Deel vs. Wise - Which One Is a Better Fit in 2026?

When you operate globally, you typically face challenges such as complex payroll regulations, costly currency conversions, and the hassle of onboarding remote teams across multiple countries.

Thus, you need a solution that simplifies both workforce management and cross-border payments without breaking the bank or risking compliance.

While both Deel and Wise enable you to operate and pay internationally, they serve distinct yet complementary purposes.

Understanding the unique value each platform provides will not only save you time but also money.

Dive into our Deel vs. Wise comparison to find the most suitable solution for your company’s global operations.

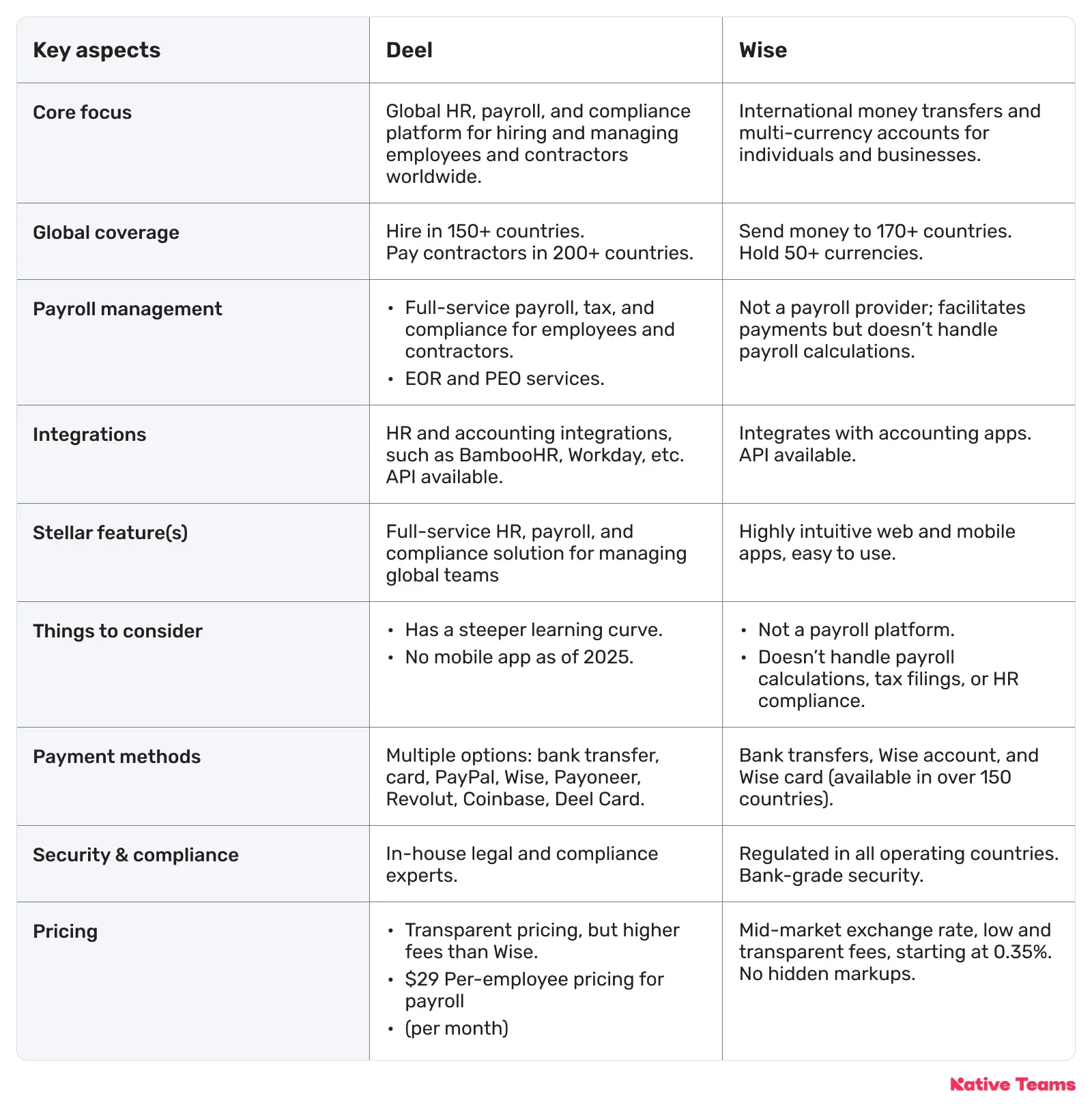

Deel vs. Wise: A quick comparison

Before we cover each solution in more depth, here’s a quick breakdown of the key aspects and areas of difference.

