9 Global Payroll Challenges and How to Avoid Them in 2026

With global growth comes a complex web of payroll regulations, diverse tax laws, and varying employee expectations.

Navigating the intricacies of international payroll can quickly become a major headache, costing you time and money and potentially exposing you to compliance risks.

We’re here to help by highlighting the key global payroll challenges with actionable tips to minimise risk and ensure seamless payroll operations across your workforce.

Let’s dive in!

9 global payroll challenges you must know about (and tips to solve them)

Here are 9 challenges that can impact your efficiency and profitability and practical ways to avoid them.

1. Regulatory compliance

Managing payroll across multiple countries requires you to comply with various tax laws, labour regulations, and reporting standards, which are constantly changing.

Each country has its own set of:

- Employment classifications,

- Minimum wage requirements,

- Overtime rules,

- Tax brackets, and

- Benefits structures.

Failure to comply can result in hefty fines, legal action, and reputational damage.

For example, in the European Union, payroll processing must adhere to GDPR regulations, which enforce strict data privacy measures.

On the other hand, in the United States, companies must ensure compliance with IRS tax codes while handling state-specific regulations.

Meanwhile, countries like Brazil and India have intricate payroll tax structures that require deep local knowledge.

These differences make global payroll compliance an ongoing challenge if you run a multinational company.

💡 Solution:

To avoid compliance issues, you should consider partnering with a Professional Employer Organisation (PEO) that has expertise in local laws and that will take over more administrative tasks.

One of Native Teams’ main services is to help you with:

- HR administration,

- Payroll management,

- Benefits administration, and other aspects, within a single platform.

Thus, you won’t have to deal with legal, tax, or administrative hurdles — we’ll do it all for you, ensuring you stay compliant with local regulations and employment laws.

2. Payroll accuracy

Errors in salary payments, tax deductions, or benefits contributions can not only lead to employee dissatisfaction but also to legal disputes and penalties from tax authorities.

Payroll errors can occur from manual data entry mistakes, outdated tax tables, incorrect employee classifications, or discrepancies in benefits administration.

Underpaying an employee due to a miscalculation may violate labour laws, while overpaying could lead to difficult-to-recover financial losses.

Payroll accuracy becomes even more challenging when dealing with remote employees, contractors, and varying work arrangements across multiple jurisdictions.

💡 Solution:

Automated payroll processing systems can significantly reduce errors by ensuring real-time calculations and compliance with tax regulations.

Some of the strategies you can try include:

- Conducting regular payroll audits to identify discrepancies and correct them before payroll is processed.

- Training payroll teams on the latest tax and employment laws to ensure they remain knowledgeable about proper calculations.

- Implementing a payroll reconciliation process where all payments are verified before disbursement.

Or you can try a quick and efficient, no-hassle approach:

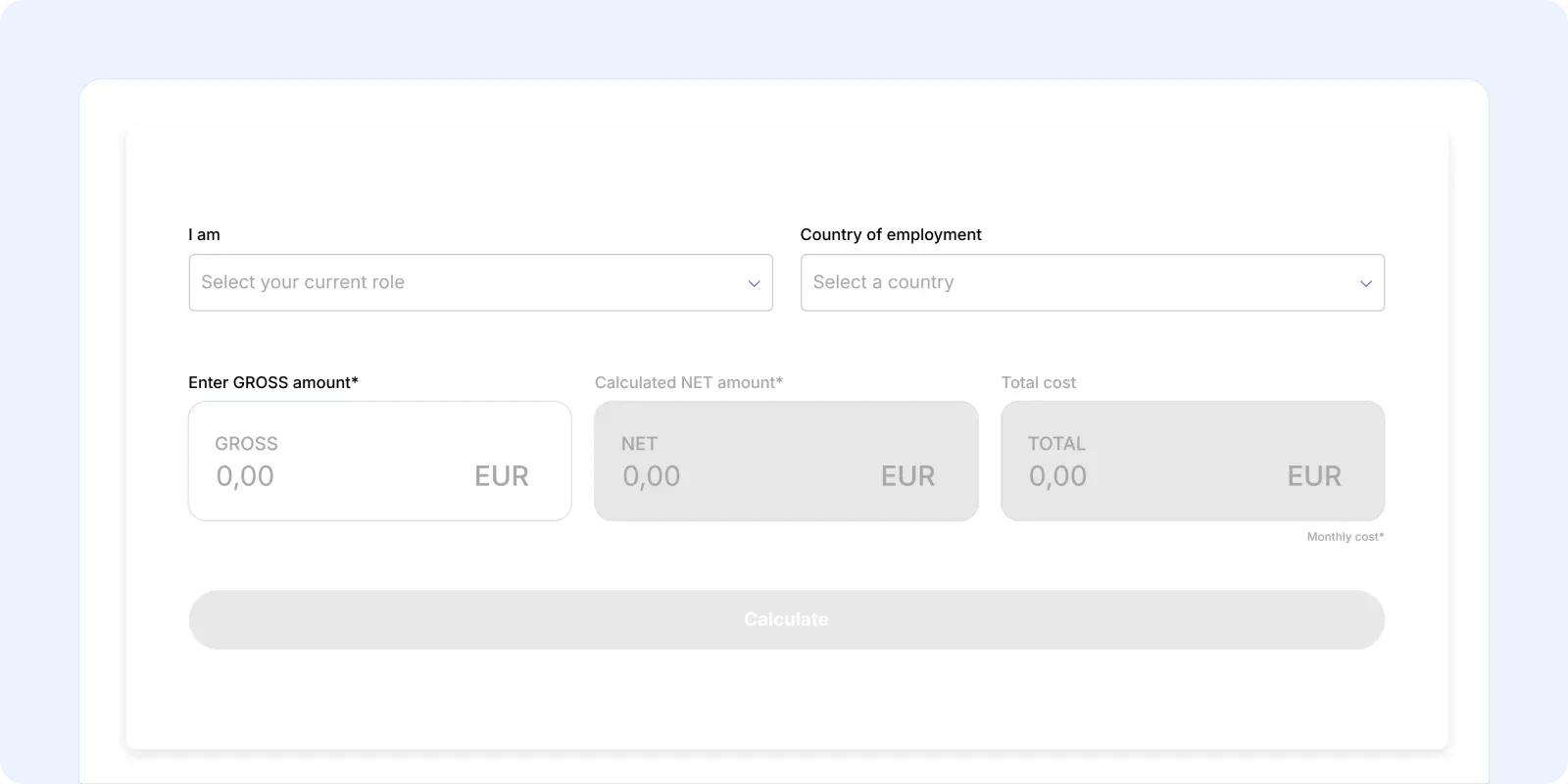

Native Teams’ Payroll calculator helps you get full salary calculations and breakdowns in a few clicks, all in sync with local laws.

3. Currency fluctuations

Operating in multiple countries means dealing with fluctuating exchange rates and associated currency risks, which can impact payroll costs and budgeting.

Sudden changes in currency values can result in employees receiving incorrect salary amounts, affecting financial stability for both the company and its workforce.

💡 Solution:

You can simplify global payroll with these two options:

- A multi-currency payroll system that automates currency calculationsor

- An Employer of Record (EOR) that manages the entire international payroll process, ensuring accurate and timely payments to your global team.

With Native Teams, you get both solutions under one roof, with all mandatory contributions and benefits included.

Our global network facilitates cross-border transactions, eliminating the hassle of dealing with multiple payment systems or currency conversions.

You can process salaries in employees’ preferred currencies while minimising exchange rate risks and transaction fees.

Thus, you can send invites in bulk and manage your employees’ payroll across multiple countries with reduced transaction fees while we process taxes, social and other contributions.

Furthermore, our EOR service allows you to hire and manage international employees compliantly and cost-effectively under Native Teams’ local entities in over 85 countries.

4. Technological integration

When employing internationally, you may struggle with outdated payroll systems that don’t integrate seamlessly with your HR, finance, and accounting platforms.

This lack of integration can lead to data discrepancies, delays in payroll processing, and inefficient reporting.

In addition, manually transferring payroll data between systems increases the risk of errors, which can lead to financial misinformation.

💡 Solution:

To overcome these challenges, you should invest in modern, cloud-based payroll solutions that integrate with existing HR and financial systems.

API-driven platforms allow real-time data sharing, reducing the need for manual data entry.

