How to Use EOR in Germany? A Complete Guide

Establishing a business presence in a new country is a major step, and when it comes to Germany, the legal and administrative requirements around employment can quickly become overwhelming.

From navigating local labour laws to setting up a compliant payroll system, the process is complex, time-consuming, and costly.

But there’s a more efficient way. Using an Employer of Record in Germany: a shortcut to compliant and efficient hiring.

Read on to learn more about how EOR services work, so you can hire employees in Germany quickly and legally, without setting up your own entity.

Why should you use an Employer of Record in Germany?

Partnering with an EOR isn’t only a smart, strategic move, but also the move that helps you avoid steep penalties. The main benefits of using an EOR include:

- Faster market entry: Avoid the lengthy and costly process of setting up a German legal entity.

- Full legal compliance: EORs ensure adherence to German labour, tax, and social security laws.

- Reduced administrative burden: The EOR manages payroll, contracts, onboarding, and statutory filings.

- Risk mitigation: EORs assume compliance liability, reducing your exposure to audits, fines, and misclassification risks.

Before we start: 5 key things you must know about German Law and legal requirements

You must follow the labour rules outlined below to ensure the hiring process is fully aligned with German legal requirements.

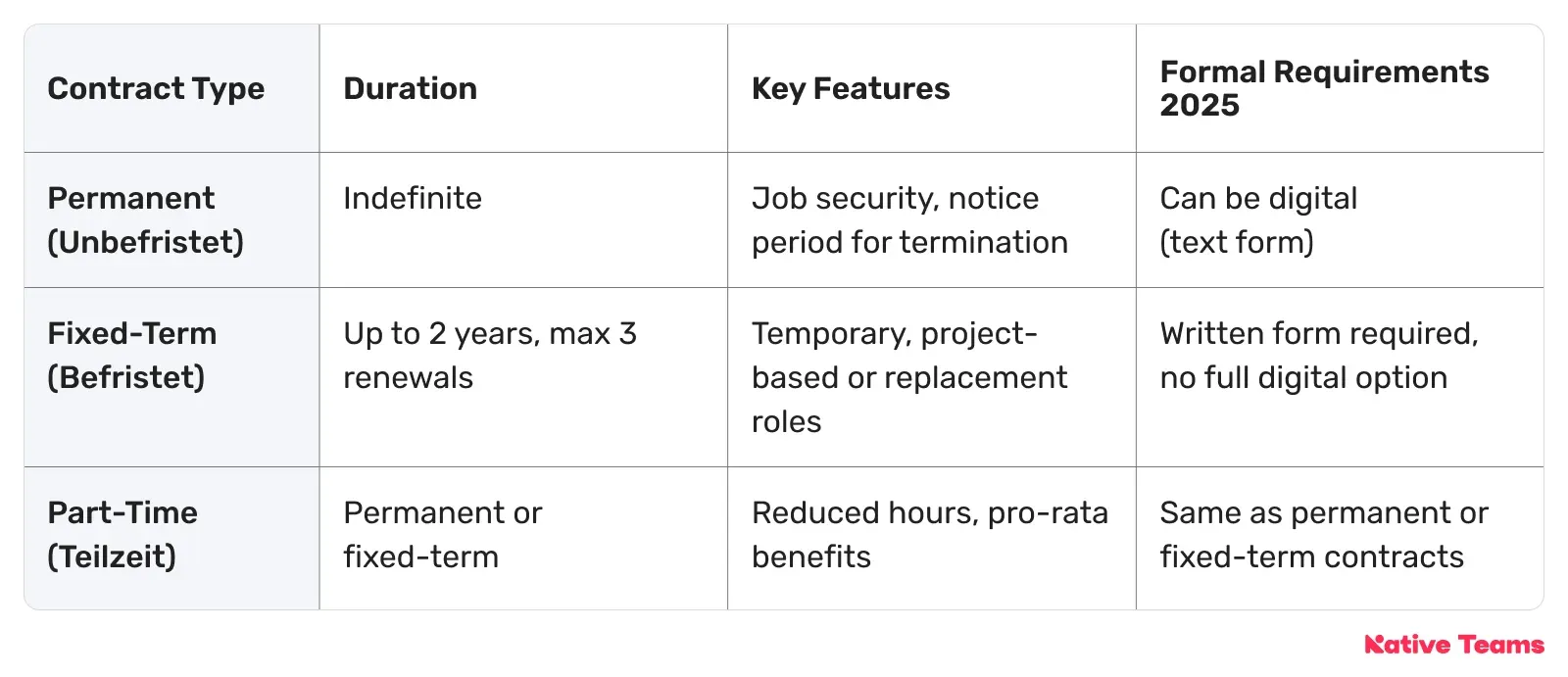

Types of employment contracts in Germany

Types of employment contracts in Germany are governed by strict labour laws that protect both employers and employees.