What is Deel? Overview & key benefits

Deel is a comprehensive global workforce management solution that helps businesses hire, onboard, pay, and manage employees and contractors in over 150 countries through a single platform.

The company has in-house legal teams to handle complex regulatory requirements in every country of operation.

Deel: Key features

Let’s check Deel’s features in more detail.

1. Global payroll and payments

Deel’s global payroll and payments solution enables you to manage payroll, payments, and compliance for employees and contractors across 150+ countries.

The platform streamlines international payroll processes, ensures regulatory compliance, and offers multiple payment options for global teams.

1. Real-time payroll engine

- Instant gross-to-net calculations: Automates payroll calculations for employees and contractors, factoring in local taxes, deductions, and benefits.

- Faster payroll processing: Enables payroll teams to process payments in real time, reducing errors and delays.

- Payroll in 50+ countries: Supports local payroll processing, ensuring compliance with country-specific regulations.

2. Automated payments

- Multi-currency support: Allows you to pay teams in their local currencies.

- Multiple payment methods: Includes bank transfers, cards, PayPal, Wise, Payoneer, Revolut, Coinbase, and Deel Card.

- Automated scheduling: Set up recurring payments and automate payroll cycles for global teams.

3. Tax compliance

- Local tax management: Automatically deducts and files taxes according to each country’s laws.

- Regulatory adherence: Keeps up with changing tax codes and labour laws to ensure ongoing compliance.

- Benefits administration: Centralised tool for managing benefits enrollment, deductions, and syncing with payroll across multiple countries.

2. HRIS and workforce management

The solution offers a unified, cloud-based platform for managing global teams, automating HR workflows, and ensuring global compliance.

1. Centralised employee data

- Digital employee files: Securely store and manage sensitive data, contracts, tax forms, payroll records, and compliance documents for employees and contractors in one place.

- Employee directory: Keep an up-to-date directory for all team members, including EOR employees, direct hires, and contractors.

2. Onboarding and offboarding automation

- Deel Engage: Enables onboarding directly within Slack and provides access to onboarding materials.

- Customisable onboarding workflows: You can create customisable onboarding workflows tailored to specific roles, and include automated tasks, training modules, and checklists so that new hires receive a structured and personalised onboarding experience.

- Personalised onboarding: Automated workflows tailored to specific roles, which include automated tasks, training modules, and checklists for new hires.

3. Time-off & attendance management

- Time-off policies: Create and manage globally compliant leave policies, including vacation, sick leave, and custom types.

- Automated tracking: Employees can request time off via self-service, with automated approval flows and payroll sync.

- Time tracking: Manual or clock-in systems for tracking work hours, overtime, and absences, integrated with payroll.

4. Workflow automation and self-service

- Workflow builder: Automate repetitive HR tasks, such as expense approvals, time-off requests, and document management without coding.

- Role-based permissions: Assign granular access rights based on department, role, or location.

3. Compliance and risk management

Deel combines automation, expert legal guidance, and real-time updates to mitigate risks related to employment laws, tax regulations, worker classification, and data privacy.

- AI-based worker classifier: Runs misclassification assessment and evaluates potential contractors.

- Documentation compliance: The self-serve tools enable you to upload and share documents securely via the centralised platform.

- Contractor of Record service: Includes classification assessments, localised contracts, and ongoing compliance monitoring.

