How Global Payroll Analytics Enhances Business Operations?

Managing payroll across multiple countries has never been easy.

Between shifting tax laws, multiple currencies, local labour regulations, and scattered data systems, even well-established companies struggle to keep operations smooth and compliant.

Add in the pressure to reduce costs, support remote teams, and scale quickly, and payroll becomes even more complex and challenging.

That’s where global payroll analytics comes in. But what exactly is it, and how can it help you transform operations?

Dive in to learn why companies that leverage global payroll analytics gain a serious competitive edge.

How global payroll analytics works

Global payroll analytics is collecting, analysing, and interpreting payroll data across multiple countries to gain actionable insights.

Nonetheless, it goes beyond processing paychecks. It helps you understand patterns in:

- Labour costs,

- Compliance issues,

- Employee compensation, and

- Workforce trends.

Technically, it is the intersection of HR, finance, and compliance.

You’re no longer just looking at payroll expenses, but:

- Tracking how your payroll aligns with your business goals,

- Where inefficiencies exist, and

- How to optimise operations at a global scale.

Modern payroll analytics tools pull data from cloud-based payroll systems, HCM platforms, and finance software in real-time to offer you predictive insights.

For example, they can highlight if contractor payments in a specific country are consistently delayed, enabling you and your team to take action early.

Inside global payroll analytics: Why it matters

Here’s how global payroll analytics can help you see concrete improvements in cost control, compliance, and workforce planning.

1. Increase operational efficiency

Payroll used to be a time-consuming and error-prone process, especially if your global team manages multiple systems and compliance rules.

1.1. Automate repetitive tasks

AI-powered payroll platforms take a lot of the grunt work off your plate.

Tasks such as data entry, tax calculations, and currency conversions across various countries? Handled automatically.

These tools integrate directly with HR and finance systems, so when a new hire is added or someone changes departments, payroll updates automatically.

The result? Fewer errors, faster processing, and payroll teams that finally have time to focus on bigger priorities, such as spotting labour cost trends or helping plan for growth.

1.2. See what’s happening in real time

With a centralised payroll analytics platform, you can instantly view key metrics:

- Who’s been paid,

- Where errors occurred,

- How many hours were logged, or

- How much leave was taken across regions.

For example, if a spike in overtime hours shows up in your APAC region, you can ‘catch’ it in real time and investigate before it becomes a cost issue.

Thus, you don’t need to wait for end-of-month reports to spot red flags.

1.3. Optimise costs

Operational efficiency isn’t only about saving your time, but also about saving money.

Payroll analytics breaks down the true cost of running payroll across different markets. You can track metrics like:

- Cost per payslip by country or vendor.

- Overtime as a percentage of total payroll.

- Budgeted vs. actual payroll spend by department.

This level of insight helps you reallocate resources, renegotiate vendor contracts, or spot inefficiencies, such as one region spending twice as much on payroll processing for the same headcount.

Therefore, you aren’t just processing payroll more efficiently but using it to operate smarter across the entire organisation.

2. Make strategic decisions

A common mistake you might make is to view payroll as a tool only for paying.

It’s a goldmine of data that, when analysed properly, you can use not just to track spending but to shape strategy and make smarter business decisions.

2.1. Look ahead with predictive analytics

Imagine being able to forecast labour costs six months out, or predict when and where you’ll need to hire based on current trends. Tools like a labour cost calculator make it easier to estimate expenses and plan accordingly.

That’s what AI-driven payroll analytics makes possible.

It analyses historical data, such as overtime trends, seasonal staffing patterns, and regional pay fluctuations, to project future costs and workforce needs.

So, instead of guessing whether now’s a good time to expand into a new region or launch a new product in another, you have the numbers to back it up.

If the data shows rising labour costs in one region but a surplus of skilled contractors in another, you can adjust plans before making expensive commitments.

2.2. Budget smartly and catch risks early

Running a business, you want to know two things: where the money’s going, and what could go wrong.

Payroll analytics answers both questions.

By looking at payroll spend as a percentage of revenue, you can quickly spot when labour costs are increasing and when it might be time to adjust budgets or hiring plans.

For example, if your payroll-to-revenue ratio jumps unexpectedly in one region, that’s a red flag. Maybe headcount grew too fast. Maybe productivity dropped.

