How to Hire International Contractors in 2026 [Step-by-Step]

You’ve found great international talent for your company, but the moment you try to hire them, you hit a wall of confusion. What forms do you need? How do you pay them legally? What kind of contracts?

And the risks are real. Misclassify a worker, and you could face tax penalties or backdated employment claims.

Miss a compliance step, and you might violate GDPR or local labour laws.

This is where our step-by-step guide comes in handy.

Read on to learn about hiring international contractors so you can hire top global talent confidently, efficiently, and within the law.

Hiring international contractors: 8 key steps you must know about

From defining your needs and drafting compliant contracts to handling payments, onboarding, and risk management, here are the main factors to consider when hiring international contractors.

Step 1: Define your needs

The first step to hiring internationally is clarity. Before you even post a job, define why you’re looking for a contractor rather than a full-time employee.

Contractors are ideal for short-term, project-based work or specialised tasks that don’t require long-term employment relationships.

Write a concise role description that includes:

- The required skills, qualifications, certifications, language proficiency, and experience levels that candidates must possess.

- The exact responsibilities and tasks the contractor will handle to avoid unambiguous expectations.

- Project duration, flexibility, and key performance indicators (KPIs) to help candidates evaluate if they fit the role.

Not only does this clarity help you find the right candidate, but it also supports compliance later, since regulators often look at project scope to determine whether a worker is truly independent.