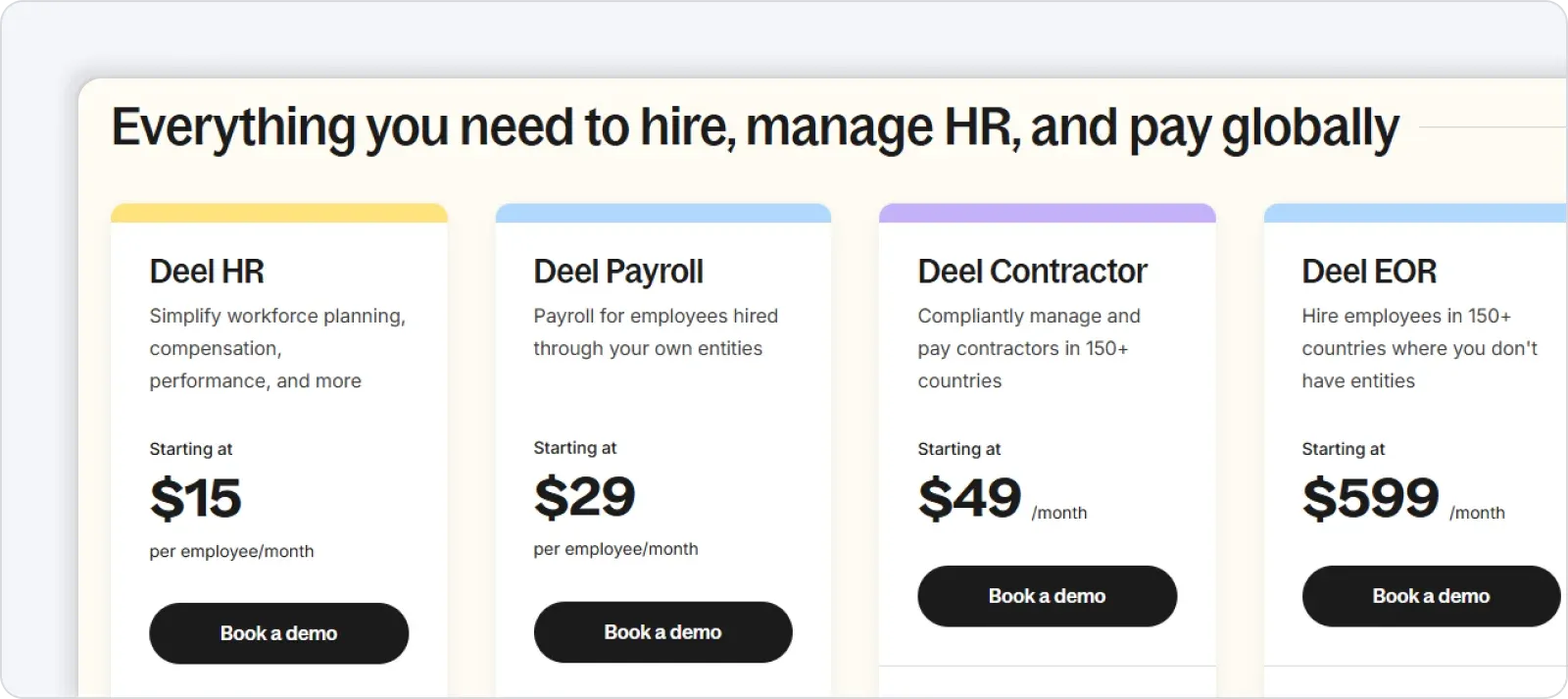

Deel: Pricing

Deel’s pricing depends on the services you use. The prices start at $15 per employee per month.

