EOR vs. Contractor – What’s the Key Difference? (2026)

A remote-first economy allows you to tap into talent pools from almost anywhere in the world.

However, with that freedom comes a critical decision: should you hire someone as an independent contractor, or through an EOR?

On the surface, the difference between them might seem like just paperwork.

But, as labour laws tighten and international hiring becomes more complex, choosing the right model can be crucial to your compliance strategy.

Read on to understand the key differences between EOR and contractor models to build a more stable, scalable global workforce.

Let’s dive in!

EOR: What is it?

An Employer of Record (EOR) is a 3rd-party organisation that legally employs a worker on your behalf, handling everything from payroll, taxes, and benefits to compliance with local labour regulations.

While your company manages the employee’s day-to-day work and responsibilities, the EOR takes care of the complex administrative backend, ensuring that everything is done by the book.

How does an EOR actually work?

Let’s say your U.S.-based SaaS company wants to hire a UX designer based in Germany.

You don’t have a German entity, and setting one up would take months and cost tens of thousands of dollars. So, what do you do?

- You partner with an EOR that already operates in Germany.

- The EOR officially hires the designer, registers them for taxes and health insurance, and manages their payroll.

- You manage the designer’s tasks, tools, and performance, just like you would with any employee.

- Each month, you pay the EOR a single invoice covering salary, benefits, and a service fee. They handle the rest.

Contractor: What is it?

An independent contractor works for a company without being legally employed by them.

They’re essentially running their own business, even if they’re a team of one.

Contractors decide how, when, and where they work, and are typically hired for their specialised skills or to complete short-term, clearly defined projects.

Unlike employees, contractors:

- Aren’t on payroll — They invoice for their work.

- Pay their own taxes, including self-employment taxes.

- Aren’t entitled to benefits like health insurance, paid leave, or retirement plans (unless arranged independently).

- Must often comply with local or international business regulations, depending on where they operate.

