What are the Real Global Payroll Costs in 2026?

Payroll isn’t just about what you pay employees, but also about everything you must pay because of them.

Hidden fees, currency exchange fluctuations, and cross-border compliance penalties can catch you off guard with costs you didn’t budget for.

Read on to see the real global payroll costs you need to consider to get a practical view of what international payroll really means and how to manage it strategically.

3 main elements that constitute global payroll costs

When you think about payroll, you may often focus on one simple figure: the salary paid to the employee. However, true payroll costs go beyond base pay.

To budget accurately and remain compliant, you must understand the full scope of what constitutes global payroll costs.

1. Base salary vs. total compensation

The base salary is only the starting point. Total compensation includes everything an employee receives, both monetary and otherwise:

- Bonuses and incentives (performance, signing, retention)

- Equity or stock options

- Allowances (housing, transport, meals)

- 13th or 14th-month pay, mandatory in many countries like the Philippines or Brazil

- Commission structures often common in sales roles.

Not accounting for these extras when budgeting for new hires or expanding internationally can cause financial strain down the road.

2. Inclusions: The real cost categories

Besides direct payments to employees, you must also take into account a range of additional costs related to hiring internationally:

- Employer payroll taxes that vary widely by country.

- Mandatory benefits, which are non-negotiable in many countries and include: health insurance, pension contributions, paid leave (parental, vacation, sick days), and severance protections.

- Compliance and legal costs

These costs cover local employment contracts that comply with country-specific labour laws, ongoing legal reviews of tax updates and labour regulations, and the risk of fines or back pay due to employee misclassification. For example, hiring a contractor who should be an employee.

- Currency exchange and banking fees. Variability in exchange rates can lead to unpredictable increases in costs. Also, international wire transfer or FX conversion fees add to the administrative overhead

3. Direct vs. indirect payroll costs

Another crucial set of costs to distinguish is direct and indirect costs. Direct costs include salaries, employer taxes, benefits, and subscriptions to payroll providers.

On the other hand, indirect costs cover the time spent by HR or finance teams managing payroll compliance across countries, as well as legal counsel, operational risks, and other related expenses.

Other key contributors to global payroll costs include:

- Turnover and onboarding (with associated training costs),

- Multi-country pay schedules,

- Difficulties with timely payments due to local holidays and banking practices, and

- The need for transparent, consolidated payroll reporting at the global level.

💡 Did you know?

According to a Forrester report, organisations typically rely on six separate tools to manage payroll.

50% of all teams combine internal and external resources, resulting in duplicate costs and unnecessary overspending.

An astonishing 97% said a single payroll solution would be extremely valuable.

Thus, although AI-driven, cloud-based payroll systems and unified dashboards come with upfront costs, they deliver significant long-term savings and operational efficiency when scaled properly.

