How Much Does a PEO Cost in 2026? A Complete Guide

Running a remote-first company has many benefits. You save on office rent, utilities, and overhead costs.

Yet, as you grow a distributed team, the price of Professional Employer Organisation (PEO) can add up fast and may become a big part of your regular expenses.

If you choose the wrong provider, you risk overpaying for services you don’t need. You might also end up tied to a contract that doesn’t fit your company’s growth.

Read on to learn how PEO’s pricing works and what impacts the total cost, so you can choose the right partner without overpaying.

What is a Professional Employer Organisation (PEO)?

A Professional Employer Organisation (PEO) is a 3rd-party company that manages HR functions through a co-employment arrangement with your company.

Thus, the PEO shares employer responsibilities, such as:

- Payroll,

- Benefits administration,

- Workers' compensation,

- Risk management,

- Legal compliance, and

- HR support.

At the same time, your company retains control over key decisions, including hiring and firing.

Key features:

- Co-employment: PEO acts as the employer of record for tax and insurance purposes.

- HR outsourcing: Frees businesses from complex HR tasks so they can focus on growth.

- Comprehensive services: Includes payroll, benefits, compliance, employee training, and more.

- Client control: You maintain control over day-to-day employee management.

6 factors that affect the Professional Employer Organisation price

Understanding the factors that drive the Professional Employer Organisation price can help you select the right PEO that aligns with your operational needs and budget.

1. Number of employees

Headcount is the most significant cost aspect.

While the overall cost rises with more employees, the per-employee cost often decreases as the workforce grows, due to economies of scale.

Small businesses may pay a higher per-employee rate compared to larger companies, which can negotiate better volume discounts.

2. Scope and level of service

Basic packages covering payroll, tax filing, and compliance are less expensive, whereas more comprehensive services, such as:

- Benefits administration,

- Recruiting,

- Training,

- Legal compliance, and

- HR consulting increase costs significantly.

You'll pay additional fees for add-ons such as background checks, learning management systems, and custom HR solutions.

3. Industry and risk profile

Industries with higher risk, such as construction and healthcare, face higher workers’ compensation premiums and insurance costs, which PEOs pass on to clients.

Additionally, specialised industries may require customised compliance and benefits solutions, which can increase the monthly cost per employee.

4. Geographic location

State and local labour laws, tax rates, and insurance requirements vary, influencing compliance costs and insurance premiums.

Businesses operating in multiple states may face complex regulatory environments, which, in turn, can increase administrative fees.

5. Contract length and terms

Longer-term contracts often come with discounted rates, while short-term or month-to-month agreements may have higher fees.

Following the same pattern, you can get reduced setup or onboarding fees for longer commitments or larger teams.

6. Platform fees

Some PEOs charge separately for access to their HR software platforms.

Furthermore, integration with existing systems or advanced HR technology solutions may add to the cost.

Regarding customisation, if you require tailored HR services, dedicated HR personnel, or industry-specific compliance support, you will pay more.

PEO’s pricing models

PEOs use several pricing structures, with the most common being:

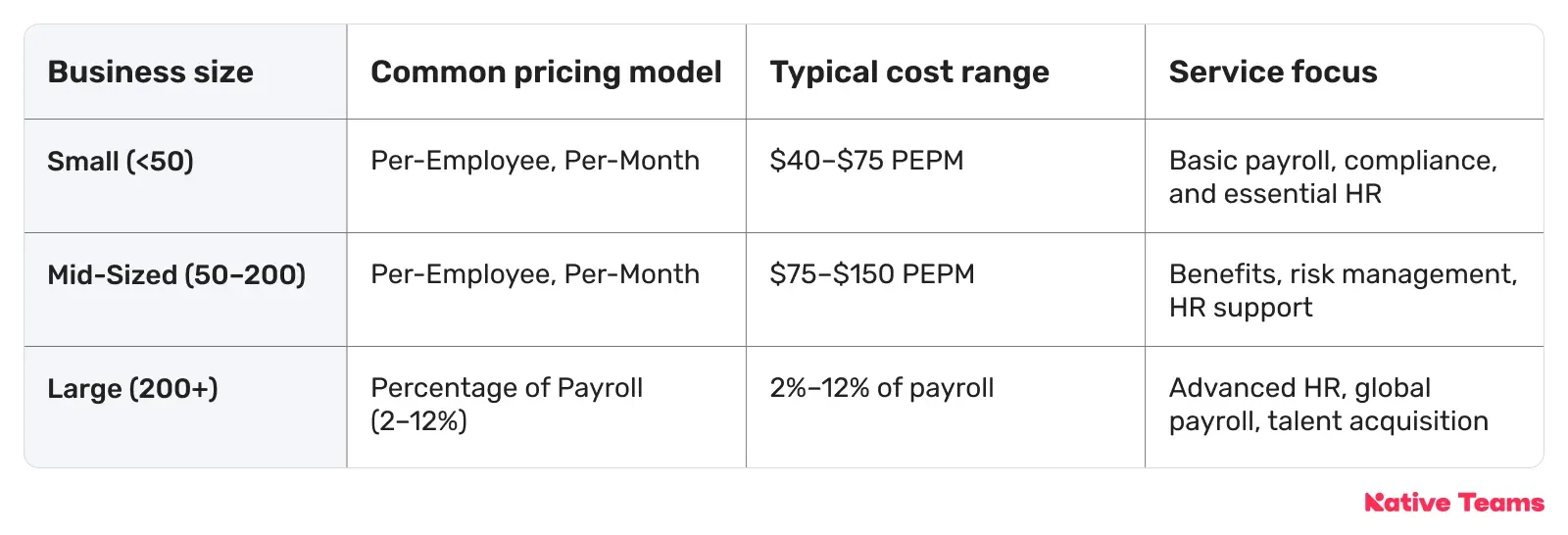

- Per-employee, per-month fee: According to CO, by the U.S. Chamber of Commerce, the typical range is between $40–$200 per employee per month. According to the same source, most businesses pay an average of around $100 to $120.

- Percentage of payroll: The typical range is between 2% and 12% of total payroll.

- Fixed monthly fee: Some PEOs offer a flat monthly rate regardless of employee count, but this is less common and usually tailored to smaller businesses or basic service packages.

- Hybrid models: Some providers may combine a base fee with a per-employee charge or offer tiered pricing, depending on the service complexity and company size.

What do Professional Employer Organisation fees usually cover?

Professional Employer Organisation fees usually include the following core HR functions:

- Payroll processing and tax filing.

- Benefits administration, such as health, dental, and retirement plans.

- Compliance and legal support, including employment law, regulatory filings, etc.

- Workers’ compensation insurance, often at group rates.

- Onboarding and offboarding support.

- Technology and HRIS tools.

Setup or onboarding fees are common, ranging from $500 to $2,000, although some PEOs may waive these for larger contracts.

PEO hidden fees you should know about

Unfortunately, hidden fees for hiring some of the PEO companies are common, and they can significantly increase your total cost beyond the advertised rates.

Here are the main types of hidden fees you should watch for.

1. Billing on gross payroll instead of taxable payroll

Some PEOs calculate their fees based on gross payroll rather than taxable wages, which includes pre-tax employee deductions, such as health insurance.

Consequently, this practice inflates fees unnecessarily because the PEO charges on amounts that should be excluded, effectively adding an extra 7.65% cost for every $100 on pre-tax deductions.

Explanation of the 7.65% Figure:

- The 7.65% refers to the combined employer portion of Social Security (6.2%) and Medicare (1.45%) payroll taxes (FICA).

- If a PEO charges on pre-tax deductions (which should be excluded from taxable wages), the employer pays 7.65% more on those amounts than required by law.