1. Permanent contracts (Unbefristeter Arbeitsvertrag)

- The most common and standard form of employment in Germany.

- No fixed end date. The contract remains in effect indefinitely until terminated by either party.

- Termination requires a notice period, typically 4 weeks, and the employer must justify it after the probation period.

- Cover full-time or part-time employment.

As of January 2025, you can document contractual conditions digitally via email, streamlining administrative processes.

2. Fixed-term contracts (Befristeter Arbeitsvertrag)

These are contracts with a defined end date or duration, typical for project work, seasonal jobs, or to replace employees who are temporarily absent.

- Legally, fixed-term contracts must be justified by either objective reasons or mutual agreement.

- The maximum duration is generally 2 years, with up to three renewals or extensions allowed within this period.

- Fixed-term contracts end automatically without requiring notice.

- Written form remains mandatory for fixed-term contracts.

3. Part-time contracts (Teilzeitarbeitsvertrag)

- Part-time contracts specify reduced working hours compared to full-time employment.

- Part-time employees enjoy the same rights and benefits as full-time employees on a pro rata basis.

- Contracts can be either permanent or fixed-term, and they must comply with the same documentation and legal requirements as other types of contracts.

Key legal and formal requirements

Under the German Verification Act (Nachweisgesetz), employers must provide written documentation of essential employment terms, which include:

- Employer and employee details,

- Job description,

- Remuneration,

- Working hours,

- Leave entitlement,

- Notice periods, and

- Applicable collective agreements.

According to the same source, as of January 1, 2025, the Fourth Bureaucracy Reduction Act (BEG IV) permits permanent contracts and changes to be documented in an electronic form.

As a result, it reduces the need for handwritten signatures.

However, don’t forget that fixed-term contracts still require a written form.

