EOR vs Payrolling: What's the Difference in 2026? [Full Guide]

Employer of Record (EOR) and payrolling services offer different ways to simplify hiring, reduce legal risk, and keep your business moving.

How do they exactly differ, and which is the right fit for your hiring needs? Read on to understand the distinctions between the EOR and payrolling to optimise workforce operations.

Let’s dive in!

What is an Employer of Record (EOR)?

An Employer of Record (EOR) is a 3rd-party organisation that legally employs workers on behalf of another company.

It manages everything from employment contracts and onboarding to tax filings, social security contributions, benefits administration, and termination procedures.

This helps you stay compliant with increasingly complex and localised employment laws, especially in regions where labour regulations and tax codes are evolving rapidly.

While the EOR handles all legal employment responsibilities, the day-to-day direction of the employee remains with your team.

This arrangement is especially useful when hiring in countries where your company doesn't have a registered legal entity.

What is payrolling?

Payrolling is a staffing or HR solution where a 3rd party places a worker on their payroll while you, the client company, manage the work and oversight.

It primarily handles wage payments, tax withholding, and sometimes limited benefits administration.

This makes payrolling a lighter-touch, lower-cost option, best suited for short-term staffing needs or when hiring in regions where you already operate legally.

EOR vs payrolling: How to tell the difference?

