PEO vs. ASO vs. HRO – Key Differences Explained

With so many outsourcing acronyms around, PEO, ASO, and HRO, it’s easy to feel overwhelmed.

But even worse, choosing the wrong model can lead to hidden costs, lost control, or even compliance issues.

Furthermore, you may end up with a solution that doesn’t scale, doesn't protect you, or doesn't provide the flexibility your business needs.

However, when you understand how PEOs, ASOs, and HROs really work, you can make an informed decision on which one fits your business model the best.

And that’s where we step in. Read on to learn what each model is, how they differ, and ultimately, which one to choose.

Let’s dive in!

What is PEO?

When using a PEO, or Professional Employer Organisation, you enter into a co-employment relationship, where the PEO legally becomes in charge of payroll, taxes, and insurance.

Meanwhile, you still manage your team’s day-to-day work, culture, and performance.

This shared responsibility means that you focus on growing your business, while the PEO handles employment regulations, tax filings, and benefits administration.

The PEO is also responsible for a significant part of the legal liability.

What services does a PEO offer?

PEO companies provide a full suite of HR services, which are often bundled:

- Payroll processing and tax filing (under the PEO’s EIN).

- Access to top-tier employee benefits, like health insurance, retirement plans, and even wellness perks.

- Regulatory compliance, including ACA, FLSA, and OSHA requirements.

- Risk management and workers' comp administration.

- Onboarding, training, and HR policy support.

What is ASO?

Unlike a PEO, an ASO doesn’t enter into a co-employment relationship.

You remain the legal employer of record, which means your company’s name stays on all tax documents, payroll filings, and compliance forms.

Nonetheless, you still get access to professional-grade HR services, just without the legal and structural aspects of co-employment.

What services does an ASO offer?

An ASO typically supports your business in all the core HR functions, including:

- Payroll processing and tax filing (under your EIN).

- Benefits administration support, such as open enrollment and vendor management.

- HR compliance assistance, including updates on labour laws and regulatory changes.

- Risk and safety program guidance.

- Employee handbooks, training, and documentation tools.

What is HRO?

HRO allows you to outsource specific HR functions, or even your entire HR department, to an external provider, without any co-employment or employer-of-record relationship.

This functionality makes HRO the most customisable and scalable of all the HR outsourcing models.

You choose the services you want, such as recruiting, compliance, training, benefits administration, or performance management, and let the experts handle them for you.

What services does an HRO offer?

HRO providers offer à la carte or fully bundled HR solutions, such as:

- Full-cycle recruitment and onboarding.

- Payroll, tax filing, and benefits management.

- Training and development programs.

- Employee relations and performance tracking.

- Global HR support for multinational companies.