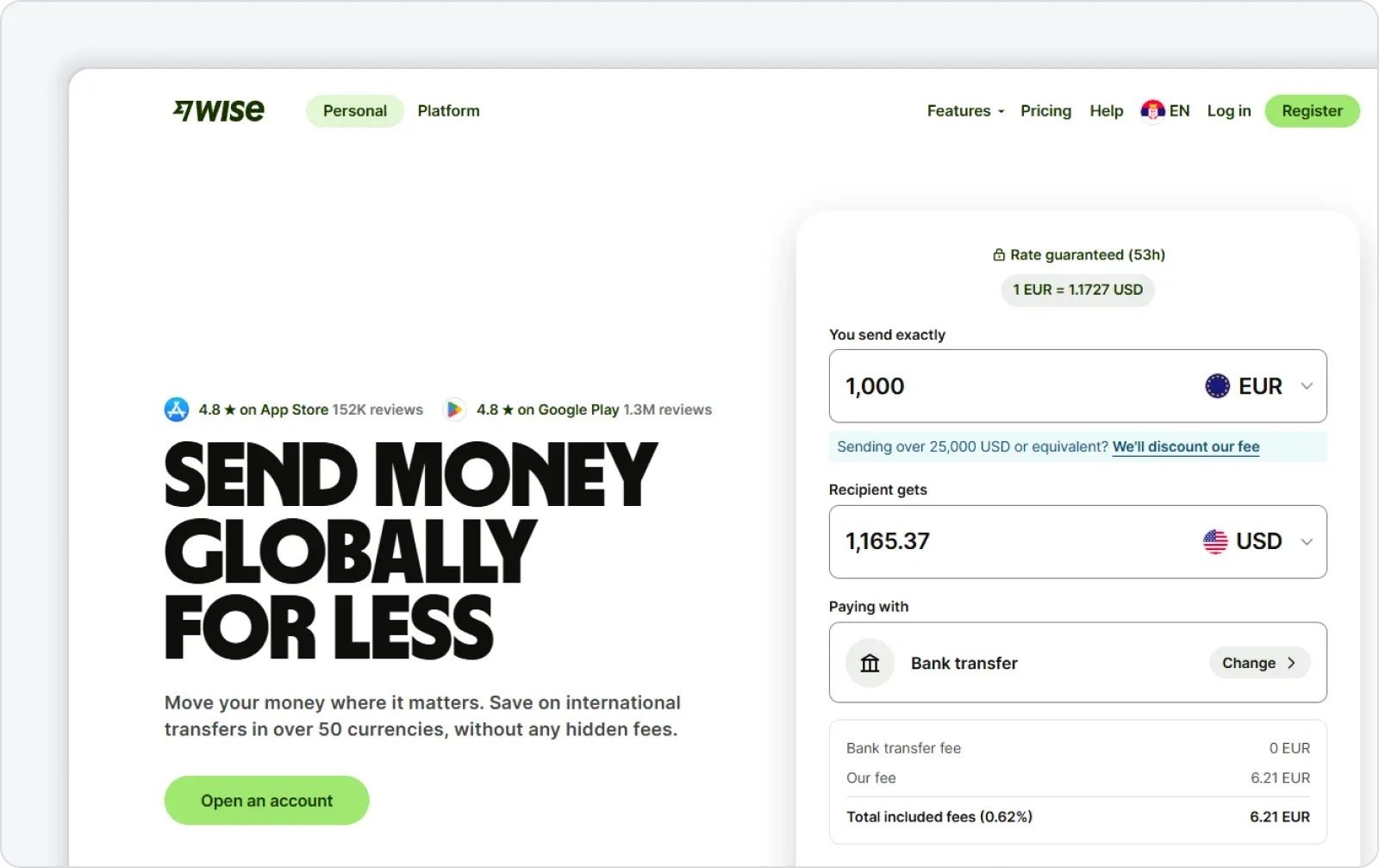

What is Wise? Overview for businesses

Wise is a global multi-currency account and international money transfer platform.

It focuses on transparency, low fees, and speed, and serves individuals and businesses with cross-border financial needs.

Wise: Key features

Although Wise facilitates payments, it isn’t a payroll provider, so it doesn’t handle payroll calculations.

1. Multi-currency account and global balances

The suite of features enables you to hold, manage, and convert money across multiple currencies.

- Hold and manage 50+ currencies within a single Wise account. The capability enables currency conversions at the real mid-market exchange rate without hidden markups.

- Receive local bank details, such as US routing number, UK sort code, Euro IBAN for major currencies, allowing users to get paid like a local in multiple countries.

- Auto-conversions: Set a target exchange rate, and Wise automatically executes the transfer when it hits the target rate.

2. International money transfers

- Batch Transfer: You can pay up to 1,000 invoices or recipients in a single transaction, which is particularly useful for businesses managing global payroll or supplier payments.

