EOR vs. Common Law Employer – What’s the Key Difference?

Expanding across borders isn’t only about finding talent but also about staying compliant with local labour laws and handling employer obligations while avoiding legal risks.

Two solutions that can help are Employer of Record (EOR) and Common Law Employer.

At first glance, they may seem similar, but they represent two very different approaches to managing workers.

So, what exactly sets them apart?

Read on to understand the core differences between EOR and Common Law Employer, and choose the right structure to scale globally.

Let’s dive in!

What is an Employer of Record (EOR)?

An Employer of Record (EOR) enables hiring employees in foreign countries without setting up a legal entity, simplifying international workforce expansion.

It is a 3rd-party organisation that legally employs workers on your behalf within a specific country.

Think of an EOR as your behind-the-scenes partner.

It takes care of the legal, tax, and HR hassle of hiring abroad, so you can focus on growing your team anywhere in the world.

How does EOR work?

The EOR takes care of all the heavy lifting behind the scenes:

- Drafting locally compliant employment contracts,

- Running payroll,

- Managing country-specific benefits, and

- Handling tax withholdings and filings.

It stays on top of local labour laws, so you don’t have to worry about falling out of compliance or facing unexpected legal issues.

Meanwhile, you continue to manage your team as usual.

You assign tasks, oversee performance, and support your employees’ growth, just like you would with any in-house team.

The EOR handles the paperwork and administrative and legal employment aspects, giving you the freedom to focus on building your global workforce without getting buried in bureaucracy.

What is a Common Law Employer?

A Common Law Employer is a company that controls how and what work gets done.

Besides assigning tasks, it’s also about calling the shots on how the work is carried out.

If your business:

- Sets the schedule,

- Provides the tools, and

- Oversees the day-to-day details of someone’s job, you're probably their Common Law Employer, even if you haven’t officially registered in their country.

In the eyes of the law, it’s the level of control you have that really matters. You're legally responsible for everything that comes with being an employer under that country’s laws.

This concept is especially important in countries like the U.S., the UK, Canada, and Australia.

💡 If the employer only controls the outcome of the work, not the methods or means, the worker is likely an independent contractor, not a common law employee.

How does a Common Law Employer work?

Before you can hire someone in most countries, you’ll need to establish a legal presence, such as opening a local branch, subsidiary, or rep office.

This lets you register with tax and labour authorities and legally operate in that market.

Other Common Law Employer traits include:

1. You draft local-friendly contracts

You're on the hook for creating employment contracts that follow local rules. That includes everything from salary and working hours to vacation days, benefits, and how terminations are handled. One-size-fits-all contracts won’t cut it.

2. You handle payroll like a local

It’s your job to:

- Register for local payroll taxes and social contributions

- Pay employees on time and in local currency

- File all required reports with the tax and social security agencies

In other words, you're running payroll on the ground even if you're not physically there.

3. You offer country-specific benefits

Ensure you provide all legally required employee benefits, including paid leave, health insurance, pensions, and overtime pay, according to the specific labour laws in each employee’s country.

4. You follow local employment laws

Complying with local laws includes:

- Respecting minimum wage laws

- Sticking to legal working hours

- Providing proper notice and severance for terminations

- Creating a safe, fair, and discrimination-free workplace

5. You own the risk

If there’s an audit, a labour dispute, or even a simple mistake in payroll, you’re on the hook.

That means handling penalties, legal claims, or back payments, all part of the deal when you’re the official employer.