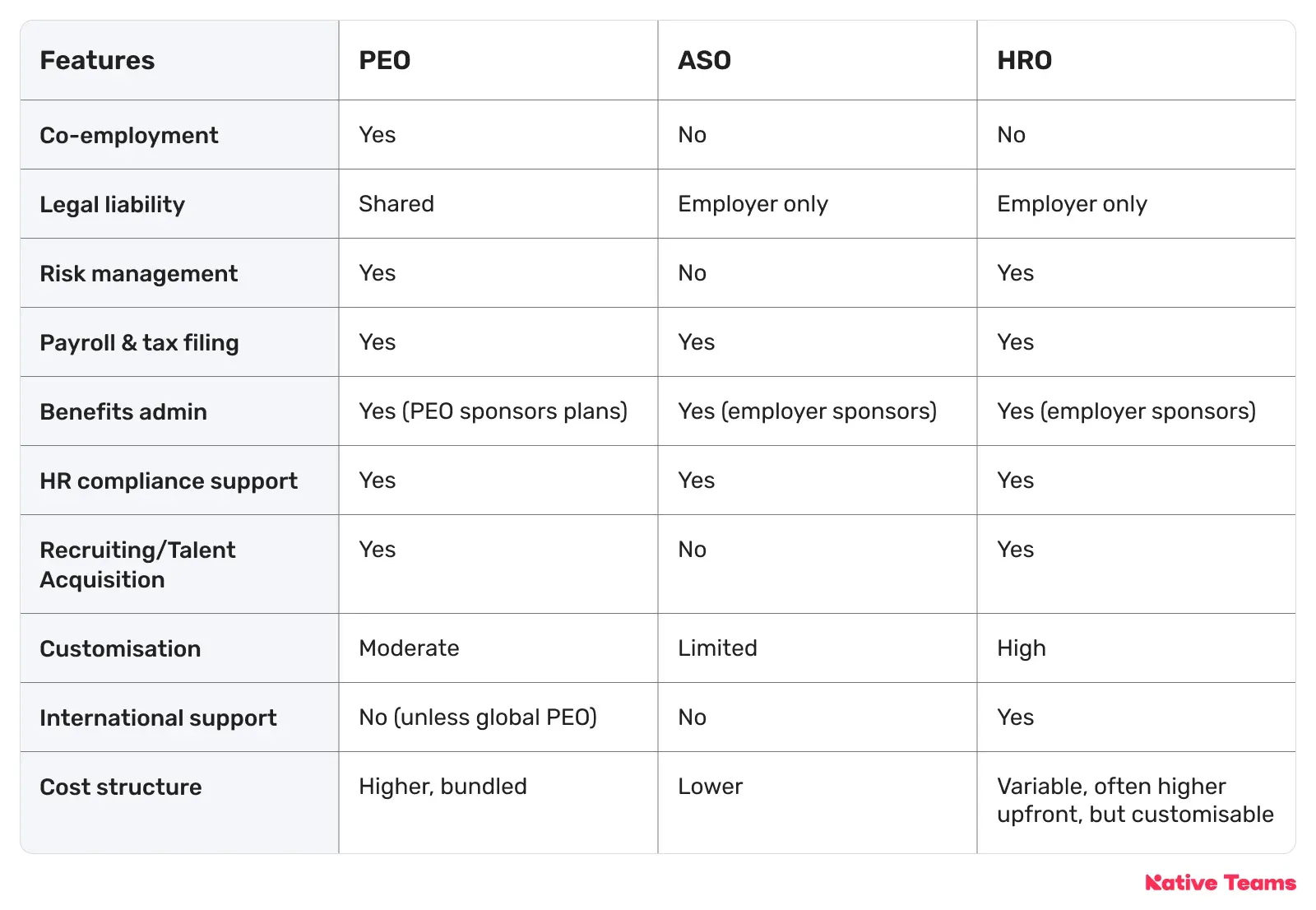

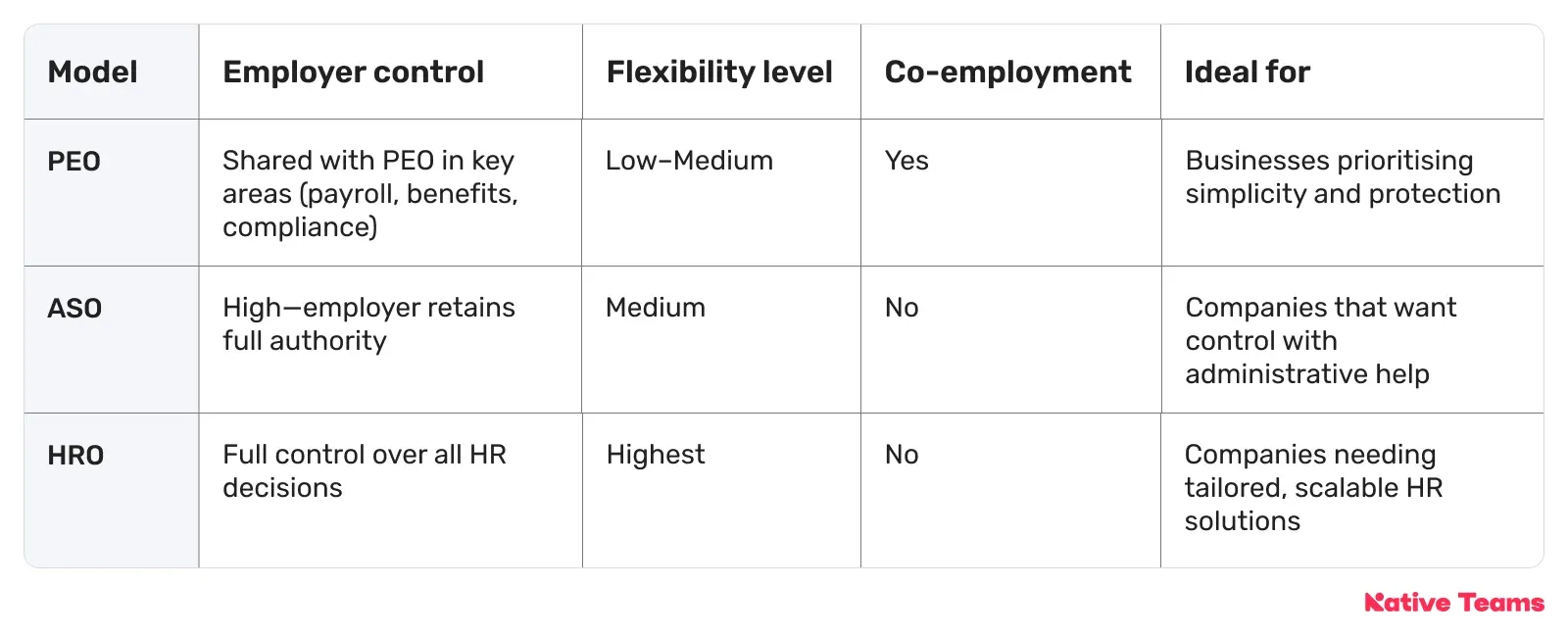

PEO vs. ASO vs. HRO: A quick comparison

Before we go through each model in more detail, here’s a quick comparison table.