Either way, catching it early means fewer surprises and more control over your financial health. Integrating these insights with broader financial planning often benefits from the expertise of data analytics consulting services, especially when aligning payroll metrics with high-level business KPIs.

Additionally, having that data on hand helps justify new initiatives, whether it’s

- Opening a new office,

- Launching a training program, or

- Bringing in more contractors.

Thus, you’re not just asking for budget but backing it with evidence.

2.3. Get workforce insights

Payroll analytics also gives you a clearer picture of your workforce.

Are certain teams experiencing higher turnover? Is absenteeism spiking in a specific region? Are some roles consistently underperforming?

These insights can fuel smarter talent strategies. Perhaps you discover that employees in one country are leaving at twice the rate of those in other countries.

What does this signal? It’s time to review compensation, culture, or workload.

Or perhaps productivity is climbing after recent training investments, proving that it's worth expanding.

By connecting payroll data with real business outcomes, your HR and finance teams can work together to retain top talent, improve performance, and plan for the future instead of only reacting to problems.

3. Manage risk and stay compliant

Not only is managing global payroll complex, but it is risky as well.

With every new market comes a web of tax laws, labour rules, benefits requirements, and reporting obligations.

Miss one update, and you could be facing hefty fines or damage to your company’s reputation. That’s where global payroll analytics steps in to do the heavy lifting.

3.1. Stay ahead with AI-driven regulatory monitoring

Modern payroll systems use AI to monitor local labour laws and tax changes in real time, across every country where your company operates.

As a result, it applies the changes instantly, ensuring your team stays compliant without manual intervention.

That kind of automation protects you from costly legal trouble while saving your time.

💡 Did you know?

