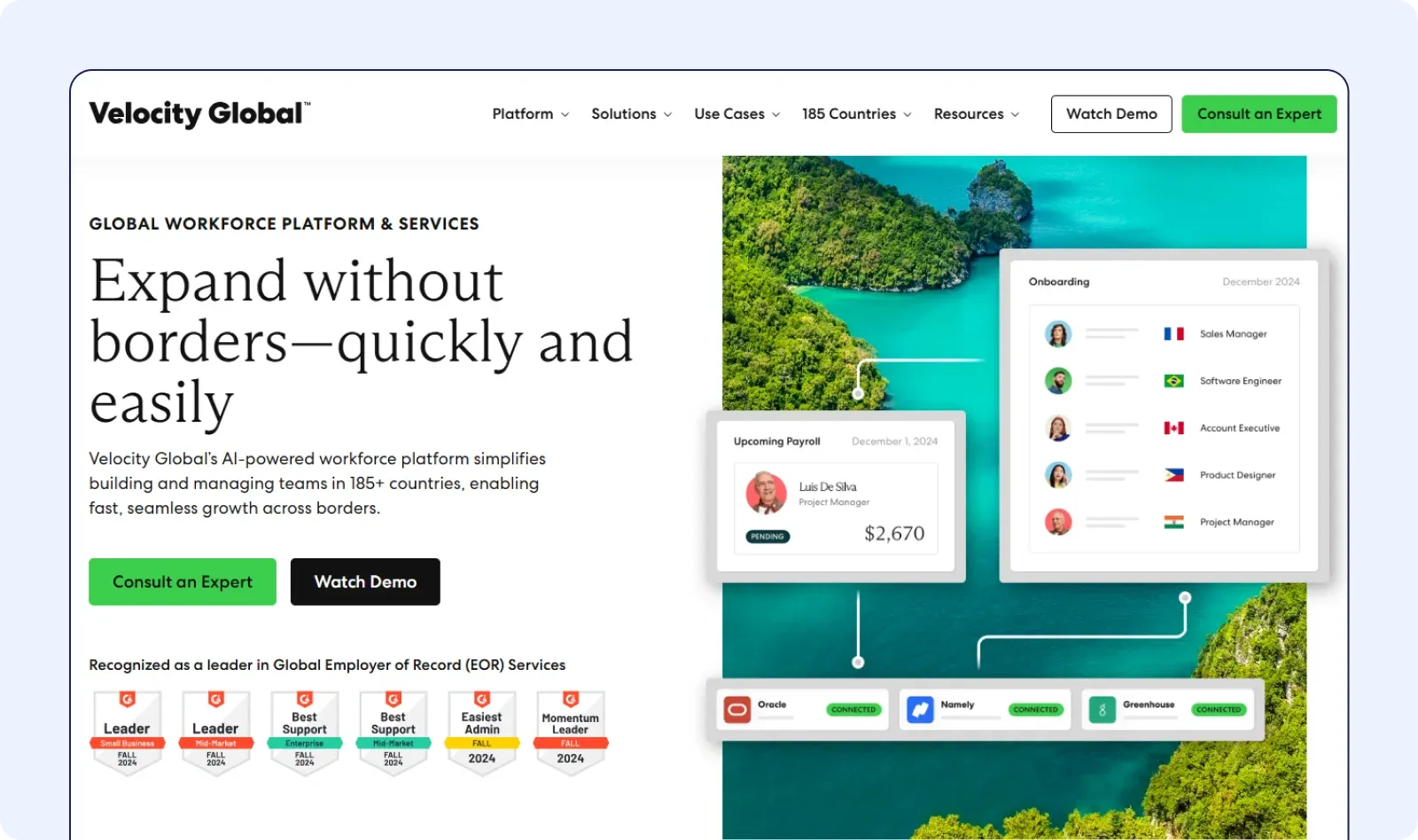

3. Velocity Global

Velocity Global is a global workforce management platform that helps you hire, manage, and pay employees across over 185 countries.

Thus, it caters to larger businesses or those with significant global operations.

Key Features:

1. EOR Services

The services aim to simplify global workforce management, providing legal compliance and expert services through a single platform.

It helps you expand globally without establishing local facilities while managing local employment laws.

Noteworthy features include:

- Accurate Budgeting — Provides insights into employee costs and country-specific contributions for compliant global workforce expansion.

- Global Work Platform™ — Enables compliant talent employment country-specific onboarding and centralised payroll. It allows you to automate workflows and manage your global workforce through integrations with your existing HRIS solutions.

- Attracting and Retaining Talent — Offers comprehensive perks such as locally compliant medical, insurance and social security coverage and rewards to attract and retain top talent.

- Hiring Process — Helps navigate local labour laws, manage employment contracts, and facilitate employee onboarding.

2. Global Payroll Management

The solution provides centralised payroll processing and includes features such as:

- Multi-Currency Support — The platform supports payroll in multiple currencies, allowing businesses to pay employees in their local currency. This feature helps manage exchange rates and ensures that employees receive their salaries correctly.

- Compliance with Local Regulations — Velocity Global complies with local tax laws and regulations, handling deductions and reporting as required by each country.

- This includes managing social security contributions and other statutory requirements.

- Employee Cost Calculator — Helps you budget payroll costs for your global team accurately. This tool helps you plan and forecast employee expenses across different regions.

- Real-Time Reporting and Analytics —The platform offers real-time reporting and analytics on payroll metrics, enabling businesses to make data-driven decisions about their workforce management.

