What is PEO Workers' Compensation: A Complete Guide

Did you know that over 200,000 businesses in the U.S. already partner with a Professional Employer Organisation (PEO) to manage HR, payroll, and workers’ compensation?

If your business is operating in multiple countries, handling workers' compensation claims, insurance, and compliance requirements independently can quickly become overwhelming.

That’s where a PEO steps in.

In this guide, we’ll break down how professional employer organisation workers' compensation works, the benefits and challenges involved, and what you should consider when choosing the right partner.

Let’s get started.

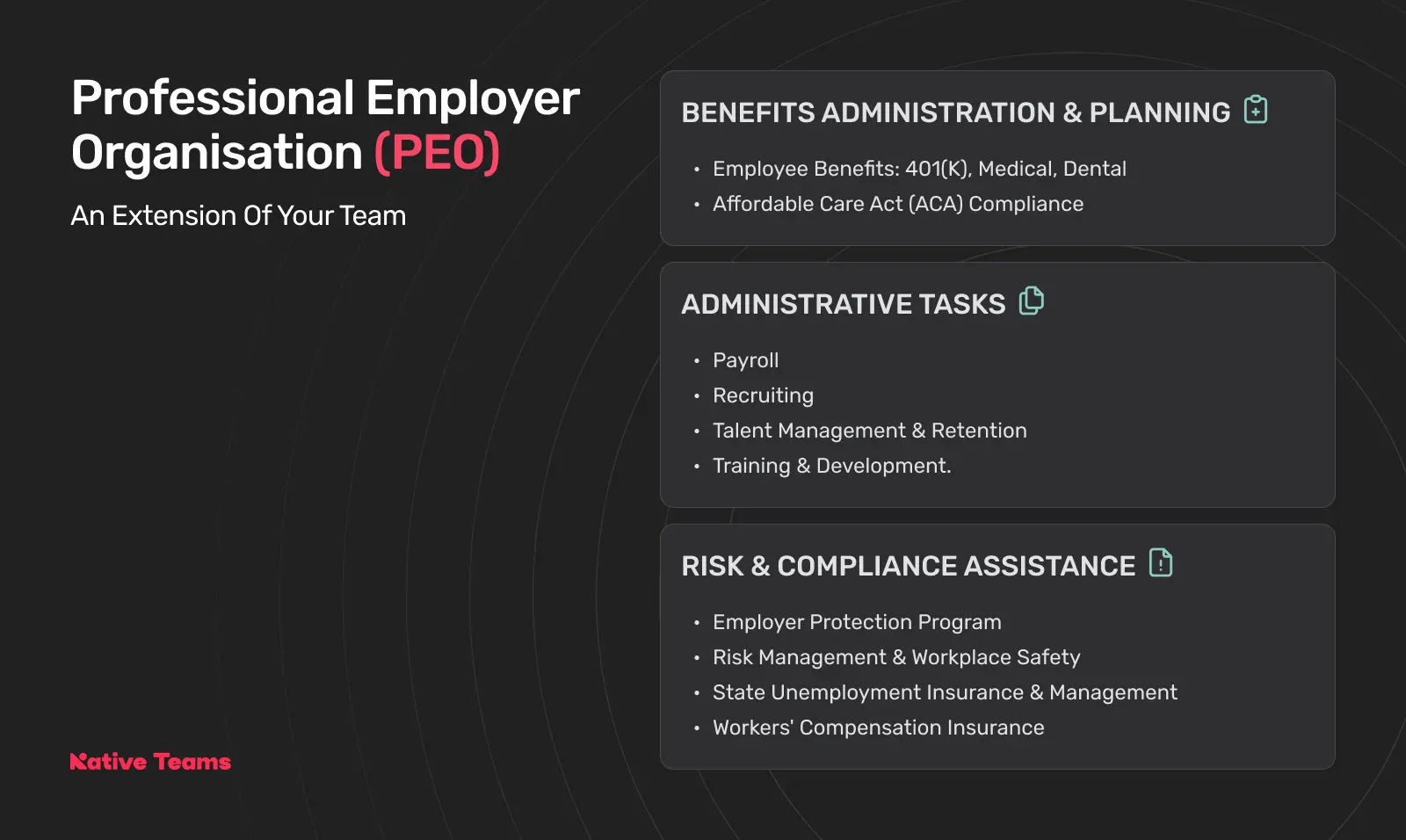

What is a Professional Employer Organisation (PEO)?

