What Is Global Payroll: A Complete Guide

Did you know that the payroll outsourcing market size grew from $12.01 billion in 2024 to $12.9 billion in 2025, at a compound annual growth rate (CAGR) of 7.4%, according to ResearchAndMarkets?

Managing payroll across multiple countries can quickly become a complex task as companies expand into global markets.

But don’t worry, as we’ll explain global payroll, its importance, and how it supports compliance, growth, and efficiency across regions.

Let’s get started!

What is Global Payroll?

Global payroll, also known as multi-country payroll, refers to the process of managing payroll for employees in multiple countries through a unified system.

It involves calculating employee pay and deductions across various jurisdictions while ensuring compliance with local laws, taxes, and currency regulations.

In essence, it combines payroll data from various regions into one centralised system that handles the unique requirements of each country.

This enables businesses to efficiently pay their international workforce in local currencies while complying with all relevant legal and financial regulations.

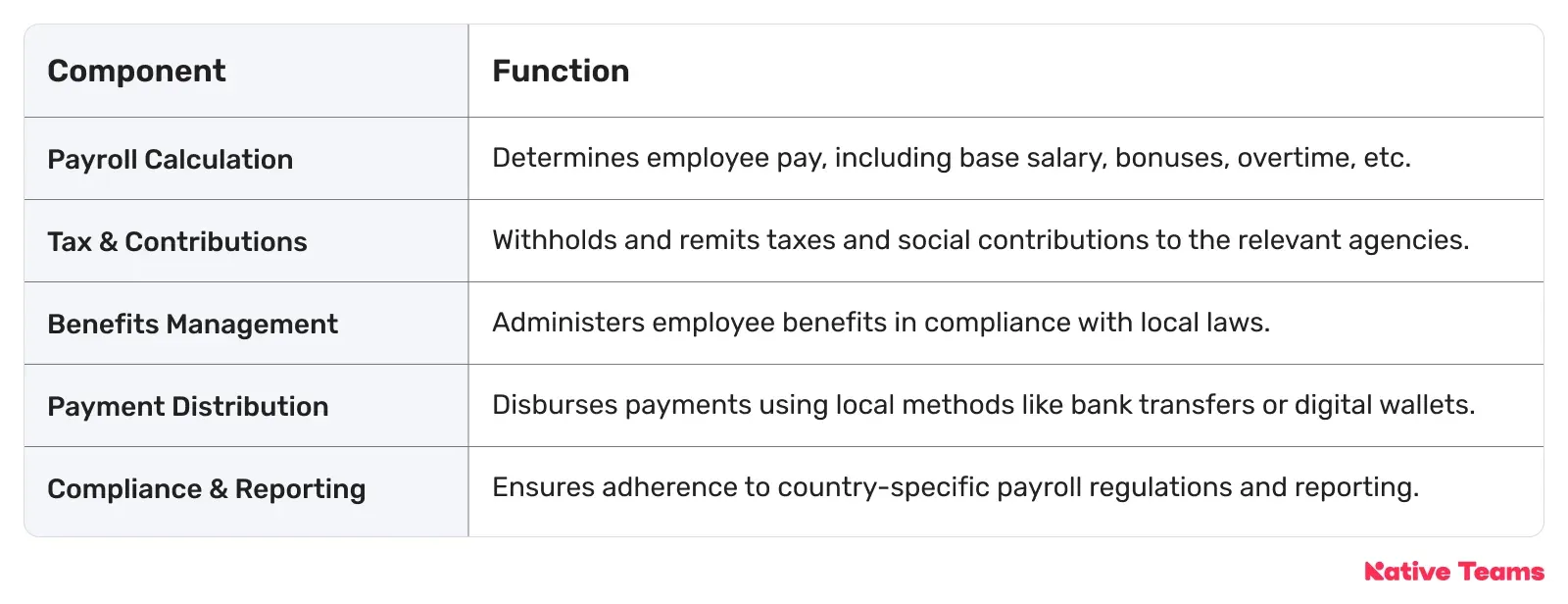

Here’s a quick overview of how global payroll works:

