How Much Does An Employer Of Record Cost in 2026?

Acting as the legal employer on behalf of a company, an EOR handles everything from compliance and payroll to benefits and taxes in foreign jurisdictions.

However, managing all the international, country-specific regulations and intricacies makes it hard to estimate how much an employer of record costs.

Read on to learn what to expect when budgeting for an EOR and what factors influence the final price.

Let’s dive in!

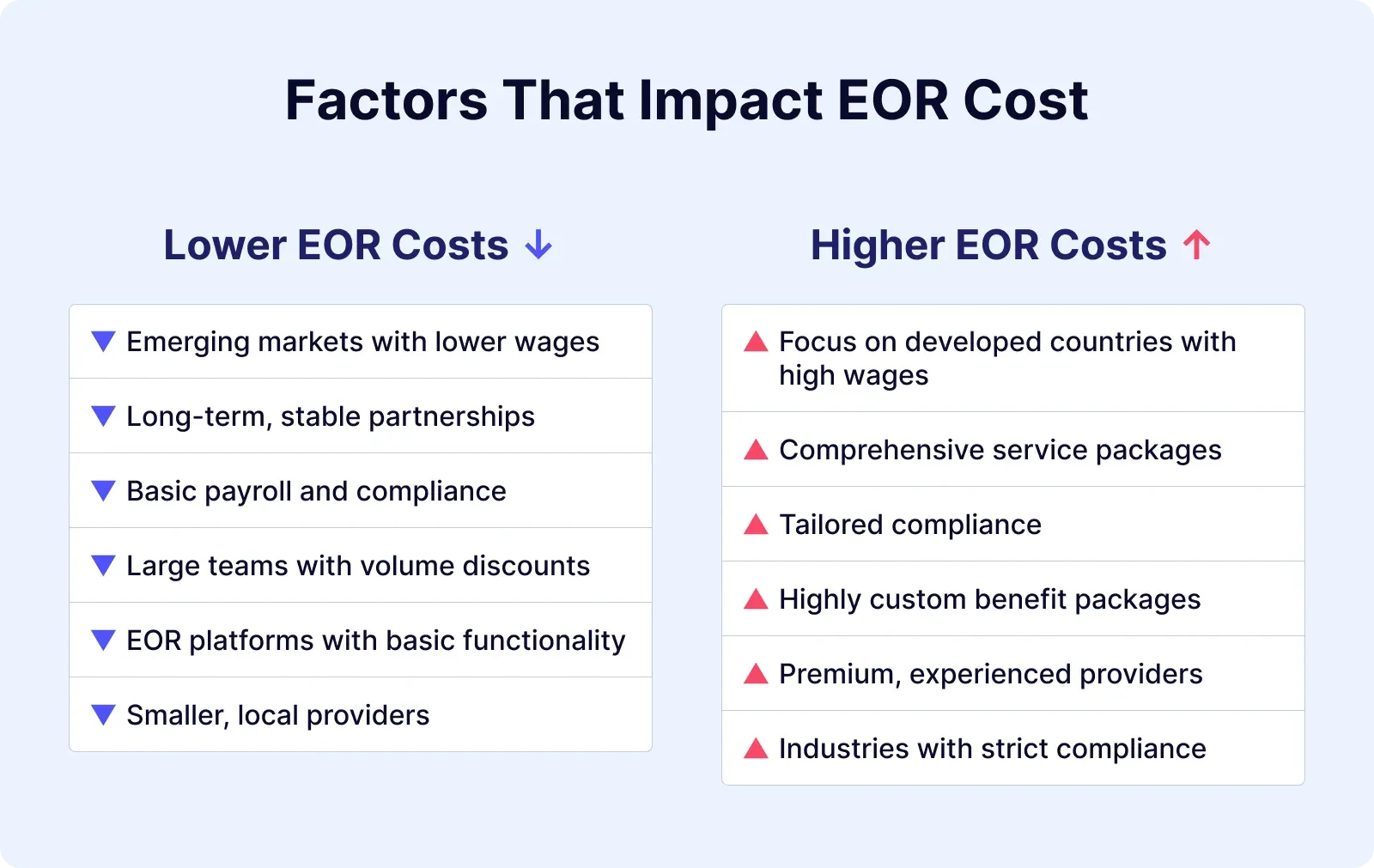

5 Factors that influence EOR costs

There are several factors that affect EOR pricing.

