What Are the PEO Pros and Cons You Should Know in 2026?

When you run a business, you're likely juggling a dozen hats: payroll, compliance, recruiting, employee benefits, etc., and still trying to grow.

That’s where Professional Employer Organisations, PEOs, come in — to take over critical HR tasks.

However, before you opt for a PEO, you should understand its perks as well as shortcomings.

Read on to learn about all the major PEO pros and cons to make a smart, strategic decision.

Let’s dive in!

What is the PEO?

A Professional Employer Organisation (PEO) is a 3rd-party service provider that partners with businesses, especially SMBs, through a co-employment model.

Thus, the PEO becomes the employer of record for tax and compliance purposes, while you retain full control over day-to-day operations and management.

Under co-employment, your company manages your employees' daily tasks, strategic direction, and performance.

On the other hand, the PEO legally shares employer responsibilities, handling HR-related functions such as:

- Payroll processing and tax remittance

- Workers' compensation

- Employee benefits administration

- HR compliance and risk mitigation

- Government reporting and audits.

💡 Did you know that the global PEO market is projected to reach $99.64 billion by the end of 2025, up from $88.72 billion in 2024?

What’s more, it’s expected to grow to $252.23 billion by 2033, reflecting a CAGR of 12.31% during the forecast period.

PEO advantages — What you gain by partnering with a PEO

Let’s check the main advantages that an expert PEO brings to the table.

1. Get access to competitive employee benefits

One of the biggest advantages of partnering with a PEO is gaining access to high-quality, cost-effective employee benefits that small businesses typically couldn’t afford on their own.

PEOs pool together thousands of employees across their client base, allowing them to negotiate large-group rates on:

- Health insurance,

- Dental and vision coverage,

- Retirement plans, mental health services, and even

- Wellness perks like gym memberships.

This group-buying power allows you to offer premium benefits without breaking the bank.

And in a labour market where top talent expects more than just a paycheck, this can be a game-changer for recruitment and retention.

2. Streamline HR and payroll administration

By outsourcing time-consuming functions, such as:

- Payroll,

- Benefits administration, and

- HR compliance to a PEO, you can dramatically reduce administrative overhead and free up valuable hours to focus on strategy, growth, and customers.

In a nutshell, PEOs automate everyday HR tasks.

From processing payroll to handling tax withholdings, benefits deductions, and year-end reporting, they ensure everything is done accurately and on schedule. Many PEOs also provide a documentation generator that automates the creation of employment contracts, policy handbooks, and compliance forms, reducing manual paperwork and human error.

This characteristic is especially valuable if you have multi-state or fully remote teams, where varying tax laws and labour regulations can become a logistical nightmare.