A Professional Employer Organisation (PEO) is a third-party company that provides HR, payroll, and compliance services through a co-employment arrangement.

In this model, your business maintains control over daily operations, while the PEO shares employment responsibilities, including those related to taxes, benefits, and workers’ compensation.

This relationship allows you to focus on running your business while the PEO handles:

- Payroll processing,

- Tax filings and withholdings,

- Employee benefits,

- Workers’ compensation insurance,

- Regulatory compliance.

According to NAPEO, PEOs serve over 4 million worksite employees across the U.S., helping small and mid-sized businesses access Fortune 500-level benefits and risk management support.

Pro tip

Native Teams is a PEO and EOR platform built to simplify global payroll, legal employment, and tax compliance.

We work closely with local tax consultants, legal experts, and accountants to ensure your payroll runs smoothly and remains fully compliant in every country you operate.

Here’s how we help:

- Payroll processing made simple: Pay your employees accurately and on time while staying compliant with local labour and tax laws.

- Expert tax compliance: Avoid penalties with precise tax calculations and on-time remittances that meet local requirements.

- Legal employment support: Get expert guidance on creating fully compliant contracts and handling local labour regulations.

- Ongoing compliance monitoring: We stay current with changing laws, ensuring your employment practices are always up to date.

What is Workers’ Compensation Insurance?

Workers’ compensation is a country-mandated insurance program that provides coverage for employees who are injured or become ill due to their job-related activities.

It typically pays for:

- Medical care,

- Rehabilitation services,

- A portion of lost wages,

- Disability and death benefits.

In exchange, employees generally waive their right to sue the employer for the injury, creating a no-fault system that benefits both parties.

If one of your workers is injured while performing their duties, workers’ comp covers their costs and shields you from potentially devastating lawsuits.

Why Workers’ Compensation is critical for employers

For nearly all businesses, carrying workers’ compensation insurance is not optional.

Most countries require coverage as soon as you hire your first employee.

Failing to secure proper insurance can lead to:

- Hefty fines or penalties,

- Criminal charges in some countries,

- Legal liability for injuries or wage loss,

- Business license suspension.

However, beyond legal compliance, it’s also a smart risk management strategy.

Without coverage, a single injury claim could put a small business at risk of bankruptcy.

That is why workers’ comp provides financial protection, keeps your workforce secure, and builds trust with your team.

How PEOs Handle Workers’ Compensation

1. Co-employment explained

In a PEO arrangement, your company and the PEO enter a co-employment agreement.

You continue to direct employee tasks, performance, and schedules, while the PEO takes on the legal and administrative responsibilities of an employer.

This includes:

- Paying wages under the PEO’s tax ID,

- Administering benefits,

- Handling workers’ comp coverage and claims,

- Ensuring compliance with labour laws.

This shared responsibility helps reduce liability and streamline complex HR functions.

2. The PEO’s role in workers’ comp coverage

Most PEOs provide workers’ compensation insurance directly.

They purchase a master policy or coordinate multiple policies and include your employees as covered workers.

The benefits are:

- You avoid large upfront premiums,

- You get access to pooled insurance rates,

- You don’t need to shop for coverage or handle renewals,

- Claims are filed under the PEO’s policy.

Some PEOs also offer additional benefits, such as safety consulting, loss prevention training, and return-to-work coordination.

3. Claims administration and risk management

When an employee gets hurt, PEO companies handle the entire claims process, including

- Filing paperwork with the insurer,

- Coordinating medical treatment,

- Ensuring legal compliance,

- Managing claim resolution.

They may also provide:

- Workplace safety audits,

- Injury prevention programs,

- Nurse case management,

- Fraud detection services.

