Global Payroll Automation: How to Simplify Payroll in 2026

Managing global payroll isn’t easy: changing tax laws, currency fluctuations, and compliance landmines.

If you still rely on fragmented systems, manual processes, and spreadsheets to manage payroll across borders, you know that manual processes can’t keep up.

Luckily, global payroll automation offers a smarter solution that reduces errors and streamlines operations.

Curious to know how? Read on to learn how to simplify global payroll and stay compliant, agile, and employee-friendly, no matter how many countries you operate in.

Let’s dive in!

What makes global payroll so complex?

Besides cutting checks, running global payroll is also about navigating a fast-moving, high-stakes puzzle of regulations, tech, people, and processes.

Obviously, juggling all of it creates lots of challenges.

1. Regulations vary everywhere — and they’re always changing

Every country (and often each region within a country) has its tax laws, labour codes, social security requirements, and reporting rules.

Unfortunately for employers like you, these laws constantly evolve, and staying on top of updates can feel like an additional full-time job.

But even more than that, if you operate globally, cross-border compliance isn't just complex, it’s risky.

One misstep can result in hefty fines or serious legal exposure.

2. A diverse workforce means diverse expectations

Today’s workforce is global, multigenerational, and highly individualised.

Employees expect flexible pay, localised benefits, and full transparency, no matter where they live or how they work.

From remote contractors in Brazil to full-time staff in Germany, catering to different compensation models and cultural expectations makes a “one-size-fits-all” payroll nearly impossible.

3. Currency conversions & cross-border payments add pressure

Managing payroll in multiple currencies covers exchange rate fluctuations, local banking delays, and cross-border payment rules, which can all disrupt payroll cycles.

You must ensure every employee gets paid on time, in the right currency, and through the right payment method, regardless of the region.

4. Disconnected systems equal data nightmares

Many organisations are juggling a mix of legacy systems and new digital tools.

Without proper integration between payroll, HR, and finance platforms, data silos emerge, increasing the risk of errors and reducing visibility.

Getting systems to “talk” to each other is essential but far from easy.

5. Scaling globally is no small feat

As you grow into new markets, you must rapidly adjust payroll operations to match local laws, languages, time zones, and cultural norms.

Managing employment contracts in Japan one day and onboarding in South Africa the next, all while keeping payroll accurate and compliant, requires both agility and precision.

Bottom line?

Global payroll complexity is driven by:

- Shifting regulations,

- Workforce diversity,

- Multi-currency logistics, and

- Tech integration challenges.

No wonder companies that want a competitive edge are turning to automation to bring order to the chaos.

6 key strategies to simplify global payroll

Simplifying global payroll isn't about doing more — it’s about doing it smarter.

Embracing technology, integration, and a business automation strategy are just some of the key drivers to simplify global payroll.

Here's how you can do the same.

