PEO vs. Payroll Services – What’s the Key Difference? (2026)

From tax filings to compliance risks, managing HR and payroll while running your business is time-consuming, and it only becomes more challenging with every new hire.

However, choosing the wrong solution for your business, such as a PEO instead of a payroll service or vice versa, can make things worse.

Too complex, and you’re overpaying. Too simple, and you’re exposed to compliance risks and limited support.

So what’s the real difference between a PEO and a payroll provider?

Read on to learn more about PEO and payroll services so you can see which one is the best fit for your business, without guesswork.

Let’s dive in!

What is PEO?

A Professional Employer Organisation (PEO) is a company that provides HR outsourcing services through a co-employment arrangement.

Thus, the PEO becomes the employer of record for tax and regulatory purposes, handling:

- Payroll processing,

- Tax filings,

- Benefits administration,

- Workers' compensation,

- Risk management, compliance, and

- Other HR functions on behalf of your company.

PEO: Scope of activities

PEO manages the above employer responsibilities and liabilities, allowing you to offload time-consuming HR administrative tasks and focus more on core business operations while gaining access to better benefits and expert HR support.

On the other hand, PEOs don’t take over hiring or firing decisions, nor supply labour. Rather, they provide outsourced HR services that supplement or replace an internal HR department, often on a long-term basis.

What are payroll services?

Payroll services are 3rd-party providers that strictly handle the entire payroll process and administration of taxes, without entering into a co-employment relationship.

Thus, they:

- Calculate wages,

- Withhold the correct taxes,

- Process direct deposits, and

- Fill payroll taxes with federal, state, and local agencies.

In addition, payroll services also maintain electronic payroll records, prepare and mail employee tax forms, and ensure compliance with relevant labour and tax laws.

Depending on the payroll service provider (PSP), you can also benefit from additional features, such as:

- Employee time and attendance tracking

- Payroll reporting and analytics

- Employee self-service portals for viewing pay stubs and updating information, etc.

