PEO vs. HRO – Key Differences Explained

As your company scales, something surprising happens - HR becomes a bottleneck. Manual payroll, fragmented compliance, and poor benefits are a recipe for burnout and lawsuits. Growing teams deserve better systems. That’s why many businesses look for external HR support. Two common models are Professional Employer Organisations (PEOs) and Human Resource Outsourcing (HRO) providers.

While they may seem similar, PEOs and HROs differ significantly in structure, responsibilities, and legal implications. Choosing the right model depends on how much control you want to keep over your HR processes and what level of support your team needs.

This guide is designed to give you a clear, practical understanding of both models so you can choose the one that best supports your HR strategy.

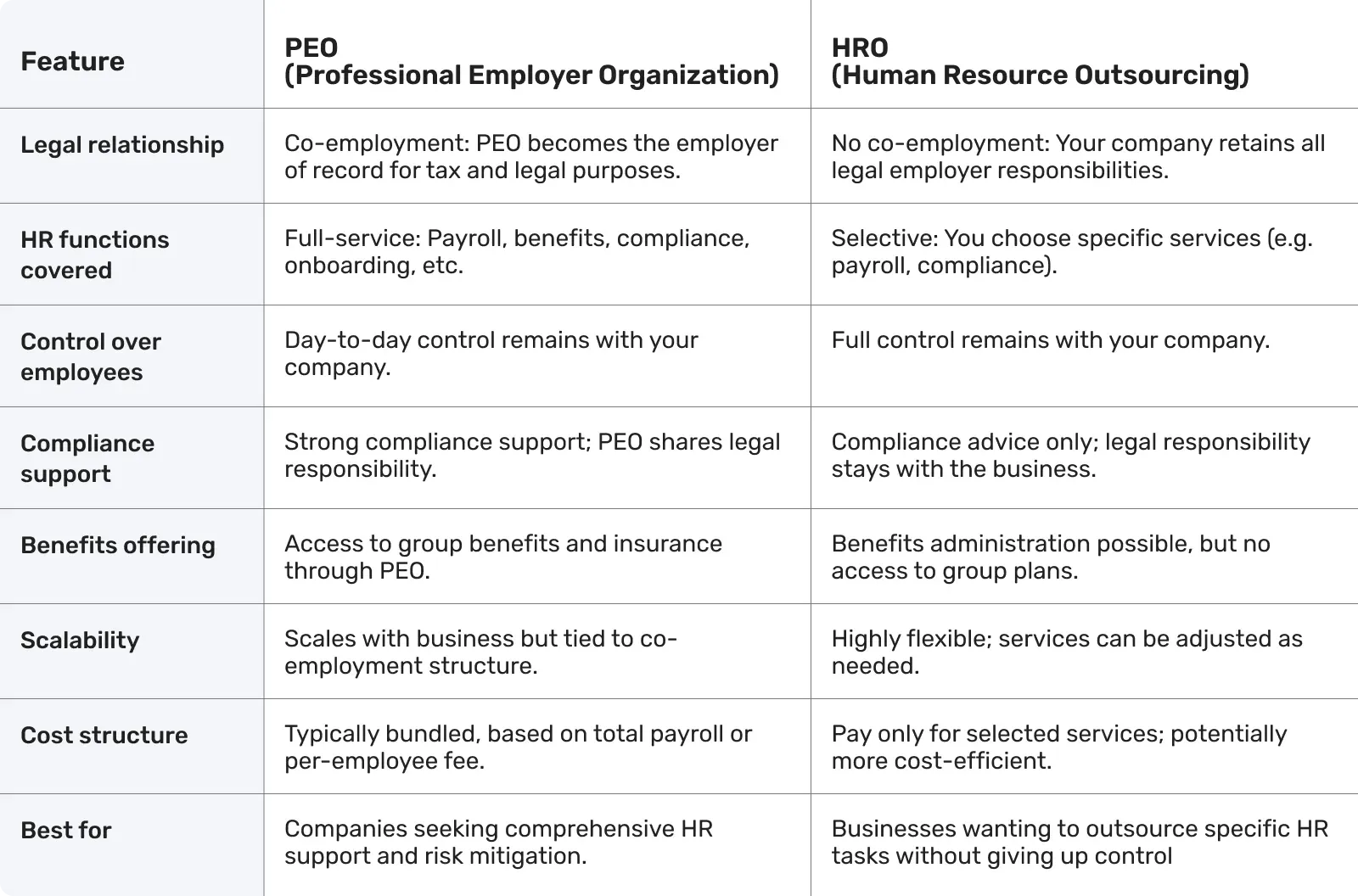

PEO vs HRO - Key differences overview table

What is a PEO?

A Professional Employer Organisation (PEO) is a third-party company that takes on specific HR responsibilities on behalf of your business. This typically includes payroll processing, employee benefits administration, compliance with labour laws, and support with hiring or onboarding.

When you work with a PEO, you enter into a co-employment arrangement. This means the PEO shares certain legal responsibilities as the official employer of record for tax and compliance purposes, while you continue to manage the day-to-day work and oversight of your employees.

According to the National Association of Professional Employer Organisations (NAPEO), businesses that use a PEO can reduce HR-related costs by over 37%. PEOs also provide access to benefits and resources that might otherwise be out of reach for smaller companies.

How PEO works?

A Professional Employer Organisation (PEO) enters into a co-employment arrangement with your business. In this setup, your company manages employees’ day-to-day tasks and responsibilities, while the PEO takes on specific HR and compliance functions. This division of roles helps reduce administrative pressure and lowers the risk of legal issues.

Here’s how a PEO typically supports your business:

- Employee onboarding - The PEO ensures that new hires complete the correct tax and employment documentation. They also help standardize onboarding processes to align with legal requirements.

- Payroll processing - The PEO calculates wages, deducts the correct taxes, and manages direct deposits and pay schedules. They also handle year-end tax forms such as W-2s.

- Regulatory compliance - Employment laws vary by state and change frequently. The PEO monitors these updates and adjusts HR practices accordingly to help your business stay compliant with labor laws and tax regulations.

