EOR vs Umbrella Company - The Difference & What To Choose?

Among the most common employment options are the Employer of Record (EOR) and the Umbrella Company—two models that sound similar but serve very different purposes.

So, what exactly sets them apart? And more importantly, which one is right for your employment situation?

Read on to learn more about all the key differences between EOR and Umbrella Company to see which one makes the most sense for your business and operational efficiency.

Let’s dive in!

What is EOR: Overview

An Employer of Record (EOR) is a 3rd-party organisation that takes on the legal responsibility of employing workers on behalf of your company.

It allows you to legally hire and pay employees in countries where you don’t have a local entity.

Thus, it handles:

- Drafting and managing compliant employment contracts

- Onboarding and offboarding processes

- Processing payroll and tax deductions

- Managing statutory benefits, such as health insurance, pension, etc.

- Labour law compliance in the worker’s country, while you still manage the employee’s day-to-day tasks and performance.

EORs are a popular solution if you’re looking to expand your teams globally without the need to establish a local branch or subsidiary.

EOR: Pros & Cons

Pros:

- Global hiring made simple: No need for local incorporation.

- Full compliance — Handles tax, labour law, and benefits properly.

- Employee experience — Workers get full employee benefits.

- Risk reduction — Minimises legal and financial liabilities.

Cons:

- May be more comprehensive (and costly) than needed for short-term or contractor roles.

What is an Umbrella Company: Overview

An Umbrella Company is a service provider that employs contractors or freelancers who work on temporary or project-based contracts, typically for end clients via recruitment agencies.

It is particularly common in the UK and EU countries, with specific contracting laws.

An Umbrella Company handles administrative tasks such as invoicing, tax withholding, and compliance with employment laws.

How it works:

- Contract setup — The contractor signs an employment contract with the Umbrella Company, which then partners with recruitment agencies or clients.

- Timesheets and invoicing — The contractor submits timesheets to the Umbrella Company, which then invoices the client or agency for the hours worked.

- Payroll processing — The Umbrella Company deducts taxes, National Insurance (in the UK), fees, and other contributions before paying the contractor.

- Compliance — Ensures adherence to tax laws (for example, IR35 in the UK) to protect contractors and clients from misclassification risks.

Umbrella Company: pros & cons

Pros:

- Simple solution for paying contractors.

- Flexible for short-term, project-based needs.

- No need to set up a legal entity.

Cons:

- Limited to contractors or freelancers.

- No HR or onboarding support.

- Admin fees and tax deductions can lower your earnings compared to direct contracting.

- Not practical for global freelancing.

- Potential for hidden fees and less employee protection.

One of the biggest concerns when using umbrella companies is that some aren’t compliant and engage in tax avoidance schemes.

How to identify a non-compliant Umbrella Company?

To identify a non-compliant Umbrella Company, watch for these key red flags and verification steps:

🚩 Unrealistic take-home pay claims — Offers over 75–80% take-home pay vs. the typical 65–75% after taxes. Claims of "90% retention" are almost always tax avoidance schemes.

🚩 Offshore operations or payments — Companies based in tax havens, such as the Isle of Man or the Cayman Islands, or those using offshore intermediaries to process payments, often avoid UK taxes illegally, exposing contractors to HMRC investigations.

🚩 Lack of accreditation — No membership with FCSA, Professional Passport, or similar bodies. You should check the provider’s website for accreditation logos and confirm directly with the accrediting body.

🚩 Opaque payslips — Fails to provide detailed payslips showing gross pay, tax/NIC deductions, and employer contributions. You can compare payslips with HMRC’s tax calculators to ensure accuracy.

🚩 Hidden fees or charges — Request a full fee breakdown in writing before signing to avoid undisclosed margins on contractor earnings.

As a general rule, always prioritise transparency and accreditation.

