Understand Global Payroll Complexity and How To Manage It

With constant changes in local tax laws, stricter data privacy regulations, and the rise of distributed teams, managing payroll across borders is more than an operational task. It’s become a strategic challenge as well.

Many companies still use outdated systems or manual processes, leading to errors, payment delays, and compliance risks.

However, global payroll doesn’t have to be this difficult.

With the right setup, tech tools, and partners, you can simplify global payroll, stay compliant, and pay employees accurately and on time.

Keep reading to understand global payroll complexity better and how the right technology can help you manage it more easily and effectively.

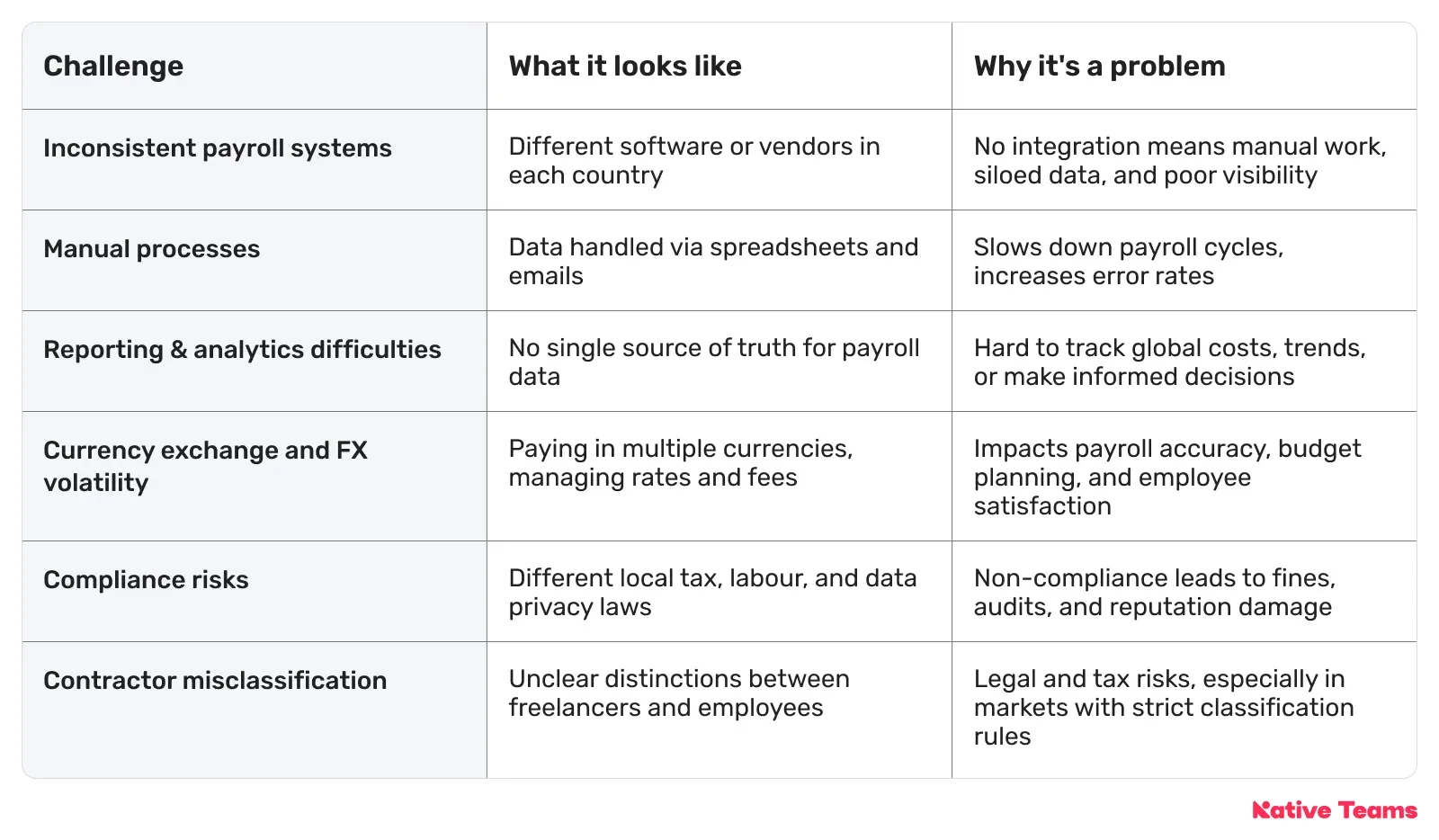

6 main factors behind global payroll complexity

To manage global payroll effectively, you first need to understand the factors that make it so complex.

