9 FreshBooks Alternatives to Consider in 2026

While FreshBooks provides robust invoicing and accounting solutions, it is by no means the only solution.

It may not be the right fit if you look for options with built-in payroll functionality or if you have more complex financial, tax and payment needs.

That’s why we’ve decided to provide you with handpicked FreshBooks alternatives, to streamline financial operations better.

Read on to see our top 9 FreshBooks alternatives to find the platform that best aligns with your current goals.

Why look for a FreshBooks alternative?

While FreshBooks now includes more accounting features, its primary focus is still on invoicing and payment collection.

Also, the app doesn’t allow you to view reports or manage team members.

In addition, you can’t assign payments to a specific bank account until the transaction clears the bank.

Although FreshBooks offers basic tax support such as sales tax calculation on invoices, expense tracking, and generating tax-ready financial reports, it lacks advanced tax compliance and reporting features.

According to a 2025 Technology Evaluation Centers (TEC) report, FreshBooks supports only 7 out of 32 tax compliance and reporting features, scoring significantly below the market average: 14.52% vs. 46.18%.

Finally, FreshBooks doesn’t have a built-in payroll system but offers payroll services through a paid integration with Gusto, and only for US-based businesses with employees (W-2) and contractors (1099).

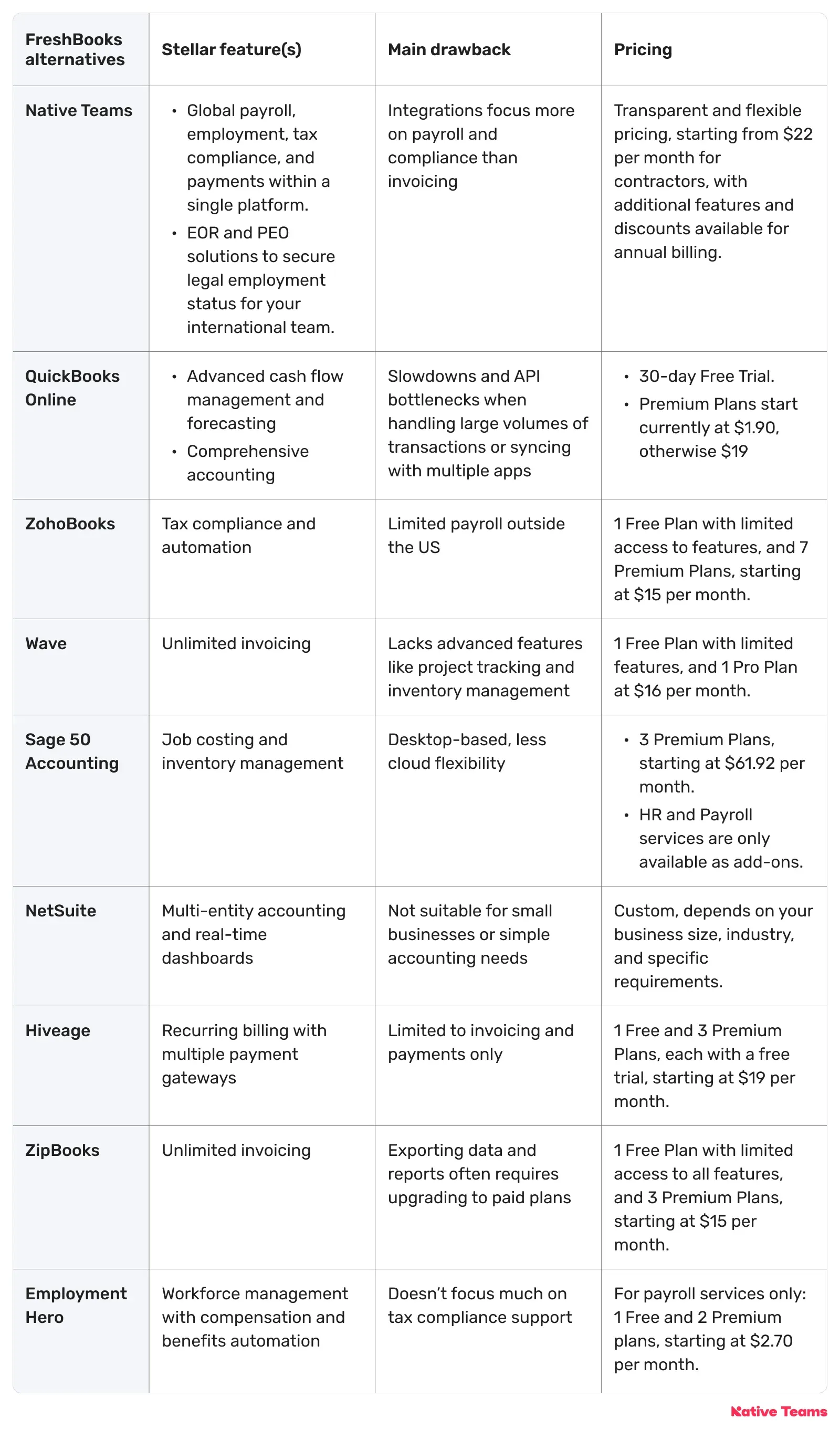

9 FreshBooks alternatives you should know about

Here are the highlights of FreshBooks alternatives.