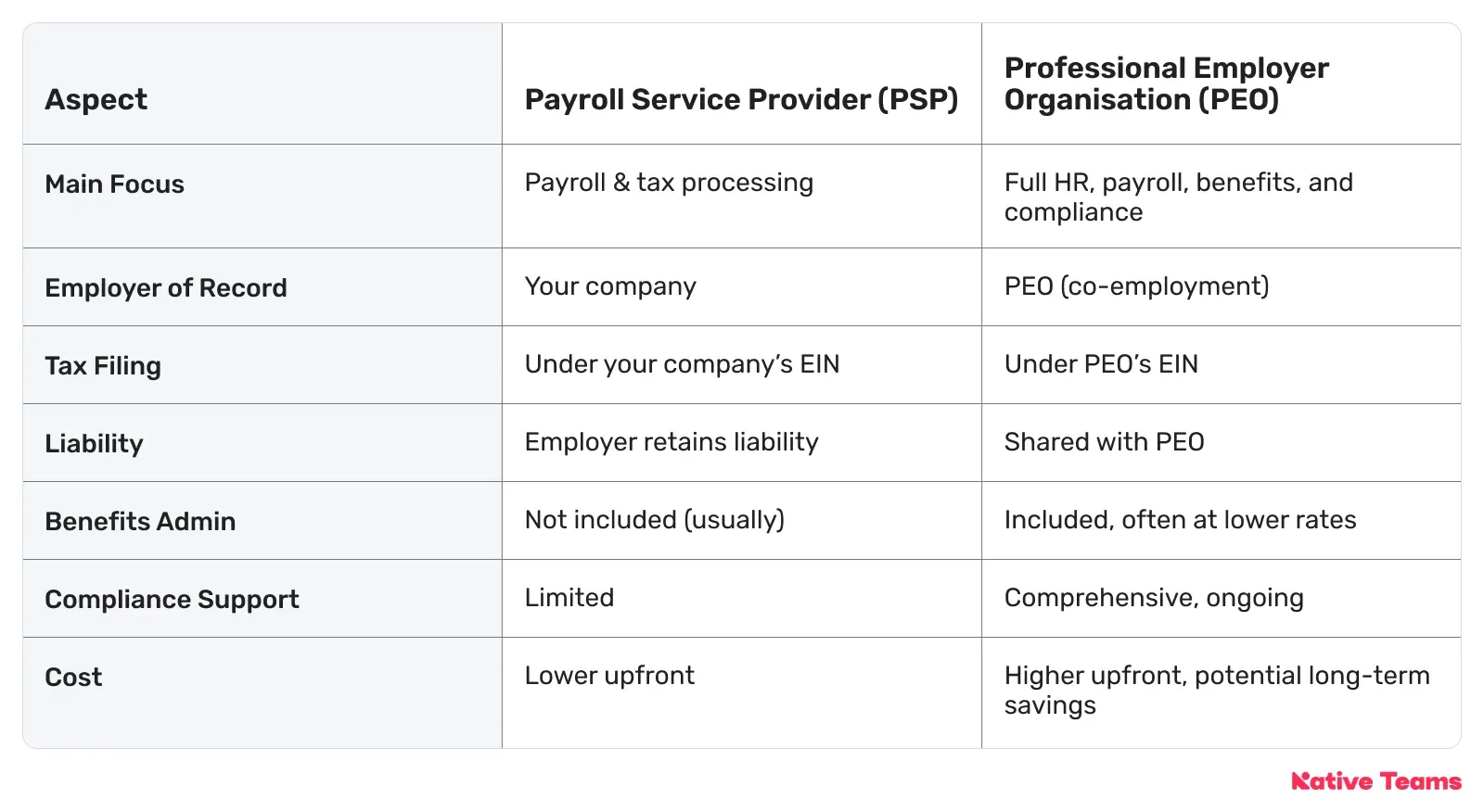

PEO vs. Payroll services: A quick comparison

Before breaking down the key differences between PEO and payroll services, here’s a quick side-by-side comparison to see where these two solutions stand apart.

1. Business relationship & legal responsibility

The most critical difference is the employer relationship. When you partner with a PEO, you're entering into a co-employment arrangement.

This means the PEO becomes the official employer of record for tax and insurance purposes, while you continue to manage day-to-day employee operations.

The PEO shares liability for compliance, payroll taxes, and certain employment practices.

In contrast, a payroll service provider is just that—a service. They act as a vendor, processing payroll on your behalf, but your business remains the sole legal employer. You retain full responsibility for compliance, benefits, and employee-related liabilities.

