7 Best PEOs for Mid-Sized Businesses To Choose in 2026

Managing HR, payroll, and compliance across multiple states or countries gets increasingly complex as your business grows.

For mid-sized companies, the administrative load can slow down expansion, drain internal resources, and expose them to compliance risks.

The more employees you add, the harder it becomes to stay efficient and compliant without a massive HR team.

Luckily, PEO companies can help you streamline operations.

But which one to choose? Read on to check our top picks of PEO services for mid-sized businesses to stay compliant and scale without the overhead.

7 PEO services for mid-sized businesses worth knowing

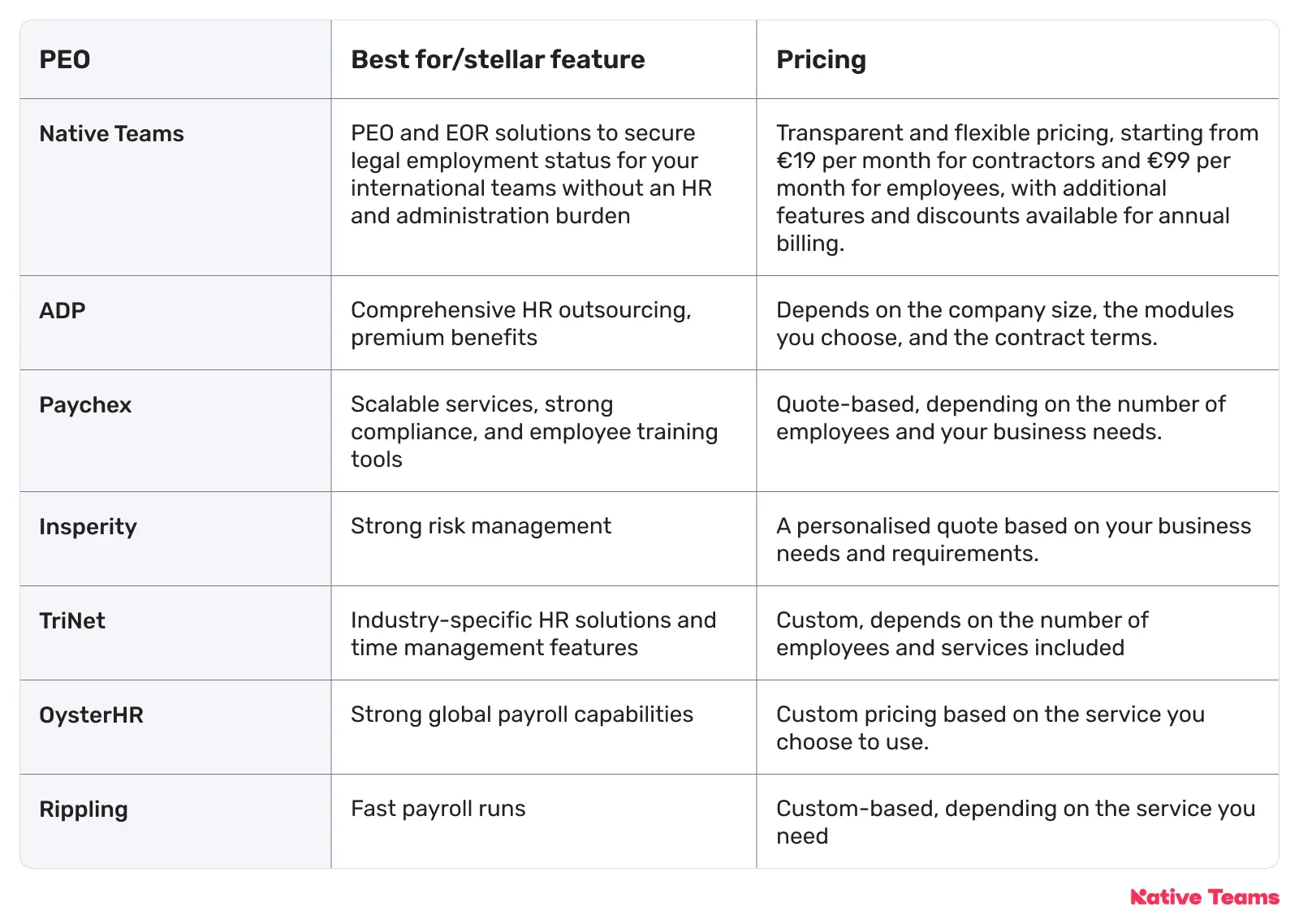

Before we explore each PEO service in greater detail, here’s a quick breakdown.

1. Native Teams

Native Teams provides an all-in-one platform to simplify every aspect of managing your global workforce, from hiring and payroll to payments and compliance.