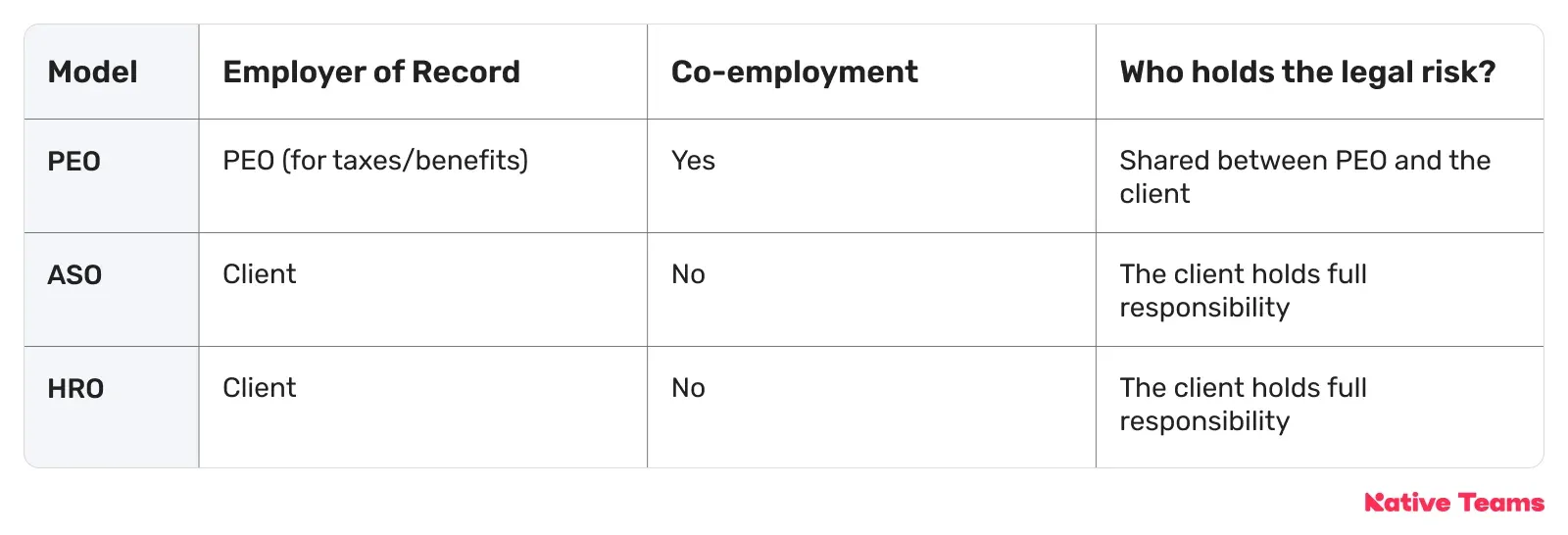

1. Employment relationship and liability

One of the most important differences between PEOs, ASOs, and HROs comes down to who legally employs your workforce and who is responsible when something goes wrong.

PEO

Due to a co-employment relationship model, the PEO shares certain legal and compliance liabilities with your business.

For example, if there’s an error in tax reporting or a misclassification of an employee, the PEO bears part of the legal burden.

This shared liability can be a major advantage, especially for small businesses that lack in-house legal or HR expertise.

Key PEO benefit: You offload a substantial part of employment risk, including tax filings, benefits compliance, and some workplace regulations.

ASO

The ASO simply provides administrative support to help you manage HR tasks more efficiently.

Since ASO doesn’t provide co-employment, your business remains the sole employer of record.

While this gives you complete control, it also means you retain 100% of the liability. If there’s a compliance issue, a lawsuit, or a payroll misstep, your company is solely responsible.

Key ASO benefit: Greater autonomy and control over your workforce, which is ideal if you have strong internal HR or legal support.

HRO

Like ASOs, HROs don’t enter into a co-employment relationship.

You retain full legal responsibility for your workforce. However, what makes HROs stand out is their broader and more strategic level of support.

While HROs don’t assume legal responsibility, their expertise can reduce your risk exposure by helping you create smarter, more compliant HR practices.

Key HRO benefit: You get access to expert HR strategy and operations without giving up legal control.