Pro tip

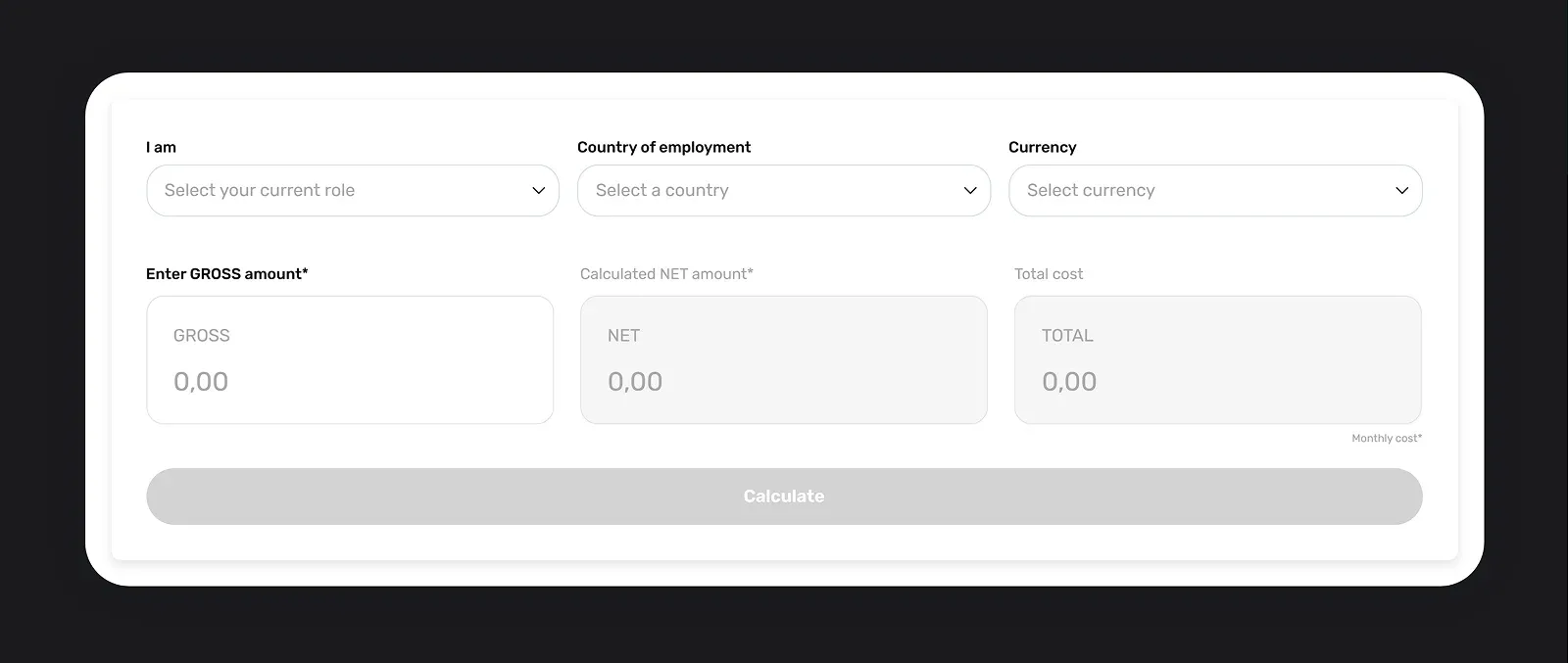

Native Teams’ Payroll Calculator provides a transparent breakdown of hiring costs by country, or allows you to calculate gross-to-net earnings based on your location.

It ensures that your salaries are accurate and fully compliant with local labour laws, offering clear insights into taxes, health and pension contributions, and other country-specific expenses.

