11 Global Payroll Best Practices You Should Know In 2026

Managing payroll is complex enough within a single country, and when it extends across borders, the challenges multiply.

Global payroll requires more than just a good spreadsheet. It calls for a well-structured, adaptable strategy that balances local compliance with timely payments.

Read on to learn about 11 global payroll best practices to build a payroll system that supports international growth while minimising legal risks.

11 global payroll best practices you should consider

1. Ensure compliance with local laws and regulations

Each country has unique labor laws, tax codes, social security regulations, and payroll reporting requirements.

Even within the same region, compliance obligations can differ significantly.

If you fail to comply with local payroll laws, you risk penalties, audits, legal actions, and reputational damage.

Best practices:

1. Regularly monitor regulatory updates

- Subscribe to legal updates from government agencies and industry sources.

- Assign compliance officers or consultants to track changes in payroll regulations.

2. Engage local payroll experts

- Hire in-country payroll specialists or work with a global payroll provider with local expertise.

- Conduct periodic compliance training for HR and finance teams.

3. Automate compliance checks

- Use payroll software that updates in real time when tax laws or social security contributions change.

- Implement automated tax calculations to ensure accurate deductions and filings.

4. Prepare for audits and recordkeeping

- Maintain organised payroll records, including payslips, tax filings, and benefits documentation, for at least 5-7 years, depending on the country.

- Ensure payroll documents are stored securely and are accessible for compliance audits.

💡 Pro tip:

Without automated payroll software, you’ll most likely struggle with compliance due to frequent regulatory changes.

Native Teams is an EOR and PEO platform that offers solutions for global payments,

payroll, legal employment, and tax optimisation.

We collaborate with in-country tax consultants, legal experts, and accountants to ensure your payroll processes comply with local regulations.

This includes:

- Streamlined Payroll Processing — Ensure your employees receive accurate and timely payments while navigating local tax and labor regulations effortlessly.

- Tax Compliance Expertise — Minimise the risk of errors and penalties with accurate tax calculations and timely remittances, ensuring compliance with local requirements.

- Proactive Legal Employment Support — Protect your business with expert guidance on drafting compliant employment contracts and navigating the nuances of local labor laws.

- Ongoing Compliance Assurance — Stay ahead of the curve by continuously monitoring changing tax and labor laws, ensuring your employment practices remain fully compliant.

2. Standardise payroll processes across regions

A lack of standardisation in payroll processes can lead to inefficiencies, payroll errors, and compliance risks.

Standardising payroll ensures consistency while allowing for necessary local adaptations.

However, standardising comes with its own set of challenges, such as different payroll processing cycles, varied taxation and social security deductions per country, etc.

Thus, it’s important to define and implement the most optimal solutions that include:

1. Developing a global payroll strategy

- Define common payroll objectives across all regions.

- Establish a central payroll team that oversees global operations while allowing local flexibility.

2. Using a global payroll management system

- Implement a unified system that consolidates payroll data from multiple countries.

- Integrate payroll software with HR and finance tools for seamless data flow.

3. Define standardised payroll policies

- Set clear guidelines on salary structures, deductions, commission pay, overtime calculations, and bonuses.

- Ensure uniform payroll reporting formats across different subsidiaries.

4. Allow for local adaptation

- Enable country-specific payroll rules within the standardised framework.

- Work with local payroll teams to ensure compliance with unique regulations.

💡 Pro tip:

Native Teams’ platform integrates salary calculations, expenses, taxes, and benefits into a unified system, simplifying payroll management across multiple countries.

With legal entities in over 85 countries, we ensure your payroll is compliant and efficient across all markets.

Our automated payroll system allows you to pay your employees instantly, regardless of their location.

You just need to add employees to the platform while we handle everything else, from payroll processing to platform delivery.

3. Leverage payroll technology and automation

Manual payroll processing is prone to errors, delays, and compliance risks. Payroll automation reduces man-made mistakes, improving accuracy and efficiency.

Automation ensures that calculations are performed correctly, tax regulations are applied consistently, and payments are processed on time.

This reduces the risk of errors, minimises the potential for costly penalties, and frees up valuable time for payroll staff to focus on more strategic tasks.

Thus, you can:

- Invest in cloud-based payroll solutions with online SMS gateway functionality for secure two-factor authentication, along with real-time updates, remote access, and seamless integration with HR and finance systems. Also, ensure the software supports multi-currency payments and country-specific tax laws.

- Automate payroll calculations, such as tax deductions, overtime, and bonuses, to minimise errors.

- Integrate payroll with other business systems such as HR, accounting, and compliance software for better data flow and operational efficiency.

- Ensure scalability and use a payroll system that can grow with your company as you expand into new markets.

💡 Pro tip:

Native Teams' payroll solutions automate salary calculations, tax withholdings, and deductions, ensuring accurate and timely payments.