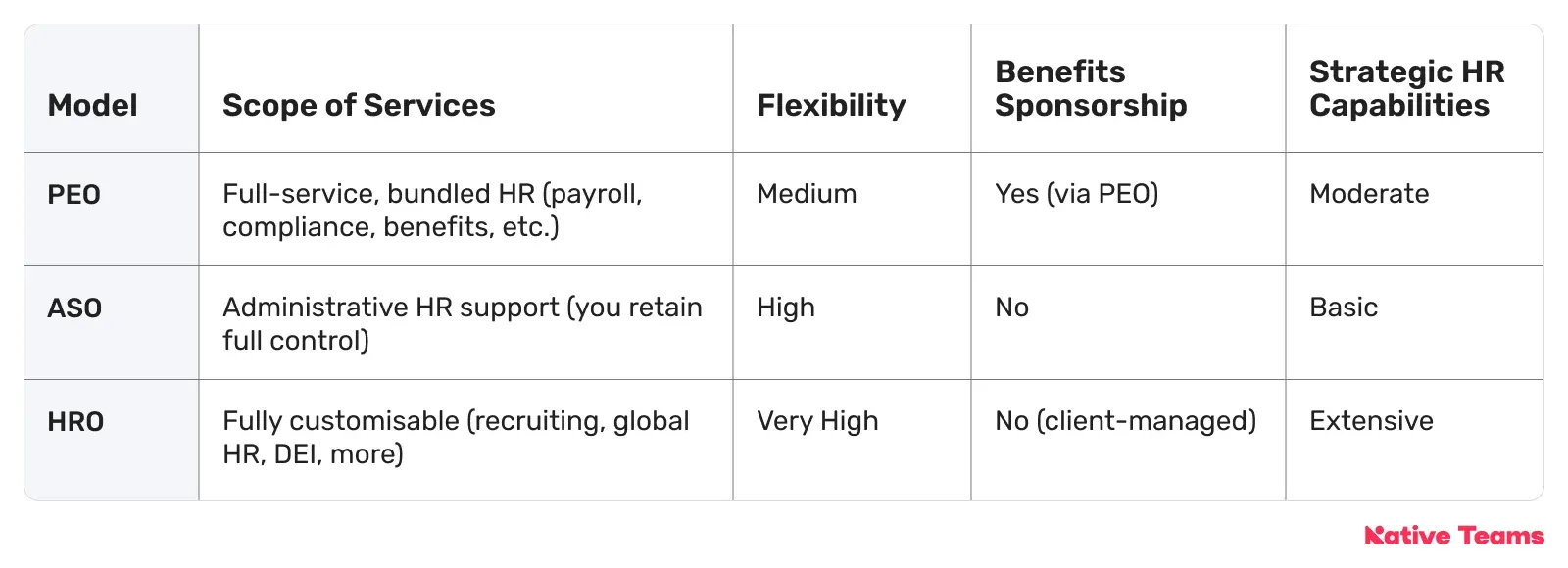

2. Scope of services

Understanding what each HR outsourcing model does is just as important as knowing how it works.

While all three offer HR support, the scope, delivery, and flexibility of their services are different.

PEO

When you partner with a PEO, you’re essentially integrating into a ready-made HR department that handles the entire employee lifecycle, often through a unified platform.

The services include everything from the basics, such as payroll, to high-value services like benefits administration and legal compliance.

ASO

ASOs provide hands-on administrative support, but don’t cover the legal and financial aspects of your employment structure.

ASOs use your company’s EIN for payroll and don’t sponsor employee benefits, but they help you manage and administer those services efficiently.

Besides sponsorship of benefit plans, ASOs also typically don’t offer legal risk-sharing, deep recruiting, or strategic workforce planning.

HRO

HROs act as strategic partners, allowing you to pick and choose exactly what HR functions you want to outsource.

As a result, HROs give you complete control over the service scope.

Unlike PEOs and ASOs, HROs are often structured as long-term strategic engagements, especially for mid-to-large enterprises with evolving HR needs.

