Employer of Record vs. Own Entity: Key Differences Explained

Expanding your business across borders is an exciting step, but it raises a big question: Should we hire through an Employer of Record (EOR) or establish our own legal entity?

Both options have their benefits, but which route is right for your business?

Let’s break down the key differences between an Employer of Record and an own entity so you can decide which fits your global expansion best.

What is an Employer of Record (EOR): Overview and benefits

An EOR is a third-party partner that legally employs talent on your behalf in countries where you don’t have a local entity.

While you focus on managing the team’s day-to-day work, the EOR takes care of payroll, taxes, benefits, and compliance with local labour laws.

As a result, you get faster market entry, fewer compliance headaches, and predictable costs, all without the hassle of setting up a company.

These capabilities make EORs perfect for short-term projects, testing new markets, or scaling small to mid-sized teams quickly.

What does "own entity" mean in global hiring?

Setting up your own legal entity means registering a local company, giving you complete control over HR policies, employment contracts, and operations.

This approach builds a strong local presence and boosts your brand credibility.

However, it comes with significant upfront costs, weeks or even months of setup time, and ongoing compliance and administrative responsibilities.

The own entity:

- Is formally registered and legally recognised in the target country.

- Can enter into contracts, sue or be sued, own assets, and pay taxes in its own name.

- Is responsible for full compliance with local regulations, employment laws, tax filing, and governance.

It can be a good solution if you want to:

- Have a permanent local presence for market expansion, credibility, and operational control.

- Fully control HR policies, employment contracts, and compliance.

- Build relationships and credibility with local employees, partners, and customers.

