How Are Bonuses Taxed in the USA?: What You Need to Know

You want to reward your team for their hard work with well-deserved bonuses.

But when it’s time to process those payments, one question pops up: how are these bonuses taxed?

If you get it right, you will avoid payroll errors, compliance issues, or frustrated employees who see less in their checks than expected.

Read on to see how bonuses are taxed in the USA, according to the latest IRS guidelines, so that you can handle bonus payouts without surprises.

First things first: What’s supplemental income?

Supplemental income is any extra cash you pay employees on top of their regular paycheck.

You must report the supplemental income on the employee’s Form W-2 (Box 1) along with regular wages.

You can think of it as the “above and beyond” category, which often includes:

- Bonuses,

- Commissions,

- Overtime pay,

- Awards,

- Prizes,

- Back pay,

- Retroactive raises,

- Severance packages,

- Payouts for unused vacation or sick leave, and even

- Certain reimbursements.

The IRS puts all of these under the umbrella of supplemental wages and taxes them differently compared to regular earnings. Let’s see how.

Understanding federal tax withholding: What employers need to know

When you pay your employees, you're required to withhold federal taxes from their paychecks and send that money directly to the IRS. Think of it as paying their annual tax bill in installments throughout the year, rather than waiting until tax season.

How does it work?

- Each paycheck includes an estimate of the employee’s tax liability based on their Form W-4, filing status, income level, and the IRS tax tables.

- These withholdings are credits toward the employee’s annual tax bill. When the employee files their tax return, the amount withheld is subtracted from what they owe.

- If too much was withheld, they get a refund. If too little was withheld, they may owe more.

For bonuses and other supplemental wages, the IRS has special withholding rules:

The flat 22% rate or the aggregate method, which often makes bonus paychecks look heavily taxed upfront.

Percentage (Flat-Rate) vs. aggregate model: How do they differ?