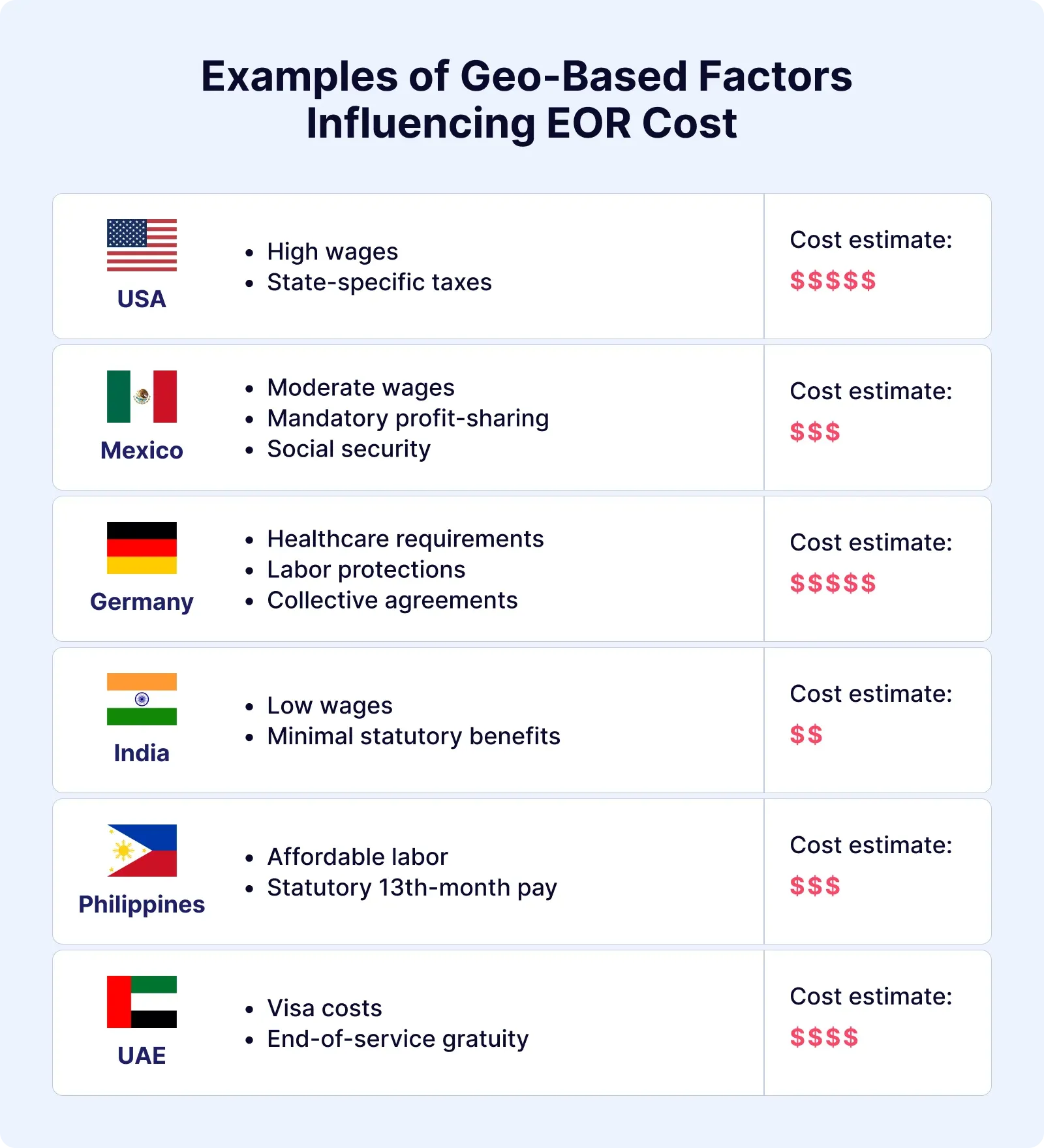

1. Geographic location

Costs vary significantly depending on the country where your employee is located. Hiring in countries with complex labor laws or high social contributions like France or Brazil, will typically be more expensive than in countries with simpler compliance requirements like the Philippines or India.