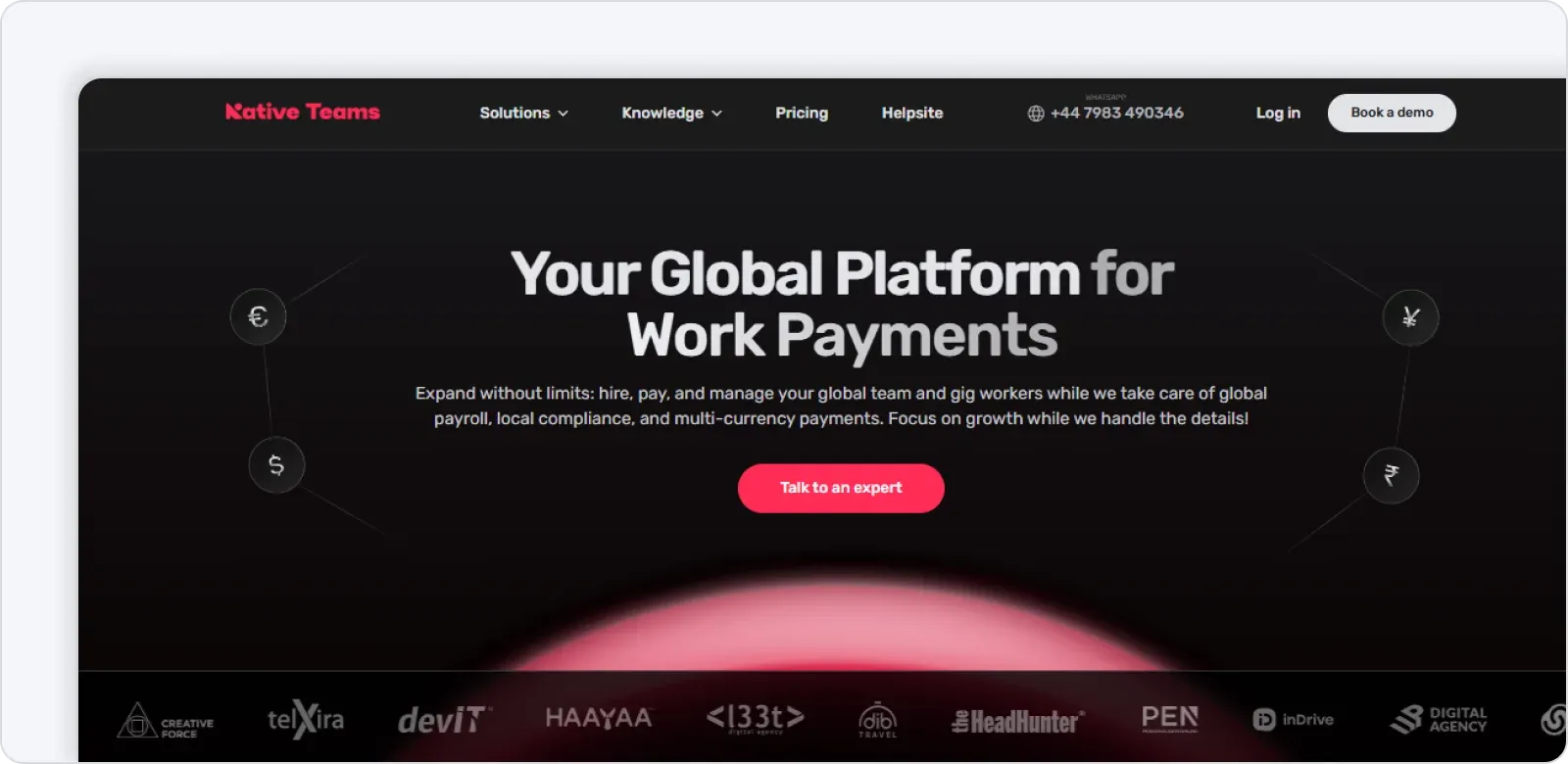

1. Native Teams: Best FreshBooks alternative for global freelancer payroll

Although Freshbooks excels at invoicing, its solutions are simply not enough if you need to pay workers in more than 85 countries, and worry about filing taxes and employee benefits.

Native Teams provides EOR and PEO solutions that help you hire, pay, and manage a remote or international workforce compliantly and efficiently in over 85 countries.

It reduces the complexity and risks of global payroll and employment by combining local expertise with a centralised, automated platform.

Key features:

1. Global payroll solutions

Our global payroll solution ensures accurate and timely payments in over 85 countries, in local currency, including all required contributions and benefits.

The centralised dashboard simplifies team management, allowing you to send payroll invites and adjust salaries with ease.

- With an integrated Multi-Currency Wallet, you can do instant fund transfers between wallets in different currencies, minimising transaction costs. You can fund your wallet with credit and debit card options, and detailed receipts for every transaction for complete transparency and financial control.

