Employment

Legal employment for your global team

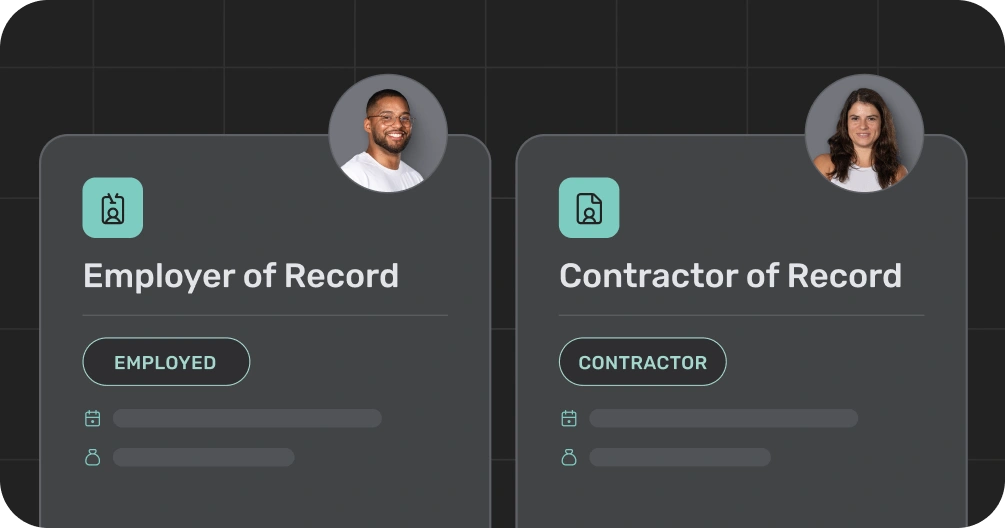

EOR (Employer of Record)

Your global team, locally employed

Entity Management

Set up and manage entities

HR, Payroll & Benefits

Manage all admin tasks from one place

Global Employee Benefits

Premium benefits for your global team

Relocation and Visa

Relocate your team anywhere

Employment Contracts

Localised employment contracts

Your Global Payroll Compliance Checklist

Get our global payroll compliance checklist for free

What you'll learn from this checklist

Understand every country's payroll rules

This checklist breaks down the essentials, including tax filing, social contributions, overtime rules and mandatory benefits. You'll learn exactly how to stay compliant in every region you operate and make an accurate global employment comparison.

Classify workers the right way

Get a clear breakdown of the rules for employees vs. contractors and avoid misclassification risks. Discover what to look out for and how Native Teams' tools help keep your workforce compliant across borders.

Keep payroll data protected

Compliance starts with data protection protocols, like enterprise-grade encryption and GDPR-compliant storage. Use this checklist to determine if your current processes meet these global standards.

Choose payment methods that follow local law

Some countries require local currency, and some require specific rails. The checklist explains what matters, while Native Teams lets you make compliant, transparent payments in multiple currencies.

Stay updated as laws change

Tax rates and reporting regulations often change. Understand how to build processes that stay up-to-date, or offload the automation process to Native Teams, so you never fall behind any tax update.

Who should use this checklist

Perfect for teams that handle payroll, compliance, or cross-border hiring. This guide is especially handy for:

Finance teams

managing multi-country payroll

Compliance teams

ensuring labour laws are followed

Founders & CFOs

expanding into new markets

Payroll managers

working with international employees

You might also be interested in…

Country hiring guides

Understand hiring rules, taxes, and labour laws for 95+ countries.

Employment contract generator

Create locally compliant employee or contractor contracts in minutes.