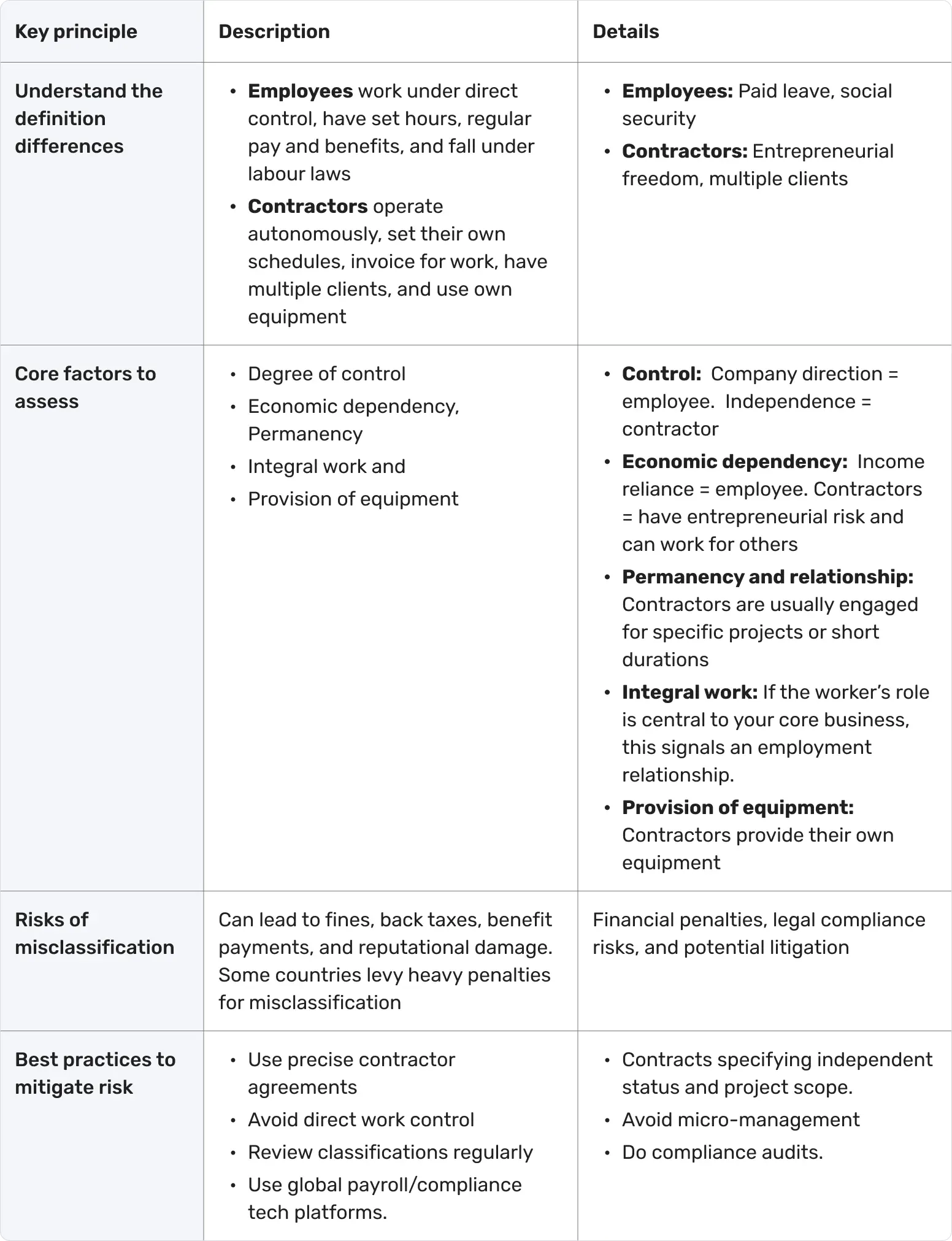

Step 2: Classify the worker correctly

Misclassifying workers is one of the most common mistakes companies make when hiring abroad.

It also doesn’t help that regulators have tightened their definitions of what constitutes an employee versus a contractor.

In the United States, the Department of Labour’s updated rule emphasises economic dependence and the degree of control you exercise over the worker.

If you dictate their hours, tools, or ongoing responsibilities, they might be legally considered an employee even if you call them a contractor.

In the United Kingdom, IR35 rules continue to hold medium and large businesses responsible for determining employment status.

If your contractor works 'inside IR35,' they must be treated as an employee for tax purposes.

Other regions, including the EU, Canada, and Australia, apply similar principles, focusing on independence, control, and financial risk.

To stay compliant, keep documentation showing that your contractor controls their own workflow, sets their own hours, and uses their own equipment.

Also, avoid perks or benefits reserved for employees.

For a more detailed view of what misclassification entails, jump to our blog, Employee Misclassification: Hidden Costs for Global Businesses.

💡 Good to know:

With operations in more than 85 countries, Native Teams provides comprehensive EOR, PEO, Contractor of Record, and global payroll solutions powered by local expertise and established in-country entities.

This means your team members, whether employees or independent contractors, are properly classified from day one, fully aligned with local labour regulations.

Step 3: Understand local law and tax obligations

Each country defines employment and taxation differently.

Before onboarding an international contractor, research the local requirements for taxes, invoicing, and social security contributions.

Some countries, such as Brazil, Spain, and France, have strict definitions that can quickly transform a contractor relationship into a de facto employment arrangement.

At the same time, others require foreign companies to register locally before paying residents.

If you don’t want to create a legal entity in each country, consider partnering with an Employer of Record (EOR) service that employs the worker on your behalf, manages payroll and benefits, and ensures compliance with local labour laws.

💡 Good to know:

With Native Teams, you can skip the entity setup and use our presence in 85+ countries to hire global talent.

We take the complexity out of global hiring by handling contracts, payroll, statutory benefits, and compliance, so you can expand internationally without the risk of misclassification or administrative burdens.

And if you already run multiple entities, you can instantly activate payroll, compliance, and contract workflow for each country, regardless of the employment type.

Step 4: Draft a contract and protect your IP

Your contractor agreement should clearly lay out deliverables, payment terms, intellectual property rights, and confidentiality obligations.

How should you create one?

- Clearly define what the project includes, and what it doesn’t. Outline each phase or milestone, along with the specific deliverables you expect.

- Set realistic deadlines for each deliverable to keep the project on track and make accountability simple.

- Be transparent about budget limits and payment terms, and include any contingency plans in case priorities shift.

- It’s also smart to agree on how revisions and feedback will be handled, as this prevents misunderstandings when changes happen mid-project.

