How Does An EOR Contract Work? + How to Create It

Employment laws change fast, and they vary wildly from country to country.

What counts as a valid probation period in one country could be illegal in another. Miss one statutory benefit, and you may be liable for months of retroactive payments.

That’s where a properly structured Employer of Record (EOR) contract comes in.

Read on to learn how an EOR contract works and how to create one correctly to avoid costly compliance mistakes.

Let’s dive in!

How an EOR contract works

An Employer of Record (EOR) contract functions through an agreement involving:

- The EOR Provider — The legal employer of the worker, operating within the local legal framework.

- The Client Company — The business that needs to hire talent in a different jurisdiction.

- The Employee — The individual performing the work for the client, but legally employed by the EOR.

This arrangement enables businesses to expand into new markets without establishing a local legal entity, while ensuring full compliance with local employment laws and regulations.

1. Core responsibilities of the EOR

The EOR acts as the official employer of record and handles all legal and administrative obligations related to employment, including:

- Employment contracts — Drafting and issuing employment agreements that comply with local labour regulations, and that are tailored to reflect the client’s needs while staying legally compliant.

- Payroll and tax compliance — Calculating and processing payroll, deducting applicable taxes, and making mandatory contributions to social security systems such as health insurance, pension funds, and unemployment insurance.

- Statutory benefits administration — Ensuring that the employee receives all mandatory benefits, such as paid vacation, sick leave, maternity/paternity leave, and minimum wage, per the laws of the country of employment.

- Onboarding and offboarding — Managing the administrative process of hiring and exiting employees, including work permit applications, residency compliance, and issuing final settlements and certificates upon termination.

2. Client company responsibilities

While the EOR handles legal employment matters, the client company retains control over the operational aspects of the employment relationship.

These responsibilities include:

- Defining the role and compensation — Specifying job descriptions, setting salaries, and determining any performance-related bonuses or incentives.

- Performance management — Overseeing the day-to-day work, setting goals, evaluating progress, and providing feedback to the employee.

- Provision of work resources — Supplying necessary equipment, software, and access to internal systems or communication tools to support job performance.

- Budget for raises and bonuses — Approving and funding salary adjustments, merit increases, and discretionary bonuses.

Critical contractual clauses

An effective EOR contract must include several key clauses to protect all parties and ensure legal soundness:

- Jurisdiction and governing law — Clearly states the country and the legal framework under which the employment agreement is governed.

- Intellectual Property (IP) rights — Specifies that any intellectual property developed during employment is assigned to the client company, protecting proprietary information and innovations.

- Termination and exit conditions — Details lawful grounds for termination, required notice periods, severance obligations, and any country-specific dismissal protections.

- Data privacy and protection — Ensures that the handling of employee data complies with local regulations such as the General Data Protection Regulation (GDPR) in Europe, including proper consent, data storage, and access protocols.

EOR contracts allow you to legally and efficiently employ workers across borders, minimising risk while retaining complete operational control.

The contracts are particularly valuable if you expand into new markets or hire remote talent in regions where you don’t have a legal entity.

10 key clauses to include in an EOR contract for compliance

To ensure legal compliance, clarity, and risk mitigation in international employment, an EOR contract must include a series of well-drafted clauses.

Here are the key clauses every compliant EOR contract should have.

1. Jurisdiction and governing law

This clause specifies which country's legal system governs the contract, typically the country of residence of the employee.

It influences all employment-related rules, including:

- Tax obligations

- Social security contributions

- Employment protections, such as working hours, minimum wage

- Termination procedures.

2. Employment terms and conditions

This clause defines the core employment parameters in compliance with local labour codes:

- Job title and description

- Scope of duties and deliverables

- Employment type: full-time, part-time, fixed-term

- Work hours and rest periods

- Remote or hybrid work setup

- Reporting structure and manager.

It also includes performance metrics or references to internal policies for performance reviews and disciplinary processes.

3. Compensation and payroll terms

This part ensures transparent financial arrangements and regulatory alignment:

- Gross salary and payment currency

- Pay frequency (monthly, biweekly)

- Bonuses or commissions, including eligibility criteria

- Mandatory benefits such as health insurance, pension, paid time off, and unemployment insurance.

- Supplementary benefits, such as equity options, wellness budgets, etc.

It also outlines how the EOR calculates payroll taxes, social contributions, and deductions.

4. Termination conditions

Here, you’ll find an outline of how the employment relationship may be lawfully terminated, including:

- Notice periods, statutory vs. extended

- Termination during probation

- Grounds for dismissal with or without cause

- Employee protections, such as reinstatement rights, union consultations

- Severance and final payment timelines

- Obligations during exit, such as returning equipment and revoking data access.

