Employee Misclassification: Hidden Costs for Global Businesses

Employee misclassification is one of the most pressing compliance risks for global businesses.

What might appear to be a simple categorisation error can, in reality, expose organisations to severe financial and legal consequences.

Beyond fines and penalties, misclassification can trigger audits, retroactive tax liabilities, and reputational damage that affect stakeholder confidence.

Read on to learn why employee misclassification can be such a hidden financial trap and the steps you can take to avoid a compliance nightmare.

What is employee misclassification?

Employee misclassification happens when a business labels someone as an independent contractor, even though their role legally qualifies as employment.

This isn’t just a technicality, but it can strip workers of critical protections and benefits they’re entitled to, including:

- Minimum wage,

- Overtime pay,

- Health coverage,

- Unemployment insurance,

- Workers’ compensation, and

- Family leave.

Misclassification can happen for two main reasons:

- Intentional: to cut costs by avoiding payroll taxes and employee benefits. According to the IRS, employers save between 20%-40% on labour costs through misclassification.

- Unintentional: Due to the complexity of local employment laws and varying definitions of what constitutes an employee.

At the heart of most classification tests is one question: How much control does the company have over how the work is done?

A high degree of control typically signals an employment relationship.

For businesses, the stakes are high.

Misclassifying workers can result in back taxes, substantial penalties, legal fees, and lawsuits from workers claiming unpaid wages and lost benefits.

What looks like savings can quickly become a costly mistake..