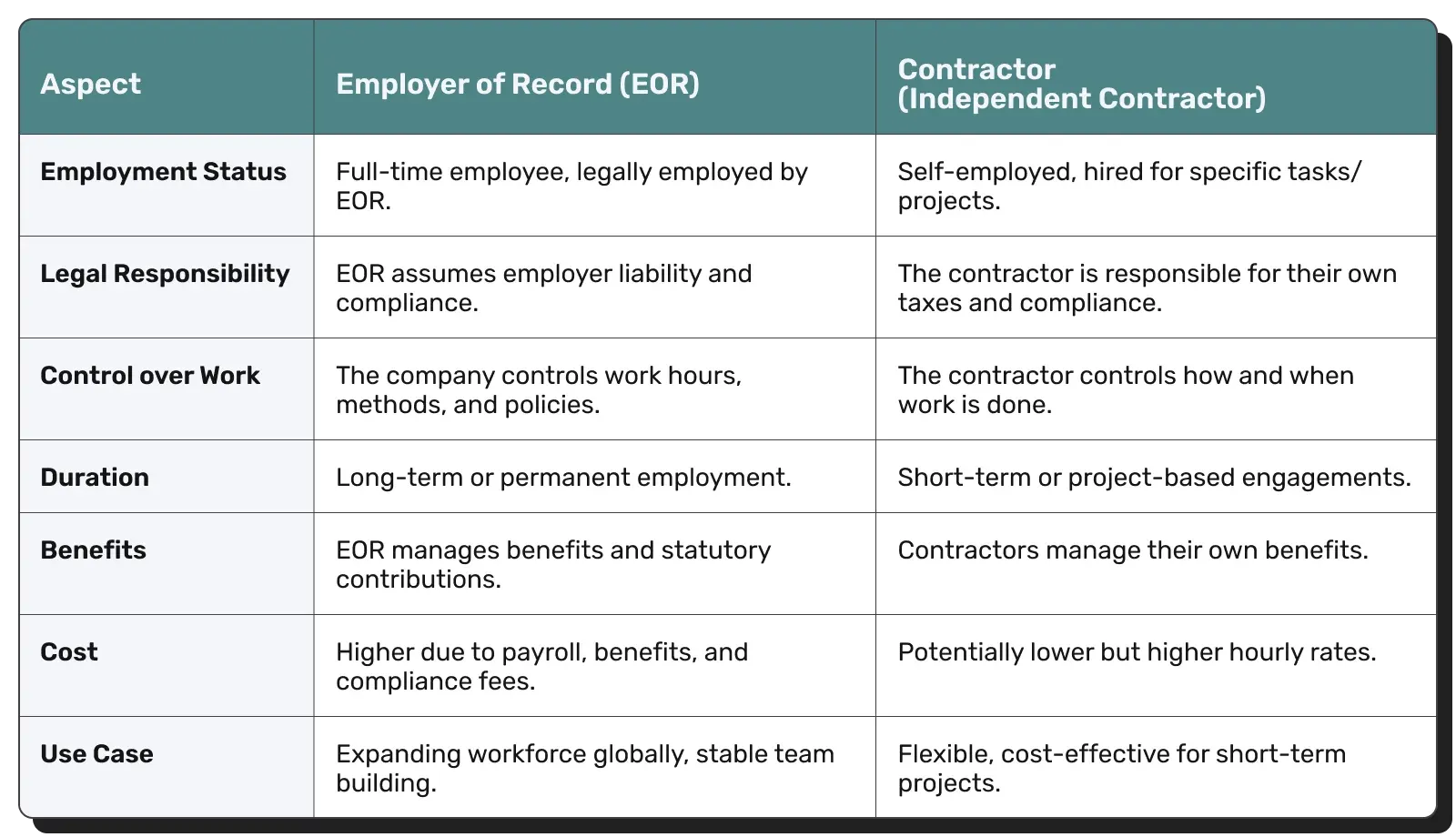

EOR vs. Contractor: What sets them apart?

At first glance, an EOR and an independent contractor might seem like two paths to the same goal: getting great talent onboard quickly.

But in practice, they’re fundamentally different models regarding the following key aspects.

1. Employment status

One of the most significant differences between hiring through an EOR and working with an independent contractor comes down to this:

- Who’s legally responsible for the worker, and

- How much control do you actually have?

1.1. EOR

When you hire through an EOR, that worker is a legal EOR employee and a fully integrated team member.

You oversee their day-to-day work, assign tasks, set working hours, and include them in team meetings and performance reviews just like any other full-time staff member.

Behind the scenes, the EOR handles all the employment logistics:

- Payroll

- Local tax withholdings

- Benefits (like healthcare or paid time off)

- Employment contracts and compliance with local labour laws

It’s the best of both worlds: you get a dedicated team member, and the EOR handles all the legal and tax requirements.

1.2. Contractors

Independent contractors, on the other hand, are self-employed professionals.

You hire them for specific tasks, deliverables, or time-bound projects, and that’s where your control ends.

Contractors typically decide:

- How the work gets done

- When they work

- Where they work from

- Whether they take on other clients simultaneously.

You’re not managing their schedule or dictating their workflow.

In fact, doing so too closely can legally blur the lines between contractor and employee, which can lead to misclassification penalties in many countries.

2. Legal and compliance responsibility

The answer to who’s carrying legal responsibility differs significantly between hiring through an EOR and working with independent contractors.

2.1. EOR

When working with an EOR, they take on full responsibility for complying with local labour laws, including:

- Drafting and managing legally compliant employment contracts

- Handling onboarding and offboarding processes

- Administering payroll, benefits, and tax withholdings

- Ensuring alignment with country-specific labour regulations.

In a nutshell, the EOR protects your company from many legal risks of international employment.

You can confidently build a global team without worrying about navigating the legal complexities of each local market.

