The Ultimate Guide to Gig Economy Payments & Workforce Management

The workplace we once knew has undergone dramatic changes. What used to require a corner office and a 9-to-5 schedule now happens from coffee shops in Barcelona, home offices in Bangkok, and co-working spaces across the globe. Companies are realising that tapping into this flexible talent pool is becoming essential for staying competitive.

Although gig workers have become the backbone of business agility, managing them has become a logistical nightmare. Companies often find themselves overwhelmed by administrative complexity, as they juggle various payment methods, currencies, and compliance requirements across multiple countries.

And that's exactly what this guide tackles. We’ll show you how the right gig economy payments platform can turn this complexity into your competitive edge, with practical strategies for staying compliant. Let’s get started!

Key takeaways

- The gig economy is rapidly expanding. Valued at $556 billion in 2024 and expected to quadruple by 2033, it’s becoming a core workforce strategy for companies worldwide.

- Manual processes don’t scale. Onboarding, compliance, and payments for hundreds or thousands of gig workers quickly overwhelm internal teams.

- Gig workers expect a smooth, transparent payment experience. Fast payouts, local currency options, and clear communication build trust, loyalty, and long-term engagement with top talent.

What is the gig economy?

At its core, the gig economy is a labour market built on temporary, flexible jobs where businesses connect with independent workers for specific projects or tasks.

Gig economy jobs began as a niche alternative for creative freelancers and part-time drivers, and have since expanded into a mainstream workforce strategy for companies of all sizes. The growth numbers highlight the significance of this shift — in 2024, it was valued at $556 billion, and this value is expected to quadruple by 2033.

A major driving force of the gig economy are gig workers. A gig worker is an individual who works as an independent contractor, freelancer, consultant, or temporary worker, rather than as a traditional full-time employee. This includes everyone from the graphic designer who handles your quarterly campaigns to the software developer building your mobile app, or the market researcher conducting customer interviews across three continents.

Here are some real-life examples of the gig economy, which will help you grasp its essence better:

- A fintech startup hires a freelance mobile developer in Poland for a 4-month app development project.

- An e-commerce company in the Philippines pays graphic designers on a per-project basis for product packaging.

- A consulting firm engages a data analytics specialist in Germany for quarterly client reports.

The mounting challenges of high-volume gig work management

The paradox of the gig economy is that it offers incredible flexibility and access to global talent, yet simultaneously creates operational hurdles for businesses managing a large number of gig workers.

👉Administrative overload: Each contractor requires individual onboarding, contract management, performance tracking, and ongoing communication across different platforms and processes. When you're dealing with 500 gig workers instead of 50, the manual work becomes completely unmanageable.

👉Legal & compliance risks: Misclassification risks multiply when you have hundreds of workers who might fall into different categories based on their work patterns, payment structures, and local employment laws. A single compliance mistake that might cost thousands with a small gig workforce can result in millions in penalties and legal fees when applied across a large contractor base.

👉High-volume payment complexity: Processing payments for hundreds or thousands of gig workers across different countries turns into a full-time operational challenge that goes far beyond simple money transfers. You're dealing with multiple currencies, varying payment preferences, different banking systems, fluctuating exchange rates, and complex fee structures.

As Filip Špiranec, Co-Founder of Hypefy, explains:

“Managing payments, contracts, and compliance across different countries was a major administrative burden and legal risk, especially as a young startup. Cross-border payments were slow, costly, error-prone, and at times, we didn’t even know how to approach them correctly. Handling freelancer and gig worker payments in a legally compliant way was one of our biggest roadblocks to scaling.”

His experience reflects the reality that many fast-growing companies face when trying to scale gig operations globally.

👉Worker satisfaction & retention: Payment delays, complicated onboarding processes, and poor communication systems have a magnified impact when you're trying to retain top talent across a large gig workforce. Gig workers have options, and they quickly move to companies that provide reliable payment experiences and clear communication channels.

The diverse landscape of gig work: Universal challenges, unified solutions

The gig economy has infiltrated virtually every corner of modern businesses. From tech startups hiring remote developers and UX designers, to creative agencies collaborating with freelance writers and graphic artists, to logistics companies relying on delivery drivers and healthcare platforms engaging on-call nurses.

Despite this diversity in roles and industries, companies across all sectors are struggling with similar challenges when managing their gig workforce. The freelance developer in Silicon Valley faces the same payment delays as the delivery driver in Detroit.