What we offer:

- EOR and PEO Services

- Integrated payroll, HR, and employment solutions

- Local compliance support in 85+ countries

- Smooth multi-currency payment handling

For added flexibility, Native Teams also offers white-label solutions, allowing you to customise the platform to match your brand and scale your service offerings with ease.

Key features

1. PEO services

Our PEO services give you complete control over your team’s day-to-day work, while we handle the administrative heavy lifting, including wage reporting, employment taxes, and compliance.

With a single, all-inclusive payment, you can streamline your operations and reduce administrative burdens.

2. EOR services

Native Teams enables you to build your team across more than 85 countries without the hassle of setting up local operations.

We manage compliant hiring and onboarding, while our integrated platform streamlines every aspect of global workforce management.

What’s included:

- Competitive local benefits: Attract and retain top talent with tailored healthcare, insurance, and pension plans that meet local expectations.

- Strategic tax optimisation: Maximise tax efficiency with expert support on local deductions, allowances, and contributions.

- Expense management: Simplify expense tracking with easy receipt uploads, automated approvals, and real-time reporting.

- Compliant absence management: Manage employee time off while staying fully aligned with country-specific labor laws.

- Automated and accurate payroll: Ensure precise, compliant payroll calculations in just seconds.

We ensure timely, accurate payments along with all required contributions and benefits for your international workforce.

Our centralised dashboard streamlines team management, letting you send payroll invites, update salaries, and monitor everything from one place.

One of our customers’ favourites, Multi-Currency Wallet allows instant transfers between wallets in different currencies, reducing transaction fees and improving efficiency.

Therefore, you can easily fund your wallet via credit or debit card and enjoy full transparency with detailed receipts for every transaction.

What makes Native Teams a good option for mid-sized businesses?

Strong global compliance, benefits, payroll and contractor support across 85+ countries benefit mid-sized businesses expanding internationally or managing remote teams.

Pricing

We offer transparent and flexible pricing, starting from €19 per month for contractors and €99 per month for employees, with additional features and discounts available for annual billing.

2. ADP

ADP provides HR, payroll, benefits and compliance solutions to US-based businesses. ADP TotalSource is ADP’s PEO service that handles payroll, tax management, benefits administration, workers’ compensation, and compliance.

Key features:

- Dedicated HR expertise: You get a dedicated HR expert, as well as access to payroll advisors, tax teams, and benefits specialists.

- Employee self-service: Employees can manage their own information, benefits, and payroll details through an intuitive, cloud-based platform.

- Payroll administration: Includes payroll processing, including audit and reconciliation and tax administration support.

- Benefits administration: Provides health, dental, vision insurance, pesnion retirement savings plan, as well as voluntary benefits

- Talent management: Includes support for hiring, onboarding, and employee retention strategies.

What makes ADP a good option for mid-sized businesses?

Scalable HR outsourcing with premium benefits and advanced analytics, suited for mid-sized businesses requiring multi-state compliance.

Pricing

ADP’s pricing depends on the company size, the modules you choose, and the contract terms.

3. Paychex

Paychex offers HR outsourcing and workforce management solutions tailored especially for small and mid-sized businesses.

It also supports recruiting, onboarding, and employee training, including an AI-powered recruiting tool, Recruiting Copilot, which searches and matches qualified candidates to job openings.

Key features:

- Tax management: The platform manages federal, state, and local payroll tax filings and payments. It also supports time tracking, annual leave requests, and scheduling.

- Benefits administrations: Includes health, dental, vision, pension plans, health savings accounts, flexible spending accounts, and wellness programmes.

- Risk and compliance management: Helps your business stay compliant with local, state, and federal regulations, including workplace safety programmes, workers’ compensation, unemployment insurance, and return-to-work initiatives.

- HR Services: Paychex assigns an HR consultant to help develop and manage company HR policies, employee handbooks, compliance with labour laws, performance evaluations, behavioural assessments, and assistance with employee termination or disputes.

- Payroll services: Employees can review and select pay options including paper checks, direct deposit, etc. You can also arrange payments for various employment types.

What makes Paychex a good option for mid-sized businesses?

Scalable services, combined with strong compliance and employee training tools, make it a good fit for mid-sized companies looking for flexibility and ongoing HR support.

Pricing

Paychex’s pricing is quote-based, and it depends on the number of employees and your business needs.

4. Insperity

Insperity is a PEO solution with a strong emphasis on risk management, compliance, and employee development.

It caters to US-based small and medium-sized businesses.

Key features:

- HR compliance: Manages federal and state employment laws, and provides guidance on HR issues, such as employee complaints, multistate complexities, employer-regulated changes, and more.

- Employee self-service: Your employees can view paystubs, W-2s, timesheets, annual leave, and more. The service enables them to manage their benefit and retirement plans directly on the platform.