- Clarify who owns the work once it’s delivered and how confidential information should be handled.

- Define what working hours make the most sense for your team. Even if your contractor is halfway around the world, a few overlapping hours can make collaboration smoother and help projects move faster.

- Factor in local holidays and working norms when creating a timeline.

- Include a clear termination clause that outlines how either party can end the contract, usually with a short notice period, and specify the conditions for termination.

- Define which country’s laws will apply to the contract to provide clarity in case of disputes and prevent costly legal complications across multiple legal systems.

💡 Did you know?

With Native Teams, you get ready-to-use, customisable templates for every employment type.

It means you can hire the way your business needs, confidently and compliantly, without the stress of second-guessing legal details.

For example, with our contractor agreement template, you can clearly define schedules, workflows, and all relevant terms, including invoicing and payment details.

It helps ensure that everyone is on the same page and that financial arrangements are completely transparent.

Step 5: Address data protection and privacy compliance

With international contractors, data protection has become a top concern.

Many will access sensitive systems and customer information from their own devices, which creates additional risk.

If your contractor handles personal data belonging to EU or UK residents, you must comply with GDPR. This means signing a Data Processing Agreement (DPA) that specifies how the contractor will process and secure the data.

To stay safe, restrict data access to what’s necessary, require the use of secure passwords and VPNs, and ensure all devices have encryption enabled.

Providing a short privacy training or handbook during onboarding can also be of great help.

Step 6: Vet and verify your contractors

Hiring internationally means you can’t always rely on in-person interviews or local reputation. Proper vetting protects your company and builds trust with stakeholders.

Verify identity and residence through official ID or utility documentation. Review the contractor’s portfolio, references, and past projects to confirm skill alignment.

Background checks should be performed carefully and with the contractor’s consent, and laws vary widely.

In the EU, for example, such checks require explicit consent and must be relevant to the job.

💡 Did you know that Native Teams offer fast, secure verification of past and current employees, perfect for HR checks, visa processes, or financial applications?

This way, you can get insights into a candidate’s job history before you make an offer.

Step 7: Set up payments and payroll system

When setting up payments for international contractors, getting the details right is crucial for smooth operations and compliance.

Here are the 3 main aspects you should pay attention to.

1. Currency

Currency is one of the first considerations.

Most contractors prefer to be paid in their local currency, which avoids unnecessary conversion fees and confusion.

Make sure you pick a single method and clearly specify it in the contract so both parties know what to expect.

Native Teams’ Multi-currency wallet allows you to pay employees or contractors, easily manage company funds across multiple currencies, and monitor team expenses, all from one centralised dashboard.

Thus, you can:

- Instantly transfer funds to team members or between company wallets.

- Convert funds between currencies at competitive rates to support global payments.

- Pay multiple employees or contractors quickly and efficiently in one go.

- Monitor every transaction and payout from your phone, with instant updates and status alerts.

Also, bonuses, tips, and incentives go straight into workers’ digital wallets, linked to physical and virtual cards for easy spending and withdrawals.