2. Number of employees

Many EOR providers offer tiered pricing based on the number of employees you manage through their platform.

Larger teams may benefit from volume discounts, while small teams or single hires might see higher per-employee costs.

3. Service scope

Not all EOR services are equal.

Some providers offer full-service packages, including everything from onboarding and benefits management to legal support and offboarding.

Optional add-ons like visa support or global talent acquisition also increase expenses.

On the other hand, some providers offer more basic, compliance-focused packages, which may result in a lower price.

4. Type of contract or worker

The type of worker you’re hiring also plays a role. Full-time employees with benefits typically cost more to manage than short-term contractors or freelancers.

The complexity and types of employment contracts, such as fixed-term vs. indefinite, local perks, etc., adds to the overall cost.

In addition, industries requiring niche expertise or positions with complex compliance needs like healthcare or manufacturing often face higher costs due to additional administrative and regulatory burdens.

5. Level of customisation or support

If you need dedicated account management, rapid onboarding, or support for complex HR policies, you may pay a premium for those services.

Custom workflows and high-touch support drive up costs compared to standardised solutions.

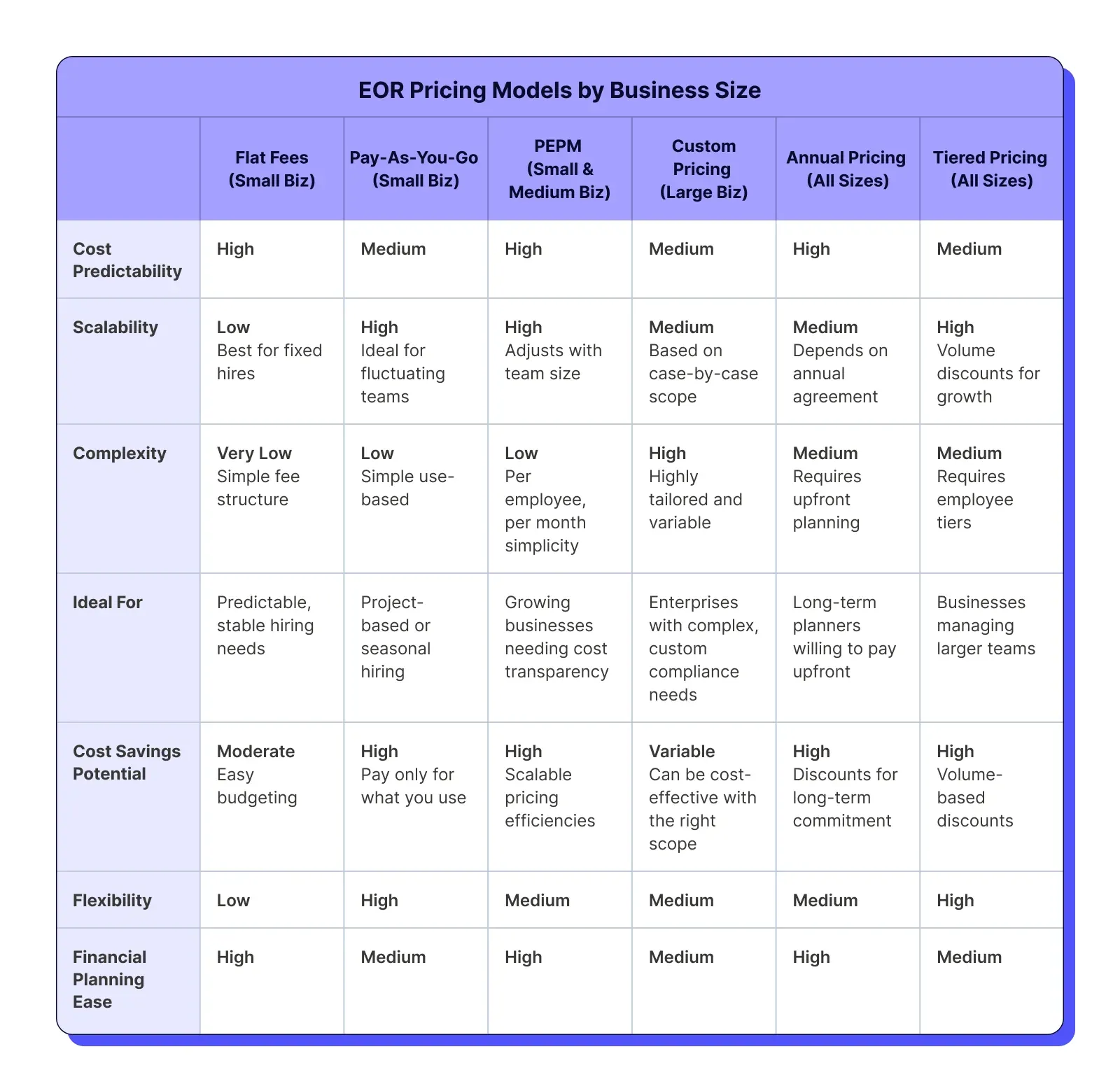

Standard pricing models for EOR services you should know about

While the exact pricing structures can vary depending on the EOR provider and the above factors, the most common models are:

1. Flat monthly fee per employee (PEPM)

Within this pricing model, the EOR charges a fixed monthly fee for each employee they manage.

As a result, it provides a predictable cost structure, making it easier for companies to budget. The fixed fee generally encompasses the core EOR services, such as payroll processing, tax filing, benefits administration, and HR support.

However, it is crucial to understand the scope of services covered by the fixed fee and whether additional charges apply for non-standard requests or specific services.