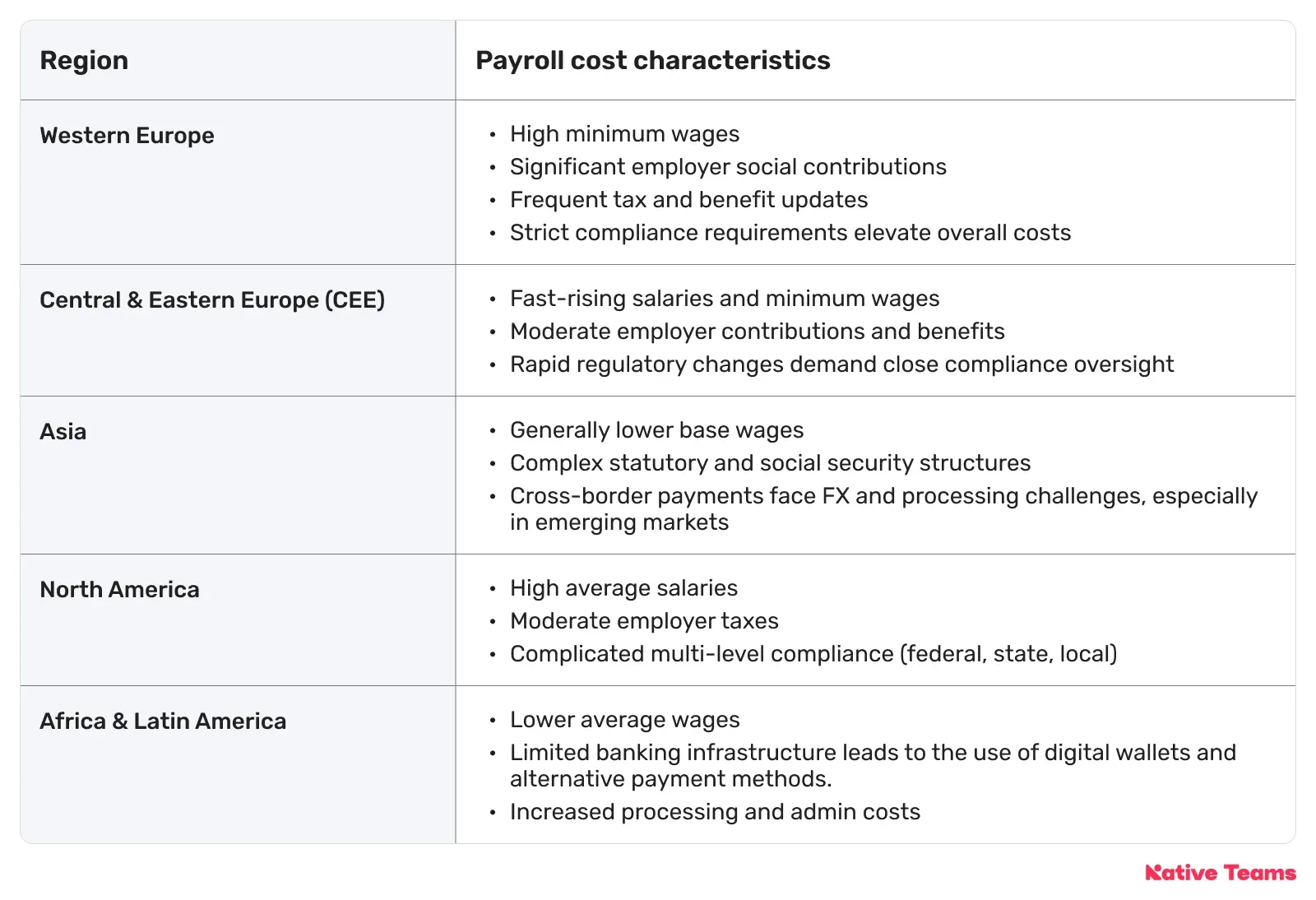

How do payroll costs vary across different regions?

Payroll costs vary significantly by region, driven by the following factors:

1. Wages and compensation

Employee salaries are the largest payroll cost and show the greatest regional variance.

Wages in North America and Western Europe are generally higher than those in Asia, Latin America, and Africa.

For example, average payroll expenses are much lower in countries like India or Vietnam compared to the US or Germany, reflecting differences in minimum wage laws and market salary rates.

2. Payroll taxes and social contributions

Payroll taxes and statutory contributions, such as social insurance, pension funds, and healthcare, differ by country and significantly impact costs.

European countries, particularly in Scandinavia and Western Europe, often have high employer social contributions, whereas some countries in Asia or the Middle East have lower statutory rates.

3. Regulatory and compliance costs

The complexity and frequency of regulatory changes vary. Countries with frequent updates to tax bands or statutory benefits, such as the Netherlands, require more resources for compliance.

Handling regional employment contracts and adapting to local pay frequency customs, such as 13th or 14th-month salary provisions in countries like Spain, also adds to the cost.

4. Currency and payment challenges

Processing payroll in multiple currencies introduces foreign exchange (FX) risk and often results in additional transaction fees, especially for emerging markets with unstable currencies or restrictive banking systems.

What trends are influencing payroll cost management strategies?

As global payroll becomes more complex, you have to rethink how you manage costs by strategically transforming payroll operations.

The most influential trends indicate a shift toward smarter, tech-enabled, employee-friendly systems that prioritise efficiency, security, and agility.

