How Long Does Payroll Take to Process? [2026 Guide]

Payroll might seem like a simple ‘click-and-done’ task, but if you’ve ever managed it, you know the reality is very different.

Between tracking hours, calculating deductions, and ensuring compliance, processing payroll can turn into a time-consuming task.

How long does payroll take to process? Read on to learn more about the expected time, as well as practical tips to speed it up, so you can pay your team on time.

What does payroll processing involve?

Payroll covers multiple steps that ensure employees are paid accurately, on time, and in full compliance with tax laws and company policies.

1. Data collection (1-3 days)

Every accurate payroll run starts with reliable data.

This involves gathering employee timesheets, overtime hours, bonuses, commissions, deductions (such as health insurance or retirement contributions), leave balances, and any updates from new hires or terminations, often leveraging ETL solutions for integrating data from disparate HR systems, time clocks, and benefit platforms into a unified payroll database.

Because mistakes here can have a domino effect on the rest of payroll, precision is key.

You may consider opting for an automated time-tracking and HR system to speed up this stage and eliminate manual errors.

2. Gross pay calculation (Same day)

Once the data is in, it’s time to calculate each employee’s gross pay: their total earnings before deductions.

This includes base salary or hourly wages, overtime, bonuses, and taxable benefits, such as allowances or company-provided devices.

You must align these calculations with employment contracts and ensure compliance with wage and hour laws.

3. Deductions and withholdings (Same day or +1 day)

Next, payroll systems calculate the required deductions, including federal, state, and local taxes, Social Security, Medicare, and voluntary contributions for benefits.

This step ensures legal compliance and accurate net pay, the amount employees actually receive.

Employer contributions or refunds are also factored in here.

4. Payroll review and approval (1–2 days)

Before anything is finalised, payroll goes through a thorough review and approval process.

This internal audit verifies the accuracy of key financial data, including tax withholdings, identifying any missing information, and detecting overpayments.

Payroll managers reconcile payroll registers, verify compliance, and correct any issues, saving the company from costly mistakes down the road.

5. Payment disbursement (1–2 days)

Once approved, payments are processed and sent out.

The timeline here depends on bank processing times and the payment methods used, from direct deposits and checks to prepaid payroll cards or digital wallets.

Providing detailed payslips at this stage builds trust and transparency, while timely disbursement ensures employees are paid exactly when they expect it.

6. Post-payroll tasks (Ongoing)

Payroll doesn’t end once payments are made. Several follow-up tasks keep everything running smoothly:

- Filing payroll taxes and submitting required reports.

- Updating accounting systems and benefits records.

- Maintaining payroll records and audit trails for compliance.

- Handling employee queries and resolving discrepancies.

What are typical payroll processing times?