What makes these challenges particularly acute is that they must be solved while respecting the diverse preferences and local nuances that define different markets and worker segments. A solution that works for tech freelancers in urban markets might completely miss the mark for skilled tradespeople in rural areas.

This raises the need for a platform that handles the complexity of diverse industries while being flexible enough to adapt to local markets and individual preferences.

The gig worker's perspective: What a smooth payment experience looks like

For gig workers, the payment experience represents far more than a simple financial transaction. It's a reflection of how much a company values their contribution, respects their time, and understands their unique circumstances. They also want clarity about when and how they'll receive compensation, fairness in the payment process, and consistency they can rely on to manage their financial lives.

👉 Timely & transparent payment: Gig workers operate on cash flow, not traditional salary cycles. They need to know exactly when they'll be paid for completed work, with clear milestones and payment schedules communicated upfront.

👉Local currency options: Beyond convenience, local currency options protect workers from volatile exchange rates and unexpected conversion fees that can eat into their earnings. A graphic designer in Buenos Aires shouldn't have to lose 3-5% of their payment to currency conversion.

👉Diverse payment methods: Some workers prefer traditional bank transfers for larger amounts, while others need instant digital wallet transfers for quick cash flow. As an employer, you should offer multiple payment methods to ensure flexibility and worker satisfaction.

👉Clear invoicing & documentation: Professional gig workers need proper documentation for tax purposes, client records, and their own financial management. This means detailed invoices that break down project components, applicable taxes, and fee structures.

Worker loyalty increases dramatically when payment processes are smooth and predictable. Satisfied gig workers become repeat collaborators, reducing the constant need to source and onboard new talent. They also become advocates within their professional networks, recommending reliable clients to their peers and helping companies access higher-quality talent pools.

The solution: Modern platforms for gig economy payments

The days of managing gig payments through spreadsheets and manual invoicing are rapidly coming to an end. Forward-thinking companies are making the strategic shift from administrative-heavy processes to proactive, automated solutions.

But how to choose the right solution that will manage your large gig workforce? The list below outlines the key features and functionalities that businesses should prioritise:

✅Automated compliance management should automate worker classification, tax documentation, and regulatory requirements across multiple countries, eliminating the need for manual intervention.

✅Global payment infrastructure must support multiple currencies, payment methods, and regional preferences while maintaining a consistent user experience.

✅Intelligent workflow automation should streamline everything from contractor onboarding to project completion and payment release.

✅Comprehensive reporting and analytics provide insights into payment patterns, contractor performance, compliance status, and cost optimisation opportunities.