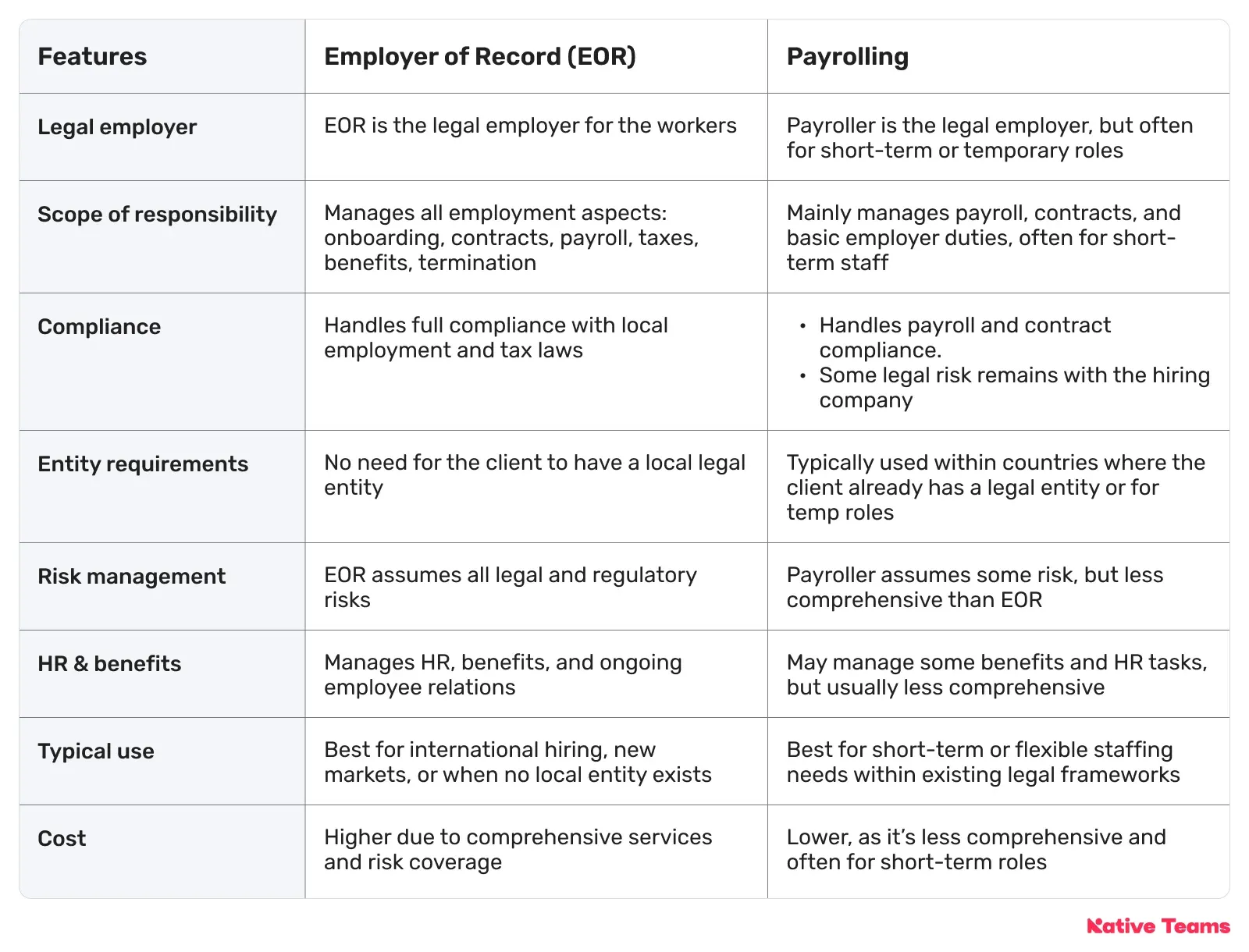

While both EOR and payrolling involve outsourcing certain employment functions, they aren’t interchangeable.

The key difference is in the legal responsibility and scope of services.

1. Legal employer status

Legal employer status is the area where EOR and payrolling probably differ the most.

1.1. EOR

With an EOR, the provider becomes the worker's legal employer.

That means the EOR is fully responsible for employment contracts, tax filings, compliance with local labor laws, and more.

Your company still directs the employee’s daily work, but the EOR handles the rest, legally and administratively.

1.2. Payrolling

With payrolling, the legal employer can vary. Sometimes the provider technically employs the worker, but you, as the client, often retain more legal responsibility.

In many cases, payrolling is used when you already have a local entity and just need help managing payment and deductions.

2. Compliance

Compliance isn’t just a buzzword. It can make or break your global hiring strategy. Here’s how each model handles it.

2.1. EOR

An EOR takes full responsibility for compliance with local employment laws, tax regulations, benefits, and mandatory contributions, so you don’t have to worry about getting it wrong.

It becomes the legal employer and handles everything from contracts to terminations, making sure you're fully covered in the eyes of local authorities.

2.2. Payrolling

Payrolling, on the other hand, mainly focuses on processing payments and ensuring tax withholdings are correct.

While it may cover contract administration and some statutory requirements, the legal risk, such as worker misclassification, local labour law compliance, and termination disputes, still falls on your company.

Payrolling keeps the admin tidy, but it doesn’t shield you from legal exposure the way an EOR does.

3. Entity requirements

Another important differentiating factor is whether you need to set up a legal entity in the country where you’re hiring.

3.1. EOR

With an EOR, you don’t need to set up a local legal entity to hire in a new country. That’s the beauty of it. The EOR acts as the legal employer in that location, so you can bring on talent in places where you have no physical or legal presence.

No incorporation, no navigating foreign bureaucracy, just hire and go.

3.2. Payrolling

Payrolling, however, is a bit different. It’s usually used when you already have a legal entity in the country, or at least some local structure in place.

It's great for streamlining payment and tax admin, but it doesn’t solve the bigger issue of establishing a presence if you don’t already have one.

It’s also commonly used for temporary or contractor roles, especially when you’ve already sourced the talent and just need someone to run payroll and handle basic compliance.

4. HR & benefits

Here’s how EOR and payrolling differ when it comes to supporting your team.

4.1. EOR

When you partner with an EOR, you get more than just payroll support. You get a full HR team behind the scenes.

The EOR manages everything from onboarding and benefits enrollment to vacation tracking, local holidays, sick leave policies, etc.

It ensures your team is supported just like any locally hired employee would be, with benefits packages and HR practices tailored to local laws and cultural norms.

4.2. Payrolling

Payrolling, however, typically offers a more stripped-down experience.

Some providers might help administer basic benefits like healthcare or pensions, especially if required by law, but the HR support is often limited.

You’re still responsible for performance reviews, managing leave policies, and resolving employee issues.

5. Use cases

So, when should you use each option? It depends on who you’re hiring and why.

5.1. EOR

An EOR is your go-to when you want to hire employees in another country, especially one where you don’t already have a legal presence.

Whether you're:

- Entering a new market,

- Building a global remote team, or

- Testing international growth without the overhead of setting up an entity, an EOR lets you do it quickly and compliantly.

It's ideal for long-term hires, full-time roles, and situations where you need full HR and legal support from day one.

5.2. Payrolling

Conversely, payrolling is better suited for short-term or flexible staffing needs, and it works best within countries where you already operate or have a legal entity in place.

It’s a great option when you’ve already sourced the talent, like a contractor or temporary employee, and just need someone to handle payroll processing and basic compliance.

If you’re hiring seasonal staff, interns, or covering a short-term project, payrolling keeps things simple without overcommitting.

6. Cost

Each model comes with its own costs, so it’s worth knowing what you’re actually paying for.

