Is an Employer of Record Legal? [2026 Fully Explained]

Misunderstanding EOR regulations can lead to contractual disputes, unexpected tax liabilities, or reputational damage.

Issues that are far costlier than doing it right the first time.

Labour laws and cross-border rules change fast. What worked last year may now be risky.

So, let’s check together: Is an Employer of Record legal?

Read on to learn what’s allowed, where the risks are, and how to ensure your international hiring strategy stays compliant while helping your business scale.

What legal aspects does an EOR cover?

An EOR is the official employer in the eyes of the law, taking on the official responsibilities such as:

- Employment contracts,

- Payroll,

- Tax withholdings,

- Benefits administration, and

- Compliance with local labour laws.

Meanwhile, the client company retains control over the day-to-day work and management of the employees.

An EOR’s legality depends entirely on how well it complies with the labour laws and regulations of the country where your employees are based.

EORs take on the legal responsibilities, so you don’t have to worry about compliance risks.

EORs are considered legal and effective for:

- Employing workers in countries where the company lacks a local entity, avoiding the need to set up subsidiaries.

- Handling all employment administration, including contracts, payroll, tax filings, and benefits, in full compliance with local laws and regulations.

- Allowing businesses to quickly enter new markets, scale their workforce internationally, and reduce administrative burdens and costs associated with employment law complexities.

- Maintaining business agility and control over employees' daily tasks while transferring the liabilities and compliance challenges to the EOR.

Employees hired through an EOR receive all legal rights and benefits identical to direct hires, such as wages following local minimums, social security, paid leave, health and safety protections, and lawful termination procedures.

How does an EOR ensure compliance with local labour laws legally?

An EOR ensures legal compliance with local labour laws primarily by assuming responsibility as the official employer in each country where employees work.

Thus, it handles critical employment functions in strict accordance with local regulations:

1. Monitoring and adapting to legal changes

EORs continuously track updates in labour laws, tax regulations, employee benefits, probation and termination rules, and notify client companies of relevant changes that impact employment compliance.

2. Employment contracts

They draft, manage, and update employment contracts to align with local legal requirements that specify:

- Wages,

- Working hours,

- Benefits,

- Termination processes, and

- Other employment conditions.

3. Correct employee classification

EORs ensure employees are correctly classified under local laws as either employees or contractors.

As a result, it prevents misclassification penalties and ensures proper tax and social security contributions according to jurisdiction-specific criteria.

4. Payroll and tax compliance

EORs handle payroll processing, including wage payments, tax withholdings, social security contributions, and timely filing of taxes to prevent legal and financial penalties for the client company.

5. Benefits administration

They manage legally mandated employee benefits such as health insurance, pensions, paid leave, and social security, ensuring those benefits meet or exceed local standards.

An experienced EOR can also adapt benefits quickly in response to changes in legislation, avoiding costly compliance gaps.

6. Legal expertise and local presence

EOR providers have dedicated legal and HR experts who really understand the labour laws in each country.

To make sure they fully follow all local rules, they either set up their own local offices or work closely with trusted local partners.

7. Risk mitigation and legal protection

By assuming employment liabilities and regulatory responsibilities, EORs reduce the risk of lawsuits, fines, and operational disruptions related to labour law violations. The main aim here is to protect the client’s legal and financial interests.

8. Compliance oversight and audits

Regular internal audits and reviews help identify and fix potential compliance issues early.

At the same time, they provide clients with ongoing updates and support for regulatory adherence.

9. Onboarding and offboarding processes

EORs ensure that employee hiring, visa or work permit applications, and termination processes follow legal requirements. They also handle the proper documentation and notifications needed by local authorities.

How do EORs handle employee contracts to meet local legal standards?

EORs draft employment agreements that comply with the specific labour laws of the country where the employee works.

They ensure contracts cover critical legal and operational elements, such as:

- Job title,

- Responsibilities,

- Compensation (salary, bonuses, payment currency),

- Statutory benefits (healthcare, pensions, paid leave),

- Working hours,

- Location,

- Probation periods, and

- Termination terms, such as notice periods and severance.

These contracts also reflect local regulatory requirements on taxation, social security contributions, and labour protections to avoid misclassification and legal risks.

EORs customise contract language to align with jurisdiction-specific labour laws and include clauses for intellectual property protection, data privacy, and dispute resolution.

They review and negotiate contracts with the employee and client company to ensure clear role definitions and expectations, supporting compliance and reducing disputes. Additionally, EORs keep contracts up to date with legislative changes to ensure ongoing legal compliance across all employment terms.

Once signed, the EOR manages onboarding processes such as registration with social security, tax filings, and benefits enrollment to fully comply with local labour laws before the employee starts work.

For more details on what an employer contract should include and what to look for in an EOR regarding contracts, jump to our blog, How Does An EOR Contract Work? + How to Create It?

EOR legality in international hiring: Is an EOR legally recognised in international employment?

An EOR is legally recognised in international employment as long as it fully complies with local labour, tax, and employment laws in each country where it operates.

