What's the Difference Between Net and Gross Income?

Did you know that in France, employees may only keep around 65% of their gross pay, while in Cyprus, it’s closer to 86%?

For employers, the gap is even more dramatic.

If you don’t account for these differences, you risk overestimating your budget, underwhelming your team, and falling behind competitors who adjust compensation to local markets.

That’s why understanding the difference between gross vs.net income helps you avoid overspending on compensation packages or underpaying your team when expanding into new markets.

Let’s figure it out!

Understanding net income: Earnings after tax and deductions

Net income is the amount that ends up in your employees’ bank accounts after all mandatory and voluntary deductions are taken from gross pay.

These deductions can include income taxes, social security contributions, health insurance premiums, and retirement plan contributions.

Often referred to as ‘take-home pay,’ net income determines how much money employees actually have available for living expenses, saving, and financial planning.

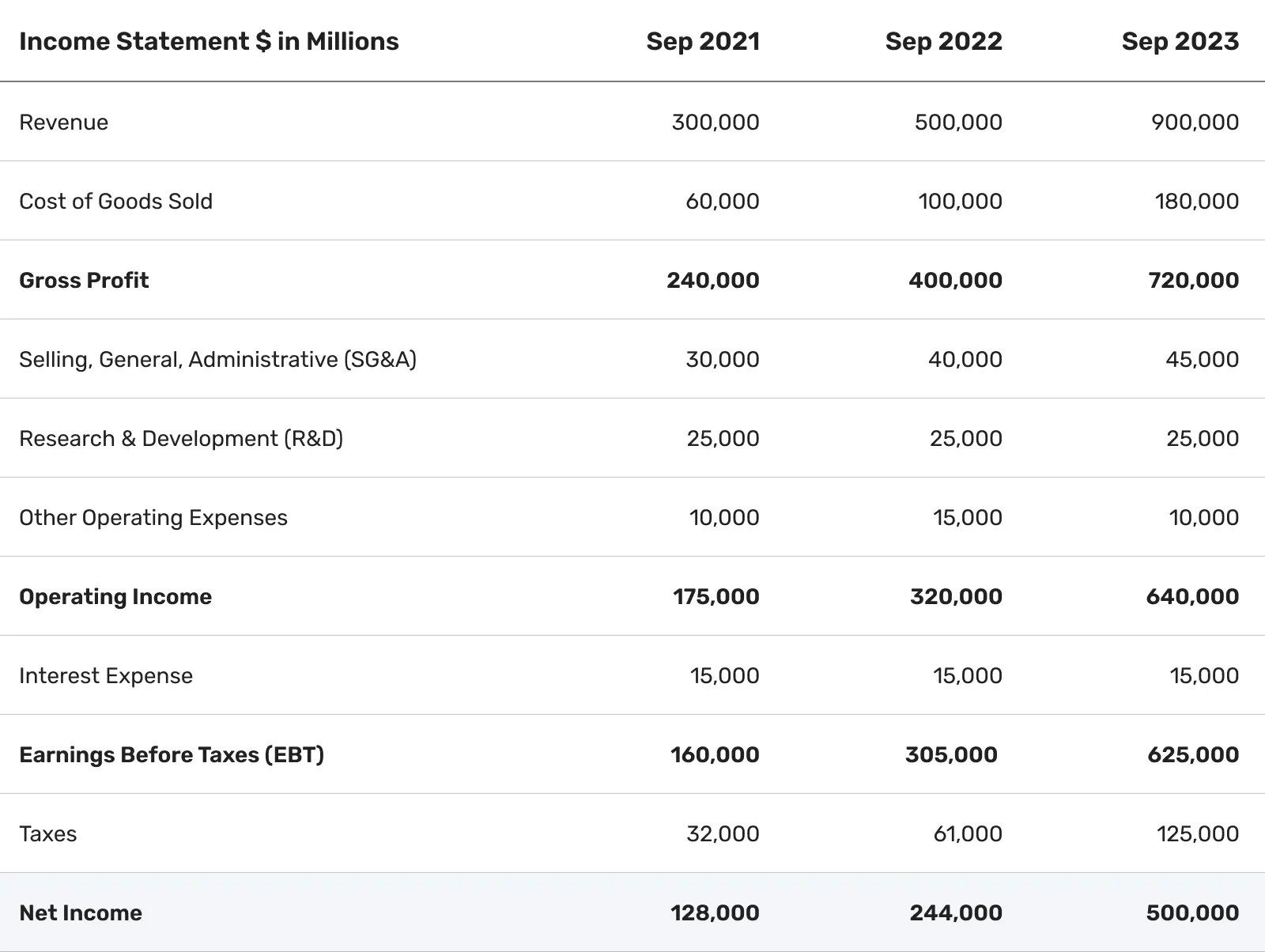

What does net income mean for businesses?