- Fast transfers: 95% of transfers are completed within 24 hours, with many instant or same-day payments available, depending on the destination and payment method.

- Send money to over 160 countries with transparent fees and mid-market exchange rates.

- 6 direct connections to payment systems that allow you to send money at low cost, in AUD, EUR, GBP, HUF, SGD, and PHP.

- Plug in customisable onboarding and KYC: Allows you to integrate the onboarding and KYC capabilities and services.

- In-house compliance, combined with automated detection, enables you to gain full visibility and control over payments.

3. Wise Business Account

- Manage global finances: Send, receive, and hold funds in 40+ currencies tailored for international businesses.

- Batch payments: Make bulk payments to suppliers, contractors, or employees efficiently.

- Accounting integrations: Connect with popular cloud accounting software, such as Xero, QuickBooks, FreeAgent, etc.

- Spend and withdraw: A linked Wise debit Mastercard allows spending in over 150 countries with low conversion fees and offers limited free ATM withdrawals.

4. Invoicing & payment tools

- Free invoicing tool: Generate and send professional invoices with detailed information about billable work, including a clear description, piece rate or hourly rate, and quantity.

- Saved recipients: Store recipient details for faster repeat payments and reduced errors.

- Real-time tracking: Monitor the status of all transfers through the dashboard and receive email notifications.

5. Business calculators

- VAT Calculator: Quickly determine how much VAT to charge clients, so you can stay compliant with tax regulations.

- Import Duty Calculator: Estimate customs charges when importing goods into countries like the UK or the US, for more accurate cost forecasting.

- Salary Calculator: Calculate net salaries after taxes and national insurance contributions, particularly useful for UK-based payroll planning.

- PayPal Fees Calculator: Understand and compare PayPal fees to see potential savings when using Wise for payments.

- eBay Fees Calculator: Helps eBay sellers assess fees associated with PayPal payments to optimise pricing and profits.

- US Sales Tax Calculator: Provides a breakdown of sales tax rates by state, helping US businesses apply the correct tax rates.

Wise: Pricing

Prices for Wise Business Account depend on the services you use, with fees starting from 0.33%.

Additionally, the more payments you send or receive, the greater the discount you will receive.

Another option is to pay a one-time setup fee of $61, which includes all features.

Deel vs. Wise: Which one should you choose?

Deel is better for managing people and payroll globally, while Wise is more effective for sending and receiving money internationally at a low cost.

While it doesn’t offer payroll or HR services like Deel, Wise compensates for this by managing global payments and currency conversions.

To sum up,

- Choose Deel if you need a full-service HR, payroll, and compliance solution for managing global teams, handling contracts, onboarding, and ensuring regulatory compliance.

- Choose Wise if you primarily need fast, low-cost, transparent international payments and multi-currency account management, but you don’t require payroll or HR functionality.

But what if you didn’t have to choose between the two, but could opt for a solution that combines the best of Deel and Wise’s robust capabilities?

Enter, Native Teams.✨

Native Teams: A robust global payroll alternative to Deel and Wise

Native Teams provides EOR and PEO services in over 85 countries.

We combine entity ownership, comprehensive payroll and compliance,multi-currency financial tools, and employee self-service, all within a single platform.

Thus, our solutions are an attractive option if you seek long-term global growth with greater control and simplified operations.

What do we bring to the table?

We combine entity ownership, comprehensive payroll and compliance,multi-currency financial tools, and employee self-service, all within a single platform.

1. Entity Ownership capability: Unlike most EOR providers, Native Teams allows you to directly own and manage foreign legal entities, providing greater control and cost savings for long-term global expansion.