Here’s a breakdown of the key factors.

1. Fragmented payroll systems

When each local payroll provider uses a different system, your data gets scattered across platforms or even in spreadsheets.

Consequently, this creates silos, making it hard to see your workforce costs, benefits, or trends across the whole organisation.

Inconsistent processes

Also, every vendor tends to have their own approach, such as different timelines, reporting formats, tax rules, and other aspects.

These inconsistencies can cause problems with wage calculations, bonuses, deductions, and filings.

Therefore, without standardisation, maintaining compliance across multiple regions becomes a serious challenge.

Operational inefficiencies

Using multiple providers means your payroll team spends more time managing tasks than planning or improving payroll.

Manual data entry, correcting errors, approving changes, it all adds up.

Each system has its own issues, which leads to more training, slower responses, and higher costs to keep everything running.

Compliance issues

When systems are fragmented, staying on top of local law changes becomes harder, and that can mean costly compliance gaps.

Additionally, if your data is stored with different vendors that have varying security protocols, the risk of a data breach increases.

2. Data consolidation challenges

When data is stored in different places and formats, mistakes like missing entries, outdated employee info, or wrong calculations are more likely.

Fixing differences between systems takes a lot of time and often leads to errors, which can cause late or incorrect payments and tax filings.

Without all your data in one place, it's hard to make smart decisions about labor costs, budgets, or planning.

By the time you gather reports from different systems, the information might be outdated, making financial forecasts less accurate.