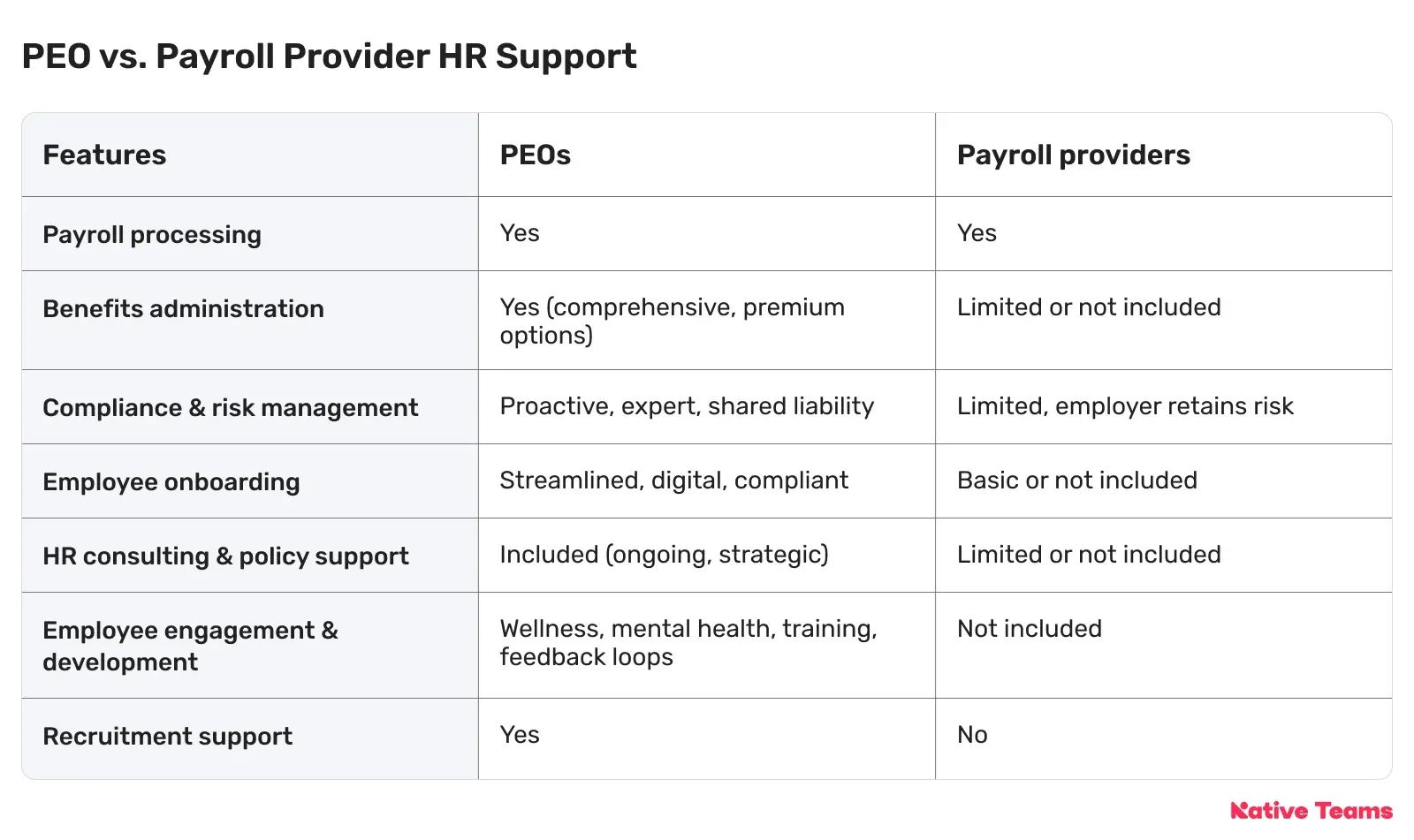

2. Scope of services

PEO companies deliver a comprehensive suite of HR services.

It includes not just payroll, but also:

- Employee benefits administration,

- Workers’ compensation,

- HR policy development,

- Onboarding,

- Training, and even

- Legal support related to employment.

It’s a full HR infrastructure as a service.

Payroll providers, on the other hand, focus exclusively on payroll functions.

They handle tasks like:

- Paycheck processing,

- Tax withholding,

- Year-end tax form distribution, and

- Direct deposits.

Some may offer add-ons, such as basic time tracking or limited HR tools, but they typically don’t provide deep compliance or benefits support.

3. Employee benefits

One major perk of a PEO is access to large-group employee benefits.

Because they pool employees from multiple client companies, PEOs can negotiate better rates for health insurance, retirement plans, dental and vision coverage, and more.

These benefits are usually out of reach for small businesses on their own.

Payroll providers don’t offer these benefits. You would need to source and manage them separately.

4. Risk and compliance management

With employment laws becoming increasingly complex, especially with varying state and local requirements, compliance is a major concern for growing companies.

PEOs typically provide hands-on compliance support, including assistance with labourr laws, workplace safety, employee classification, and evenconducting audits.

They share legal responsibility and often offer guidance on how to avoid penalties.

Payroll services ensure compliance only in the narrow context of payroll taxes. They’ll file your tax paperwork correctly and on time, but they don’t protect you from broader HR risks or offer legal advice.

5. Cost and flexibility

PEOs tend to be more expensive, often charging a percentage of your total payroll or a per-employee monthly fee.

However, this cost includes a wide range of HR services that would otherwise require multiple vendors or internal staff.

Payroll providers are generally more affordable, especially for businesses that only need payroll and can handle HR internally.

In some respects, payroll services also offer more flexibility.

Since they don’t control your HR processes or benefits, you can mix and match systems to suit your needs.

With a PEO, you may have to adopt their platforms, policies, and timelines and therefore, trading some flexibility for efficiency and support.

Pros & cons of PEO and payroll services

PEO: Pros & cons

✅ Comprehensive HR solution — From onboarding to benefits, everything is streamlined.

✅ Access to better benefits — Provide group rates and options typically reserved for large enterprises.

✅ Compliance protection — Help with avoiding costly penalties related to employment laws and tax regulations.

✅ Reduced liability — Shared legal burden in employment-related lawsuits or audits.