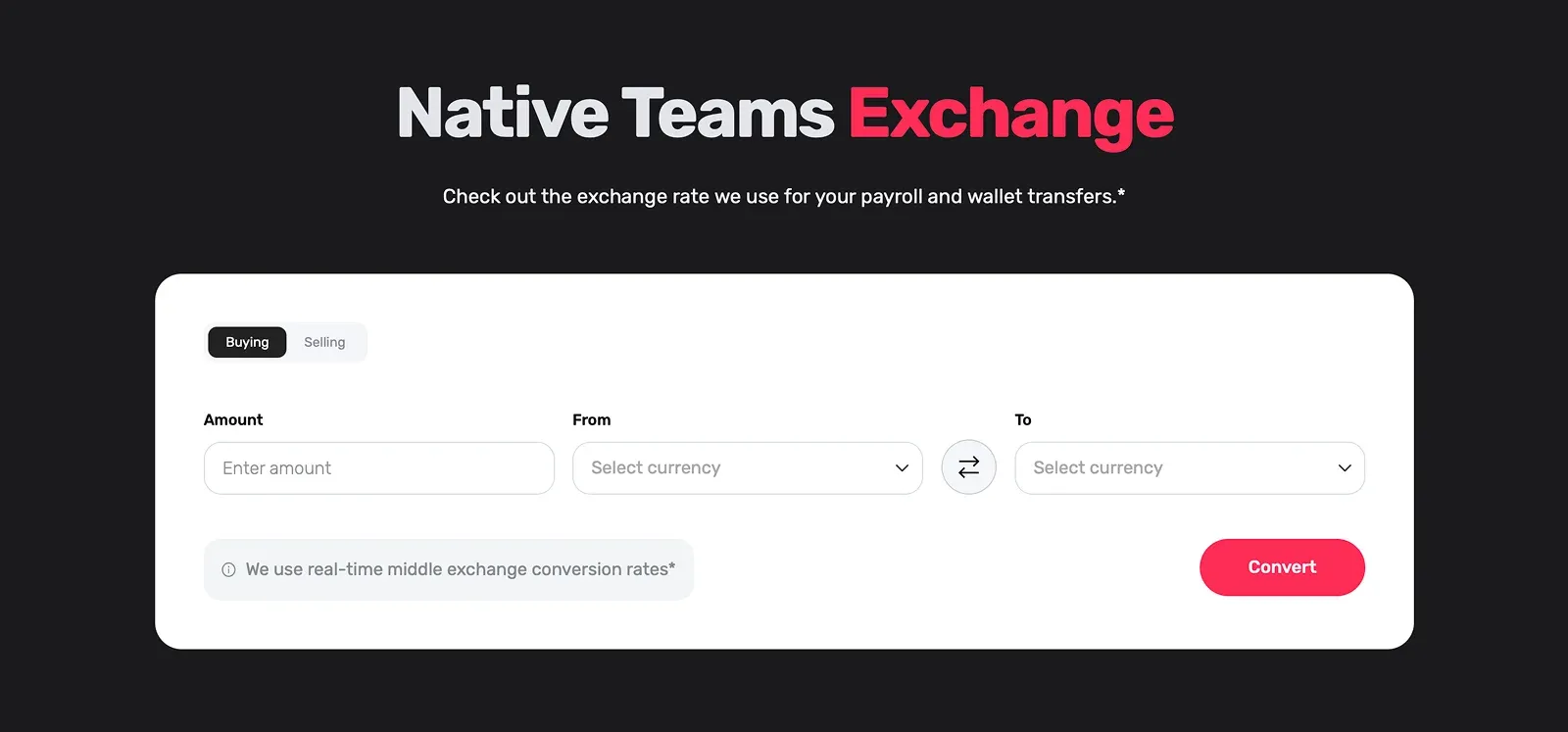

2. Integrated multi-currency wallet: Facilitates instant currency conversions and cross-border payments with minimal fees, improving cash flow management. Additionally, you can monitor team expenses from a centralised dashboard.

3. Batch transfers: Pay multiple employees or contractors in one go.

4. Wallet-to-wallet transfers: Instantly transfer funds to team members or between company wallets.

5. Top up money: Add funds to your business wallet via bank transfer, card, Payoneer, and more.

6. Native Teams cards: Allow your team to access their funds, monitor and track transactions in real-time, with both physical and virtual cards.