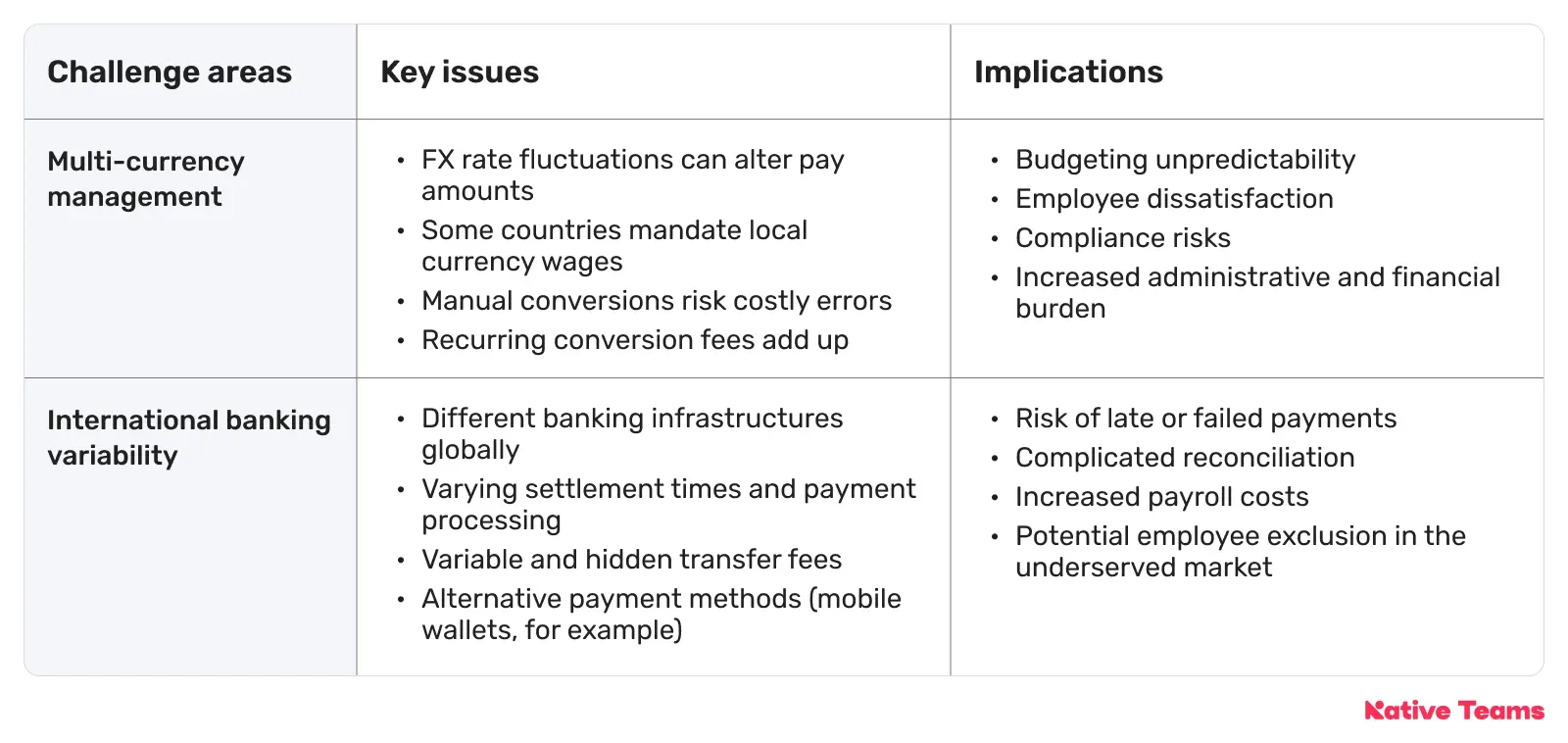

3. Cross-border payments and currencies

Handling payroll payments in multiple local currencies introduces significant foreign exchange (FX) risks and operational challenges:

Currency fluctuations

Exchange rates frequently fluctuate, sometimes abruptly, making it challenging for you to stick to your budget.

But it’s also tough for employees who may end up with less in their paychecks than expected.

Without a real-time plan for handling foreign exchange (FX), payroll can quickly become unpredictable and harder to manage.

Local laws on currency usage

Some countries, such as China, require salaries to be paid in the local currency.

On the other hand, others may have tax rules or banking regulations that penalise foreign currency payments.

Thus, paying in the wrong currency or without proper local adjustments can trigger compliance issues and unnecessary costs.

FX conversion errors

Manual or delayed currency conversions can lead to incorrect salary amounts.

Every currency conversion usually comes with fees and FX margins, costs that multiply fast when you're paying a global team.

Inconsistent processing times

Depending on the country and the banks, payroll payments might be completed on the same day or take several business days.

Local holidays, time zone differences, and different bank hours can add extra scheduling challenges.

One late payment can damage employee trust, and if it breaks regulations, you could also face legal problems.

Variable and hidden fees

Cross-border payments often route through multiple intermediary banks, and each one deducts fees.

Different fees and exchange rates make payments more expensive and harder to keep track of.

Limited payment methods

In some regions, particularly in emerging markets, employees may lack access to formal banking services.

That means that you need to support alternative payment methods, such as mobile wallets, digital payment platforms, or even crypto.

It’s true that each option has its own rules and challenges, but offering choices is crucial to creating a diverse, global workforce.

4. Data security and privacy

Payroll data isn’t just sensitive but also tightly regulated.

Local laws may dictate:

- Exactly what kind of information you collect (national ID numbers, salary details, or bank account info),

- Where it’s stored,

- How long you keep it, and

- Who can access it.

Failing to follow rules because of complexity or oversight can lead to big fines, lawsuits, and harm to your company’s reputation.

It’s not just about storing data safely, but also about how you handle problems when they happen.

Many jurisdictions require you to report data breaches to both authorities and affected individuals within strict deadlines.