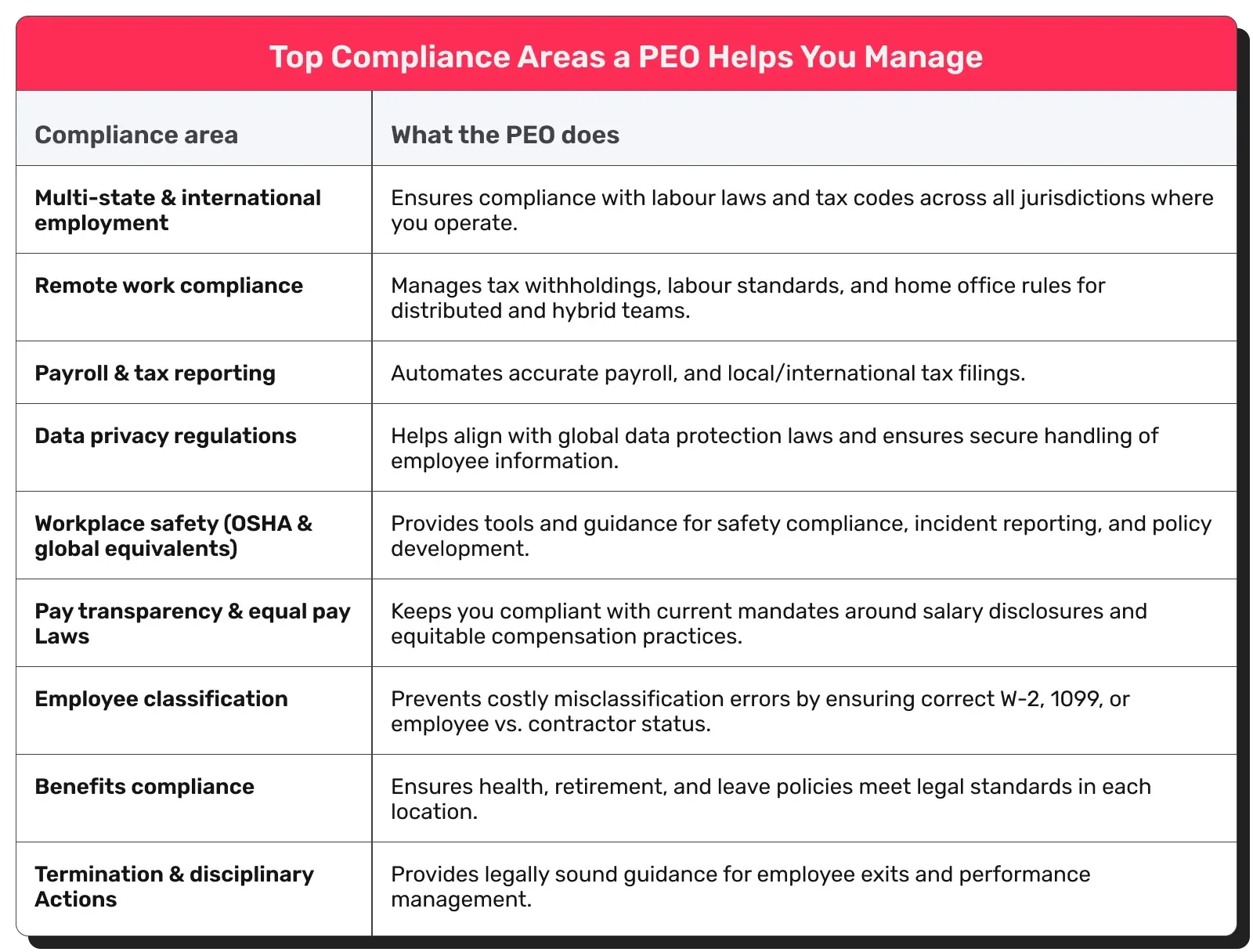

3. Get expert compliance support

Rapidly evolving labour laws, new pay transparency mandates, remote work tax rules, and data privacy regulations make it hard to keep up with all the changes, especially if you operate globally.

Consequently, it means that even a tiny misstep can lead to hefty fines or legal disputes.

However, PEOs offer ongoing, expert-level compliance support from teams of certified HR professionals and legal specialists who stay on top of the latest federal, state, and local laws, so you don’t have to.

They monitor regulatory changes across all jurisdictions where you operate and adjust your policies, contracts, and processes to stay fully compliant and minimise risk and legal exposure.

4. Manage risk and get legal protection

Risk management is one of the most valuable, but often overlooked, benefits of partnering with a PEO.

PEOs don’t just handle administrative tasks. They actually absorb and manage certain HR-related liabilities on your behalf.

These liabilities include critical responsibilities like:

- Workers’ compensation coverage,

- Unemployment insurance filings, and

- Compliance with health and safety regulations.

They also provide guidance and documentation for high-risk situations such as employee terminations, discrimination claims, or workplace harassment reports.

By sharing liability through the co-employment model, a PEO helps protect your business from costly litigation and regulatory penalties.

Many also offer Employment Practices Liability Insurance (EPLI), which provides an extra layer of protection against wrongful termination, retaliation, or discrimination lawsuits.

5. Improve recruitment and employee support

With a PEO, even small teams can offer:

- Premium benefits packages, including health insurance, retirement plans, mental health services, and family support.

- Streamlined onboarding that’s fast, digital, and professional.

- Compliance-backed hiring processes that avoid legal pitfalls and ensure fairness across every geography.

Many PEOs also provide recruitment support tools, including access to applicant tracking systems (ATS), job posting syndication, and guidance on competitive compensation.

Actually, companies using PEOs have 12% lower employee turnover, which isn’t that surprising considering that the PEO companies ensure your employees are supported via:

- Consistent HR support with real-time answers to benefit, payroll, and policy questions

- Robust performance management systems to drive growth and feedback

- Compliant and thoughtful policies around leave, flexibility, and development.

6. Predict costs

PEOs typically offer transparent, predictable pricing models, either as a flat monthly fee per employee or a percentage of total payroll (commonly between 2% and 12%).

This consistency makes budgeting easier and protects you from unexpected HR-related expenses like legal consultations, payroll penalties, or surprise benefits rate hikes.