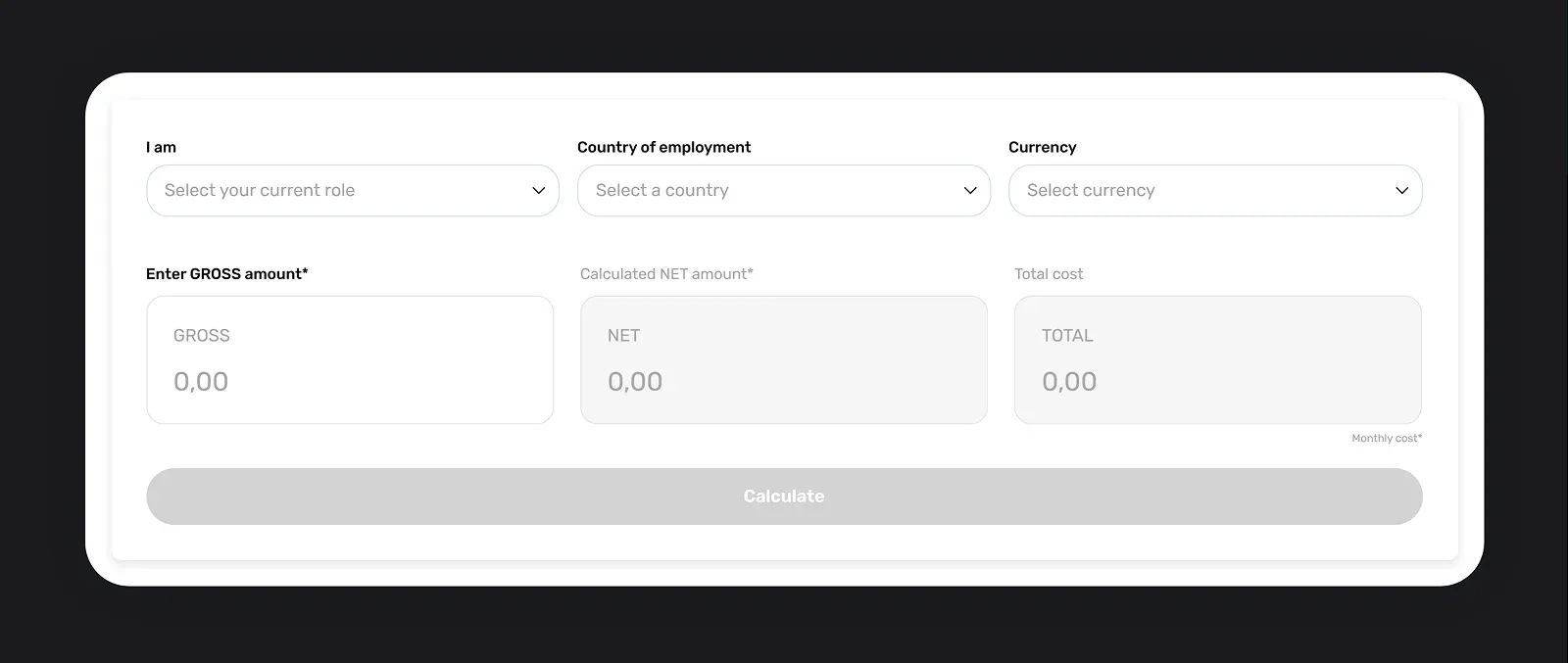

Native Teams’ Payroll Calculator gives you a clear breakdown of hiring costs by country, or lets you calculate your own gross-to-net earnings based on where you live.

This way, you can set salaries that are both accurate and compliant with local labour laws while giving you clear insights into taxes, health and pension contributions, and other country-specific costs.

3.2. Catch errors before they become liabilities

Even a small mistake, such as misclassifying a worker or applying the wrong tax rate, can spiral into a significant issue.

That’s why advanced analytics platforms use machine learning to identify red flags early.

If something appears off, like inconsistent overtime pay, missing deductions, or duplicate payments, the system sends up a signal before the problem escalates.

Instead of discovering them months later during an audit, you identify and resolve issues right away.

3.3. Simplify compliance across borders

One of the biggest challenges if you operate globally is standardising payroll processes across countries that do things very differently.

Unified payroll platforms solve this by creating a consistent framework while still respecting local rules.

For example, your teams in Japan and the UK can both follow the same process for submitting hours or calculating bonuses, and the system automatically applies the correct local compliance logic behind the scenes.

When it’s time for audits or end-of-year reporting, everything’s already aligned and ready to go.

💡 Did you know?

In addition to EOR services, our PEO solution lets you manage payroll and send salary invites to your entire team, all from one centralised dashboard.

We handle the full scope of payroll compliance, including taxes, social security, and all required contributions, so you stay worry-free and fully covered.

4. Retain talent and boost employee experience

Payroll goes beyond a back-office function, serving as an everyday touchpoint between employees and your company.

When it’s seamless, accurate, and responsive, it builds trust. When it’s clunky or confusing, it becomes a source of frustration.

4.1. Hyper-personalise pay structure

It goes without saying that the fixed paycheck is something that employees expect. However, they also want flexibility and control.

Payroll analytics analyses individual preferences, job types, and financial behaviour, so you can offer hyper-personalised pay options:

- On-demand access to earned wages,

- Flexible pay schedules, or

- Customised benefit bundles.

💡Did you know that our EWA feature provides your employees with access to their earned wages before the regular payday, promoting financial stability and flexibility?

Furthermore, we support multiple payment options, ranging from direct bank transfers to digital wallets, so your employees can receive payment in the way that works best for them.