6.1. EOR

Using an EOR typically comes at a higher price tag, but there’s a reason.

You're not just paying for payroll processing — you're paying for a full-service solution which includes:

- Legal employment,

- Compliance with local labour laws,

- Benefits administration,

- Tax filings, and

- Protection from misclassification or labour disputes.

Think of it as hiring a local HR, legal, and payroll team in one package. It costs more, but it also reduces your risk and workload dramatically.

6.2. Payrolling

Payrolling is a lighter, more budget-friendly option. Since it focuses mainly on processing paychecks and handling tax withholdings, it usually comes with lower fees.

However, you’ll need to handle much of the employment process on your own, and the provider's role is purely administrative.

Payrolling suits companies with some infrastructure that just need help with the admin side, especially for short-term or lower-risk roles like temps or interns.

What’s new in EOR & payrolling? Here’s what’s changing in 2026

Both EOR and payrolling services have evolved significantly, driven by digital transformation, regulatory complexity, and the global expansion of workforces.

EOR: What’s new?

- Tech-driven global employment solutions — EORs now offer end-to-end digital platforms that streamline onboarding, payroll, compliance, and HR management for distributed teams. Automation and AI are used for instant background checks, smart contract generation, and digital document verification, reducing onboarding time and errors.

- AI-powered compliance dashboards — Real-time monitoring of regulatory changes across multiple countries, with alerts for law amendments, tax updates, and benefits regulations, helps companies stay compliant and mitigate risks.

- Cloud-based HRIS integration — EOR systems integrate seamlessly with major HRIS platforms, enabling automated data flow, centralised reporting, and enhanced accuracy in global workforce management.

- Predictive analytics and business intelligence — EORs provide actionable insights on hiring costs, turnover, benefits utilization, and compliance risks, supporting data-driven decision-making for global expansion.

- Crypto and blockchain payroll — Some EORs now support blockchain-based payroll ledgers and cryptocurrency payments, offering transparency, security, and new payment options for international hires.

Payrolling: What’s new?

- Strategic role expansion — Payrolling is evolving from a back-office function to a strategic partner, influencing workforce planning, audits, compliance, and cost-effectiveness. Payroll teams are now more involved in business-critical decisions and analytics.

- Increased self-service — Employees can manage time tracking, PTO, and personal information through self-service platforms, while payroll managers gain more control over system setup and pay group creation. This trend improves efficiency and empowers both employees and managers.

- AI and automation — Automation handles repetitive tasks like data entry, validation, time tracking, and tax compliance, freeing up payroll professionals for more strategic work. AI also improves fraud detection and benefits management.

- Digital and remote payroll solutions — Cloud-based payroll systems allow for remote processing and flexible payment models, catering to the needs of distributed and gig workforces.

- Integration with HR Systems — Payroll is increasingly integrated with HR systems, centralizing data, reducing errors, and enabling comprehensive reporting for better decision-making.

These advancements reflect a shift toward automation, data-driven insights, and strategic collaboration in both EOR and payrolling services, aligning with the needs of a global, digital, and flexible workforce.

