EOR vs Staffing Agency - The Difference & Which One To Choose?

Hiring the right talent is critical for business success, but navigating employment laws, payroll, and compliance can be complex, especially when hiring across borders.

Both EOR and staffing agencies help you manage workforce needs, but they serve different purposes.

So, which one is the right fit for your business?

We’ll break down the key differences, benefits, legal considerations and other important aspects of EOR vs. a staffing agency so you can make the best decision for your international hiring.

What is an Employer of Record (EOR)?

An Employer of Record (EOR) is a 3rd-party organisation that legally employs workers on behalf of a company, taking care of all:

- Administrative,

- Legal, and

- Compliance responsibilities associated with employment.

You can use EORs to expand into new markets without establishing a legal entity in each country.

Key responsibilities of an EOR

An EOR becomes the legal employer, assuming all the associated risks and obligations and encompassing all responsibilities to ensure compliance and best practices.

1. Onboarding and offboarding

The EOR manages the entire employee lifecycle, from the initial onboarding process to the final offboarding procedures.

This includes:

- Creating employment contracts,

- Conducting background checks

- Ensuring proper completion of paperwork, and

- Managing the termination process in accordance with local laws, including providing any required notices and severance packages.

2. Payroll management

Accurate and timely payroll processing is a cornerstone of EOR services.

It involves calculating wages, withholding taxes, including income tax, social security contributions, and other statutory deductions, and disbursing employee payments.

Furthermore, the EOR is responsible for remitting all withheld taxes and contributions to the appropriate government agencies on time, avoiding penalties and ensuring compliance. Another critical aspect of payroll management is accurate record-keeping.

3. Tax compliance

Tax regulations can be complex and vary significantly from country to country and even within different regions of the same country.

The EOR is responsible for staying on top of these ever-changing regulations and ensuring all employment-related taxes are filed correctly and on time.

Besides income tax and social security, it also handles unemployment insurance, payroll taxes, and any other applicable taxes.

4. Benefits administration

Managing employee benefits is another significant responsibility. The EOR typically supervises employee benefits packages, such as:

- Health insurance,

- Retirement plans,

- Paid time off (vacation, sick leave, and holidays),

- Disability insurance, and other perks.

The process involves enrolling employees in benefit plans, processing claims, and ensuring compliance with relevant regulations.

5. Compliance with labour laws

The EOR acts as the legal employer and is responsible for adhering to all applicable labor laws.

It comprises minimum wage requirements, overtime pay regulations, working hours restrictions, employee classification rules, and anti-discrimination laws.

6. Immigration and visa sponsorship

When your company hires foreign workers, the EOR may assist with immigration and visa sponsorship and navigate the complex visa application process.

It ensures that employees have the necessary work permits and comply with immigration regulations.

7. HR support

While your company typically manages the day-to-day tasks and performance of the employee, the EOR often provides HR support to you and the employee.

For example, the EOR can provide guidance on HR best practices, assist with employee relations issues, and offer training and development opportunities.

When to Use an EOR?

- Expanding into new countries without establishing a local entity.

- Hiring remote permanent or full-time roles while ensuring compliance with labor laws.

- Reducing administrative burdens related to payroll and HR management.

- Ensuring tax and employment compliance in foreign markets.

What is a staffing agency?

A staffing agency specialises in sourcing, screening, and placing employees in temporary, contract, or permanent positions.

Staffing agencies act as intermediaries between employers and job seekers, providing workforce solutions based on company needs.

However, although the agency handles payroll and administrative tasks, it doesn’t become the legal employer for permanent roles.

Key responsibilities of a staffing agency

Staffing agencies play a crucial role in connecting you with qualified talent. Their services streamline the hiring process and provide flexible workforce solutions.

1. Candidate recruitment & screening

Staffing agencies actively seek out potential employees through various channels:

- Posting job openings on popular job boards like Indeed.

- Leveraging professional networking platforms like LinkedIn, and

- Using their own internal databases of pre-screened candidates.

Regardless of the channel, effective candidate sourcing requires a proactive and multi-faceted approach.

Once staffing agencies receive applications, they review resumes and cover letters to identify candidates whose skills and experience align with the job requirements.