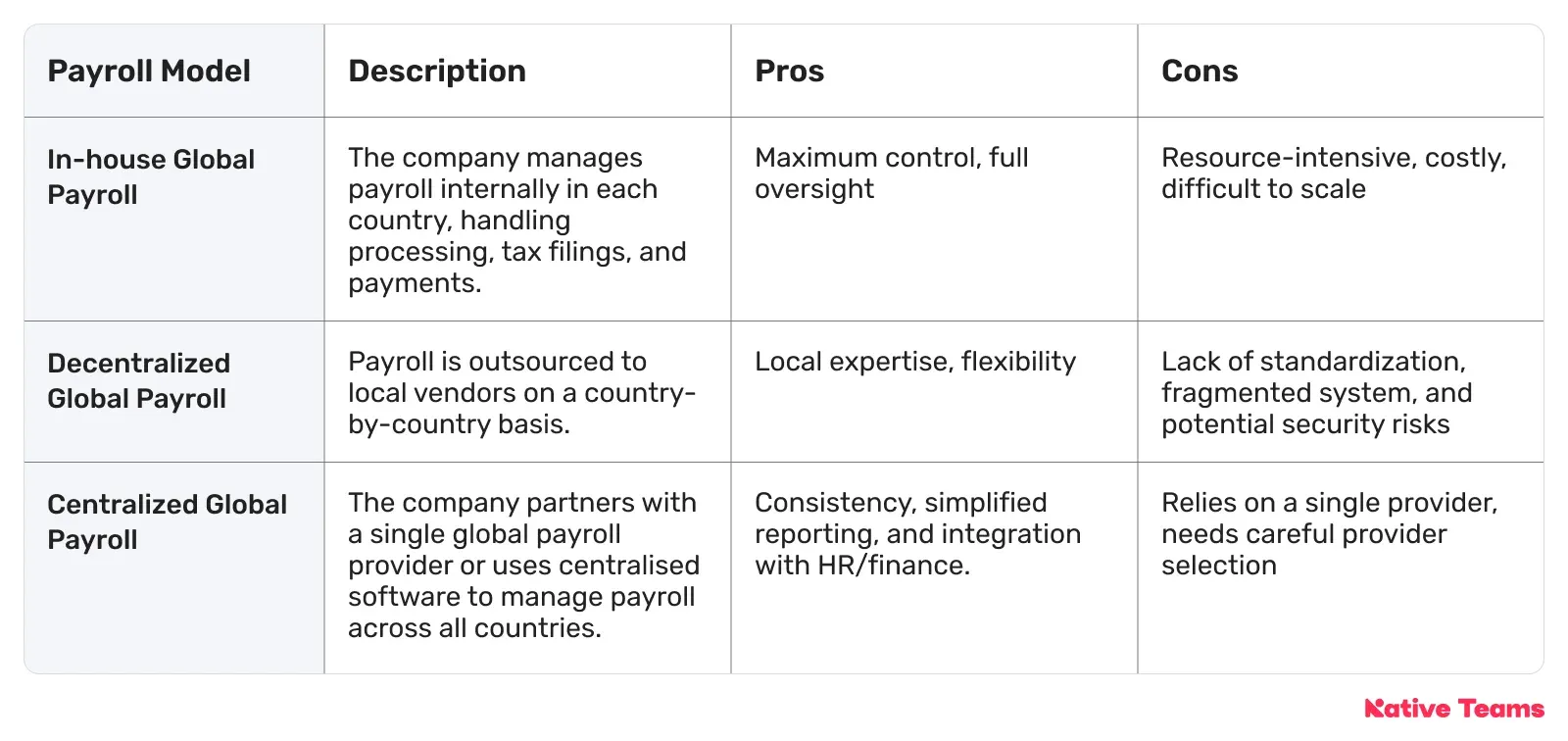

Types of Global Payroll methods

You can approach global payroll in one of three ways:

Key components of Global Payroll

A whole global payroll system has several essential components working together:

- Payroll processing: Computes employee pay (base salary, overtime, commissions) and applies country-specific deductions (taxes, social insurance, etc.). Using a reliable pay stub maker can simplify this step by automatically generating accurate pay documentation for each employee.It handles various pay cycles and ensures local compliance (e.g., overtime rates, shift differentials).

- Tax compliance: Withholds and remits taxes, social security, and other contributions according to each country’s laws. Automates complex calculations, generates tax forms, and ensures worldwide tax compliance.

- Benefits administration: Manages mandatory and supplementary benefits (e.g., healthcare, pensions, paid leave) for each country. Tracks enrollments and contributions to ensure accurate deductions and payments.

- Multi-country reporting: Consolidates payroll data from multiple countries into standardised reports, providing clear visibility of global labour costs and ensuring compliance with local reporting requirements.

- Payment distribution: Distributes net salaries through international channels (bank transfers, SWIFT, digital wallets), ensuring timely and accurate payments in local currencies.

Pro tip

Native Teams is an all-in-one global payroll and compliance solution, providing flexible and tailored support for your global workforce.

With a presence in over 85 countries, we simplify hiring, payroll, compliance, and payments, enabling you to expand quickly and efficiently.

Our platform ensures seamless, tax-friendly payments, local compliance, and employee satisfaction, allowing you to focus on growth without the administrative hassle.

Importance of Global Payroll for employers

Global payroll is crucial for any company with an international workforce, as beyond simply paying people, it provides significant value in several areas:

1. Compliance and risk management

Each region, including states and provinces, has unique rules governing pay schedules, tax rates, benefits, work hours, and other aspects of employment.

Non-compliance with those elements can result in costly fines and legal issues, making it vital to maintain compliance and protect your business.

Here is what you can do:

- Avoid fines and legal trouble by keeping payroll compliance processes aligned with changing local regulations.

- Demonstrate good governance through consistent and accurate payroll management across regions.

✅ One compliance tip to take it further:

Regularly review and update your payroll processes to stay ahead of changing regulations and minimise risks.

2. Strategic growth and scalability

A mismatched or overly simplistic payroll system can become a bottleneck, particularly when navigating diverse laws, currencies, and jurisdictions.

That is why a global payroll strategy should be created with scalability in mind, enabling you to add new countries or payroll providers without a complete system overhaul.

To make this easier, you can:

- Scale your payroll operations seamlessly as you expand into new regions.

- Achieve economies of scale by consolidating payroll services and lowering per-employee costs.

✅ One scalability tip to take it further:

Invest in a scalable payroll solution that can grow with your business, making it easier to manage new locations and employee bases.

3. Employee satisfaction and retention

When payroll mistakes or delays occur, it can negatively impact employee trust and engagement.

In contrast, a well-managed global payroll system ensures employees receive consistent, transparent, and understandable payslips, reducing stress and boosting overall job satisfaction.

To keep the morale of your employees high, you can:

- Enhance employee trust and morale by ensuring timely and accurate payroll.

- Boost retention rates by offering a seamless payroll experience that makes employees feel valued.