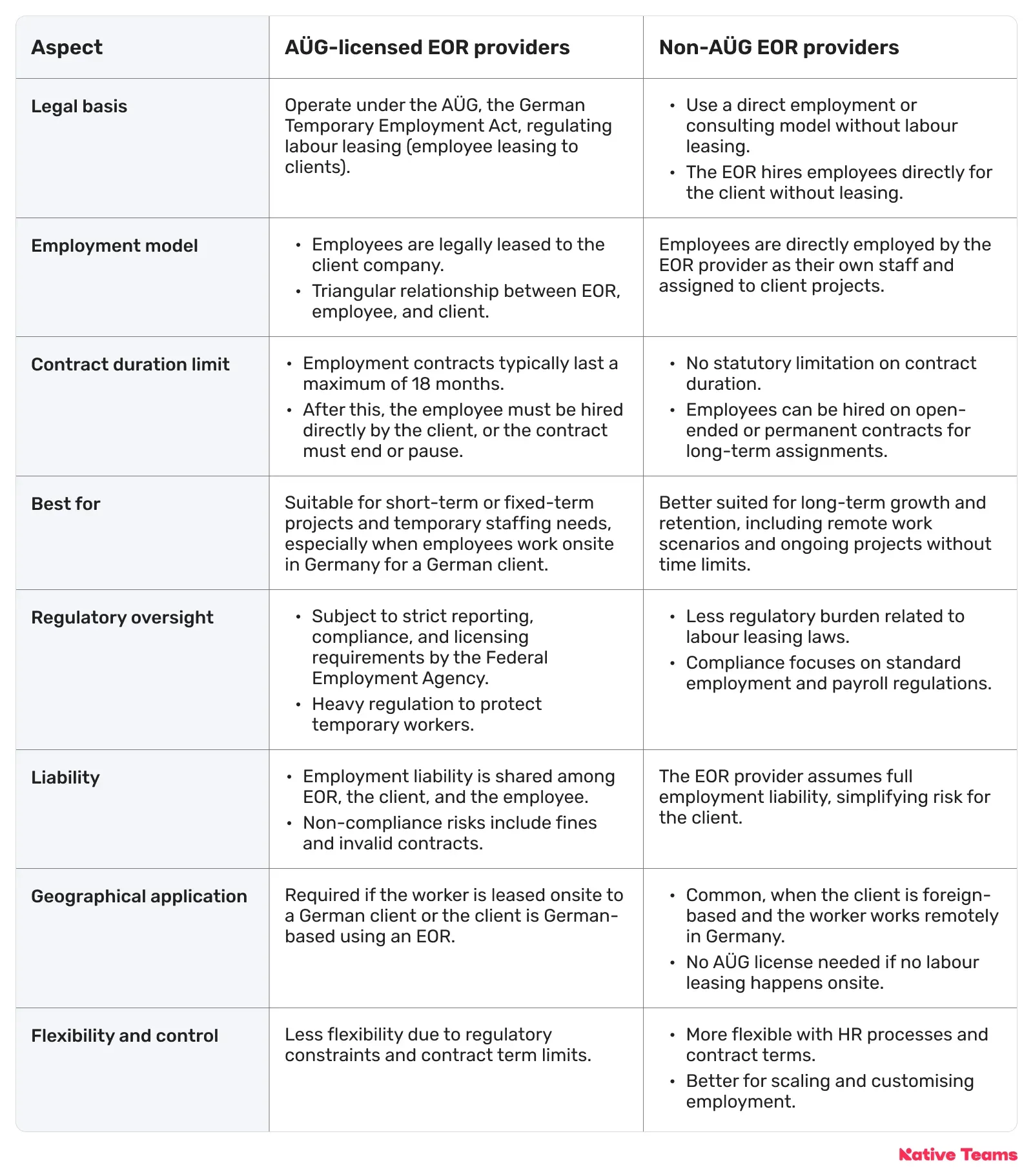

What are AÜG-licensed and non-AÜG EOR providers (and how do they differ)?

AÜG-licensed EORs function as labour leasing agencies under Germany’s Temporary Employment Act (AÜG).

This model requires a maximum contract duration of 18 months and comes with strict compliance requirements.

It’s best suited for short-term or temporary staffing needs, particularly when employees are working onsite for German clients.

On the other hand, non-AÜG EORs use a direct employment or consulting approach, hiring talent as part of their own staff without leasing them out.

This structure enables open-ended contracts with no time restrictions, making it ideal for long-term remote or on-site roles, especially for international companies that want to hire in Germany without establishing a local entity.

The key differences between AÜG-licensed and non-AÜG EOR providers in Germany revolve around:

- The legal framework,

- Employment duration,

- Liability, and

- Operational flexibility.

What the 18-month labour leasing limit means for long-term hiring in Germany

Understanding this rule is essential for long-term workforce planning. Here are the main things you need to know about its impact.

1. The 18-month maximum leasing period

German labour law restricts the duration of employee leasing under the AÜG.

Thus, an employee provided to your company via a labour leasing or AÜG-licensed EOR arrangement can’t work at the same company for more than 18 consecutive months.

After this period, the leasing agreement must end unless your company directly hires the employee to continue the working relationship legally.

2. Implications for long-term hiring

The 18-month cap reinforces that leasing shouldn’t be used for permanent staffing. It’s intended for temporary or project-based roles, not long-term workforce planning.

If you wish to retain leased employees beyond 18 months, you must either hire them directly or rotate them out of the role to remain compliant.

After the leasing term ends, there’s typically a mandatory 3-month waiting period before the same employee can be reassigned to the same client through leasing.

3. Compliance and workforce strategy

Both you and EOR should monitor leasing durations to avoid illegal extensions.

Violations can result in substantial fines and even criminal liability in severe cases.

As the 18-month limit approaches, you must prepare to rotate workers or transition them to direct employment.

4. Impact on business models and hiring decisions

The rule favours using labour leasing for short-term projects, peak demand, or trial roles, rather than core, ongoing positions.

For long-term hiring needs in Germany, consider establishing a local legal entity or working with non-AÜG EORs that aren't bound by labour leasing restrictions.

Improper use of leased employees beyond the legal limits can unintentionally create a permanent establishment under German tax law, resulting in additional tax liabilities and compliance risks for foreign employers.