3. Immigration and Visa Support

This feature assists international relocations by handling visa paperwork and ensuring compliance with changing regulations.

- Global Immigration Services — Provide expert guidance on international immigration laws and regulations. The services include consulting on global mobility strategies, obtaining necessary authorisations, and ensuring ongoing compliance with changing immigration requirements.

- Visa Processing — Helps you handle the paperwork and logistical aspects of global visa processing, facilitating talent relocation across borders.

- Compliance and Risk Management — Ensures that all immigration processes comply with local laws, mitigating potential risks associated with non-compliance. This includes managing different visa types and requirements across various countries.

Pros & Cons

Pros:

- Has extensive global reach.

- Ensures legal compliance with local employment laws and regulations.

- Helps with immigration and visa support.

Cons:

- Not catering to smaller teams.

- Navigating the platform can be complex.

Pricing

Velocity Global doesn’t publicly disclose specific pricing tiers for its services.

Instead, pricing is based on the number of countries requiring support, the services needed, and the workforce size you want to manage.

4. Oyster

Oyster is a global employment platform that simplifies hiring, managing, and paying international teams.

It enables you to hire full-time talent in over 120 countries and contractors in over 180 countries.

Key Features:

1. Compliant Payroll Management

Oyster's global payroll solution ensures compliance across borders, automating workflows for timely and accurate payments.

It supports payroll in over 120 currencies, managing tax withholdings, social contributions, and currency conversions.

The platform provides real-time reports on payroll metrics, including payslips, invoices, and other payroll-related documents.

2. Global Payroll

This feature simplifies multi-country payroll management from a single platform.

- Multi-Country Payroll on One Platform — Provides access to invoices, payslips, and reports from a single, intuitive platform.

- Accelerated Payroll Operations — Automate payroll processing to ensure timely payments to global teams.

- Multi-Currency Payments — Allows you to make payments in various currencies and includes workflows for approving and delivering payments on time.

- Compliance — Helps you stay on top of country-specific compliance and regulations and ensures adherence to labour and tax laws in different countries.

- Centralised System — Keeps HR and payroll teams aligned with a centralised system for payroll and benefits data.

3. Integrations

Oyster provides multiple integrations with Hiring, Automation, Productivity, and various apps and platforms like Carta, TriNet, Concur Expense, etc.

In addition, it also provides API so you can customise your workflow.

4. Talent Mobility

Oyster supports visa sponsorship in 60+ countries and guides with visa options, eligibility criteria, application requirements, and costs. You can also track the app and get updates.

Pros & Cons

Pros:

- Has integrations with various HR and business tools.

- Has a global reach in over 100 countries.

- Helps with visa sponsorship.

Cons:

- Can have long waiting times.

- Customer support isn’t always responsive.

Pricing

Oyster offers customisable pricing with plans starting at $29 monthly per contractor, $25 monthly per employee for Global Payroll, and $699 monthly per employee for Employer of Record services.

5. Multiplier

Multiplier is a platform that offers solutions for employing teams internationally.

Its solutions help you with topics such as local compliance, labour contracts,

payroll, benefits, and taxes.

Key Features:

1. Global Hiring and Onboarding

Multiplier’s EOR empowers you to hire and onboard employees in 150+ countries. You can access a wide range of data-driven insights, including headcount, gross-to-net, and cost centre reports.

2. Global Payroll

You can manage global payroll in 100+ countries and pay your team using their preferred currency and method, from bank transfer to crypto.

The solution allows you to calculate multi-country tax, benefits and compensation.

The platform ensures compliance with local labour and tax regulations.

3. Contractor Management

Multiplier supports contractor hiring with instant contracts and multi-currency payments, including crypto options.

You can pay contractors in 120+ currencies and manage invoices, expenses and timesheets from one dashboard.

4. Immigration

The feature helps you move employees to over 140 countries. It provides guidance from visa filing to issuance.

Your employee’s visa status will be updated regularly, and you’ll get information about the upcoming steps.

Pros & Cons

Pros:

- Offers multi-currency payroll processing.

- Has an intuitive platform.

Cons:

- Doesn’t provide fully-owned entities.

- Has slow customer service.

Pricing

Multiplier pricing starts at $400 monthly for Employer of Record (EOR) services for full-time employees, with additional plans starting at $40 monthly for contractors.

5 Deel alternatives: which one to choose?

Our top Deel alternative picks will help you streamline your payment processes and management and ensure you comply with legal and tax regulations.

With Rippling, you can get fast payroll runs, while Velocity Global has extensive global reach in over 185 countries.

However, only one solution provides a full suite of tools together with the entity ownership capability, a rare trait in the EOR world.

That solution is Native Teams.

Why opt for Native Teams?

You can simplify your global operations with Native Teams, the intuitive all-in-one platform.

In addition to our powerful Employer of Record (EOR) solutions, we offer a range of tools to effortlessly manage payments, legal compliance, recruitment, and more.

Therefore, you can:

🔥 Efficiently handle local and global payments and simplify workflows.

🔥 Enjoy swift and secure payments, ensuring your transactions are processed efficiently and securely.

🔥 Eliminate the hassle of dealing with multiple payment systems or currency conversions.

🔥 Stay compliant with regulations and provide a legal employment status and all the

employment benefits.

🔥 Expand your offering and enjoy a greater global reach, all under your unique

branding via our white-label solutions.

And the list goes on.

Ready to dig deeper?

Start with Native Teams today, or book a demo to enhance cash flow management and financial efficiency.