✅ One retention tip to take it further:

Make payroll a key part of your employee satisfaction strategy by providing clear, transparent payslips and a reliable system for resolving issues quickly.

4. Financial efficiency

Managing payroll across multiple countries through a single provider reduces costs related to tax filings, late-payment fees, and the need for additional payroll experts in each region.

It also increases transparency, allowing leadership to easily monitor global labour costs and optimise budgeting decisions.

To reach goals in financial efficiency, you can:

- Reduce payroll costs by consolidating services and using a single provider across regions.

- Improve visibility into global payroll data for better financial decision-making.

✅ One efficiency tip to take it further:

Centralising payroll operations not only saves money but also provides a clearer understanding of labour costs, enabling more informed financial strategies.

Pro tip

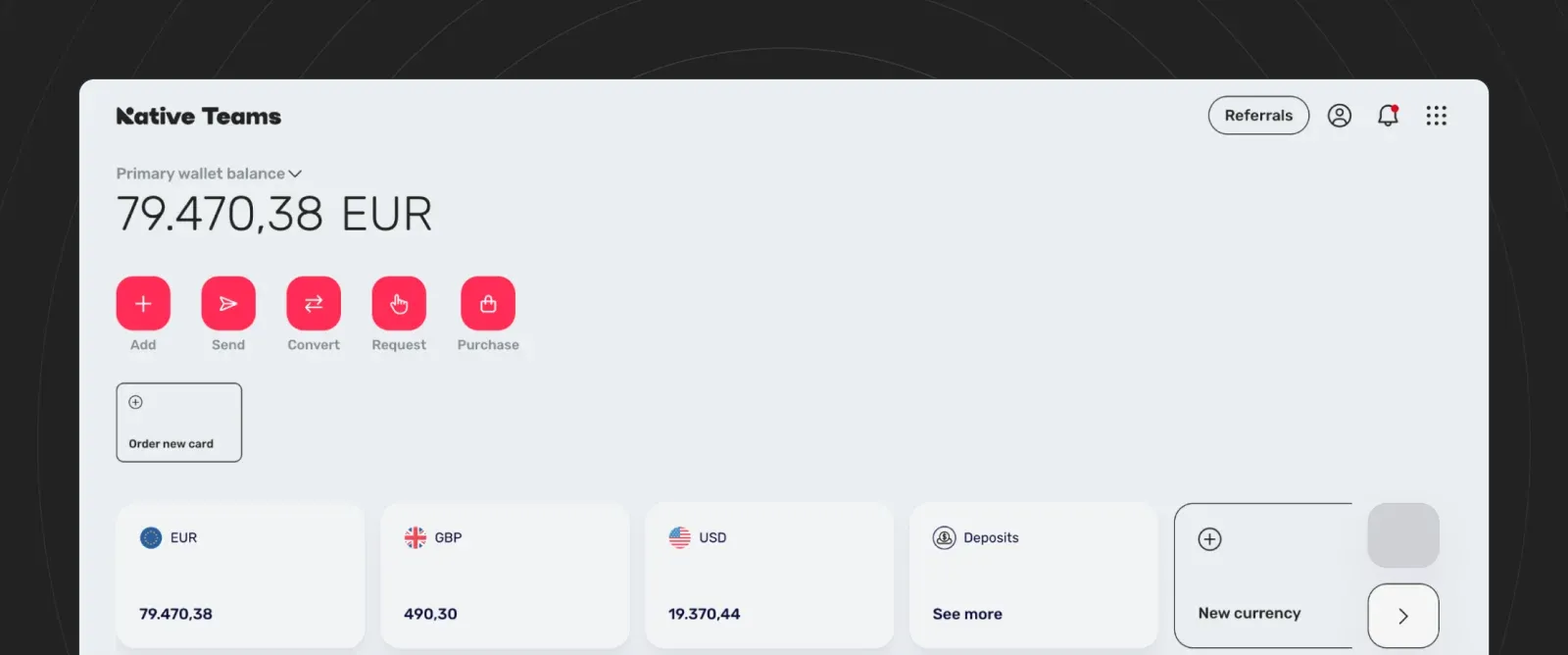

Native Teams’ Multi-Currency Virtual Wallet simplifies payroll by consolidating payments across regions, reducing transaction fees and the need for multiple platforms.

This enhances financial visibility, allowing better control of global labour costs and improved budgeting decisions.

Global Payroll challenges

Managing global payroll comes with several practical challenges:

1. Complex employment laws and local tax regulations

Each country (and sometimes region) has its own unique payroll rules, including tax withholding rates, social contributions, and benefits.

For instance, one country might mandate specific overtime limits or require benefits that another country does not.

That is why staying compliant with global payroll regulations requires constant attention to local laws and frequent updates to processes, and you should consider the following factors:

- Tax rates, reporting deadlines, and filing requirements vary significantly across different countries.

- Regulations are constantly changing, making it difficult to stay compliant.

❗ Possible consequences:

Failure to adapt to these changes can lead to costly fines (e.g., up to 10 million euros or 4% of revenue under GDPR).