This centralised management reduces claim delays, avoids costly mistakes, and keeps your premium costs in check.

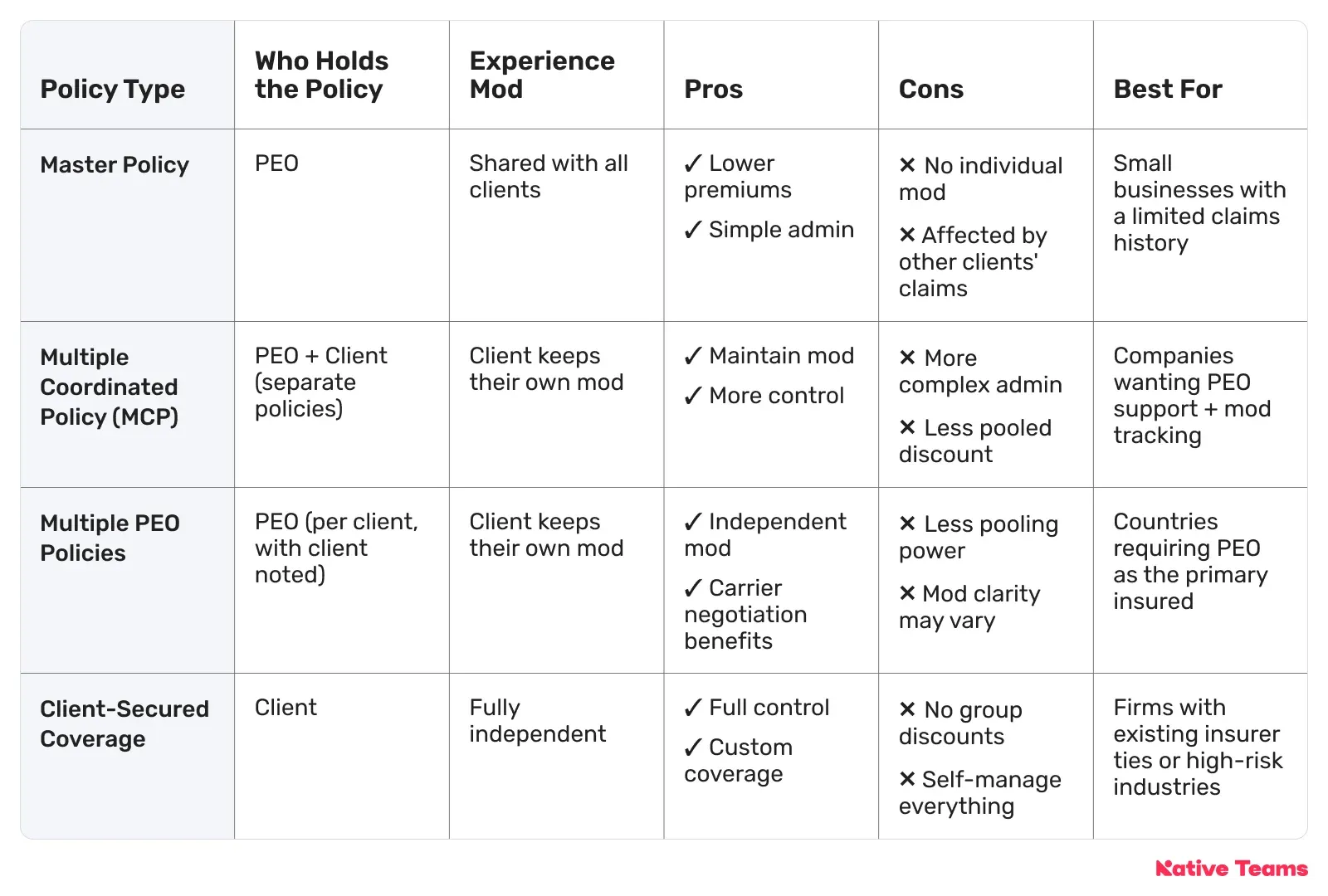

Types of Workers’ Compensation Policies offered by PEOs

PEOs and insurers have developed several models for issuing workers' compensation coverage in these co-employment setups.