2. Markup on health benefits and insurance

Professional Employer Organisations often bundle benefits through master plans and apply a hidden markup of 5% to 20% on health insurance premiums.

Sadly, this markup is rarely transparent, meaning you may pay more than the actual provider cost without clear visibility into the provider’s rates.

3. Annual administrative or compliance fees

Beyond monthly fees, many PEOs charge annual administrative or compliance fees, which typically start at $2,500 and are often listed vaguely in contracts.

The problem with these fees is that they may not correspond to additional value and are difficult to audit.

4. Termination fees

Although onboarding one-time fees are common, some PEO providers also charge termination fees if you exit the contract before its term ends.

5. Workers’ compensation premium audits and charges

If payroll estimates are inaccurate, you might face year-end premium adjustments or audits that increase your workers’ comp costs, especially in high-risk industries.

Some PEOs charge workers' compensation separately.

6. Minimum monthly charges

Some Professional Employer Organisations impose minimum monthly fees regardless of headcount, which can be costly for companies with part-time or seasonal employees.

7. Annual fee increases and contractual limitations

PEO fees, especially admin and benefits costs, may increase annually without caps or sufficient notification, leading to unexpected higher expenses.

Long-term contracts may also limit your flexibility and control over benefit plans or HR policies.

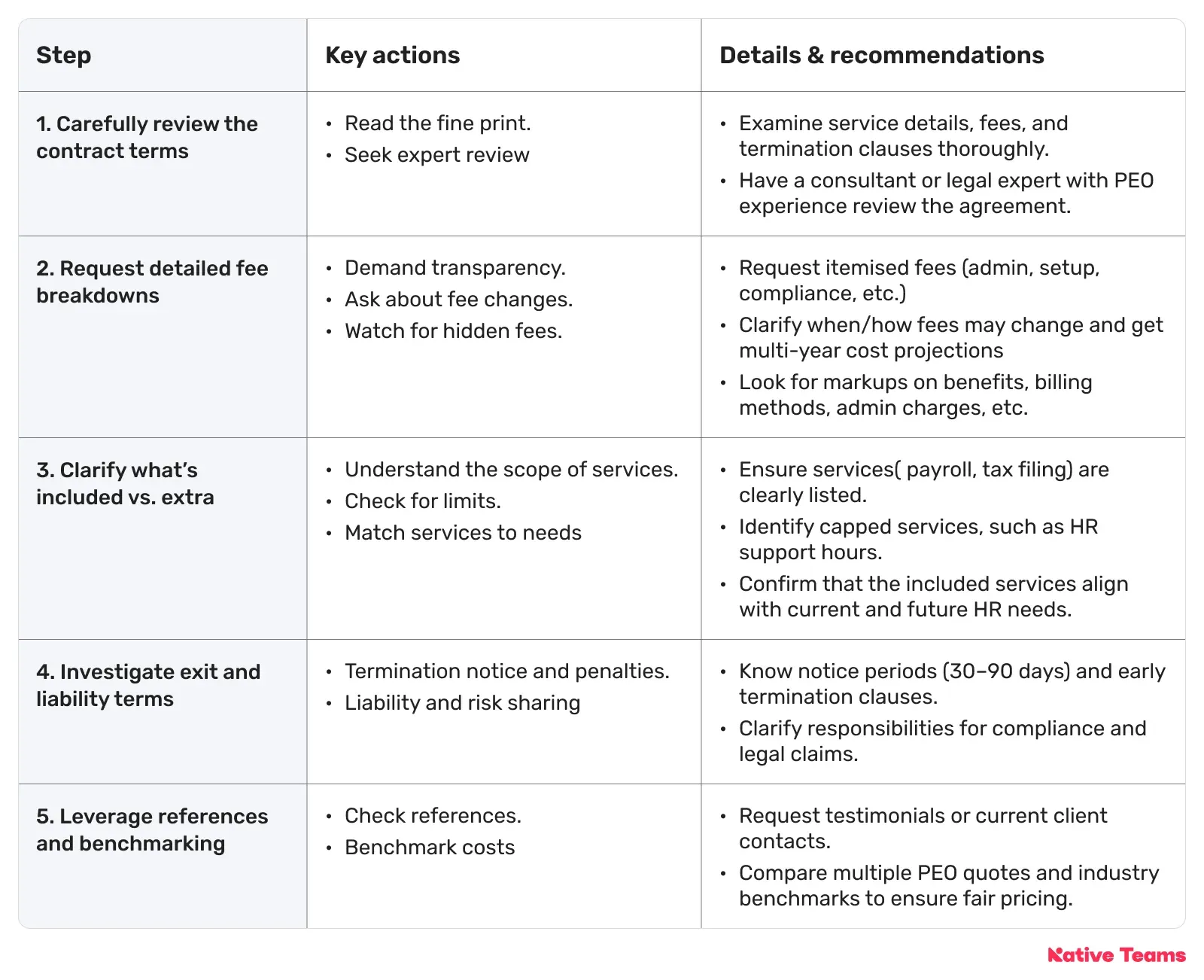

How to avoid hidden fees and costly surprises in your PEO agreement?

To avoid surprises when partnering with a Professional Employer Organisation, you should take a proactive and thorough approach to contract review, fee transparency, and service clarification before signing any agreement.

Check out our tips below to ensure you’re fully protected and informed.

