Pros and Cons of Employer of Record (EOR) To Consider in 2026

Did you know that projections indicate that by 2030, the global EOR market will reach around $6.64 billion, reflecting a CAGR of 6.8% during the forecast period from 2024 to 2030?

Thus, the market is experiencing significant growth due to the increasing need to expand businesses internationally without establishing local entities.

But are there any challenges that come with EOR services? If yes, can you avoid or at least mitigate them?

Read on to learn more about employer of record pros and cons so you can hire talent globally while ensuring compliance with local employment standards.

Let’s dive in!

Understanding Employer of Record (EOR)

An Employer of Record (EOR) is a 3rd-party organisation that legally employs workers on behalf of your company.

While the company retains control over daily work tasks, the EOR assumes legal responsibility for employment-related duties such as:

- Payroll processing

- Tax withholdings and filings

- Benefits administration

- Compliance with local labor laws

- Employment contracts and termination procedures.

Therefore, it allows you to hire employees in different countries without establishing a legal entity, significantly reducing time, costs, and regulatory complexity.

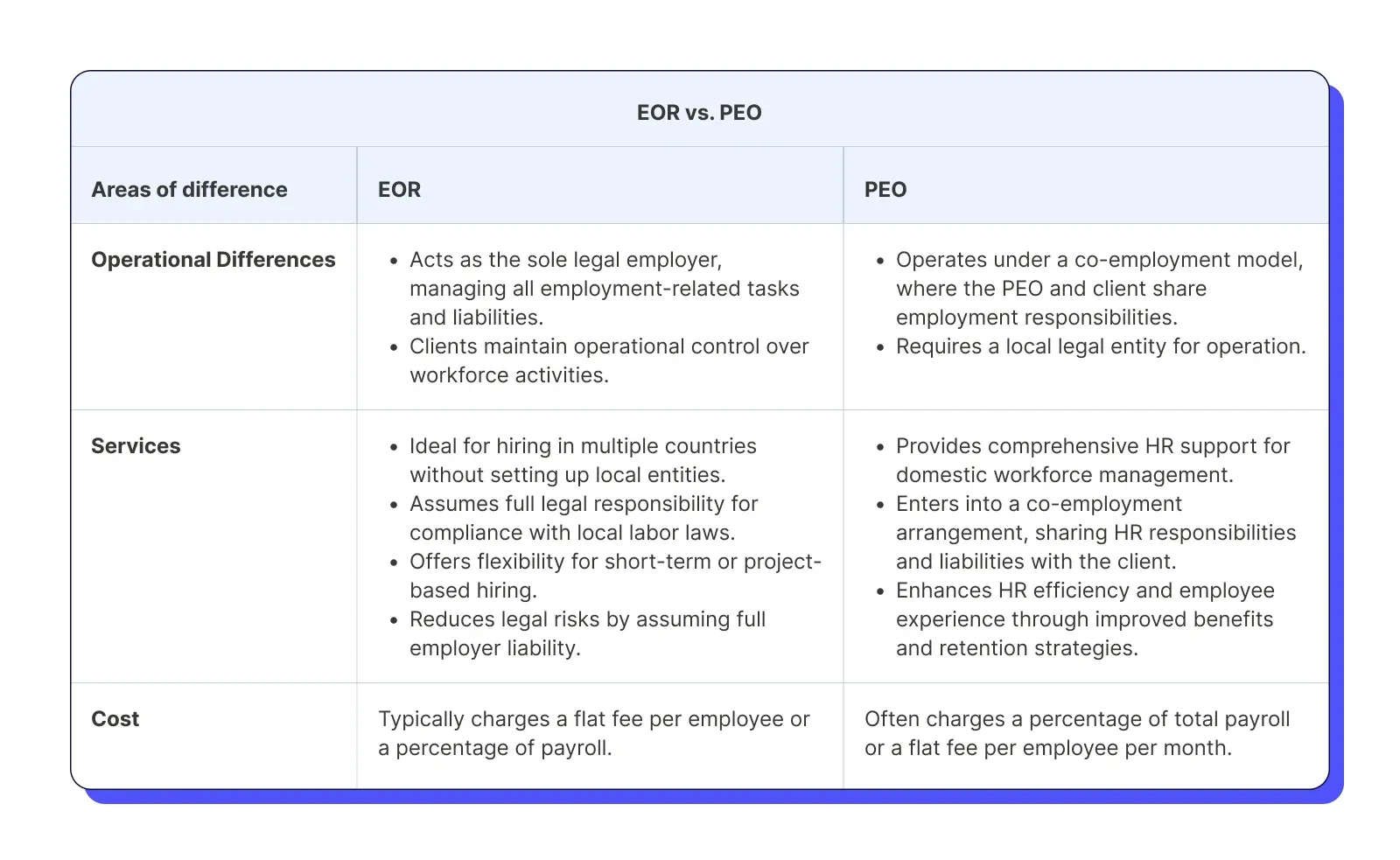

EOR services vs. PEO services: What’s the difference?

Differences between EOR and PEO are often overlooked, as the terms are used interchangeably, but they operate in significantly different ways.

6 Key EOR pros for streamlined global workforce management

EOR benefits offer multifold opportunities for companies expanding globally.

1. Easier global expansion

Setting up a legal entity in a foreign country can take months, requiring business registration, legal approvals, tax ID setup, and more.

An EOR already has legal entities established in multiple countries, allowing you to hire within weeks instead of months.

EOR for startups and companies is particularly useful for testing new markets before committing to a full local presence.

Besides quick market entry, EOR provides expertise in:

- Local labour laws,

- Tax systems, and

- Employment regulations, ensuring compliance and reducing the risk of legal issues.

2. Compliance assurance

Each country has unique hiring, termination, tax, and benefits regulations that you must follow.

With an EOR, you can ensure contracts are compliant, reducing the risk of fines or lawsuits.