Standardising payroll data formats across all systems will also improve compatibility and reduce errors.

Native Teams combines EOR, PEO, and Global Payroll solutions into a single platform.

With this platform, you can easily build and manage an international workforce and access all relevant data, such as expenses, taxes, local fees, etc.

Furthermore, you can connect our payroll with other employment solutions on one platform and empower employees with easy self-service options.

5. Data security and privacy

Payroll systems store highly sensitive employee data, including social security numbers, bank account details, tax records, and personal identification information.

This makes them prime targets for cyberattacks, phishing scams, and insider threats. Furthermore, unauthorised access to payroll data can lead to financial fraud and legal issues.

Without proper security measures, sensitive payroll information could be exposed to unauthorised personnel, resulting in compliance violations.

Thus, data breaches can result in:

- Financial losses,

- Regulatory fines, and

- A loss of employee trust.

Many countries have strict data protection laws, such as the GDPR in Europe, the California Consumer Privacy Act (CCPA) in the U.S., and China’s Personal Information Protection Law (PIPL).

If you operate across multiple regions, you must comply with these varying laws while ensuring secure data transmission and storage.

💡 Solution:

Here at Native Teams, we take compliance, security and data protection very seriously. Our platform is GDPR compliant while we:

- Encrypt all sensitive data on our servers so that only authorised persons can access information and nobody else can bypass it.

- Run our platform on Amazon Web Services, the leading cloud computing infrastructure.

- Monitor and back up our infrastructure and applications daily.

- Regularly do 3rd-party testing.

- Use two-factor authentication.

- Run our network traffic over SSL/HTTPS.

And this is just a fraction of our security measures.

6. Employee classification

Misclassifying workers, as independent contractors or vice versa carries significant risks that can severely impact your business.

Misclassification, even if unintentional, can result in the imposition of significant back taxes, fines, and penalties assessed by tax authorities.

Therefore, risks extend beyond simple administrative errors and can trigger a cascade of negative consequences, including:

- Misclassified employees may be entitled to retroactive benefits, such as unemployment insurance, workers' compensation, and employer-sponsored health insurance, which can further increase your business's financial burden.

- Affecting your company's public image and creating lasting reputational damage.

Governments worldwide, recognising the potential for tax avoidance, intensify their scrutiny of worker classifications to ensure businesses fully comply with applicable labour laws and regulations.

💡 Solution:

For starters, you should establish clear and comprehensive policies that align with the specific labour laws and regulations of each place you operate.

This is not a one-size-fits-all endeavour since labour laws vary significantly. Therefore, a qualified legal expert can help verify worker classifications before finalising and signing contracts.

Thus, you can identify and address potential misclassifications early on, avoiding costly penalties, back taxes, and possible litigation.

With Native Teams, you can skip the worry of navigating local regulations and document translations.

Our automatic onboarding provides localised, customised employment documents to meet all your needs.

Whether you're hiring:

- Full-time staff,

- Part-time employees, or

- Contractors, our easy-to-use templates simplify the process, ensuring your agreements are professional, comprehensive, and legally compliant.

Our local experts in over 85 countries ensure that all employment contracts, benefits, and tax deductions fully comply with national laws.

7. Tracking Employee Work Hours and Overtime

Managing employee work hours and overtime is a major challenge since each country has unique regulations regarding standard work hours, overtime pay, and mandatory rest periods.

For example, in the United States, employees covered by the Fair Labor Standards Act (FLSA) must receive overtime pay for hours worked beyond 40 per week at a rate of at least 1.5 times their regular pay.

Meanwhile, in the EU, the Working Time Directive limits the maximum workweek to 48 hours, including overtime, and mandates a minimum daily rest period.

If you run a multinational company, tracking hours by employees across different time zones, work schedules, and employment contract types adds another layer of complexity.

Additionally, hybrid and remote work arrangements make it harder to monitor employee hours, leading to potential compliance risks, payroll discrepancies, and disputes over unpaid overtime.

💡 Solutions:

You can consider automated time-tracking systems that integrate seamlessly with your payroll software for real-time data synchronisation.

As a result, you can minimise errors and streamline payroll processing.

Don’t forget to regulate different work schedules, shifts, and holiday pay rules for various locations.