- Benefits administration - A PEO can provide access to employee benefits such as health insurance, retirement plans, and paid leave. These are managed on your behalf, often at better rates due to the PEO’s group buying power.

Using a PEO doesn’t mean giving up control over your team—it means gaining support for tasks that carry legal and administrative weight. For companies with limited internal HR resources, this can help reduce errors, support compliance, and make HR operations more efficient.

Benefits of using a PEO

The benefits of a PEO are especially significant for small to mid-sized businesses seeking to enhance HR efficiency without enlarging their internal teams.

1. Lower HR and benefits costs

PEOs often pool employees from multiple companies, which allows them to negotiate lower rates for health insurance and other employee benefits. This can reduce your overall HR expenses compared to managing everything independently.

2. Compliance support

Employment laws change frequently and vary by location. A PEO provides access to legal and regulatory expertise, helping your business stay compliant with tax requirements, labor laws, and workplace safety standards.

3. Simplified payroll administration

A PEO manages payroll processing, including wage calculations, tax withholdings, and issuing payments. This reduces the likelihood of errors and helps ensure employees are paid on time and in full compliance with tax regulations.

4. Access to comprehensive benefits

PEOs often offer benefit packages that include health, dental, vision, retirement plans, and more, options that are typically unavailable or too costly for small businesses to offer directly.

5. Increased employee satisfaction

Timely payroll, accessible HR support, and solid benefits contribute to a better employee experience. Satisfied employees are more likely to stay, reducing turnover and improving overall productivity and working culture.

For instance, on average, businesses working with PEO companies report an annual growth rate of 4.3% - more than double the rate of businesses that manage HR independently.

These advantages can help your business reduce administrative overhead, stay compliant, and offer a more stable and supportive environment for your employees.

What is HRO?

Human Resource Outsourcing (HRO) is a service model where a business delegates specific HR tasks to an external provider. Unlike a PEO, an HRO does not enter into a co-employment agreement. Your company retains full legal responsibility for employees while outsourcing selected HR functions to a third party.