2.2. Contractors

Contractors operate as self-employed professionals, meaning they’re responsible for their own taxes, benefits, and legal compliance.

On the surface, this reduces your administrative burden—no payroll taxes, benefits, or long-term commitments.

But here’s the catch: if the working relationship looks too much like traditional employment, you risk misclassification — a serious legal issue in many countries.

The consequences can be steep: fines, audits, back payments, and even criminal penalties in severe cases.

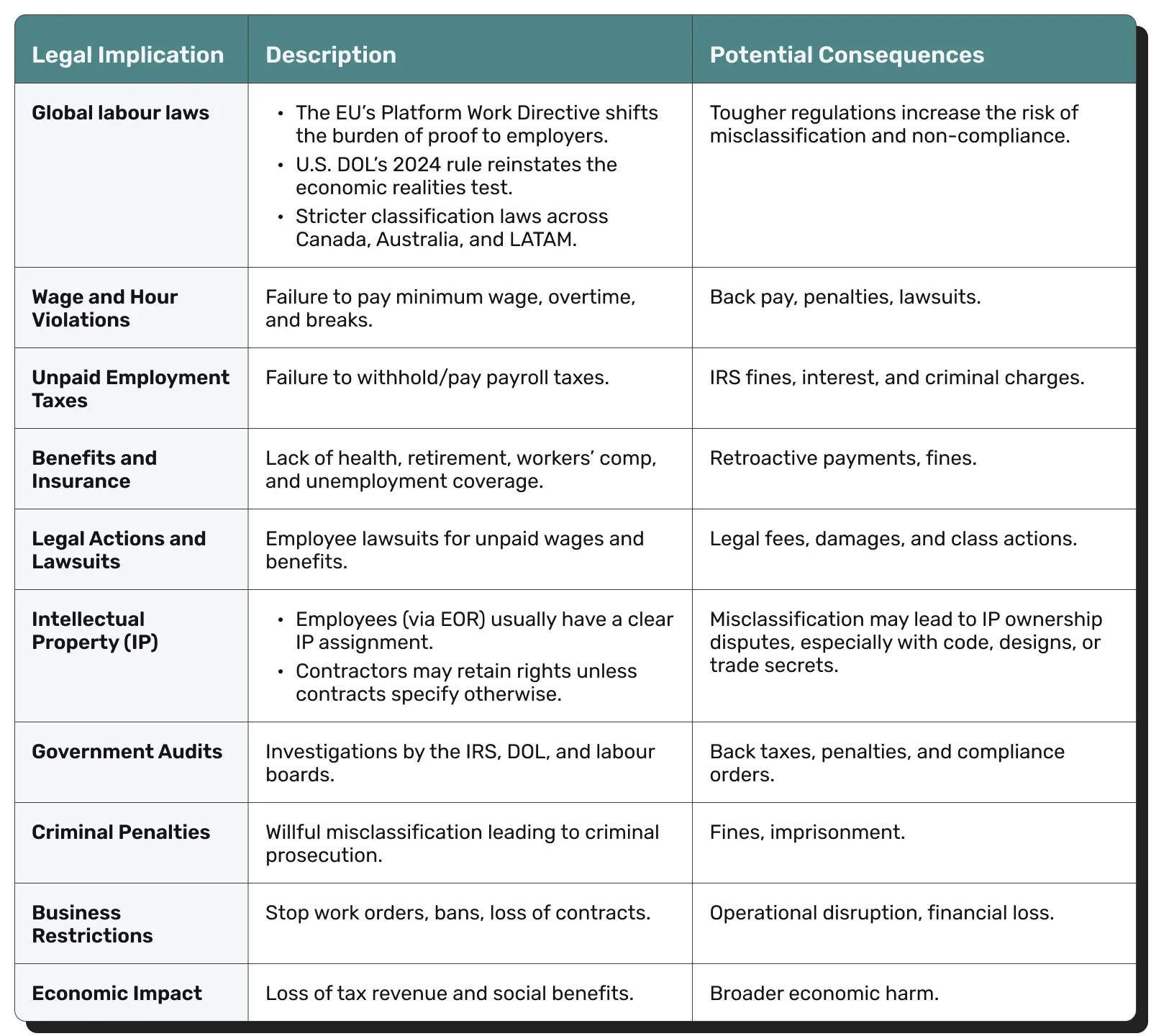

2.3. The cost of getting it wrong: Legal risks of misclassifying contractors

The line between contractors and employees isn't just a technical classification. It's a strategic decision with real legal, financial, and operational consequences.

As remote work and global hiring become the norm, governments are responding with:

- Stricter labour laws,

- More aggressive enforcement, and

- Steeper penalties for companies that get it wrong.

The risks include:

- Wage violations — You may owe back pay, overtime, and benefits if workers are denied legal protections like minimum wage or rest breaks.

- Unpaid taxes — Failing to withhold payroll taxes can result in substantial IRS penalties, interest, and possible criminal charges for willful violations.

- Loss of benefits — Misclassified workers may miss out on health insurance, retirement plans, and unemployment or workers’ compensation, triggering back costs and fines.

- Lawsuits — Workers can pursue legal action, including class-action lawsuits, demanding unpaid wages, damages, and legal fees.

- Government audits — Agencies like the IRS and the Department of Labour actively investigate misclassification, often leading to corrective actions and financial penalties.

- Criminal penalties — In severe cases, misclassification can lead to criminal charges, imprisonment, and multimillion-dollar fines.

- Operational risks — Your business may face stop-work orders, lose licenses, or be barred from government contracts.

- Broader economic impact — Misclassification undermines tax systems and social protections, shifting costs to workers and governments.

3. Duration and commitment

When deciding between an EOR and an independent contractor, it’s essential to consider not just the role itself, but the level of commitment and continuity you desire or need.

3.1. EOR

Hiring through an EOR is typically ideal for long-term or permanent roles.