Pro tip

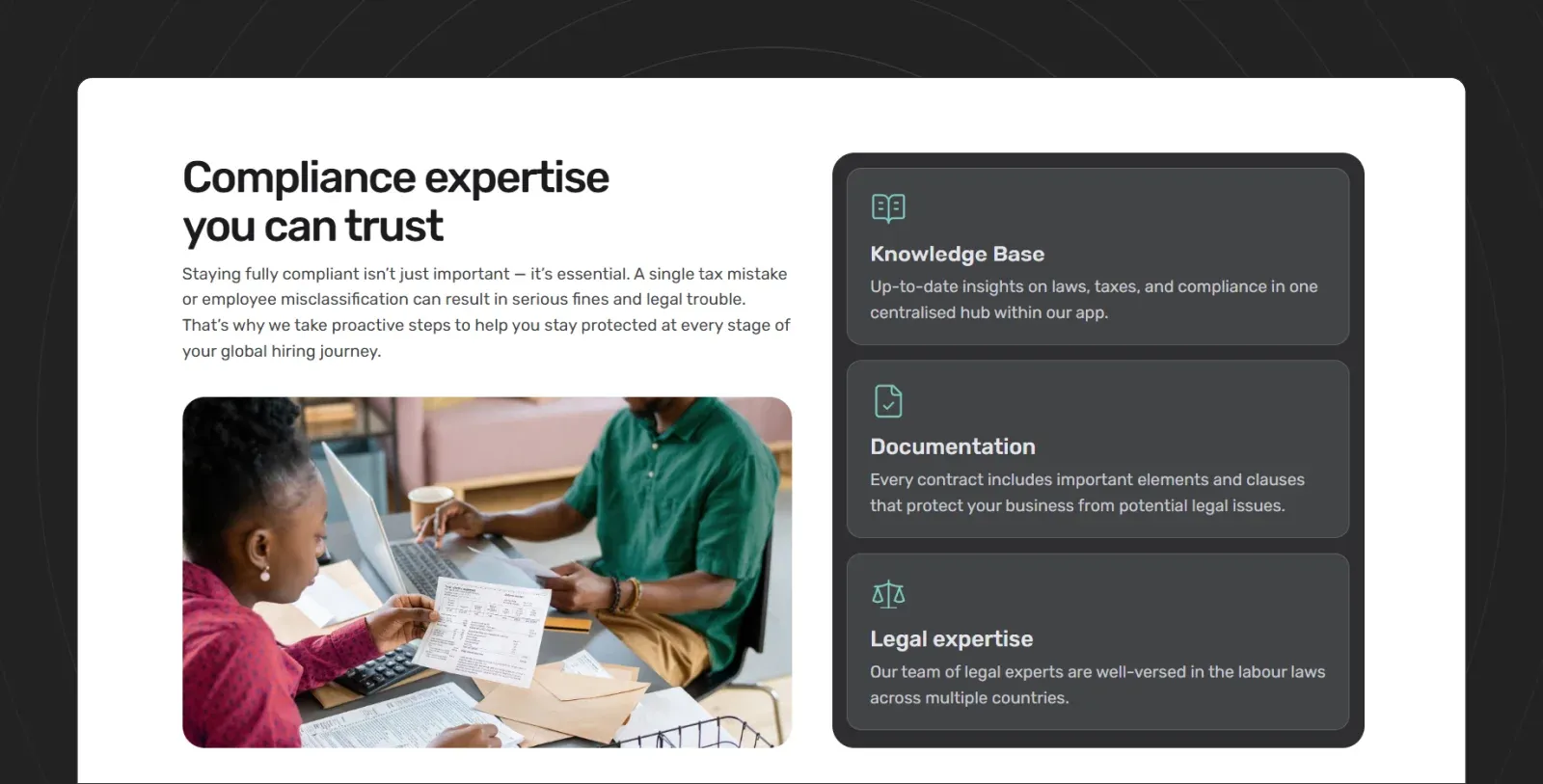

Native Teams ensures full compliance with local labour laws by providing tailored employment contracts and expert guidance on tax allowances and benefits in each jurisdiction.

Our proactive approach helps you stay ahead of legal risks and simplifies global hiring, ensuring a smooth and compliant expansion.

2. International payments and fees

Paying employees across borders involves currency exchanges, bank fees, and processing delays.

You must ensure the correct amount of foreign currency is available and account for extra time for cross-border transfers.

Here are the key considerations for managing international payments:

- Currency exchange often incurs fees of 1–5% per transfer.

- Some countries require salary payments to be processed via local bank accounts.

- Transaction fees and slow processing can hinder timely payments.

❗ Possible consequences:

Hidden fees and delays can disrupt payroll timelines, leading to employee dissatisfaction and potential legal complications if payments are not processed on time.

3. Data protection and privacy

Payroll systems handle sensitive personal information, including names, addresses, and bank account details.