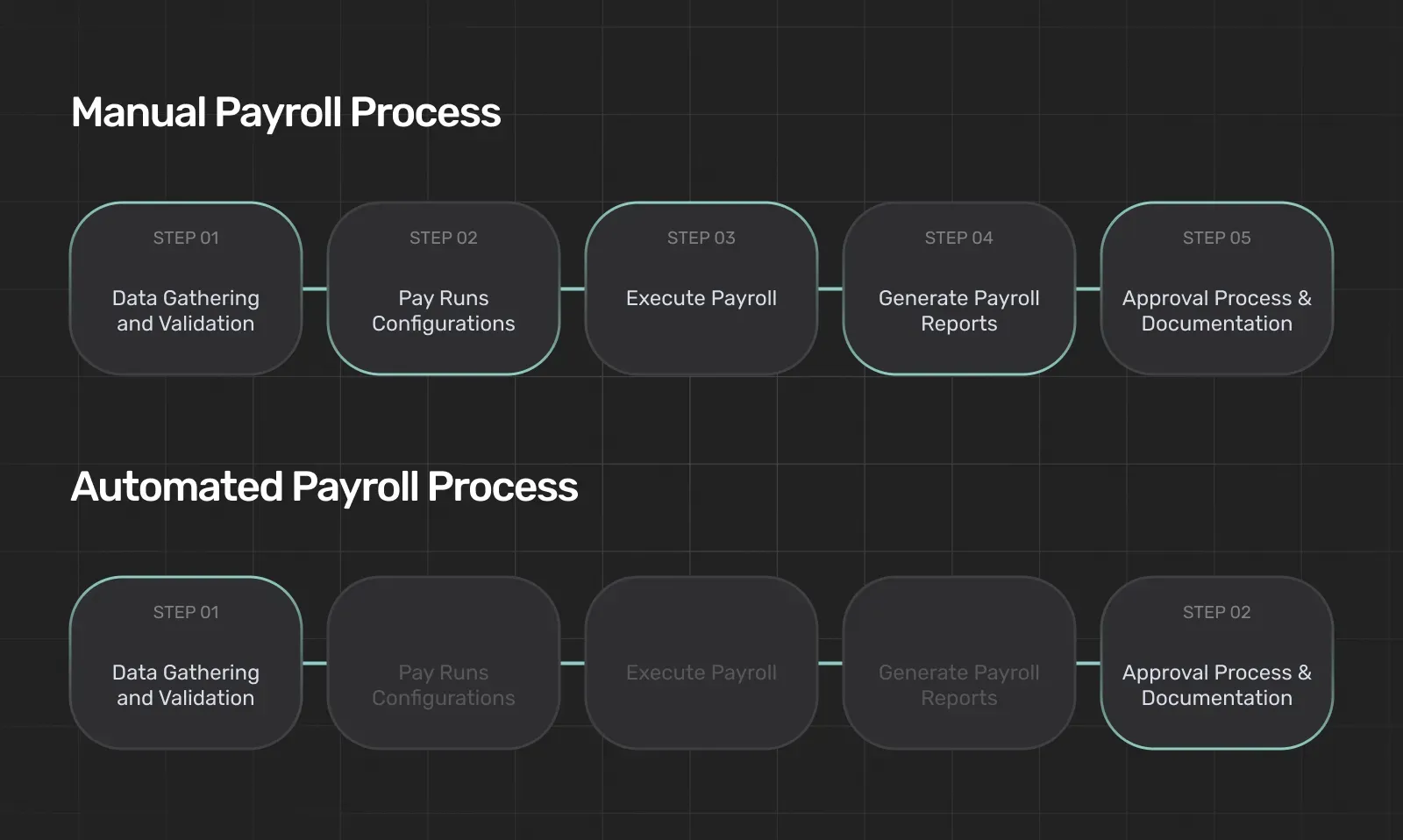

1. Leverage AI and Machine Learning

AI and Machine Learning are transforming payroll into a fast, accurate, and strategic operation.

AI-powered payroll systems can automate tasks like:

- Entering employee data,

- Validating timesheets,

- Calculating taxes, and

- Generating reports.

As a result, it means fewer errors, faster processing, and a considerable drop in compliance risks.

But it doesn’t stop there. Machine learning algorithms:

- Identify anomalies,

- Predict payroll costs, and

- Flag potential compliance issues before they escalate, enhancing accuracy and financial oversight.

Furthermore, AI-driven platforms can interpret real-time updates to labour laws and social security thresholds, ensuring cross-border compliance even as regulations evolve.