For example, complex compliance issues or specialized reporting might incur extra fees.

2. Percentage of payroll

This is one of the most prevalent pricing models. The EOR provider charges a percentage of the employee's gross salary.

It typically covers the EOR's costs for managing payroll, taxes, benefits administration, compliance, and other employment-related responsibilities.

The percentage can fluctuate depending on factors such as the number of employees, the complexity of local labor laws, and any additional services required.

EORs usually charge 10–25% of the gross salary.

Again, it's important to clarify with the provider what is included in the percentage and whether there are any hidden fees or additional charges for specific tasks.

3. Pay-as-you-go

Some EOR providers offer a pay-as-you-go model, where you only pay for the services you use.

This can be a cost-effective option if you have fluctuating hiring needs or require specific services from the EOR.

For instance, you might only need payroll processing for a short-term project.

The pricing for this model can be based on per-transaction fees, hourly rates for HR support, or a combination of both.

4. Bundled packages

EOR providers sometimes offer bundled service packages combining various services at a single, discounted price.

These packages might include core services like payroll and benefits administration, as well as additional services such as recruitment support, visa sponsorship, or relocation assistance.

Bundled packages can offer cost savings and convenience, but it's essential to evaluate whether the included services align with your specific requirements.

5. Hybrid models

These models combine elements of the above options.

For example, the EOR provider might charge a fixed monthly fee for core services and then add a percentage of salary for specific benefits administration.

Hybrid models can provide flexibility and allow you to customise your EOR service to meet your unique needs.

Are there any hidden fees associated with EOR services?

EOR services often include hidden fees that can significantly increase costs if you don’t review them carefully. Here are the most common ones to watch for:

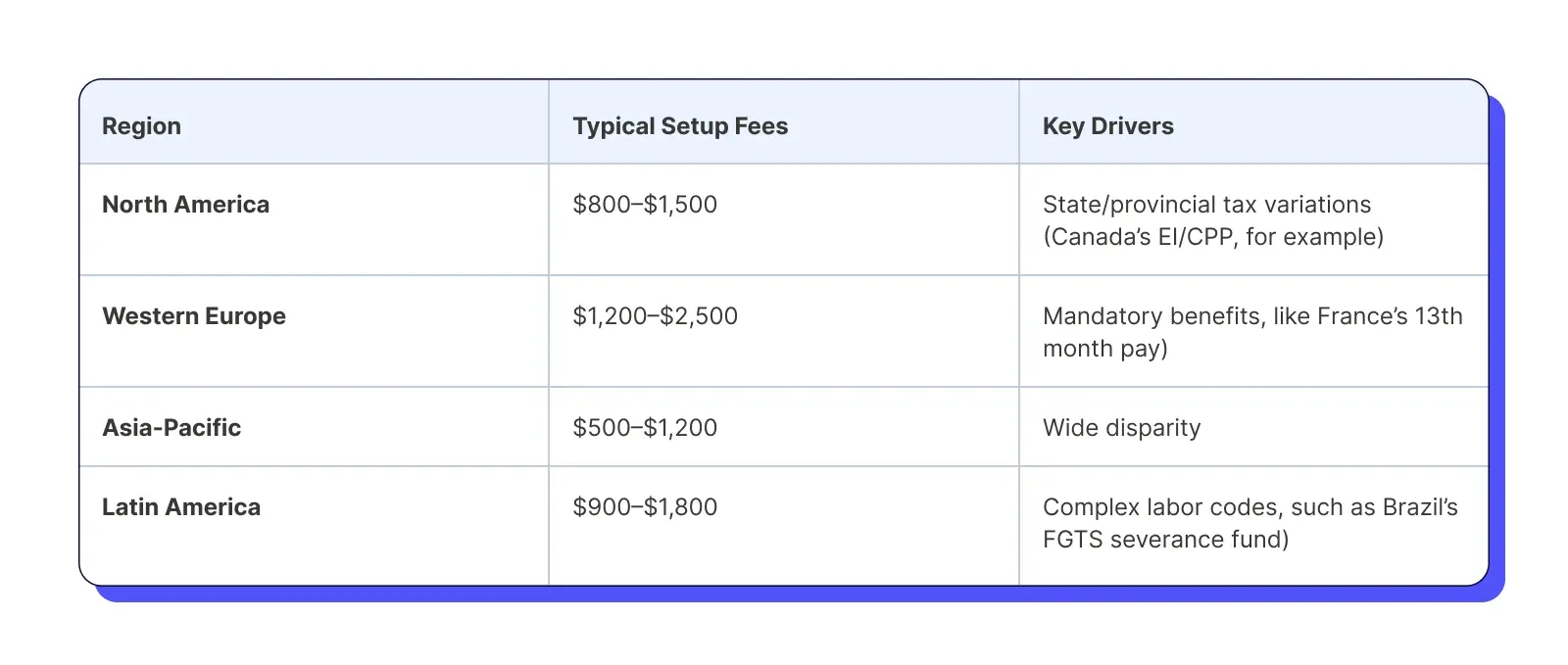

1. Onboarding/setup fees

One-time charges for initial employee registration, payroll setup, and compliance checks.

These fees can vary depending on the complexity of the employee's situation. Some providers advertise "no setup fees" but later add administrative charges.

Thus, be sure to clarify exactly what is included in the onboarding fee to avoid surprise charges later.

💡 Worth knowing

Setup fees for EOR services vary by country due to differences in local compliance requirements, labour laws, and administrative complexity. The key country-specific factors include:

- Compliance burden

- Local benefits requirements

- Documentation complexity.

*Disclaimer: Please note that these figures are estimates and can vary based on the specific EOR provider, the exact services included, and changes in local regulations or economic conditions.

2. Termination/offboarding fees

These are costs incurred when an employee leaves the company, whether through resignation, termination, or retirement.

The fees cover the processing of final paychecks, issuing necessary tax documents and removing the employee from the payroll system.

Some providers may also charge extra for generating termination reports or providing documentation related to the employee's departure.

3. Currency conversion (FX) & banking fees

When dealing with international payroll, especially in countries with fluctuating currency exchange rates or complex banking regulations, paying attention to these fees is vital.

Payroll providers may charge fees for converting funds from your company's base currency to the local currency for employee payments.