Compliance with data protection laws (like GDPR) is crucial, as mishandling this data can lead to severe penalties.

Below are important aspects of ensuring data protection and privacy:

- Payroll systems must comply with stringent data privacy regulations.

- Managing data across multiple jurisdictions introduces complexity, particularly when storing or transferring it across international borders.

- High security standards (e.g., encryption, ISO certifications) are required.

❗ Possible consequences:

Breaches in data privacy can result in hefty fines, loss of employee trust, and damage to the company’s reputation.

4. System integration challenges

Global payroll must integrate with various systems, including HR, time-tracking, finance, and benefits.

Without proper integration, payroll teams face the time-consuming task of manually entering data.

Consider the following issues related to system integration:

- Lack of integration leads to errors and data mismatches.

- Choosing payroll software with open APIs ensures smoother data transfers between systems, facilitating seamless integration.

- Poor integration can cause inefficiencies and increased error rates.

❗ Possible consequences:

Failing to integrate payroll systems with other business tools can lead to costly mistakes, wasted time, and frustration among payroll teams, ultimately affecting the overall efficiency of the organisation.

5. Transparency and visibility

When payroll is handled by multiple vendors or systems across different countries, it becomes difficult for leadership to get a clear, consolidated view of global payroll costs.

Key factors to consider for improving transparency and visibility include:

- Data from different providers is often not standardised, making it difficult to track costs.

- Consolidating payroll data into a single platform enables better visibility and informed decision-making.

- A unified reporting system offers insights into wages, taxes, and benefits across regions.

❗ Possible consequences:

Without a clear, unified view of payroll data, leadership may miss important trends, budgeting issues, or audit concerns, leading to poor decision-making and inefficiencies.

🔍 How did Native Teams help Digital Up Agency with Global Payroll

Digital Up Agency experienced significant growth and operational efficiency thanks to Native Teams' expertise in global payroll.

Here's how Native Teams made a difference:

- Automated, compliant payroll solutions: Native Teams provided fully automated payroll systems across multiple regions, ensuring compliance with local regulations while minimising manual work.

- Seamless onboarding: Tailored and localised documentation ensured smooth and compliant onboarding for the agency’s international workforce, saving time and reducing complexity.

- Tax optimisation & Cross-border contributions: By handling tax filings and managing cross-border contributions, Native Teams allowed Digital Up Agency to focus on growth without worrying about the intricacies of international payroll.

- Reduced overheads & Risks: Native Teams’ comprehensive payroll solutions streamlined operations, leading to faster payroll processing and full compliance, ultimately cutting down overheads and legal risks.

Global Payroll and Employer of Record (EOR)

An Employer of Record (EOR) is a third-party organisation that assumes the legal responsibility for employing workers in a foreign country.

At the same time, your company retains control over the employees' day-to-day activities.

The EOR handles all employer-related tasks like:

- Hiring paperwork,

- Contracts,

- Payroll,

- Taxes,

- Benefits,

- Compliance,

- And sometimes even terminations.

This solution is particularly useful if you want to hire internationally without setting up a local legal entity.

With Global Payroll, when partnering with an EOR, payroll processing is done through the EOR’s systems.

The EOR calculates taxes, handles deductions, and ensures compliance with local labour laws, allowing you to focus on managing employee performance.

Here’s a comparison between Global Payroll and Employer of Record:

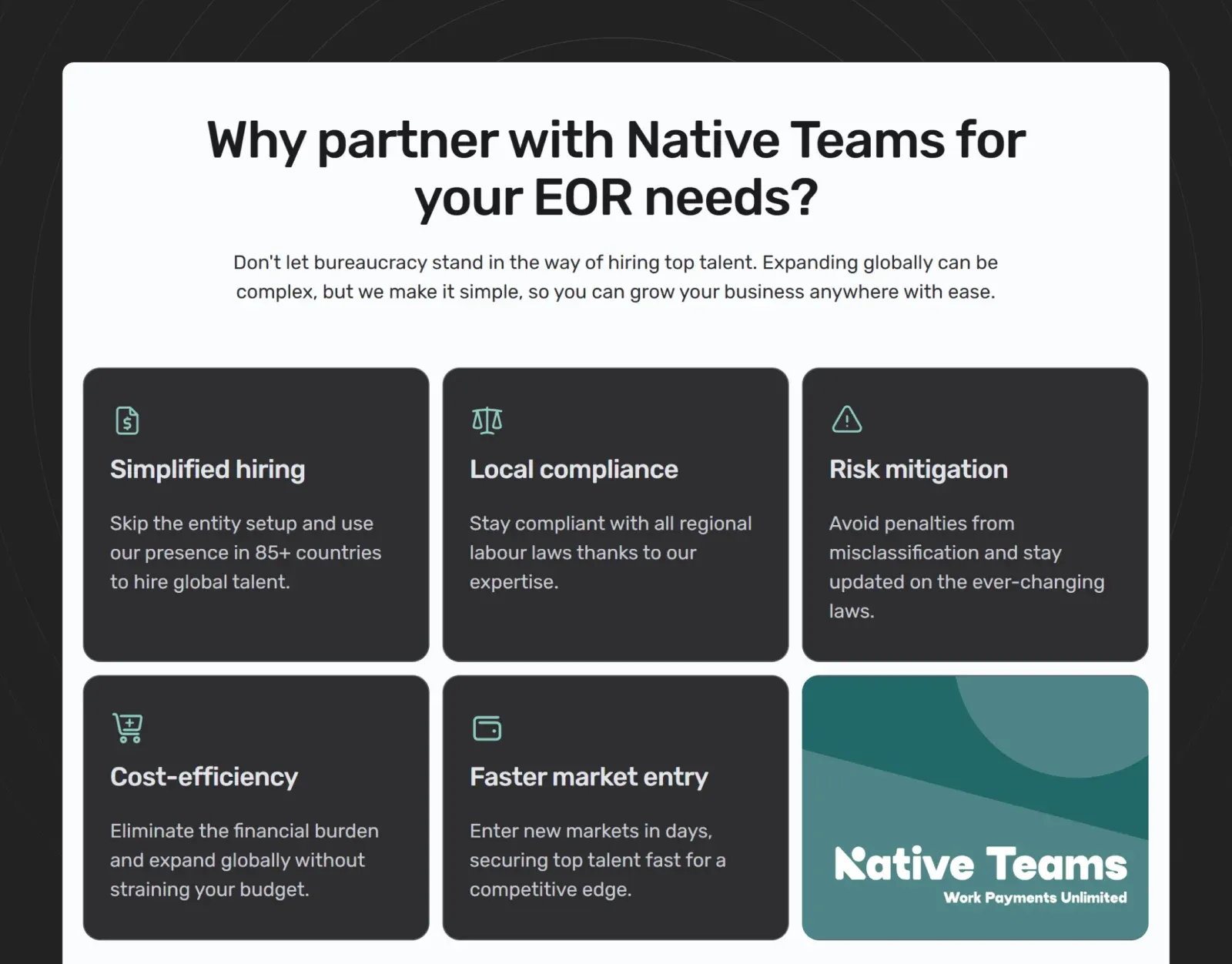

Pro tip

Native Teams’ EOR services simplify global expansion by handling compliance, payroll, and benefits so that you can hire top talent without the need for local entities.

Our expert-driven, risk-free approach ensures quick market entry and full legal compliance, allowing you to focus on growing your business.

Future trends in Global Payroll

Looking ahead, global payroll is being transformed by technology and workforce changes:

- Advancements in payroll technology: Cloud-based platforms, mobile access, and integration with HR/finance tools will improve payroll processes. Innovative payment options (e.g., digital wallets, crypto) and data analytics will forecast costs and improve efficiency. Blockchain exploration is also emerging for secure transactions.

- Increased automation and AI: AI and machine learning will automate routine tasks, reducing errors by up to 20%. Additionally, tools like realistic text to speech are transforming employee communication and training materials, helping international teams stay aligned through lifelike, multilingual audio.

- Globalisation of the workforce: Remote and hybrid work model is driving global talent acquisition, increasing demand for payroll systems that manage distributed teams, contractors, and gig workers. Payroll solutions must scale to manage multi-status payroll (full-time, part-time, contractor) as regulations evolve globally.

How to choose the right Global Payroll solution

When selecting a global payroll provider, it's essential to look for a combination of key features and qualities to ensure smooth operations across multiple regions.

Here's what to keep in mind:

🔄 Comprehensive automation and features

Your provider should offer a full suite of services, including automated pay processing, tax filing, benefits management, and support for both contractors and full-time staff.

This reduces manual work and streamlines payroll tasks.

📊 Robust tracking and reporting

Look for tools that allow you to monitor employee hours, payroll amounts, and tax filings in real-time.

Efficient payment processing should also be a priority, ensuring quick and reliable international transfers.

🔒 Security and compliance support

Data security is crucial, so seek ISO-certified platforms and ensure the provider offers expert guidance on local compliance with payroll regulations, tax rules, and filings.

🌍 Local expertise and customer support

Choose a provider with global offices or local partners, offering customer support and dedicated account managers to help with issues as they arise.

👥 Employee experience

A user-friendly portal or mobile app for employees is crucial, offering features such as electronic payslips, multilingual support, and easy access to payroll information, which enhances employee satisfaction and productivity.

💰 Cost and efficiency

Evaluate the provider's pricing structure for transparency, considering the long-term return on investment (ROI) and its potential impact on overall costs.

The provider should help eliminate errors and reduce payroll-related staff costs.

🔗 Integration and automation

Ensure the provider’s system integrates well with your existing HR, time-tracking, and accounting software.

Look for features like automation, bulk uploads, and AI-driven calculations to reduce manual effort and minimise errors.

Why is Native Teams a perfect solution for your Global Payroll?