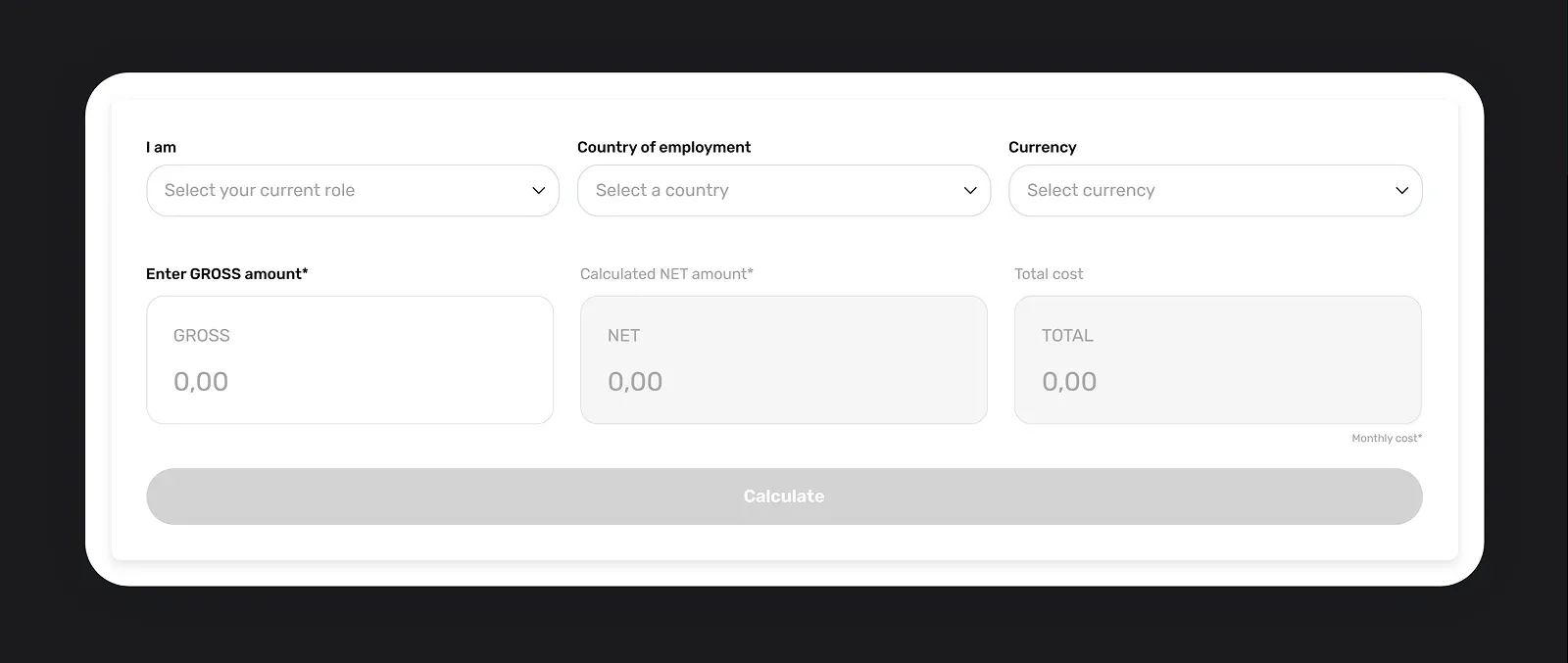

- The global payroll calculator simplifies calculating salaries and understanding total employment costs across more than 85 countries. The tool helps you get clear insights into gross and net salaries, taxes, social security contributions, and other mandatory deductions based on local laws.

2. Native Teams cards: Global business payment cards

Native Teams cards provide you and your employees with a simple, secure, and compliant way to manage spending worldwide.

We provide 2 types of cards: Physical and Virtual cards.

- Physical cards: Linked to your digital wallet, these cards allow you to track transactions, transfer funds, and make purchases at any Visa or MasterCard merchant worldwide.

- Virtual cards: They are connected to Google Pay or Apple Pay for quick, contactless payments. Virtual cards stay accessible on a mobile phone, making them convenient for remote or mobile workers.

In addition, each card is linked to an individual account, making it easy for you to track expenses, manage team budgets, and ensure compliance from the start.

The integrated expense management feature allows you to set spending limits, allocate funds, monitor usage, and generate expense reports with just a few clicks.

3. EOR and PEO services

Native Teams' EOR solutions let you hire in over 85 countries without the burden of setting up local legal entities.

We handle compliant onboarding for employees and contractors, while our integrated platform simplifies global workforce management with:

- Attractive benefits that meet the specific needs of each country.

- Accurate payroll processing, customised for local regulations.

- Tax optimisation with allowances and deductions in each country.

Other notable features:

- Simplified leave tracking: Monitor worker availability in real-time with an intuitive leave and absence management system, helping you plan your resources efficiently.

- Unified income tracking: Consolidate earnings from multiple sources into a single, easy-to-track platform, giving workers clarity and control over their income.

- Salary costs analysis: Understand employee salary costs for different countries and get a detailed breakdown of all the mandatory tax liabilities.

Pricing