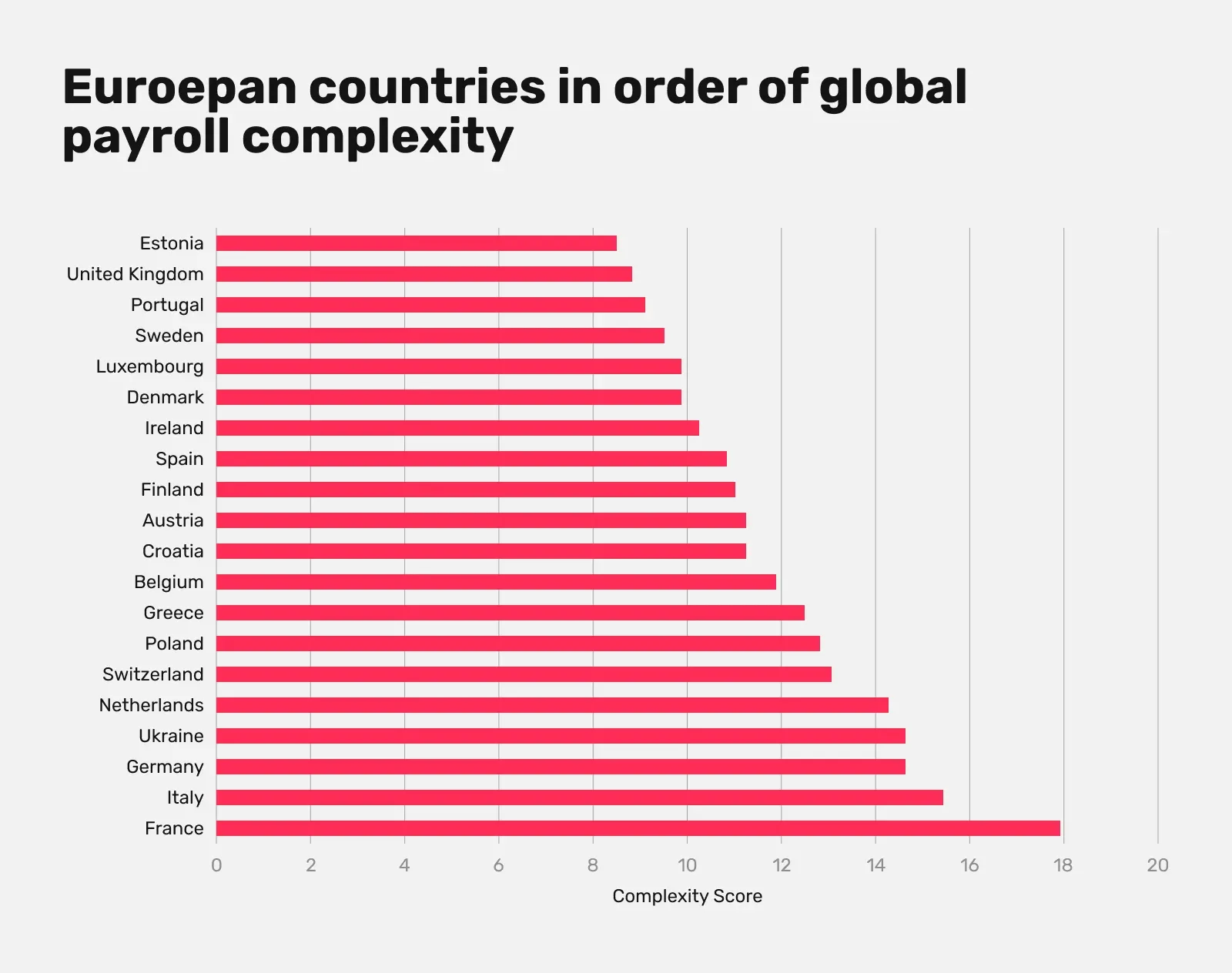

Source: Global Payroll Complexity Index

Consequently, a short delay can increase the pressure to stay on top of compliance at all times.