These employees are considered fully integrated team members, aligned with your company’s culture, goals, and day-to-day operations.

For example, they:

- Participate in ongoing projects

- Join regular team meetings

- Receive benefits

- Grow with the company over time

EOR arrangements are perfect if you look for stable, global teams without establishing a local legal entity.

If you are entering a new market or expanding a department, EORs provide the infrastructure to support sustained workforce development.

3.2. Contractors

Contractors, by contrast, are typically engaged for short-term, project-based, or seasonal work. They’re an excellent choice when:

- You need specialised skills for a one-off initiative

- You're working on a fixed budget or timeline

- You want to test a new market or role before committing to full-time employment.

Because contractors maintain autonomy and aren’t formally tied to your company, the relationship is naturally more transactional and flexible, which can be a strength when agility is your top priority.

4. Cost and flexibility

When choosing between hiring a contractor or going through an EOR, cost is often a deciding factor, but it’s important to look beyond the invoice.

The actual cost of talent goes far beyond hourly rates.

4.1. EOR

The EOR cost may appear higher initially because hiring through an EOR involves a more comprehensive service package. Nonetheless, that cost covers:

- Full compliance with local labour laws

- Payroll processing, tax remittance, and benefits administration

- Employment contracts and onboarding

- Ongoing HR and legal support in the worker’s jurisdiction.

Thus, it makes an EOR a smart investment if you’re expanding into new countries or looking to build stable, compliant international teams without opening a local entity.

It also significantly reduces your administrative burden and legal exposure, making the EOR model ideal for long-term roles and strategic growth.

4.2. Contractors

Independent contractors can appear more cost-effective, especially for short-term or project-based work, because you’re not responsible for:

- Paying employee benefits (health insurance, PTO, retirement plans)

- Making statutory contributions (like Social Security, unemployment insurance, etc.)

- Managing payroll or HR compliance

However, contractors often counterbalance this by charging higher hourly or project rates to account for their self-managed taxes, insurance, and flexibility.