Native Teams' pricing starts at $22 per employee per month for Work Payments and $116 őer employee per month for EOR, with additional features and annual billing discounts, plus 1 free client/employer admin account.

Best for:

Native Teams suits best businesses that want to simplify international hiring, payroll, and payments without local entities.

2. QuickBooks Online

QuickBooks Online is a cloud accounting software platform that streamlines bookkeeping, improves cash flow management, and enhances collaboration.

It offers customisable invoicing and advanced reporting as its core features.

Key features

- AI–powered automation and insights: Automates transaction categorisation and provides smarter business insights. AI-driven cash flow forecasting and predictive analytics help you anticipate expenses and manage liquidity.

- QuickBooks Online Payments supports multiple payment options, including the ability to take deposits on estimates.

- Task management: You can set tasks and reminders to review transactions, and get activity summaries and detailed transaction overviews.

- Customisable reporting: Enables you to tailor your reports, incorporate branding elements, and set parameters that are important to your business. You can also compare your financial position monthly, quarterly, or annually.

- Invoicing capabilities: Allow you to track invoice statuses, split the amount for bigger projects with progress invoicing, and send automatic reminders and follow up on overdue invoices.

Pricing

QuickBooks Online offers 4 Premium Plans, all with a 30-day Free Trial.

Pricing currently starts at $ 2.22 per month for the first 6 months. Otherwise, it starts at $22.20 a month.

However, payroll add-ons are available at an additional cost.

Best for:

Small to mid-sized businesses looking for automation and flexibility.

2. Xero

Xero is a cloud accounting platform that provides solutions for global compliance for small businesses and sole traders.

The platform’s solutions focus on deep automation, compliance, and collaboration features.

Key features:

- Automated payment reminders: Schedule automatic reminders to reduce late payments and improve cash flow.

- Quote to invoice conversion: Quickly convert quotes into invoices, saving time and reducing errors.

- Receipt capture: You can snap photos of receipts via the Xero mobile app or integrate with Hubdoc for automatic extraction and categorisation.