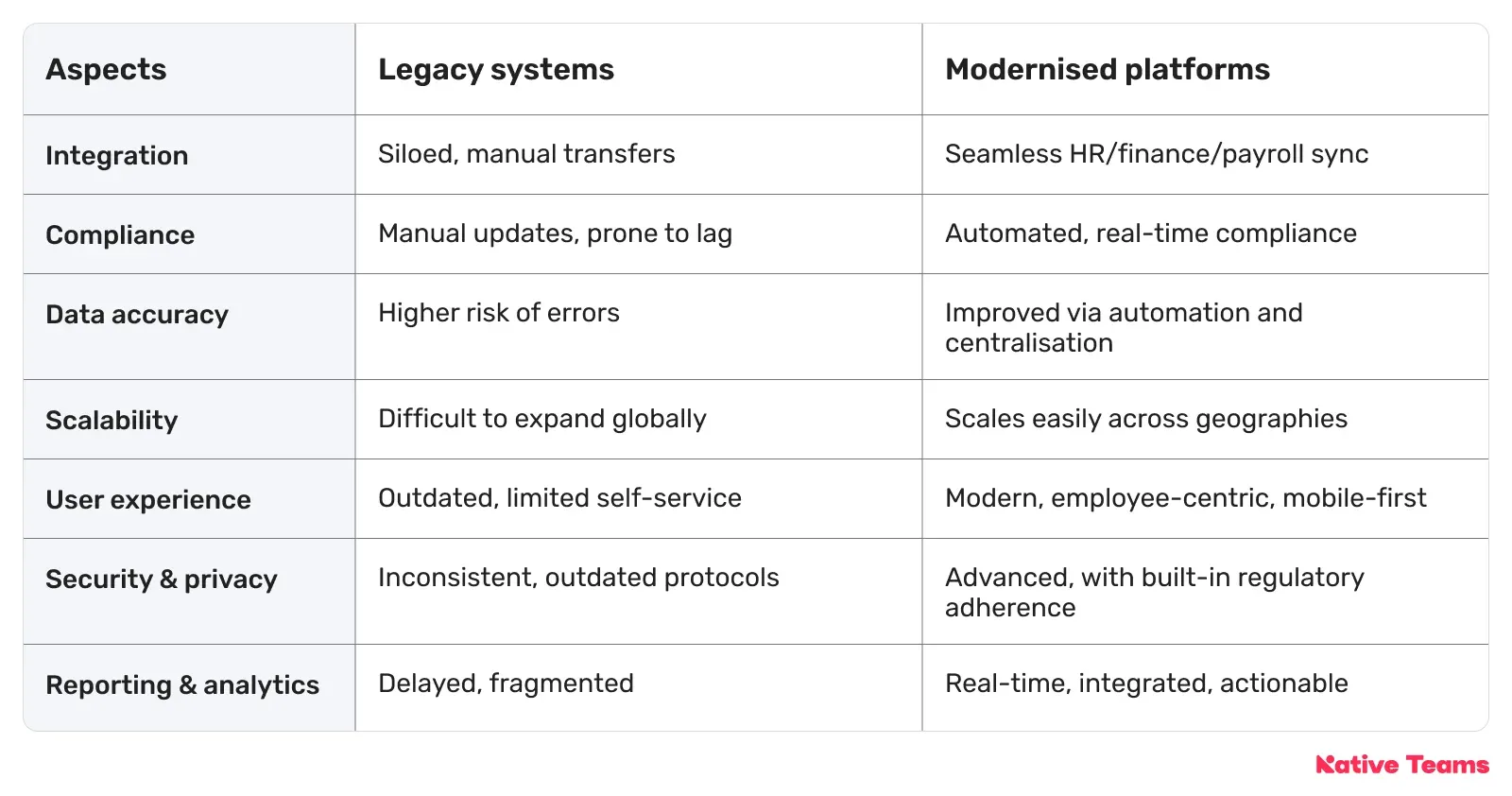

5. Outdated tech makes global payroll even messier

Many companies are still relying on on-premise, localised payroll systems, which are largely disconnected from the rest of the business.

Unfortunately, these outdated platforms don’t connect with modern HR, finance, or time-tracking systems, which creates data silos, duplicated work, and limited visibility across your organisation.

Additionally, legacy systems rely heavily on manual data entry, increasing the risk of errors and inefficiency.

The lack of automation means slow processing times for payroll runs, complex updates, and delayed reporting.