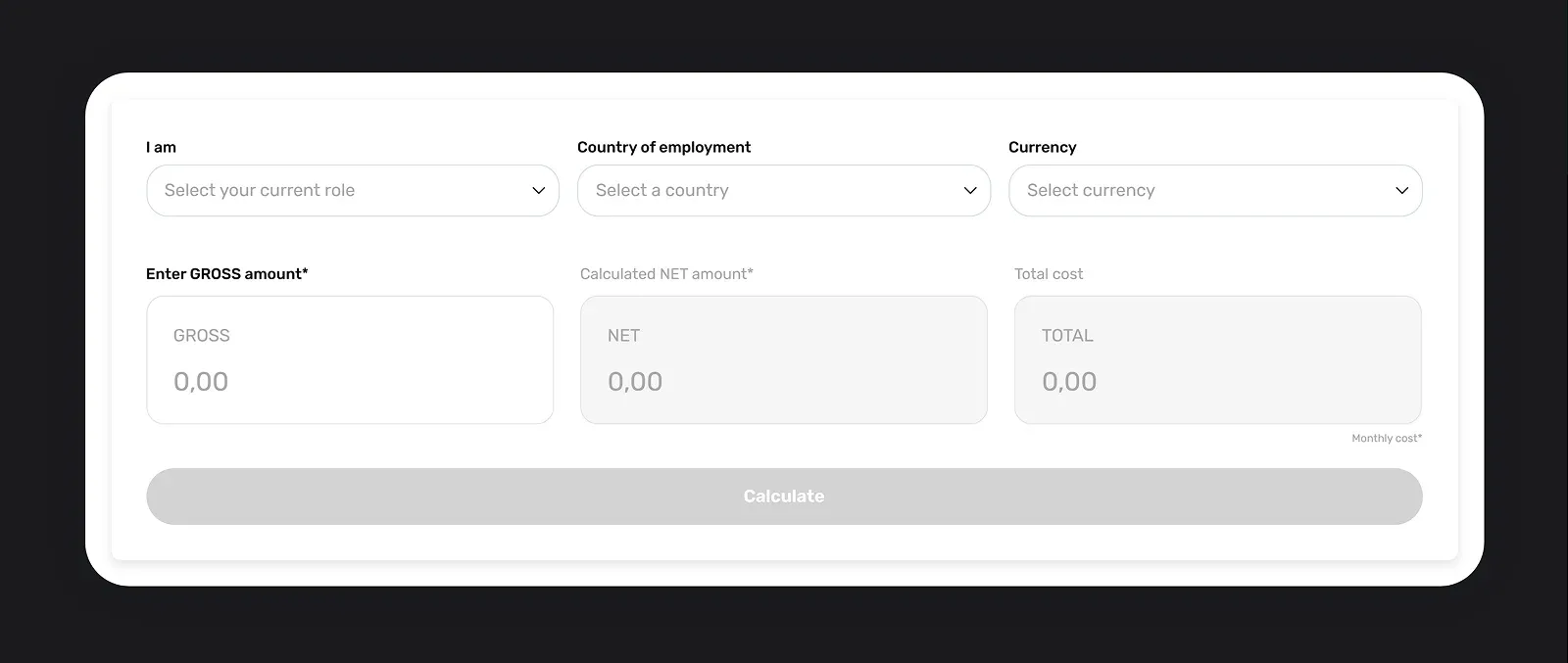

7. Global Payroll Calculator: A user-friendly tool that simplifies salary calculations and provides detailed insights into the total cost of employment across more than 85 countries. It helps you and employees understand gross and net salary figures, mandatory deductions such as taxes and social security contributions, and other country-specific payroll obligations.

8. Comprehensive compliance: Local expertise in each county where we operate, combined with automation, ensures adherence to employment laws, taxes, and reporting requirements, thereby mitigating risks.

9. Employee empowerment: Employee self-service dashboards improve transparency and engagement by giving workers direct access to payroll information, tax documents, and benefits.

10. Detailed payslips: Your employees will receive payslips that showcase their earnings, deductions, and taxes.

And the list goes on.

Ready to dive deeper?

Book a free demo today to learn how to take control of your international cash flow and pay your global team faster and smarter.

Keep learning:

Deel vs. Rippling - Which One Is a Better Fit?