Native Teams’ Absence Management tool allows you to track employee absences.

Thus, it lets you track, manage and approve holiday requests, times off, and leaves quickly and easily, all in one place.

Doing so enables you to determine fair vacation policies for your staff with 24/7 access to all relevant data.

8. The lack of flexible payment methods

Many companies still rely on traditional payroll methods, such as direct bank deposits, which may not be suitable for all employees, especially those in countries with varying banking systems and financial inclusion levels.

While employees in developed countries typically have access to bank accounts and seamless electronic transfers, workers in emerging markets may lack access to traditional banking services.

This issue is particularly prevalent in regions such as Africa, Latin America, and parts of Asia, where mobile money and digital wallets are more commonly used than traditional bank accounts.

Freelancers and gig workers, who make up an increasing portion of the global workforce, also face difficulties if employers only offer limited payment options.

Many prefer to be paid through:

- Digital wallets,

- PayPal,

- Cryptocurrency or other alternative methods.

Another issue arises when international employees face delays and high transaction fees when receiving payments.

Traditional bank transfers, especially cross-border payments, often involve intermediaries, currency conversion fees, and processing delays that can frustrate employees.

💡 Solutions:

Native Teams provides various payment solutions, with Multi-Currency Wallet being one of the most popular.

It allows you to easily manage and store your funds and get a comprehensive overview of your total balances in the desired currency.

Thus, you can:

- Instantly fund transfers between wallets in various currencies.

- Receive funds in preferred currencies and sidestep the typical conversion fees.

- Add money to your wallet via Payoneer, a bank transfer, a card, and other options.

- Do batch transfers and send money from your wallet to multiple employees in a consolidated transaction.

9. Inefficient Data Consolidation

One of the most significant challenges in global payroll management is inefficient data consolidation and information silos occurring across different departments, locations, and payroll systems.

As you expand internationally, you often rely on multiple payroll providers, accounting systems, and HR platforms, leading to fragmented payroll data that is difficult to reconcile.

While this approach may be necessary to adhere to regional tax laws and labour regulations, without a centralised payroll dashboard, you can’t:

- Generate unified reports,

- Track payroll expenses, and

- Ensure accuracy in financial reporting.

In addition, many organisations still rely on disconnected systems that require manual data entry and reconciliation.

For example, an employee’s hours might be tracked in one system, benefits and deductions stored in another, and payroll processing in a separate tool.

This lack of synchronisation can lead to errors, miscalculations, and compliance risks.

When payroll data is stored in multiple locations without proper integration, businesses struggle to access real-time insights.

Consequently, it can delay decision-making, making it difficult to:

- Analyse payroll costs,

- Monitor compliance risks, and

- Respond to employee inquiries.

💡 Solution:

Instead of managing multiple payroll providers and systems across different countries, companies should transition to unified global payroll providers that support multi-country operations.

This enables you to manage payroll across different regions while ensuring compliance with local tax laws.

Payroll shouldn’t operate in isolation.

It must be tightly integrated with HR systems (employee data, benefits, and time tracking) and finance systems (cost reporting, tax deductions, and expense management).

Payroll platforms are good solutions since they provide real-time access to payroll data, enabling you to:

- Track payroll expenses,

- Generate reports, and

- Monitor compliance risks instantly.

As a result, a centralised payroll dashboard allows HR and finance teams to view employee salaries, tax deductions, and payment statuses in one place, improving transparency and decision-making.

How can Native Teams help you solve global payroll challenges?

Native Teams is an all-encompassing platform that combines tools for global payments and payroll, legal employment provisions, and tax optimisation.

Our carefully designed suite of tools enables you to:

🔥 Obtain or provide legal employment status in more than 85 countries, all in compliance with local labour laws.

🔥 Navigate global transactions effortlessly in multiple currencies.

🔥 Secure employment contracts customised and aligned with local legal requirements for clarity and compliance.

🔥 Maximise your tax savings by getting eligible tax-free allowances for your

country, all in compliance with your local regulations.

🔥 Simplify your billing process and create and manage professional invoices for smooth transactions.

And the list goes on.

Curious to know more?

Start with Native Teams today, or book a demo to streamline global payroll management without administration hassle.