This initial screening process helps narrow the applicant pool to the most promising individuals.

By handling the recruitment and screening process, staffing agencies significantly reduce the time-to-hire for companies.

This allows you to fill open positions more quickly and avoid costly delays.

2. Interview & skill assessment

Staffing agencies conduct in-depth interviews to assess a candidate's qualifications, experience, and personality.

To ensure candidates possess the necessary skills for the job, staffing agencies often do skill assessments: candidate's technical skills, problem-solving abilities, and communication skills.

3. Temporary employee management

Staffing agencies handle all aspects of payroll processing for temporary employees, including calculating wages, withholding taxes, and issuing paychecks.

In addition, they ensure compliance with all applicable labor laws and regulations related to temporary employment.

However, although they ensure candidates are eligible and qualified, they don't typically manage legal compliance post-hire.

When to use a staffing agency?

- Filling temporary positions during peak seasons.

- Addressing urgent or high-turnover positions.

- Managing short-term projects requiring specialised skills.

EOR vs. staffing agency: 5 ways in which they differ

Although EOR services and staffing agencies help you manage employment needs, they serve distinct purposes.

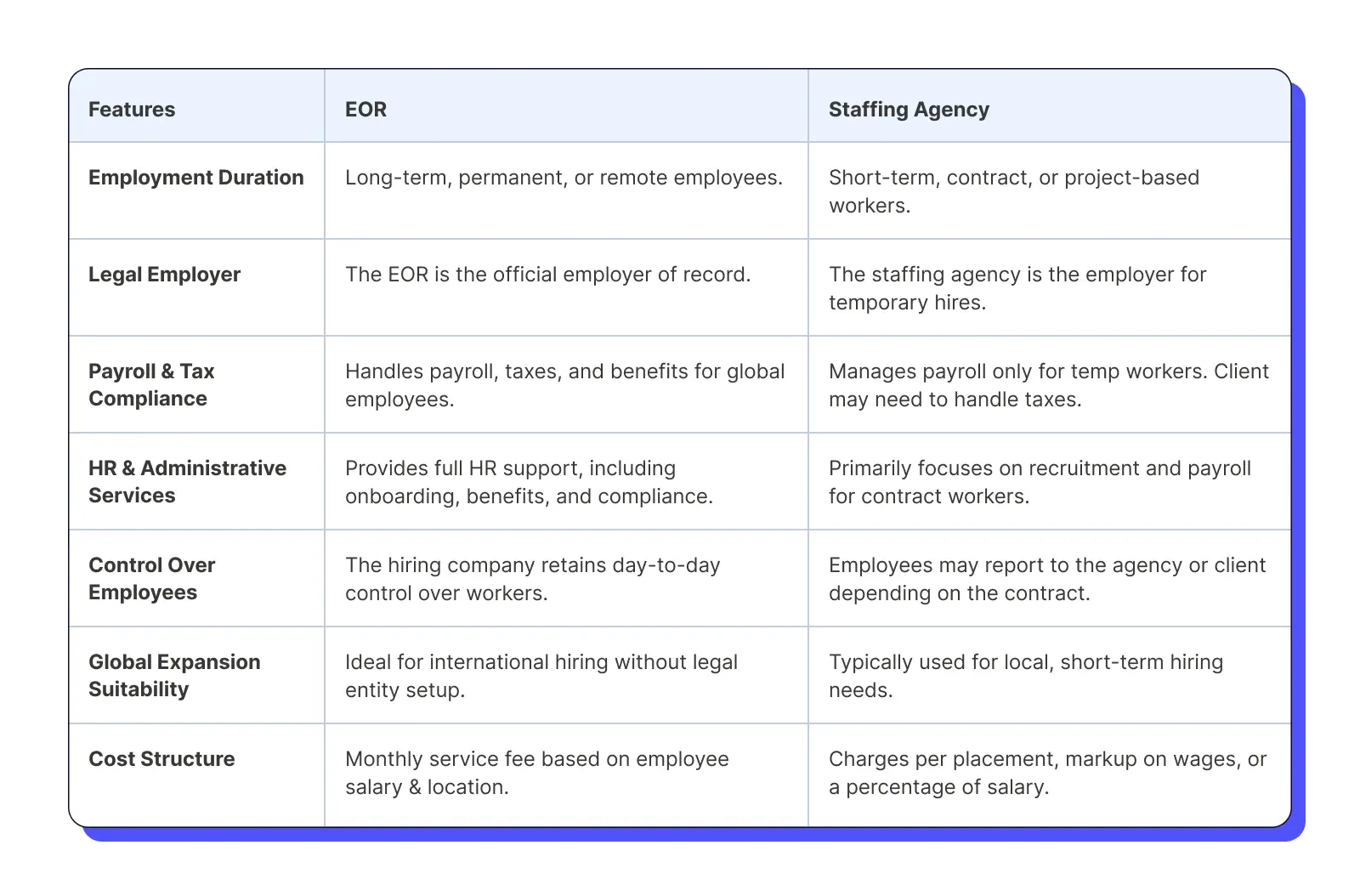

Before we dig deeper, here’s a breakdown of the key differences between these 2 services.

1. Employment duration: long-term vs. short-term needs

EOR is best if you’re looking for full-time, long-term employees, especially for international expansion or remote workforces.

On the other hand, a staffing agency is optimal for short-term employment, such as contract workers, temporary employees, and seasonal staff.

For example, if you’re a U.S.-based tech company expanding to Germany, you can use an EOR to legally employ software developers full-time without setting up a German entity.

In contrast, if your retail company hires extra cashiers for the holiday season, it would rely on a staffing agency for short-term workers.

2. Legal employer status & compliance responsibilities

EOR is the legal employer, taking full responsibility for employment contracts, payroll, tax filings, and labor law compliance.

Your company directs the employee's work but doesn’t handle legal employment obligations.

Staffing agencies typically act as employers for temporary hires, handling payroll and HR matters while leasing workers to client companies.

However, if your company directly hires permanent employees through the agency, it assumes legal employer responsibilities.