5. Intellectual Property (IP) and confidentiality

To safeguard the client’s assets and operations, all work-related inventions, designs, code, or deliverables created by the employee during employment are assigned to the client company.

It also includes non-disclosure agreements (NDAs) to protect sensitive data, and it may contain non-solicitation or non-compete clauses, where applicable.

6. Data privacy and protection

This section describes how the employee’s personal and professional data will be:

- Collected, stored, and transferred.

- Used for payroll processing, background checks, etc.

- Protected from unauthorised access or breaches.

- Managed under data subject rights.

In addition, depending on the country, it should refer to applicable data protection laws, such as the GDPR in the EU, PIPL in China, LGPD in Brazil, and POPIA in South Africa, among others.

7. Responsibilities and liability allocation

The contract should explicitly define the responsibilities of the EOR, such as payroll, tax withholding, and compliance, versus those of the client company, including corporate taxes and operational control.

It should also specify liability limits and indemnification clauses protecting each party against legal or financial claims resulting from the other's actions or omissions.

8. Dispute resolution

The contract covers procedures for resolving disputes:

- Choice of mediation, arbitration, or court proceedings

- Designated country and jurisdiction

- Language of arbitration

- Enforcement mechanisms.

9. Force Majeure

In the event of unforeseen circumstances that prevent either party from fulfilling their contractual obligations, this section is crucial. It includes:

- Natural disasters

- Pandemics or health emergencies

- Government actions or war

- Cyberattacks or infrastructure failure

As a result, this clause temporarily relieves both parties from performance penalties due to events beyond their control.

10. Pricing and fees

You should get a transparent breakdown of all fees, including onboarding, monthly service fees, transaction fees, and any additional costs, to avoid surprises.

This way, you’ll ensure that all ‘hidden fees’ are disclosed and part of the contract.

How to create an EOR contract in 6 steps?

Creating a compliant and enforceable EOR contract helps you do a global legal, tax, and employment setup right.

Let’s check the key steps to creating one.

1. Define roles and expectations clearly

Before drafting anything, decide on the roles you want to fill, the number of employees, and the hiring timeline.

Also, think about the work setup. Will it be remote, hybrid, or on-site? Which tools will you provide? What hours are expected in which time zone?

Why this matters

Misaligned expectations can trigger disputes, misclassification risks, or even permanent establishment exposure in the employee’s country.