For companies, net income is the ‘bottom line’, the ultimate measure of profitability once you account for all costs.

It’s what remains after deducting not just operating expenses but also interest on debt, depreciation, amortisation, and taxes from total revenue.

Net income reflects the complete financial picture.

It answers the question: After everything is paid, suppliers, staff, rent, interest, taxes, how much profit is actually left for reinvestment, dividends, or reserves?

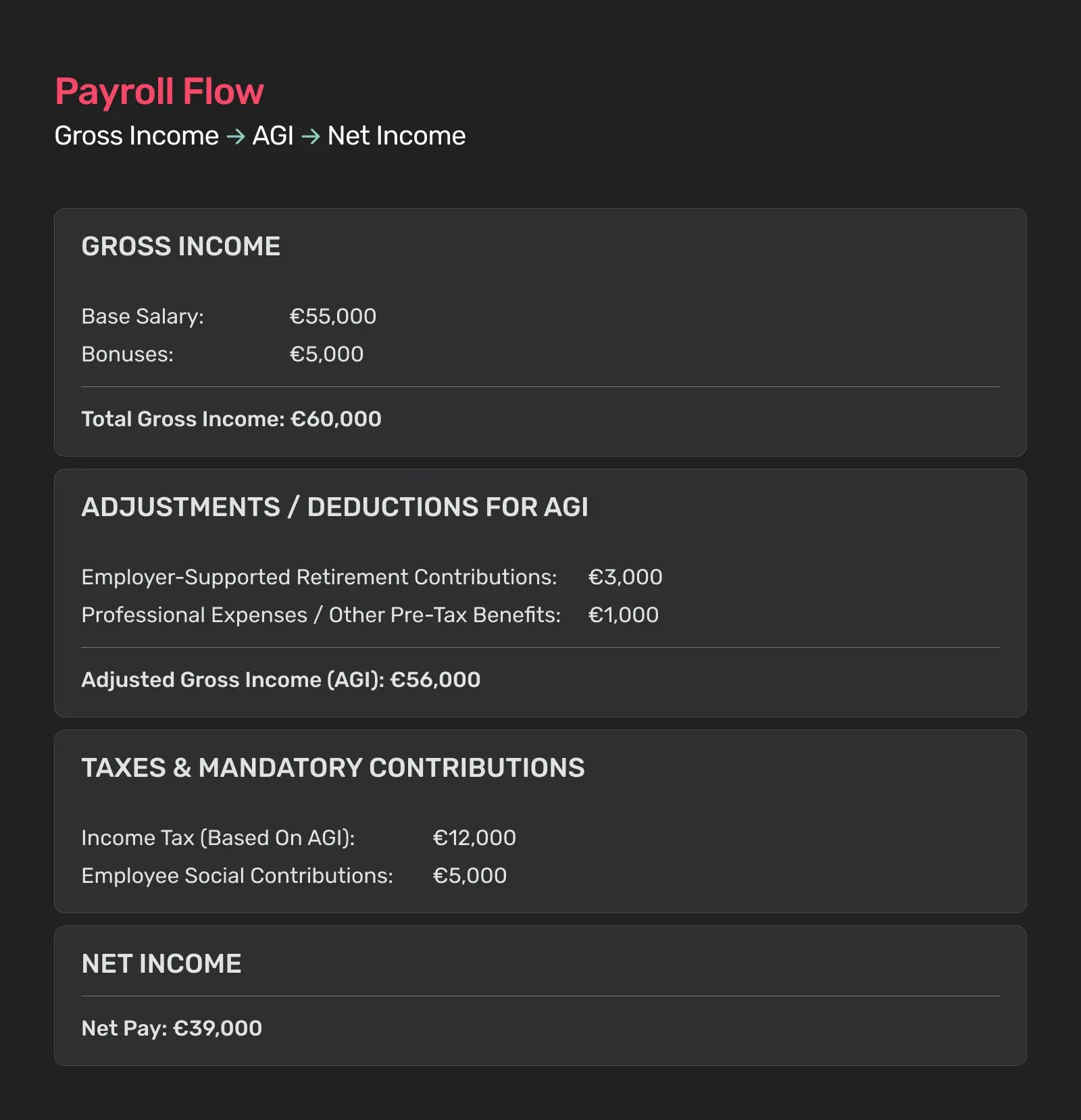

For example, let’s say you hire a software engineer in Germany with a gross annual salary of €60,000. On paper, €60,000 gross annual salary might seem competitive.