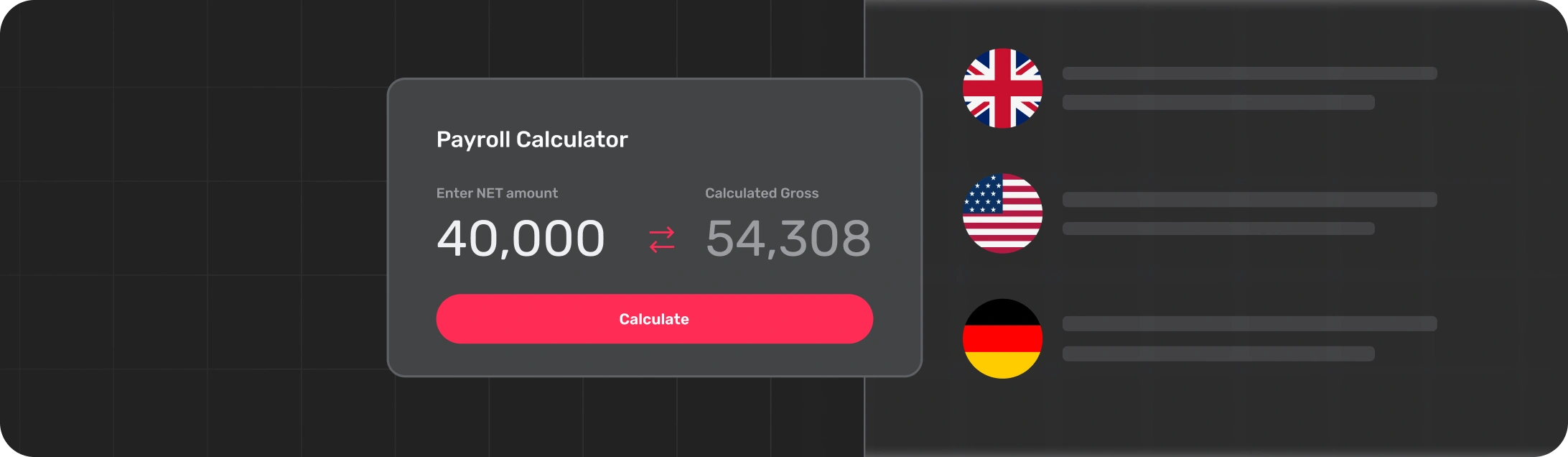

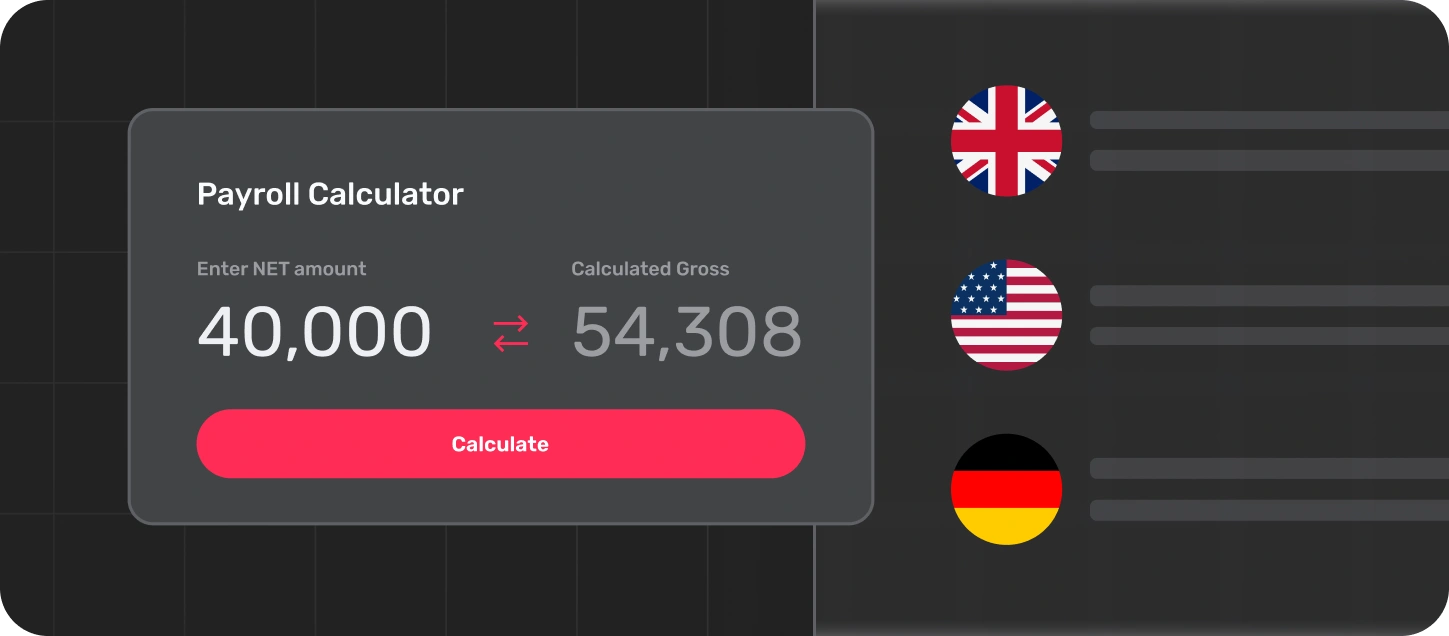

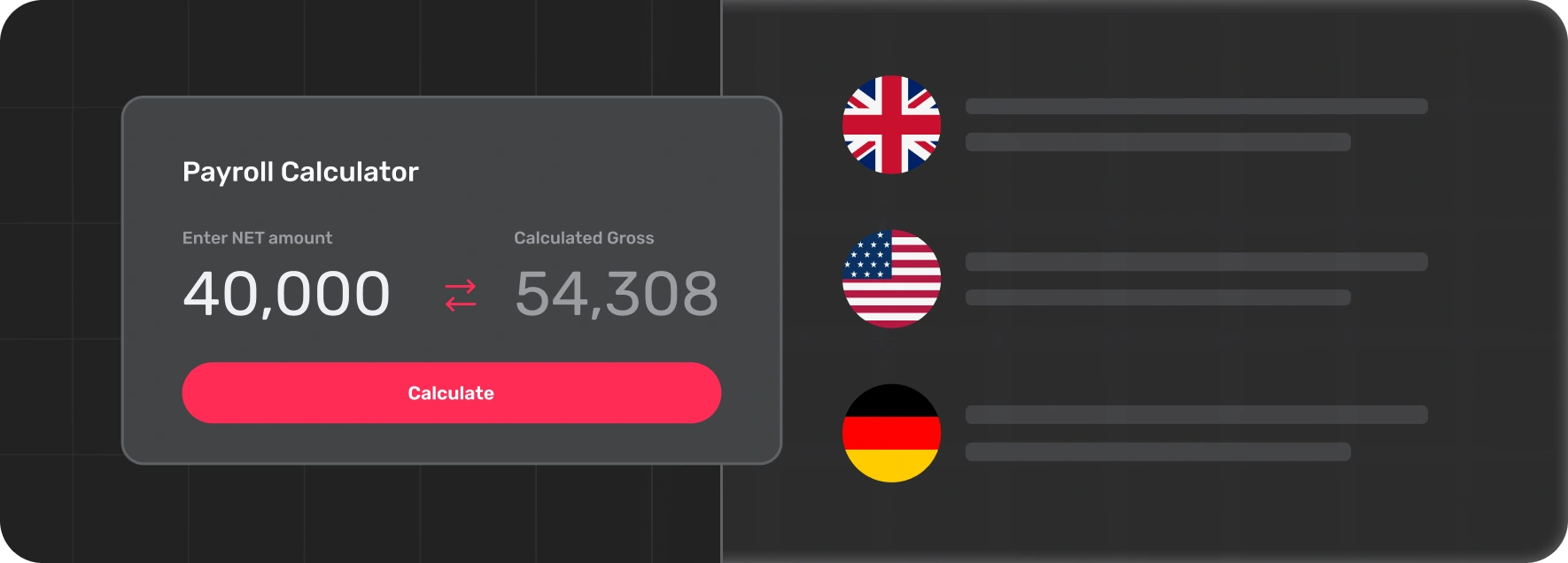

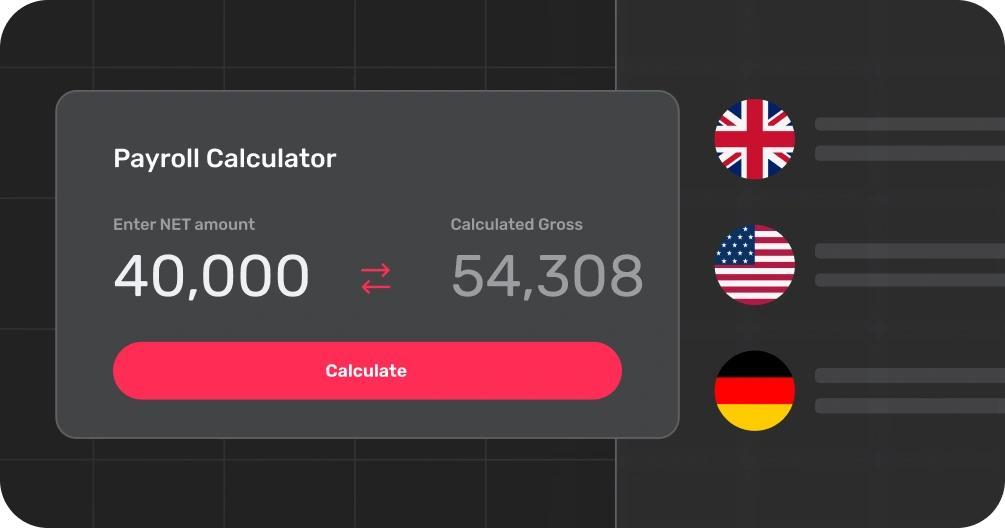

Employee cost calculator

Estimate net salaries, employer costs, and taxes for any country.

Ready for a more compliant way to run payroll?

Get the free payroll implementation checklist for peace of mind in every country you hire in.