HRO providers typically support tasks such as:

- Payroll processing

- Benefits administration

- Recruitment and hiring support

- Employee training

- Compliance monitoring

This model gives companies more flexibility in choosing which HR areas to outsource while maintaining direct control over employee management.

According to the Society for Human Resource Management (SHRM), outsourcing certain HR functions can improve internal efficiency and reduce operational costs, particularly for companies that don’t require full-service HR support.

How HRO works?

Human Resource Outsourcing (HRO) provides targeted support for specific HR functions based on the needs of your business. Unlike PEOs, HRO providers do not share legal responsibility for employees. Instead, they deliver selected services while your company retains full control over HR decisions and employee management.

Here’s how a typical HRO process works:

- Initial assessment - The HRO provider reviews your existing HR setup to identify areas that can be improved or outsourced.

- Service agreement - You define which functions to delegate, such as payroll, compliance tracking, or recruiting and formalize these in a contract.

- Implementation of services - The HRO sets up systems and workflows to handle the agreed-upon tasks. This might include configuring payroll software, creating job postings, or updating compliance procedures.

- Ongoing support and updates - The HRO continues to manage the selected HR functions and provides updates on regulatory changes or industry best practices relevant to your business.

This approach is often used by companies that want more control over HR strategy while reducing the administrative workload involved in day-to-day operations.

Benefits of using an HRO

Working with a Human Resource Outsourcing (HRO) provider can offer practical advantages for businesses that want to maintain control over HR decisions while reducing the administrative load. Here are some of the main benefits:

1. Cost efficiency

Instead of maintaining a full in-house HR team, businesses can outsource only the functions they need. This can lower overhead costs and improve budget flexibility.

2. Operational focus

Outsourcing routine HR tasks—such as payroll, compliance tracking, or benefits administration—allows internal teams to focus on other areas of the business, such as operations or customer service.

3. Specialized knowledge

HRO providers often have dedicated experts in areas like labor law, tax regulations, and employee benefits. This can improve accuracy and reduce the risk of compliance errors.

4. Scalability

As your business changes, HRO services can be adjusted to match your current needs, without the delays or costs associated with hiring or training new staff.

5. Legal and regulatory support

HRO providers stay informed on evolving employment laws and help apply necessary updates to your HR processes. This reduces the risk of fines or legal issues related to non-compliance.

By outsourcing selected HR responsibilities to an HRO, businesses can improve efficiency, lower costs, and ensure access to up-to-date HR expertise, while keeping control over internal decision-making.