We provide fully compliant payroll services with taxes, social security, and other mandatory contributions covered, allowing you to:

- Send payroll invites and

- Manage the salaries of all your employees in one single dashboard.

- Manage your employees’ salaries, allowances, sick days, etc.

- Monitor, survey, and control all expenses in one place.

Furthermore, our Global Payroll Calculator helps you break down the expenses for hiring employees in different countries or calculate your gross and net earnings in your country of residence.

4. Manage currency exchange and payment methods efficiently

International payroll involves different currencies, exchange rate fluctuations, and banking regulations, which can lead to payment delays and financial losses.

To ensure smooth and accurate compensation for your international team, consider the following strategies:

1. Leverage multi-currency payroll platforms

Choose payroll software that handles a wide range of currencies beyond just the most common ones.

This will streamline your processes and reduce the need for manual conversions.

In addition, opt for a platform that automatically updates exchange rates using reputable sources, ideally with customisable update frequencies: hourly, daily, etc.

2. Offer Secure and Timely Payment Options

It’s a good idea to ensure employees receive payments through preferred methods, such as direct deposit, digital wallets, or international payroll providers.

3. Consider Payroll Cards for Remote Employees

Payroll cards can be a good alternative for employees in countries with limited banking infrastructure.

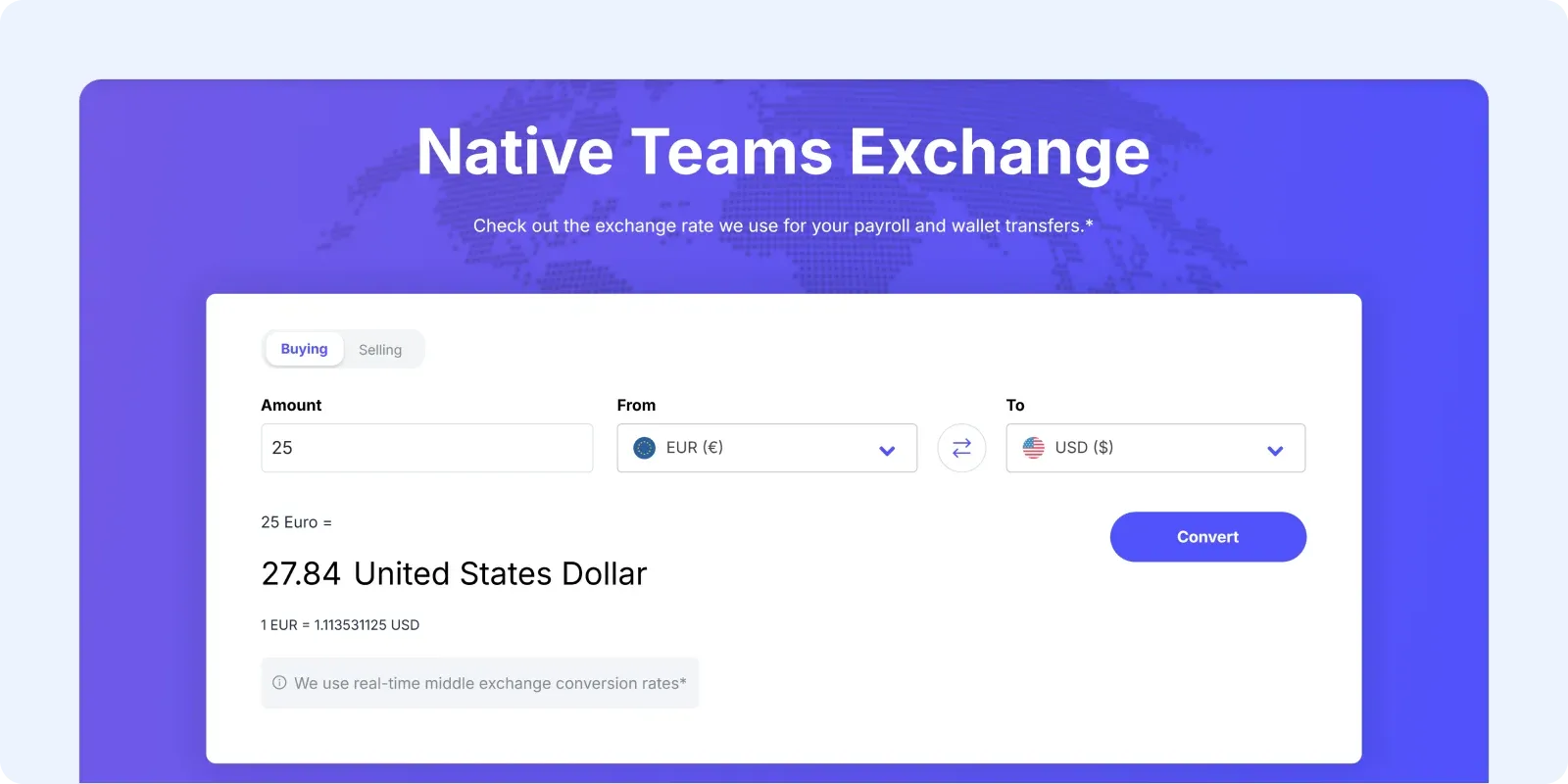

💡 Pro tip:

Native Teams supports various payment options, including direct bank transfers and digital wallets, ensuring employees receive their salaries using their preferred method.