The type of policy chosen affects who holds the policy, how premiums and claims are reported, and how experience ratings are calculated.

Here are the most common models:

Master Policy

Under a master policy, the PEO holds a single workers' compensation policy covering all co-employed staff across all clients.

Your company is added as an “additional insured,” but the entire group shares the same policy and experience modifier (mod).

✅ Lower premiums through pooled buying power.

✅ Simple administration with fewer moving parts.

❌ You don’t retain your individual experience modifier (mod).

❌ Your mod is affected by the claims history of other PEO clients.

💡 Quick tip: Ideal for small businesses with a limited or no prior claims history, seeking simplicity and group savings.

Multiple Coordinated Policy (MCP)

In this model, the PEO has its own policy, and each client has a separate policy under their own tax ID.

The insurer coordinates coverage through endorsements to ensure there are no gaps in coverage between policies.

✅ You maintain your individual experience modifier.

✅ More control over how your company’s claims data is tracked.

❌ Slightly more complex to manage administratively.

❌ May not offer the deepest discount compared to the master policy pooling.

💡 Quick tip: Ideal for businesses that want to maintain their own mod while still accessing PEO support.

Multiple PEO Policies

Each client has its own policy, but the PEO is listed as the primary insured.

The client's name is referenced in the policy, and each company’s premiums and claims are tracked separately.

✅ Your experience mod remains fully independent.

✅ You can still benefit from the PEO’s carrier negotiations.

❌ Less pooling leverage compared to a master policy.

❌ May raise questions about ownership of the policy (since PEO is listed as the primary insured).

💡 Quick tip: Useful when country laws require the PEO to be listed, but you still want clear separation in the mod history.

Client-Secured Coverage

Your business purchases its own workers’ comp policy, and the PEO simply supports with administration and claims handling.

The PEO is not listed on the policy, and you manage coverage entirely.

✅ Full control over insurer, policy structure, and endorsements.

✅ Maintains clean, independent mod and full carrier flexibility.

❌ No access to PEO’s group rate discounts.

❌ You handle renewals, negotiations, and policy decisions yourself.

💡 Quick tip: Best for companies that already have strong relationships with insurers or operate in high-risk sectors with special coverage needs.

Benefits of using a PEO for Workers’ Compensation

Cost savings and pooled insurance rates

PEOs group thousands of employees across multiple businesses, giving them serious leverage when negotiating with insurance providers.

Here’s how that helps you save:

- Group-rated premiums: Even if your business has a high experience modifier (mod), you can benefit from the PEO’s lower group rating.

- Pay-as-you-go billing: Instead of a large upfront premium, you pay incrementally based on real-time payroll. That’s great for cash flow.

- No separate administrative contracts: One system for payroll, insurance, and reporting means fewer fees and less duplication.

- Reduced overhead: Bundling comp insurance with payroll and compliance services lowers the per-policy cost.