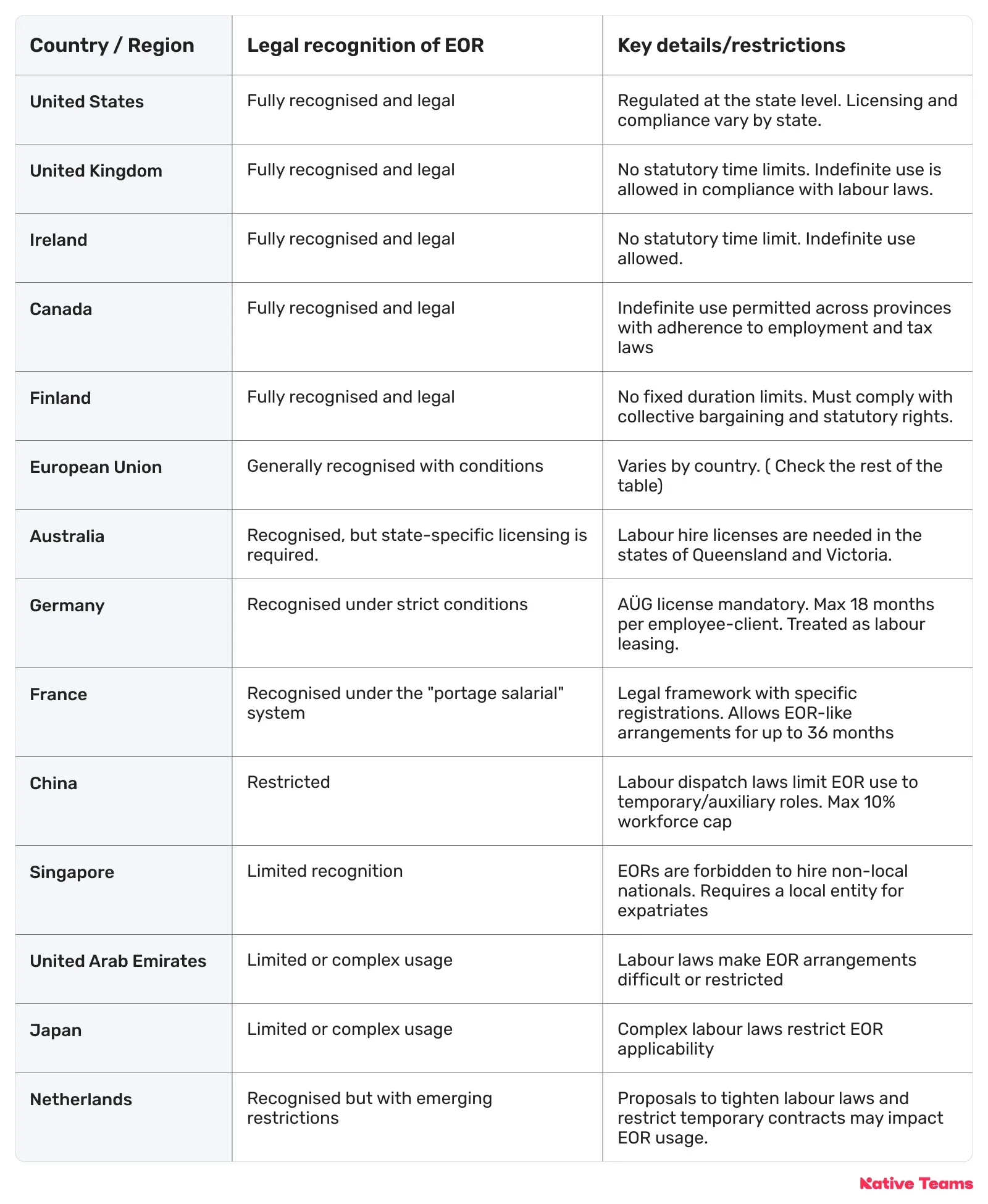

However, EOR recognition and the specific legal framework vary by country.

Many countries accept EORs as legal employers that help with international hiring, but some impose limits or strict regulations.

💡 Visit our Country Guides to explore in-depth hiring, employment, and payroll insights for multiple countries. From contracts and tax regulations to employee benefits and work permits, you can access all the information you need in one place.

7 key ways country-specific laws impact EOR legality

Country-specific laws significantly affect the legality and operational framework of EOR services by imposing diverse labour, tax, licensing, and regulatory requirements.

Top-notch EORs must adhere to them in each jurisdiction where they operate.

1. Labour leasing and licensing requirements

Some countries regulate EORs as labour leasing or temporary employment agencies, requiring them to obtain special licenses or registrations to operate legally.

For example, Germany mandates EORs hold an AÜG license under the Arbeitnehmerüberlassungsgesetz.

It limits employee assignments to a maximum of 18 months per client and requires equal pay and working conditions.

Non-compliance can result in heavy fines and legal penalties.

2. Time limits on EOR usage

Many countries restrict how long an employee can be employed through an EOR arrangement to protect local labour markets.

As seen above, Germany limits it to 18 months.

France allows up to 36 months under the portage salarial system, and some countries like Norway or Poland have similar caps.