But after deductions for income tax, social contributions, and other withholdings, the employee’s net income falls to roughly €39,000, about 65% of their gross pay.

For you as the employer, though, the story doesn’t end there. Once you add employer social security contributions, the total employment cost can rise to nearly €72,000.

So, while you've budgeted €72,000, the employee only sees €39,000 in their bank account.

That gap between gross, net, and total employer cost is what makes it crucial to understand net income when designing attractive, realistic offers.

Why is net income important for employers and business owners?

The net income tells you whether the business is actually creating long-term value, or simply burning cash to sustain operations.

- Performance indicator: Net income shows whether your business model is sustainable and scalable. A strong top line (revenue) is meaningless if net income is weak.

- Investor confidence: Lenders and investors pay close attention to net margins, as they indicate true profitability and efficiency.

- Strategic decisions: Whether you’re considering expansion, hiring, or launching a new product, net income helps determine what’s financially viable.

- Comparisons across markets: In a European context, net income can fluctuate significantly between countries, even with similar revenues, because of differences in employer contributions, tax regimes, and labour costs.

Net income vs. Adjusted Gross Income (AGI): How do they differ?

Adjusted Gross Income (AGI) is the starting point for calculating your employees' taxable income.

It begins with their gross income, which includes everything they earn, and then subtracts certain allowable deductions, such as retirement plan contributions, professional expenses, or other pre-tax benefits.

AGI gives you a clearer picture of what portion of their earnings will be used to calculate taxes.

Net income, on the other hand, is the actual take-home pay your employees receive after all taxes, social contributions, and other deductions are factored in.

This is the amount they can spend, save, or invest.

For employers, understanding the difference between AGI and net income affects:

- Effective payroll planning and budgeting require understanding total compensation costs.

- Employee satisfaction and retention: Employees care about what they actually take home.

- Benefit and deduction structuring: Optimising tax-advantaged contributions to improve net pay without increasing gross costs.

AGI helps you calculate and report taxes correctly, while net income reflects the real value your employees receive.

As a result, you can create competitive and transparent compensation packages.

Understanding gross income: The starting point of every paycheck

Gross income represents the total compensation your employees earn before any deductions. This includes base salary, bonuses, commissions, tips, and other forms of compensation.

It’s the figure you stated in the employment contract or on the paycheck before taxes, social contributions, and benefits are subtracted.

What does gross income mean for businesses?

Gross income is the total earnings an employee receives before any deductions. This includes:

- Base salary or wages: The agreed-upon amount for the employee's role.

- Bonuses and commissions: Additional earnings based on performance or sales.

- Overtime pay: Compensation for hours worked beyond the standard workweek.

- Allowances, such as housing, travel, and meal stipends.

- Other benefits: Including stock options or profit-sharing schemes.