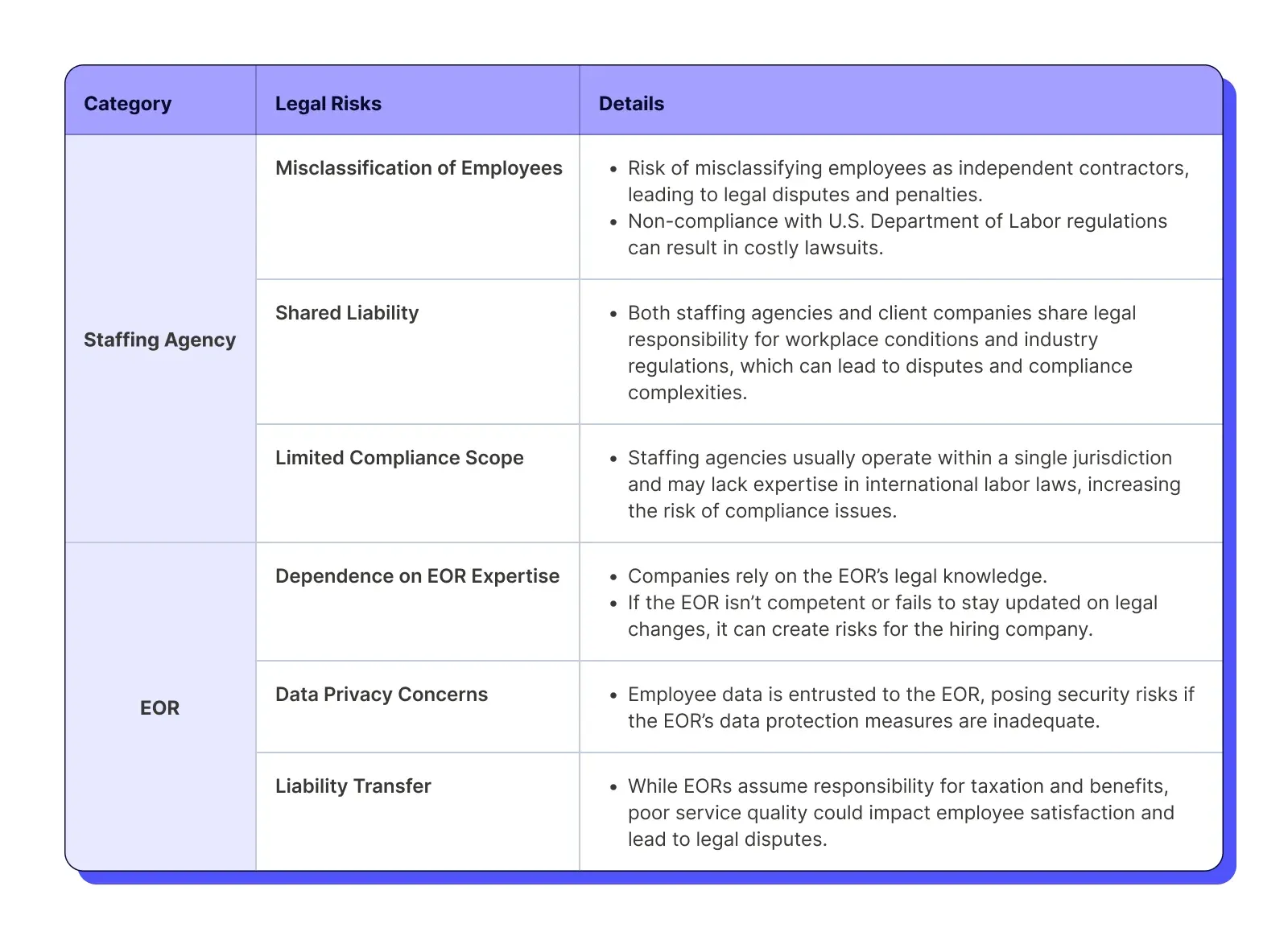

What are the legal risks when using a staffing agency and EOR?

The most significant difference regarding legal risk between these 2 services lies in compliance scope and liability management.

3. Payroll, benefits, and tax compliance

EOR manages the entire payroll process, including:

- Tax deductions,

- Health insurance,

- Pensions, and

- Statutory benefits in line with the local labour laws of the country where the employee is based.

Conversely, a staffing agency covers payroll and basic benefits only for temporary workers.

You can hire permanent employees directly, but you must manage benefits independently.

4. Control over employee management

While the EOR handles the administrative burdens, your company retains day-to-day control over the employees' work, tasks, projects, performance management, and overall direction.

Thus, you dictate the job responsibilities, set performance goals, and provide regular feedback.

However, decisions related to termination, compensation adjustments, and certain disciplinary actions often require close consultation and collaboration with the EOR to ensure legal compliance and minimise risk.

You essentially manage the what and how of the work, while the EOR manages the employment.

In contrast, a staffing agency typically provides workers on a temporary or contract basis.

Your company still has significant control over the employee's day-to-day tasks and performance, similar to the EOR model.

However, the staffing agency's role often extends to more involvement in recruitment and initial screening.

Furthermore, the staffing agency often retains more direct control over employee onboarding and certain HR functions.

The degree of control the staffing agency retains can vary depending on the specific agreement.

For example, some staffing agencies offer "temp-to-hire" arrangements, where you can hire the worker directly after a probationary period.