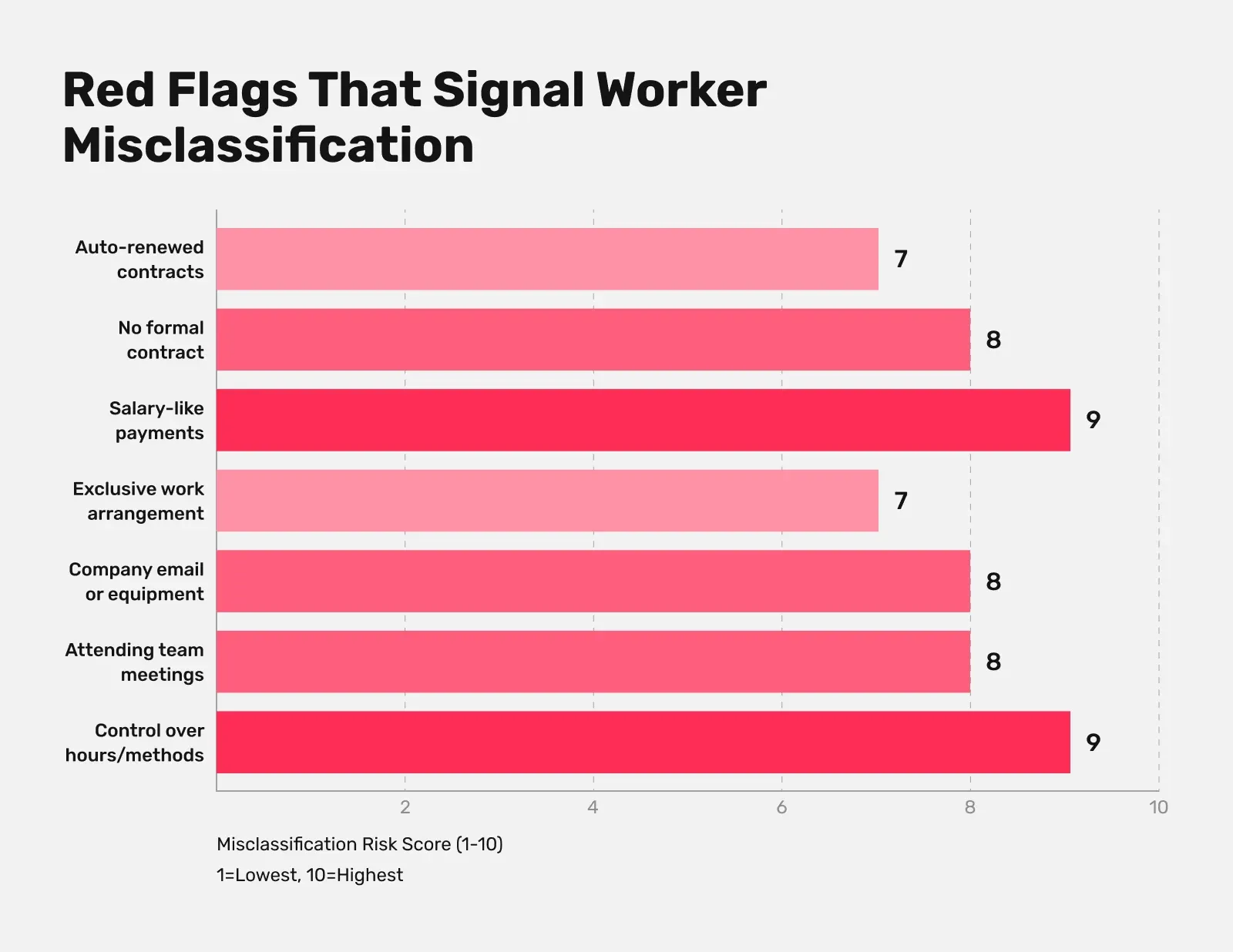

Misclassification red flags: How to spot misclassified workers?

Spotting misclassification isn’t always straightforward, but there are clear signs that can help identify it.

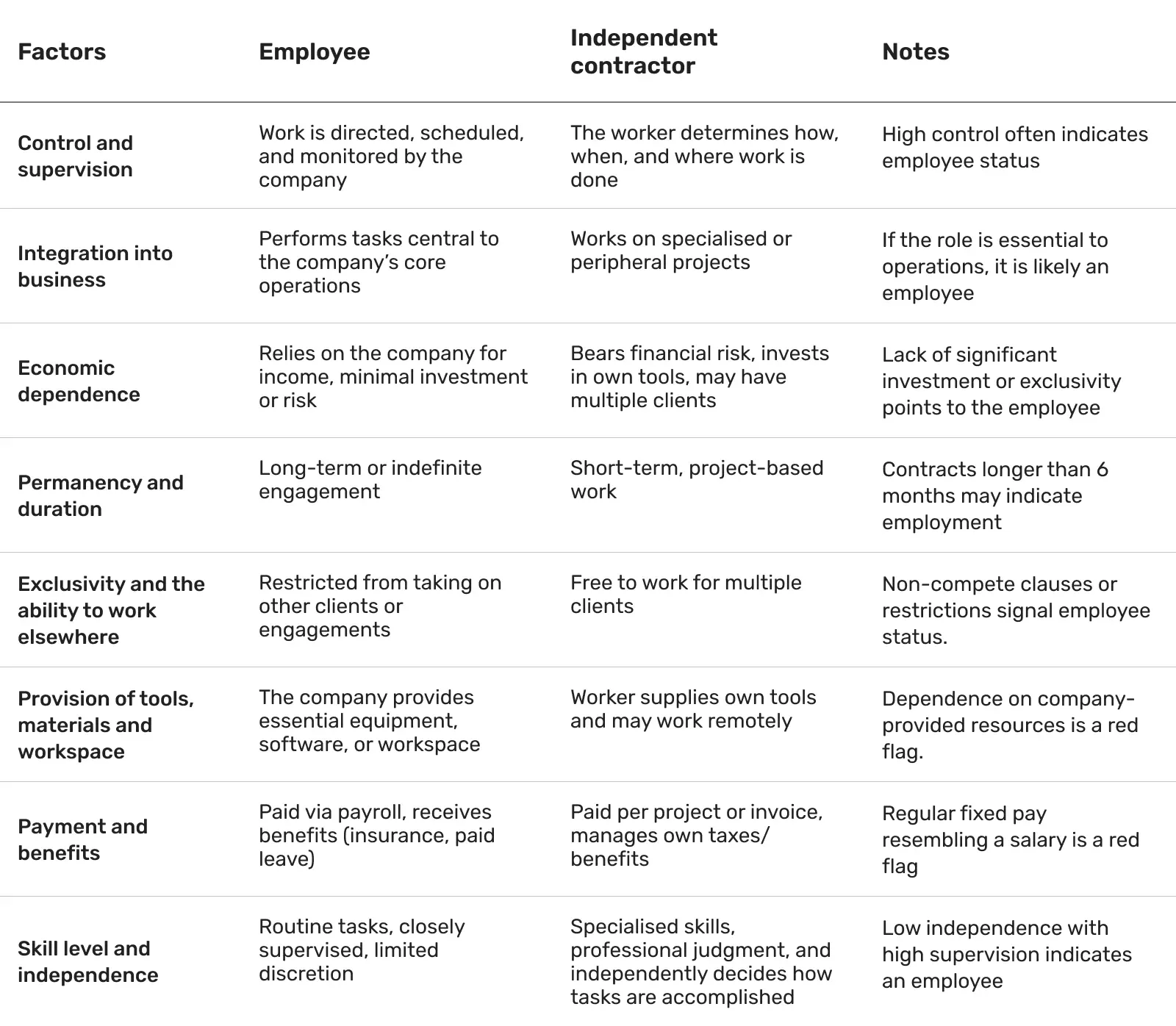

Below are 8 practical factors employers should review when determining whether a worker is truly an independent contractor or an employee.