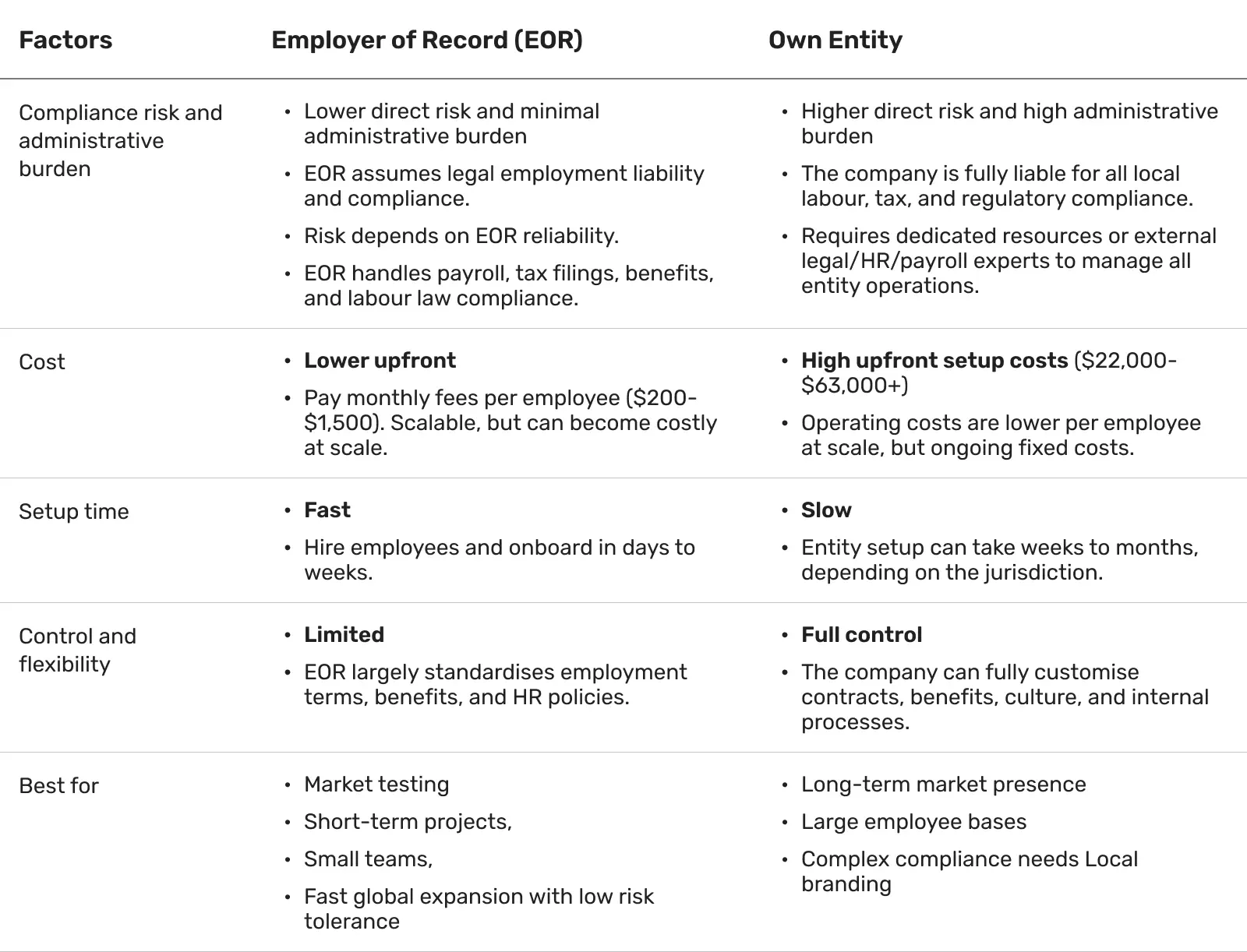

Employer of Record vs. own entity: Where do they differ?

While both options help you hire internationally, the real differences lie in control, cost, compliance, and speed.

1. How do compliance risks differ between using an employer of record and setting up your own entity?

Compliance is one of the biggest challenges in global hiring, and the risks can vary significantly depending on whether you choose an employer of record or establish your own entity.

1.1. Compliance with an EOR

Employer of Record (EOR) services take the compliance burden off your shoulders. They legally employ workers on your behalf and handle everything from payroll and taxes to benefits.

EORs also handle work permits and proper employee classification while ensuring adherence to local labour laws.

This reduces your exposure to costly mistakes, such as tax misfilings, labour law violations, or misclassification penalties.

By ensuring proper classification, they help you avoid costly fines and legal disputes that could affect your global growth.

To stay ahead of changing global regulations, EORs continuously track legal updates across multiple countries.

Many leverage advanced tools such as real-time compliance monitoring, automated contract generation, and localised payroll systems, ensuring accuracy and minimising risk.

But not all EORs are equal. If your provider relies on third-party partners instead of owning local entities, compliance risks rise.

Unclear responsibilities, slower communication, and limited control can lead to gaps in compliance, leaving your company vulnerable to legal and financial risks.

1.2. Compliance with an own entity

Owning a local entity means full accountability rests on your shoulders.

Your company becomes responsible for managing complex local labour laws and tax filings, drafting employee contracts, administering benefits, and meeting all reporting requirements.

As a consequence, this approach requires in-house or local expert legal and HR teams to manage risks effectively.

Any misstep can lead to direct liability, including fines, penalties, or legal action.

Compliance challenges are particularly evident in jurisdictions with complex regulations or those where laws are subject to frequent changes.

Maintaining full compliance requires constant awareness and caution, including regularly updating payroll processes, employment practices, tax procedures, and benefits administration to ensure ongoing compliance.

2. What are the costs of using an employer of record vs. your own entity?

Budget definitely plays a huge part in expansion plans, so let’s see how costs differ for both options.

Both an EOR and setting up your own entity come with their own unique cost structures, which can significantly influence your overall strategy.

Evaluating these expenses early on can help you make a more informed decision that aligns with your company’s goals.

2.1. EOR costs explained

EORs generally have lower upfront costs and enable hiring employees within days, charging a monthly fee per employee that covers payroll, legal compliance, and benefits administration.

EORs typically charge a monthly fee per employee ranging from around $200 to $1,500, depending on the provider, country, service inclusions, and employee salary level.

Common pricing models include a fixed monthly fee per employee or a percentage of payroll, typically ranging from 5% to 15%.

Depending on the provider, there can be onboarding or setup fees, which may be one-time.

This model is highly scalable and flexible for smaller teams or short-term projects, but can become more expensive as headcount grows.

2.2. Own entity cost explained

Establishing a legal entity entails significant initial registration fees, legal and administrative costs, and infrastructure setup, with a longer timeline before hiring can start.

While potentially more cost-effective over a large headcount and extended period, the initial overhead and complexity are much higher.