And while they can be a lean solution, the cost of misclassification or non-compliance can far outweigh the upfront savings.

Contractors are best suited when you need agility and specialised expertise.

Still, they require strict boundaries and careful oversight to avoid crossing into ‘employee’ territory, particularly in countries that are very strict with worker classification.

EOR vs. Contractor: Which is the right fit for your business?

Deciding between hiring through an EOR or working with an independent contractor doesn’t rely only on a job type but on aligning your workforce strategy with your business goals, compliance needs, and growth plans.

When an EOR makes sense

An EOR is the best choice when you're looking to build long-term, compliant, and scalable teams, especially across borders. It’s ideal for situations where:

1. You’re expanding into a new country without a legal entity

Setting up a legal entity takes time, money, and legal expertise. An EOR enables you to hire employees in a new market quickly and compliantly, without the need to establish a local presence.

2. You need to attract and retain top talent

Offering competitive benefits like health insurance, paid time off, and retirement plans is often essential to securing top-tier talent. EORs provide access to local benefits packages, helping you stay attractive in global talent markets.

3. You have compliance concerns or long-term plans

If you plan to employ someone full-time or for an extended period, an EOR ensures you're not exposed to misclassification risks.

It handles payroll, taxes, labour law compliance, and employee rights, all essential for long-term stability.

Thus, an EOR is best for:

- Full-time or permanent roles

- Strategic international growth

- Focus on compliance and long-term investment.

When Contractor makes sense

Contractors offer speed and flexibility, making them a strong option when you need results fast, without the commitment of full-time employment.

A contractor is ideal when:

1. You’re hiring for a short-term project

If you need someone to build a prototype, consult on strategy, or cover a temporary skills gap, hiring a contractor allows you to quickly onboard talent without the administrative load of employment.

2. You’re working within tight budgets

While contractors may charge higher hourly rates, you save on overhead costs like benefits, tax contributions, and long-term obligations.

This aspect can be beneficial for startups or teams operating lean.

3. You need specialised, non-core expertise

Contractors are ideal for highly specialised roles where you don’t need someone full-time, such as niche developers, legal consultants, or designers.

They bring deep expertise for the task at hand, with minimal ramp-up.

Thus, a Contractor is best for:

- Project-based work

- Freelance or gig economy jobs

- Rapid, budget-conscious execution.

However, choosing between an EOR and a contractor isn’t always black and white. You may need to combine both.

The good news is that there is a solution that enables you to do just that.

With Native Teams, you get a platform that enables you to hire full-time employees compliantly through EOR services and easily manage contractors.

Native Teams: Your all-in-one solution for full-time and flexible talent

In the remote-first world, you shouldn’t have to choose between compliance and flexibility. With Native Teams, you don’t have to.

You can hire and onboard both full-time employees and contractors within a single platform, compliantly and efficiently.

Here at Native Teams, we:

✨ Act as your EOR, enabling you to onboard team members in 85+ countries while we handle contracts, payroll, tax compliance, and statutory benefits. You get the talent, we manage all the rest.

✨ Enable you to engage, manage, and pay contractors globally in their preferred currency, with built-in tax documentation, automated invoicing, and clear legal agreements to avoid misclassification risks.

✨ Handle social security contributions and provide the necessary benefits to your global workforce.

✨ Provide detailed payslips to your employees that showcase their earnings, deductions, and taxes.

✨ Pay all your gig workers with CSV bulk uploads.

✨ Monitor worker availability in real-time with an intuitive leave and absence management system, helping you plan your resources efficiently.

✨ Easily create, manage, and store multiple contracts for all your gig workers in one place, reducing paperwork and saving time.

✨ Consolidate earnings from multiple sources into a single, easy-to-track platform, giving workers clarity and control over their income.

And the list goes on.

Enticed to discover more?

Book a free demo today and hire globally without the legal guesswork.