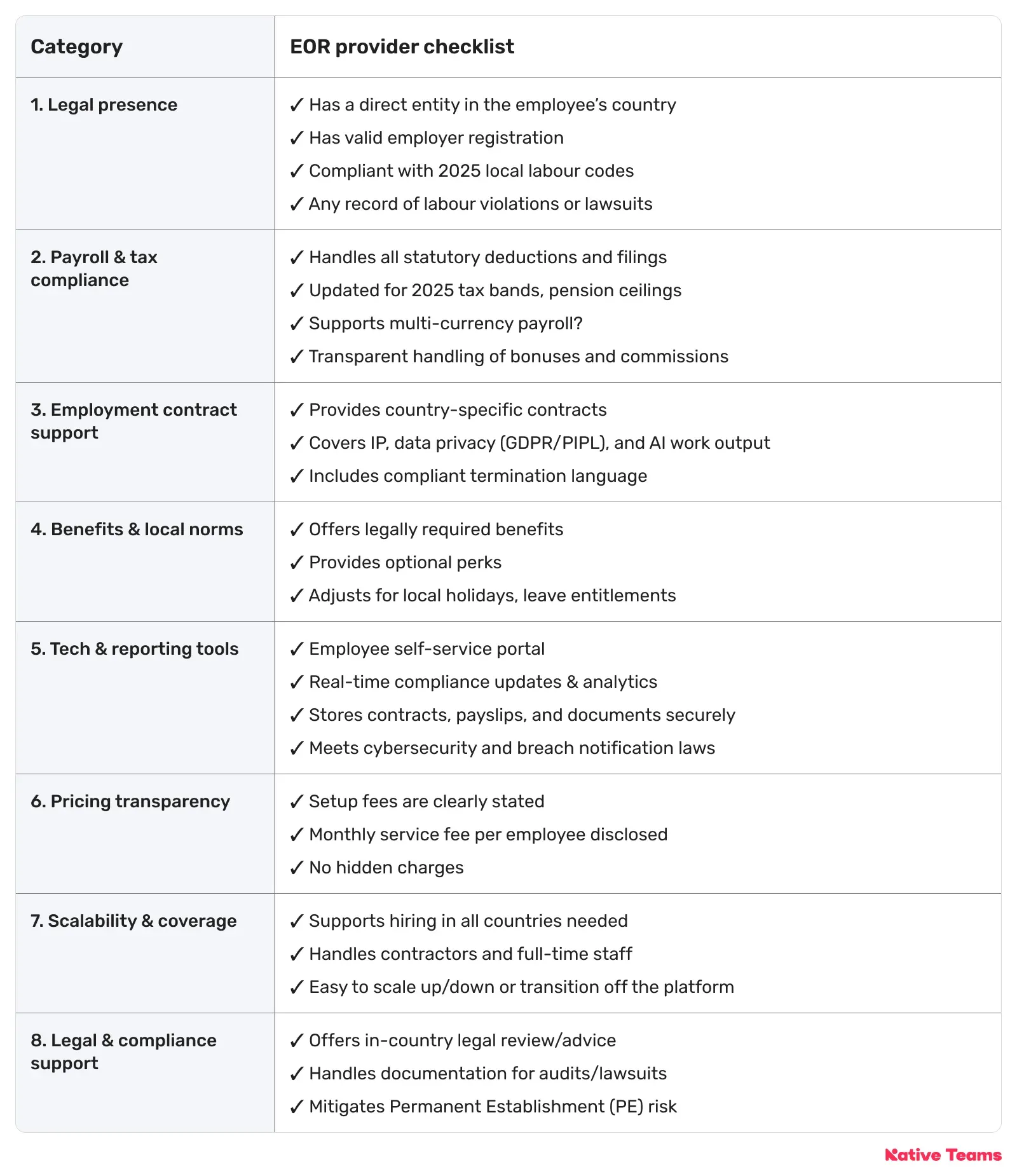

2. Choose the right EOR provider

When choosing the provider, ensure that they have:

- Established legal presence in the employee’s country.

- Deep knowledge of local labour laws and tax systems.

- User-friendly platform.

- Transparent fee structure and compliance guarantees.

- Built-in tech for payroll, benefits, and reporting.

- A clean record with no prior labour violations.

3. Draft the contract

Even if your EOR offers templates, you would still need to customise and adjust contracts to meet your needs.

Besides personal details, job role, compensation, work schedule, and probation period, the contract should use compliant language tailored to local regulations.

In addition, you should:

- Adjust it to jurisdiction-specific labour rules

- Ensure tax and IP clauses are enforceable locally

- Add force majeure, termination, and dispute resolution language.

4. Add compensation and benefits details

You should specify the salary, bonuses, payment currency, statutory benefits (such as healthcare and pension), and any additional perks, like private insurance or equipment leasing.

The EOR will ensure these comply with local standards, such as:

- Notice periods, leave entitlements, and statutory benefits.

- Payroll deductions and social security thresholds.

- Local holiday calendars and working hours.

5. Review and negotiate

Submit the contract details to the EOR for a cost estimate, including salary and service fees.

Before finalising:

- Review the full contract with internal stakeholders and the EOR

- Allow time for the employee to understand the terms, including in their native language if required.

- Address any local legal review requirements

Also, review the quote carefully before signing the deal.

💡 Quick tip

Always keep a copy of the executed agreement in both parties’ jurisdictions for audit trails and dispute resolution.

6. Sign the contract and onboard the employee

After the online signature is completed, the EOR manages onboarding tasks such as registering the employee with social security, setting up tax filings, and enrolling them in benefits.

As a result, you ensure legal compliance before the employee starts working.

5 EOR contract mistakes you can’t afford

Before you sign anything, make sure you’re not walking into one of these common, and costly, EOR contract mistakes.

1. Not customising the contract per country

Why it’s a problem: Labour laws vary not just by country, but sometimes by region. What’s compliant in Germany may not fly in South Korea.

What to do instead:

Work with your EOR to localise contracts per hire, including holiday calendars, benefits, probation rules, and termination procedures.

Also, always get a legal review in the employee’s jurisdiction.

2. Overlooking local statutory benefits

Why it’s a problem: Statutory benefits aren’t optional.

Therefore, if your contract doesn’t reflect these, or if your EOR isn’t properly funding them, your company may be on the hook for back payments, fines, or worse, lawsuits.

What to do instead:

Ask your EOR for a detailed breakdown of all statutory benefits per country and verify that they’re included in gross compensation and reported accordingly.

3. Failing to clarify IP ownership or confidentiality terms

Why it’s a problem:

In a cross-border setup, who owns the work product?

If your contract doesn’t clearly state that all intellectual property transfers to your company, you could end up in a legal grey zone, especially in jurisdictions where the default IP owner is the employee.

What to do instead:

Include robust IP assignment language that explicitly covers manual, digital, and AI-assisted work.

Furthermore, add GDPR- or other equivalent-compliant confidentiality clauses, especially when handling personal or health-related data.

4. Assuming the EOR does everything

Why it’s a problem:

Your EOR is the legal employer, but they don’t manage your team.

If you think the EOR is handling performance reviews, bonuses, equipment, or team culture, you’re in for an unpleasant surprise.