1. Degree of control and supervision

The greater the control your company has over how, when, and where work is done, the more likely the worker should be classified as an employee.

For example, requiring workers to follow fixed schedules, use company-approved tools, or report to supervisors typically signals employee status.

Independent contractors, on the other hand, control their own work methods and timelines.

2. Integration into core business activities

If the worker’s tasks are central to your company’s main operations and not just peripheral projects, that suggests an employment relationship.

A delivery driver for a logistics firm or a software developer for a tech company is likely an employee if they’re part of the core workflow.

3. Economic dependence and profit opportunity

Employees generally have limited financial risk and earn a steady wage.

Contractors, however, invest in their own equipment, market their services, and may serve multiple clients.

No significant investment and exclusivity to your company point toward employee status.

4. Permanency and duration of work

Long-term or open-ended engagements of more than six months are strong indicators of employment.

Actual contractors typically work on defined, short-term projects.

5. Exclusivity and ability to work for others

If your contract includes a non-compete clause or limits outside engagements, that’s a strong signal of employment rather than independent contracting.

In contrast, contractors typically advertise their services and manage multiple projects to diversify income.

6. Provision of tools, materials, and workspace

When the company supplies essential tools, software, or a dedicated workspace, it suggests an employment relationship.

Real contractors often invest in their own equipment and choose where and how to work.

7. Payment structure and benefits

If a contractor is paid on a weekly, biweekly, or monthly schedule, regardless of project milestones, it starts to resemble payroll.

Genuine contractors are typically compensated per project, per deliverable, or upon achieving defined milestones rather than receiving a predictable paycheck.

Payments that resemble a salary and include employee-style perks, such as reimbursements, bonuses, or equity grants, indicate an employment relationship. Independent contractors generally invoice for specific services and manage their own expenses.

8. Skill level and independence

Work that requires specialised expertise, professional judgment, and independent decision-making supports contractor status.

On the other hand, routine, closely supervised tasks align with employment.

The hidden price of employee misclassification: Why it’s a growing risk?

Employee misclassification remains one of the most costly compliance risks for global businesses.

Classifying workers as independent contractors instead of employees can quickly backfire.

Regulators worldwide are intensifying audits, introducing stricter laws, and imposing heavier penalties, making this issue impossible to ignore.

1. Financial costs

The financial consequences of misclassification can be staggering. Penalties can often reach millions in fines, like in the case of Uber, which paid $100 million for misclassifying drivers as independent contractors instead of employees.

On top of that, companies can be liable for retroactive payroll taxes, back wages, and missed benefits, such as health insurance and paid time off.

What initially looked like cost savings can spiral into a multi-million-dollar liability overnight.

2. Legal and compliance risks

Misclassification opens the door to lawsuits from workers seeking lost wages, overtime, and benefits.

Besides being expensive, these cases are also lengthy, often resulting in large settlements or judgments.