Multi-Currency Virtual Wallet is one of our clients’ favourite tools. It allows you to easily add money to your wallet via a bank transfer, card, Payoneer, and other options.

Thus, you can withdraw, deposit, or transfer funds across various platforms, including local bank accounts, personal cards, and separate wallets.

It’s flexible, allowing you to integrate your preferred currency smoothly upon request, access various wallets in various currencies, and move funds between them.

As a result, you can receive funds in preferred currencies and sidestep the typical conversion fees.

On top of that, we provide physical cards linked to the digital wallet, allowing you to allocate funds, set spending limits, track transactions, and generate expense reports to streamline expense management..

5. Prioritise data security and confidentiality

Payroll data contains sensitive employee information, making it a prime target for cyber threats and fraud.

Protecting payroll data ensures compliance and builds employee trust.

Therefore, you’d want to:

- Ensure compliance with data privacy laws — Align payroll processes with regulations like GDPR in Europe and other local data protection laws.

- Use encryption and secure authentication — Encrypt payroll data and implement multi-factor authentication to prevent unauthorised access.

- Limit data access — Only allow relevant personnel access to payroll data, reducing the risk of internal fraud.

- Conduct regular security audits — Perform periodic security audits to identify and fix vulnerabilities in your payroll system.

💡 Pro tip:

Here at Native Teams, we take security seriously and safeguard your personal, financial, and employment data through a secure, compliant platform.

All sensitive data stored on our servers is encrypted to ensure only authorised personnel have access.

We provide:

- Secure Infrastructure — Our platform is hosted on Amazon Web Services (AWS), a globally trusted cloud provider that invests heavily in security and compliance tools.

- Daily Backups — We run daily backups of our infrastructure and applications to ensure data integrity.

- KYC & AML Compliance — We conduct Know Your Customer (KYC) checks and adhere to Anti-Money Laundering (AML) policies to verify user identities and comply with international financial regulations.

- Strong Customer Authentication (SCA) — We use SCA protocols to ensure only authorised individuals can log in or approve financial transactions, adding extra protection to online banking activities.

- Two-factor Authentication (2FA) — All user accounts require 2FA, adding a secondary login confirmation step via SMS or email.

- SSL/HTTPS Encryption — All communications across our network are encrypted using SSL/HTTPS to ensure secure online interactions.

6. Optimise employee experience

A smooth payroll experience is more than ensuring employees receive their paychecks on time. It's a key element in building employee trust and overall job satisfaction.

The administrative burden associated with correcting payroll errors, answering employee inquiries about discrepancies, and managing the fallout from late or inaccurate payments can be significant.

How to minimise it or prevent it?

- Provide clear payroll communication — Ensure employees understand salary breakdowns, tax deductions, and benefits in their local language.

- Offer self-service portals — Give employees access to payslips, tax documents, and payroll-related inquiries through an online portal or mobile app.

- Ensure timely and accurate payments — Avoid delays by setting up automated payments and maintaining a payroll calendar.

- Resolve payroll issues promptly — Establish a dedicated payroll support team to handle employee concerns quickly and efficiently.

💡 Pro tip:

Transparency is crucial in payroll processing, and payslips contribute to it.

We provide detailed payslips that break down earnings, deductions, and taxes, ensuring employees clearly understand their payments.

These records are securely stored and easily accessible, complying with local payslip distribution and documentation regulations.

Once you maintain organised payroll records, you can easily track payments and meet audit requirements without unnecessary complications.

7. Establish a centralised payroll governance model

Managing payroll across multiple countries without a centralised governance structure can lead to inconsistencies, a lack of transparency, and inefficiencies.

It should standardise payroll processes, controls, policies, and reporting across all countries or regions where you operate.

Therefore, it ensures that your payroll operations worldwide follow the same rules and standards.

To establish the model, you need to:

- Define clear policies for payroll execution, compliance, and reporting across all locations.

- Assign responsibilities to regional payroll managers while maintaining central oversight.

- Use unified payroll reporting templates for all subsidiaries.

- Standardise compliance tracking and performance metrics.

- Ensure payroll teams work closely with HR, finance, and legal departments for consistency.

💡 Pro tip:

A centralised payroll governance model should go hand-in-hand with a global payroll provider.