EORs manage compliance, not culture. You still own onboarding, performance, promotions, and terminations.

What to do instead:

Get crystal clear on who does what. Ensure your internal teams are aligned and understand what the EOR will and won’t handle.

5. No clear exit terms

Why it’s a problem:

Without country-specific termination terms, you risk:

- Legal disputes over severance, final pay, or wrongful termination.

- Unexpected liability from automatic employment protections.

- Delays in offboarding due to unclear notice procedures or mandatory approvals.

What to do instead:

Include a clause requiring the EOR to follow country-specific offboarding checklists, including a certificate of employment, benefits closure, and final settlement timelines.

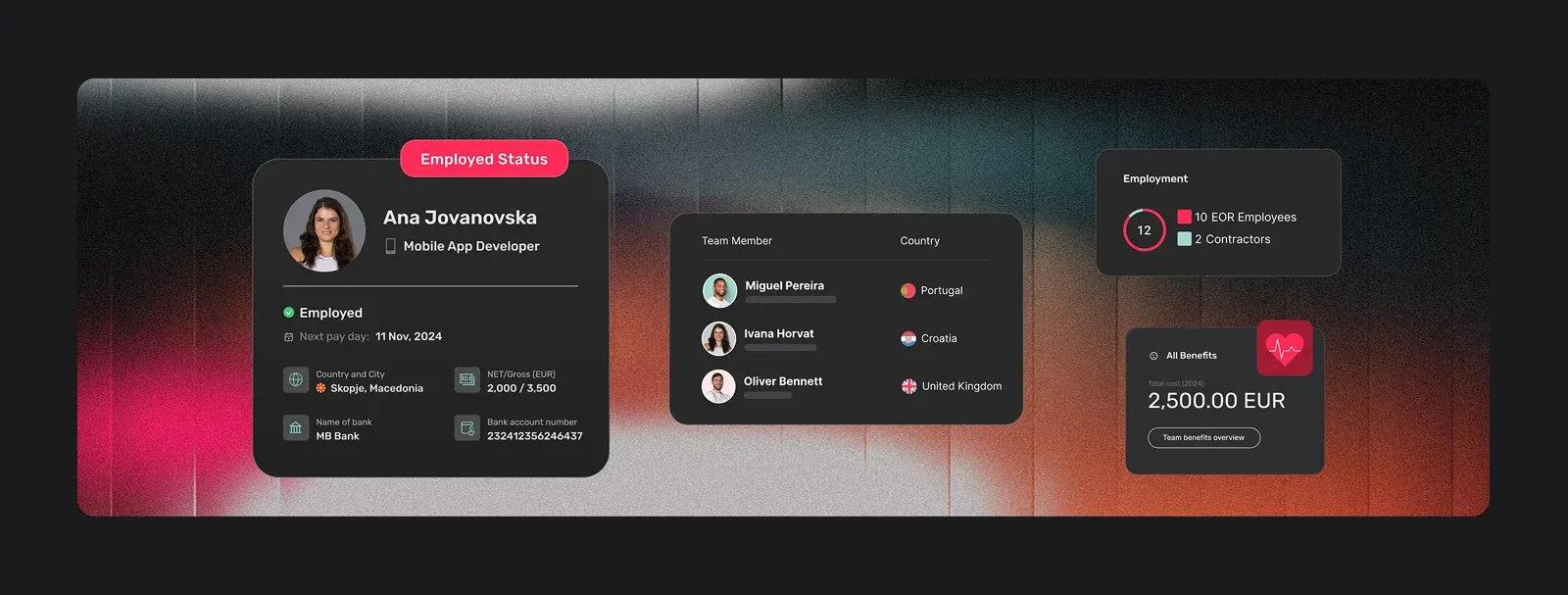

Native Teams: Your shortcut to smart, compliant EOR contracts

Native Teams supports hiring in over 85 countries with fully compliant, country-specific contracts and benefits tailored to each jurisdiction.

We offer customisable templates for the different employment types, so you can hire the way your business needs, without second-guessing compliance or clarity.

Our EOR and PEO solutions enable you to:

- Provide your team with proper employment status with local benefits and flexibility.

- Pay your team in their preferred currency, fast, easy, and compliant.

- Send payroll invites, adjust salaries, and oversee all payments from a centralised dashboard.

- Maximise your tax savings with expert guidance on local allowances and deductions.

- See hiring costs upfront with detailed salary and tax breakdowns.

- Offer health insurance, pensions, and local perks to attract top talent.

- Enable visas and permits so your team can work anywhere, legally.

Thus, with Native Teams, you get a trusted partner to cover every stage of the global employment process.

Ready to find out more?

Book a free demo call today to create fully compliant EOR contracts in minutes without legal guesswork or payroll headaches.