In addition, EORs can help you avoid the misclassification of employees.

It’s common for many companies to misclassify independent contractors as employees, leading to legal issues.

EORs help classify employees correctly to ensure proper tax payments, social security contributions, and benefits.

Since labour laws, such as minimum wage adjustments, worker protections, and tax rates, change frequently, EORs monitor these updates and automatically adjust policies to keep your business compliant.

3. Reduced overhead and HR costs

Running an in-house HR and legal team in multiple countries is expensive. While the EOR cost may seem significant upfront, it centralises HR, payroll, and compliance, ultimately reducing staffing needs and operational costs.

Moreover, you can hire employees in new markets without the risk of committing to a permanent entity.

If a market underperforms, you can exit easily without entity closure costs.

4. Payroll and benefits management

EORs handle payroll in local currencies and ensure timely salary payments.

They manage:

- Tax deductions and filings (income tax, social security, pension contributions).

- Employee benefits administration (healthcare, insurance, paid leave).

- Year-end tax reporting for employees.

As a result, you can reduce the risk of penalties for incorrect filings or late tax payments.

Also, many EORs offer pre-negotiated benefits plans, such as health insurance, retirement plans, bonuses, etc.

This way, you can offer top-tier benefits without high costs.

5. Faster and smoother hiring process

EORs have local hiring teams who understand:

- Employment norms, such as required benefits, probation periods, contract structures, etc.

- Industry-specific regulations like tech, healthcare, finance hiring practices, and more.

- Competitive salary benchmarks to attract top talent.

EOR services handle paperwork, compliance checks, and tax registration so you can start hiring immediately.

6. Seamless employee termination and offboarding

Improper terminations can lead to wrongful dismissal claims. Not to mention that employment law violations can lead to hefty fines or business bans in some regions.

An EOR mitigates these risks by ensuring employment terms align with local laws and that all dismissals are legally sound.

Thus, EORs prevent mistakes like:

- Unlawful terminations, which may require severance in some countries.

- Non-compliant overtime payments.

- Failure to meet mandatory leave requirements.