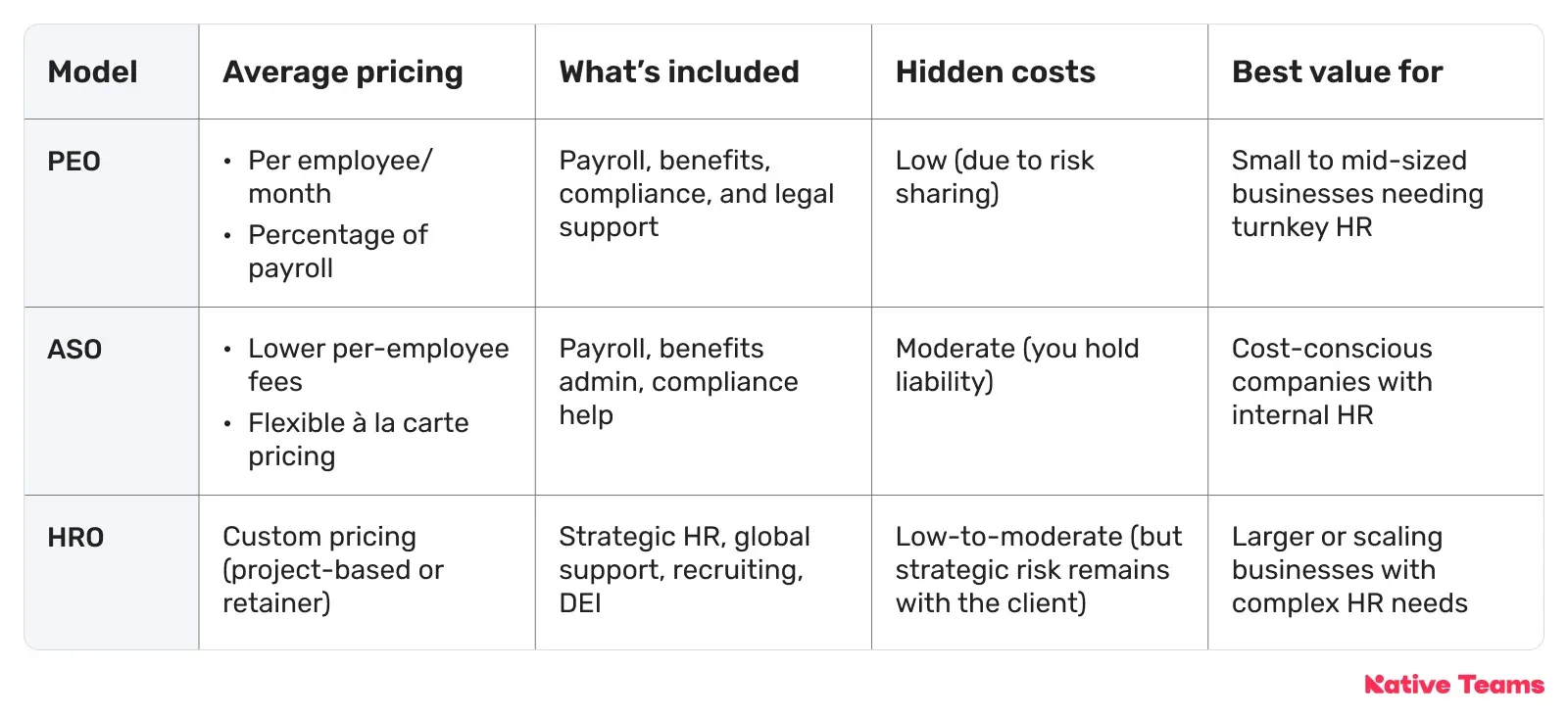

3. Cost

The cost of PEO, ASO, and HRO services varies based on the level of support, risk assumed, and customisation involved.

PEO

PEOs typically charge in one of two ways:

- Per-employee-per-month (PEPM) fee, or

- A percentage of total payroll.

While this might seem expensive at first, you should think about what’s included.

In addition to outsourcing payroll, you also gain access to enterprise-level benefits, robust compliance support, and risk mitigation services.

Moreover, these services are bundled into a single fee, which is often lower than the cost of building an in-house HR team with similar capabilities.

Additional cost benefits include:

- Providing better insurance rates through group buying power.

- Avoiding penalties due to payroll or compliance errors.

- Reducing legal exposure.

ASO

ASO pricing is generally lower and more flexible than PEOs because you're not paying for co-employment, benefits sponsorship, or legal risk sharing.

Fees may be based on:

- A flat monthly rate

- A per-employee fee (usually lower than PEOs), or

- À la carte pricing based on selected services

ASOs are often a cost-effective solution for businesses with basic HR needs or an in-house HR department that simply needs help with processes, such as payroll, time tracking, or benefits coordination.

However, because you’re still the employer of record, any compliance mistakes or legal risks still fall on you, which could mean higher hidden costs if you lack proper oversight.

HRO

HRO pricing can vary widely, depending on the level and type of support you need. It’s often structured as:

- Project-based

- Ongoing retainer for full-service HR partnerships) or

- Custom contracts tailored to multinational or enterprise-level operations.

While upfront costs may be higher than ASOs or even PEOs, HROs offer highly strategic and scalable services that can lead to long-term savings, especially if you have:

- International teams

- High-volume recruiting needs

- Specialised HR challenges like mergers, acquisitions, or restructuring.

4. Flexibility and control

The amount of control you’ll keep depends heavily on the model you choose.

Thus, understanding how flexible and customisable each option is can make all the difference in your decision.

PEO

A PEO offers a full-service HR solution, but it comes with co-employment, which means some employer responsibilities are shared between you and the PEO.

While this structure provides convenience and protection, it also means you give up some flexibility in how certain HR functions are handled.

For example:

- The PEO may choose which benefit plans are available to your team.