More importantly, these fees often replace the cost of multiple vendors like payroll, benefits administration, compliance consultants, and HR staff, reducing your overall HR overhead significantly.

Beyond money savings, PEOs help avoid expensive mistakes:

- Late payroll filings or tax errors can trigger fines from agencies like the IRS or equivalent global bodies.

- Non-compliance with evolving labour laws can cost tens of thousands in legal fees or settlements.

- Poorly managed benefits or employee relations can lead to high turnover.

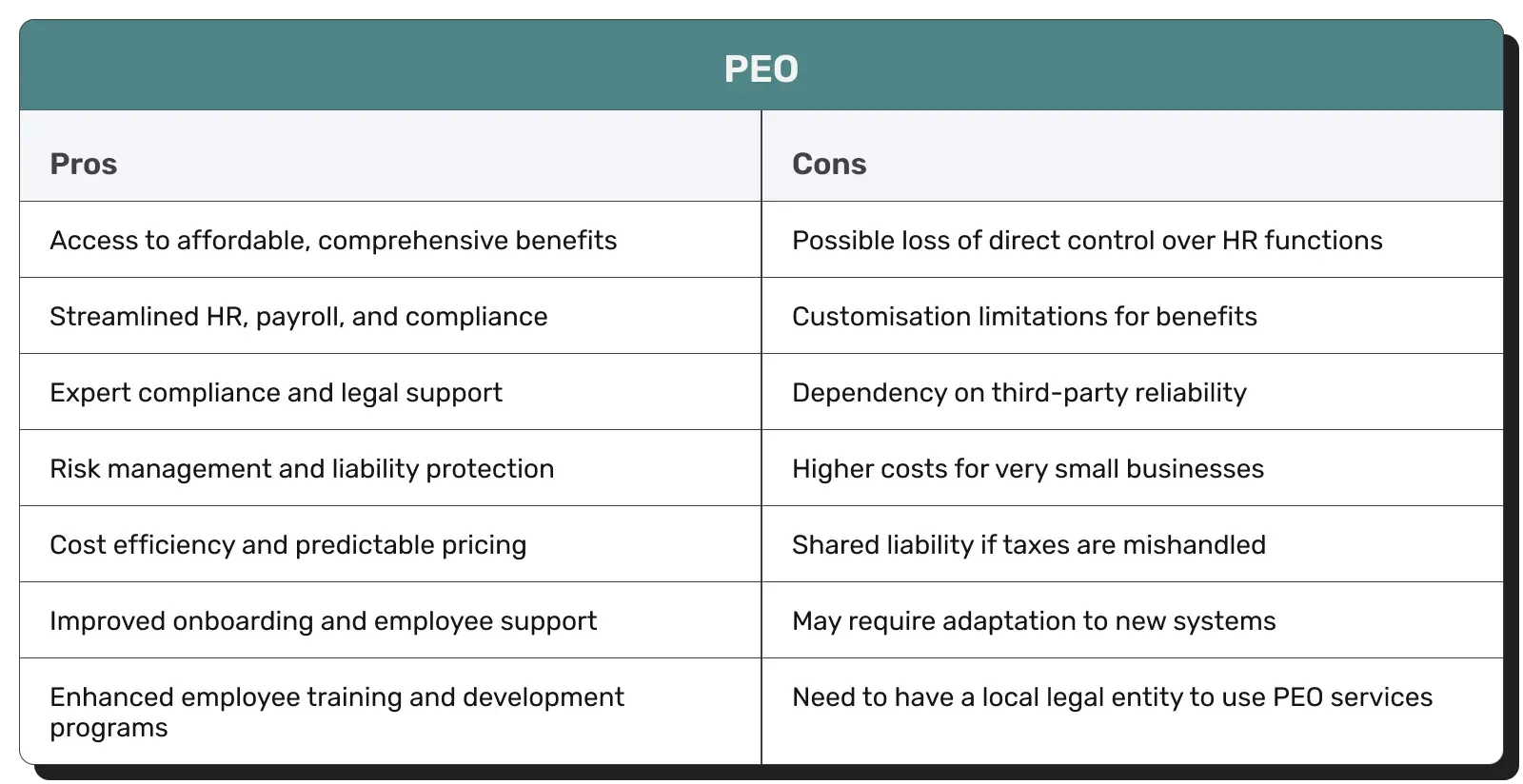

PEO shortcomings — Where PEOs fall short and what to watch for

Despite its many benefits, the PEO also poses specific challenges you should be aware of before you choose to sign the deal.