Another problem is that regulations move fast, but legacy systems struggle to keep up.

Without regular updates or built-in compliance tools, you are more likely to fall behind on changing tax laws, reporting rules, or data privacy requirements.

That can quickly translate into fines or reputational damage.

6. Workforce globalisation

Remote and hybrid work let you hire talent from anywhere, but they bring payroll challenges:

- You must follow labour laws, tax rules, social contributions, and benefits for each worker’s country. This includes different rules on overtime, minimum wage, leave, and deductions.

- Payroll needs to handle payments in many local currencies, considering exchange rates, taxes, and banking rules to make sure employees get paid correctly and on time.

- Payslips and reports must be in the right language, currency, and format for compliance and clarity.

- Different types of workers have different legal rules that affect how they are paid, taxed, and reported. Misclassification can result in heavy penalties and affect employment relationships.

- Payroll systems must tell the difference between employees (who have taxes, withholdings, and benefits) and contractors (who receive the full amount and have different invoices), and automatically perform the correct calculations and filings.

How to manage global payroll complexity through a unified platform?

While the goal of global payroll is simple: pay your people accurately and on time, the execution becomes incredibly complex when dealing with a global workforce.

Luckily, the solution to overcome the above challenges can be pretty simple and straightforward if you choose unified and integrated payroll systems.

The goal of global payroll is simple: pay your people accurately and on time. But, things get very complicated when managing a global workforce.

Now that you know the problem, let’s see what you can do about it.

Luckily, the solution can be straightforward if you use unified and integrated payroll systems.