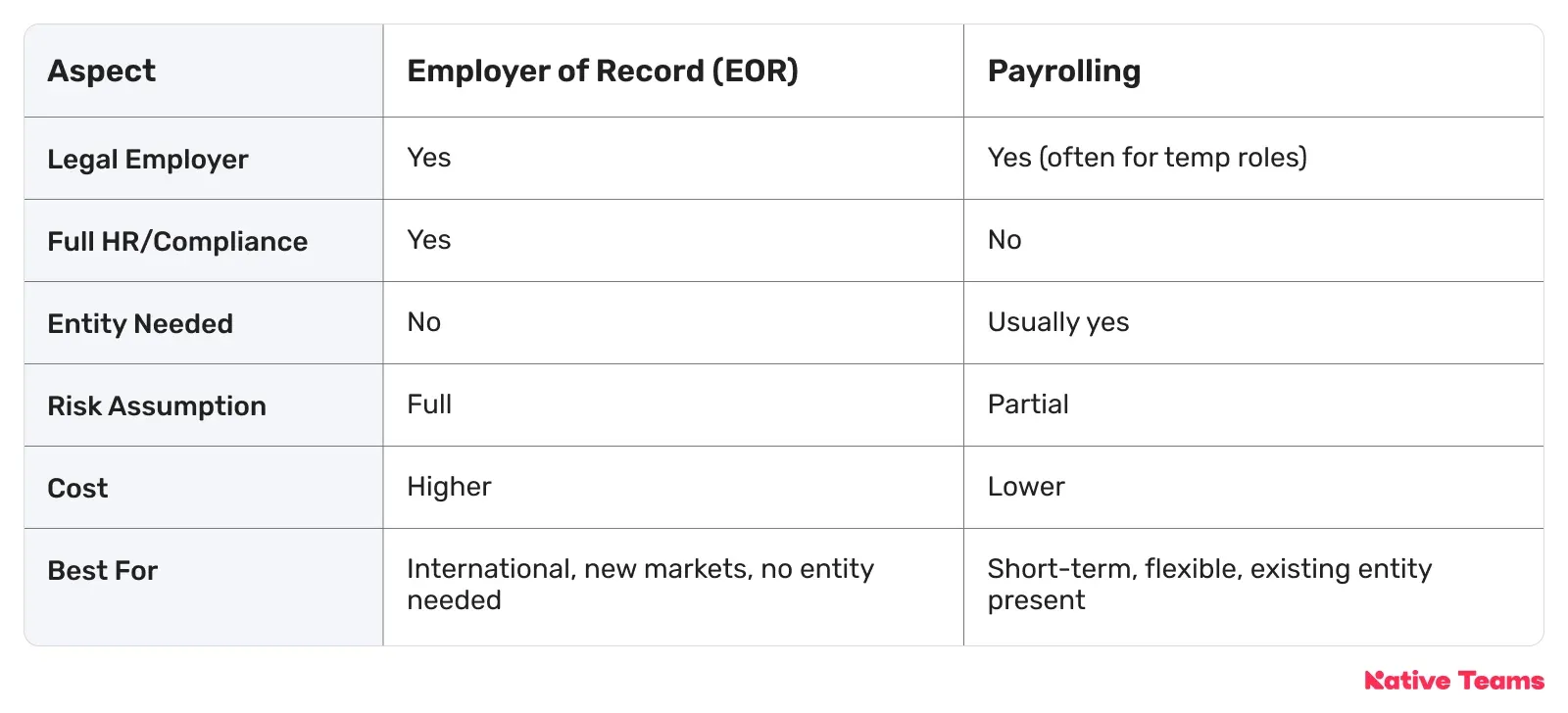

EOR vs. Payrolling: Which is the right fit for your business?

Here’s a quick summary of both solutions so you can make an informed decision that aligns with your business needs, goals, and strategy.

When to choose an EOR?

The ideal time to choose an EOR is when you need to hire full-time employees in a country where your business doesn’t have a local legal presence.

It’s also ideal when you want to test a market without committing to setting up a foreign entity, or when you want to outsource HR, payroll, and compliance in a risk-heavy jurisdiction.

Common cases include:

- Hiring remote employees in foreign countries to access specialized talent

- Expanding into emerging markets quickly and legally

- Avoiding permanent establishment risk by not opening a local branch

- Ensuring compliance with complex labor laws in heavily regulated jurisdictions.

With new data protection laws, labour audits, and stricter employee classification rules emerging, EORs provide a safety net that ensures you remain compliant while staying agile.

When to choose payrolling?

Payrolling is best suited for companies that already have a local entity or aren’t looking to establish long-term employment relationships.

Payrolling is a simpler, cost-effective option if you’ve already sourced the talent and just need an administrative partner to run payroll and handle withholdings.

Common cases include:

- Staffing seasonal workers or short-term contractors through a local provider

- Using pre-identified talent where you need help managing payment and taxes

- Operating in your home country or regions where you have a legal entity

- Avoiding the overhead of onboarding and administering benefits for temporary staff.

Staffing agencies and internal HR teams often use payrolling to reduce administrative burden.

It’s a solid option when full legal employer responsibility isn’t required, but you still want to streamline payments and reduce risk.

However, what if your business requires both solutions and you don’t want to go to different providers, which only add to the costs and make it much harder to get a proper overview of your workforce management?

Luckily, there is Native Teams, one platform, two solutions.

Whether you need full legal employment support in a new country or just a simple way to pay contractors and temp staff, Native Teams gives you the flexibility to scale your workforce on your terms.

Native Teams — EOR and payrolling made easy

Operating in over 85 countries, Native Teams provides legal employment solutions that ensure compliance with local labour laws and tax regulations.

Our core solutions include:

1. EOR & PEO solutions

Our EOR services allow you to hire international employees without establishing a local entity, handling everything from employment contracts to benefits administration.

- Legal employment status — Employees receive official employment status in their respective countries, complete with localised contracts.