Thus, setting up a legal entity comes with a big upfront investment.

It involves one-time costs for registration fees, legal and administrative costs, and the expense of setting up infrastructure, all before you can even hire your first employee.

Ongoing entity management includes accounting, auditing, tax filings, payroll, compliance, and HR functions, which can cost several thousand dollars annually.

Additionally, operating an entity requires internal or outsourced resources to maintain compliance, adhere to legal requirements, and manage payroll processes, which represents a significant fixed administrative burden.

Although entity ownership requires a substantial upfront investment and higher fixed overhead, the per-employee monthly cost is usually lower over time for larger teams.

3. Setup time: Employer of Record vs. your own entity?

Speed to market is often a key priority for businesses going global. But how fast can you get started with an employer of record compared to building your own entity?

The timeline for each approach can vary widely, and understanding how long each path takes and what factors impact those timelines is the key to planning a smooth and timely market entry.

3.1. How fast can you hire with EOR?

EORs enable companies to hire employees within days to a few weeks.

This fast timeline is possible because the EOR is already a legally registered employer in the target country, managing all local employment compliance, payroll, and tax duties.

The client company focuses primarily on onboarding and operational management without handling complex legal registrations or regulatory approvals.

As a result, the rapid onboarding enables you to quickly seize market opportunities, test new locations, and scale teams flexibly without the delays and risks associated with setting up an entity.

3.2. How long does it take to set up an entity?

Setting up a local legal entity is a time-intensive process. Depending on the country, it can take anywhere from several weeks to several months to get fully operational.

The process typically involves registering your business, securing tax IDs, opening bank accounts, obtaining regulatory approvals, and meeting requirements such as having local directors or maintaining a minimum capital.

Delays can happen due to differing legal rules, government processing times, and the need for specialised legal and accounting expertise.

Because of these extended timelines, you must plan thoroughly.

Longer lead times often come with higher upfront costs and increased administrative effort.

The timeline can stretch even further if you need additional licenses, approvals, or regulatory steps before you can start hiring.

4. What level of control and flexibility can you expect from an Employer of Record vs. your own entity?

Choosing between an employer of record (EOR) and setting up your own entity often comes down to how much oversight and customisation you need.

The level of control you have over your operations can shape your long-term strategy, so it’s good to know how flexible you are with both options.

4.1. Control level with EOR

EOR standardises and controls employment contracts, benefits packages, and HR policies to a great extent.

On the good side, it simplifies compliance, but it limits tailoring to company culture or unique operational needs.

While you manage employees’ day-to-day work and performance, EOR externally controls legal employment terms and benefits administration.

EORs offer high flexibility to hire and scale rapidly across many countries without investing in local administrative resources or infrastructure.

EOR employees legally work for the EOR provider, potentially ‘blurring’ the local brand identity and limiting direct employee engagement on legal or policy matters.

4.2. Own entity control level

Companies can create fully customised employment contracts, tailored benefits, and HR policies aligned with corporate values and strategic goals.

Owning your entity means direct management of employment terms, compliance, payroll, tax filings, and labour relations.

As a result, it enables more complex and strategic workforce planning.

Additionally, having a registered entity enhances brand reputation, credibility, and the ability to build strong local relationships, including sponsoring visas or bidding for local contracts.

However, this autonomy comes with increased administrative overhead, higher compliance risks, and the need for in-house or outsourced expertise.

Which countries are favourable for either using an EOR or establishing your own entity?

When it comes to hiring abroad, some countries make using an EOR easier, while others favour setting up your own entity.

Local laws, regulatory complexity, and market conditions can all influence which approach works best in a particular region.

Knowing about these differences can help you target the right markets and choose the most strategic option for your global expansion.

Countries and regions that favour EORs

It all depends on local rules and market conditions.

In the UK, across much of Europe, and in many Asian markets, EORs are gaining popularity.

Emerging markets with evolving or unclear labour regulations may also lean towards EOR use initially to reduce compliance risk.

Companies are drawn to the speed, lower upfront costs, and the ability to outsource complex local compliance to specialised providers.

Countries and regions that favour their own entities

On the other hand, the North American markets, as well as some Southern American states, such as Brazil, Argentina, and Paraguay, favour local legal entities.