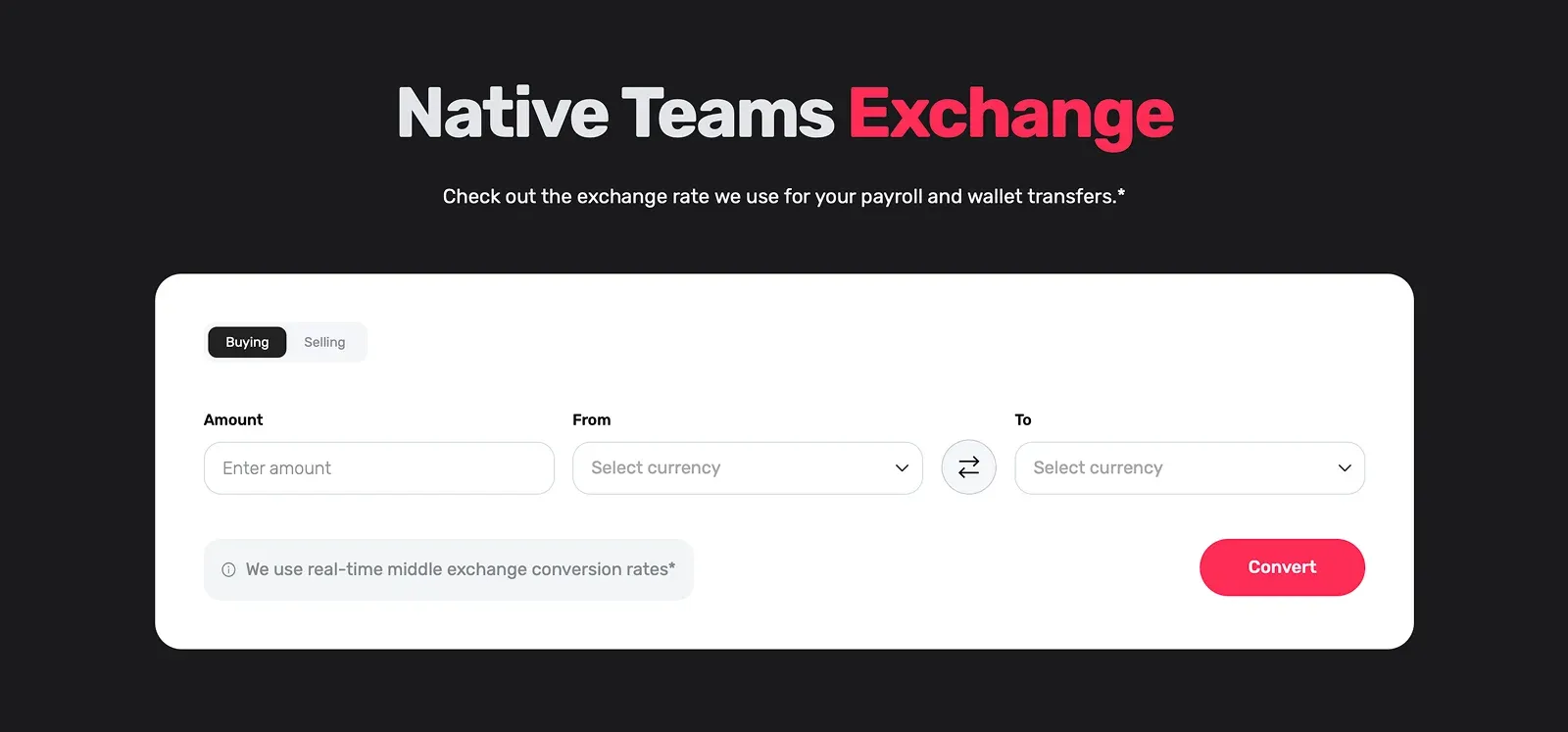

2. Fees and exchange rates

Next, keep an eye on fees and exchange rates.

Even small differences in transaction costs can add up over multiple payments, so compare platforms and banks to minimise hidden charges.

Using payroll providers that specialise in international payments can help you get better rates while ensuring timely transfers.

Native Teams’ Exchange Tool provides a transparent way for you to check out the exchange rate we use for your payroll and wallet transfers with no conversion fees.

3. Tax compliance

Tax compliance is another critical piece.

In the U.S., foreign contractors should provide Form W-8BEN to verify non-U.S. tax status, while domestic contractors require a Form 1099-NEC for reporting.

For contractors in the EU or other VAT jurisdictions, it’s important to maintain detailed invoices with tax ID numbers and VAT/GST information.

This keeps you compliant and also provides transparency for both accounting and audit purposes.

💡 A quick tip:

Consider automating payments through a compliant global payroll platform.

Automation reduces the risk of errors, ensures contractors are paid on time, and produces audit-ready records for your finance team.

With Native Teams, you can conduct regular audits and risk monitoring to ensure compliance with evolving regulations, including new rules for platform work and gig economy roles.