❌ Higher cost — Fees typically range from 2–12% of total payroll or per-employee-per-month pricing.

❌ Less flexibility — You may have to adopt the PEO’s processes, policies, and tools.

❌ Complex exit process — Disengaging from a PEO requires unwinding the co-employment structure.

Payroll services: Pros & cons

✅ Cost-effective — Lower fees; ideal for budget-conscious businesses.

✅ Simple & fast setup — Easy onboarding, especially for very small companies.

✅ Modular flexibility — You control which HR tools and services to use alongside payroll.

❌ No HR or legal support —You’re on your own for compliance, labour disputes, and employee issues.

❌ Limited strategic guidance — No help with workforce planning, employee engagement, or organizational development.

❌ Fragmented tools — You may need to manage multiple systems for benefits, time tracking, and onboarding.

PEO vs. Payroll services: Which is the right fit for your business?

As regulatory demands grow and talent becomes harder to retain, the right choice depends on your internal resources, current operational needs, compliance risk, and long-term goals.

To make your decision more easily, ask yourself these 5 key questions:

1. Do I have in-house HR expertise?

If you already have an experienced HR manager or team, you may only need a payroll provider to handle tax filings and employee payments.

Conversely, if HR tasks are currently falling to the founder or office manager, or if HR is a patchwork of ad hoc tools, a PEO can fill that gap quickly and professionally.

2. Am I worried about compliance risks or lawsuits?

From wage-and-hour disputes to employee misclassification and ever-changing state laws, employment compliance is a legal minefield, especially if you run remote teams or multi-state operations.

PEOs share legal responsibility in a co-employment model and typically offer hands-on compliance assistance, including help with labour law changes, employee handbooks, and even wrongful termination claims.

If peace of mind is a priority, a PEO is the stronger choice.

Payroll services, by contrast, will ensure you file the right tax forms, but they won’t step in if you’re hit with a lawsuit.

3. Do I just need help processing paychecks and taxes?

If your team is small, your HR processes are under control, and your main concern is getting people paid on time and staying on top of tax filings, then a payroll service may be all you need.

Advanced payroll platforms are automated, user-friendly, and often come with integrations for time tracking and accounting.

For lean teams or businesses with straightforward payroll needs, this is a cost-effective, low-maintenance solution.

Nonetheless, if your business needs expand beyond payroll, for example, adding benefits or dealing with HR compliance, you’ll either need to build internal capacity or partner with 3rd parties, which comes at a higher cost.

4. Do I want to offer employees competitive benefits?

Small businesses often struggle to afford high-quality health insurance, retirement plans, or wellness programs on their own.

That’s where PEOs stand out. They leverage their large employee pools to negotiate better rates and access to benefits typically reserved for large corporations.

As a result, you may get lower premiums, more plan options, and a better experience for your employees, all without you managing it manually.

Payroll providers don’t offer benefits administration, so if you go this route, you'll need to work with a separate provider.

5. Am I scaling rapidly or expanding to new states?

If you're planning a rapid expansion, entering new markets, or scaling remote teams, a PEO helps simplify and support that growth.

Because PEOs already operate in multiple jurisdictions, they’re equipped to handle state-specific compliance, multi-state tax registration, and local employment laws.

They also provide infrastructure, such as onboarding workflows and benefits enrollment that scales with you.

Payroll services may support multi-state payroll, but they generally don’t assist with regulatory compliance across different states, which could leave you exposed.

Let’s recap

If you're a small business with stable headcount and minimal HR complexity, a payroll service might be exactly what you need.

However if you’re managing growth, facing compliance risk, or struggling with benefits and employee management, a PEO could be the strategic partner to choose.

The good news is that you don’t always have to choose between the limited scope of a payroll service and the full complexity of a traditional PEO.

Some modern platforms now combine both functions, offering payroll automation and HR infrastructure, without the overhead of a legacy provider.

Native Teams is one such solution.

It offers flexible global payroll, local tax compliance, and employment support, whether you’re paying gig workers, full-time employees, or remote teams across borders.

So if your business is growing, but not yet ready to take on a full in-house HR operation, or if you want the benefits of a PEO without giving up control, Native Teams can meet you where you are and scale with you.

Native Teams: One platform to handle global payroll, local compliance, and full employment support.