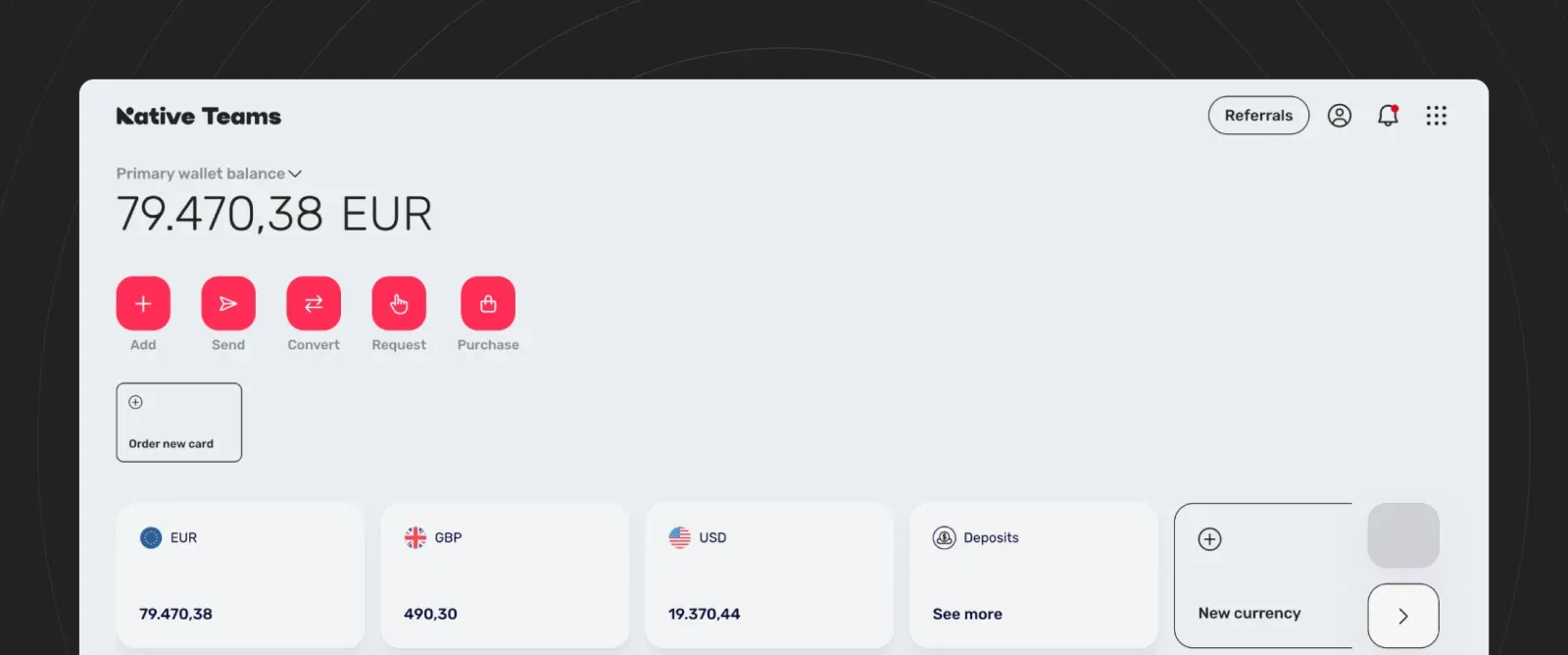

With our Multi-Currency Virtual Wallet, they can easily add funds via bank transfer, card, Payoneer, and more.

The Wallet is just as flexible when it comes to access: employees can withdraw, deposit, or move money between local bank accounts, personal cards, and other wallets, whenever they need to.

4.2. Provide transparency

How many times have employees pinged your HR with questions about their paycheck or tax deductions?

Real-time payroll systems can offer self-service portals where employees can check everything themselves, all in one place, and up to date:

- Payslips,

- Tax documents,

- Benefit contributions.

Beyond convenience, providing people with clear and immediate access to their pay data builds transparency and trust.

And for your HR teams, it means fewer repetitive inquiries and more time to focus on other tasks.

4.3. Promote pay equity

Fair pay shouldn’t be a guessing game.

Payroll analytics helps you actually measure compensation across roles, departments, regions, and demographics to spot gaps that need attention.

Whether it’s a gender pay disparity or uneven bonuses across offices, the data makes the invisible visible.

As a result, it enables HR and leadership to take informed action, implement equitable policies, and show employees they’re serious about fairness.