3 Main Employer of Record cons you should pay attention to

Although leveraging EORs brings plenty of benefits, weighing the advantages and disadvantages is essential to determine if this approach aligns with your company's strategic goals.

1. Limited control over employment terms

One of the potential challenges is that EORs typically use pre-set employment contracts that comply with local laws.

Consequently, it may imply that you have limited flexibility in customising agreements for:

- Unique salary structures like commission-heavy roles.

- Equity compensation since some EORs can’t handle stock options.

- Company-specific benefits, including flexible work perks, commission pay, bonuses, retirement plans, etc.

Moreover, since the EOR is the official employer, some company policies may not be applicable or enforceable.

Issues might arise in areas like:

- Performance management — You might struggle to enforce disciplinary actions through an EOR.

- Remote work policies — Local labour laws might require fixed working hours despite company preferences.

- Leave and benefits customisation — You may have limited say in structuring benefits beyond the EOR’s standard package.

💡 Pro tip:

Native Teams, an EOR platform, combines tools for:

- Global payments and payroll,

- Legal employment provisions,

- Tax optimisation and

- Wealth management solutions, providing you with a flexible suite of functionalities for successful global expansion.

You can tailor employment contracts according to specific business needs and legal requirements, ensuring clarity and protection for both parties involved.

The platform not only offers tailored employment solutions for your business, but you can also customise it per your unique branding requirements and needs.

Thus, you can easily integrate our solutions within your offer while we handle everything else.

2. Inconsistent service quality among EOR providers

Not all EORs offer the same level of service quality in every country.

Some global EORs might not have strong local expertise in:

- Industry-specific labor laws like those for fintech, healthcare, the tech sector, etc.

- Country-specific taxation policies.

- Local hiring norms and best practices.

Since EORs handle employees across multiple jurisdictions, it means that

- Payroll processing times may vary between countries.

- Benefits packages might differ, leading to employee dissatisfaction.

- Customer service responsiveness can vary based on local team efficiency.

Thus, you must carefully choose an EOR with the right level of support for your needs.

💡 Pro tip:

Native Teams’ centralised solutions mean that you can easily:

- Leverage multi-currency payment options to ensure employees receive their salaries in their local currency without unnecessary conversion fees.