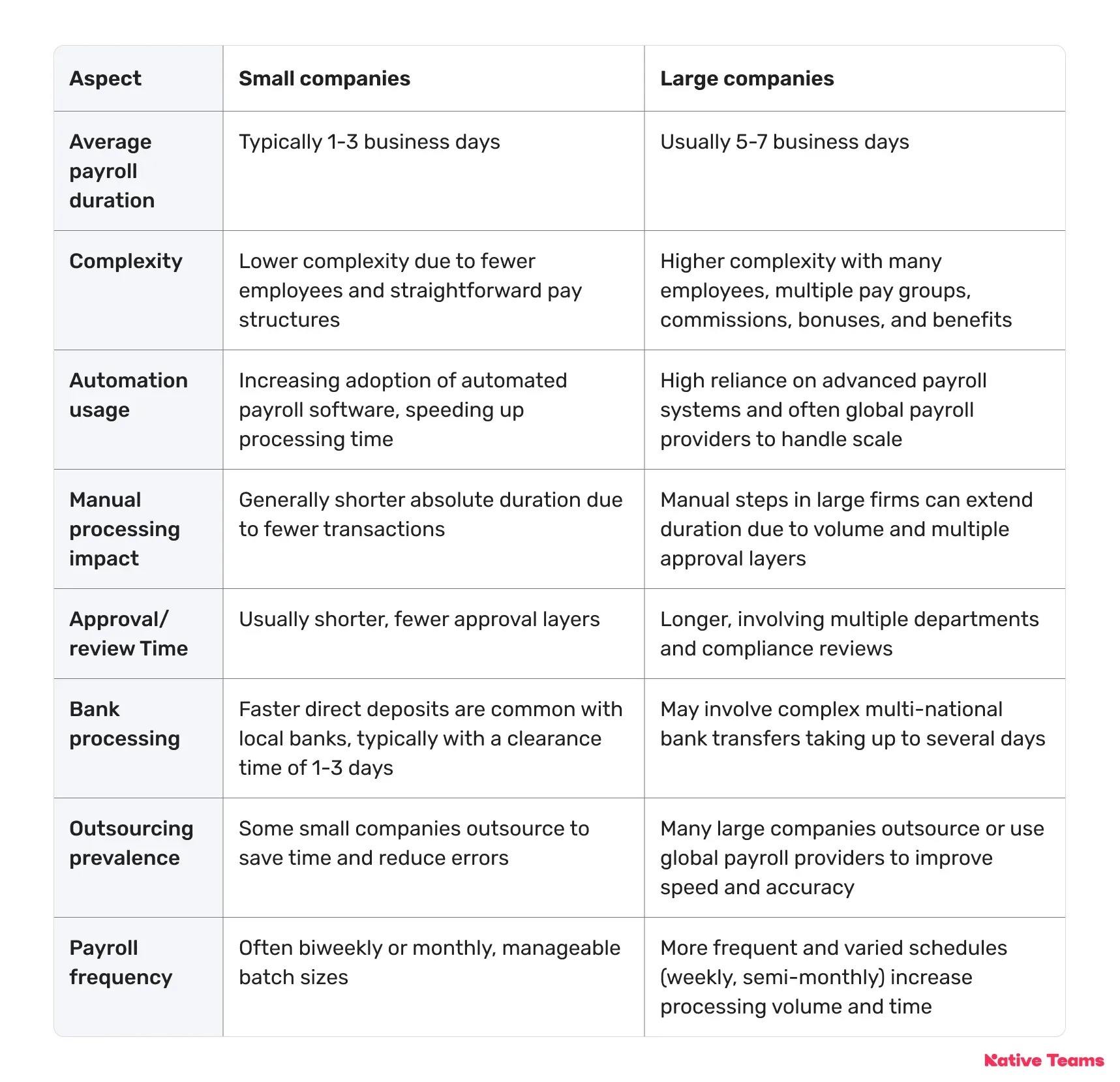

Payroll processing typically takes between 1 and 7 business days, depending on factors such as company size, payroll complexity, automation level, and payment methods used.

Most companies submit payroll at least 3-4 business days before payday due to bank processing times.

Small businesses with simple payrolls may complete the process within a day or two.

At the same time, larger companies or those managing multiple locations and complex pay structures can take up to a week.

Both benefit significantly from automation and outsourcing, which can reduce payroll processing time.

4 key factors that affect payroll duration

The difference in payroll timelines often comes down to a few main factors that influence how quickly (and accurately) payroll gets processed.

1. Size and complexity of your payroll

The bigger and more complex your workforce, the longer payroll takes.

Companies with hundreds or thousands of employees, a mix of hourly and salaried staff, commissions, bonuses, and teams spread across multiple countries have far more data to gather, verify, and reconcile.

And if you add in complex benefits, stock options, or multiple pay groups, the calculation layers multiply.

Smaller businesses with simpler pay structures, on the other hand, often move through payroll much faster.

2. Automation vs. manual processes

Nothing speeds up payroll like automation.

Modern payroll platforms automatically handle calculations, tax withholdings, compliance checks, and even payment disbursements, often in a fraction of the time manual methods require.

When payroll data is integrated with time-tracking and HR systems, approvals happen faster, errors are minimised, and the entire cycle shortens.

In contrast, manual payroll isn’t only slower but far more prone to costly mistakes.

3. Bank processing times and payment methods

How you pay your employees directly impacts how long payroll takes to complete.

Direct deposits and ACH transfers are among the fastest, usually clearing within 1–3 business days. Physical checks or payroll cards can take longer due to mailing and manual handling.

For global businesses, cross-border payments add another layer of complexity, with currency conversions, compliance checks, and international banking delays all potentially extending the timeline.

4. Regional compliance and filing requirements

Beyond payment, payroll also means staying compliant with the law.

Every region has its own tax laws, social security requirements, and reporting deadlines, all of which affect payroll time. Preparing tax forms, submitting filings, and conducting internal audits take careful planning.

In countries with electronic filing systems or especially complex regulations, payroll teams need extra validation steps, which can delay finalisation if not managed proactively.

Other factors that can add time

Besides the big four, a few other elements also influence payroll duration:

- Payroll frequency: Weekly or biweekly payrolls require more frequent runs, which can add up.

- Approval processes: Multi-step internal reviews can introduce waiting periods.

- Data accuracy: Any time spent fixing errors or validating employee info slows things down.

- Global workforce: International teams bring added complexity with compliance, currencies, and local labour laws.

Advanced payroll software and process automation are must-haves to optimise and shorten payroll timelines while ensuring accuracy and regulatory adherence.

Key compliance deadlines that delay payroll

The main compliance deadlines that delay payroll come from mandatory tax filings, electronic submissions, and regulatory updates that vary by country.

International payroll

- Local filing deadlines: Each country sets its own schedule for tax withholdings, payroll reporting, and social security contributions. Missing these deadlines results in fines and interest charges.

- Mandatory electronic filing: In many regions, once your payroll reaches a threshold number of forms or filings, you’re required to submit everything electronically. While this can speed up submissions, it also shrinks the window for making corrections, leaving less room for last-minute fixes.