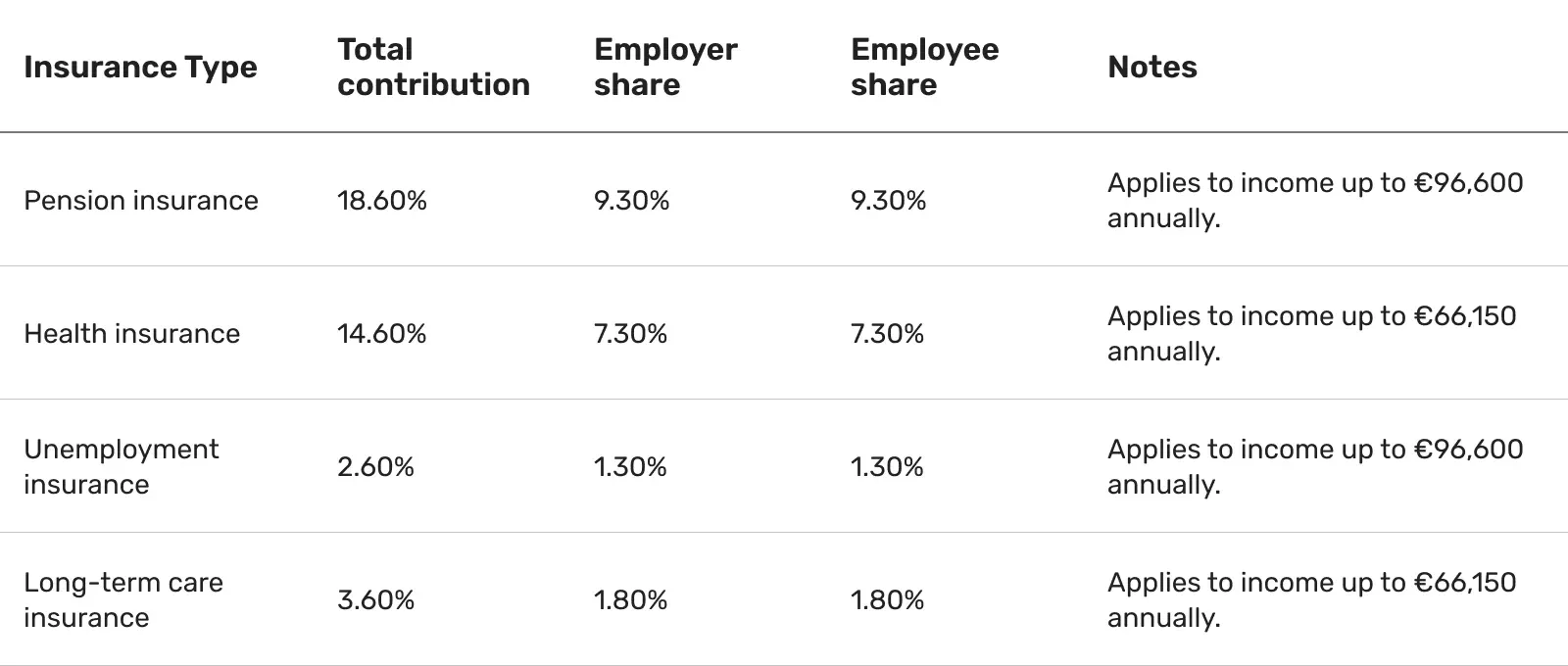

Let’s get back to our software engineering company in Germany with a gross annual salary of €60,000.

Part of your contributions would include:

Source: Deutsche Flagge

As you can see, the real cost of hiring goes beyond the gross salary.

Those extra contributions for social security, health insurance, and other mandatory payments can really add up, so you should know the full financial picture before making payroll decisions.

💡 Good to know:

Beyond the gross salary, you should account for an additional 20–30% in mandatory social security contributions.

Why is gross income important for employers and business owners?

Knowing what gross income entails will help you with accurate budgeting, competitive compensation planning, and compliance with local and global market regulations.

- Budgeting and forecasting: Gross income helps you plan your payroll expenses accurately. It’s the basis for calculating total compensation costs, which include both direct and indirect expenses.

- Compliance with tax regulations: Gross income determines the tax brackets applicable to employees.

- Eligibility for benefits and loans: Financial institutions and government programs often assess eligibility based on gross income.

- Attracting and retaining talent: While net income is what employees take home, the gross salary is often the figure discussed during recruitment and negotiations.

Gross vs. net income: Why is it important to distinguish between them?

By understanding the difference between gross and net income, you can accurately assess profitability and make informed financial decisions.

Here are the additional important reasons:

1. Financial planning and budgeting

Knowing your employees’ net income provides accurate budgeting and managing of day-to-day expenses.

Gross income alone doesn’t reveal how much money you actually have available to spend or save.

2. Business performance assessment

Gross income shows how much revenue you generate from sales minus the direct costs of goods sold. Thus, you get an insight into operational efficiency.

Net income, however, accounts for all expenses and taxes, providing a true picture of overall profitability and financial health.

3. Tax purposes

Tax calculations and filings are based on net income, not gross income.

Understanding the difference helps you comply with tax laws accurately and plan for potential tax liabilities.

4. Loan and investment decisions

Lenders and investors evaluate net income as a critical metric to assess your ability to repay debt or generate returns.

Gross income doesn’t reflect the actual disposable or profitable earnings.

5. Strategic business decisions

Gross income helps in pricing products and controlling direct costs, while net income supports decisions related to spending, expansion, hiring, and cost-cutting efforts.