1. Automation and Artificial Intelligence (AI)

Organisations are leveraging AI and robotic process automation to handle repetitive payroll tasks, predict errors, deliver real-time analytics, and enhance compliance.

As a result, you can reduce labour costs, increase speed, and support proactive cost management.

2. Tech stack consolidation

Remember the Forrester report a few lines ago?

It comes as no surprise that companies started shifting away from fragmented payroll solutions towards unified, cloud-based systems that integrate HR, payroll, time tracking, and analytics.

These integrated systems reduce the risk of data duplication and errors while minimising the need for multiple vendor contracts.

They also simplify onboarding, tax reporting, and end-to-end payroll management.

3. Real-time analytics and data-driven strategy

With advanced dashboards and data tools, payroll teams can now monitor costs, forecast liabilities, and align workforce spending with broader business goals.

These capabilities enable more agile decisions and support both compliance and financial forecasting.

Advanced payroll analytics deliver maximum value when integrated with comprehensive ERP systems.

4. Self-service and employee empowerment

Modern payroll portals enable workers to manage tasks such as updating personal information, submitting leave requests, and accessing pay slips independently.

At the same time, payroll managers can use intuitive setup tools to configure compliance settings or onboard new employees faster.

This reduces HR workload and enhances transparency, which contributes to both cost savings and higher employee satisfaction.

5. Flexible and on-demand pay

More employers are offering flexible payroll cycles and on-demand access to earned wages as a response to worker preferences for greater financial control.

While these innovations can support employee retention, they also introduce new operational requirements, including real-time liquidity management and precise regulatory handling.

6. Increased data security and compliance

With payroll data increasingly targeted by cyber threats, you should prioritise data security and compliance.

Investments in encryption, multi-factor authentication, secure transfer protocols, and AI-based threat detection are becoming standard.

At the same time, you must comply with evolving global privacy laws, such as the GDPR and CPRA, among others.

While these safeguards add upfront costs, they’re essential for protecting employee data and avoiding costly breaches or regulatory fines.

7. Payroll outsourcing and global scalability

As global expansion is getting in full swing, outsourced payroll partners are becoming popular solutions to help navigate cross-border compliance and scale efficiently.

Global payroll providers and Employer of Record (EOR) services offer the infrastructure and local expertise you need to enter new markets without establishing legal entities in every country.

As a result, this approach delivers predictable costs, faster market entry, and reduced internal complexity.

Let’s recap: Best practices for controlling global payroll costs

If you want to manage payroll efficiently, you should apply smart, proactive cost-control strategies:

- Consolidate payroll platforms to eliminate data silos, reduce license fees, and improve accuracy.

- Benchmark compensation across countries to optimise cost-to-talent ratios.

- Leverage real-time analytics to monitor workforce costs, track overtime, and prevent overpayment.

- Implement automated compliance tools to avoid penalties.

- Use self-service portals to cut down HR overhead and streamline workflows.

- Negotiate with vendors and EORs for transparent pricing and bundled services.

Don’t forget that payroll is one of the largest operating expenses.

Therefore, small improvements in accuracy, automation, and process efficiency can result in substantial savings.

How can you efficiently manage global payroll costs with Native Teams?

Native Teams offers a unified EOR and PEO solution that provides legal employment, region-specific contracts, and ensures compliance with all tax, social security, and labour regulations in over 85 countries.

Thus, we:

✨Offer a single platform to manage payroll for employees and contractors, centralising all payroll data, automating calculations, and streamlining the entire process.

Thus, you can reduce manual workloads, minimise costly errors, and get real-time visibility into payroll costs and key metrics.

✨ Support multi-currency payroll and automate conversions at real-time exchange rates.

Our payments hub allows you to pay international employees and contractors quickly in their local currencies, avoiding hidden fees and FX discrepancies.