As a result, you can save hours of manual work while keeping your business protected.

By setting up a clear, consistent, and compliant payment process, you create a professional and trustworthy experience that attracts and retains top international talent.

Step 8: Onboard contractors professionally

A structured onboarding process helps contractors integrate quickly and ensures compliance.

Start with signed copies of the contractor agreement and any necessary NDAs. Provide secure access to the tools and systems they’ll need, such as project management software, communication channels, and shared drives.

However, follow the principle of 'least privilege,' granting only what’s required for their role.

You can also organise a brief onboarding session explaining your company’s communication expectations, deadlines, and data policies.

Don’t forget to keep a record of all onboarding documents and dates, as they can be crucial if you ever face a compliance audit.

💡 Good to know:

With Native Teams, you can start onboarding employees in new markets in days instead of months.

A dedicated onboarding manager will guide you through every step, ensuring a seamless setup.

On top of that, we streamline administrative work by automating key tasks, such as creating employment contracts and preparing all required documentation.

Step-by-step checklist for hiring international contractors

Before we wrap things up, here’s a quick recap of the most important steps for hiring international contractors.

✅ Define the role & project scope

- Clearly outline deliverables, milestones, and expected outcomes.

- Decide on the project duration and whether it suits a contractor or an employee.

- Set expectations upfront to prevent scope creep and misunderstandings.

✅ Classify workers correctly

- Determine if the worker is an independent contractor or employee.

- Document control, independence, financial risk, and relationship factors.

- Check local laws (IRS, DOL, IR35, EU regulations) to avoid misclassification.

✅ Understand local law & tax obligations

- Research labour laws, payroll requirements, and social contributions.

- Verify if you need a local entity or can use an Employer of Record (EOR).

✅ Draft strong contracts & protect IP

- Create agreements with clear scope, deliverables, and timelines.

- Include payment terms, intellectual property clauses, and confidentiality rules.

- Define governing law, termination procedures, and dispute resolution upfront.

✅ Ensure data protection & privacy

- Comply with GDPR and local data laws when handling personal information.

- Sign Data Processing Agreements (DPAs) if contractors handle sensitive data.

- Provide secure tools and enforce privacy standards for remote work.

✅ Vet and verify contractors

- Confirm identity, residence, and qualifications before hiring.

- Review portfolios and contact professional references.

- Conduct background checks that are legal and compliant in the contractor’s country.

✅ Set up payments and payroll

- Opt for a global payroll provider for streamlined and quicker payment processing.

- Specify currency, invoicing format, and payment schedule clearly.

- Collect tax forms and maintain audit-ready records.

✅ Onboard effectively

- Provide signed contracts, NDAs, and welcome materials.

- Set up access to tools, systems, and communication platforms.

- Clearly explain workflows, deadlines, and expectations.

How to effectively hire international contractors with Native Teams?