- Payroll is run under the PEO’s EIN, not yours.

- Policies and procedures often need to align with the PEO’s standardised systems.

Nonetheless, you still control the day-to-day management of your employees. Their roles, responsibilities, and performance expectations remain in your hands.

ASO

With an ASO, there is no co-employment, which means your business retains full legal and operational control over all employment matters.

You maintain your tax IDs, select your own benefits plans, and set policies that reflect your company culture and priorities.

The ASO is there to support, not direct, your HR operations.

You gain moderate flexibility to pick and choose which services to outsource, but you’ll likely use the ASO’s systems and processes.

Therefore, you get help managing tasks, but you stay fully in charge.

HRO

Unlike PEOs or ASOs, HROs allow you to tailor your service package fully.

There’s no co-employment, so your business retains complete control over hiring decisions, benefits strategy, company culture, and compliance responsibilities.

The HRO provider adapts to your internal systems, policies, and goals.

Additionally, some HROs can integrate seamlessly with your HRIS, payroll, or ERP platforms, providing you with total operational continuity and expert support.

5. International support

If you operate or plan to expand globally, knowing which of the 3 models provides international support can be a deal-maker or breaker.

PEO

Most traditional PEOs operate within a single country, typically where you have your headquarters.

If you want to hire abroad, you’ll need to partner with a Global PEO.

A Global PEO enables you to:

- Hire employees in foreign countries.

- Stay compliant with local tax laws and labour regulations.

- Offer regionally appropriate benefits packages.

- Onboard international talent quickly and legally.

ASO

ASOs are strictly domestic service providers.

Their support is limited to the country where your business is legally registered, and they don’t handle international payroll, compliance, or labour laws.

If you're planning to hire employees abroad, you'll need to:

- Set up your own foreign legal entities.

- Manage local labour law compliance yourself.

- Handle complex international payroll and tax systems independently.

HRO

HROs offer end-to-end solutions suitable for global workforce management.

Thus, you can:

- Handle multi-country payroll and benefits through a centralised platform.

- Ensure compliance with local labour laws and tax regulations.

- Streamline global onboarding and offboarding.

- Leverage expertise in cross-cultural talent acquisition.