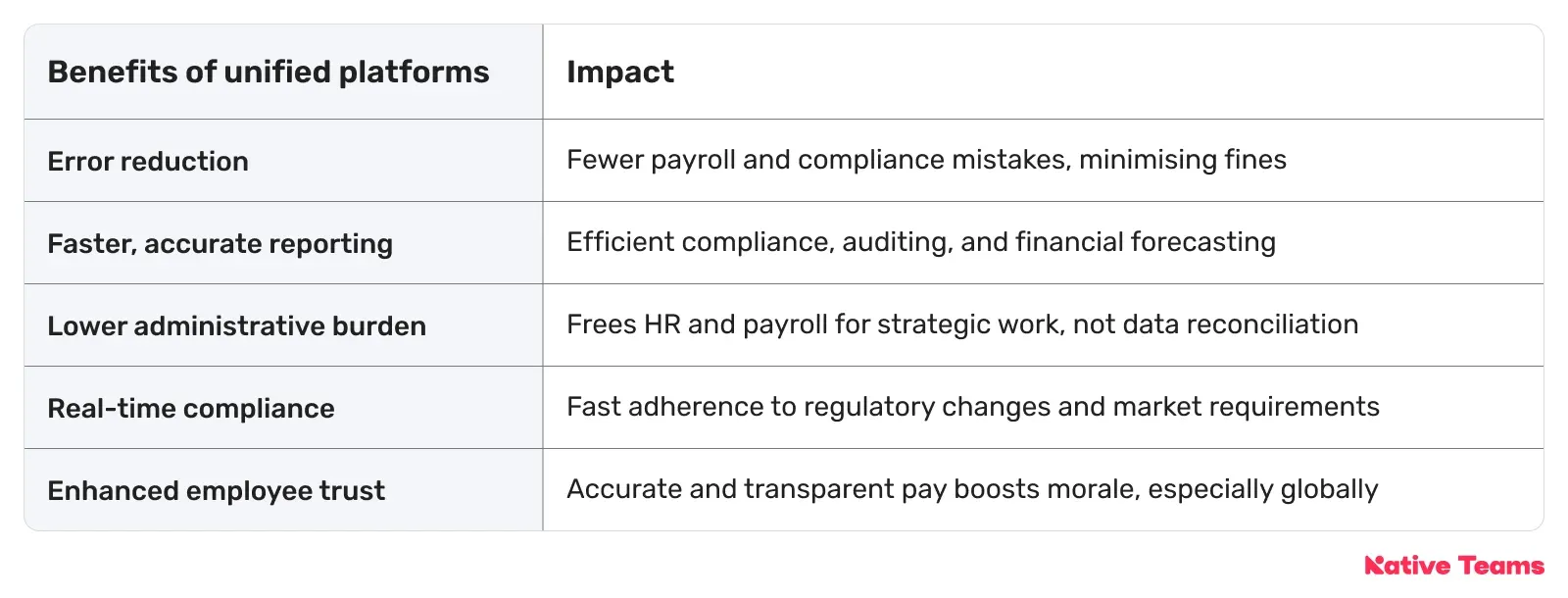

Bringing HR, finance, and payroll platforms together improves accuracy and compliance by removing data silos, automating tasks, and centralising information.

1. Improve data accuracy

Single source of truth: Integration means you only enter employee data once, eliminating repeated entries and reducing mistakes. When one department like HR, payroll, or finance updates info, it automatically updates everywhere, making sure payroll uses the latest data.

Automated workflows: When things such as hiring, promotions, benefits, or terminations change, integrated systems update all financial and payroll records right away. This removes manual work, lowers errors, and helps prevent paying someone too much or too little.

Error reduction: Automated, consistent data flow greatly lowers manual mistakes, such as wrong paychecks or tax errors from mismatched info across separate systems.

✨Get inspired

Hypefy, an AI-powered influencer marketing platform, was scaling so quickly that its internal operations began to show signs of strain.

They had a strong product, enterprise clients, and 500+ gig workers across markets, but they didn’t have a system to manage contracts, payments, and compliance at scale.

They’ve partnered with us, and using our platform, Hypefy was able to:

- Bulk-pay freelancers in local currencies

- Digitally create, sign, and store country-specific contracts

- Ensure full legal compliance without a large finance or legal team

The result?

300% reduction in admin time.

Smooth expansion into 28 countries.

The ability to say “yes” to complex campaigns in unfamiliar markets.

2. Enhance global compliance

Integrated systems automatically update compliance with changes in tax rules, labour laws, and reporting for different countries.

A unified system also creates accurate, ready-to-audit reports for global and local regulators, making it easier to prove you follow wage laws, data privacy rules, and government requirements.

An integrated system supports central global payroll rules but also allows local adjustments like currency, benefits, and required deductions.

3. Streamline currency management

Centralised, cloud-based systems streamline payments, integrate local payout methods, and automate compliance updates, enabling on-time, compliant payments worldwide.

With multi-currency wallets, you can pay employees in their preferred currency and method, avoiding traditional bank fees and providing faster, more transparent settlements.

4. Incorporate employee self-service portals

Self-service portals let remote employees view payslips, manage documents, and request time off.

As a result, they reduce work for HR and improve the employee experience and transparency.

5. Consider hiring an EOR provider

If you’re hiring in countries where you don’t have a legal presence, using an Employer of Record (EOR) can make things much easier.

An EOR becomes the official employer on your behalf.

They take care of everything, from setting up local contracts, managing benefits, and handling taxes and payroll correctly for all types of workers.

How can you manage global payroll complexity efficiently with Native Teams?

Native Teams is an EOR and PEO platform that is helping you avoid compliance pitfalls, FX chaos, and endless admin by automating and centralizing your entire process.

How can we help? We:

- Enable you to hire and pay employees worldwide without opening a local subsidiary, while we handle employment contracts, registration, compliance, and payroll taxes.

- Manage country-specific labour laws, social contributions, and tax deductions, ensuring you stay compliant with changing regulations.

- Provide a payroll calculator to break down salary costs, taxes, and deductions.

- Manage payroll, HR, expenses, contracts, and payments from a single, unified dashboard to gain complete visibility and control over your workforce.