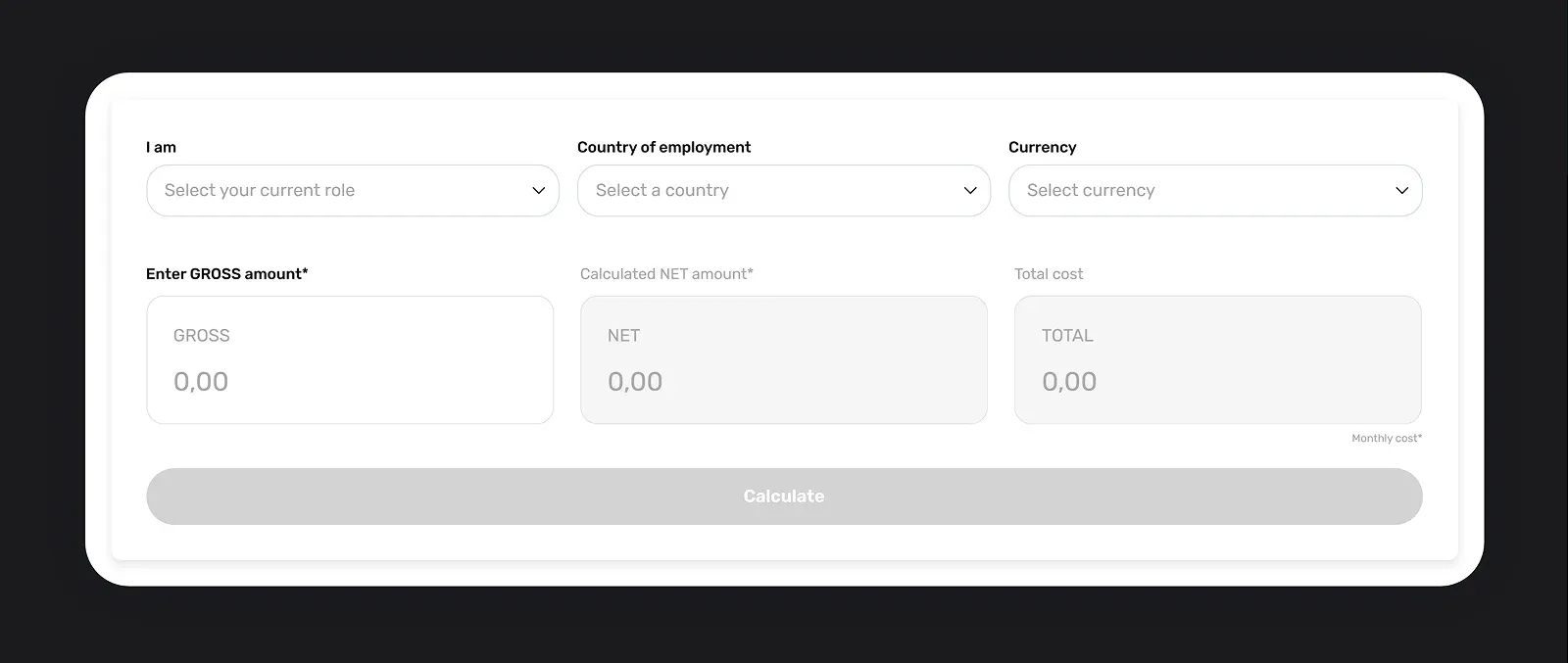

Worth knowing

Did you know that with our Payroll Calculator, you can get a breakdown of the expenses for hiring employees in different countries or calculate your own gross and net earnings in your residential country?

As a result, you can determine salaries accurately and compliantly with local labour laws and get insights into tax obligations, health and pension contributions, and other mandatory costs specific to the selected country.