6. Transparency and communication

Clear knowledge of gross vs. net income avoids misunderstandings during salary negotiations, financial discussions, and reporting.

As a result, all parties have realistic expectations.

In what ways do changes in income definitions and tax policies influence gross and net income calculations in Europe?

Operating or expanding your business in Europe brings along tax systems and social policies that vary significantly from country to country.

Here are the key takeaways:

1. The gross vs. net income variability

The average annual gross earnings in the EU are approximately €41,004, whereas average net earnings are around €28,217, meaning a gap of €12,787.

Tax systems, social security contributions, and family allowances across countries directly affect the above gap.

For example, net earnings as a percentage of gross earnings vary significantly, from about 60.1% in Belgium to 85.9% in Cyprus for a single person without children.

Family status, such as being a one-earner couple with two children, enjoys a much higher net take-home ratio, averaging 82.7%.

In addition, in countries such as Slovakia (109.3%) and Czechia (102.3%), net can even exceed gross due to tax benefits and negative income tax schemes that boost family support.

You’ll find the best net-to-gross ratios in Cyprus (85.9%), Switzerland (81.4%), Estonia (81.1%), and Czechia (80%), for single earners without kids.

We also have to mention the UK. Although it isn’t part of the EU, it’s still in Europe.

The UK stands out with the highest take-home percentage and one of the lowest employer costs, making it an efficient market for both employees and employers.

Employee net pay is €46,245, with a take-home percentage of 77.1%.

On the other hand, Belgium, Germany, Lithuania, Romania, Denmark, Slovenia, and Hungary all go below 66% approximately.