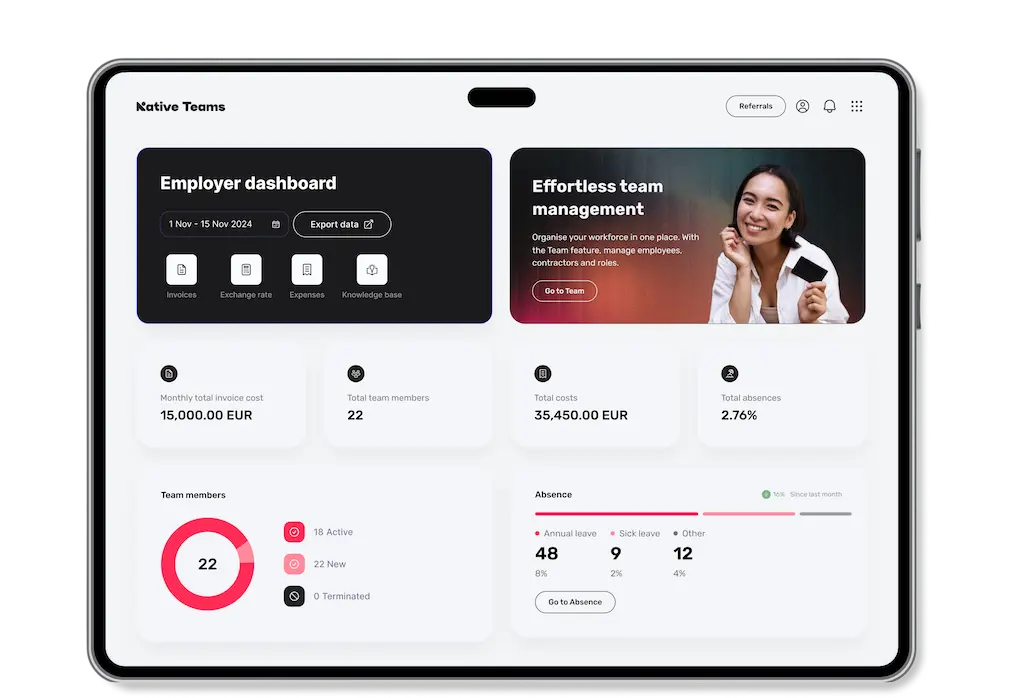

Multiple platforms on the market check some of these features, but not all, giving a fragmented experience for your business. With Gig Pay, you can directly address every payment challenge through a comprehensive platform, specifically designed for gig work management.

The platform adapts to the unique needs of each worker type, whether it’s Uber and Bolt drivers, Glovo delivery workers, creative freelancers, or TaskRabbit-style service providers. Some of the core features include:

- Smart contract management

- Automated payroll processing

- Real-time compliance

- Unified income tracking

- Early salary access

- Simplified leave management

Take a look at what the Co-Founder of Hypefy said after using Gig Pay to overcome their payment challenges:

"Payments became faster and more reliable, contracts were managed in one place, and compliance was handled automatically. We saved time, and our workers got paid on time."

Need a simpler way to manage your gig payments?

The future of gig economy payments: Trends & what's next

The gig economy is changing rapidly, and two major forces are driving this transformation. AI and automation are revolutionising the way payments are processed. Smart systems handle everything from generating invoices to detecting fraud and enforcing compliance rules, processing thousands of payments simultaneously with precision that humans simply can't match.

At the same time, governments worldwide are revising the rules surrounding gig work, introducing new protections for workers, stricter tax requirements, and more straightforward guidelines on who qualifies as an employee versus a contractor.

Native Teams isn't just watching these changes happen – we're ahead of the curve. Gig Pay already uses AI automation and compliance tools. While competitors scramble to keep up with new regulations and worker demands, our clients are already equipped with the technology and systems they need to thrive.

Stay ahead of regulatory changes with our actionable playbook on EU Gig platforms Directive Compliance

To wrap up

The gig economy represents one of the most significant workforce transformations of our time; however, it also demands sophisticated solutions that can handle the complexity of managing a modern gig workforce.

The challenges are real and substantial. From compliance headaches and payment friction to worker retention and operational scalability, businesses across all industries face similar challenges when leveraging gig workers effectively. But these challenges aren’t insurmountable, and companies that address them proactively gain significant competitive advantages.

Gig Pay transforms these challenges into opportunities by providing a comprehensive platform that handles the entire gig worker lifecycle.

Ready to transform how you manage your gig workforce?

Frequently Asked Questions (FAQs)

1. What is Gig Pay by Native Teams?

Gig Pay by Native Teams is a work payments solution designed for businesses working with gig workers, such as freelancers, drivers, and delivery personnel. It streamlines onboarding, contract management, payroll processing, and instant payments, consolidating all gig worker payments and compliance needs into one platform.

2. How does Gig Pay help with compliance?

Gig Pay helps businesses maintain compliance with both local and international regulations by enabling the bulk import of worker data and facilitating the deployment of locally compliant contracts with e-signature capabilities. The platform supports multi-jurisdiction payroll, adapting to regulations such as the EU’s Platform Work Directive and U.S. contractor laws.

3. Can I use Gig Pay to pay freelancers in different countries?

Yes, Gig Pay is built for global scalability and can be used to pay freelancers and contractors in over 85 countries across Europe, North America, Latin America, and Asia-Pacific. It supports payments in multiple currencies and complies with local financial regulations, making it suitable for cross-border gig work.

4. How does Gig Pay improve the worker experience?

Gig Pay improves the experience of gig workers by offering a mobile-first application that allows them to consolidate earnings from multiple platforms into a single, user-friendly wallet. Workers benefit from instant or early access to their earnings through both virtual and physical cards, enabling greater financial flexibility and control.

5. Is Gig Pay suitable for startups and large enterprises?

Gig Pay is designed to be flexible and scalable, making it suitable for both startups and large enterprises. Startups can benefit from simplified onboarding and payroll without expanding their finance or legal teams, while large enterprises can efficiently manage payments and compliance for a global workforce, reducing administrative time and supporting rapid scaling.