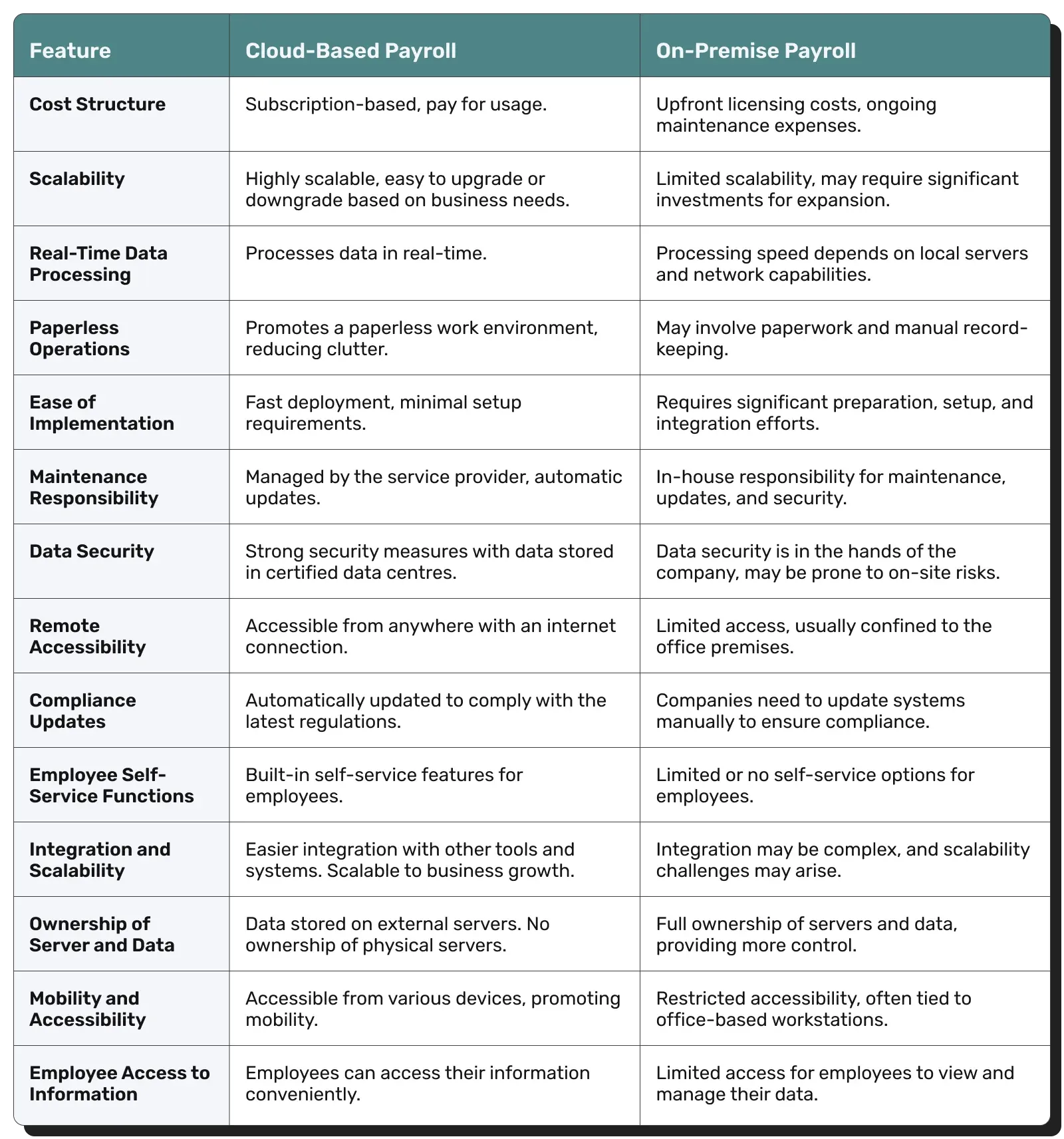

2. Embrace cloud-based payroll systems

Cloud payroll solutions offer real-time access, unmatched flexibility, and centralised control over even the most complex payroll operations.

Whether your finance team is in London, your HR leads are in São Paulo, or your employees are scattered across time zones, the cloud ensures everyone stays connected and on the same page.

Here’s why cloud payroll is a game-changer:

Provides anywhere, anytime access

Cloud systems allow HR and payroll teams to manage pay runs, update records, and access reports from any device, in any location, which is particularly crucial for global teams.

Enables real-time collaboration

Payroll no longer has to be a siloed function.

Cloud platforms enable real-time collaboration between HR, finance, and compliance teams, breaking down data silos and ensuring payroll accuracy and efficiency across departments.

Does automatic updates and compliance

Cloud platforms update automatically to reflect the latest tax laws, labour regulations, and compliance standards, so you’re always aligned with local laws without lifting a finger.

Helps scale without the hassle

Expanding into a new country? Hiring a remote contractor?

Cloud systems scale with you and add new employees, currencies, and jurisdictions without the need for infrastructure overhauls.

Provides security

With payroll data being among the most sensitive, cloud platforms offer enterprise-grade encryption, role-based access controls, and compliance with global data privacy laws like GDPR, ensuring your employee information stays protected.

Offers integrated ecosystems

Most cloud payroll platforms integrate seamlessly with core business systems like HRIS, ERP, time tracking, and benefits management.

This unified data environment reduces manual input, minimises risk, and boosts efficiency.

Worth knowing

Native Teams streamlines global employment with combined EOR and PEO services, managing:

- Payroll,

- Payments,

- Compliance, and

- Tax optimisation in one platform.

We partner with local experts in countries where we operate to ensure full compliance with evolving regulations and handle:

- Tax codes,

- Labour laws, and

- Contributions across borders.

From accurate payroll to compliant contracts, we reduce legal risks and keep your team paid on time, everywhere.