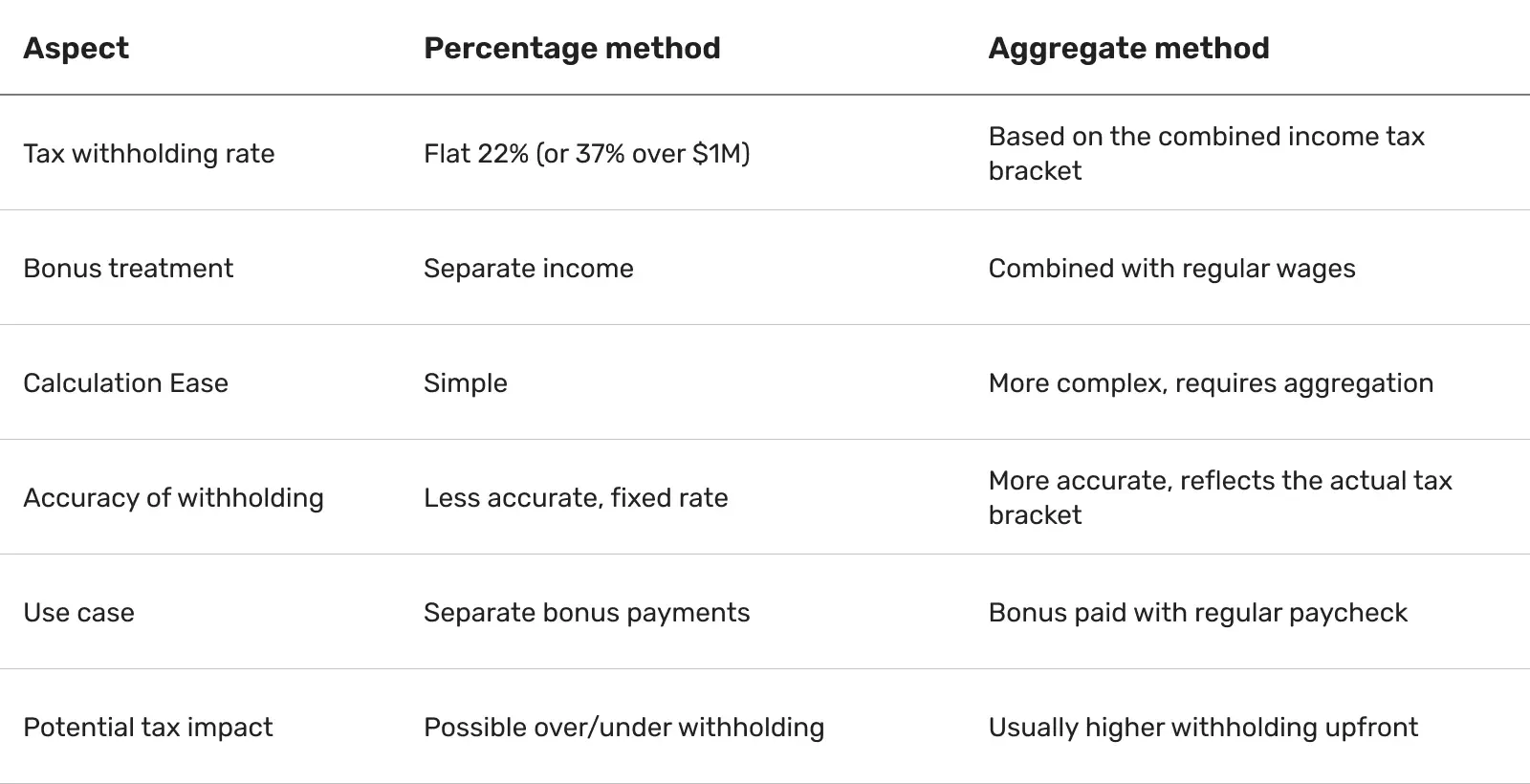

When it comes to withholding taxes on bonuses, the IRS gives employers two main options.

Choosing the right one can make a big difference in how much comes out of your employees’ paychecks.

1. Flat withholding rate (Percentage method)

This method is simple: the IRS requires a flat 22% federal tax on most supplemental wages, such as bonuses up to $1 million.

Any amount above $1 million is taxed at 37%.

This flat rate applies regardless of the taxpayer’s regular income tax bracket.

It’s straightforward to apply, which is why many employers prefer it.

However, it can result in over- or under-withholding compared to the employee’s actual tax rate, potentially leading to a tax refund or additional tax due when filing.

How the flat-rate method works

Suppose an employee is receiving a $10,000 bonus.

Using the flat-rate method, the IRS requires you to withhold a fixed 22% federal tax on the bonus, no matter the employee’s regular paycheck or tax bracket.

So, the bonus is $10,000, and based on the fixed rate, the federal withholding would be $10,000 x 22% = $2,200.

2. Aggregate method (Optional for employers)

With the aggregate method, the bonus is combined with the employee’s regular paycheck, and withholding is calculated as if it were a single payment.

It’s more complex to calculate because you must determine the tax on combined income and subtract the tax already withheld on regular wages.

Also, it often results in higher withholding because the bonus plus regular pay can push income temporarily into a higher tax bracket.

How the aggregate method works

Let’s say an employee normally earns $6,000 in a paycheck, and you’re giving them a $10,000 bonus. Using the aggregate method, the IRS treats the total $16,000 as one big paycheck.

To figure out withholding, the IRS calculates it at an annual level: $16,000 x 12 months = $192,000 annualized income.

At that level, the employee falls into a higher tax bracket (24%).

Consequently, more money is withheld upfront compared to the flat 22% rate you’d use if you taxed the bonus separately.

Beyond federal withholdings: What other taxes affect bonuses?

When you issue a bonus, it's not just federal income tax that comes into play. Several other taxes can affect the total amount withheld from your employees' bonus payments.

1. Social Security taxes

The Social Security tax of 6.2% applies to wages up to $176,100.

For example, an employee earning $170,000 annually who receives a $10,000 bonus will only have Social Security tax withheld on $6,100 of the bonus, as the total earnings reach the $176,100 cap.

2. Medicare taxes

Medicare tax of 1.45% applies to all wages, plus an additional 0.9% for wages above $200,000 (single filers) or $250,000 (joint filers).

There is no wage base limit, and all earnings are subject to Medicare tax.