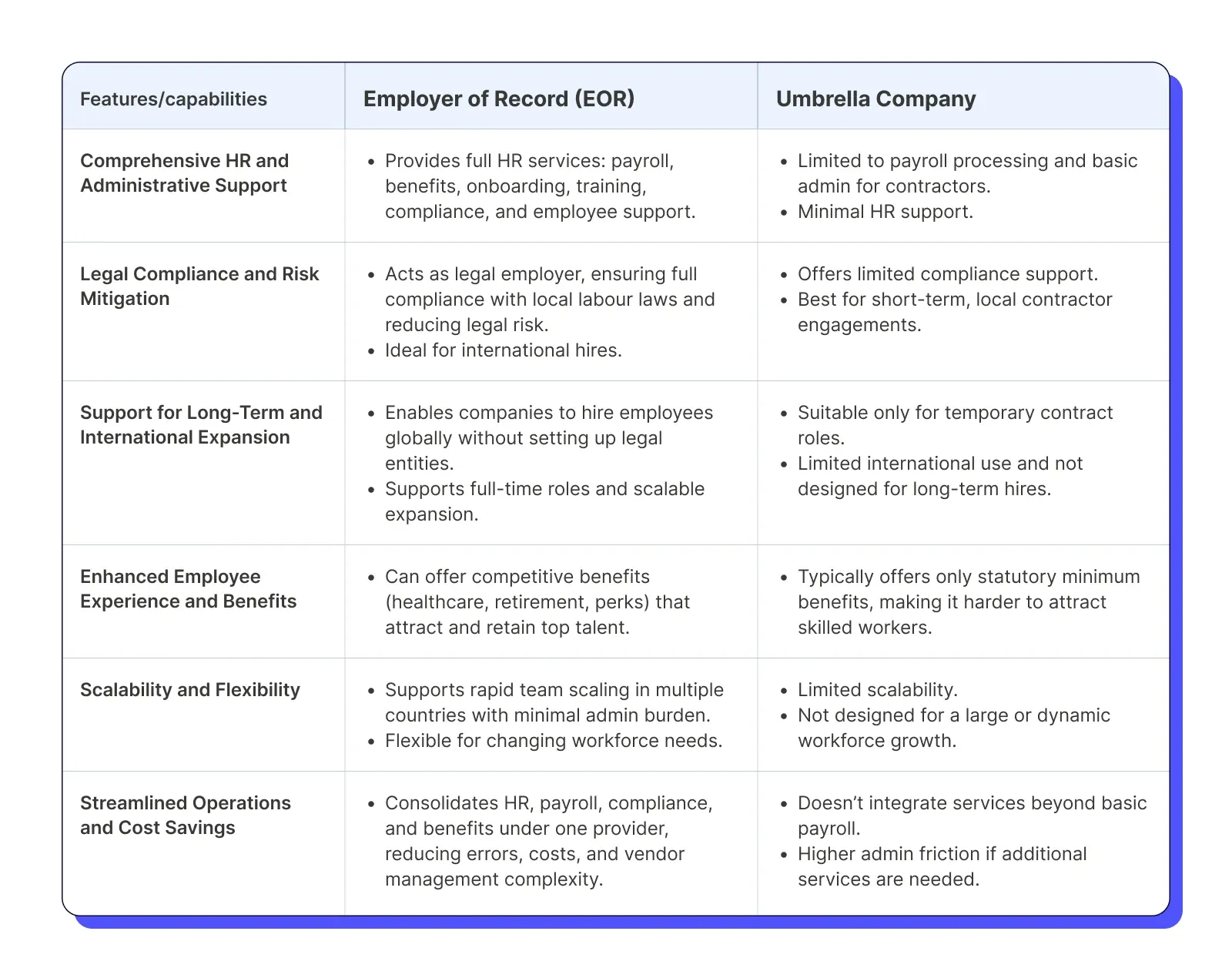

EOR vs. Umbrella Company: 6 key differences you should know about

Here’s a clear breakdown of the key areas of difference to help you opt for the most optimal solution for your business.

EOR vs. Umbrella Company: which one to choose

Choosing between an EOR and an Umbrella Company depends on your business needs, the type of workforce you plan to engage, and your expansion strategy.

When to choose an EOR:

- You want to hire employees (not just contractors) in a foreign country without setting up a local legal entity.

- Your business needs to ensure compliance with local labour laws, payroll, and tax regulations.

- You require HR support, onboarding, employee benefits, and ongoing administrative assistance.

- You’re building a long-term, international team or workforce.

- You want to minimise legal risks and free up internal resources for core business activities.

When to choose an Umbrella Company:

- You only need to hire independent contractors or freelancers, usually for short-term or project-based work.

- Your business operates in a known market and simply needs a compliant way to pay contractors and manage taxes.

- You want a straightforward, intermediary solution for payroll and basic compliance, but will handle HR, onboarding, and management yourself.

- You do not require long-term employment relationships or comprehensive employee benefits.

However, there is a solution that enables you to hire workers regardless of their employment status, while enjoying all the benefits of an EOR provider.

Meet Native Teams!

Hire, pay, and manage globally and stay compliant with Native Teams

Native Teams is an EOR and PEO provider that lets you hire in 85+ countries without the burden of setting up local legal entities.

We handle the hassle of wage reporting, employment taxes, and compliance, so you can focus on growing your business.

With just one payment that covers payroll, taxes, benefits, and fees, you can take on more tasks.

We help you avoid misclassification penalties with types of employment contracts:

- Full-time contract

- Part-time contract

- Contractor agreement, and

- Contractor agreement PRO.

Not only does our solution streamline the entire process, but it also guarantees that all mandatory contributions and benefits are included.

What else is in the store for you?

- Seamlessly handle payments in multiple currencies and minimise transaction fees.

- Guarantee legal employment status, provide comprehensive benefits, and build a fully compliant workforce worldwide.

- Determine your eligibility for tax-free allowances to ensure compliance with local regulations while benefiting from potential tax reductions.

- Streamline your operations by consolidating multiple systems and simplifying currency conversions.

- Do instant fund transfers between wallets in different currencies, eliminating delays and maximising control.

- Gain complete transparency with detailed receipts for every transaction.

- Benefit from a centralised dashboard where you can manage your global team, send payroll invites, and adjust salaries.

- Get detailed reports and insights into employee, country, and role salary costs, helping you optimise your budget.

And the list goes on.

Enticed to dig deeper?

Start with Native Teams today, or book a demo and start hiring internationally hassle-free for any employment type.

FAQ

1. Are there specific industries where EOR is more beneficial than an Umbrella Company?

EOR services are particularly valuable in sectors that require:

- Rapid global expansion

- Strict regulatory compliance

- Long-term or permanent employees

- Complex HR and payroll management.

On the other hand, Umbrella companies are best suited for industries that:

- Rely heavily on contractors and freelancers

- Have project-based or seasonal work

- Need flexibility in workforce management.

2. How do the fees of EORs compare to those of Umbrella Companies?

EORs cost more due to their broader scope and increased legal responsibilities, while umbrella companies offer a simpler and cheaper solution for contractor payments.

Both models have a flat fee structure, with EOR typically taking a percentage of the salary, while Umbrella takes a percentage of the invoice.

3. Can Umbrella Companies provide support for international contractors?

Umbrella Companies can support international contractors through local partnerships, but true global coverage requires hybrid models or EOR solutions for compliance.