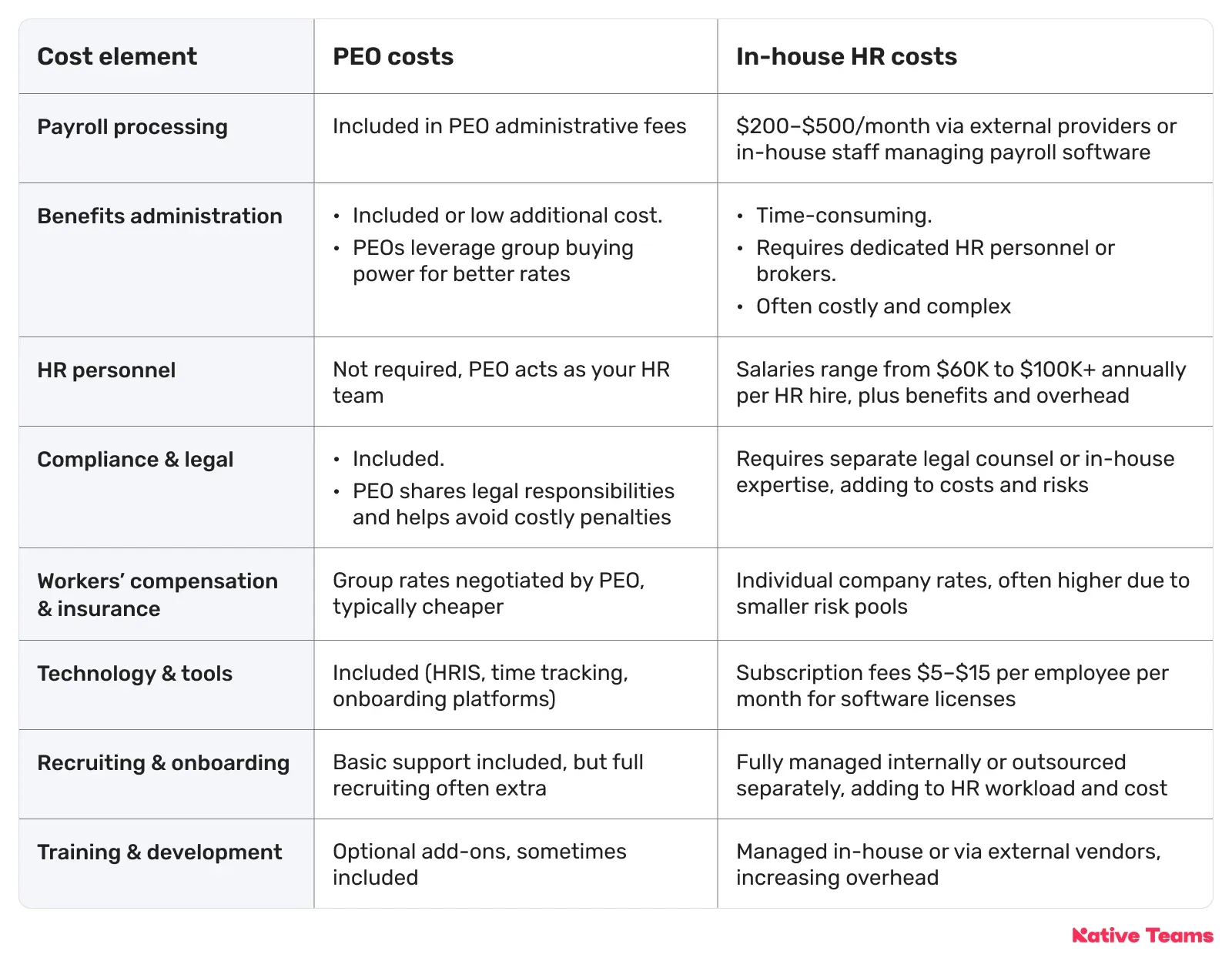

Professional Employer Organisation vs. in-house HR: Which delivers the best value?

Only by understanding the actual cost differences between partnering with a Professional Employer Organisation and managing HR in-house can you make the best financial and operational decision for your business.

Let’s check the key cost factors to help you decide which option, Professional Employer Organisation or in-house HR, offers the greatest return on your investment.

While the upfront fees for PEO services may appear higher than minimal in-house HR costs, the comprehensive bundled services, risk mitigation, administrative relief, and access to better insurance rates often make PEOs more cost-effective and strategically beneficial.

PEO pricing comparison: Top 5 PEO solutions

If you are still searching for PEO solutions, here’s a list of our top picks, with pricing included.

1. Native Teams: Starting at $22 per month for contractors and $117 per employee per month, with flexible pricing with discounts for annual billing.

2. Oyster: Starting at $29 per month for contractors, and $699 per employee per month.

3. Justworks: Starting at $8 plus a $50 monthly base fee per employee, and $100 per month per employee to access more advanced PEO.

4. TriNet: PEO prices start at $100–150 per employee per month.

5. Insperity: Prices range from $125 to $167 per employee per month.

For a more detailed description and more solutions, jump to our blog, 10 Best PEO Service Providers You Should Know About.