Additionally, banking fees may be incurred for transferring funds to local banks or processing international transactions.

These fees can quickly add up, so it's essential to understand the provider's currency conversion policies and any associated banking charges. Transparency on exchange rates is key here.

4. Benefit administration markups

Many payroll providers offer benefit administration services, handling tasks like enrolling employees in health insurance, managing retirement plans, and tracking paid time off.

However, some may add a markup to the cost of these 3rd-party benefits.

This markup represents the provider's fee for managing the benefits on your behalf.

It's crucial to understand how the provider calculates this markup and to compare it against the cost of managing benefits in-house or using a dedicated benefits administration platform.

5. Legal or compliance updates

Labour laws are constantly evolving, and payroll providers must stay up-to-date with these changes to ensure compliance.

Some providers may charge ad hoc fees to cover the cost of implementing updates related to new labour laws, tax regulations, or compliance requirements.

It’s important to ask the provider about their process for handling legal and compliance updates and whether these updates will result in additional fees.

A good payroll provider will proactively communicate these changes and their associated costs.

💡 4 quick tips on how to avoid hidden fees

- Review contracts thoroughly — Scrutinize clauses about "processing fees," "local employer obligations," or "premium support".

- Demand transparent pricing — Choose providers that itemize costs and avoid percentage-based models unless fully explained.

- Clarify currency exchange rates — Ensure FX rates match mid-market benchmarks and avoid providers that silently mark up rates.

- Negotiate termination terms — Predefine offboarding costs and avoid providers charging excessive exit fees.

How to evaluate EOR pricing: a must-have checklist

✅ Transparency in fees — Are the fees clear and predictable?

Don't hesitate to ask for a detailed breakdown of all potential fees, and be wary of vague language or bundled services that make it difficult to discern individual charges.

✅ Total cost of ownership — The monthly fee is just one piece of the puzzle. Calculate the total cost of ownership by factoring in all potential expenses over the contract period.

Check the fine print for potential hidden fees.

✅ Value-added services — Consider support quality, automation tools, and local expertise in the countries where you hire since it’s crucial for navigating complex labor laws and ensuring compliance.

Also, check if the EOR offers robust reporting capabilities. You should be able to easily access data on payroll, expenses, and other key metrics.

✅ Comparisons and quotes — Shop around and always obtain quotes from multiple EOR providers.

This will give you a better understanding of the market rate and help you identify the best value for your needs.

Ensure that you're comparing quotes on a like-for-like basis, and consider the same services and level of support when evaluating different providers.

✅ Client reviews and Service Level Agreements (SLAs) — Ask about KPIs, such as payroll accuracy rates, time to onboard new employees, and response times to inquiries.

Review the EOR’s SLA to understand their commitment to service quality and response times. It should outline the EOR's responsibilities and the consequences of failing to meet them.

Moreover, research the EOR's reputation by reading client reviews and testimonials and looking for patterns in customer feedback.