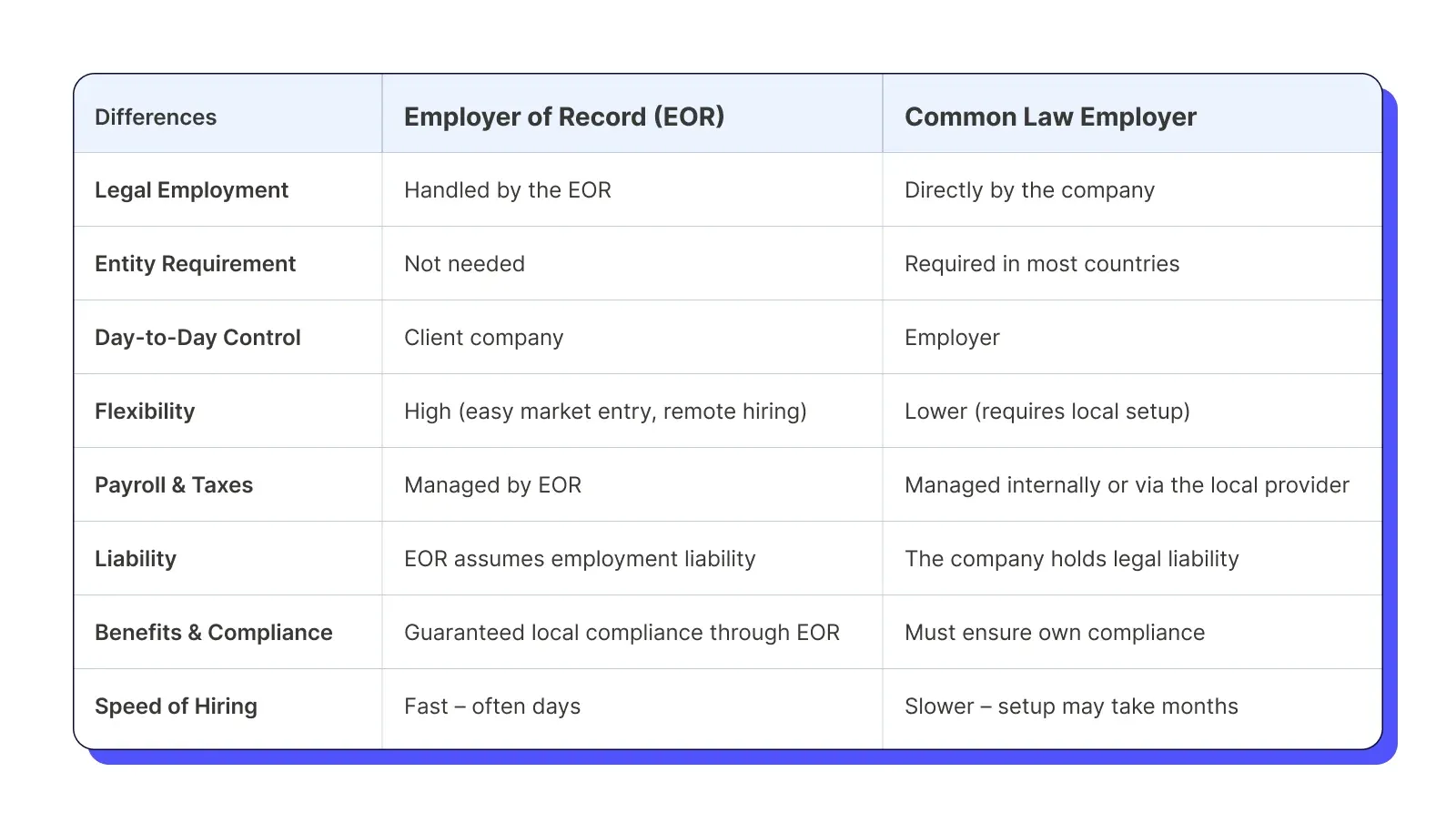

EOR vs. Common Law Employer: What’s the real difference?

Both options help you hire a workforce, but take very different routes. Thus, knowing the difference can save you time, money, and major compliance headaches.

Here’s a quick breakdown before we dive deeper.

1. Legal entity and responsibility

- EOR officially employs workers on your behalf, handling all the behind-the-scenes stuff like payroll, taxes, benefits, and staying on top of local labor laws. You still manage the employee’s daily work, but the EOR takes care of the legal and administrative load, so you don’t have to set up a company in a new country.

- On the other hand, the Common Law Employer is the classic, do-it-yourself route. Your company directly hires, manages, and legally employs the worker.

That means you’re in charge of everything, from paying salaries and filing taxes to providing benefits and staying compliant with local employment laws. You get full control, but also full responsibility.

2. Control over employees

- With an EOR, you stay in charge of the work—you assign tasks, manage performance, and guide the employee's day-to-day responsibilities. The EOR isn’t the boss. It simply handles the legal and administrative side of employment, like payroll, taxes, and compliance.

- On the other hand, as a Common Law Employer, you own the full picture. That includes not just managing the work itself but also overseeing hiring, onboarding, training, supervision, and even termination. You're fully responsible, both operationally and legally.

3. Liability and compliance

- The EOR does the heavy lifting of employment compliance, such as handling tax filings and managing statutory benefits. However, when it comes to workplace disputes such as wrongful termination or discrimination claims, that responsibility stays with you, the client company.

- As a Common Law Employer, you're fully in charge. That means you take on all legal and compliance duties, from regulatory filings to managing employee disputes and claims directly.