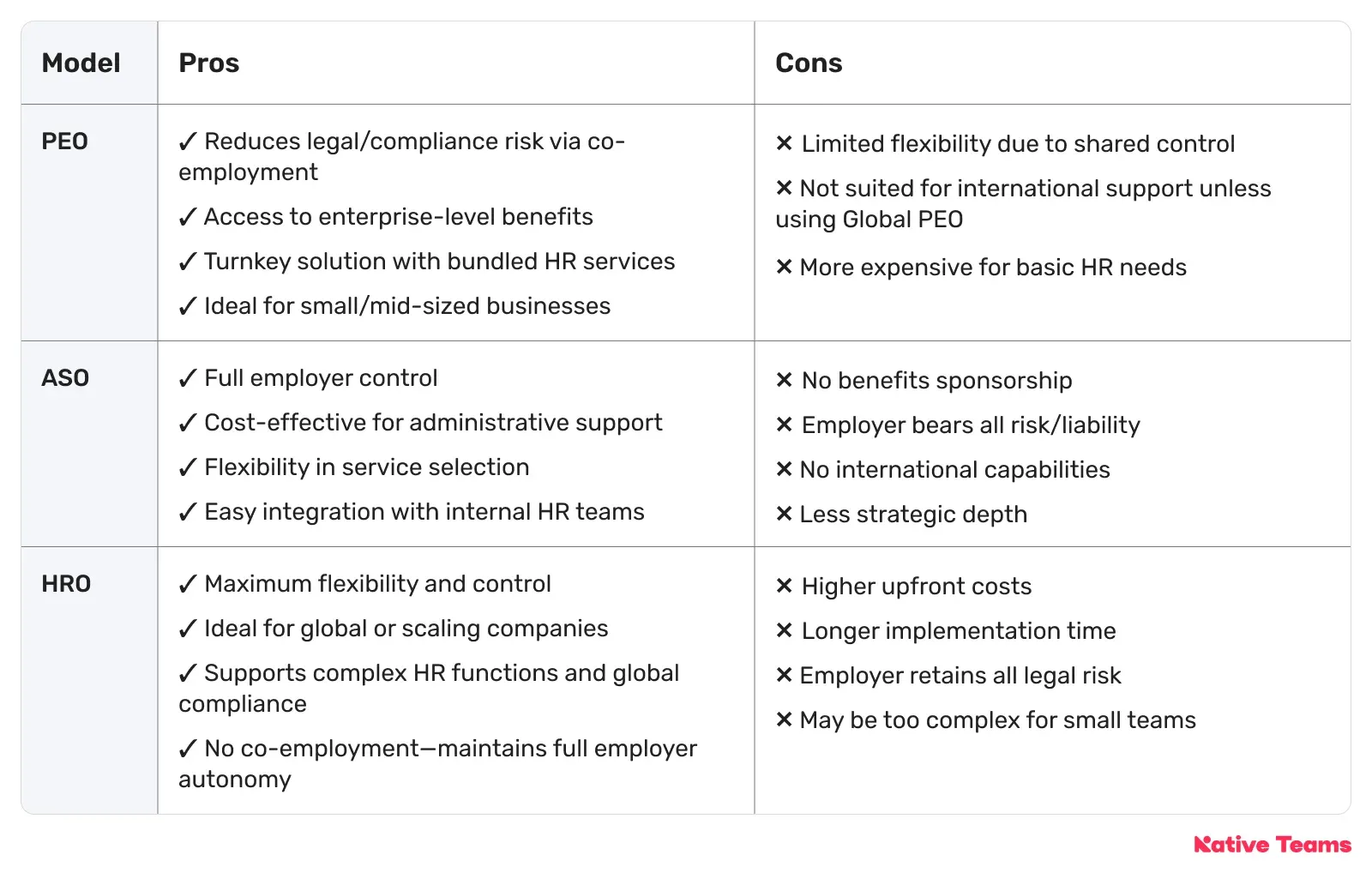

PEO vs. ASO vs. HRO: Pros and cons

All 3 models come with unique advantages, but there are also areas where they fall short.

PEO vs. ASO vs. HRO: Which is the right fit for your business?

Choosing the right HR outsourcing model depends on your business size, complexity, and growth plans.

PEOs are ideal for comprehensive all-in-one HR support, incorporating compliance and benefits, while ASOs provide administrative assistance without giving up control.

On the other hand, HROs are ideal if you need flexible, global, and strategic HR solutions.

However, if you want an all-in-one solution that combines the best of these models, comprehensive HR support, flexibility, and international reach, Native Teams offers an innovative solution.

Native Teams specialises in building and managing distributed, global teams with seamless HR, payroll, and compliance services tailored to your company’s needs.

Native Teams: One flexible platform for payroll, compliance, and international hiring

Native Teams offers Employer of Record (EOR) services in over 85 countries without the need for your company to establish local legal entities.

We deliver a customised, scalable solution that blends strategic HR functions with operational support.

This way, you can hire, onboard, and pay international employees compliantly and efficiently through a single, centralised platform.

What do you get with our solutions?

- Legal employment — Provides localised employment contracts, manages tax withholdings, social security contributions, and benefits, all under Native Teams’ legal entities.

- Global payroll & gig payments — Supports employees and contractors in multiple currencies, offering integrated payment tools like virtual cards and expense management, making it highly flexible for various workforce types.

- Compliance-first approach — Offers EOR status, local HR and legal expertise, and regularly updated contracts and regulatory guidance.

- Employee-centred support — Includes detailed payslips, onboarding assistance, competitive, localised benefits packages such as health insurance, pensions, and dedicated account managers for a human-centric experience.

Curious to know more?

Book a free demo today to learn how to start expanding faster and paying smarter while staying legal.

Keep learning:

PEO vs. Payroll Services – What’s the Key Difference?