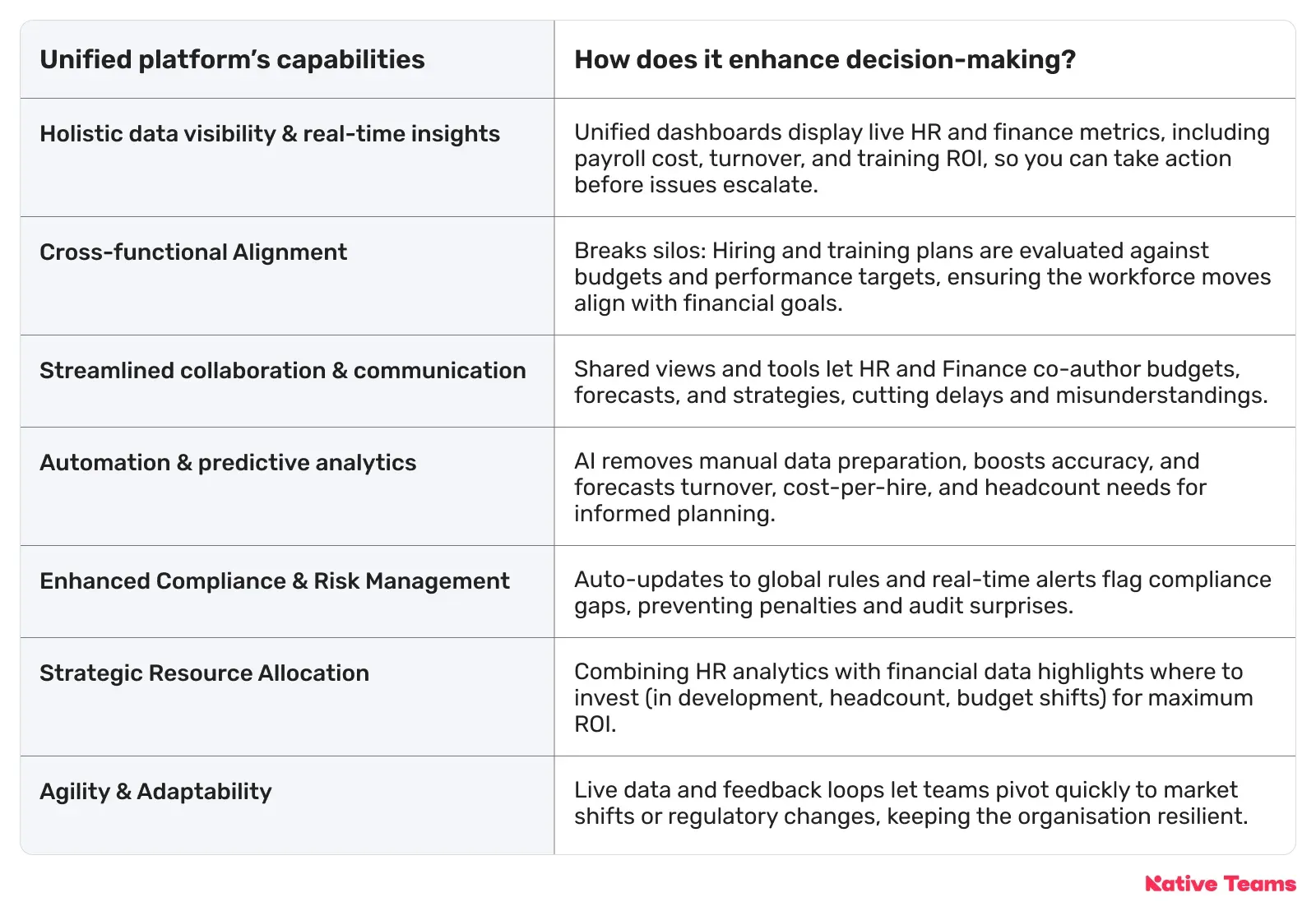

5. Integrate with broader systems

Unfortuantely, in many companies, HR and finance operate in silos.

HR tracks headcount and performance, while finance tracks spend and forecasts.

But what if both teams could work from the same source of truth?

That’s exactly what happens when payroll data is integrated into a unified HR/finance ecosystem.

Suddenly, you’re not just looking at isolated numbers but getting a complete, real-time view of organisational health.

For example, if you’re planning a new hiring, finance can instantly see the budget impact.

If turnover spikes in a region, HR can link it back to compensation trends.

With everyone on the same page, cross-functional decisions become faster, smarter, and more aligned.

Moreover, having all your payroll data centralised means you maintain oversight and cost control.

How can you maximise your payroll data with Native Teams?