When you choose the Professional Employer Organisation provider, it’s crucial that they align with your business needs, compliance requirements, and growth plans.

Naturally, your project budget will play a significant role.

While lower Professional Employer Organisation’s prices often indicate limited or basic features, Native Teams’ solution offers advanced capabilities without a hefty price tag.

Why should you trust Native Teams?

Native Teams is a global PEO and Employer of Record (EOR) provider specialising in helping businesses expand internationally by managing local employment, payroll, compliance, and benefits across more than 85 countries.

At Native Teams, we believe affordable global team management shouldn’t come at the expense of premium service.

How else can we help? We handle:

🔥 Centralised HR management: A centralised dashboard for managing payroll, benefits, and employee data globally, streamlining administrative tasks and improving visibility.

🔥 Compliance and risk mitigation: We take responsibility for employment law compliance, minimising risks related to misclassification, tax penalties, and regulatory breaches.

🔥 Customised employment contracts, declarations, and compliance paperwork per country requirements.

🔥 Automated payroll processing with tax and social security contributions handled in local currency.

🔥 Local health insurance, pensions, and other employee benefits that are compliant with regional laws.

🔥 Financial tools, such as virtual wallets, international payments, and local cards, to facilitate smooth financial operations.

Enticed to learn more?

Book a free demo today to simplify global team management without worrying about transparency.