Switzerland and Saudi Arabia are also among the countries that require legally owned entities.

The main reason for this is due to regulatory, legal, and market-specific reasons. Thus, establishing an entity becomes the only way to maintain full operational control and scale sustainably.

💡 Fun fact:

Did you know that Germany has specific legal restrictions on EOR use under the AÜG law? It limits how long temporary employment via an EOR can last (up to 18 months).

Employer of Record vs. Own entity: Which is the right fit for your business?

The answer depends on your growth goals, budget, compliance needs, and long-term strategy.

Opt for an EOR when speed, reduced compliance risk, and lower upfront costs matter most.

This approach works well for testing new markets, running short-term projects, or managing small to medium teams without in-house local legal expertise.

On the other hand, consider establishing your own entity when you’re planning a long-term presence.

If your goal is to scale teams and if you have the resources to handle complex local compliance, HR, and legal responsibilities, owning an entity provides greater control and stability.

Many companies start with an EOR and transition to a local entity later.

The shift often makes sense as teams grow, costs justify the investment, or greater operational control becomes necessary.

Native Teams supports both approaches, offering flexible EOR solutions as well as services for companies that already have established entities. Let’s check how.

Native Teams: Your all-in-one solution for global hiring and compliance

With a legal presence in over 85 countries, Native Teams delivers legal employment solutions that keep your global workforce fully compliant with local labour laws and tax regulations.

Having entities in each country we operate means that we don’t have to rely on third-party services, giving us full control over compliance, payroll, and HR processes while ensuring a smooth experience for our customers.

Our core solutions include:

1. EOR services

Our EOR services enable you to hire and pay globally without setting up a local entity, while we handle everything from employment contracts to benefits management and administration.

This is what we bring to the table:

✨ Local legal employment: Provide your team proper employment status with local benefits and flexibility.

✨ Compliant contracts & documents: Country-specific contracts tailored to your needs, always aligned with local laws.

✨ Global payroll services: Pay your team in their preferred currency-fast, easy, and compliant.

✨ Employee benefits: Offer health insurance, pensions, and local perks to attract top talent.

✨ Relocation and visa assistance: We handle visas and permits so your team can work anywhere, legally.

You don’t want EOR services, but to set up your own entity? We’ve got you covered.

2. Entity management

We can help you set up your own entities, run payroll, issue contracts, and stay compliant in each country you operate.

We’ll provide:

- Expert-led entity setup tailored to local legal requirements.

- Transparent timelines, cost, and documentation tracking.

- Ongoing support from registration through operational readiness.

Already having your own entity? Not a problem, we have solutions for that as well.

Our team handles employment contracts, social contributions, taxes, and benefits, all tailored to local legal requirements.

Each month, we also run payroll and ensure your team members are paid on time, in their local currency.

And if you run multiple entities, you can instantly activate payroll, compliance, and contract workflow for each country via a single, centralised dashboard for all your legal entities.

3. Gig Pay

Our Gig Pay solution enables you to handle contracts, payments, and compliance all in one place.

How does it function?

- We open a dedicated EU IBAN in your company’s name and manage operations and fees automatically.

- Main salaries are sent directly from the EU account to workers, ensuring transparency, without reliance on wallets.

- Bonuses, tips, or extra earnings can go into digital wallets, which are linked to physical or virtual cards for spending and withdrawals.

- Payment processing is handled via licensed third-party processors.

Regardless of the solution that you choose, we also provide global payroll capabilities for each.

4. Global Work Payments

We run compliant payroll in over 85 countries, and our flexible payroll solutions include:

✨ Payroll processing: Streamlined handling of salaries, tax withholdings, and social contributions.

✨ Multi-currency support: Easily pay employees in multiple currencies to accommodate your global team.

✨ Expense management: Simple tools to track, approve, and reimburse employee expenses without hassle.

✨ Payroll calculator: See hiring costs upfront with detailed salary and tax breakdowns.

✨ Detailed payslips: Your employees will receive payslips that showcase their earnings, deductions, and taxes.

Curious to know more?

Book a free demo today to learn how you can start expanding globally with or without your own entity.

Keep learning:

EOR Compliance Checklist: What You Need to Know Before You Hire

What is a PEO? Understanding Co-Employment and HR Support Services