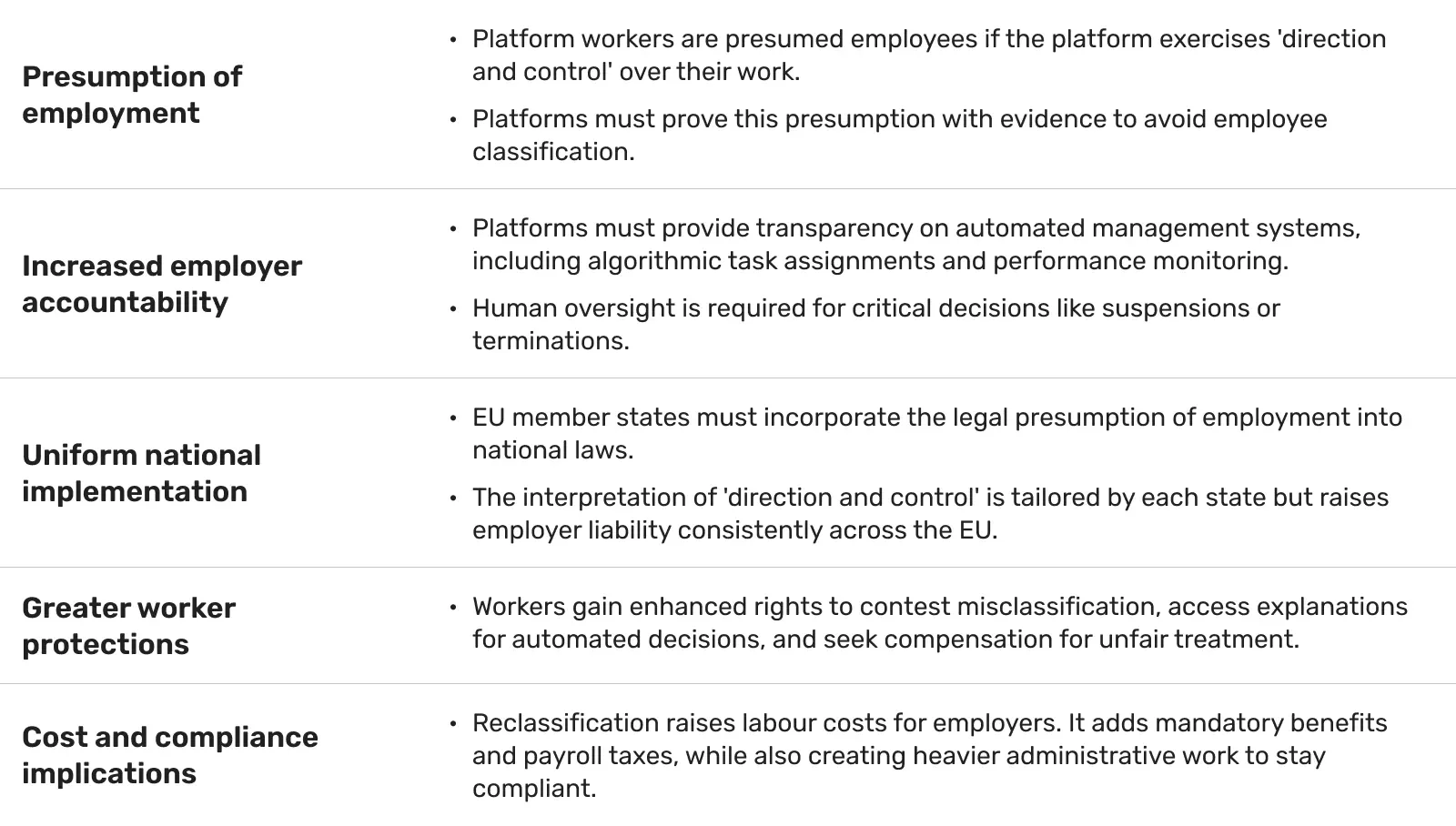

Compliance pressures are mounting, with stricter audits and new regulations such as the EU Platform Worker Directive coming into effect by 2026, creating consistent standards across multiple jurisdictions.

In some regions, such as Germany, severe violations even carry the risk of criminal charges and potential imprisonment for executives.

How does the EU Platform Work Directive change employer liability?

The EU Platform Work Directive marks a major shift in employer responsibility for platform-based gig workers.

Under the new rules, there is a legal presumption that platform workers are employees, unless the platform can provide clear evidence proving otherwise.

This change places the burden of proof on employers, making them more accountable for employment-related obligations such as wages, social protections, and benefits, and significantly increasing potential liability for non-compliance.

3. Business interruptions

When audits hit, in addition to costs, they disrupt business.

Investigations consume internal resources, stall projects, and can freeze hiring in critical roles.

With the rise of remote work and the global gig economy, classification decisions have become more complex.

Organisations must invest in ongoing risk assessments, regular job classification audits, and technology solutions that proactively monitor compliance.

What practical steps can you take to audit classifications across remote teams?

The following steps can help you improve workforce transparency.

1. Set clear classification policies

- Define detailed policies outlining criteria for employee vs. contractor classification, aligned with applicable local and international labour laws.

- Regularly update these policies to reflect changes in regulations and business models, including specific rules for remote and platform jobs.

2. Use technology and automated tools

- Implement classification management and compliance software that can track worker contracts, job descriptions, and payment structures.

- Use digital audit trails and automated alerts for discrepancies or deviations in classification standards.

3. Conduct regular and scheduled audits

- Schedule audits with a combination of automated scans (daily/weekly) and manual reviews by HR or compliance teams (monthly/quarterly).