1. Potential loss of direct control

While PEOs streamline HR, they also require you to give up some direct control. Here’s how that tradeoff can impact your operations:

- Limited oversight — With core HR tasks like payroll, onboarding, and benefits managed externally, it’s harder to ensure everything aligns perfectly with your internal standards.

- Cultural disconnect — PEOs may not reflect your company’s values or culture fully, leading to impersonal policies and potential morale dips.

- Rigid systems — You’ll often need to use the PEO’s platforms and follow their processes, reducing agility and limiting quick policy changes.

- Communication hurdles — Working through a 3rd party introduces delays, especially for time-sensitive HR issues or when managing international teams.

- Talent management gaps — PEOs might not prioritise cultural fit or respond quickly to changing recruitment needs.

2. Customisation limitations

When partnering with a PEO, businesses often encounter significant limitations regarding customising employee benefits and HR solutions.

- PEOs typically offer pre-set plans designed for broad use, not tailored to your workforce. Thus, employee satisfaction can go low if benefits don’t align with their needs.

- Your business may have little say in carriers or coverage. PEOs can switch providers with minimal notice, risking disruption and confusion.

- As your workforce evolves with demands, PEOs may struggle to adapt quickly.

- If you aim to stand out with unique benefits, you may find PEO models too rigid, impacting talent attraction and retention.

- While group rates are a perk, bundled admin fees can add up, especially as your needs outgrow their standard offering.

- Operational hiccups or vendor changes on the PEO’s side can delay employee access to key benefits.

3. Dependency on 3rd-party reliability

Relying on a PEO means trusting a 3rd party with critical HR functions like payroll, compliance, and benefits. While convenient, this creates vulnerabilities:

- Payroll errors or compliance lapses by the PEO can hurt employee trust and expose your business to penalties.

- Slow response times or poor issue resolution from the PEO can frustrate staff and leadership alike.

- Layers between you, the PEO, and employees can cause miscommunication, especially across time zones.

4. Shared liability risks

The co-employment agreement you create with a PEO means that you share responsibilities, as well as liabilities for HR, payroll, and compliance.

Even though PEOs handle payroll taxes and compliance, your business can still be held liable if the PEO fails to pay taxes or follow employment laws.

However, working with an IRS-certified PEO (CPEO) shifts full tax payment responsibility to the PEO, protecting your business from federal tax penalties and wage base resets.

PEOs provide various protections, including workers’ compensation and EPL coverage, but these policies may have limits or exclusions that leave you exposed.

For example, coverage gaps for executives, temporary workers, or incidents occurring before the PEO processes employment paperwork.

5. A local entity is a must

PEOs require your company to already own or establish a legal entity in the country where you’ll hire employees.

Therefore, you must go through the often time-consuming, complex, and costly process of registering and maintaining a local subsidiary or branch before engaging a PEO.

Consequently, it creates a significant barrier if your company wants to quickly scale internationally or hire a small number of remote employees abroad.

Setting up a local entity involves:

- Administrative overhead,

- Legal compliance, tax registrations, and

- Ongoing operational management, which can be inefficient or impractical for startups or businesses testing new markets.

If you don’t anticipate a major expansion in a specific country, owning a local entity just to use a PEO can be a waste of resources.

Let’s recap: Is the PEO the right solution for your business needs?

While PEOs offer valuable support in managing HR, payroll, and compliance, the co-employment model comes with shared liability, limited flexibility, dependency on 3rd-party systems, and the necessity for a legal entity.

As you scale globally or seek more agile, tailored solutions, you may want to explore Employer of Record (EOR) services as a streamlined alternative.

Unlike PEOs, EORs assume full legal responsibility for employment, without co-employment complexities, allowing you to:

- Expand internationally,

- Onboard talent faster, and

- Reduce compliance risks with greater ease and control.

If you want to combine the best of both models, a comprehensive HR infrastructure with full legal compliance across borders, we have a solution for you.

Native Teams offers an all-in-one platform that integrates both PEO and EOR capabilities under one roof.

Whether you're hiring locally or globally, we help you stay compliant, streamline operations, and support your workforce.

How can Native Teams help you unify HR, payroll, and compliance for your global workforce?

By combining EOR and PEO services, Native Teams allow you to hire, manage, and compensate employees across borders without the complexities of establishing local legal entities.