CSV bulk uploads and a unified dashboard enhance efficiency for mass payments, especially for gig workers or large distributed teams

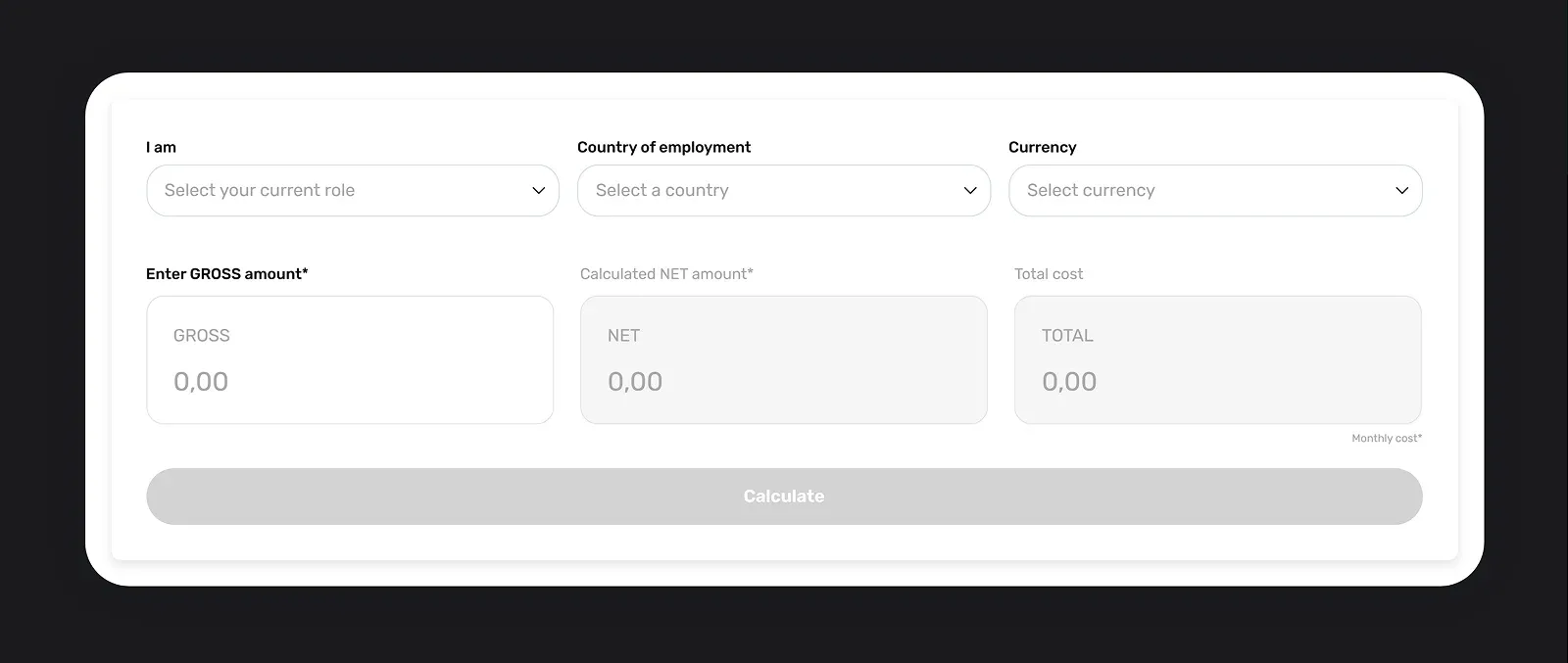

✨ Accurately determine salary costs and get a detailed breakdown of the net and gross salaries, along with detailed insights into social security contributions, tax obligations, and other deductions in the selected country.

✨ Automatically handle tax filings, benefits administration, and statutory deductions for each country, ensuring timely and accurate compliance.

Detailed reporting and dashboards enable you to track liabilities and optimise costs on a global scale without relying on disparate, disjointed systems.

✨ Offer flexible pricing and services tailored to your needs. Our solution easily scales as you expand, removing administrative barriers and letting you focus on strategic growth instead of back-office complications.

Nonetheless, choosing an EOR provider isn’t only about the price, it’s about what you actually get for it.

While others charge extra for admin support, compliance, and local expertise, Native Teams includes everything in one clear, cost-efficient package. No unexpected add-ons and hidden fees.

Schedule a free demo today to see how you can streamline your global payroll and optimise costs.