So, if an employee earns $195,000 annually and receives a $10,000 bonus, they will have $145 in Medicare tax withheld on the entire bonus.

State and Local Taxes:

3. State and local taxes

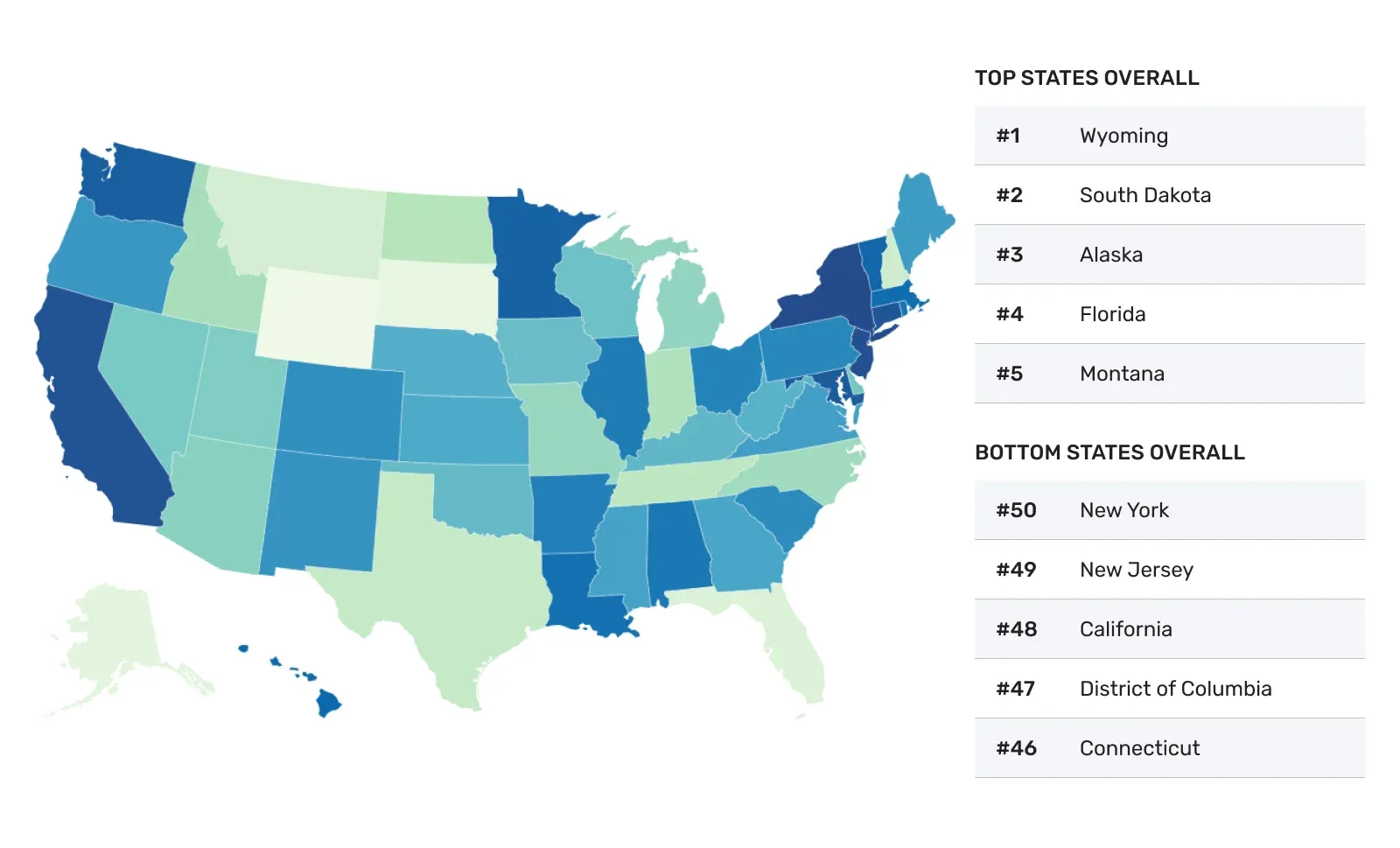

In addition to federal taxes, bonuses are subject to state and local taxes, which vary depending on where the employee works.