- Record retention and audit requirements: Countries often require payroll records to be stored for years, and to be audit-ready at all times. Ensuring that every detail is accurate before submission can slow things down, but it’s a crucial step to stay compliant and avoid problems along the way.

Global payroll considerations

- Cross-border payment timing: Compliance with currency controls and international banking regulations can delay payroll payments, especially involving tax withholding submissions and multi-currency reconciliations.

- Employee classification and benefits compliance: Changes in classification rules, such as the distinction between contractor and employee, impose additional compliance checks, which can delay payroll finalisation.

How can you speed up payroll processing with automation: 9 effective steps

Manual payroll tasks slow operations and increase the risk of errors.

With automation, you can streamline every stage of payroll.

Below are 9 practical steps to accelerate payroll processing and boost efficiency.

1. Integrate payroll with HR and time tracking systems

By integrating payroll software with your HRIS and time-tracking platforms, data such as hours worked, bonuses, and deductions flows in automatically.

As a result, you’ll eliminate manual data entry errors and shorten the payroll cycle.

2. Automate tax calculations

Tax laws change constantly, but automation keeps you ahead.

AI-driven payroll platforms automatically update tax codes, calculate withholdings, and apply the latest compliance rules.

That means less time spent researching regulations while reducing compliance risks.

3. Implement automated data validation and reconciliation

Before payments go out, automation can scan payroll data for errors, missing fields, or inconsistencies.

These built-in checks ensure clean, accurate payroll runs, and when combined with automated approval workflows, they help each stage move faster and more smoothly.

4. Leverage AI to spot payroll anomalies early

AI speeds things up, but it also makes payroll smarter.

Machine learning tools can detect duplicate payments, misclassifications, or other red flags in real time, preventing time-consuming manual fixes and reducing the risk of costly audit issues later.

5. Enables employee self-service portals

Give your HR team a break and your employees more control.

Self-service payroll portals enable staff to view payslips, update their information, and submit queries at any time without creating bottlenecks for payroll administrators.

6. Centralise payroll vendors on one platform

If your business runs payroll across multiple countries or vendors, unify it all on a single platform.

Centralising vendor management streamlines communication, reduces errors, and speeds up cross-border payments and compliance checks.

7. Adopt real-time payroll and payments

Real-time payroll processing enables faster salary disbursement, cutting down employee waiting periods and shortening the overall payroll timeline.

Real-time payroll also improves cash flow visibility for employers, making it easier to plan and allocate resources.

Additionally, it enhances employee satisfaction and retention by ensuring workers have instant access to their earnings when they need it most.

8. Use predictive analytics for smarter planning

Automation is about foresight. Predictive analytics can forecast payroll costs, tax liabilities, and cash flow needs, helping you plan proactively and avoid last-minute surprises that can slow things down.

9. Automate audits and standardise approvals

Regular payroll audits keep your data clean and compliant, and automation makes them effortless.

By standardising and automating approval workflows, you eliminate slow manual sign-offs and ensure payroll moves quickly from calculation to payment.

How can Native Teams help you optimise payroll processing times while staying compliant?

Native Teams is an all-in-one global payroll, Employer of Record (EOR), Professional Employer Organisation (PEO), and workforce management platform that operates in 90 countries.

Our solutions help you hire, manage, and pay your international workforce compliantly, regardless of their employment status.

Here’s what we deliver:

✨ The centralised payroll dashboard that simplifies team management, allowing you to send payroll invites, adjust salaries, and track payments in one place.

✨ Multi-currency wallet: Instantly send and receive payments in multiple currencies while minimising fees and cutting out frustrating delays. It’s a smarter, faster way to handle global payroll without the usual cost and complexity.

✨ A Payroll Calculator gives you a detailed breakdown of hiring costs across different countries and helps you accurately calculate your own gross and net earnings

✨ Built-in currency exchange management allows you to check out the exchange rate we use for your payroll and wallet transfers based on real-time middle exchange conversion rates. Also, we don’t charge fees for currency conversions.

✨ Maintain full control over your employees’ daily activities, while we calculate salaries, fulfil your tax obligations, and administer employee benefits.

✨ Contractor of Record services, taking on compliance, classification, contracts, and local legal responsibilities in your contractor’s country.

✨ Monitor every transaction and payout from a phone, with instant updates and status alerts.

✨ Set up your own entities and manage your existing ones from a centralised platform.

✨ Manage country-specific labour laws, social contributions, and tax deductions to remain compliant with evolving regulations.

✨ Provide a secure self-service portal where employees can easily access payslips, track payment history, and update their personal information, putting control in their hands.

✨ Ensure all employment practices from contracts and benefits to employee rights and obligations meet local legal requirements, keeping your business fully compliant.

Curious to know more?

Book a free demo today to learn how you can pay your team on time, every time, without the stress.

Keep learning:

Managing Global Payroll: A Comprehensive Guide for Remote Teams