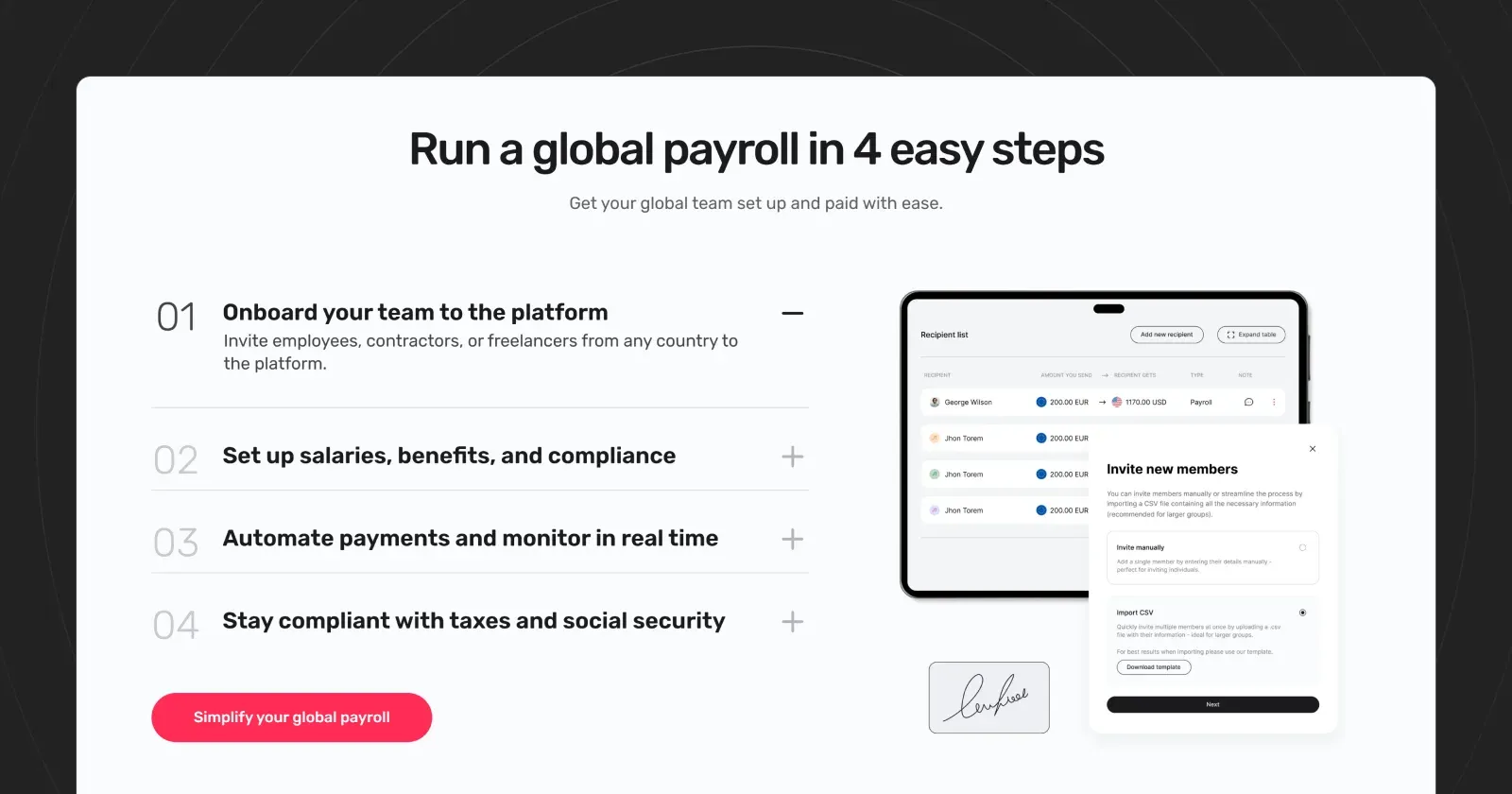

Native Teams centralises your global payroll, compliance, and payment processes, combining EOR and PEO services into one platform, managing everything from payroll and payments to compliance and tax optimisation.

By integrating payroll, tax management, and payment tools, Native Teams enables your business to run smoothly and efficiently, regardless of your team's location.

We work with local experts in every country we operate in to stay ahead of changing regulations, ensuring compliance with:

- Tax codes,

- Labour laws, and

- Cross-border contributions.

From issuing compliant contracts to running accurate, on-time payroll, we help you reduce legal risk and keep your global team supported, wherever they are.

Thus, our solution reduces overheads, eliminates manual errors, and ensures:

- 70% faster payroll processing

- 100% compliance with local tax laws

- Real-time breakdowns of salaries, deductions, and benefits.

📢 Ready to simplify your global payroll process?

Book a free demo call to see how we can help you streamline payroll, compliance, and payments effortlessly. 🚀

Keep learning:

Global Payroll Automation: How to Simplify Payroll