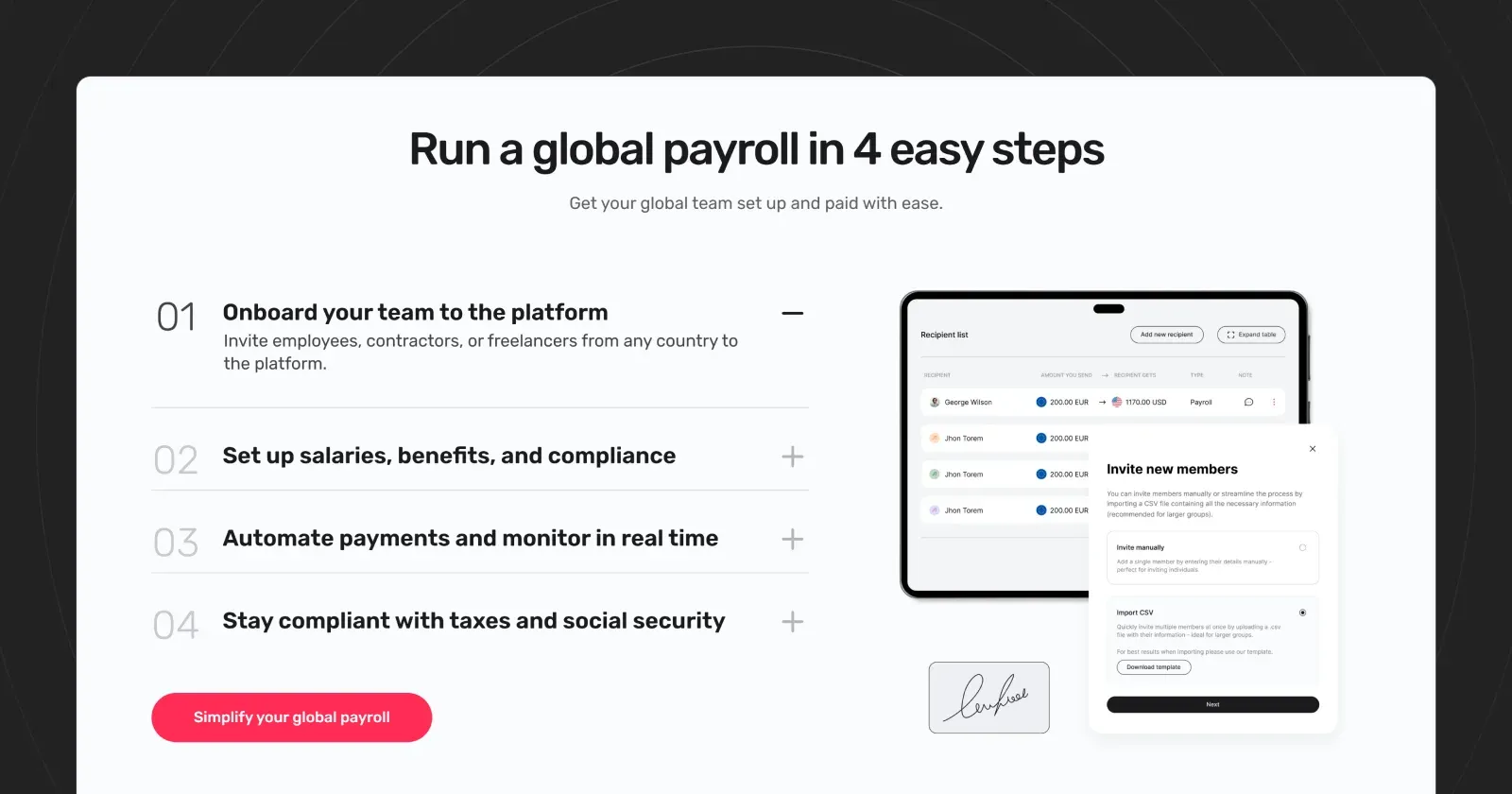

Native Teams simplifies global employment by combining EOR and PEO services into one platform, managing everything from payroll and payments to compliance and tax optimisation.

We work with local experts in every country we operate in to stay ahead of changing regulations, ensuring compliance with:

- Tax codes,

- Labour laws, and

- Cross-border contributions.

From issuing compliant contracts to running accurate, on-time payroll, we help you reduce legal risk and keep your global team supported, wherever they are.

Thus, our solution reduces overheads, eliminates manual errors, and ensures:

- 70% faster payroll processing

- 100% compliance with local tax laws

- Real-time breakdowns of salaries, deductions, and benefits.

Enticed to know more?

Book a free demo call to start paying your global workforce accurately, on time, and without hassle.

Keep learning:

11 Global Payroll Best Practices You Should Know