- Payroll management — Automated payroll processing ensures timely and accurate salary payments in local currencies.

- Benefits administration — Provides country-specific benefits such as health insurance, pensions, and other mandatory contributions.

- Compliance handling — Management of tax filings, social contributions, and adherence to local labour laws.

2. Flexible payroll solutions

In addition, for businesses with existing legal entities or those needing to manage contractors and freelancers, we provide flexible payrolling solutions that include:

- Payroll processing — Efficient handling of salary payments, tax withholdings, and social contributions.

- Multi-currency support — Allows you to make payments in various currencies, accommodating global teams.

- Expense management — Provides tools to track, approve, and reimburse employee expenses seamlessly.

3. Integrated platform features

Our platform offers additional features to streamline workforce management:

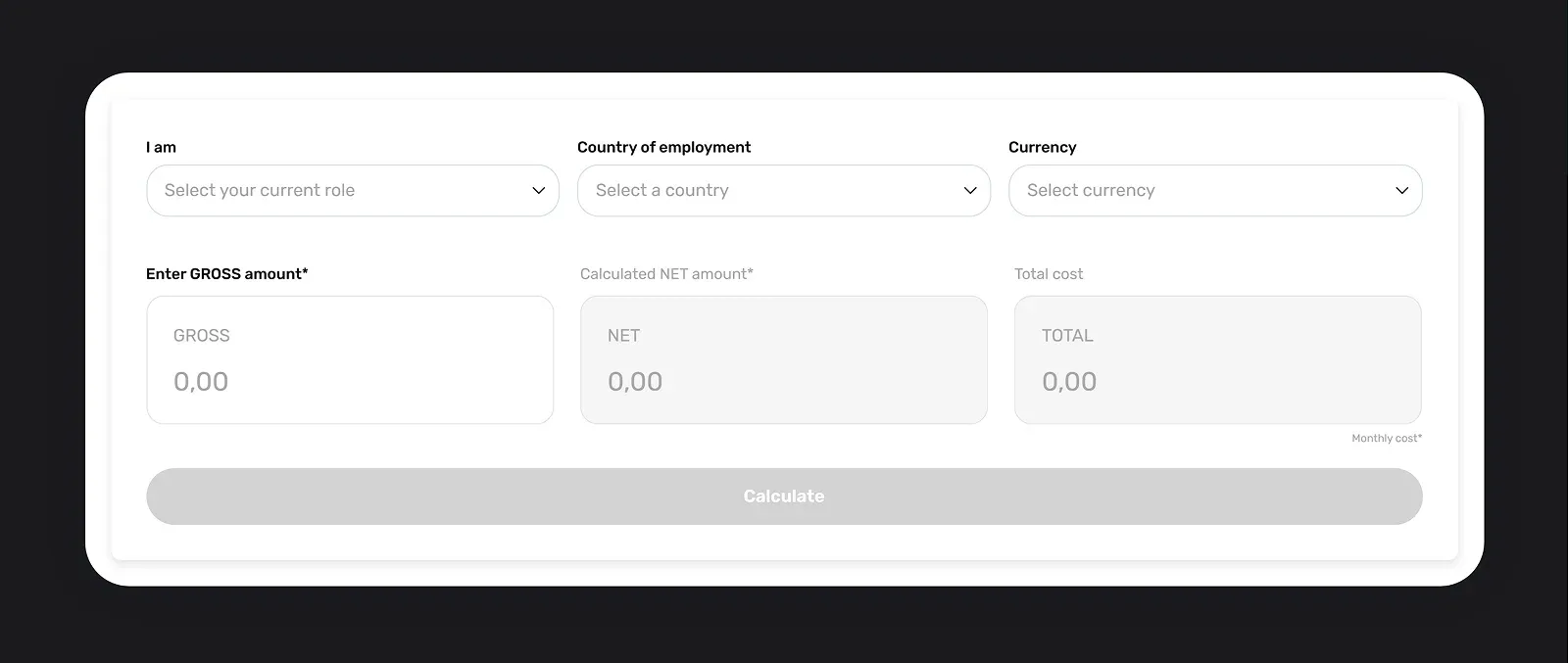

- Payroll calculator — Up-to-date tool for calculating salaries, contributions, and other mandatory costs specific to the selected country.

- Time and absence tracking — Monitor employee attendance and manage leave requests efficiently.

- Document management — Secure storage and management of employment-related documents.

- Employee self-service portal — Empowers employees to access their payroll information, benefits, and personal data.

Ready to find out more?

Book a free demo today to hire globally and pay easily while staying compliant.