- Bulk reconciliation: Enables you to process multiple transactions at once.

- Built-in payroll: Available in countries like the UK, Australia, New Zealand, and the US, supporting automated payslip generation, tax calculations, and statutory leave management.

Pricing

Currently, you can get 90% off your plan for 3 months. Otherwise, plans start at $29 per month.

Best for:

Small and medium-sized enterprises that need a flexible, scalable cloud accounting solution.

3. Zoho Books

ZohoBooks is an automation-driven cloud accounting platform tailored for small and growing businesses.

The platform supports payment gateways, eCommerce platforms, and other business apps. It also connects with other Zoho products, such as Zoho CRM, Inventory, Payroll, and Creator.

Key features:

- Built-in tax calculations: Automated VAT, GST, and other tax computations tailored to regional requirements.

- Automation capabilities: Automate daily tasks, such as sending invoices and recording transactions, reconciling bank accounts, etc.

- Kit items: Manage complex inventory by grouping multiple items into kits or assemblies, and sell them as a single unit.

- Module-level approval: Enables you to assign approval workflows at the module level, such as Invoices, Purchase Orders, etc.

- Multi-bill landed cost allocation: Allocate landed costs across multiple bills for accurate expense tracking and inventory valuation.

Pricing

Zoho Books has 1 Free Plan with limited access to features, and 7 Premium Plans, starting at $15 per month.

Best for:

Suitable for startups, SMBs, and businesses already using Zoho products and looking for a scalable, integrated financial management solution with compliance support.

4. Wave

Wave is a cloud-based accounting software that provides core accounting services for startups and microbusinesses.

It handles invoicing, bookkeeping, and payments, as well as payroll options for the US and Canada.

Key features:

- Online payments: Accept credit cards, bank transfers, and Apple Pay through Wave Payments (processing fees apply).

- Direct deposit: Enables you to deposit payments directly into your employees’ bank accounts.

- Tax compliance: Supports automated W2 and 1099 tax form generation and filing in 14 US states, and offers guidance for other states. For Canada, you can create T4 and T4A slips and summaries for tax season.

- Employee self-service: Employees access their pay stubs and W2S, and manage their contact and banking information.

- Bank reconciliation: Matches bank transactions with invoices, bills, and expenses.

Pricing

Wave has 1 Free Plan with limited features, and 1 Pro Plan at $16 per month.

Best for:

Wave is ideal for US and Canada-based small businesses and freelancers seeking a cost-effective, easy-to-use accounting solution with essential bookkeeping and invoicing capabilities.

5. Sage 50 Accounting

Sage 50 Accounting is a desktop-based accounting software with cloud connectivity for SMEs.

It provides accounting, inventory, payroll, and reporting solutions.

Key features:

- Expense, sales, and cash flow tracking with automated bank reconciliation.

- Sage Connect integration enables real-time access to invoices, speeding up payment processing and reconciliation.

- Run payroll add-on: Helps with state and federal payroll tax deduction calculations, vacation, sick time, insurance plans, retirement plans, and flexible spending accounts setups.

- Track payroll tax expenses: Helps you create state and federal tax forms, W2S, and T4, RL-1 in Canada.

- Invoicing: Enables you to send invoices in bulk and set up recurring invoices.

Pricing

Sage 50 Accounting offers 3 Premium Plans, starting at $61.92 per month. However, HR and Payroll services are only available as add-ons.

Best for:

SMEs that require robust accounting, inventory, payroll, and reporting capabilities.

6. NetSuite

NetSuite is a cloud-based Enterprise Resource Planning (ERP) platform that automates and streamlines core business processes across finance, supply chain, and customer management.

It combines AI-powered automation and real-time insights.

Key features:

- NetSuite OneWorld: Supports multi-subsidiary, multi-currency, and multi-taxation operations with real-time financial consolidation and compliance.

- SuiteProcurement: Automates approval workflows, manages documents electronically, and improves visibility into spending and vendor performance.

- NetSuite Payroll: Available only for US employees, it automates payroll processes, including calculating gross-to-net earnings, withholding mandatory taxes, deducting benefits and scheduling and issuing payments.

- NetSuite Workforce Management: Enables you to capture time and attendance across your workforce and calculate wages.

Pricing

NetSuite’s pricing is custom and depends on your business size, industry, and specific requirements.