Native Teams combines EOR and PEO services, enabling you to hire, manage, and compensate employees in over 85 countries without the complexities of establishing local legal entities.

With our solutions, you can:

✨Stay fully compliant with local employment laws, including contracts, taxes, and statutory benefits, no matter where your team is based.

✨ Simplify HR operations by managing payroll, benefits, and compliance documentation in one platform, saving time and reducing admin complexity.

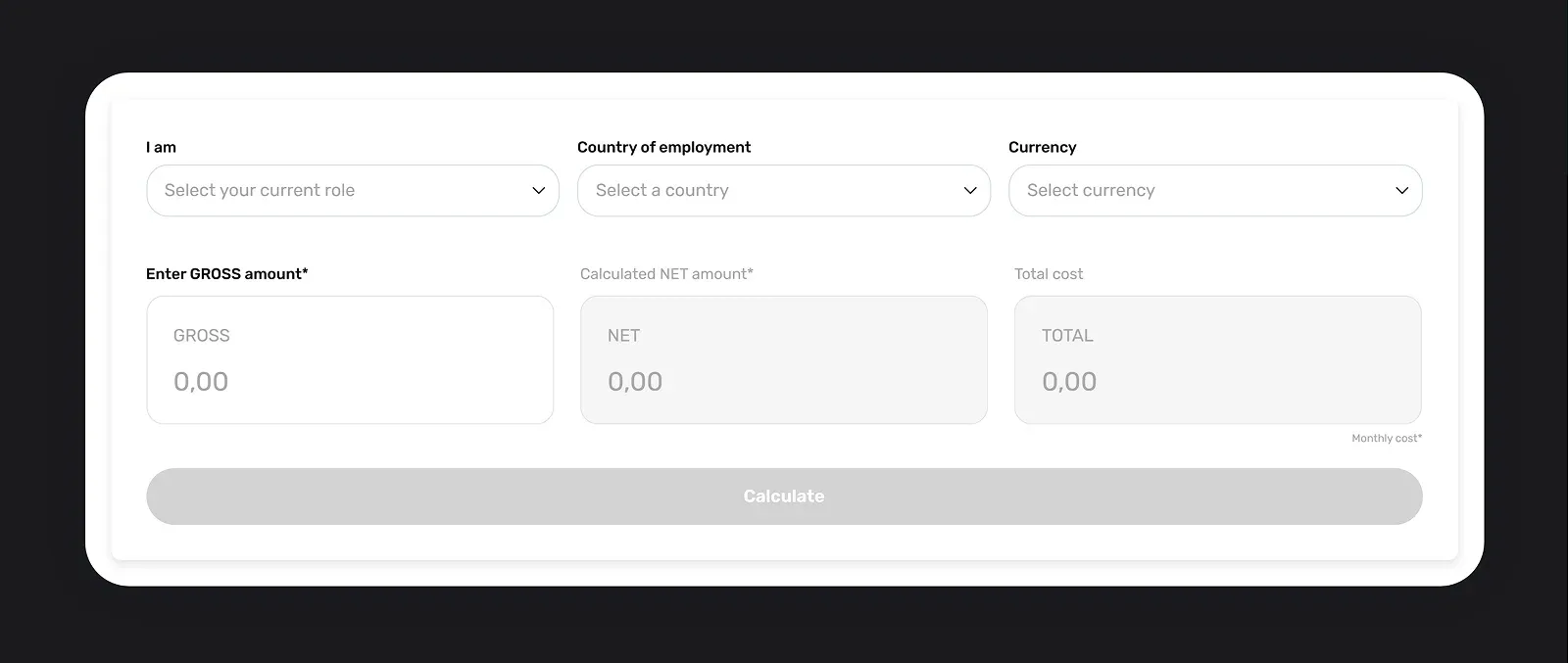

✨ Ensure accurate, on-time payments with our Payroll Calculator and global payroll tools that handle salaries, taxes, and contributions seamlessly.

✨ Offer competitive benefits, from mandatory healthcare and pensions to extras like wellness programs and learning support to attract and retain top talent globally.

Curious to discover more?

Book a free demo to see how to get payroll, compliance, and hiring sorted in one place.

Keep learning:

PEO vs. HRO – Key Differences Explained