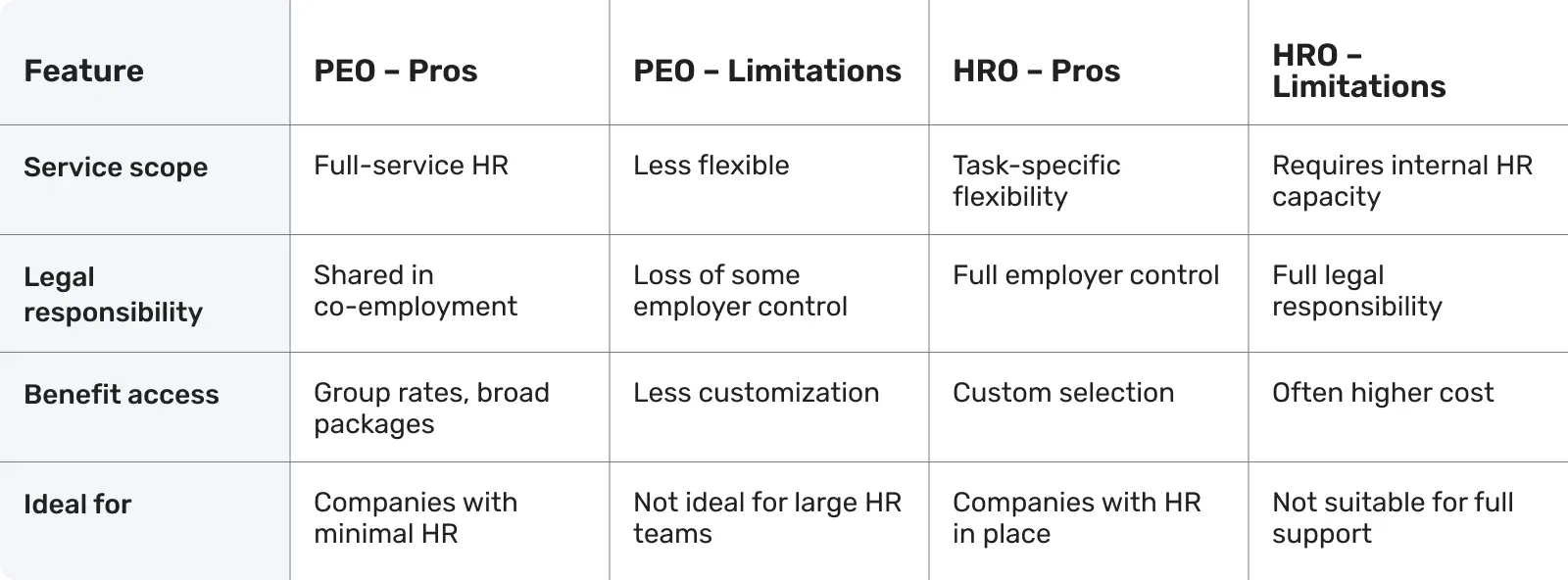

PEO vs. HRO: Key differences

1. PEO vs. HRO: Service structure

The way a PEO and an HRO deliver services is different.

A PEO (Professional Employer Organization) works through a co-employment agreement. This means the PEO shares legal and administrative responsibilities with your business, including payroll, tax filing, and employee benefits. Services are usually offered as a bundled package, which allows the PEO to manage multiple HR functions under one contract.

An HRO (Human Resource Outsourcing) provider does not become a co-employer. Instead, you outsource specific tasks - such as payroll, recruitment, or compliance monitoring, while keeping full control over your employees and HR strategy. This setup gives businesses more flexibility to choose only the services they need.

The choice between these two models depends on how much internal HR capacity you have and whether you need full-service support or help with selected tasks.

2. PEO vs. HRO: Compliance management

Compliance management is one of the most important differences between a PEO and an HRO.

Why?

A PEO shares legal responsibility for compliance with employment laws, tax filings, and benefit-related regulations. Because the PEO is the official employer of record, it actively monitors regulatory changes and applies them on your behalf. This structure can reduce the risk of errors or fines, especially helpful for businesses operating in multiple states or countries with varying legal requirements.

In contrast, an HRO provides advisory support for compliance, but the legal responsibility remains entirely with your company. While HRO providers can help interpret laws and recommend best practices, they do not assume liability if something goes wrong.

This distinction matters. If your business needs hands-on compliance management and shared legal accountability, a PEO may be the better fit. If you prefer to keep control in-house while receiving expert guidance, an HRO could be more appropriate.

3. PEO vs. HRO: Employee benefits

The way employee benefits are handled is another key difference between a PEO and an HRO.

A PEO provides access to a bundled benefits package, which typically includes health insurance, retirement plans, and other standard offerings. Because PEOs group employees from multiple client companies, they can often negotiate better rates with insurance providers. This arrangement can make it easier for smaller businesses to offer competitive benefits that are usually available only to larger employers.

An HRO, on the other hand, supports your business in selecting and managing benefits independently. While this gives you more control over the structure and provider of each benefit, it generally doesn’t include access to group purchasing power. As a result, the cost or coverage options may not be as favorable as those offered through a PEO.

Choosing between the two depends on whether your priority is gaining access to broader benefit plans through a pooled model (PEO), or maintaining full control over your offerings (HRO).

4. PEO vs. HRO: Administrative tasks

The way administrative tasks are managed is another clear difference between a PEO and an HRO.