How can we help?

We offer:

✨ Global employment compliance

With legal entities in over 85 countries, we ensure that your international hires fully comply with local employment laws, covering aspects like contracts, taxes, and benefits.

✨ Centralised HR administration

We manage HR tasks such as payroll processing, benefits administration, and compliance documentation through a unified platform, reducing administrative overhead.

✨ Flexible payroll solutions

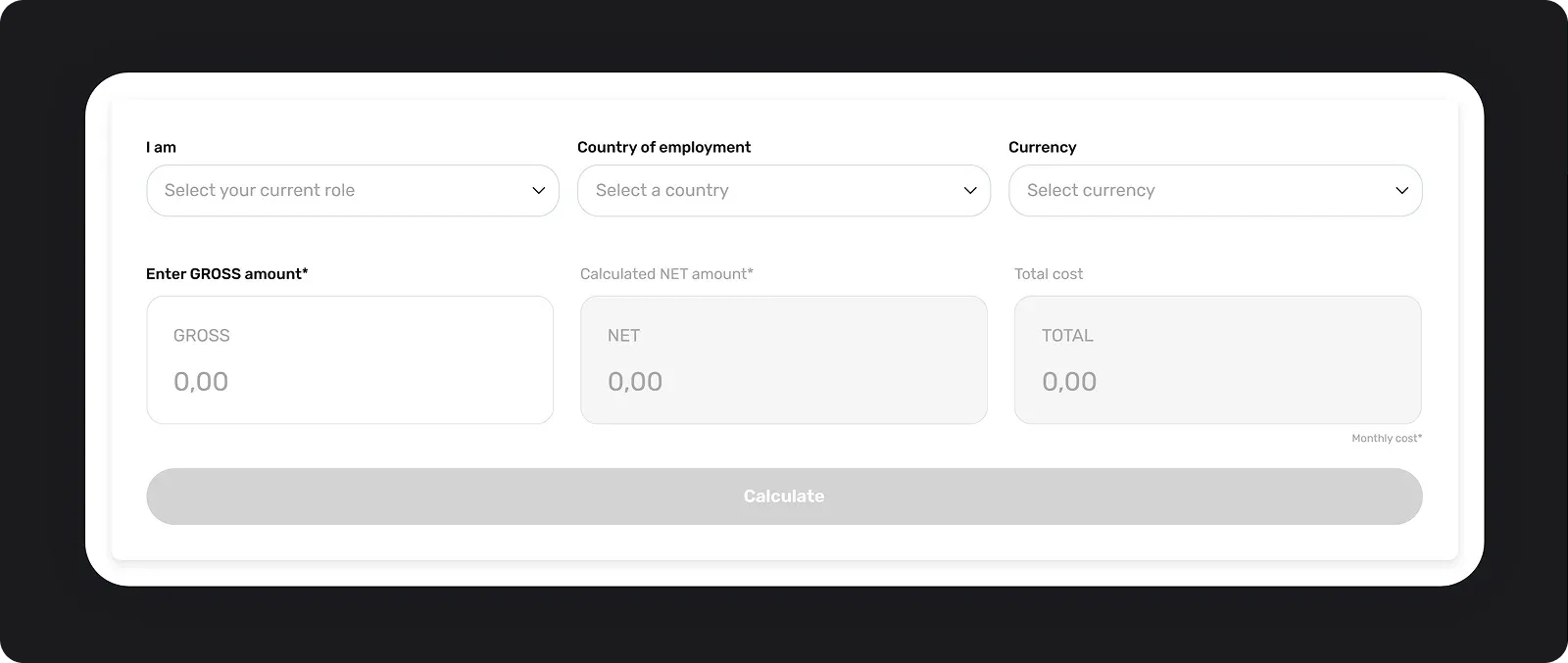

You can use payroll calculators and global payroll services to accurately process salaries, taxes, and contributions, ensuring timely and compliant payments to your workforce.

✨ Employee benefits management

Provide your employees with access to mandatory benefits like healthcare and pensions, as well as additional perks such as wellness programs and professional development opportunities.

✨ Support for freelancers and remote workers

Offer official employment status to freelancers and remote workers, enabling them to receive regular salaries and benefits while ensuring compliance with local regulations.

Curious to find out more?

Book a demo today and explore how we can help you manage international teams efficiently, legally, and all in one place.

Keep learning:

EOR vs Staffing Agency - The Difference & Which One To Choose?