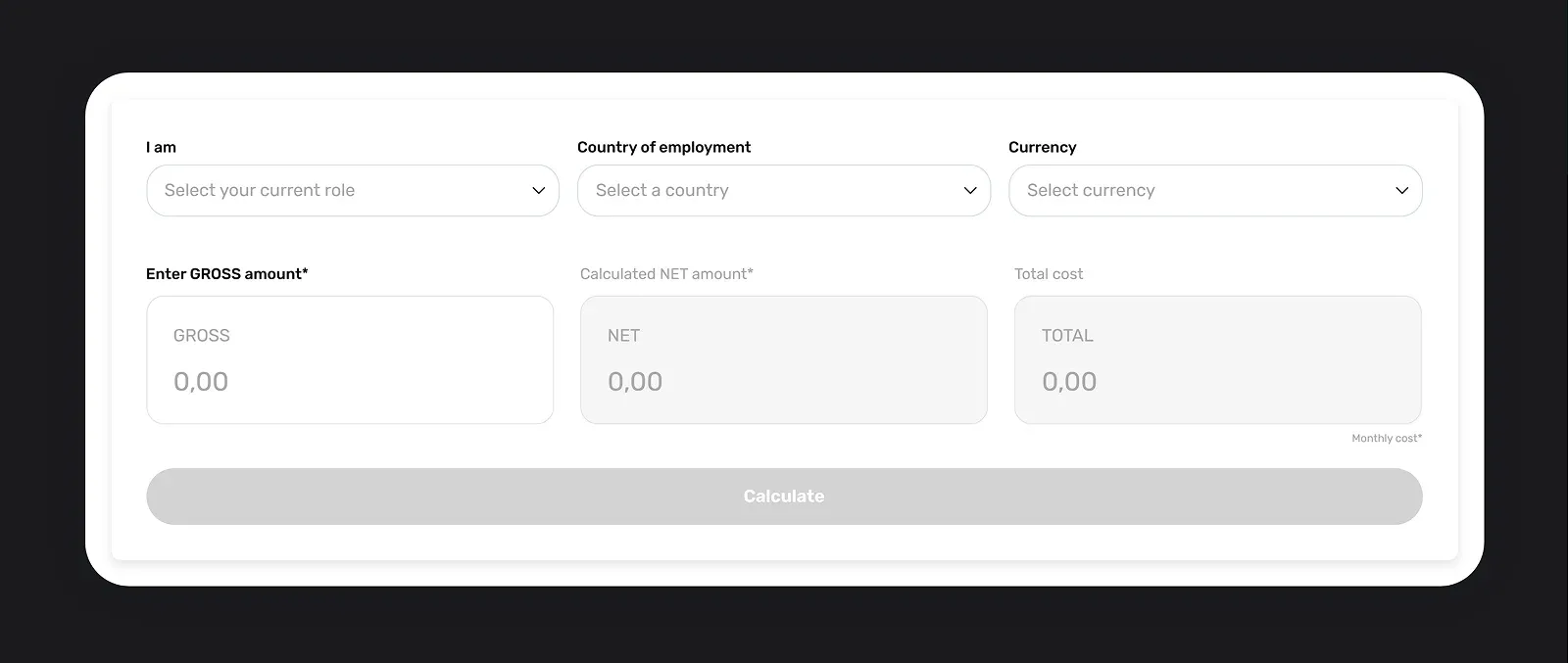

Pro tip

Native Teams automates salary calculations, tax withholdings, and contributions, ensuring accurate, compliant, and timely payroll.

With a single dashboard and a Global Payroll Calculator, you can manage salaries, track expenses, and estimate hiring costs across countries.

Compliance with country regulations

Workers’ comp rules differ widely by country, and keeping up with them isn’t easy if you operate in more than one location.

A PEO helps you stay compliant by:

- Registering your business in the required countries.

- Tracking changes to coverage thresholds and local laws.

- Classifying employees correctly for insurance purposes.

- Handling audits and producing proof-of-insurance documents.

Pro tip

Native Teams ensures compliance by providing locally tailored employment contracts, tax support, and legal oversight across more than 85 countries.

With in-house legal experts and real-time updates on labour laws, we help you avoid fines, misclassification, and compliance risks as you scale globally.

Efficient claims handling

Filing and managing a workers’ comp claim can be complex, especially when you’re also trying to run your business.

With a PEO, you get:

- A dedicated claims team that handles everything from reporting to resolution.

- Accurate job and wage coding to avoid overpaying premiums.

- Fast turnaround on claims to reduce employee downtime.

- Better documentation that protects against future disputes.

Access to safety programs and Return-to-Work support

Reducing workplace injuries helps protect your employees and lower your overall costs.

Many offer:

- On-site safety audits and risk assessments.

- Custom safety training based on OSHA guidelines.

- Injury tracking systems and compliance checklists.

- Return-to-work programs with modified duties and faster reintegration.

Fraud prevention and risk mitigation

Fraudulent claims can inflate your insurance costs and damage your company’s reputation.

PEOs combat this through:

- Injury surveillance and claims monitoring.

- Verification tools to confirm diagnoses and job duties.

- Internal red-flag systems for spotting abuse patterns.