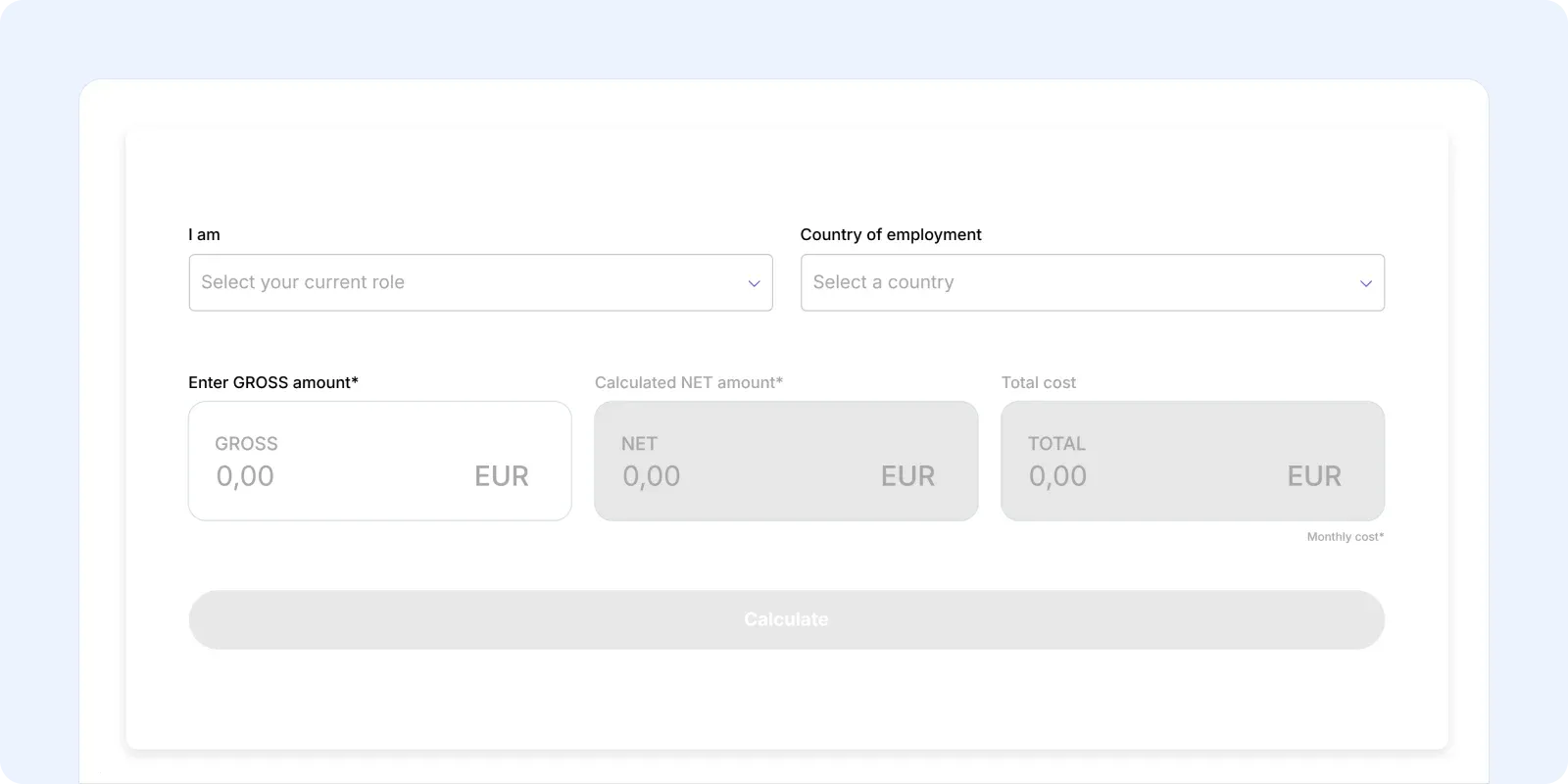

- Get full salary calculations and breakdowns in a few clicks with our Payroll Calculator, all in sync with local laws.

- Get a dedicated point of contact for all your people since we have experts in our focus countries who understand how things work in practice.

- Simplify benefits management and choose from a wide range of global employee benefits, including healthcare, insurance, pension, and others specific to each individual’s country.

3. Legal and compliance risks

Even though EOR services handle a lot of the compliance work for you, there's still a risk of things going wrong.

International labor laws are complicated, and even experts can sometimes misunderstand them.

Additionally, these laws change all the time. An EOR might not always keep up with the latest updates, which could lead to accidental violations.

These mistakes, even if not intentional, can cost you money in fines.

Non-compliance can also hurt your company's reputation, especially since customers, investors, and future employees care more than ever about businesses acting ethically and legally.

The same issue can occur with taxes — failing to properly withhold and remit payroll taxes, social security contributions, and other taxes in each country.

EOR may make errors in tax calculations or fail to remit taxes on time.

💡 Pro tip:

Always make sure that the EOR provider has its own entity wherever you want to hire from and has all the needed knowledge about compliance, taxes, payroll, benefits, etc.

Thus,

- Choose an EOR with a strong track record of compliance in your target countries.

- Review the EOR's compliance processes and procedures.

- Verify the EOR's tax registration and reporting procedures.

An important aspect is to check if the EOR has its own business entities in the country where you need help.

Otherwise, you might end up working with a 3rd-party provider, which means you won’t have so much control over quality.

Native Teams has legal entities in 85+ different countries around the world.

Moreover, we also have local teams in each of our countries, so we can offer ground support for you and your team.