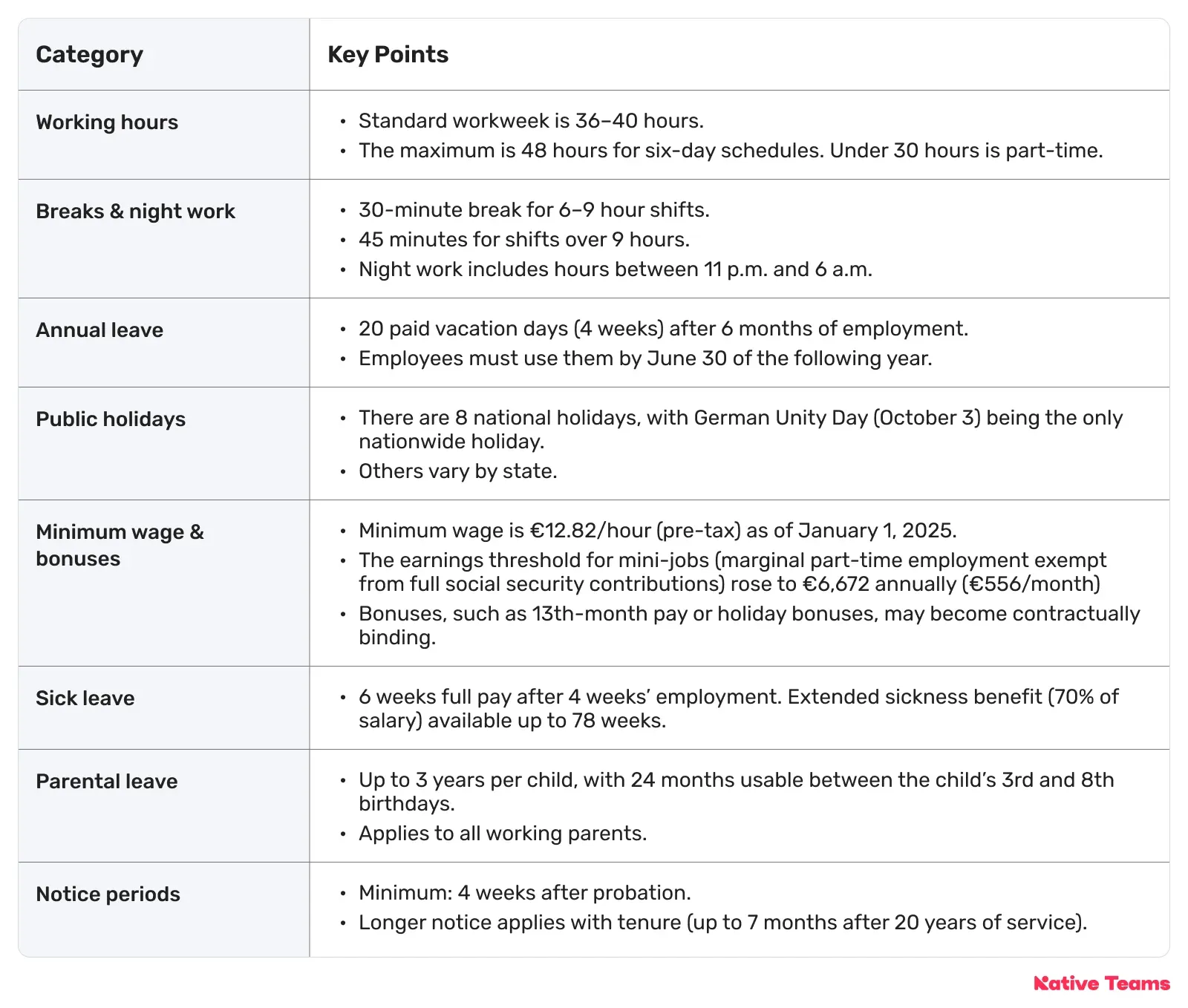

Employment conditions in Germany: What you must know

Below, you’ll find the key legal and compliance points for employment in Germany to ensure lawful hiring, contract management, and employee relations.

For a more detailed view, jump to our hiring guide, What should I know about hiring in Germany?

Step-by-step guide: How to use an Employment of Record in Germany?

1. Choose a Compliant EOR Provider

Select an EOR with a fully-owned German entity for direct registration with tax and social authorities.

Verify the provider’s compliance, reputation, and transparent pricing structure.

2. Candidate selection

You either source and select the employee yourself or use the EOR’s recruitment services.

Also, you maintain full control over who you want to hire and manage their daily work and performance.

3. Employment contract creation

EORs draft a locally compliant employment contract that covers salary, benefits, working hours, leave, and termination terms.

Contracts must be issued within one month of the start of employment and comply with German labour law.

4. Onboarding and registration

The EOR handles employee registration with local authorities, as well as social security and health insurance.

It manages payroll setup, background checks, and account creation.