They also maintain an arm’s-length relationship between you and the claimant, helping reduce liability in sensitive cases.

Improved employee benefits and experience modifier access

PEOs often give small businesses access to better benefits than they could secure on their own.

Employees may gain access to:

- Group health, disability, and dental insurance.

- Long-term wellness and mental health programs.

- Professional claims support and structured recovery assistance.

Challenges and considerations

While PEOs offer strong benefits, they may not always be the right fit for every business.

Here are key challenges to keep in mind:

- Loss of experience modifier history: Under a master policy, your company’s workers’ comp history is blended with others. You won’t build your experience mod while with the PEO, and re-establishing it after leaving can be a complex process.

- Limited insurance flexibility: You must use the PEO’s selected insurance carrier and coverage terms. This limits your ability to shop around or customise policies for specific risks.

- Additional administrative fees: PEOs charge fees in addition to premiums, typically ranging from 3% to 15% of payroll. Ensure that the savings on premiums outweigh the additional service costs.

- May not suit high-risk industries: Some PEOs avoid high-risk businesses, such as construction or specialised trades. Even if accepted, you might face higher rates or stricter safety requirements.

- Less control over claims and renewals: Since the PEO manages claims and policy renewals centrally, you have less direct control over how claims are handled or when to switch carriers.

Trends in Workers’ Compensation and PEOs (2025)

Rising claims and medical costs

Between 2021 and 2023 total claim costs rose 2–14% annually across 18 U.S. states.

Higher wages and longer recovery times are driving this trend.

Small businesses should expect continued premium increases into 2025, although PEOs may buffer some of the impact through pooled rates.

Mental health and compensable claims

In 2023, 71 bills targeted PTSD alone out of 86 comp-related mental health bills.

Although mental health claims account for just 2% of volume, they cost 3.5× more and last significantly longer.

Expect more claims tied to stress and psychological injury, especially in high-pressure industries.

Classification and compliance scrutiny

The 2024 DOL rule narrows the definition of who qualifies as an independent contractor.

This shift could increase comp exposure, especially if gig workers are reclassified as employees.

At the same time, regulators are increasing audits of job codes and payroll reporting.

PEOs can help, but it’s critical to verify classifications.

The role of technology in claims management

AI and automation are speeding up policy issuance by up to 40%.

Tools like blockchain and RPA are reducing admin work and creating more transparent, tamper-proof claims records.

Businesses using PEOs that leverage technology may benefit from faster claims processing and reduced errors.

Evolving Return-to-Work expectations

RTW efforts are expanding, with countries pushing for modified duty and early re-engagement.

Sedgwick found that early intervention, especially on mental health claims, can reduce lost workdays by up to 70%.

With an increasing number of claims from workers over 60, accommodations such as flexible hours and lighter duties are becoming essential.

How to choose the right PEO for Workers’ Compensation?

Questions to ask a potential PEO partner

- What type of workers’ comp policy do you use?

- Will I retain my experience modifier?

- How are claims handled and monitored?

- Do you offer safety training or RTW programs?

- Can I see a detailed breakdown of fees?

- Are you ESAC and IRS certified?

Evaluating policy types and coverage options

Understand:

- Who holds the policy?

- How are premiums calculated?

- What happens to your mod if you leave?

- Are all employees covered in all countries?

Importance of service quality and claims support

A PEO should feel like part of your team.

Look for:

- Dedicated contacts.

- Claims support with fast response times.

- Transparency in fees and performance.

- Strong client references.

How Native Teams supports PEO Workers’ Compensation

Native Teams offers an all-in-one solution that simplifies workers’ compensation under a Professional Employer Organisation (PEO) model.

From handling contracts and payroll to ensuring compliance and timely tax filings, Native Teams helps you:

- Onboard employees quickly in 85+ countries.

- Manage global payroll, taxes, and HR tasks.

- Ensure workers' comp compliance across borders.

- Apply localised benefits and handle claims administration.

With Native Teams, you get a streamlined, compliant approach to PEO workers’ comp, backed by global reach and expert support.

Ready to simplify workers’ comp?

Book a demo today with Native Teams.