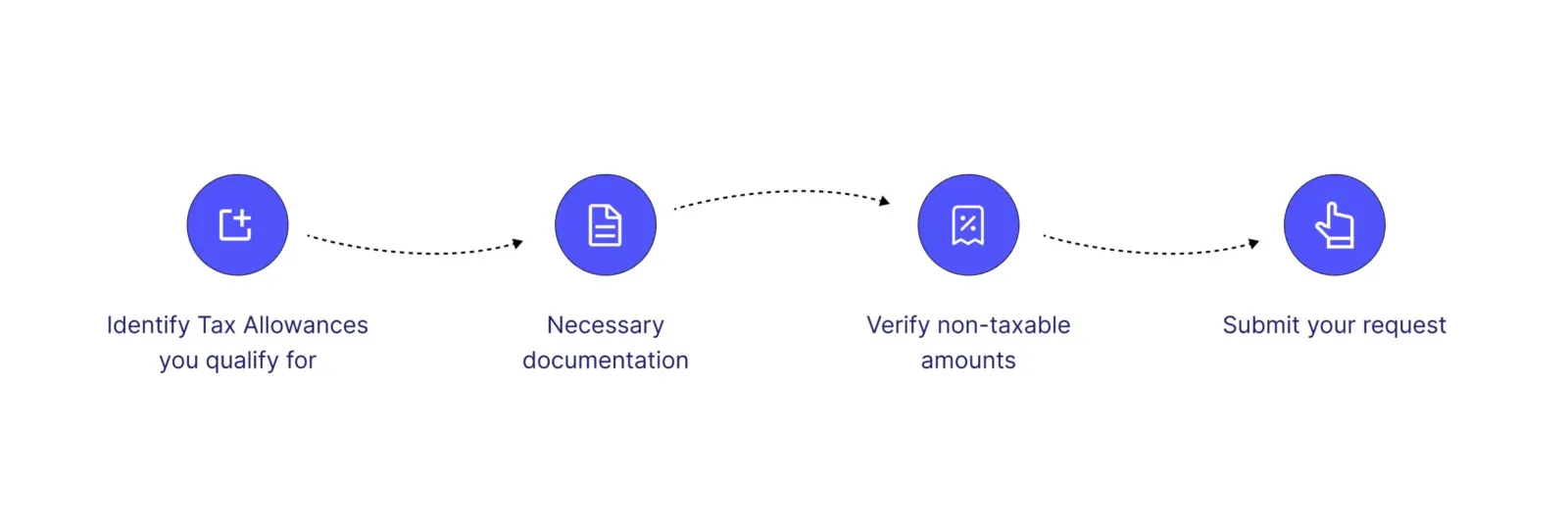

Furthermore, our Tax Allowance tool enables you to comply with the complex framework of current tax and labour laws and regulations.

More than just ensuring compliance, you can claim your Tax Allowance based on your current needs, ensuring no obligation to pay taxes and securing non-taxable benefits.

As a result, you can effortlessly transfer your funds directly from your Native Teams wallet to your bank account, all following the applicable laws.

🎁 Bonus: How to choose the right EOR provider for your business?

Your business objectives, resources, and long-term plans will affect your choice, but overall, the professional EOR should:

- Have deep expertise in local labor laws, tax regulations, and compliance requirements in the countries where you plan to hire.

- Stay updated on changing labour laws.

- Have legal entities in the countries where you plan to hire.

- Easily onboard employees across multiple countries without delays.

- Support multi-currency payroll and provide accurate and timely salary payments in local currencies.

- Handle tax deductions, filings, and social security contributions.

- Offer customisable benefits.

- Have transparent pricing with no hidden fees.

How can Native Teams drive your global growth?

Native Teams combines EOR, PEO, and Global Payroll solutions, providing a comprehensive suite of tools and features to:

- Handle contracts, payroll and compliance on your behalf.

- Take care of payroll, taxes and HR administration.

- Onboard your employees in just 2 weeks.

- Expand smoothly and compliantly in more than 85 countries.

- Make secure and timely payments.

- Apply localised benefits for your employees.

- Do tax fillings.

And the list goes on.

Thus, we offer an end-to-end solution that spans employment contracts, salary payments and tax filings.

Eager to dig deeper?

Start with Native Teams today, or book a demo to maximise EOR benefits while avoiding potential drawbacks.