A Professional Employer Organization (PEO) typically takes over most routine HR administration. This includes payroll processing, tax filings, employee onboarding paperwork, and regulatory reporting. These tasks are handled under a single agreement, reducing the amount of manual work required from your internal team and helping ensure consistency and accuracy across all HR operations.

An HRO (Human Resource Outsourcing) provider, in contrast, supports only the functions you choose to delegate. You may outsource payroll, for example, but continue to handle compliance or onboarding internally. This setup provides more flexibility but also requires more internal oversight to manage what remains in-house.

The right choice depends on your current capacity: if you want to reduce involvement in day-to-day HR tasks, a PEO offers more complete coverage. If you need targeted support while keeping control over core HR processes, an HRO may be a better fit.

PEO vs. HRO - Which one to choose and when

When a PEO might be the right choice

A Professional Employer Organization (PEO) is a good option for businesses that need broad HR support and prefer not to manage administrative tasks internally.

This model is especially useful if your business is:

- Operating in multiple states or countries where employment laws vary

- Lacking internal HR staff or resources to handle compliance and payroll

- Interested in offering competitive employee benefits that may be difficult to access independently

Using a PEO allows you to outsource responsibilities like tax reporting, benefits administration, and regulatory compliance, while still managing your team’s day-to-day activities.

For companies that want to reduce administrative workload, improve consistency, and stay current with employment regulations, a PEO offers a practical, centralized solution.

When an HRO might be the right choice

A Human Resource Outsourcing (HRO) provider is well-suited for businesses that want to outsource selected HR tasks while maintaining full control over employee management and HR strategy.

This model is a good fit if your company:

- Has an existing internal HR team but needs additional support in specific areas such as payroll, recruitment, or compliance tracking

- Prefers to avoid entering a co-employment arrangement

- Needs flexibility to scale or adjust HR services based on changing operational needs

- Wants to customise HR functions without relying on bundled services

Choosing an HRO allows you to decide which tasks to delegate and which to manage in-house. It offers a focused, adaptable approach that supports your internal capabilities rather than replacing them.

Making the Right Choice Between PEO and HRO

Deciding between a Professional Employer Organisation (PEO) and a Human Resource Outsourcing (HRO) provider depends on the level of HR support your business requires and how much control you want to retain over HR functions.

A PEO may be a better fit if your company needs full-service support, including payroll, compliance, and benefits and wants to reduce administrative workload through a co-employment model. This can be especially helpful for businesses without a dedicated HR department or those navigating complex regulatory environments.

An HRO, by contrast, is more suitable for companies with internal HR capabilities that need help with specific tasks. It allows you to maintain full legal responsibility for your workforce while outsourcing selected functions such as recruitment, payroll, or compliance guidance.

Both models can improve efficiency, but the right choice depends on your internal resources, regulatory exposure, and preference for either bundled or customised services.

What to consider in 2026: Regulatory shifts that may impact your decision

As HR and employment regulations continue to develop, choosing between a PEO and HRO isn’t just about structure or cost, it’s also about which model can adapt to increased complexity.

In 2026, businesses should be aware of:

- Diverging state laws: Even if policy becomes more business-friendly, countries are introducing more varied rules around wage transparency, paid leave, workplace privacy, and data security.

- Stricter rules on workplace AI: New regulations are emerging to govern how AI is used in hiring and HR processes. PEOs and HROs using these tools must be able to demonstrate fairness, transparency, and compliance.

- Greater immigration enforcement: Businesses may face more audits and scrutiny related to employee eligibility, documentation, and verification processes.

- Rising cybersecurity expectations: With more employee data at risk, both PEOs and HROs need to meet higher standards in breach prevention and data protection.

Need help deciding between PEO and HRO support for your business?

With Native Teams, you don’t have to choose between fragmented services.

You can:

✅ Hire and manage employees across 85+ countries

✅ Stay compliant with local tax and labour laws

✅ Offer competitive benefits without setting up local entities

✅ Simplify payroll, contributions, and HR admin within a single platform

Whether you're looking for full-service HR support or just need help in one area, Native Teams adapts to your needs.

Book a free demo to see how we can support your HR operations - legally, efficiently, and globally.