On the other hand, countries including the UK and Canada impose no statutory time limits, allowing indefinite EOR use, subject to compliance with local employment laws.

3. Compliance with local labour laws

Country-specific laws define detailed requirements for wages, working hours, leave entitlements, employee classification, termination, and social security contributions. EORs must tailor their contracts and operations to each country’s legal standards to be recognised as legal employers.

If you fail to do so, you risk fines, reclassification, or invalid employment contracts.

4. Taxation and social security regulations

Local tax laws impact the payroll functions of EORs, requiring proper withholding and filings.

Different countries have varied approaches to tax treaties, social security coordination, and employee benefit mandates that EORs must integrate to remain compliant.

5. Restrictions based on national policies

Certain countries impose additional restrictions based on immigration and labour protection policies.

In Singapore, you can’t use an EOR to hire foreign workers. Companies must set up a local entity to employ expatriates.

China strictly regulates labour dispatch for temporary or auxiliary roles.

6. Licensing and state-level regulation variability

Even within countries like the United States, EORs face varied state-by-state licensing, financial assurance, and reporting requirements.

Consequently, compliance complexity increases with multi-jurisdictional operations.

7. Prospective or emerging restrictions

Countries like the Netherlands are proposing stricter legislation that could further limit EOR activities to protect local employment standards.

💡 Tip:

Make sure to use reputable EOR providers who maintain local licensing, legal expertise, and compliance to ensure the arrangement remains fully legal in each jurisdiction.

What legal risks do companies face without an EOR's compliance help?

Without an EOR ensuring compliance, you risk fines, legal disputes, and even losing the right to operate in certain countries.

- Worker misclassification: Calling employees contractors when they’re not can lead to big fines and legal headaches.

- Many countries strictly define employee status. Thus, treating workers as contractors while they function as employees can result in reclassification and legal consequences.

- Violations of local labour laws: Without local legal expertise, you risk unintentionally breaching laws on minimum wage, working hours, paid leave, severance, and termination. Consequently, these violations can result in fines, labour disputes, and reputational damage.

- Tax and social security compliance failures: Companies may fail to withhold proper taxes and social security contributions or misfile payroll taxes, exposing them to penalties, back payments, and legal scrutiny.

- Permanent establishment (PE) risk: Misusing an EOR or ignoring tax rules can lead authorities to treat your company as a permanent establishment, creating unexpected tax liabilities and legal problems. This risk weakens the legal protection an EOR should offer.

- Unauthorised employment risks: Hiring without an EOR or proper local registration can lead to unauthorised employment, resulting in fines, loss of intellectual property protection, and damage to corporate reputation.

- Operational and financial disruptions: Without an EOR's compliance systems, you struggle with payroll errors, late salary payments, flawed contracts, and legal disputes, which create business interruptions.

- Administrative and regulatory burden: Companies that handle foreign employees on their own often struggle to keep up with changing local laws, which can lead to compliance problems.

Let’s recap: Is an Employer of Record legal?

Although the legal recognition of EORs is subject to country-specific regulations, an EOR remains a lawful and practical employment model globally as long as the EOR provider complies with the local laws and regulations in the relevant jurisdiction.

That’s why you should look for a reputable EOR provider with local licenses, legal know-how, and strong compliance to keep everything fully legal in every country.

Enter, Native Teams!🚀

How can Native Teams help you hire legally across the globe?

Native Teams enable you to hire, onboard, manage, and pay international employees quickly, across over 85 countries, without the need to establish local legal entities, while ensuring full compliance with local labour laws and regulations.

What sets us apart from the majority of EOR providers is that we own legal entities in each country we operate, ensuring that employment operations remain fully compliant as laws change.

As a result, we keep up with changing local labour laws by combining:

- Continuous legal monitoring,

- Expert local knowledge,

- Proactive contract and policy updates, and comprehensive client support.

Our key services include:

🔥 Local employment and compliance: We provide country-specific contracts and handle local labour law compliance, payroll, and statutory benefits administration to ensure all hiring is legal and aligned with regional rules.

🔥 Global payroll and payment flexibility: Native Teams support global payroll in employees’ preferred currencies with transparent salary and tax breakdowns, simplifying costs and compliance.

🔥 Work permits and visa assistance: We help you obtain necessary work permits and visas so employees can work legally internationally without you managing complex immigration processes.

🔥 Fast market entry: By leveraging our existing entities worldwide, you can avoid the cost and administrative burden of establishing subsidiaries, enabling rapid and budget-friendly expansion.

🔥 Employee experience and care: We offer localised benefits, timely salary payments, and flexible fund withdrawal options to enhance employee satisfaction and retention.

🔥 Expert support: We provide dedicated account managers, expert advice on tax and labour laws, and a centralised digital platform for streamlined payroll, compliance, and HR management.

🔥 Entity management: If you already operate globally, we enable you to manage multiple entities from a single place.

Ready to explore deeper?

Book a free demo today to see how you can expand seamlessly across borders while staying fully compliant and on the right side of the law.

Keep learning:

20 Best Countries to Hire Remote Employees