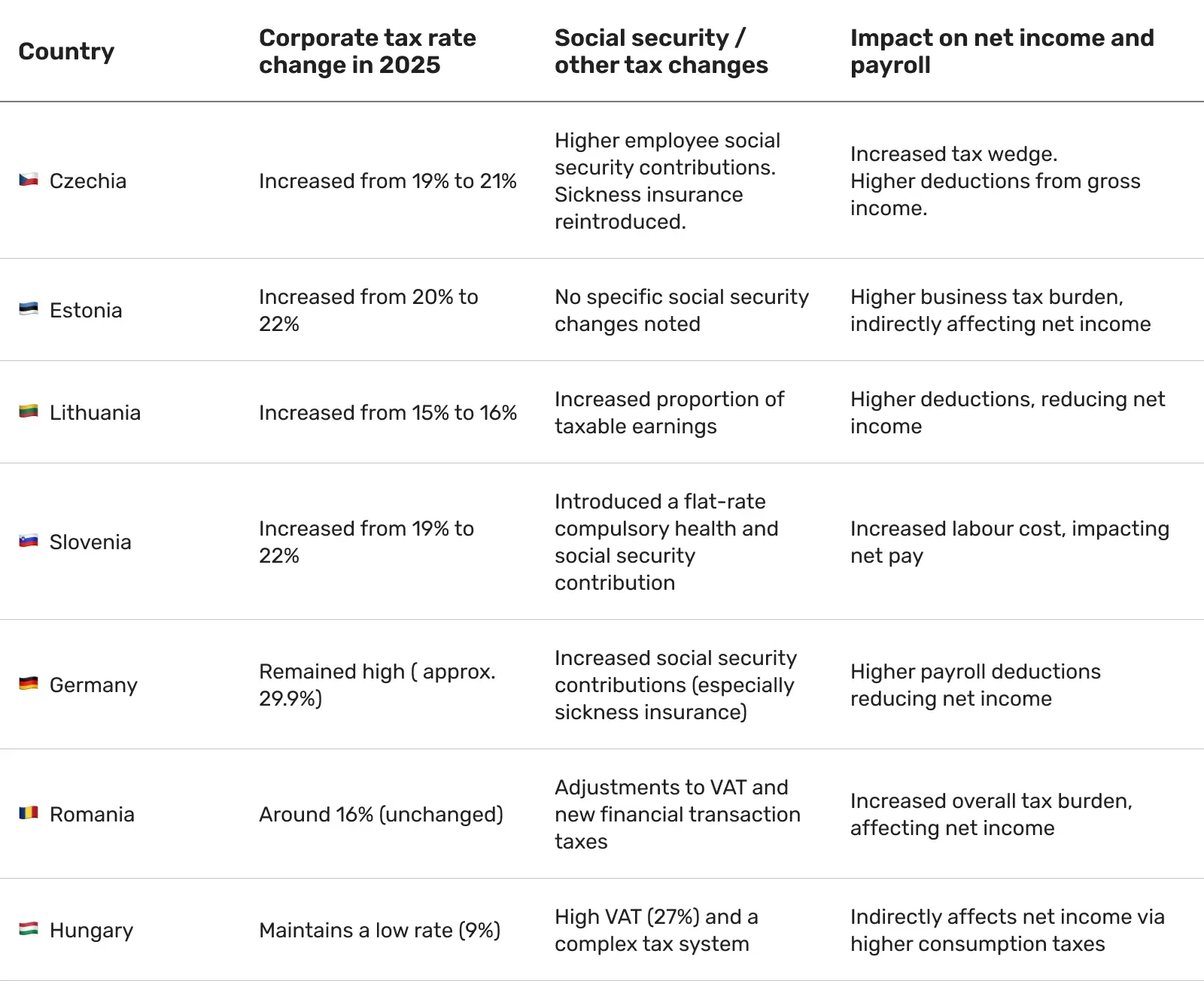

2. Tax and social security changes

Some European countries are introducing new rules for corporate income, VAT, and even financial transactions, all impacting your net income.

Let’s check some examples of European countries that introduced tax and social security changes affecting income calculations.

Source: Taxing Wages 2025 Report

3. Automatic indexing of wages

Some European countries have automatic wage indexing, which means that salaries, pensions, and sometimes even benefits get adjusted automatically to keep pace with inflation or agreed wage growth.

The main aim is to protect workers’ purchasing power so they don’t fall behind when the cost of living goes up.

Countries like Belgium, Luxembourg, Italy, Cyprus, and Malta follow this system, either fully or partially.

For example, Luxembourg implemented an automatic 2.5% pay increase in May 2025 to balance rising living costs.

But here’s where it gets interesting for employers.

As gross wages rise, so does the possibility of employees moving into higher tax brackets under progressive tax systems.

So, while staff see their gross salaries go up, their net income (take-home pay) may not rise by as much as expected because tax contributions increase, too.

Wage indexing is great for keeping employees financially protected against inflation, but it also raises payroll costs for businesses and can subtly affect the net income workers take home.

4 practical tips: Make the most of gross vs. net

Operating your business is also about knowing what really stays in your pocket after all the bills, taxes, and payroll costs are paid.

Here are some practical ways to help you keep an eye on the numbers that matter:

1. Calculate net income, not just gross revenue

Just as employees need to know their real take-home pay, you should focus on net income after all expenses, taxes, and contributions.

Gross revenue looks good on paper, but only net income shows true profitability and available cash flow.

2. Use financial planning tools that reflect net results

Budgeting and forecasting based on gross sales alone can be misleading.

Tools that account for operating expenses, employer payroll contributions, and tax liabilities will give you a much clearer view of your financial health.

3. Track AGI separately from net income

Doing so will help you adjust gross revenue for deductible expenses before calculating tax.

Keeping these figures distinct also helps in tax planning, compliance, and cash flow forecasting.

4. Compare gross margin vs net margin

Gross margin shows how efficiently you generate profit from sales, while net margin reveals the bottom line after all costs.

Monitoring both can identify whether issues lie in production or sales efficiency (gross) or in overheads, financing, or taxes (net).

💡 Employees see the difference between gross and net in their pockets, while businesses feel it in their payroll budgets.

Gross vs. income net: Let’s recap!

Perhaps the simplest way to differentiate between the two is to see gross income as what’s promised on paper, and net income as what truly counts in practice.

Gross figures are useful for planning, reporting, and setting expectations, but it’s net income that shapes real-life decisions, from what employees can spend to how businesses can invest.

For employers, understanding the difference goes beyond payroll accuracy.

It also means building trust with your team, budgeting smarter, and handling the true costs of employment.

This is especially true if you operate across different European markets where tax systems and contributions vary.

Managing these differences is complex, but workforce management tools like Native Teams help simplify the process.

With streamlined payroll, benefits, and compliance support across borders, you can focus less on the admin and more on your team and smooth global expansion.

How can you simplify payroll and stay compliant with Native Teams?

Native Teams is an EOR and PEO provider that enables you to hire, pay, and manage your global teams in over 85 countries, while we take care of:

- Global payroll,

- Compliance, and

- Multi-currency payments.

This is how we can help:

1. Payroll management

We take the stress out of global payroll by ensuring your employees and freelancers receive accurate, timely payments in their preferred currency.