5. Payroll, taxes, and social contributions

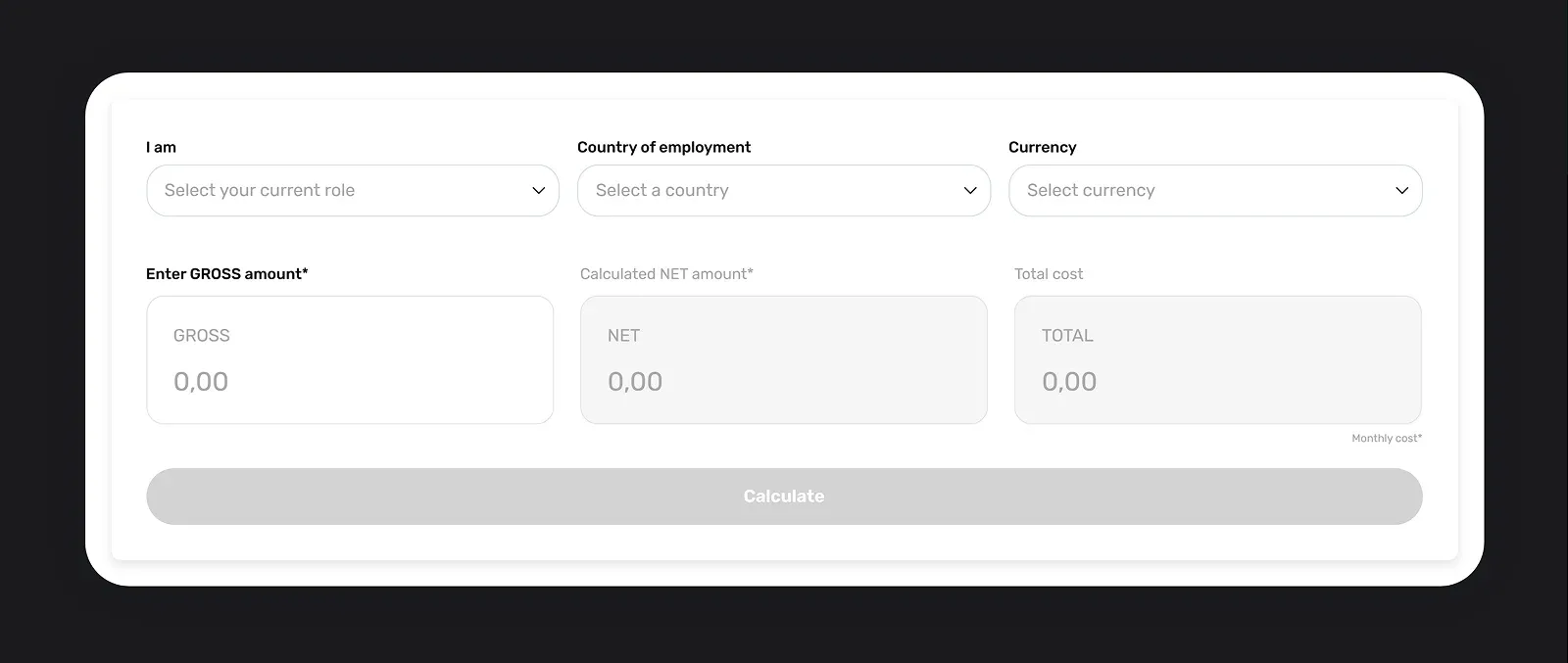

EORs calculate gross-to-net pay, withhold income tax, and submit employer and employee contributions for:

- Health insurance,

- Pension,

- Unemployment, and

- Long-term care, totalling approximately 20–22% of gross wages.

6. Ongoing compliance and HR support

The EOR manages statutory benefits, tracks leave, communicates with the works council, and ensures GDPR-compliant data processing.

The EOR handles regular updates on labour law changes and payroll tax rates.

7. Offboarding and termination

EORs ensure legal compliance with notice periods, documentation, etc.

German law requires valid grounds for dismissal and strict adherence to the Termination Protection Act after 6 months of employment.

Why choose Native Teams as your Employer of Record in Germany?

Native Teams provides EOR and PEO services in over 85 countries, enabling you to hire, pay, and manage your global team in their preferred currency while providing detailed salary and tax breakdowns upfront.

We have legal entities in all countries where we operate, including Germany, so you can hire and onboard talent while staying compliant with German labour laws.

How else can we help you hire in Germany?

✨Our platform automates HR tasks, including payroll processing, tax deductions, social security contributions, and essential document management.

You get easy access to all employee documents and payroll data through a centralised dashboard, simplifying administrative overhead.

✨ We provide country-specific contracts tailored to your needs, always aligned with local laws.

✨ You can offer comprehensive healthcare, lifestyle, pension, and more benefits to attract top talent.

✨We offer global mobility services to make the relocation process smooth.

✨ Our team provides personalised support, from onboarding to offboarding.

By partnering with Native Teams, you can hire and onboard employees in Germany within days, bypassing the time-consuming and costly process of establishing your own legal entity.

Ready to discover more?

Book a free demo today to see how our solutions can help you focus on your core business and growth without worrying about administration and legal obligations.