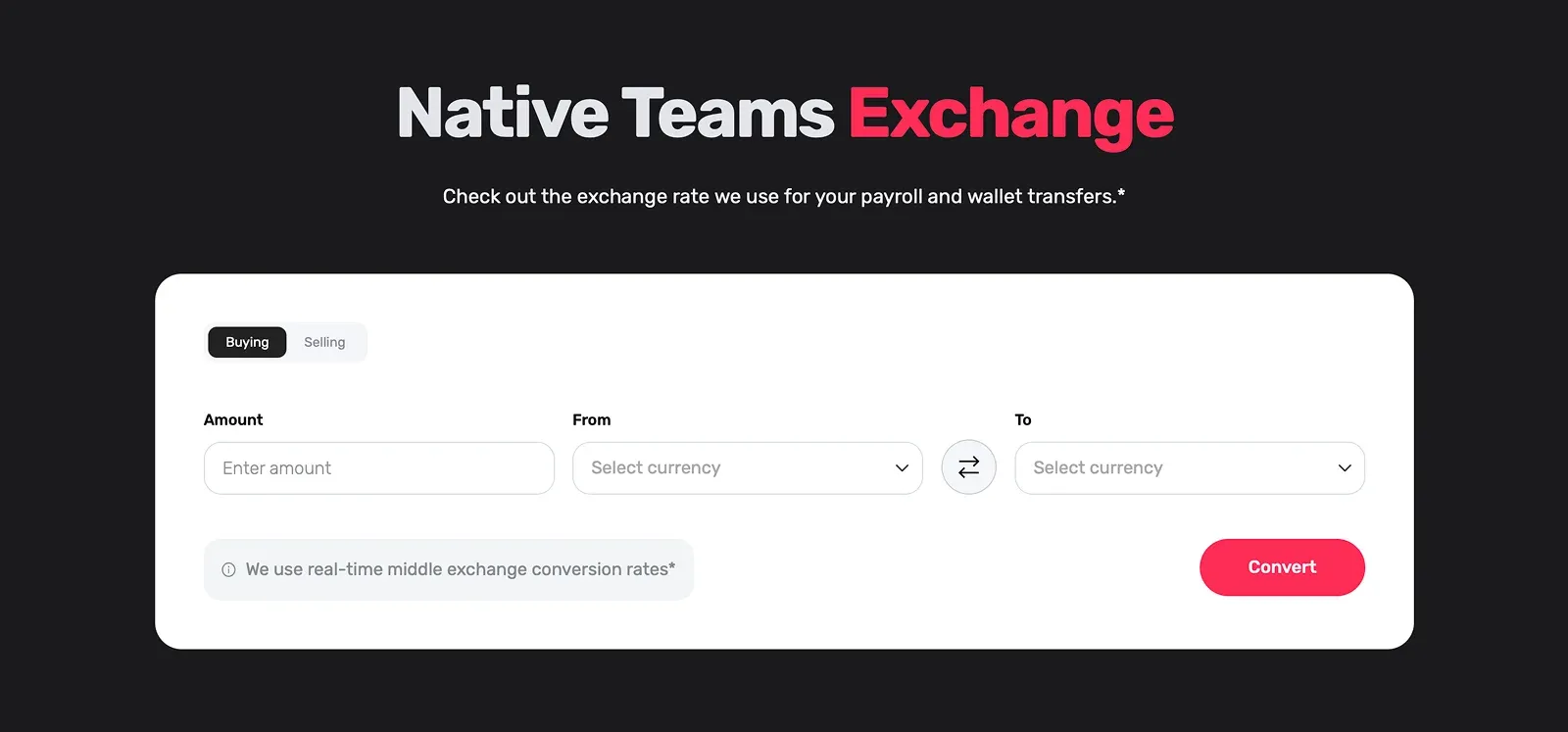

- Help you instantly pay employees in their local currencies and see detailed receipts for every transaction via our Multi-currency wallet.

- Provide transparent currency exchange fees and rates so you can easily calculate payroll and wallet transfers.

- Enable you to send bulk invites, set up payroll in multiple currencies, and onboard employees quickly.

- Boost employee experience by letting employees access payslips, review payment history, and manage data securely through the employee portal.

- Ensure your practices meet local expectations for contracts, benefits, rights, and obligations.

- Help you provide tailored health, pension, and wellness packages in full alignment with country-specific legal requirements.

Ready to know more?

Book a free demo call today and see how our solutions can help you ensure accurate, timely, and compliant payroll across borders.

Keep learning:

11 Global Payroll Best Practices You Should Know