State and local tax rates vary widely, with some states having flat income tax rates, while others have progressive systems.

Although it doesn’t address only bonus taxes, the State Tax Competitiveness Index evaluates each state across more than 150 factors in five key tax categories:

- Corporate taxes,

- Individual income taxes,

- Sales and excise taxes,

- Property and wealth taxes, and

- Unemployment insurance taxes.

These scores are then combined to produce an overall ranking of how competitive each state’s tax system is.

For example, an employee in California will face a higher state tax rate on their bonus compared to an employee in Texas.

4. Federal Unemployment Tax Act (FUTA)

The Federal Unemployment Tax Act (FUTA) is a federal payroll tax paid by employers to fund unemployment benefits for workers who lose their jobs.

Any supplemental income, such as bonuses paid to employees, counts as wages for FUTA tax purposes.

Employers must include bonuses when calculating FUTA taxes owed.

The FUTA tax rate is 6.0% on the first $7,000 of taxable wages per employee annually.

Most employers receive a credit for state unemployment taxes paid, reducing the effective FUTA rate to 0.6%.

If an employee has already earned $6,500 in regular wages, a $10,000 bonus will be subject to FUTA tax on the remaining $500.

Employers paying state unemployment taxes on wages (including bonuses) generally get a credit reducing FUTA tax liability.

💡 FUTA is an employer-paid tax only. Employers don’t withhold FUTA from employees' paychecks. Employers pay it directly to the IRS instead.

How to reduce tax impact: 6 smart strategies

Issuing bonuses is a great way to reward your team, but it comes with tax implications that can affect both your business and your employees.

With some planning, you can minimise the tax bite and make bonus payments more efficient.

1. Offer deferred compensation plans

Deferred compensation programs let employees postpone receiving bonuses to a future tax year.

As a result, it can reduce immediate payroll tax burdens for you and help employees spread out their tax liabilities, potentially saving both sides money.

It’s also a great way to retain top talent with future incentives.

2. Incorporate non-cash bonus alternatives

Cash isn’t the only option. You may consider:

- Stock options

- Equity grants

- Other non-cash perks

These can be taxed more favourably (often at capital gains rates) and can help reduce cash outflows and payroll tax exposure while still rewarding employees.

3. Encourage contributions to tax-advantaged accounts

Help your employees maximise contributions to 401(k)s, HSAs, or similar accounts using their bonuses.

It reduces taxable wages, which in turn lowers payroll tax obligations for you and decreases the employee’s taxable income.

4. Time bonus payments strategically

The timing of bonuses is another important aspect. For example, deferring a year-end bonus to the early part of the next tax year can smooth payroll tax liabilities.

This can prevent employees from being temporarily pushed into a higher withholding bracket, making the bonus feel more substantial.

5. Review and adjust payroll reporting

Make sure your payroll system:

Correctly classifies bonuses as supplemental wages

Calculates FUTA and state unemployment taxes properly

Doing so helps avoid penalties or interest and ensures compliance with federal and state rules.