- Randomly sample employees’ classification documentation and contracts for consistency checks.

4. Engage cross-functional teams

- Include compliance, legal, HR, and remote team managers in the audit process to gather comprehensive feedback and identify classification risk areas.

- Collaborate closely with local labour law experts for jurisdiction-specific insights.

5. Train teams on classification compliance

- Provide ongoing training for managers and remote HR teams on classification rules, audit processes, and legal implications.

- Use simulated scenarios and real examples to reinforce learning and improve accuracy in classification decisions.

6. Maintain transparent documentation

- Keep centralised, secure, and easily accessible records of contracts, classification decisions, communication, and audit outcomes.

- Ensure documentation supports classification justifications based on concrete work control, benefit eligibility, and reporting lines.

7. Regularly review and refine processes

- Analyse audit findings to identify common errors or trends.

- Adjust classification policies, training programs, and audit methodologies to address risks proactively and reduce misclassification errors over time.

8. Communicate clearly with remote workers

- Establish clear communication about employment status, rights, and expectations.

- Provide channels for remote workers to ask questions and report concerns about classification.

4. Reputational damage

Misclassification doesn’t stay hidden for long.

Once exposed, it can damage employer branding, public trust, recruitment, and investor confidence.

The workforce expects transparency and fair treatment. Failing on these fronts can undermine recruitment and retention efforts.

Rebuilding a tarnished reputation is costly and time-consuming, making compliance not just a legal necessity, but a core part of a company’s long-term sustainability strategy.

5 best strategies for avoiding misclassification

Preventing employee misclassification requires proactive planning, legal guidance, and ongoing operational discipline.

Companies that take steps early can reduce financial, legal, and reputational risks while maintaining flexibility in workforce management.

1. Leverage Employer of Record (EOR)

For cross-border hires, using an EOR can significantly reduce exposure to misclassification.

EORs assume responsibility for employment-related compliance, including taxes, benefits, and local labour regulations, effectively transferring liability from the parent company. This approach is especially valuable in jurisdictions with high enforcement intensity.

Quick tip:

Opting for an EOR with its own legal entities in the countries where you operate is generally safer than relying on EORs that work through local partners because it reduces layers of liability and increases control over compliance.

When the EOR has a legal presence in-country, they are directly responsible for employment obligations such as payroll taxes, social contributions, and mandatory benefits.

As a result, this direct responsibility:

- Minimises the risk of misclassification,

- Ensures following local labour laws, and

- Provides clearer accountability if regulators audit your workforce.

2. Design compliance-first contracts

Contracts should be structured to reflect true independent contractor relationships, avoiding language or obligations that suggest employee-like control.

Clearly define deliverables, timelines, and payment structures, and refrain from imposing strict schedules, mandatory reporting, or company-controlled tools that could imply subordination.

Well-crafted contracts demonstrate compliance and also provide legal clarity in the event of an audit.

Did you know that an EOR can also handle contract creation and tailor contracts to suit the type of employment?

3. Obtain legal sign-offs on classification decisions

Before classifying long-term contributors as contractors, consulting a local legal counsel is a must.

Each jurisdiction has nuanced tests, from control-based to economic-dependence assessments, and proper documentation ensures your classification decisions can withstand scrutiny.

Legal review also helps identify potential red flags early.

4. Set aside a reserve for potential liabilities

Even with careful planning, misclassification risk can’t be eliminated entirely. One way to prepare is by setting aside a financial reserve for potential back wages, benefits, and penalties. This ensures your business can handle unexpected enforcement actions without disrupting operations or cash flow.