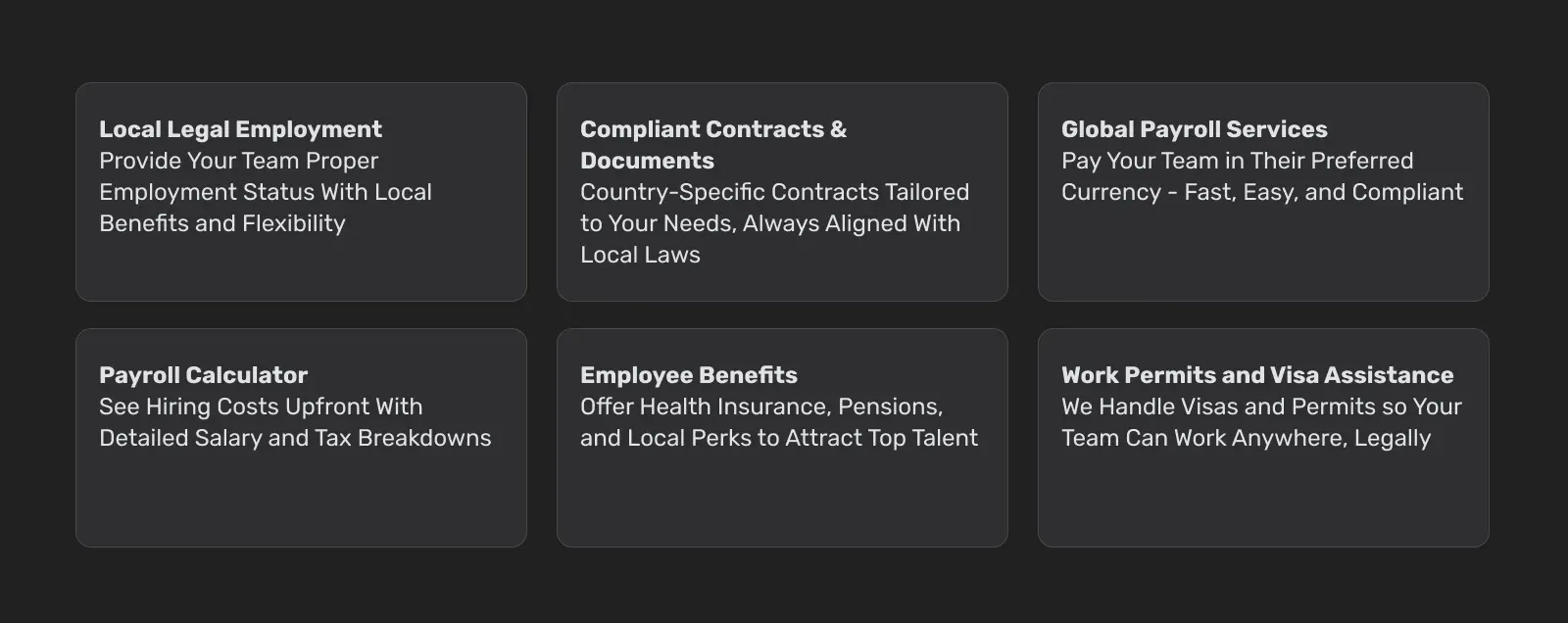

Native Teams is a global EOR, PEO, payroll, and Contractor of Record solution that enables you to compliantly hire, onboard, pay, and manage your workforce in 90 countries, regardless of their employment status.

Here’s a small portion of how we can help:

✨ Classify every worker correctly, employee or contractor, so your business stays fully compliant and avoids costly penalties.

✨ Build contracts that work globally, clear, localised, and tailored to your business needs, covering every employment type.

✨ Simplify payroll and benefits: We handle taxes, statutory obligations, and payments effortlessly, keeping your team compliant from day one.

Want the inside scoop?

Book a free demo today and see how Native Teams can help you hire international contractors simply, fast, and fully compliant.

FAQ:

1. How to run international payroll?

Running international payroll starts with understanding local labour laws, tax requirements, and currency regulations in each country where your employees or contractors work.

Using a global payroll platform or Employer of Record (EOR), such as Native Teams, simplifies the process by automating payments, tax filings, and statutory benefits.

This ensures your workforce is paid accurately, on time, and fully compliant with local regulations.

2. How to collect payments as a contractor?

As a contractor, collecting payments starts with clearly defining payment terms in your contract, including currency, schedule, and invoicing requirements.

Using reliable international payment platforms can simplify transactions and reduce delays. Always keep detailed records of invoices and payments to ensure accuracy, transparency, and compliance with tax obligations.

3. Can I hire someone to help me move abroad?

Yes, you can hire professionals to help you move abroad, such as relocation specialists, moving companies, or immigration consultants.

They can assist with logistics, paperwork, visa applications, and settling into a new country. Working with experienced providers ensures a smoother, more organised transition.

Native Teams’ relocation & visa assistance service provides end-to-end support, from preparing visa paperwork to liaising with local authorities and keeping you updated at all times.

Keep learning:

Top 10 Remote Workforce Management Software