3. Prioritise system integration

Payroll doesn’t, and shouldn’t, operate in isolation. Cloud-based payroll solutions act as a central hub that connects payroll with your HR, finance, and ERP systems.

The result? A unified, intelligent ecosystem that makes your operations faster, more efficient, and infinitely more strategic.

Thus, instead of juggling siloed systems and manually syncing data between platforms, cloud integration allows for seamless data flows across departments.

For example,

- Employee hours logged in your time-tracking tool automatically sync with payroll.

- Tax data from HR feeds directly into financial reports.

- Everything updates in real time, reducing the IT workload and significantly cutting down the risk of errors or inconsistencies.

With all your payroll, HR, and finance data working together, you get

- A real-time view of labour costs,

- Trends in compensation,

- Headcount projections, and

- Budget forecasts, making payroll not just an operational task but a strategic asset.

This level of visibility helps you make smarter decisions about hiring, expansion, and workforce planning.

Therefore, by centralising and integrating payroll through the cloud, you’re not just streamlining operations but empowering your entire organisation with better data and deeper insights.

4. Stay compliant across borders

As you expand across borders and hire remote talent, you’re entering an increasingly complex regulatory system. That’s where automated payroll steps in.

It automatically tracks and implements changes in:

- Tax rates,

- Social contributions,

- Labour laws, and

- Reporting standards across multiple countries.

Instead of relying on manual updates or regional teams to catch every shift in legislation, automated paroll systems adjust in real time, dramatically reducing the risk of:

- Missed updates,

- Costly errors, or

- Government penalties.

It’s like having a global compliance expert working around the clock in every region you operate.

Furthermore, automated payroll solutions can now handle multi-currency transactions, region-specific pay cycles, and even help assess whether a worker qualifies as an employee or independent contractor in each jurisdiction.

Not only does this level of precision ensure compliance, but it also builds trust with your global workforce and protects your business from legal risks.

Worth knowing

Besides EOR services, our PEO services enable you to send payroll invites and manage the salaries of all your employees in a single dashboard.

We provide fully-compliant payroll services with taxes, social security, and other mandatory contributions covered.

5. Focus on employee experience

Companies now manage full-time employees, freelancers, gig workers, and remote teams often across multiple countries and time zones.

Modern payroll platforms offer flexible payment options such as

- Earned wage access (EWA) so employees can access a portion of their earnings before payday, and

- Support for various payment methods, from bank transfers to digital wallets.

These features make a real difference in helping employees feel financially secure and supported, especially in regions where traditional banking infrastructure is limited.

Moreover, with intuitive self-service portals, employees can now:

- View payslips,

- Download tax documents,

- Track benefits, and even

- Update their own personal information, all in one place.

This reduces the administrative burden on HR and payroll teams and gives employees greater autonomy and visibility into their compensation and benefits.

The result? Fewer emails, faster resolutions, and a more empowered workforce.

At a time when attracting and retaining talent is extremely competitive, offering a seamless, modern payroll experience isn’t just a nice-to-have but a key part of your employee value proposition.

Worth knowing

Native Teams support various payment options, including direct bank transfers and digital wallets, so your employees can receive salaries using their preferred method.

Multi-Currency Virtual Wallet allows your employees to easily add money to your wallet via a bank transfer, card, Payoneer, and other options.

Therefore, you can withdraw, deposit, or transfer funds across platforms, including local bank accounts, personal cards, and separate wallets.

In addition, our EWA feature provides your employees with access to their earned wages before the regular payday, promoting financial stability and flexibility.

6. Implement robust safeguard measures

When it comes to payroll, accuracy isn’t optional, and neither is data security.

Managing sensitive employee information across multiple platforms, departments, and countries introduces serious risks.

A single error in data entry or a security lapse can cascade into incorrect paychecks, faulty tax filings, or even compliance violations.

For example, fragmented payroll, HR, and finance systems often don’t ‘communicate’ with each other, increasing the chances of mismatched records and outdated data.

When systems are siloed, your payroll teams are left juggling spreadsheets, emails, and manual updates, making it easy for mistakes to slip through the cracks.

Consequently, you’ll experience overpayments, underpayments, missed tax deadlines, and potentially, costly audits.