Best for:

The solution is optimal for companies in search of a scalable, integrated system capable of managing complex, multi-entity global operations.

7. Hiveage

Hiveage is a cloud-based invoicing and billing platform that simplifies financial management.

It enables you to create professional invoices, accept payments, track time and expenses, and manage subscriptions.

Key features:

- Payment processing: The platform integrates with payment gateways including PayPal, Stripe, and Braintree. It also supports partial payments and deposits.

- Recurring and subscription billing: Enables you to automate recurring invoices and subscription charges, send invoices manually or automatically with auto-billing capabilities. You can also set automatic payment reminders to reduce late payments.

- Hiveage Payments: Currently only available in the US, it allows you to accept payments with Visa, Mastercard, Amex and Discover, at a 2.9% fee per transaction.

- Invoicing: Allows you to create custom invoices and track their status.

Pricing

Hiveage offers 1 Free and 3 Premium Plans, each with a free trial, starting at $19 per month.

Best for:

Hiveage can be a good solution for small businesses, freelancers, and service providers that want a simple but powerful invoicing and billing platform.

8. ZipBooks

ZipBooks is a user-friendly, cloud accounting platform that helps you streamline invoicing, bookkeeping, expense tracking, and financial reporting.

It focuses on simplicity and automation, making it attractive for businesses without advanced accounting knowledge.

Key features:

- Payment capabilities: The platform supports all major credit cards and payments from 22 different countries. It also enables you to accept digital payments through Square and PayPal.

- Unlimited invoices: You can send one-time or recurring invoices with professional, customisable templates.

- Auto billing and payment reminders: Automate recurring payments and send automatic reminders to clients to reduce late payments.

- Tagging options: Enable you to label transactions with custom tags to better organise, track, and report on your business activities.

- Taxes Invoiced feature: You can keep track of the taxes you collect and create unlimited tax types, see reports of the taxes you've charged, and filter these reports by date.

Pricing

ZipBook has 1 Free Plan with limited access to all features, and 3 Premium Plans, starting at $15 per month.

Best for:

ZipBooks caters to small businesses, freelancers, and service providers who need a simple, affordable accounting solution with invoicing capabilities.

9. Employment Hero

Employment Hero is a human resources management system (HRMS) that integrates payroll, benefits administration, compliance, performance management, recruitment, and employee self-service into a single cloud platform.

It provides solutions to simplify and automate HR processes and improve workforce engagement.

Key features:

- Automated payroll processing: Streamlines payroll with automated calculations, tax filings, and payslip generation.

- Payroll compliance: Helps with employee data management by integrating rotas, timesheets, and leave entitlements directly into the pay run.

- Payroll submission: The platform handles automatic submissions of essential payroll reports such as FPS (Full Payment Submission), EPS (Employer Payment Summary), P11, P11D, P32, and P60 forms directly to HMRC.

- Post-payroll automation: Automatically calculates and syncs pension payments, generates payslips, and sends salary journals to the general ledger.

- HR software: Manages hiring, onboarding, compliance and employee engagement.

Pricing

Regarding payroll services, Employment Hero has 1 Free and 2 Premium plans, starting at $2.70 per month. For HR services, pricing starts at $9.45 per employee per month.

Best for:

Best for:

SMEs, especially in Australia, the UK, and New Zealand, which are in search of scalable HR, payroll, and compliance solutions.

Why should you go for Native Teams?

Native Teams offers a comprehensive, all-in-one EOR and PEO solution that simplifies global payroll, legal employment, tax compliance, and employee benefits management across more than 85 countries.

We help you:

- Manage payroll for international teams with expert local knowledge, ensuring accurate salary payments, tax filings, and social security contributions in multiple currencies from a centralised dashboard.

- Streamline tax reporting and benefit from expert guidance to optimise tax liabilities while maintaining compliance across jurisdictions.

- Ensure data security and compliance with local laws, reducing risks associated with managing global payroll and employee data.

- Hire and legally employ workers internationally without needing to establish local entities.

- Outsource payroll, taxes, benefits, and compliance management in countries where you already have a presence, sharing employment responsibilities and reducing administrative burden.

Curious to learn more?

Book a free demo today to see how you can pay employees worldwide accurately, on time, and with appropriate benefits.

Keep learning:

15 Tips to Create a Global Payroll Strategy