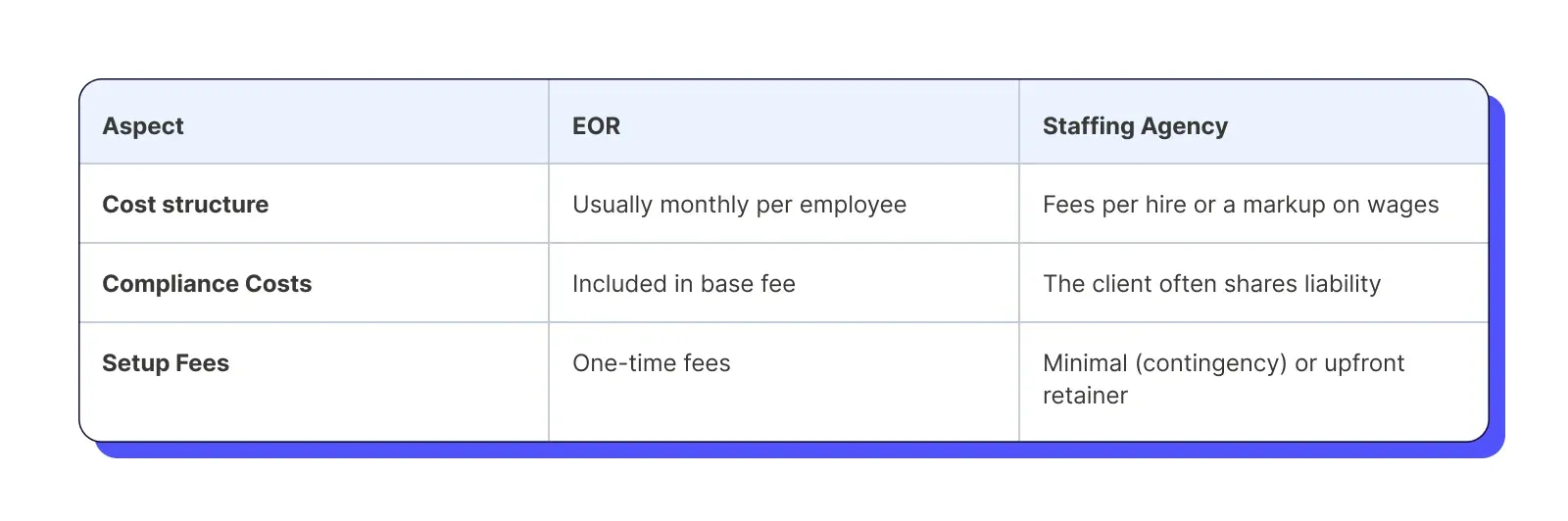

5. Cost structure

EOR typically charges a monthly fee per employee. Some providers offer volume discounts for larger teams.

Location, currency, and number of employees are usually the driving factors behind the price.

Staffing agencies charge fees per hire or a markup on wages. For temporary workers, agencies may charge a recurring fee based on the worker’s time on the job.

The number of hires, level and service type usually dictates the price.

EOR vs. a staffing agency: which one should you choose?

It’s important to remember that EOR and staffing agencies are complementary and not competitors.

The choice depends on business goals, legal risks, employment duration, and administrative complexity.

EOR can be a good option if:

- You need permanent employees or plan to expand internationally.

- Compliance with local labor laws is a priority.

- You want predictable costs for long-term growth.

On the other hand, staffing agencies may be your top choice if:

- You need temporary or seasonal workers.

- Flexibility and quick hiring are essential.

- You are managing short-term projects requiring specific skills.

However, there is a solution that bridges the gap between EOR and staffing agencies, allowing you to hire both contractors and full-time employees while enjoying full legal and administrative support.

Enter, Native Teams!

How can you streamline a hiring process with Native Teams?

Native Teams is an EOR and PEO solution that offers an all-in-one platform for navigating the complexities of global operations.

Instead of setting up a legal entity in multiple countries, you can hire employees under Native Teams’ local entities in over 85 countries.

Beyond our robust EOR services, we provide a comprehensive suite of tools to simplify:

- Global payments,

- Legal compliance,

- Recruitment, and other essential aspects.

In addition, our PEO services allow you to focus on your core business by sharing employment responsibilities.

Thus, you manage the employees' work while we handle administrative tasks like wage reporting and employment taxes.

So, what else is in store for you?