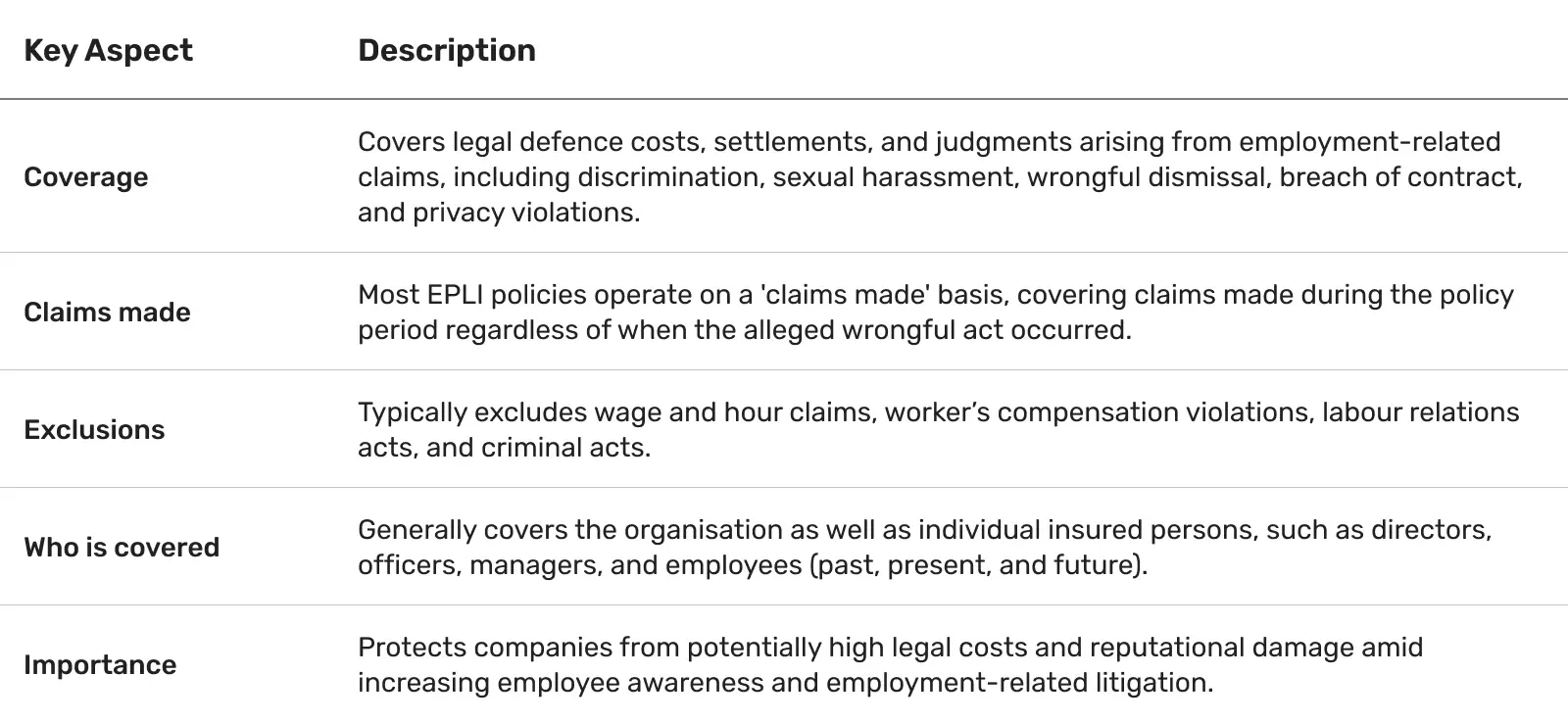

5. Consider insurance and indemnity

You should evaluate employment practices liability insurance (EPLI) to cover misclassification claims.

EPLI is specialised insurance to protect companies against claims brought by employees, former employees, or prospective employees alleging wrongful acts in the employment process.

Additionally,clear contracts with vendors, partners, or freelancers can include indemnity clauses, further mitigating financial exposure. Indemnity clauses are important because they help decide who is responsible for certain risks in a contract and protect each party from unforeseen liabilities.

How can you mitigate employee misclassification with Native Teams?

Native Teams offers EOR, PEO, and global payroll solutions in over 85 countries, leveraging local expertise and in-country legal entities.

As a result, we can ensure that all employees and contractors are classified correctly from day one, meeting local labour law requirements.

In addition, we help you comply with local labour laws, create contracts, manage payroll, and provide statutory benefits, all without the guesswork that often leads to misclassification.

Our tools and solutions:

✨ Classify all workers accurately as employees or contractors based on jurisdiction-specific rules to avoid fines and back pay.

✨ Create localised, structured, clear, and compliant contracts for all employment types, tailored to your business needs.

✨ Handle payroll, taxes, and statutory benefits to keep compliance consistent and avoid misclassification penalties.

✨ Do regular audits and risk monitoring to ensure evolving regulations are met, including new rules for platform work and gig economy roles.

✨ Help you build and manage a distributed team confidently, knowing that Native Teams manages local employment obligations.

Curious to explore more?

Book a free demo today and see how Native Teams can help you manage a compliant, global workforce while reducing the risks of employee misclassification.

Keep learning:

EOR for Startups: The Smartest Way to Go Global Fast

How EORs Protect Companies From Permanent Establishment Risk

EOR Compliance Checklist: What You Need to Know Before You Hire