4. Flexibility and market entry

- An EOR gives you more flexibility to hire in new countries or regions without the hassle of setting up a local legal entity. This is perfect if you're expanding internationally or want to test the waters by hiring remote talent on a temporary basis.

- Common Law Employer is typically less flexible, as it requires setting up a legal entity and managing all compliance requirements in each jurisdiction where you hire employees.

EOR vs. Common Law Employment: Which is the right fit for your business?

Deciding between an EOR and Common Law Employment can be a game-changer for expanding internationally and managing your workforce.

Both have perks, depending on where your business is and where you want to go.

When to Choose an EOR:

1. Expanding to a new market quickly without entity setup

If you need to move fast and hire talent in a new country, an EOR is your go-to option.

It lets you expand globally without the hassle of establishing a local entity, so you can start hiring immediately.

2. Hiring employees in multiple countries

Got a growing team spread across different countries?

An EOR makes it easy to hire and manage employees in multiple locations, without the complexity of setting up a legal entity in each one.

3. Short-term or project-based international roles

Need to bring someone on for a short-term project or a specific international role?

An EOR allows you to hire temporarily without committing to long-term operations or managing all local compliance.

4. Avoiding permanent establishment risk in early stages

Suppose you’re not yet ready to establish a permanent presence in a country but still want to hire locally.

In that case, an EOR helps you avoid the risk of triggering permanent establishment tax liabilities.

It’s a smart move for early-stage growth.

When to choose Common Law Employment:

1. Long-term presence in a country

If your business is ready for a long-term investment in a country, hiring directly as a Common Law Employer may be the way to go.

It gives you full control over local operations and positions your company for sustained growth in that market.

2. Building a full local team or opening an office

Planning to expand your team or even open a physical office? Common Law Employment allows you to fully integrate your workforce into the local culture and business environment while managing the details in-house.

3. Having greater control over employee contracts, benefits, and onboarding

If you want more control over the fine details of employment, such as contracts, employee benefits, and how onboarding is handled, a Common Law Employer relationship gives you direct oversight, ensuring it aligns with your company’s values and goals.

4. Willing to invest in HR/legal infrastructure locally

Ready to build out your own HR and legal team in the country where you’re hiring? Common Law Employment is ideal if you want to invest in the local infrastructure to stay compliant, manage payroll, and handle employee relations independently.

But what if you didn’t have to choose one over the other, but combine the best of both? With Native Teams, you can.

How can you hire internationally and hassle-free with Native Teams?

Whether you’re exploring the flexibility of an EOR or ready to commit as a Common Law Employer, Native Teams makes international hiring:

- Easier,

- Safer, and

- Smarter, no matter your growth stage.

With Native Teams, you don’t have to choose between agility and control, you get both, thanks to our PEO and EOR services combined.

✨Need to hire quickly in a new country without setting up a local entity?

Native Teams acts as your EOR, helping you onboard talent in 85+ countries, handling:

- Contracts,

- Payroll,

- Tax compliance, and

- Benefits, so you can focus on managing your team, not the red tape.

✨ Ready to build a long-term presence and hire directly?

Native Teams supports you with HR infrastructure, local expertise, and compliance guidance, making operating as a Common Law Employer easier.

From drafting contracts that align with local laws to managing statutory benefits and tax filings, we’ve got your back.

✨ Want to pay your global team from one unified platform?

With multi-currency payroll tools and integrated wallets, Native Teams simplifies salary payments, taxes, and social contributions— all in one dashboard.

Furthermore, with our Payroll Calculator, you can get a breakdown of the expenses for hiring employees in different countries.

You get clarity and control, no matter where your team is based.

✨ Need localised benefits that keep your global team happy?

Native Teams ensures your employees receive locally compliant and competitive benefits, so you can attract and retain top talent across borders.

✨ Concerned about compliance in fast-changing labour markets?

With real-time legal updates and compliance tracking, Native Teams helps you stay ahead of ever-evolving employment laws, minimising legal risk while scaling globally.

✨ Looking for contractor and freelancer support too?

Beyond full-time employees, Native Teams offers compliant solutions for contractor management, including:

- Contract creation via templates,

- Payment processing, and

- Tax documentation, tailored to each country’s regulations.

No matter how you scale, project-based contractors, first hires in new regions, or full in-country teams, we adapt to your needs and grow with you.

Book a demo today to simplify global hiring and stay fully compliant.