Why data privacy laws raise the stakes?

Also, with stricter data protection regulations, you can face serious legal and financial penalties if employee payroll data isn’t properly secured.

But the impact isn’t only reputational.

A payroll data breach can damage employee trust, especially when sensitive information like salaries, social security numbers, and bank details is involved.

To stay compliant and build trust, you must prioritise data protection by:

- Investing in secure, cloud-based payroll platforms with encryption and role-based access controls

- Conducting regular system audits and vulnerability assessments

- Establishing strong internal controls around data access and sharing

- Training teams on data privacy best practices.

By modernising payroll systems and embracing robust security practices, you can ensure compliance, reduce risk, and give your employees the peace of mind they deserve.

Here at Native Teams, we take serious steps to secure and protect data and financial information. Below are just some of our security practices:

- Secure Infrastructure — Our platform is hosted on Amazon Web Services (AWS), a globally trusted cloud provider that invests heavily in security and compliance tools.

- Daily Backups — We run daily backups of our infrastructure and applications to ensure data integrity.

- KYC & AML Compliance — We conduct Know Your Customer (KYC) checks and adhere to Anti-Money Laundering (AML) policies to verify user identities and comply with international financial regulations.

For a more detailed overview, jump to our Security and Compliance section.

Key features to look for in a global payroll provider

Besides automating payments, a global payroll provider should support compliance, flexibility, and employee satisfaction across borders.

Check the must-have features below that separate the outdated systems from the future-ready platforms.

- Multi-country tax compliance tools — Automatically stay up to date with local tax laws, labour regulations, and social contributions, no matter how often they change. Look for platforms with built-in compliance engines capable of handling country-specific requirements, minimising the risk of penalties and reducing your legal exposure.

- Integrated FX and cross-border payment processing — The right payroll platform should handle real-time exchange rate adjustments, support multiple payment methods, and streamline cross-border transfers.

- Employee self-service portals — Empower team members to access their payslips, tax forms, benefits details, and even update personal information without going through HR.

- Customisable reporting & analytics — Look for platforms that offer customisable dashboards and analytics so you can track payroll costs, headcount trends, tax liabilities, and more.

- Secure data handling — With stricter data privacy regulations in place globally, your provider should offer end-to-end encryption, role-based access controls, and automated audit trails to keep sensitive employee data safe and compliant.

Why opt for Native Teams?

Native Teams specialises in providing streamlined work payments, employment, tax management and mobility solutions for you and your global team.

Our combined EOR and PEO solution integrates:

- Salary calculations,

- Expenses,

- Taxes, and

- Benefits, into a unified system, simplifying payroll management across multiple countries.

With Native Teams:

✅ Maintain full visibility, control, and consistency across your global workforce.

✅ Enter new regions quickly without getting slowed down by complex admin.

✅ Minimise costly errors and keep your employees happy with on-time, accurate payments.

✅ Cut back on manual processes and overhead while boosting overall efficiency.

Get inspired: Native Teams’ real stories, real outcomes

Here at Native Teams, we highly value the feedback of our loyal customers that help us grow and continue to provide robust global payment and employment solutions.

Let’s see our solutions in action.

Success story no 1: How Native Teams helped Nila IT handle payments and invoicing across borders?

As Nila IT engaged in international transactions, they encountered complexities in handling cross-border payments, such as:

- Currency conversions,

- Transaction fees, and

- Ensuring timely and accurate invoicing for their services.

These operational challenges weren’t only time-consuming but also posed a risk of errors and financial discrepancies.

According to Nila IT’s team, the lack of a streamlined financial process was a major hurdle in maintaining efficiency and client satisfaction in their international dealings.

How did we help?

We provided tailored solutions to their invoicing and payment challenges:

- Unified payment platform — Paying employees in their local currency was no longer a hassle. Our platform enabled accuracy and efficiency in payments and currency conversions.

- Digital wallet and automated invoicing system significantly reduced administrative burdens and errors and helped organise and streamline payments.

Want to become a part of our Native family?

We promise 40% faster operations, 3x faster onboarding and 70% less admin time.

Schedule a free demo call and soon start turning payroll from a back-office burden into a strategic asset.

Keep learning:

15 Tips to Create a Global Payroll Strategy