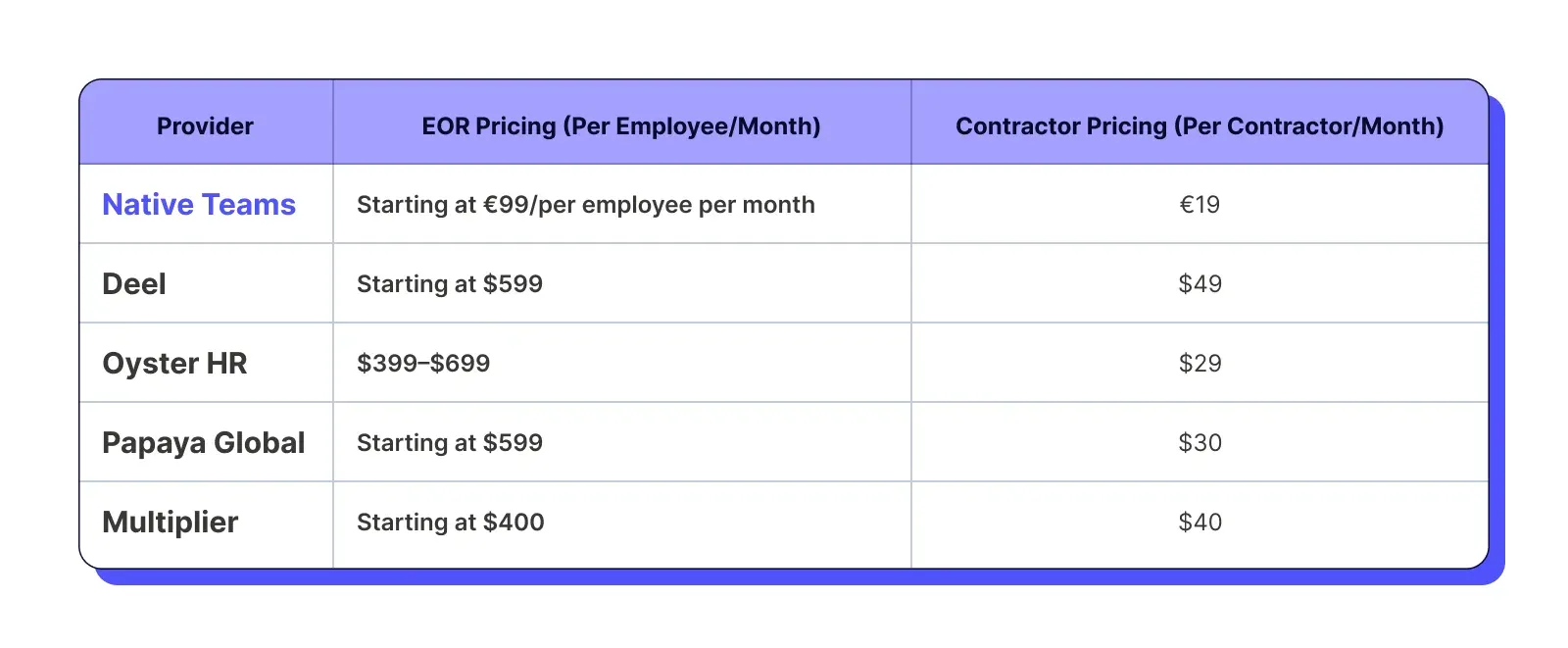

EOR pricing comparison: Top 5 EOR solutions

To give you a headstart in exploring EOR providers, here’s a list of the top 5 solutions with pricing.

Choosing the right EOR service and pricing model requires carefully considering your needs, budget, and risk tolerance.

While costs vary, a well-chosen EOR can save significant time, reduce compliance risks, and simplify global HR management.

Although lower prices often signal that the solution lacks more robust or advanced capabilities, that’s not the case with our solution.

Native Teams: complete EOR. Unbeatable price.

Native Teams is an all-in-one EOR and PEO platform that allows you to hire, pay, and manage your team without worrying about global payroll, local compliance, and multi-currency payments.

We’ll handle that for you.

Here at Native Teams, we believe that affordable global team management doesn't mean sacrificing premium service.

By putting your employees at the heart of everything we do and providing localised, dedicated support and expert navigation of local regulations, we create a streamlined and efficient system that delivers exceptional value to your team and your bottom line.

What else do we bring to the table?

🔥 Locally relevant benefits to win top talent.

🔥 Streamlined expense processes that enable you to simplify and automate expense tracking with quick uploads, approvals, and reports.

🔥 Fast and accurate payroll processing, allowing you to generate compliant payroll calculations in seconds, customised for local regulations.

🔥 Seamless payment handling in multiple currencies to minimise transaction fees.

And the list goes on.

Start with Native Teams today, or book a demo and see that you don't have to break the bank for powerful EOR.

FAQs

How Much Does an Employer of Record Cost (EOR)?

EOR costs typically range from $200-$800 per employee monthly, or 10-15% of salary. Pricing varies by country, provider, and services included. Some start as low as $199/month while others begin at $599+/month.

What is the deposit for EOR?

Some EOR providers require a security deposit of 1-3 months of employee salary to cover potential risks like severance pay or unpaid invoices. This deposit is usually refundable after contract termination.