The former model sets the rules while the latter executes them, especially across complex or unfamiliar markets.

Implementing both enables you to maintain control internally while leveraging the local expertise and operational efficiency of a 3rd-party provider.

For example, leveraging Native Teams solutions and tools will provide global payroll expertise and compliance while maintaining control over your internal HR data flows.

8. Optimise tax and social security contributions for cost efficiency

Global payroll involves managing complex tax structures, social security obligations, and employee benefits.

Failing to optimise tax payments can result in overpayments, compliance risks, and unnecessary financial burdens.

What are some of the ways to optimise taxes?

- Identify countries with tax treaties that offer tax exemptions or deductions for expatriates.

- Ensure compliance with both home and host country tax laws.

- Use tax-efficient benefits such as stock options, allowances, and performance bonuses.

- Consider tax-free employee benefits like meal vouchers, transportation subsidies, or educational reimbursements.

- Regularly audit payroll tax filings to identify potential savings.

💡 Pro tip:

Native Teams ensure full compliance with local regulations by working with in-house teams of tax consultants, legal experts, and dedicated accountants in every country where you want to employ team members.

We understand that managing labour and tax laws is complex, so our platform makes it simple for you:

- We ensure the correct taxes and contributions (such as income tax and social security) are calculated accurately and paid to the right authorities on time.

- We keep up with changes in tax and labour laws to ensure that your employment management processes remain compliant at all times.

Not only does our platform provide tax support, but it also offers tools to:

- Get non-taxable allowances,

- Optimise your taxes and other features to save money on taxes in compliance with laws.

For example, employees can request payments for remote work allowances, bonuses, commute costs, and similar expenses that are exempt from taxes in some instances.

Our Tax Allowance tool helps you determine your eligibility for tax-free allowances to ensure compliance with local regulations while benefiting from potential tax reductions.

9. Improve payroll visibility with real-time analytics

Unfortunately, there is often a lack of integration between payroll and financial systems with limited visibility into payroll data across different subsidiaries.

Consequently, that creates difficulty in tracking payroll trends and compliance risks.

So, you need to use a payroll solution that provides real-time analytics on salaries, tax payments, and benefits costs.

Also, the solution should:

- Monitor KPIs such as payroll processing time, error rates, and compliance trends.

- Analyse payroll data to forecast labor costs and optimise budget allocation.

- Identify patterns in payroll errors and compliance risks before they escalate.

- Automate payroll cost reporting for finance teams.

💡 Pro tip:

Native Teams provides detailed reports and insights into employee, country, and role salary costs, aiding in budget optimisation.

10. Conduct Regular Payroll Audits to Identify Risks

Payroll errors, such as miscalculations, incorrect tax withholdings, and late payments, can lead to financial losses, compliance fines, and employee dissatisfaction.

Regular payroll audits help you identify and fix issues before they escalate.

Therefore, you can:

- Conduct internal audits to review payroll accuracy, compliance, and reporting standards.

- Engage external auditors to verify payroll processes.

- Verify employee classifications, full-time vs. contractors, to avoid misclassification penalties.

- Ensure accurate tax withholdings and social security contributions.

- Check for duplicate or unauthorised payroll transactions.

- Automate payroll audit reports and use payroll software that flags discrepancies in salary payments, tax filings, and benefits deductions.

- Set up automated alerts for payroll compliance violations.

💡 Pro tip

Native Teams can help you avoid misclassification penalties with versatile employment contacts:

- Full-time contract

- Part-time contract

- Contractor agreement, and

- Contractor agreement PRO.

Our country-specific contract templates allow you to create fully tailored, comprehensive, and legally compliant contracts.

11. Partner with a global payroll provider

Instead of working with multiple local vendors or managing fragmented processes, a global provider offers:

- One platform for all payroll operations

- Unified reporting and dashboards

- Standardised processes across countries.

When choosing a global payroll provider, consider the following criteria:

- Choose providers with proven experience in handling multi-country payrolls.

- Opt for providers that offer EOR services so you can onboard employees legally without setting up local entities.

- Check if the payroll provider's system integrates seamlessly with your HR and finance software.

- Check data and security practices.

- Monitor performance regularly.

Why should you opt for Native Teams?

Native Teams combines EOR and PEO services and provides end-to-end solutions to manage and streamline your international hiring, payment, and payroll processes.

Our robust solutions help you:

✅ Avoid penalties and legal issues by staying fully compliant in every location.

✅ Greater visibility, control, and consistency across your entire workforce.

✅ Faster international market entry with reduced administrative effort.

✅ Enhanced payroll accuracy to avoid fines or employee dissatisfaction.

✅ Reduce operational overhead while improving efficiency.

Curious to explore more?

Start with Native Teams today, or book a demo to grow across borders without reinventing your payroll process each time.