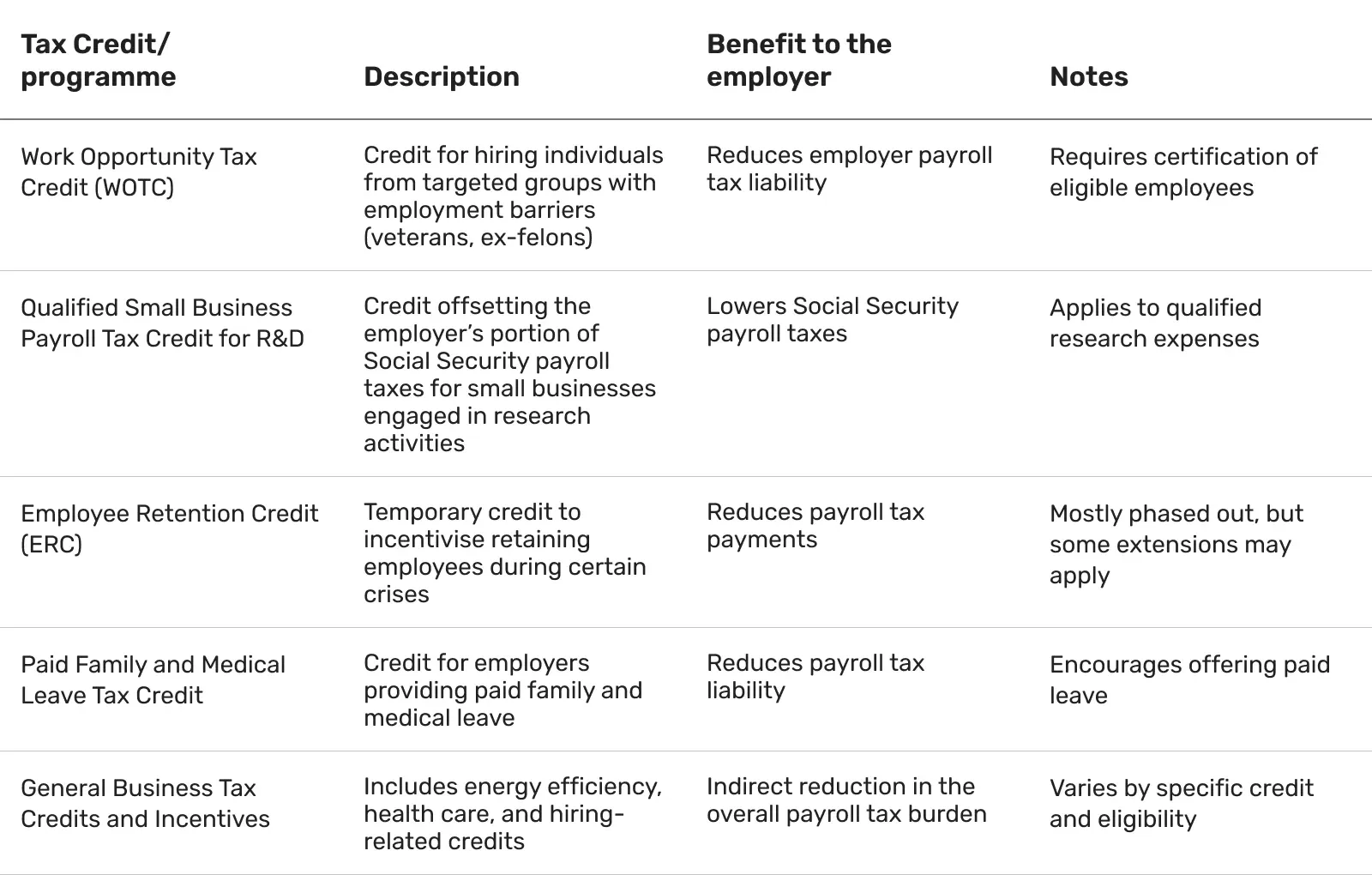

6. Take advantage of tax credits and incentives

Some states and programs offer credits or relief for certain types of compensation or employment conditions.

Exploring these options can help offset overall employer tax liability and make bonus programs more cost-effective.

How are bonuses taxed in the USA: Final thoughts

Bonuses are one of the most powerful tools for motivating and rewarding employees, but taxes can quickly ‘eat’ into their impact.

Careful planning not only keeps your business compliant but also ensures employees feel the full value of their rewards, making bonuses a true win-win for both your team and your bottom line.

Partnering with Native Teams can simplify bonus management, helping you optimise payouts, while we handle taxes.

Managing bonus taxes: simplifying the process with Native Teams

Handling bonus taxation correctly requires attention to multiple tax obligations, withholding calculations, and compliance requirements across different jurisdictions. Many businesses find that managing these complexities internally can lead to errors and administrative burden.

Key areas where businesses often need support:

- Payroll processing accuracy: Ensuring correct application of flat-rate vs. aggregate methods, proper calculation of supplemental wage withholdings, and accurate reporting on Form W-2. Understanding how modern payroll processing works can help streamline these calculations.

- Multi-jurisdiction compliance: Managing varying state and local tax requirements, especially when employees work in different locations.