- Time and attendance tracking: You can collect and analyse payroll and control employee time-tracking, scheduling, annual leave accrual and clock-ins.

- Risk management: Insperity offers legal compliance support, workplace safety audits, assistance with Equal Employment Opportunity Commission (EEOC) complaints, and workers’ compensation programmes.

- HRCore: Unifies HR functions, such as payroll, time and attendance, onboarding new employees, etc., into a single platform.

What makes Insperity a good option for mid-sized businesses?

Comprehensive HR outsourcing, combined with strong risk management and extensive employee training, suits mid-sized businesses that prioritise compliance, employee development, and flexible plans.

Pricing

Insperity provides a personalised quote based on your business needs and requirements.

5. TriNet

TriNet offers comprehensive HR solutions, such as payroll, benefits, compliance, and risk management through a unified platform.

Their solutions are tailored to your business’s industry, size, and location.

Key features:

- Payroll administration: Provides full payroll processing with direct deposit and debit options, paperless payroll with e-pay stubs, pay cards, and electronic W-2 preparation and delivery. Employees can view pay stubs and request time off via TriNet’s mobile app. Also, the system integrates with accounting systems like QuickBooks Online, so you can synchronise it with your general ledger.

- HR management platform: A comprehensive HR platform for managing the entire employee lifecycle from recruiting and onboarding to payroll processing and benefits admin.

- Compliance tools and monitoring: TriNet monitors HR requirements to provide up-to-date HR compliance, in accordance with federal, state, and local employment laws. You can also apply custom rules for your business or industry.

- Time tracking and management: Includes dashboards that provide overviews into employees’ work schedules, pending timecard approvals, clock-ins, etc. It’s also possible to add rest and meal period rules according to company policies.

- Visual scheduler: Enable you to generate work schedules and view scheduled work hours by day, week or month. Additionally, you can create and view schedules by employee, shift, department or job.

What makes TriNet a good option for mid-sized businesses?

Industry-specific HR expertise combined with compliance solutions makes TriNet well-suited for mid-sized companies needing tailored support.

Pricing

TriNet’s pricing depends on the number of employees and the employee benefits and HR services you choose.

6. OysterHR

OysterHR helps you hire, onboard, pay, and manage employees internationally while staying compliant.

The platform offers strong global payroll capabilities and automation-driven workflows.

Key features:

- Global payroll management: You can manage payroll across more than 28 countries from a single platform. The platform also supports multi-currency payments.

- Automated payroll processing: Handles taxes, filings, and local compliance tailored to your business needs.

- HRIS integration: Enables you to integrate with your existing HR tools to automate workflows, sync employee data, and eliminate manual entry.

- Benefits administration: Offers country-specific health insurance and statutory benefits, with employee self-service for benefits enrollment and claims.

What makes OysterHR a good option for mid-sized businesses?

OysterHR is a good fit for mid-sized companies expanding internationally that need compliant payroll and benefits administration.

Pricing

Oyster offers custom pricing based on the service you choose to use.

7. Rippling

Rippling unifies HR, payroll, and IT into a single platform, streamlining and automating the management of a global workforce.

It provides solutions to manage both domestic and global workforces.

Key features

- Automated global compliance: Helps you stay compliant with local laws through automatic tax filings, enforcement of minimum wage and overtime rules, and up-to-date labour law management.

- Integrated HRIS: Consolidates employee data, documents, time-off tracking, policy management, and workflows to reduce administrative overhead and eliminate manual data entry.

- Employee self-service: Gives access to employees so that they can view pay stubs, access benefits, and manage time off within the same platform.

- Localised employment agreements: Enables you to generate country-specific employment contracts and collect required onboarding information.

What makes Rippling a good option for mid-sized businesses?

Unified HR, payroll, IT, and finance automation, along with flexible PEO options, benefits mid-sized businesses searching for a scalable platform that integrates workforce and IT management.

Pricing

Rippling has quote-based pricing depending on the services you need.

Why should you go for Native Teams?

Operating in over 85 countries, we deliver end-to-end solutions, including payroll, legal employment, tax optimisation, and wealth management, empowering you to scale seamlessly across borders.

What makes us a reliable partner:

- All-in-one global workforce platform that handles payment processing, compliance, and recruitment tools to manage your international team from one place.

- Legal entity establishment capability to set up and manage legal entities across multiple countries while ensuring full compliance with local laws and regulations.

- Streamlined global operations that simplify complex international processes, including entity setup, visa applications, and work permit handling.

Beyond HR and payroll, we provide custom financial tools to help you manage taxes, savings, and investments, supporting smarter, scalable growth.

Ready to learn more about how we can help?

Book a free demo call today to start simplifying global hiring and compliance from a single platform.

Keep learning:

What Are the PEO Pros and Cons You Should Know