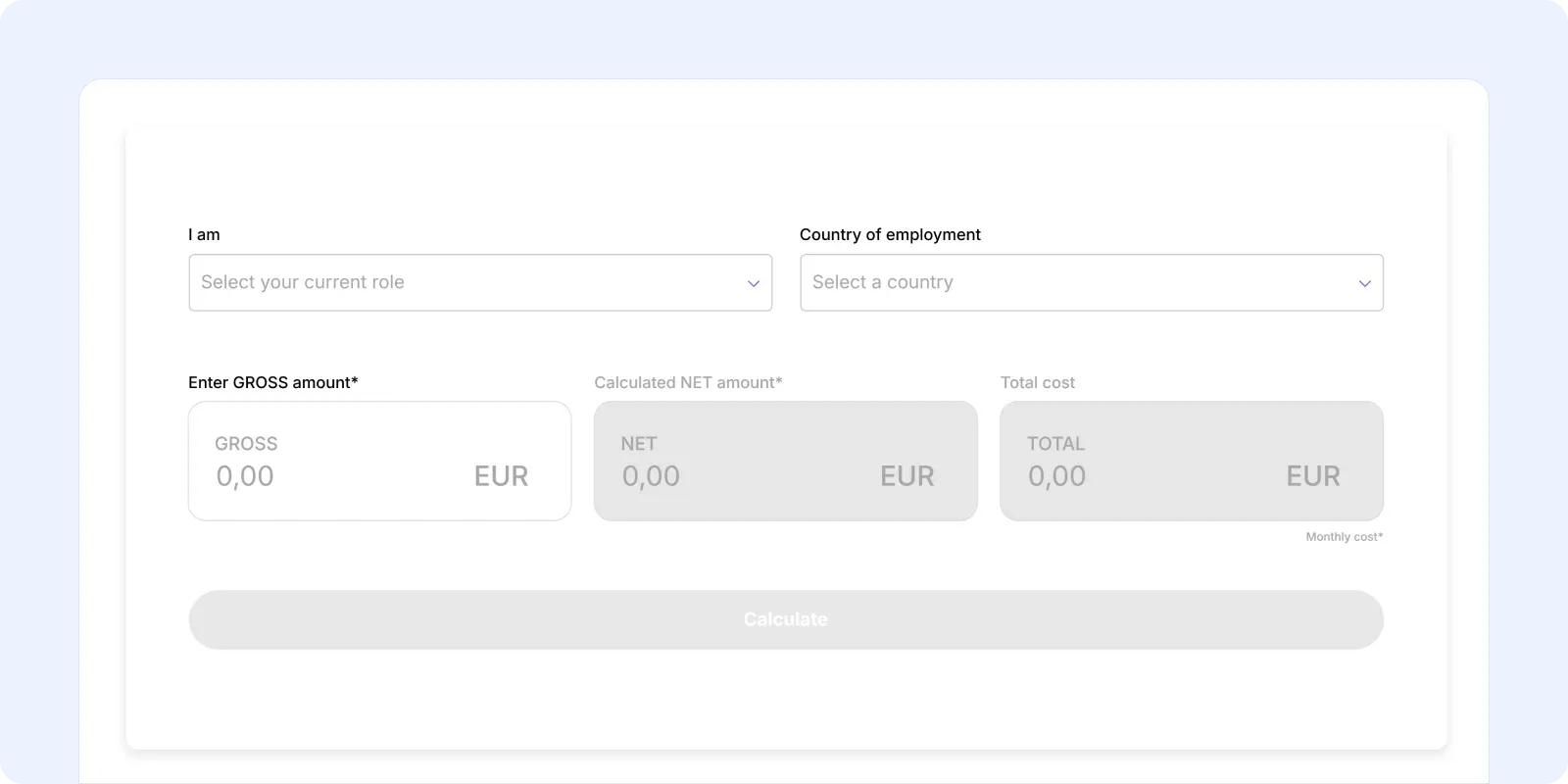

✅ Get full salary calculations and breakdowns in a few clicks, all in sync with local laws with our Payroll calculator.

✅ Leverage multi-currency payment options so your employees can receive their salaries in their local currency without unnecessary conversion fees.

✅ Determine your allowance eligibility and optimise your tax savings with our Tax Allowance tool.

✅ Create contracts for hiring full-time staff, part-time employees, or contractors with our easy-to-use templates that you can fully customise.

✅ Simplify benefits management and boost work satisfaction by choosing from various global employee benefits, including healthcare, insurance, pension, and other country-specific benefits.

✅ Track, manage and approve employee absences with our Absence management tool to check who is taking time off and when. Thus, you can determine fair vacation policies for your staff.

✅ Access visa and work permit assistance to relocate employees or hire foreign workers who require legal documentation.

And the list goes on.

Start with Native Teams today, or book a demo to get an end-to-end solution that covers everything from employment contracts to salary payments and tax filings.