With built-in multi-currency wallets, your team can choose how they access their earnings: withdrawing with a Visa card or transferring funds internationally.

And because everything runs in line with local labour laws and tax rules, you can stay compliant without the usual administrative headaches.

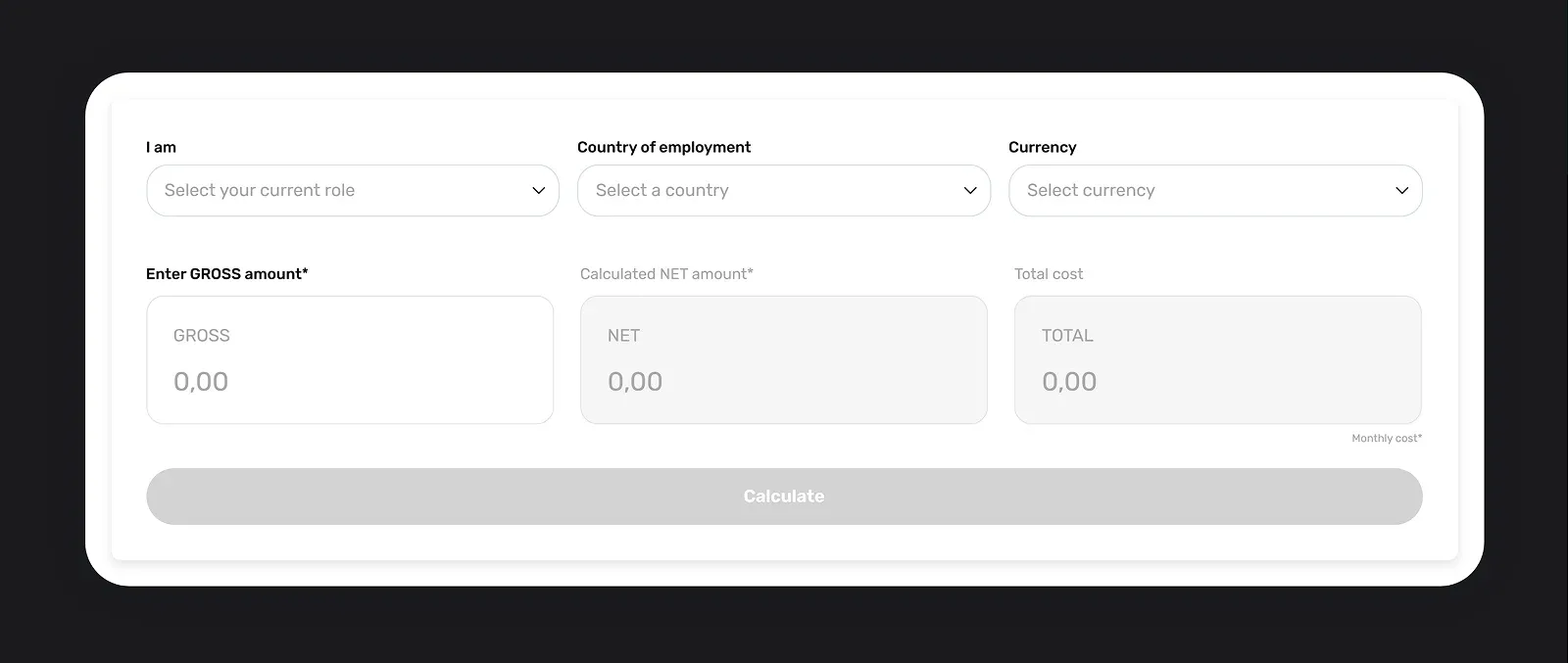

A special perk is our Payroll Calculator, which shows how gross salaries translate into net pay and total employer cost, simplifying salary breakdowns.

2. Tax compliance

We take care of tax rules and social security contributions by keeping up with local laws, so both employers and employees stay compliant without the stress.

That way, you can avoid the risk of fines or legal headaches, while leaving the hassle of filing and managing tax systems in multiple countries to us.

3. Expense management

You can approve and pay expenses, easily separate business vs. personal expenses, and generate PDF tax reports.

Also, you can upload and track all your expense receipts in one place, including salaries, sick days, and allowances.

And the list goes on.

Want to get all the perks and no paperwork?

Book a free demo today to learn how to turn payroll complexity into clarity.

Keep learning

Common Payroll Mistakes Companies Make and How to Avoid Them