- Tax optimization: Implementing strategies like deferred compensation plans, timing bonus payments effectively, and maximizing available tax credits. Consider exploring additional employee benefits that can complement bonus programs while providing tax advantages.

- Record keeping: Maintaining proper documentation for bonus classifications, withholding calculations, and compliance audits.

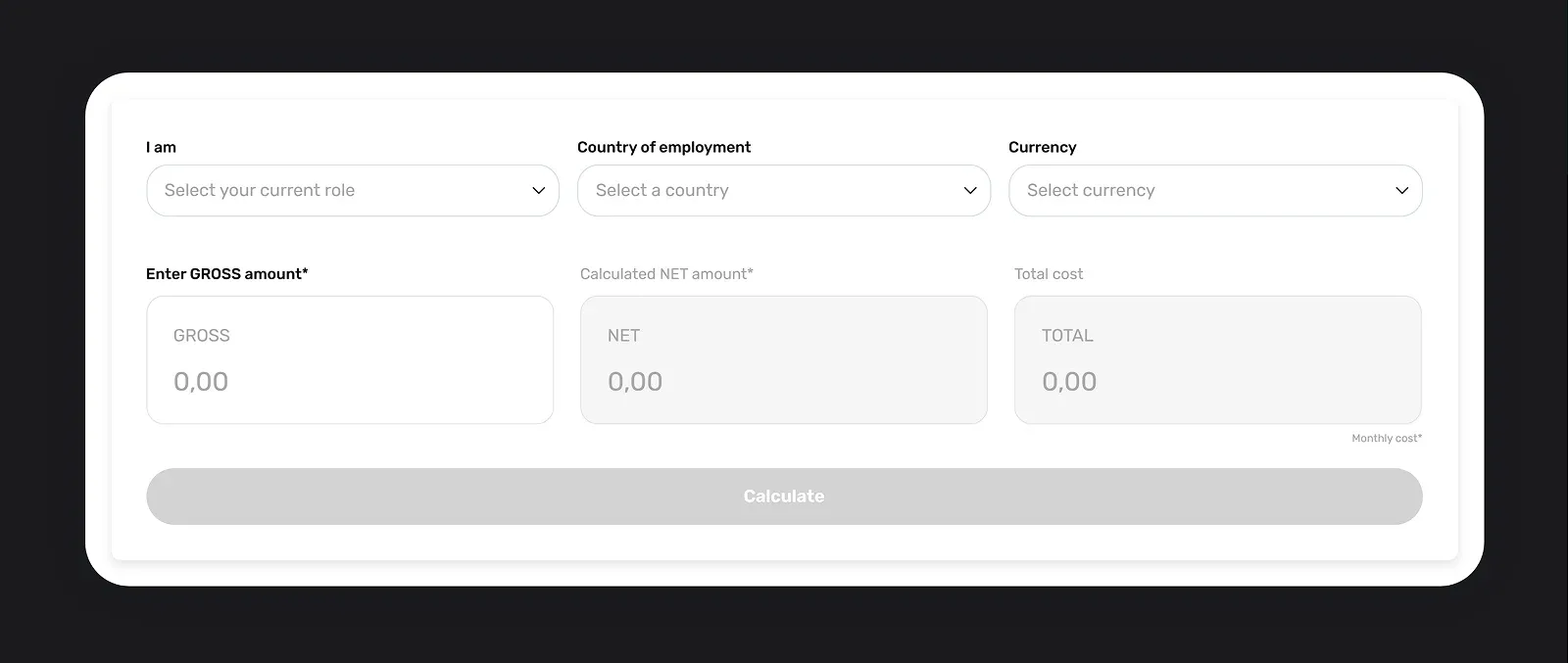

Before finalizing bonus amounts, use a payroll calculator to estimate the total cost including taxes and contributions, helping you budget accurately for bonus payments.

For businesses operating internationally or managing remote teams across multiple states, partnering with an Employer of Record (EOR) service can streamline these processes. EOR providers handle employment-related administrative tasks including payroll processing, tax withholding, social security contributions, and benefits administration while ensuring compliance with local regulations.

Book a free call today to see how we can help you maximize benefits while minimising taxes.